TIDMCML

RNS Number : 6814G

CML Microsystems PLC

24 November 2015

CML Microsystems Plc

INTERIM RESULTS

CML Microsystems Plc ("CML"), which designs, manufactures and

markets a broad range of semiconductor products, primarily for the

global communication and data storage markets, announces Interim

Results for the six months ended 30 September 2015.

Financial Highlights

-- Group revenues up 8% to GBP11.00m (H1 2014: GBP10.21m)

-- Gross profit up 10% to GBP7.98m (H1 2014: GBP7.22m)

-- Underlying profit before tax up 22% to GBP1.51m (H1 2014: GBP1.24m)

-- Basic EPS up 30% to 7.69p (H1 2014: 5.92p)

-- Cash reserves of GBP12.26m (31 March 2015: GBP13.19m) - after GBP1.12m dividend payment

Operational Highlights

-- Release of two new RF ICs suitable for the global industrial wireless markets

-- SD and USB flash memory controller products continue to win "design-ins"

-- Strengthened marketing, sales and support resources

-- Higher investment in new product development

Chris Gurry, Group Managing Director of CML, said: "The first

six months of the current trading year produced a meaningful

advance in revenue and profitability against the comparable

period.

"Whilst the recent signals from some market areas necessitate an

air of caution, the Board's current expectations are for a

sequential revenue improvement and for a full year advance in

profitability."

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Group Managing Tel: 01621 875 500

Director

Neil Pritchard, Group Financial

Director

Cenkos Securities Plc Tel: 020 7397 8900

Jeremy Warner Allen (Sales)

Max Hartley (Corporate Finance)

SP Angel Corporate Finance Tel: 020 3463 2260

LLP

Jeff Keating

Walbrook PR Ltd Tel: 020 7933 8780 or cml@walbrookpr.com

Paul McManus Mob: 07980 541 893

Helen Cresswell Mob: 07841 917 679

Chairman's statement

I am pleased to state that as expected the Group has moved

forward, increasing both sales revenue and profitability when

compared to the same period last year. Results reported are broadly

in line with expectations despite current global market conditions

becoming more difficult.

In the first six month period to 30 September 2015, sales

revenues increased 8% to GBP11.00m (2014: GBP10.21m) and pre-tax

profits increased by 22% to GBP1.51m (2014: GBP1.24m). Cash at the

period end reduced compared to the March year end mainly as a

result of payment of the dividend, the planned increase in

development expenditure and the purchase of our own shares to be

held in treasury.

Recently, one or two of the market areas addressed are showing

signs of softness and a small number of customers have delayed the

launch of their new products, albeit only by a few months. This

appears to be a short-term problem that has reduced the Board's

expected growth rate for the second half. Despite this caveat, the

Board remains confident that the Group will move forward for the

financial year as a whole.

The Group's visible growth opportunities provide me with clear

evidence that the execution of the Board's strategy is driving

progress, regardless of the short-term headwinds in some market

areas. I am confident of a more significant improvement in the

results over the medium and longer term.

As always the progress of any business is dependent upon the

quality and dedication of its employees. The Board wishes to thank

its employees worldwide for the performance and commitment they

have shown throughout this period.

Nigel Clark

Group Non-Executive Chairman

24 November 2015

Group Managing Director's statement and operational and

financial review

Operational and Financial Review

The first six months of the current trading year produced a

meaningful advance in revenue and profitability against the

comparable period. Total sales reported to 30 September 2015 were

GBP11.00m representing an increase of 8% (2014: GBP10.21m).

The overall rise was a result of improved trading from each of

the three major market areas addressed; namely Storage, Wireless

and Wireline Telecoms. Geographically, shipments into the Far East

recorded the largest gain whilst across the customer base, the

majority of the Group's current top customers increased their

spend.

Gross margin remained robust and drove gross profit 10% higher

to GBP7.98m (2014: GBP7.22m). As previously communicated, the Group

continued to invest in marketing, sales and support resources

whilst simultaneously maintaining high levels of R&D

investment. Distribution and administration costs increased to

GBP6.62m (2014: GBP6.17m), delivering an operational profit (before

share-based payments and finance income) of GBP1.54m (2014:

GBP1.28m).

Other operating income, principally rental proceeds from

commercial properties and regional engineering development grants,

fell to GBP0.19m (2014: GBP0.22m).

Profit before taxation advanced by over 22% to GBP1.51m (2014:

GBP1.24m) delivering a diluted earnings per share of 7.65p (2014:

5.84p).

Cash balances at 30 September 2015 stood at GBP12.26m which is a

reduction on the 31 March 2015 position of GBP13.19m due mainly to

the payment of a GBP1.12m dividend and the increased investment in

development costs.

Summary

The trading performance through the first half of the current

financial year was ahead of the comparable period and reflected the

Group's multifaceted approach to delivering growth.

Advances were made with strengthening our marketing, sales and

support resources and new product development activities continue

to receive high levels of investment.

In recent months, the Group has released two new RF ICs suitable

for global industrial wireless applications along with a focused

baseband processing solution for Digital Mobile Radio (DMR).

For the industrial storage markets, our SD and USB flash memory

controller products continue to gain acceptance at the design-in

and qualification level, although the sale of SATA interface

controllers has been slower than expected. Ongoing activities are

directed towards those market sub-segments that we believe will

deliver on our multi-year growth objectives.

Outlook

Despite the improvement in first half results, it is important

to convey that a number of the end markets the Group addresses are

going through technological change with respective Group customers

at varying stages of adoption, market introduction and

manufacturing ramp. Predicting the timing of some of these end

market transitions is challenging.

Whilst the recent signals from some market areas necessitate an

air of caution, the Board's current expectations are for a

sequential revenue improvement and for a full year advance in

profitability.

Chris Gurry

Group Managing Director

24 November 2015

Condensed consolidated income statement

for the six months ended 30 September 2015

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/15 30/09/14 31/03/15

GBP'000 GBP'000 GBP'000

--------------------------------------------------- ------------ ------------ --------

Continuing operations

Revenue 11,003 10,209 21,804

Cost of sales (3,027) (2,986) (6,339)

--------------------------------------------------- ------------ ------------ --------

Gross profit 7,976 7,223 15,465

Distribution and administration costs (6,623) (6,168) (12,777)

--------------------------------------------------- ------------ ------------ --------

1,353 1,055 2,688

Other operating income 190 221 419

--------------------------------------------------- ------------ ------------ --------

Profit before share-based payments 1,543 1,276 3,107

Share-based payments (49) (61) (95)

--------------------------------------------------- ------------ ------------ --------

Profit after share-based payments 1,494 1,215 3,012

Revaluation of investment properties - - 100

Finance income 20 22 66

--------------------------------------------------- ------------ ------------ --------

Profit before taxation 1,514 1,237 3,178

Income tax expense (266) (281) (476)

--------------------------------------------------- ------------ ------------ --------

Profit after taxation from continuing operations 1,248 956 2,702

Profit for period attributable to equity owners of

the parent 1,248 956 2,702

--------------------------------------------------- ------------ ------------ --------

Basic earnings per share

From continuing operations 7.69p 5.92p 16.71p

--------------------------------------------------- ------------ ------------ --------

From profit for the year 7.69p 5.92p 16.71p

--------------------------------------------------- ------------ ------------ --------

Diluted earnings per share

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:00 ET (07:00 GMT)

From continuing operations 7.65p 5.84p 16.51p

--------------------------------------------------- ------------ ------------ --------

From profit for the year 7.65p 5.84p 16.51p

--------------------------------------------------- ------------ ------------ --------

Condensed consolidated statement of comprehensive income

for the six months ended 30 September 2015

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/15 30/09/14 31/03/15

GBP'000 GBP'000 GBP'000

-------------------------------------------------------------------------------- ------------ ------------ --------

Profit for the period 1,248 956 2,702

Other comprehensive income:

Foreign exchange differences 65 (258) (477)

Actuarial loss on retirement benefit obligations - - (1,133)

Deferred tax on actuarial loss - - 227

-------------------------------------------------------------------------------- ------------ ------------ --------

Other comprehensive income/(expense) for the period net of tax attributable to

equity holders

of the parent 65 (258) (1,383)

-------------------------------------------------------------------------------- ------------ ------------ --------

Total comprehensive income for the period net of tax attributable to equity

holders of the

parent 1,313 698 1,319

-------------------------------------------------------------------------------- ------------ ------------ --------

Condensed consolidated statement of financial position

as at 30 September 2015

Unaudited Unaudited Audited

30/09/15 30/09/14 31/03/15

GBP'000 GBP'000 GBP'000

------------------------------------------------------ --------- --------- --------

Assets

Non-current assets

Property, plant and equipment 5,146 5,040 4,976

Investment properties 3,550 3,450 3,550

Development costs 8,289 7,258 6,984

Goodwill 3,512 3,512 3,512

Deferred tax asset 1,301 1,238 1,310

------------------------------------------------------ --------- --------- --------

21,798 20,498 20,332

------------------------------------------------------ --------- --------- --------

Current assets

Inventories 1,779 1,456 1,763

Trade receivables and prepayments 2,525 2,777 2,864

Current tax assets 767 191 628

Cash and cash equivalents 12,263 11,586 13,188

------------------------------------------------------ --------- --------- --------

17,334 16,010 18,443

------------------------------------------------------ --------- --------- --------

Total assets 39,132 36,508 38,775

------------------------------------------------------ --------- --------- --------

Liabilities

Current liabilities

Trade and other payables 3,583 2,845 3,471

Current tax liabilities 246 446 196

------------------------------------------------------ --------- --------- --------

3,829 3,291 3,667

------------------------------------------------------ --------- --------- --------

Non-current liabilities

Deferred tax liabilities 2,654 2,291 2,513

Retirement benefit obligation 3,624 2,698 3,624

------------------------------------------------------ --------- --------- --------

6,278 4,989 6,137

------------------------------------------------------ --------- --------- --------

Total liabilities 10,107 8,280 9,804

------------------------------------------------------ --------- --------- --------

Net assets 29,025 28,228 28,971

------------------------------------------------------ --------- --------- --------

Capital and reserves attributable to equity owners of

the parent

Share capital 813 811 813

Share premium 5,700 5,614 5,700

Treasury shares - own share reserve (190) - -

Share-based payments reserve 336 388 287

Foreign exchange reserve (201) (47) (266)

Accumulated profits 22,567 21,462 22,437

------------------------------------------------------ --------- --------- --------

Total shareholders' equity 29,025 28,228 28,971

------------------------------------------------------ --------- --------- --------

Condensed consolidated cash flow statement

for the six months ended 30 September 2015

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/15 30/09/14 31/03/15

GBP'000 GBP'000 GBP'000

------------------------------------------------- ------------ ------------ --------

Operating activities

Net profit for the period before taxation 1,514 1,237 3,178

Adjustments for:

Depreciation 121 110 267

Amortisation of development costs 1,661 1,408 3,224

Revaluation of investment properties - - (100)

Movement in pension net costs - - (207)

Share-based payments 49 61 95

Profit on sale of plant and equipment - - (4)

Finance income (20) (22) (66)

Movement in working capital 435 608 852

------------------------------------------------- ------------ ------------ --------

Cash flows from operating activities 3,760 3,402 7,239

Income tax (paid)/refunded (174) 151 (270)

------------------------------------------------- ------------ ------------ --------

Net cash flows from operating activities 3,586 3,553 6,969

------------------------------------------------- ------------ ------------ --------

Investing activities

Purchase of property, plant and equipment (290) (256) (318)

Investment in development costs (2,905) (2,672) (4,363)

Disposals of property, plant and equipment - 52 12

Finance income 20 22 66

------------------------------------------------- ------------ ------------ --------

Net cash flows from investing activities (3,175) (2,854) (4,603)

------------------------------------------------- ------------ ------------ --------

Financing activities

Issue of ordinary shares - 557 645

Purchase of treasury shares (190) - -

Dividend paid to Group shareholders (1,118) (1,014) (1,013)

------------------------------------------------- ------------ ------------ --------

Net cash flows from financing activities (1,308) (457) (368)

------------------------------------------------- ------------ ------------ --------

(Decrease)/increase in cash and cash equivalents (897) 242 1,998

------------------------------------------------- ------------ ------------ --------

Movement in cash and cash equivalents:

At start of period/year 13,188 11,373 11,373

(Decrease)/increase in cash and cash equivalents (897) 242 1,998

Effects of exchange rate changes (28) (29) (183)

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:00 ET (07:00 GMT)

------------------------------------------------- ------------ ------------ --------

At end of period/year 12,263 11,586 13,188

------------------------------------------------- ------------ ------------ --------

Condensed consolidated statement of changes in equity

for the six months ended 30 September 2015

Share Share Treasury Share-based Foreign exchange Accumulated

capital premium shares payments reserve profits Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

At 31 March 2014 798 5,070 - 327 211 21,520 27,926

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Profit for period 956 956

Other comprehensive income:

Foreign exchange differences (258) (258)

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Total comprehensive income for the

period - - - - (258) 956 698

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Transactions with owners in their

capacity as owners:

Dividend paid (1,014) (1,014)

Issue of ordinary shares 13 544 557

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Total of transactions with owners

in their capacity as owners: 13 544 - - - (1,014) (457)

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Share-based payments 61 61

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

At 30 September 2014 811 5,614 - 388 (47) 21,462 28,228

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Profit for period 1,746 1,746

Other comprehensive income:

Foreign exchange differences (219) (219)

Actuarial loss on retirement

benefit obligation (1,133) (1,133)

Deferred tax on actuarial losses 227 227

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Total comprehensive income for the

period - - - - (219) 840 621

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Transactions with owners in their

capacity as owners:

Issue of ordinary shares 2 86 88

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Total of transactions with owners

in their capacity as owners: 2 86 - - - - 88

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Share-based payments 34 34

Cancellation/transfer of

share-based payments (135) 135 -

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

At 31 March 2015 813 5,700 - 287 (266) 22,437 28,971

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Profit for period 1,248 1,248

Other comprehensive income:

Foreign exchange differences 65 65

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Total comprehensive income for the

period - - - - 65 1,248 1,313

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Transactions with owners in their

capacity as owners:

Dividend paid (1,118) (1,118)

Purchase of treasury shares (190) (190)

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Total of transactions with owners

in their capacity as owners: - - (190) - - (1,118) (1,308)

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Share-based payments 49 49

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

At 30 September 2015 813 5,700 (190) 336 (201) 22,567 29,025

---------------------------------- ------- ------- -------- ----------- ---------------- -------------- -------

Notes to the condensed consolidated financial statements

for the six months ended 30 September 2015

1 Segmental analysis

Business segment

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/15 30/09/14 31/03/15

---------- ------- ---------- ------- ---------- --------

Semi- Semi- Semi-

conductor conductor conductor

components Group components Group components Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ---------- ------- ---------- ------- ---------- --------

Revenue

By origination 17,423 17,423 15,842 15,842 34,031 34,031

Inter-segmental revenue (6,420) (6,420) (5,633) (5,633) (12,227) (12,227)

------------------------------------- ---------- ------- ---------- ------- ---------- --------

Segmental revenue 11,003 11,003 10,209 10,209 21,804 21,804

------------------------------------- ---------- ------- ---------- ------- ---------- --------

Profit/(loss)

Segmental result 1,494 1,494 1,215 1,215 3,012 3,012

------------------------------------- ---------- ---------- ----------

Revaluation of investment properties - - 100

Net financial income 20 22 66

Income tax (266) (281) (476)

------- ------- --------

Profit after taxation 1,248 956 2,702

------- ------- --------

Assets and liabilities

Segmental assets 33,514 33,514 31,629 31,629 33,287 33,287

------------------------------------- ---------- ---------- ----------

Unallocated corporate assets

Investment properties 3,550 3,450 3,550

Deferred tax assets 1,301 1,238 1,310

Current tax receivable 767 191 628

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:00 ET (07:00 GMT)

------- ------- --------

Consolidated total assets 39,132 36,508 38,775

------- ------- --------

Segmental liabilities 3,583 3,583 2,845 2,845 3,471 3,471

------------------------------------- ---------- ---------- ----------

Unallocated corporate

liabilities

Deferred tax liabilities 2,654 2,291 2,513

Current tax liabilities 246 446 196

Retirement benefit obligation 3,624 2,698 3,624

------- ------- --------

Consolidated total liabilities 10,107 8,280 9,804

------- ------- --------

Other segmental information

Property, plant and equipment

additions 290 290 256 256 318 318

------------------------------------- ---------- ------- ---------- ------- ---------- --------

Development cost additions 2,905 2,905 2,672 2,672 4,363 4,363

------------------------------------- ---------- ------- ---------- ------- ---------- --------

Depreciation 121 121 110 110 267 267

------------------------------------- ---------- ------- ---------- ------- ---------- --------

Amortisation 1,661 1,661 1,408 1,408 3,224 3,224

------------------------------------- ---------- ------- ---------- ------- ---------- --------

Other significant non-cash income - - - - 307 307

------------------------------------- ---------- ------- ---- ---------- ------- ----- ---------- --------

Geographical segments

UK Rest of Europe Americas Far East Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ------- -------------- -------- -------- --------

Unaudited

Six months ended 30 September 2015

Revenue by origination 5,101 5,577 2,562 4,183 17,423

Inter-segmental revenue (2,518) (3,902) - - (6,420)

----------------------------------- ------- -------------- -------- -------- --------

Revenue to third parties 2,583 1,675 2,562 4,183 11,003

----------------------------------- ------- -------------- -------- -------- --------

Property, plant and equipment 5,022 97 11 16 5,146

----------------------------------- ------- -------------- -------- -------- --------

Investment properties 3,550 - - - 3,550

----------------------------------- ------- -------------- -------- -------- --------

Goodwill - 3,512 - - 3,512

----------------------------------- ------- -------------- -------- -------- --------

Development costs 2,906 5,383 - - 8,289

----------------------------------- ------- -------------- -------- -------- --------

Total assets 25,538 10,162 1,325 2,107 39,132

----------------------------------- ------- -------------- -------- -------- --------

Unaudited

Six months ended 30 September 2014

Revenue by origination 4,865 5,282 2,001 3,694 15,842

Inter-segmental revenue (2,170) (3,463) - - (5,633)

----------------------------------- ------- -------------- -------- -------- --------

Revenue to third parties 2,695 1,819 2,001 3,694 10,209

----------------------------------- ------- -------------- -------- -------- --------

Property, plant and equipment 4,909 114 14 3 5,040

----------------------------------- ------- -------------- -------- -------- --------

Investment properties 3,450 - - - 3,450

----------------------------------- ------- -------------- -------- -------- --------

Goodwill - 3,512 - - 3,512

----------------------------------- ------- -------------- -------- -------- --------

Development costs 2,655 4,603 - - 7,258

----------------------------------- ------- -------------- -------- -------- --------

Total assets 24,991 8,131 1,473 1,913 36,508

----------------------------------- ------- -------------- -------- -------- --------

Audited

Year ended 31 March 2015

Revenue by origination 10,134 10,627 4,688 8,582 34,031

Inter-segmental revenue (5,036) (7,190) - (1) (12,227)

----------------------------------- ------- -------------- -------- -------- --------

Revenue to third parties 5,098 3,437 4,688 8,581 21,804

----------------------------------- ------- -------------- -------- -------- --------

Property, plant and equipment 4,849 104 14 9 4,976

----------------------------------- ------- -------------- -------- -------- --------

Investment properties 3,550 - - - 3,550

----------------------------------- ------- -------------- -------- -------- --------

Goodwill - 3,512 - - 3,512

----------------------------------- ------- -------------- -------- -------- --------

Development costs 2,440 4,544 - - 6,984

----------------------------------- ------- -------------- -------- -------- --------

Total assets 27,060 8,388 1,370 1,957 38,775

----------------------------------- ------- -------------- -------- -------- --------

Segmental reporting is in accordance with IFRS 8, is based on

internal management reporting information that is regularly

reviewed by the chief operating decision maker. The measurement

policies the Group uses for segmental reporting under IFRS 8 are

the same as those used in its full year financial statements.

Revenue

The geographical classification of business turnover (by

destination) is as follows:

Unaudited Unaudited Audited

6 months 6 months

end end Year end

30/9/15 30/9/14 31/3/15

GBP'000 GBP'000 GBP'000

---------------- ---------- ---------- ---------

United Kingdom 495 473 853

Rest of Europe 2,379 2,640 5,220

Far East 5,205 4,538 10,438

Americas 2,745 2,336 4,804

Other 179 222 489

---------------- ---------- ---------- ---------

11,003 10,209 21,804

---------------- ---------- ---------- ---------

2 Dividend paid and proposed

A dividend of 6.9p per 5p ordinary share in respect of the year

ended 31 March 2015 was paid on 3 August 2015 (2014: 6.25p per

ordinary share of 5p in respect of the year ended 31 March 2014).

No dividend is proposed in respect of the six months period ended

30 September 2015 (2014: GBPNil per ordinary share of 5p in respect

of the period ended 30 September 2014).

3 Income tax

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of its subsidiary

undertakings and have provided on that basis.

Unaudited Unaudited Audited

6 months end 6 months end Year end

30/09/15 30/09/14 31/03/15

GBP'000 GBP'000 GBP'000

---------------------------------- ------------ ------------ --------

UK income tax credit (167) (160) (598)

Overseas income tax charge 283 285 430

---------------------------------- ------------ ------------ --------

Total current tax charge/(credit) 116 125 (168)

Deferred tax charge 150 156 644

---------------------------------- ------------ ------------ --------

Reported income tax charge 266 281 476

---------------------------------- ------------ ------------ --------

4 Earnings per share

(MORE TO FOLLOW) Dow Jones Newswires

November 24, 2015 02:00 ET (07:00 GMT)

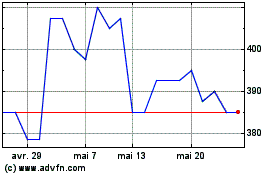

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024