TIDMCML

RNS Number : 0674B

CML Microsystems PLC

14 June 2016

CML Microsystems Plc

FULL YEAR RESULTS

CML Microsystems Plc ("CML" or "the Group"), which designs,

manufactures and markets mixed-signal and Radio Frequency (RF)

semiconductors, primarily for global communication and solid state

storage markets, announces Full Year Results for the year ended 31

March 2016.

These results reflect a full year return to profitable growth

with new product releases achieving market penetration across their

target segments during the year. The Company also continued to make

significant investments in new product development and operational

improvements during the year to ensure this profitable growth

trajectory can be sustained in the current year and beyond.

Financial Highlights

-- Group revenues of GBP22.83m (2015: GBP21.80m)

-- Gross profit of GBP16.25m (2015: GBP15.47m)

-- Profit before tax of GBP3.32m (2015: GBP3.18m)

-- Basic EPS up 8% to 18.03p (2015: 16.71p)

-- Final dividend increased to 7.0p (2015: 6.9p)

-- Debt free and net cash increased to GBP13.60m (2015: GBP13.19m)

Operational Highlights

-- Storage: 51% of group revenue

o Revenue up 8% to GBP11.65m (2015: GBP10.82m)

o Product range now includes CompactFlash, SATA, SD and

USB2/USB3 interface technologies, with the USB3 launched in

February this year

o Growth drivers included increased sales of new products and

the growth in in-vehicle infotainment (IVI) markets

o Operational investments and improvements delivered on budget

and on-time respectively with further investment in field-based

application engineers completed during the period

-- Wireless: 36% of group revenues

o Revenue marginally down at GBP8.21m (2015: GBP8.28m)

o Delayed customer product shipments, announced at the half year

stage, re-commenced by the financial year end

o Voice-centric markets, transitioning from analogue to digital,

present significant growth opportunity going forward

-- Wireline telecom: 11% of group revenues

o Revenue up 13% to GBP2.57m (GBP2.28m)

o Market share growth across all major regions with China

showing year-on-year growth, particularly for high-speed wireline

modems

Chris Gurry, Group Managing Director of CML, said: "Financial

year 2016 represented a steady period of organic progress and

delivered a return to sales and profit growth, as expected. It was

a record year of R&D investment, with an amount equal to 27% of

Group turnover invested in new products that will ultimately

position the Group to increase its market share. New ICs that were

launched during the year offered either enhanced performance or

closed a gap in the existing product range.

"Over the current year, the Board expects a further advance in

revenues and profitability and a continuing pipeline of new

semiconductor solutions that address a wider range of end-customer

requirements and additional market areas. Our goal is to be the

first choice key component supplier within our chosen

end-markets."

CML Microsystems plc www.cmlmicroplc.com

Chris Gurry, Group Managing Tel: +44 (0) 1621 875 500

Director

Neil Pritchard, Group

Financial Director

Cenkos Securities plc Tel: +44 (0) 20 7397 8900

Jeremy Warner Allen (Sales)

Max Hartley (Corporate

Finance)

SP Angel Corporate Finance Tel: +44 (0) 20 3463 2260

LLP

Jeff Keating

Walbrook PR Ltd Tel: +44 (0) 20 7933 8780

/ cml@walbrookpr.com

Paul Cornelius

Helen Cresswell

Paul Whittington

CHAIRMAN'S STATEMENT

Introduction

The CML Group is a business based upon world class products, an

inherent knowledge of the markets it addresses and growing global

coverage. This is all supported by a strong balance sheet that

includes significant cash reserves. These factors give CML the

ability to stay focused on its strategic goals in the knowledge

that the fundamental business stability is intact, allowing

investment today where the return on those investments can be some

way in the future.

The need to improve market coverage in the Far East and more

specifically in China to drive growth in that market, coupled with

the opportunity to acquire a company with complementary solutions,

led to the identification of Sicomm and the recently announced

intended acquisition. Although I expect this acquisition will

enhance the Group's performance in the coming year I must also

stress that this is an important strategic move targeted to give a

long term benefit. Sicomm brings improved market access and

customer support geographically whilst also increasing our product

range. This acquisition builds on our existing resources in the

region and provides an established Chinese trading operation with

an instant impact. Coupling these benefits with those of the

complimentary product line, which has yet to be fully marketed

globally, demonstrates the compelling nature of this

acquisition.

Results and dividend

Revenues increased 5% to GBP22.83m (2015: GBP21.80m) marginally

ahead of market expectations, profit before taxation increased by

4% to GBP3.32m (2015: GBP3.18m) and basic EPS increased 8% to

18.03p (2015: 16.71p). Importantly, in a year of significant

development expenditure, cash increased to GBP13.60m (2015:

GBP13.19m) and net assets moved up to a record GBP32.58m (2015:

GBP28.97m).

The need for strong cash reserves in the business is important

in fulfilling the expansion strategy and so, as always, there is a

requirement to balance the needs of the Group whilst also being

mindful that shareholder return expectations are met in both the

short and long term. In light of the progress made this year,

coupled with the continued confidence in the Group's financial

position and future prospects the Board is pleased to recommend a

slightly increased dividend to 7.0p (2015: 6.9p). If approved, this

dividend will be paid on 29 July 2016 to shareholders whose names

appear on the register at the close of business on 24 June

2016.

Management

With the reorganisation and strengthening of the Group's senior

management team in 2015 we have had the opportunity through this

year to focus on improving operational effectiveness globally. This

process, though started, is ongoing and is expected to be enhanced

still further with the technical capabilities and market knowledge

of the new Sicomm team. Product innovation, focussed sales efforts

and driving efficiency are all priorities for the management

team.

Prospects and outlook

The Board's core strategy of sustainable growth remains

paramount and as stated in my report last year we will pursue this

strategy utilising our strong balance sheet to invest in growth,

both organically and through targeted acquisitions. Through this

year we expect to be integrating Sicomm but this will not detract

from pursuing appropriate opportunities should they be

presented.

What must not be forgotten is that the key to moving forward in

any business is the contribution from the workforce and our

employees across the world, as always, have been crucial to

achieving our goals. They have consistently met the demands placed

on them with innovation, passion and commitment which is much

appreciated and I would like to place on record the Board's

appreciation and gratitude for this.

In summary we start this year with a clear direction but still

have much to do. We have returned to growth and I am confident CML

is well positioned for further progress in the year ahead on the

back of our innovative products and market traction gained, but as

always, there will likely be challenges. What is pleasing is that

the fundamentals of the business remain sound, and my confidence

this year is underpinned by the positive trend in order bookings in

the second half of the year just finished coupled with the strong

and enthusiastic management team.

N G Clark

Group Non-Executive Chairman

OPERATING AND FINANCIAL REVIEW

Introduction

At the beginning of the financial year under review we predicted

revenue and profits growth, high levels of engineering investment,

and expansion of our marketing and customer facing resources. It is

pleasing to report that we have made firm progress in each of those

areas placing the business in a stronger position than it was one

year ago.

Total sales for the period moved higher, key new product

launches occurred within both the Storage and Wireless

semiconductor categories, additional selling and support resources

were added in each major region and the number of meaningful

customer opportunities grew.

Towards the end of the financial year we also took the decision

to re-organise our operational structure in the Americas region.

The changes made, once fully enacted, will enhance our focus within

this important market region and also provide a scalable structure

that better suits the Group's multi-faceted growth strategy.

Results

Group turnover for the year to 31 March 2016 amounted to

GBP22.83m representing an increase of 5% against the prior full

year (2015: GBP21.80m). The growth was driven by advances in

Storage and Wireline Telecom revenues whilst geographically,

improvements were recorded in each of the main territories

addressed; namely the Far East, Americas and Europe. That said, it

is important to note that annual revenue comparisons by region can

be misleading as some customers can and do alter their

manufacturing locations periodically. Revenue analysis at a market

sector level is covered later in this report.

Sales in the second half of the year improved by 8% compared to

the first six-month period and new order bookings in the final

months of the year were notably stronger.

Stable gross margins delivered a gross profit for the period of

GBP16.25m (2015: GBP15.47m).

Distribution and administration (D&A) costs rose to

GBP13.27m (2015: GBP12.78m) due partly to an increase in staff

costs, associated with the investment in sales, marketing and

engineering support resources (GBP0.29m) but also resulting from

the lack of the prior year IAS19 pension credit (GBP0.22m). The

overall amortisation level was higher at GBP3.33m (2015: GBP3.22m),

with the positive effect of aligning amortisation and

capitalisation procedures across the Group cancelled out by a

GBP0.58m negative swing in foreign exchange benefit compared to the

previous year.

R&D costs for the year were markedly higher, as expected.

Total expenditure for the year amounted to GBP6.09m and represents

an increase of 16% (2015: GBP5.21m). Of this total, GBP0.73m was

expensed and is included within the D&A figure (2015:

GBP0.85m).

Other income consists of amounts received from the commercial

rental of Group-owned property assets that are now surplus to

operational requirements and from the award of EU grants associated

with specific engineering development activities. The amount

recorded this year was GBP0.41m (2015: GBP0.42m). Rental income

increased through the year and EU funding decreased.

Profit from operations increased by 9% to GBP3.39m compared to a

figure of GBP3.11m for the prior year. Despite healthy cash

balances, finance income reflected the low prevailing interest

rates that exist globally. After accounting for share-based

payments and finance income, a profit before tax of GBP3.32m was

posted (2015: GBP3.18m) representing growth of 4%.

The Group continued to benefit from UK tax credits associated

with some of its R&D activities and that is the primary driver

behind the lower than average tax rate achieved. An income tax

expense of GBP0.40m was posted against a prior year expense of

GBP0.48m.

Profit after tax amounted to GBP2.93m (2015: GBP2.70m).

The Group's cash reserves at 31 March 2016 stood at GBP13.60m,

representing an increase of GBP0.41m when compared to the same

cut-off date one year earlier (31/3/15: GBP13.19m). The balance

reported follows a record spend on R&D (GBP6.09m), payment of a

dividend in respect of the prior financial year (GBP1.12m), capital

expenditure of GBP0.44m and the payment of an escrow deposit in

respect of the Sicomm acquisition that was announced on 27 May 2016

(GBP0.33m).

Included in the cash balance is a conditional customer

prepayment of approximately GBP1.39m (2015: GBP0.67m) against

future product purchases. Initial deliveries to the customer in

question commenced in the final months of the financial year.

Inventory levels at the year-end totalled GBP1.57m (2015:

GBP1.76m) and comprised slightly higher raw material levels and

lower finished goods stock levels when compared to the previous

year.

Pension scheme

The Group operates a number of pension schemes globally which

are generally money purchase type schemes with a minimum employee

contribution level required in order to trigger a company

contribution. The one exception is an historic UK final salary

scheme that has been closed to both new members and future accruals

for a number of years. At the time of publishing the 2015 Annual

Report, the Group was taking professional advice relating to this

scheme with the objective of achieving the right balance between

adequate scheme funding and business growth objectives. As a

result, the scheme funding position has improved and, with a higher

discount rate of 3.8% (2015: 3.6%) being applied for the IAS19

accounting standard, a net deficit of GBP2.07m has been recorded

(2015: net deficit of GBP3.62m). The pension assets increased

through the year and the liabilities decreased. The company also

benefited from a reduction in annual contributions to clear the

deficit.

Customer dependency

There was relatively little movement through the year in terms

of customer dependency. Only two customers contributed greater than

10% to Group turnover. These customers each purchase Storage

semiconductors from us and then manufacture and supply a storage

module/product to a wide range of end-customers. Together, these

two customers have a combined contribution of approximately 27% of

overall revenues. Customer number three contributed approximately

6% and all remaining customers are below the 4% threshold.

Property

The Group headquarters is located on a 28 acre freehold site in

Essex with existent planning permission for additional commercial

space. A residential planning application directed at a separate

part of the site is currently awaiting determination following an

appeal inquiry in October 2015.

STORAGE

The contribution to Group turnover from Storage products rose by

8% to GBP11.65m (2015: GBP10.82m) representing 51% of total Group

revenues. Sales into Europe and the Far East were responsible for

the gain with the Americas posting a flat year. As mentioned

earlier, revenue at a geographical level is attributed to the

territory in which the goods are actually sold (e.g. the customers

own manufacturing location or the customers sub-contract location)

and does not necessarily relate to the region in which the original

design win was recorded.

Our objectives for the year were to increase sales, commence

initial revenues from the new products that were recently launched

and to execute our engineering developments on-time and to budget.

The level of achievement against these objectives was good.

Product shipments for the year went into a variety of

end-customer products across a range of application areas. Within

telecoms/Infrastructure markets, historically our largest

sub-market, our Storage IC's were used within equipment for

internet switching and routing and within wireless base stations

for mobile connectivity. Our Hyperstone brand is becoming well

known in these markets and associated with high quality and

reliability; two essential pre-requisites for being accepted in the

market.

Within the automotive market, our sales into in-vehicle

infotainment (IVI) applications progressed well with multiple car

manufacturers utilising Hyperstone-driven solutions and additional

manufacturers entering the qualification process. Our customised

automotive solution provides application-specific features that

maximise the life of the solid state drive itself and delivers

class leading reliability and recovery in the event of power supply

interruptions. Other end-applications served through the year

included industrial automation and embedded computing for licensed

Gaming machines.

The outlook at the interim stage was for automotive revenue

growth and an expansion of our market and customer share in the

telecoms/infrastructure and Industrial/embedded areas. The sales

levels reported coupled with the progress made with new customer

opportunities and qualification activities means that we are on

track.

In previous reporting we have commented on our strategy to

expand the product portfolio to fill the gaps that we saw in order

to maximise growth in our chosen end-markets. We have made good

progress with that strategy and now have a product range that

includes flash memory controllers equipped with CompactFlash, SATA,

SD and USB2/USB3 interface technologies.

The new USB3 product was announced to the market in February

2016 at the Embedded World show in Nuremburg, Germany, and,

together with the hyMap technology that has further evolved since

being launched in the prior year, we are building an impressive

platform portfolio that we can leverage well into the future. The

engineering team continue to excel and, as with the hyMap

development, the USB3 project was an impressive achievement. It

uses 65nm process geometry and resulted in right first time silicon

being sampled to customers on schedule.

Through the year, we continued to invest in the technology we

will need in the future to be able to maximise growth in the

markets we are working hard to penetrate. Trends in flash memory

technology are one important consideration and our expanding

relationships with tier 1 flash memory providers are key supporting

factors.

We made specific investments in marketing and field-based

application engineering roles during the year to ensure we continue

to capitalise on the customer opportunities that the enlarged

product portfolio is uncovering. Additional investments were made

in customer facing tools and internal testing environments all

ultimately expected to improve the customer experience and enhance

our product performance and quality even further.

WIRELESS

Revenues received from the shipment of semiconductors into

wireless end-applications were marginally down against the prior

year at GBP8.21m (2015: GBP8.28m) but broadly in line with

expectations that were set following the delays to one or two

customer product launches, as communicated at the interim stage. By

financial year end shipments into these customer projects had

commenced.

Regionally the business mix was a little different for the year

as a whole. Good growth was seen in the Americas as customer

production schedules began to ramp whilst in the Far East, China

was adversely affected by weaker local manufacturing and to some

extent by reduced government spending on infrastructure-related

projects such as power networks and railways. Europe also posted a

weaker performance, partly due to the one or two project delays

that have previously been communicated.

Wireless goals for the year were underpinned by a focus on

securing significant chip-set design-wins, in all regions, capable

of driving sustainably higher business levels. Continuing effort

was put into positioning the Group to participate in the growth

expected to come from voice-centric markets as they transition from

analogue technology to the newer digital standards. Within wireless

data, additional revenues from chip-set solutions for satellite M2M

applications made a meaningful contribution.

The majority of IC shipments categorised as Wireless were

delivered to customers who manufactured professional voice

communication terminals and industrial quality radio equipment for

the transmission and reception of data. Customers deployed varying

combinations of our baseband, modem and RF IC's into these

applications and particularly pleasing was the strong performance

from our RF product portfolio. Evolving from a pure baseband/modem

semiconductor supplier, CML is now an established provider of

complementary high performance RF IC's to a growing number of the

leading companies in each of the chosen target markets.

Our strategy within Wireless communications application areas

has been to continue evolving the product range so that we can

target new end-applications and expand the total available market.

We progressed well with this strategy through the year, releasing

two new RF products; one of which raised the bar in terms of direct

conversion receiver performance, and one which offered the customer

base greater flexibility in reducing power consumption within

applications that are not as technically demanding. We launched a

baseband processor IC specifically targeted at the DMR standard

which is predicted to be the dominant choice for non-public safety

applications as customers replace currently installed analogue

terminals and base stations.

Engineering capabilities within the baseband and modem teams

were enhanced through the year with specific investments being made

in prototyping systems and, more generally for enhanced internal

information systems. We have a multi-site, multi-disciplinary

engineering team and these investments will help minimise the risks

and costs associated with developing new products on increasingly

lower geometry silicon processes.

Current R&D programmes are focussed on being able to offer

the customers elements of our existing RF product portfolio across

a wider range of radio frequencies and to ensure our baseband and

modem platforms are suitably advanced to cope with the demanding

performance requirements that our customers need in the future.

As with our Storage resource levels, we made specific

investments in customer-facing application engineering roles during

the year to provide key support to our customers and help to

minimise their development timelines. CML is renowned for the

superior levels of technical support we provide and it is important

to maintain that reputation as we grow.

WIRELINE TELECOM

Revenues from the Wireline Telecom product portfolio delivered a

pleasing growth rate of 13% following a somewhat weaker previous

year. A full year figure GBP2.57m was posted (2015: GBP2.28m).

Each major region saw advances for the full year. Within China,

shipments into higher speed point of payment terminals were

stronger and the Group reaped the rewards from design-wins secured

for our higher data rate modem IC's. In North America, sales

improved for telephone signalling and data transfer IC's used

within residential and commercial alarm communicators. These

products typically have dual mode telephone line & 3G/4G

wireless connectivity capabilities and Group products handle the

wireline communications functionality.

We are one of a reducing number of semiconductor companies

supplying dedicated solutions for inclusion within equipment

intended for operation on analogue telephony networks. This

continues to present us with new design-in opportunities and

customers value the longevity of product supply the Group typically

offers. This is an important advantage when dealing with

multi-national industrial organisations who are constantly

concerned about component level product obsolescence.

Aside from the Storage, Wireless and Wireline Telecom revenue

generating markets already reviewed, the Group received additional

revenue from the sale of miscellaneous semiconductor products and

services derived from historic operational activities. The sale of

products classified under this category amounted to GBP0.40m (2015:

GBP0.43m) for the year under review.

SUMMARY AND OUTLOOK

Financial year 2016 represented a steady period of organic

progress and delivered a return to sales and profit growth, as

expected. It was a record year of R&D investment, with an

amount equal to 27% of Group turnover invested in new products that

will ultimately position the Group to increase its market share.

New IC's that were launched during the year offered either enhanced

performance or closed a gap in the existing product range.

Operationally, important investments were made in sales,

marketing and engineering support resources to handle the

increasing customer engagement levels that an expanding product

range demands.

Internally, structural changes took place that will maximise

efficiency, increase productivity and provide a scalable operating

structure in anticipation of focussed bolt-on acquisitions.

For the 2017 financial year, we currently expect a firmer

revenue contribution from those customer projects that have already

commenced meaningful shipments in the last twelve months or so. Our

customer facing resources will be supporting our more recent

product introductions through the promotion, sampling and multiple

qualification processes that are required prior to end-customers

launching their own products to market.

Taking a medium term view, it is important to mention that the

gestation period from initial customer contact through to shipping

production quantities against a specific customer project typically

exceeds one year and, for some industrial markets, can extend

beyond three. Although this lengthy gestation period can sometimes

be frustrating, we are not at the start of the process and have

been seeding a number of customer projects for some time.

Conversely, typical Group customers do not rapidly re-design their

own products which usually results in a multi-year revenue

generating period for us.

Our main market areas for Storage and Wireless continue to offer

compelling growth opportunities. For Storage, we are making steady

progress within the automotive market and for

telecoms/infrastructure applications, the product range we have is

well suited to the needs of the customer base. The number of top

tier equipment manufacturers approving our IC's for use within

their own products is increasing.

In Wireless end-markets, the transition from analogue voice to

digital is now gathering pace and for our data communication

solutions, the chip-set design wins that we have already secured

are now beginning to contribute revenues. Within our industrial

markets, the move by some regulatory authorities to increase RF

performance requirements should play to our strengths.

Over the current year, the Board expects a further advance in

revenues and profitability and a continuing pipeline of new

semiconductor solutions that address a wider range of end-customer

requirements and additional market areas. Our goal is to be the

first choice key component supplier within our chosen

end-markets.

C A Gurry

Group Managing Director

Consolidated income statement for the year ended 31 March

2016

Unaudited Audited

2016 2015

GBP'000 GBP'000

------------------------------------ ---------- ---------

Continuing operations

Revenue 22,833 21,804

Cost of sales (6,580) (6,339)

------------------------------------- ---------- ---------

Gross profit 16,253 15,465

Distribution and administration

costs (13,272) (12,777)

------------------------------------- ---------- ---------

2,981 2,688

Other operating income 405 419

------------------------------------- ---------- ---------

Profit from operations 3,386 3,107

Share--based payments (117) (95)

------------------------------------- ---------- ---------

Profit after share--based

payments 3,269 3,012

Revaluation of investment

properties - 100

Finance income 55 66

------------------------------------- ---------- ---------

Profit before taxation from

continuing operations 3,324 3,178

Income tax expense (399) (476)

------------------------------------- ---------- ---------

Profit after taxation from

continuing operations 2,925 2,702

------------------------------------- ---------- ---------

Profit after taxation attributable

to equity owners of the parent 2,925 2,702

------------------------------------- ---------- ---------

Basic earnings per share

------------------------------------ ---------- ---------

From profit for year 18.03p 16.71p

------------------------------------- ---------- ---------

Diluted earnings per share

From profit for year 17.94p 16.51p

------------------------------------- ---------- ---------

Consolidated statement of total comprehensive income for the

year ended 31 March 2016

Unaudited Unaudited

2016 2016 Audited 2015 Audited 2015

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------------- ---------- ---------- ------------- -------------

Profit for the year 2,925 2,702

Other comprehensive income, net of tax

Items that will not be reclassified subsequently to profit

or loss

Actuarial gain/(loss) on retirement benefit obligations 1,570 (1,133)

Deferred tax on actuarial (gains)/losses (283) 227

-------------------------------------------------------------- ---------- ---------- ------------- -------------

Items reclassified subsequently to profit or loss upon

derecognition

Foreign exchange differences 584 (477)

-------------------------------------------------------------- ---------- ---------- ------------- -------------

Other comprehensive income/(expense) for the year net of

taxation attributable to equity owners

of the parent 1,871 (1,383)

-------------------------------------------------------------- ---------- ---------- ------------- -------------

Total comprehensive income for the year attributable to the

equity holders of the parent 4,796 1,319

-------------------------------------------------------------- ---------- ---------- ------------- -------------

Consolidated statement of financial position as at 31 March

2016

Unaudited Unaudited Audited Audited

2016 2016 2015 2015

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ---------- ---------- -------- ---------

Assets

Non--current assets

Property, plant

and equipment 5,171 4,976

Investment properties 3,550 3,550

Development costs 9,292 6,984

Goodwill 3,512 3,512

Deferred tax asset 893 1,310

---------------------------- ---------- ---------- -------- ---------

22,418 20,332

Current assets

Inventories 1,571 1,763

Trade receivables

and prepayments 3,458 2,864

Current tax assets 830 628

Cash and cash equivalents 13,596 13,188

---------------------------- ---------- ---------- -------- ---------

19,455 18,443

Total assets 41,873 38,775

---------------------------- ---------- ---------- -------- ---------

Liabilities

Current liabilities

Trade and other

payables 4,190 3,471

Current tax liabilities 39 196

---------------------------- ---------- ---------- -------- ---------

4,229 3,667

Non--current liabilities

Deferred tax liabilities 3,001 2,513

Retirement benefit

obligation 2,067 3,624

---------------------------- ---------- ---------- -------- ---------

5,068 6,137

--------------------------- ---------- ---------- -------- ---------

Total liabilities 9,297 9,804

---------------------------- ---------- ---------- -------- ---------

Net assets 32,576 28,971

---------------------------- ---------- ---------- -------- ---------

Capital and reserves

attributable to

equity owners of

the parent

Share capital 813 813

Share premium 5,700 5,700

Treasury shares (190) -

- own share reserve

Share--based payments

reserve 388 287

Foreign exchange

reserve 318 (266)

Accumulated profits 25,547 22,437

---------------------------- ---------- ---------- -------- ---------

Total shareholders'

equity 32,576 28,971

---------------------------- ---------- ---------- -------- ---------

Consolidated cash flow statement for the year ended 31 March

2016

Unaudited Audited

2016 2015

GBP'000 GBP'000

----------------------------- ----------- --------

Operating activities

Net profit for the

year before taxation 3,324 3,178

Adjustments for:

Depreciation 254 267

Amortisation of development

costs 3,330 3,224

Revaluation of investment

properties - (100)

Movement in pensions

net costs 13 (207)

Share--based payments 117 95

Profit on sale of

plant and equipment - (4)

Finance income (55) (66)

Movement in working

capital 317 852

-------------------------------- ----------- --------

Cash flows from operating

activities 7,300 7,239

Income tax received/(paid) 279 (270)

-------------------------------- ----------- --------

Net cash flows from

operating activities 7,579 6,969

-------------------------------- ----------- --------

Investing activities

Purchase of property,

plant and equipment (443) (318)

Investment in development

costs (5,356) (4,363)

Payment of escrow (331) -

cash deposit

Disposal of property,

plant and equipment - 12

Finance income 55 66

-------------------------------- ----------- --------

Net cash flows from

investing activities (6,075) (4,603)

-------------------------------- ----------- --------

Financing activities

Issue of ordinary

shares - 645

Purchase of treasury (190) -

shares

Dividend paid to

shareholders (1,118) (1,013)

Net cash flows from

financing activities (1,308) (368)

-------------------------------- ----------- --------

Increase/(decrease)

in cash and cash

equivalents 196 1,998

-------------------------------- ----------- --------

Movement in cash

and cash equivalents:

At start of year 13,188 11,373

Increase/(decrease)

in cash and cash

equivalents 196 1,998

Effects of exchange

rate changes 212 (183)

-------------------------------- ----------- --------

At end of year 13,596 13,188

-------------------------------- ----------- --------

Consolidated statement of changes in equity for the year ended

31 March 2016

Treasury Share Foreign

Share Share shares -based exchange Acc-umulated

capital premium payments reserve profits Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- -------- -------- -------- --------- --------- ------------ ---------

At 31 March

2014 - audited 798 5,070 - 327 211 21,519 27,925

---------------------- -------- -------- -------- --------- --------- ------------ ---------

Profit for year 2,702 2,702

Other comprehensive

income net of

taxes

Foreign exchange

differences (477) (477)

Net actuarial

loss recognised

directly to

equity (1,133) (1,133)

Deferred tax

on actuarial

loss 227 227

---------------------- -------- -------- -------- --------- --------- ------------ ---------

Total comprehensive

income for year - - - - (477) 1,796 1,319

---------------------- -------- -------- -------- --------- --------- ------------ ---------

798 5,070 327 (266) 23,315 29,244

Transactions

with owners

in their capacity

as owners

Issue of ordinary

shares 15 630 645

Dividend paid (1,013) (1,013)

---------------------- -------- -------- -------- --------- --------- ------------ ---------

Total transactions

with owners

in their capacity

as owners 15 630 - - - (1,013) (368)

---------------------- -------- -------- -------- --------- --------- ------------ ---------

Share--based

payments in

year 95 95

Cancellation/transfer

of share--based

payments (135) 135 -

---------------------- -------- -------- -------- --------- --------- ------------ ---------

At 31 March

2015 - audited 813 5,700 - 287 (266) 22,437 28,971

---------------------- -------- -------- -------- --------- --------- ------------ ---------

Profit for year 2,925 2,925

Other comprehensive

income net of

taxes

Foreign exchange

differences 584 584

Net actuarial

gain recognised

directly to

equity 1,570 1,570

Deferred tax

on actuarial

gain (283) (283)

---------------------- -------- -------- -------- --------- --------- ------------ ---------

Total comprehensive

income for year - - - - 584 4,212 4,796

---------------------- -------- -------- -------- --------- --------- ------------ ---------

813 5,700 - 287 318 26,649 33,767

Transactions

with owners

in their capacity

as owners

Dividend paid (1,118) (1,118)

Purchase of

treasury shares (190) (190)

---------------------- -------- -------- -------- --------- --------- ------------ ---------

Total transactions

with owners

in their capacity

as owners - - (190) - - (1,118) (1,308)

---------------------- -------- -------- -------- --------- --------- ------------ ---------

Share--based

payments in

year 117 117

Cancellation/transfer

of share--based

payments (16) 16 -

---------------------- -------- -------- -------- --------- --------- ------------ ---------

At 31 March

2016 - unaudited 813 5,700 (190) 388 318 25,547 32,576

---------------------- -------- -------- -------- --------- --------- ------------ ---------

1 Segmental analysis

Reported segments and their results in accordance with IFRS 8,

are based on internal management reporting information that is

regularly reviewed by the chief operating decision maker (C. A.

Gurry). The measurement policies the Group uses for segmental

reporting under IFRS 8 are the same as those used in its financial

statements.

Information about revenue, profit/loss, assets and

liabilities:

Unaudited

2016 Audited 2015

------------- -------- ------------- --------

Semiconductor Semiconductor

components Group components Group

GBP'000 GBP'000 GBP'000 GBP'000

------------------------- ------------- -------- ------------- --------

Revenue

By origin 35,924 35,924 34,031 34,031

Inter--segmental

revenue (13,091) (13,091) (12,227) (12,227)

------------------------- ------------- -------- ------------- --------

Total segmental

revenue 22,833 22,833 21,804 21,804

------------------------- ------------- -------- ------------- --------

Segmental result 3,269 3,269 3,012 3,012

------------- -------------

Revaluation of

investment properties - 100

Finance income 55 66

Income tax expense (399) (476)

------------------------- ------------- -------- ------------- --------

Profit after

taxation 2,925 2,702

------------------------- ------------- -------- ------------- --------

Assets and liabilities

Segmental assets 36,600 36,600 33,287 33,287

------------- -------------

Unallocated corporate

assets

Investment properties 3,550 3,550

Deferred tax

assets 893 1,310

Current tax assets 830 628

------------------------- ------------- -------- ------------- --------

Consolidated

total assets 41,873 38,775

------------------------- ------------- -------- ------------- --------

Segmental liabilities 4,190 4,190 3,471 3,471

------------- -------------

Unallocated corporate

liabilities

Deferred tax

liabilities 3,001 2,513

Current tax liabilities 39 196

Retirement benefit

obligation 2,067 3,624

------------------------- ------------- -------- ------------- --------

Consolidated

total liabilities 9,297 9,804

------------------------- ------------- -------- ------------- --------

Other segmental information:

Audited

Unaudited 2016 2015

--------------- -------- -------------- --------

Semiconductor Semiconductor

components Group components Group

GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------------- -------- -------------- --------

Property,

plant and

equipment

additions 443 443 318 318

------------------- --------------- -------- -------------- --------

Development

cost additions 5,356 5,356 4,363 4,363

------------------- --------------- -------- -------------- --------

Depreciation 254 254 267 267

------------------- --------------- -------- -------------- --------

Amortisation 3,330 3,330 3,224 3,224

------------------- --------------- -------- -------------- --------

Other non--cash

(expense)/income (13) (13) 307 307

------------------- --------------- -------- -------------- --------

Geographical information:

UK Rest of Americas Far East Total

Europe

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ -------- -------- --------- --------- ---------

Year ended 31

March 2016 -

Unaudited

Revenue by origination 10,563 11,647 4,858 8,856 35,924

Inter--segmental

revenue (5,526) (7,565) - - (13,091)

------------------------ -------- -------- --------- --------- ---------

Revenue to third

parties 5,037 4,082 4,858 8,856 22,833

------------------------ -------- -------- --------- --------- ---------

Property, plant

and equipment 4,997 143 12 19 5,171

------------------------ -------- -------- --------- --------- ---------

Investment properties 3,550 - - - 3,550

------------------------ -------- -------- --------- --------- ---------

Development

costs 3,121 6,171 - - 9,292

------------------------ -------- -------- --------- --------- ---------

Goodwill 3,512 - - - 3,512

------------------------ -------- -------- --------- --------- ---------

Total assets 28,281 10,100 1,412 2,080 41,873

------------------------ -------- -------- --------- --------- ---------

Year ended 31

March 2015 -

Audited

Revenue by origination 10,134 10,627 4,688 8,582 34,031

Inter--segmental

revenue (5,036) (7,190) - (1) (12,227)

------------------------ -------- -------- --------- --------- ---------

Revenue to third

parties 5,098 3,437 4,688 8,581 21,804

------------------------ -------- -------- --------- --------- ---------

Property, plant

and equipment 4,849 104 14 9 4,976

------------------------ -------- -------- --------- --------- ---------

Investment properties 3,550 - - - 3,550

------------------------ -------- -------- --------- --------- ---------

Development

costs 2,440 4,544 - - 6,984

------------------------ -------- -------- --------- --------- ---------

Goodwill 3,512 - - - 3,512

------------------------ -------- -------- --------- --------- ---------

Total assets 27,060 8,388 1,370 1,957 38,775

------------------------ -------- -------- --------- --------- ---------

Inter--segmental transfers or transactions are entered into

under commercial terms and conditions appropriate to the location

of the business entity whilst considering that the parties are

related.

2 Revenue

Unaudited Audited

2016 2015

GBP'000 GBP'000

-------------------------------- ---------- --------

Geographical classification

of turnover (by destination):

United Kingdom 950 853

Rest of Europe 5,621 5,220

Far East 10,704 10,438

Americas 5,122 4,804

Others 436 489

-------------------------------- ---------- --------

22,833 21,804

-------------------------------- ---------- --------

3 Dividend - paid and proposed

It is proposed to pay a dividend of 7.0p per ordinary share of

5p in respect of the year ended 31 March 2016. During the year a

dividend of 6.9p per ordinary share of 5p was paid in respect of

the year ended 31 March 2015.

4 Income tax expense

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of a subsidiary and have

provided on that basis.

Unaudited Audited

2016 2015

GBP'000 GBP'000

--------------------------- ---------- --------

Current tax

UK corporation tax

on results of the period (501) (597)

Adjustment in respect

of previous periods - (1)

--------------------------- ---------- --------

(501) (598)

Foreign tax on results

of the period 433 430

Foreign tax - adjustment (2) -

in respect of previous

periods

--------------------------- ---------- --------

Total current tax (70) (168)

--------------------------- ---------- --------

Deferred tax

Current period movement 453 652

Adjustments to deferred

tax charge in respect

of previous periods 16 (8)

--------------------------- ---------- --------

Total deferred tax 469 644

--------------------------- ---------- --------

Tax charge on profit

on ordinary activities 399 476

--------------------------- ---------- --------

5 Earnings per ordinary share

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders, divided by the

weighted average number of shares in issue during the year.

Unaudited 2016 Audited 2015

------------------------------ ------------------------------

Weighted Weighted

average average

number Profit number Profit

per per

Profit of shares share Profit of shares share

GBP'000 Number p GBP'000 Number p

------------------- -------- ----------- ------- -------- ----------- -------

Basic earnings

per share 2,925 16,219,037 18.03 2,702 16,167,635 16.71

------------------- -------- ----------- ------- -------- ----------- -------

Diluted earnings

per share

Basic earnings

per share 2,925 16,219,037 18.03 2,702 16,167,635 16.71

Dilutive effect

of share options - 86,877 (0.09) - 200,100 (0.20)

------------------- -------- ----------- ------- -------- ----------- -------

Diluted earnings

per share 2,925 16,305,914 17.94 2,702 16,367,735 16.51

------------------- -------- ----------- ------- -------- ----------- -------

6 Investment properties

Investment properties are revalued at each discrete period end

by the directors and every third year by independent Chartered

Surveyors on an open market basis. No depreciation is provided on

freehold investment properties or on leasehold investment

properties. In accordance with IAS 40, gains and losses arising on

revaluation of investment properties are shown in the income

statement. Everett Newlyn, Chartered Surveyors and Commercial

Property Consultants professionally valued the investment

properties on the basis of open market value as at 31 March 2015.

The Directors do not consider that the present valuation has

materially changed as at 31 March 2016 having considered the local

property market.

7 Analysis of cash flow movement in net cash

The cash flow below is a combination of the actual cash flow and

the exchange movement:

Unaudited

Net cash

Audited at

Net cash

at

1 April Cash Exchange 31 March

2015 flow movement 2016

GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- -------- ---------- ----------

Cash and cash

equivalents 13,188 196 212 13,596

13,188 196 212 13,596

--------------- --------- -------- ---------- ----------

8 Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with

foreign currencies and customer dependency. With the majority of

the Group's earnings being linked to the US Dollar a decline in

this currency will have a direct effect on revenue, although since

the majority of the cost of sales are also linked to the US Dollar,

this risk is reduced at the gross profit line. Additionally, though

the Group has a very diverse customer base in certain market

segments, key customers can represent a significant amount of

revenue. Key customer relationships are closely monitored, however

changes in buying patterns of a key customer could have an adverse

effect on the Group's performance.

Key risks of a non-financial nature

The Group is a small player operating in a highly competitive

global market, which is undergoing continual and geographical

change. The Group's ability to respond to many competitive factors

including, but not limited to pricing, technological innovations,

product quality, customer service, manufacturing capabilities and

employment of qualified personnel will be key in the achievement of

its objectives, but its ultimate success will depend on the demand

for its customers' products since the Group is a component

supplier.

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve

its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements, the

enforceability of laws and contracts, changes in the tax laws,

terrorist activities, natural disasters or health epidemics.

9. Directors' statement pursuant to the disclosure and

transparency rules

The directors confirm that, to the best of their knowledge:

a. the consolidated financial statements, prepared in accordance

with IFRS as adopted by the EU give a true and fair view of the

assets, liabilities, financial position of the company and the

undertakings included in the consolidation taken as a whole;

and

b. the Group Non-Executive Chairman's Statement and Group

Managing Director's Operating and Financial Review includes a fair

review of the development and performance of the business and the

position of the company and the undertakings included in the

consolidation taken as a whole together with a description of the

principal risks and uncertainties that they face.

The Directors are also responsible for the maintenance and

integrity of the CML Microsystems Plc website. Legislation in the

UK governing the preparation and dissemination of the financial

statements may differ from legislation in other jurisdictions.

10. Significant accounting policies

The accounting policies used in preparation of the annual

results announcement are the same accounting policies set out in

the year ended 31 March 2015 financial statements.

11. Post balance sheet event - Acquisition subject to regulatory

clearance

On 27 May 2016 the Company announced that it has entered into a

definitive agreement to acquire China-based Wuxi Sicomm

Technologies Ltd ("Sicomm") and affiliated companies.

Founded in 2003, Sicomm is a fabless semiconductor company and

solutions provider specialising in the development of integrated

baseband processors and RF semiconductors for global wireless

communication markets. Sicomm has approximately 30 employees and is

headquartered in Wuxi, China, with offices in Shanghai and

Quanzhou. The company's product range, which partially competes

with existing CML solutions, is targeted for use within consumer,

industrial and professional radio products and focusses on the

customer need to achieve the right balance between cost,

functionality and technical performance.

This acquisition expands the Group's product portfolio,

strengthens its Far Eastern regional support resources and

reinforces CML's position as a leader in the professional and

industrial wireless communication semiconductor market.

The acquisition, which is subject to normal Chinese domestic

regulatory clearance, has an agreed consideration of US$11m and

will be funded from a mixture of existing cash resources and the

issue of 774,181 new CML shares. The majority of the shares are

subject to specific lock-in restrictions over a three year period

and are provided under existing AGM resolution approval. The deal

is expected to close during the first half of the current financial

year to 31 March 2017 and a further announcement will be made at

that time. Consequently, further disclosures will be made when the

initial accounting of the business combination, in line with IFRS

and CML Group policies, is able to be completed.

12. General

The results for the year have been prepared using the

recognition and measurement principles of international financial

reporting standards as adopted by the EU.

The audited financial information for the year ended 31 March

2015 is based on the statutory accounts for the financial year

ended 31 March 2015 that has been filed with the Registrar of

Companies. The auditor reported on those accounts: their report was

(i) unqualified, (ii) did not include references to any matters to

which the auditor drew attention by way of emphasis without

qualifying the reports and (iii) did not contain statements under

section 498(2) or (3) of the Companies Act 2006.

The statutory accounts for the year ended 31 March 2016 are

expected to be finalised and signed following approval by the Board

of Directors on 24 June 2016 and delivered to the Registrar of

Companies following the Company's Annual General Meeting on 27 July

2016.

The financial information contained in this announcement does

not constitute statutory accounts for the year ended 31 March 2016

or 2015 as defined by Section 434 of the Companies Act 2006.

A copy of this announcement can be viewed on the company website

http://www.cmlmicroplc.com.

13. Approval

The Directors approved this annual results announcement on 14

June 2016.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFFFADFMSEEM

(END) Dow Jones Newswires

June 14, 2016 02:00 ET (06:00 GMT)

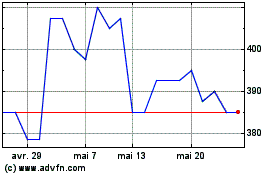

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024