TIDMCML

RNS Number : 2518X

CML Microsystems PLC

18 November 2014

CML Microsystems Plc

INTERIM RESULTS

CML Microsystems Plc ("CML"), which designs, manufactures and

markets a broad range of semiconductor products, primarily for the

global communication and data storage markets, announces Interim

Results for the six months ended 30 September 2014.

Financial Highlights

-- First half results in-line with management budgets and market expectations

-- Group revenues down 21% to GBP10.21m (H1 2013: GBP12.99m)

-- Underlying profit before tax down 62% to GBP1.24m (H1 2013: GBP3.21m)

-- Basic EPS down 62% to 5.92p (H1 2013: 15.73p)

-- Cash reserves of GBP11.59m (31 March 2014: GBP11.37m) - after GBP1.01m dividend payment

Operational Highlights

-- Promising H2 order book meaningfully ahead of prior half year

-- Storage sales weaker but improved as the half year progressed

-- Sales of Flash memory controllers for the automotive infotainment market grew strongly

-- Encouraging early interest in new industrial class USB controller

-- Wireless sales improved towards the end of the half

-- Orders from two new customers for machine-to-machine applications

-- Sales into analogue telephony applications were lower across all major regions

Chris Gurry, Chairman and Chief Executive of CML, said:

"The Group continues to make good progress with its numerous

engineering, selling and market-related activities that are

directed at widening the product range, the customer base and the

addressable market areas. Whilst these activities are not expected

to contribute meaningfully to the current year, I am confident that

the product and management strategies being followed should allow

the Group to return to growth beyond this financial year."

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Chairman and Chief Tel: 01621 875 500

Executive

Nigel Clark, Financial Director

Cenkos Securities Plc Tel: 020 7397 8900

Jeremy Warner Allen (Sales)

Max Hartley (Corporate Finance)

SP Angel Corporate Finance Tel: 020 3463 2260

LLP

Jeff Keating

Walbrook PR Ltd Tel: 020 7933 8780 or cml@walbrookpr.com

Paul McManus Mob: 07980 541 893

Helen Cresswell Mob: 07841 917 679

Chairman and Chief Executive's statement and operational and

financial review

Overview

As anticipated, the results for the opening six months of the

financial year saw revenue from continuing operations down 21% to

GBP10.21m (2013: GBP12.99m), underlying profit before tax reduce by

62% to GBP1.24m (2013: GBP3.21m) and basic earnings per share fall

62% to 5.92p (2013: 15.73p). This performance arises from the

combined effects of previously communicated prior-year events

within our storage market along with some cyclical volatility

within wireless centred on regional government spending.

The results were in line with management budgets and, notably,

the outstanding order book at the end of September 2014 was

meaningfully ahead of the prior half year, supporting expectations

for a firmer second half performance.

The sale of semiconductors into industrial solid state storage

and removable card applications improved as the half year

progressed. Good advances were made with expanding future revenue

potential through a combination of new customer growth and a

broader product portfolio. Shipments of flash memory controller

integrated circuits ("ICs") for use within the automotive

infotainment market grew strongly and early interest shown in the

Group's new industrial class USB controller has been

encouraging.

The shipment of ICs into Wireless voice and data application

areas also improved towards the period end after commencing the

year at a relatively low level. The number of customers designing

end products that contain Group chip-set solutions increased and it

was particularly pleasing that initial orders were received from

two new customers who each serve differing machine-to-machine

("M2M") application areas.

Revenue from the sale of Telecom ICs into traditional analogue

telephony applications was lower and reflected a general weakness

across all of the major regions served.

Financial summary

Revenue of GBP10.21m combined with stable gross margin delivered

gross profit of GBP7.22m (2013: GBP9.21m). Distribution and

administration costs were flat at GBP6.17m (2013: GBP6.16m) with an

operating profit of GBP1.06m being recorded (2013: GBP3.06m). The

Group benefited from other operating income of GBP221k (2013:

GBP192k), principally EU grants and the rental income on

group-owned industrial properties. Finance income fell to GBP22k

(2013: GBP35k) as a result of lower interest rates on cash

reserves. Profit before tax amounted to GBP1.24m (2013:

GBP3.21m).

At the period end, cash reserves stood at GBP11.59m (31 March

2014: GBP11.37m) after payment of a GBP1.01m dividend in respect of

the prior year. Working capital was better controlled and further

enhanced by the receipt of a conditional customer-prepayment of

US$600k against a key new product development. The Group has no

borrowings.

Summary and outlook

Whilst it is disappointing to report interim results that

interrupt the Group's sustained growth record over recent years,

operating performance through the opening six-month period has

progressively improved and the results delivered meet both

management and market expectations.

In addition to a promising order book at 30 September 2014, new

order bookings since that date serve to reinforce expectations that

second half revenue should exceed the first.

The Group continues to make good progress with its numerous

engineering, selling and market-related activities that are

directed at widening the product range, the customer base and the

addressable market areas. Whilst these activities are not expected

to contribute meaningfully to the current year, I am confident that

the product and management strategies being followed should allow

the Group to return to growth beyond this financial year.

C. A. Gurry

Chairman and Chief Executive

17 November 2014

Condensed consolidated income statement

for the six months ended 30 September 2014

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/14 30/09/13 31/03/14

GBP'000 GBP'000 GBP'000

-------------------------------------------------------- ------------ ------------ --------

Continuing operations

Revenue 10,209 12,989 24,393

Cost of sales (2,986) (3,777) (6,511)

-------------------------------------------------------- ------------ ------------ --------

Gross profit 7,223 9,212 17,882

Distribution and administration costs (6,168) (6,156) (12,470)

-------------------------------------------------------- ------------ ------------ --------

1,055 3,056 5,412

Other operating income 221 192 474

-------------------------------------------------------- ------------ ------------ --------

Profit before share-based payments 1,276 3,248 5,886

Share-based payments (61) (69) (156)

-------------------------------------------------------- ------------ ------------ --------

Profit after share-based payments 1,215 3,179 5,730

Finance costs - - -

Finance income 22 35 62

-------------------------------------------------------- ------------ ------------ --------

Profit before taxation 1,237 3,214 5,792

Income tax expense (281) (710) (1,024)

-------------------------------------------------------- ------------ ------------ --------

Profit after taxation from continuing operations 956 2,504 4,768

Profit/(loss) from discontinued operations (see note 4) - - -

-------------------------------------------------------- ------------ ------------ --------

Profit for period attributable to equity owners of

the parent 956 2,504 4,768

-------------------------------------------------------- ------------ ------------ --------

Basic earnings per share

From continuing operations 5.92p 15.73p 29.96p

-------------------------------------------------------- ------------ ------------ --------

From profit for the year 5.92p 15.73p 29.96p

-------------------------------------------------------- ------------ ------------ --------

From discontinued operations - - -

-------------------------------------------------------- ------------ ------------ --------

Diluted earnings per share

From continuing operations 5.84p 15.73p 29.20p

-------------------------------------------------------- ------------ ------------ --------

From profit for the year 5.84p 15.73p 29.20p

-------------------------------------------------------- ------------ ------------ --------

From discontinued operations - - -

-------------------------------------------------------- ------------ ------------ --------

Condensed consolidated statement of comprehensive income

for the six months ended 30 September 2014

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/14 30/09/13 31/03/14

GBP'000 GBP'000 GBP'000

-------------------------------------------------------------------------------- ------------ ------------ --------

Profit for the period 956 2,504 4,768

Other comprehensive income:

Foreign exchange differences (258) (214) (302)

Actuarial loss on retirement benefit obligations - - 3,393

Income tax on actuarial loss - - (678)

-------------------------------------------------------------------------------- ------------ ------------ --------

Other comprehensive income for the period net of tax (258) (214) 2,413

-------------------------------------------------------------------------------- ------------ ------------ --------

Total comprehensive income for the period net of tax attributable to equity

owners of the

business 698 2,290 7,181

-------------------------------------------------------------------------------- ------------ ------------ --------

Condensed consolidated statement of financial position

as at 30 September 2014

Unaudited Unaudited Audited

30/09/14 30/09/13 31/03/14

GBP'000 GBP'000 GBP'000

------------------------------------------------------------ --------- --------- --------

Assets

Non-current assets

Property, plant and equipment 5,040 5,025 4,937

Investment properties 3,450 3,450 3,450

Development costs 7,258 5,611 6,188

Goodwill 3,512 3,512 3,512

Deferred tax asset 1,238 2,242 1,271

------------------------------------------------------------ --------- --------- --------

20,498 19,840 19,358

------------------------------------------------------------ --------- --------- --------

Current assets

Inventories 1,456 1,536 1,129

Trade receivables and prepayments 2,777 4,187 3,388

Current tax assets 191 - 283

Cash and cash equivalents 11,586 9,737 11,373

------------------------------------------------------------ --------- --------- --------

16,010 15,460 16,173

------------------------------------------------------------ --------- --------- --------

Non-current assets classified as held for sale - properties - 103 100

------------------------------------------------------------ --------- --------- --------

Total assets 36,508 35,403 35,631

------------------------------------------------------------ --------- --------- --------

Liabilities

Current liabilities

Trade and other payables 2,845 3,863 2,509

Current tax liabilities 446 422 274

------------------------------------------------------------ --------- --------- --------

3,291 4,285 2,783

------------------------------------------------------------ --------- --------- --------

Non-current liabilities

Deferred tax liabilities 2,291 2,058 2,224

Retirement benefit obligation 2,698 6,122 2,698

------------------------------------------------------------ --------- --------- --------

4,989 8,180 4,922

------------------------------------------------------------ --------- --------- --------

Total liabilities 8,280 12,465 7,705

------------------------------------------------------------ --------- --------- --------

Net assets 28,228 22,938 27,926

------------------------------------------------------------ --------- --------- --------

Capital and reserves attributable to equity owners of

the parent

Share capital 811 798 798

Share premium 5,614 5,060 5,070

Share-based payments reserve 388 240 327

Foreign exchange reserve (47) 299 211

Accumulated profits 21,462 16,541 21,520

------------------------------------------------------------ --------- --------- --------

Shareholders' equity 28,228 22,938 27,926

------------------------------------------------------------ --------- --------- --------

Condensed consolidated cash flow statements

for the 6 months ended 30 September 2014

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/14 30/09/13 31/03/14

GBP'000 GBP'000 GBP'000

------------------------------------------------- ------------ ------------ --------

Continuing operations

Operating activities

Net profit for the period before income taxes 1,237 3,217 5,792

Adjustments for:

Depreciation 110 124 255

Amortisation of development costs 1,408 1,109 2,588

Movement in pensions deficit - - 31

Share-based payments 61 69 156

Finance income (22) (35) (62)

Decrease/(Increase) in working capital 608 (959) (1,109)

------------------------------------------------- ------------ ------------ --------

Cash flows from operating activities 3,402 3,525 7,651

Income tax refunded/(paid) 151 65 (202)

------------------------------------------------- ------------ ------------ --------

Net cash flows from operating activities 3,553 3,590 7,449

------------------------------------------------- ------------ ------------ --------

Investing activities

Purchase of property, plant and equipment (256) (58) (103)

Investment in development costs (2,672) (2,067) (4,139)

Disposals of property, plant and equipment 52 4 5

Finance income 22 35 62

------------------------------------------------- ------------ ------------ --------

Net cash flows from investing activities (2,854) (2,086) (4,175)

------------------------------------------------- ------------ ------------ --------

Financing activities

Issue of ordinary shares 557 87 97

Decrease in bank loans and short-term borrowings - (338) (338)

Dividend paid to Group shareholders (1,014) (873) (873)

------------------------------------------------- ------------ ------------ --------

Net cash flows from financing activities (457) (1,124) (1,114)

------------------------------------------------- ------------ ------------ --------

Increase in cash and cash equivalents 242 380 2,160

------------------------------------------------- ------------ ------------ --------

Movement in cash and cash equivalents:

At start of period/year 11,373 9,323 9,323

Increase in cash and cash equivalents 242 380 2,160

Effects of exchange rate changes (29) 34 (110)

------------------------------------------------- ------------ ------------ --------

At end of period/year 11,586 9,737 11,373

------------------------------------------------- ------------ ------------ --------

Condensed consolidated statement of changes in equity

as at 30 September 2014

Foreign

Share Share Share-based exchange Accumulated

capital premium payments reserve profits Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

At 31 March 2013 794 4,977 171 513 14,910 21,365

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Profit for period 2,504 2,504

Other comprehensive income:

Foreign exchange differences (214) (214)

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Total comprehensive income for the period - - - (214) 2,504 2,290

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Transactions with owners in their capacity as owners:

Dividend paid (873) (873)

Issue of ordinary shares 4 83 87

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Total of transactions with owners in their capacity as

owners 4 83 - - (873) (786)

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Share-based payments 69 69

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

At 30 September 2013 798 5,060 240 299 16,541 22,938

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Profit for period 2,264 2,264

Other comprehensive income:

Foreign exchange differences (88) (88)

Actuarial loss on retirement benefit obligation 3,393 3,393

Deferred tax on actuarial losses (678) (678)

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Total comprehensive income for the period - - - (88) 4,979 4,891

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Transactions with owners in their capacity as owners

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Issue of ordinary shares 10 10

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Total of transactions with owners in their capacity as

owners: - 10 - - - 10

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Share-based payments 87 87

At 31 March 2014 798 5,070 327 211 21,520 27,926

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Profit for period 956 956

Other comprehensive income:

Foreign exchange differences (258) (258)

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Total comprehensive income for the period - - - (258) 956 698

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Transactions with owners in their capacity as owners:

Dividend paid (1,014) (1,014)

Issue of ordinary shares 13 544 557

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Total of transactions with owners in their capacity as

owners 13 544 - - (1,014) (457)

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Share-based payments 61 61

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

At 30 September 2014 811 5,614 388 (47) 21,462 28,228

------------------------------------------------------- ------- ------- ----------- -------- ----------- -------

Notes to the condensed consolidated financial statements

1 Segmental analysis

Business segments

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/14 30/09/13 31/03/14

------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Semi- Semi- Semi-

Discontinued conductor Discontinued conductor Discontinued conductor

Equipment components Group Equipment components Group Equipment components Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Revenue

By origination - 15,842 15,842 282 21,497 21,779 282 39,758 40,040

Inter-segmental

revenue - (5,633) (5,633) - (8,508) (8,508) - (15,365) (15,365)

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Segmental

revenue - 10,209 10,209 282 12,989 13,271 282 24,393 24,675

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Profit/(loss)

Segmental result - 1,215 1,215 3 3,179 3,182 3 5,729 5,732

---------------- ------------ ---------- ------------ ---------- ------------ ----------

Net financial

income 22 35 62

Income tax (281) (713) (1,026)

------- ------- --------

Profit after

taxation 956 2,504 4,768

------- ------- --------

Assets and

liabilities

Segmental assets - 31,629 31,629 - 29,608 29,608 - 30,527 30,527

---------------- ------------ ---------- ------------ ---------- ------------ ----------

Unallocated

corporate assets

Investment

property

(including held

for sale) 3,450 3,553 3,550

Deferred

taxation 1,238 2,242 1,271

Current tax

receivable 191 - 283

------- ------- --------

Consolidated

total assets 36,508 35,403 35,631

------- ------- --------

Segmental

liabilities - 2,845 2,845 - 3,863 3,863 - 2,509 2,509

---------------- ------------ ---------- ------------ ---------- ------------ ----------

Unallocated

corporate

liabilities

Deferred

taxation 2,291 2,058 2,224

Current tax

liability 446 422 274

Retirement

benefit

obligation 2,698 6,122 2,698

------- ------- --------

Consolidated

total

liabilities 8,280 12,465 7,705

------- ------- --------

Other segmental

information

Property, plant

and equipment

additions - 256 256 - 58 58 - 103 103

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Development cost

additions - 2,672 2,672 - 2,067 2,067 - 4,139 4,139

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Depreciation - 110 110 - 124 124 - 255 255

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Amortisation - 1,408 1,408 - 1,109 1,109 - 2,588 2,588

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Other

significant

non-cash income - - - - - - - 31 31

---------------- ------------ ---------- ------- ------------ ---------- ------- ------------ ---------- --------

Geographical segments

UK Germany Americas Far East Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------------- ------- ------- -------- -------- --------

Unaudited

Six months ended 30 September 2014

Revenue by origination 4,865 5,282 2,001 3,694 15,842

Inter geographical segmental revenue (2,170) (3,463) - - (5,633)

---------------------------------------------- ------- ------- -------- -------- --------

Revenue to third parties 2,695 1,819 2,001 3,694 10,209

---------------------------------------------- ------- ------- -------- -------- --------

Property, plant and equipment 4,909 114 14 3 5,040

---------------------------------------------- ------- ------- -------- -------- --------

Investment properties including held for sale 3,450 - - - 3,450

---------------------------------------------- ------- ------- -------- -------- --------

Goodwill - 3,512 - - 3,512

---------------------------------------------- ------- ------- -------- -------- --------

Development cost 2,655 4,603 - - 7,258

---------------------------------------------- ------- ------- -------- -------- --------

Total assets 24,991 8,131 1,473 1,913 36,508

---------------------------------------------- ------- ------- -------- -------- --------

Unaudited

Six months ended 30 September 2013

Revenue by origination 6,610 6,956 2,981 5,232 21,779

Inter geographical segmental revenue (2,870) (5,638) - - (8,508)

---------------------------------------------- ------- ------- -------- -------- --------

Revenue to third parties 3,740 1,318 2,981 5,232 13,271

---------------------------------------------- ------- ------- -------- -------- --------

Property, plant and equipment 4,826 70 123 6 5,025

---------------------------------------------- ------- ------- -------- -------- --------

Investment properties including held for sale 3,450 - 103 - 3,553

---------------------------------------------- ------- ------- -------- -------- --------

Goodwill - 3,512 - - 3,512

---------------------------------------------- ------- ------- -------- -------- --------

Development cost 2,148 3,463 - - 5,611

---------------------------------------------- ------- ------- -------- -------- --------

Total assets 23,918 7,134 1,930 2,421 35,403

---------------------------------------------- ------- ------- -------- -------- --------

Audited

Year ended 31 March 2014

Revenue by origination 12,574 11,930 5,856 9,680 40,040

Inter geographical segmental revenue (5,827) (9,538) - - (15,365)

---------------------------------------------- ------- ------- -------- -------- --------

Revenue to third parties 6,747 2,392 5,856 9,680 24,675

---------------------------------------------- ------- ------- -------- -------- --------

Property, plant and equipment 4,752 68 115 2 4,937

---------------------------------------------- ------- ------- -------- -------- --------

Investment properties including held for sale 3,450 - 100 - 3,550

---------------------------------------------- ------- ------- -------- -------- --------

Goodwill - 3,512 - - 3,512

---------------------------------------------- ------- ------- -------- -------- --------

Development cost 2,376 3,812 - - 6,188

---------------------------------------------- ------- ------- -------- -------- --------

Total assets 25,273 6,926 1,491 1,941 35,631

---------------------------------------------- ------- ------- -------- -------- --------

On 13 August 2013 Radio Data Technology Limited which represents

100% of the equipment segment went into liquidation and

consequently after that date the Group only has one segment.

Reported segments and their results in accordance with IFRS 8,

is based on internal management reporting information that is

regularly reviewed by the chief operating decision maker. The

measurement policies the Group uses for segmental reporting under

IFRS 8 are the same as those used in its financial statements.

Revenue

Geographical classification of continuing business turnover (by

destination)

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/14 30/09/13 31/03/14

GBP'000 GBP'000 GBP'000

--------------------------- ------------ ------------- ---------------

United Kingdom 473 357 823

Rest of Europe 2,640 2,197 4,325

Far East 4,538 6,732 12,386

Americas 2,336 3,396 6,263

Others 222 307 596

--------------------------- ------------ ------------- ---------------

10,209 12,989 24,393

--------------------------- ------------ ------------- ---------------

2 Dividend paid and proposed

A dividend of 6.25p per 5p ordinary share in respect of the year

ended 31 March 2014 was paid on 1 August 2014 (2013: 5.5p per

ordinary share of 5p in respect of the year ended 31 March 2013).

No dividend is proposed in respect of the six months period ended

30 September 2014 (2013: GBPNil per ordinary share of 5p in respect

of the period ended 30 September 2013).

3 Income tax

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of its subsidiary

undertakings and have provided on that basis.

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/14 30/09/13 31/03/14

GBP'000 GBP'000 GBP'000

--------------------------- ------------ ------------ --------

UK income tax credit (160) - (300)

Overseas income tax charge 285 174 364

--------------------------- ------------ ------------ --------

Total current tax charge 125 174 64

Deferred tax charge 156 536 960

--------------------------- ------------ ------------ --------

Reported income tax charge 281 710 1,024

--------------------------- ------------ ------------ --------

4 Discontinued operations

On 13 August 2013 Radio Data Technology Limited went into

liquidation and consequently qualifies as a discontinued operation.

The results of the discontinued operation which have been included

in the consolidated income statement are presented below:

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/14 30/09/13 31/03/14

GBP'000 GBP'000 GBP'000

-------------------------------------- ------------- ------------- ---------

Revenue - 282 282

Cost of sales - (171) (171)

-------------------------------------- ------------- ------------- ---------

Gross profit - 111 111

Distribution and administration costs - (108) (108)

-------------------------------------- ------------- ------------- ---------

Profit before taxation - 3 3

Taxation - (3) (3)

-------------------------------------- ------------- ------------- ---------

Profit from discontinued operations - - -

-------------------------------------- ------------- ------------- ---------

5 Earnings per share

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year.

Ordinary 5p shares

----------------------

Weighted

average Diluted

number number

----------------------------------- ---------- ----------

Six months ended 30 September 2014 16,152,635 16,376,911

----------------------------------- ---------- ----------

Six months ended 30 September 2013 15,915,946 16,296,334

----------------------------------- ---------- ----------

Year end 31 March 2014 15,917,895 16,332,587

----------------------------------- ---------- ----------

6 Investment properties

Investment properties are revalued at each discrete period end

by the Directors and every third year by independent Chartered

Surveyors on an open market basis. No depreciation is provided on

freehold investment properties or on leasehold investment

properties. In accordance with IAS 40, gains and losses arising on

revaluation of investment properties are shown in the income

statement. At 31 March 2012 the investment properties were

professionally valued by Everett Newlyn, Chartered Surveyors and

Commercial Property Consultants on an open market basis.

7 Analysis of cash flow movement in net cash

Net cash at 6 months end Net cash at 6 months end Net cash at 6 months end Net cash at

01/04/13 30/09/13 30/09/13 31/03/14 31/03/14 30/09/14 30/09/14

Cash flow Cash flow Cash flow

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ----------- ------------ ----------- ------------ ----------- ------------ -----------

Cash and cash

equivalents 9,323 414 9,737 1,636 11,373 213 11,586

Bank loans and

overdrafts (338) 338 - - - - -

------------------------ ----------- ------------ ----------- ------------ ----------- ------------ -----------

8,985 752 9,737 1,636 11,373 213 11,586

------------------------ ----------- ------------ ----------- ------------ ----------- ------------ -----------

The cash flow above is a combination of the actual cash flow and

the exchange movement.

8 Retirement benefit obligations

The Directors have not obtained an actuarial report in respect

of the defined benefit pension scheme for the purpose of this Half

Yearly Report.

9 Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with

foreign currencies and customer dependency. With the majority of

the Group's earnings being linked to the US Dollar, a decline in

this currency would have a direct effect on revenue, although since

the majority of the cost of sales are also linked to the US Dollar,

this risk is reduced at the gross profit line. Additionally, though

the Group has a very diverse customer base in certain market

segments, key customers can represent a significant amount of

revenue. Key customer relationships are closely monitored; however

changes in buying patterns of a key customer could have an adverse

effect on the Group's performance.

Key risks of a non-financial nature

The Group is a small player operating in a highly-competitive

global market, which is undergoing continual geographical change.

The Group's ability to respond to many competitive factors

including, but not limited to pricing, technological innovations,

product quality, customer service, manufacturing capabilities and

employment of qualified personnel will be key in the achievement of

its objectives, but its ultimate success will depend on the demand

for its customers' products since the Group is a component

supplier.

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve

its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements, the

enforceability of laws and contracts, changes in the tax laws,

terrorist activities, natural disasters or health epidemics.

10 Directors' statement pursuant to the Disclosure and

Transparency Rules

The Directors confirm that, to the best of their knowledge:

a) the condensed financial statements, prepared in accordance

with IFRS as adopted by the EU give a true and fair view of the

assets, liabilities, financial position and profit of the Group and

the undertakings included in the consolidation taken as a whole;

and

b) the condensed set of financial statements have been prepared

in accordance with IAS 34 "Interim Financial Reporting"; and

c) the Chairman and Chief Executive's statement and operational

and financial review include a fair review of the development and

performance of the business and the position of the Company and the

undertakings included in the consolidation taken as a whole

together with a description of the principal risks and

uncertainties that they face.

The Directors are also responsible for the maintenance and

integrity of the CML Microsystems Plc website. Legislation in the

UK governing the preparation and dissemination of the financial

statements may differ from legislation in other jurisdictions.

11 Basis of preparation

The basis of preparation and accounting policies used in

preparation of the Half Yearly Financial Report are the same

accounting policies set out in the year ended 31 March 2014

financial statements.

12 General

Other than already stated within the Chairman and Chief

Executive's statement and operational and financial review there

have been no important events during the first six months of the

financial year that have impacted this Half Yearly Financial

Report.

There have been no related party transactions or changes in

related party transactions described in the latest Annual Report

that could have a material effect on the financial position or

performance of the Group in the first six months of the financial

year.

The principal risks and uncertainties within the business are

contained within this report in note 9 above.

In the segmental analysis (note 1) inter-segmental transfers or

transactions are entered into under commercial terms and conditions

appropriate to the location of the entity whilst considering that

the parties are related.

This Half Yearly Financial Report includes a fair review of the

information required by DTR 4.2.7/8 (indication of important events

and their impact, and description of principal risks and

uncertainties for the remaining six months of the financial

year).

This Half Yearly Financial Report does not include all the

information and disclosures required in the Annual Report, and

should be read in conjunction with the consolidated Annual Report

for the year ended 31 March 2014.

The financial information contained in this Half Yearly

Financial Report has been prepared using International Financial

Reporting Standards as adopted by the European Union. This Half

Yearly Financial Report does not constitute statutory accounts as

defined by Section 434 of the Companies Act 2006. The financial

information for the year ended 31 March 2014 is based on the

statutory accounts for the financial year ended 31 March 2014 that

have been filed with the Registrar of Companies and on which the

Auditor gave an unqualified audit opinion.

The Auditor's report on those accounts did not contain a

statement under Section 498(2) or (3) of the Companies Act 2006.

This Half Yearly Financial Report has not been audited or reviewed

by the Group Auditor.

A copy of this Half Yearly Financial Report can be viewed on the

Company website www.cmlmicroplc.com

13 Approvals

The Directors approved this Half Yearly Report on 17 November

2014.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGGBPGUPCGQM

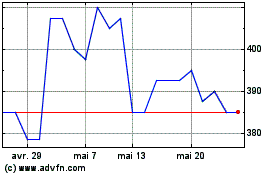

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024