TIDMCML

RNS Number : 1909T

CML Microsystems PLC

23 November 2021

23 November 2021

CML Microsystems Plc

("CML", the "Company" or the "Group")

Half Year Results

CML Microsystems Plc (the "Group" or the "Company"), which

develops mixed-signal, RF and microwave semiconductors for global

communications markets, today announces its unaudited results for

the six months ended 30 September 2021.

Financial Highlights

-- Revenue increased by 30% to GBP8.00m (H1 FY21: GBP6.14m)

-- Profit before taxation improved to GBP1.0m (H1 FY21:

loss of GBP0.3m)

-- Adjusted EBITDA up 43% to GBP2.12m (H1 FY21: GBP1.48m)

-- Diluted EPS significantly improved to 4.87p (H1 FY21:

loss of 1.67p)

-- Cash balances at period end of GBP22.59m (31 March 2021:

net cash of GBP31.91m) following a special dividend payment

totalling GBP8.30m to shareholders in August 2021

-- Recommended half year dividend of 4.0p per share (H1

FY21: 2.0p per share)

Operational Highlights

-- Recovery in existing markets, driving growth

-- New product releases show early signs of success

-- Expanded product range targeting an increasing total

addressable market

-- Record order book at period end

-- Significant R&D investment

-- Completed move from standard segment of Main Market to

AIM

Chris Gurry, Managing Director of CML Microsystems Plc,

commented on the results:

"The foundations for expansion laid during previous years,

coupled with the energy and enthusiasm to succeed within the

business, is starting to deliver tangible results at the financial

level. The Board remains confident that continuing progress will be

made through the second half of the year, delivering a very

positive outcome for the financial year as a whole."

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Group Managing Director Tel: +44(0)1621 875 500

Nigel Clark, Executive Chairman

Shore Capital Tel: +44(0)20 7408 4090

Toby Gibbs

James Thomas

John More

SP Angel Corporate Finance LLP Tel: +44(0)203 463 2260

Jeff Keating

Alma PR

Josh Royston Tel: +44 (0)20 3405 0212

Caroline Forde

Andy Bryant

Matthew Young

About CML Microsystems Plc

CML develops mixed-signal, RF and microwave semiconductors for

global communications markets. The Group utilises a combination of

outsourced manufacturing and in-house testing with trading

operations in the UK, Asia and USA. CML targets sub-segments within

Communication markets with strong growth profiles and high barriers

to entry. It has secured a diverse, blue chip customer base,

including some of the world's leading commercial and industrial

product manufacturers.

The spread of its customers and diversity of the product range

largely protects the business from the cyclicality usually

associated with the semiconductor industry. Growth in its end

markets is being driven by factors such as the appetite for data to

be transmitted faster and more securely, the upgrading of telecoms

infrastructure around the world and the growing prevalence of

private commercial wireless networks for voice and/or data

communications linked to the industrial internet of things

(IIoT).

The Group is cash-generative, has no debt and is dividend

paying.

Chairman's statement

Introduction

CML has enjoyed a strong start to the year. In my Annual Report

back in June 2021, I highlighted that I had never before

experienced a year with more challenges and opportunities. Whilst

many of those challenges remain, it is particularly pleasing to see

recovery in the end-markets that were most impacted by the

pandemic. The improved trading witnessed in the second half of last

year has continued and gathered pace. This is a testament to the

Group's multi-year strategic focus on R&D, acting as a partner

to our global customer base, creating the products that help them

achieve success.

Results and trading

The previously reported figures for the prior year first half

included contributions from the Storage Division which was part of

the Group throughout the first half of the last financial year

(before being sold in February for $49m). For this set of results,

we have restated the figures, in line with reporting requirements,

but do believe this provides shareholders with a more meaningful

picture of the Group's performance. The Communications Division is

today the sole operational focus of CML.

The financial performance for the six months to 30 September

2021 is ahead of management's expectations. Revenue for the six

months increased by 30% to GBP8.00m compared to the prior year (H1

FY21: GBP6.14m). Profit before taxation improved to GBP1.0m (H1

FY21: loss GBP0.3m), with adjusted EBITDA improving by 43% to

GBP2.12m (H1 FY21: GBP1.48m) and diluted EPS showed a dramatic

improvement to 4.87p (H1 FY21: loss of 1.67p). Cash balances at the

period end stood at GBP22.59m (31 March 2021: net cash of

GBP31.91m) following a special dividend payment totalling GBP8.30m

to shareholders in August 2021 after completion of the sale of the

Storage Division. The Group has no debt.

The Board is recommending a half year dividend of 4.0p per share

(H1 FY21: 2.0p per share), payable on 17 December 2021 to

shareholders on the Register on 3 December 2021.

Move to AIM

In September this year, CML completed its move from the standard

segment of the Main Market to the AIM Market of the London Stock

Exchange ("AIM"). As highlighted above, the Company enjoys very

healthy cash balances and remains debt free. In addition, it has

considerable value in a number of non-operational assets that the

Board is continually evaluating to enable maximum shareholder value

to be delivered. A number of opportunities are currently being

actively explored and are at various stages of progression. The

Group's addressable market stands at over $1bn annually and

alongside our organic growth strategy, which is our core focus, our

balance sheet strength gives us the opportunity to seek and

consider acquisitions which could help us further our strategic

objectives. The move to AIM provides us with greater flexibility to

take advantage of any opportunities as and when they are

identified.

Employees

The improvement in our trading performance is undoubtedly a

reflection of the sheer hard work and determination shown by our

highly talented workforce. They have continued to tackle each

challenge with vigour and enthusiasm and on behalf of the Board. I

offer them my sincere thanks.

Prospects and outlook

With a record order book, a growing product range targeting an

increasing total addressable market and a strong balance sheet

affording us strategic flexibility, the future for CML has never

been brighter. We must remain conscious of the fact that many of

the challenges which have been present over recent years are still

active and could affect our customers' purchasing decisions in the

short term. However, we are confident in both the long-term

performance of the business and in meeting this year's

expectations.

Nigel Clark

Executive Chairman

23 November 2021

Operational and financial review

Introduction

It is pleasing to report that the positive momentum seen within

the business through the second half of the prior financial year

has continued through the opening six-months of the current year,

with a healthy trading improvement being recorded.

Revenues are ahead of management expectations at the halfway

stage, with the associated benefits of operational leverage flowing

through. New order intake has been strong, assisted by improving

end market conditions and increased demand linked to customer

concerns around supply chain constraints within the semiconductor

market generally. Alongside the revenue growth achieved, the

Group's order book at 30 September 2021 was once again at a record

level, with scheduled delivery visibility extending into the next

financial year.

The progress demonstrated within these interim results follows a

multi-year period of enduring headwinds. During this time, the

Group has invested heavily in research and development activities

targeted at products and application areas that are expected to

drive growth over the coming years. The business optimisation that

took place prior to this year commencing, coupled with the enhanced

strategy now being followed, positions the Group well to take

advantage of the increasing number of opportunities being

presented.

Strategy

The Group's vision is to be the first-choice semiconductor

partner to technology innovators, together transforming how the

world communicates.

We are focused on our customers' success by delivering

advantages through the improved functionality and performance of

class leading IC solutions. R&D activity is targeted at

developing the product portfolio to support emerging and evolving

customer requirements for size, cost and performance, whilst

striving to remain our customer's first choice supplier within

their advanced communication platforms.

In today's world, 'connected everything' is propelling

exponential increases in data consumption - driving growth across

wireless communications markets globally. We are expanding our

total addressable market having enlarged our market emphasis to

include applications within the so-called mega trend areas of

Industrial Internet of Things ("IIoT"), 5G and Industry 4.0. This

complements the existing markets of public safety, maritime and

mission critical wireless voice and data communications, leveraging

our systems knowledge, engineering capabilities and routes to

market.

Markets and operations

For the comparable period, revenues from voice-centric wireless

applications were heavily impacted by the COVID-19 crisis, with the

situation across a wide range of data-centric IIoT customers

somewhat mixed. More recently, we communicated that customer and

market intelligence suggested conditions for voice applications

were expected to improve as the year progressed and it is pleasing

to report that has proven to be the case.

The order intake from wireless voice product manufacturers has

grown, with a significant recovery seen amongst the leading

customers. Equally pleasing was the progress from data-centric

customers, who are producing proprietary wireless communications

equipment for a wide range of industrial and mission critical

applications including oil, gas, utilities, transport, telecom,

enterprise, precision farming, land surveying, environmental

monitoring and military applications areas.

The order intake situation is multidimensional. As a complement

to the improving market conditions, which was the main driver,

growth was assisted by new design-wins moving to the production

phase along with increased order receipts associated with customer

concerns over semiconductor part availability. Conversely, there is

evidence of ordering restraint where customers cannot secure

deliveries of more generic parts needed within their end products,

such as microprocessors, from other semiconductor suppliers.

The semiconductor market is being hindered by well documented

supply chain issues and the Group has not been immune from

associated raw material delays and extended lead times from

third-party assembly services providers. We continue to hold a

raised level of inventory to help minimise the impact the global

semiconductor supply chain scenario is having. Delays do remain and

capacity constraints in the supply chain are expected to continue

well into 2022. That said, we have an experienced team monitoring

the situation closely and have so far been able to minimise end

customer disruptions.

The communications market globally is exhibiting a number of

growth areas, including the transition to higher-capacity digital

networks within voice-centric markets and, in data-centric markets,

the increasing throughput requirements from terrestrial and

satellite communications applications. As well as the existing

wireless voice and data market areas served, our strategy for

widening the product portfolio to address broader application areas

is well underway.

Through the first six-months of the financial year, a number of

new ICs were released, or priority sampled to market, developed to

help accelerate the design of RF products operating across a wide

range of radio frequencies including microwave and millimetre wave

bands. These new products include fully matched MMIC Power

Amplifiers (PAs) along with Positive Gain Slope Amplifiers designed

to compensate for frequency related gain losses that occur when

designing wide band wireless products. Marketed under the SuRF

brand, these new ICs are beginning to achieve design-win status

with new customers and it is satisfying to report that first orders

have been received from early stage adopters within vehicle

tracking and smart grid applications. End-customer shipments are

scheduled to commence during the second half of the year.

In addition to the SuRF product range, we continue to actively

invest in new platform technology and differentiated

wireless/baseband products to gain market share in a combination of

existing and new end application areas under the communications

umbrella. These new releases build upon prior year investments and

product introductions that also serve to increase the number of

market opportunities we can address.

The quantity of product introductions emanating from the Group

is set to increase significantly as we move forward, and this has

necessitated several internal organisational and operational

adjustments since the start of the year. It is therefore essential

to acknowledge the efforts being expended by the whole team in that

regard and its importance towards maximising our chances of success

in the future.

The Group is now addressing an annual serviceable market of over

$1bn, comprising a number of key growth areas including critical

infrastructure (public utilities, smart grid, RFID), 5G (repeaters,

small/pico cells, fixed wireless access, distributed antenna

systems) and satellite communications (terminals, broadband

access). We remain in the early stages of penetrating these new

market areas but, based upon customer engagements and resulting

feedback, we expect to be successful in securing significant

design-wins to fuel our growth. Aside from technical performance

and commercial competitiveness, the focus on our customers' success

and our inherent partnership capabilities are key factors that bode

well for the future of the business.

CML has excellent routes to market and over recent years has

invested significant effort in ensuring sales channels globally

were appropriate for the direction of travel that the business was

taking. Where possible, those channels are being exploited to good

effect as the release of new products gathers pace, although the

process is one of evolution and refinement, with ongoing

adjustments needed. Customer reach has been extended further

through a widening of the existing USA distributor agreement with

RFMW to become a global partner, along with the addition of several

new manufacturers' representatives in the Americas region.

Outlook

The year commenced with the business in a relatively strong

position from which to grow. Through the first six-month period,

shipments into those application areas most affected by the

pandemic during the prior year have begun to recover and, as we

move forward, the operational effort being put towards capturing

the growth opportunities already identified should start to bear

fruit. Clearly headwinds remain, including the pandemic,

geo-political uncertainties and ongoing semiconductor capacity

issues, however the advancement the Group is making is

encouraging.

Our organic growth prospects are exciting and should drive the

business forward over the short term, although an appropriate

amount of effort is being devoted to exploring the potential for

acquisition opportunities that would accelerate delivery of our

objectives.

The foundations for expansion laid during previous years,

coupled with the energy and enthusiasm to succeed within the

business, is starting to deliver tangible results at the financial

level. The Board remains confident that continuing progress will be

made through the second half of the year, delivering a very

positive outcome for the financial year as a whole.

Financial review

Total revenues for the first six-months of the financial year

increased by 30% over the comparable prior year period, totalling

GBP8.00m (H1 FY21: GBP6.14m). As already explained, several

customers active in the Group's voice communication markets have

started to recover from the heavy impact of the pandemic.

Additionally, data-centric market sectors linked to IIoT and

machine-to-machine communications performed strongly.

The higher revenues drove a 29% uplift in gross profitability to

GBP6.05m (H1 FY21: GBP4.70m). Gross margin as a percentage was

relatively stable but is expected to come under pressure as raw

material price increases take effect. To help counteract those

pressures, it has been necessary to invoke price increases across

the Group's product range.

Geographically, sales were higher in each of the major regions

serviced, with the Far East showing the strongest growth in

absolute terms. It is noteworthy, however, that a number of the

Group's customers make use of Asian manufacturing partners for

their production requirements and Group revenues are classified

geographically in terms of shipping destination.

Distribution and administration expenses increased to GBP5.59m

(H1 FY21: GBP5.26m) and include the costs associated with the move

to an AIM listing from the Main Market (GBP0.25m).

Other operating income rose to GBP0.56m (H1 FY21: GBP0.31m) and

included a one-off contribution of GBP0.28m from a pandemic related

US government loan that was ultimately forgiven (H1 FY21:

GBP0m).

Profit from operations was GBP1.01m (H1 FY21: GBP0.30m loss)

and, after accounting for share-based payments and net finance

income, the Group recorded a profit before tax of GBP1.01m, against

a loss of GBP0.30m for the prior year first half.

Taxation was GBP0.20m compared to a slight credit during the

comparable period, leading to a diluted earnings per share of 4.87p

being recorded (H1 FY21: loss of 1.67p).

Adjusted EBITDA increased by 43% to GBP2.12m (H1 FY21:

GBP1.48m).

Inventory levels increased slightly following the previously

communicated policy to maintain a higher level of raw material

stocks commensurate with current market dynamics. This strategy

continues to help reduce the impact our customers feel from ongoing

capacity issues within the semiconductor market generally. At 30

September 2021, inventory levels were GBP1.53m (H1 FY21:

GBP1.42m).

The Group has no debt and cash balances stood at GBP22.59m at 30

September 2021 (31 March 2021: net cash of GBP31.91m) following

payment of a special dividend of GBP8.30m during August 2021. Tight

working capital control is being maintained amidst the need to keep

inventory levels appropriate.

R&D expenditure for the period was GBP2.27m (H1 FY21:

GBP1.99m) reflecting an increase in the number of new products

being developed. In addition, and linked to expansion of the

product range, capital expenditure rose to GBP0.88m due to

necessary investment into additional final test and evaluation

equipment capable of handling higher radio frequencies (H1 FY21:

GBP0.13m).

Chris Gurry

Group Managing Director

23 November 2021

Condensed consolidated income statement

for the six months ended 30 September 2021

Unaudited Unaudited Audited

6 months 6 months year end

end end 31/03/21

30/09/21 30/09/20 GBP'000

GBP'000 Restated

GBP'000

--------------------------------------------------- ------------ ----------- ----------

Continuing operations

Revenue 8,001 6,138 12,470

Cost of sales (1,951) (1,435) (3,197)

--------------------------------------------------- ------------ ----------- ----------

Gross profit 6,050 4,703 9,273

Distribution and administration costs (5,593) (5,263) (10,567)

--------------------------------------------------- ------------ ----------- ----------

457 (560) (1,294)

Other operating income 555 314 830

--------------------------------------------------- ------------ ----------- ----------

Profit/(loss) from operations 1,012 (246) (464)

Share-based payments (45) (80) (143)

--------------------------------------------------- ------------ ----------- ----------

Profit/(loss) after share-based payments 967 (326) (607)

Revaluation of investment properties - - 579

Finance income 57 40 75

Finance expense (13) (18) (37)

--------------------------------------------------- ------------ ----------- ----------

Profit / (loss) before taxation 1,011 (304) 10

Income tax (charge)/credit (202) 26 792

--------------------------------------------------- ------------ ----------- ----------

Profit/(loss) from continuing operations 809 (278) 802

Profit from discontinued operation - 1,069 22,762

--------------------------------------------------- ------------ ----------- ----------

Profit after taxation for period

attributable to equity owners of

the parent 809 791 23,564

--------------------------------------------------- ------------ ----------- ----------

The condensed consolidated income statement has been restated for

unaudited six months ended 30 September 2020 for the discontinued

operation announced on 10 December 2020, where the Group had entered

into a definitive agreement to divest its Storage Division, Hyperstone.

See note 13 for further details.

Earnings per share from continuing operations attributable

to the ordinary

equity holders of the Company:

Basic earnings per share 4.87p (1.67)p 4.81p

Diluted earnings per share 4.80p (1.67)p 4.79p

Earnings per share from total operations

attributable to the ordinary equity

holders of the Company (comparatives

include discontinued operations):

Basic earnings per share 4.87p 4.74p 141.13p

Diluted earnings per share 4.80p 4.73p 140.56p

Adjusted EBITDA(1) 2,118 1,477 2,731

------------ -----------

1. See note 12 for definition and reconciliation.

Condensed consolidated statement of total comprehensive

income

for the six months ended 30 September 2021

Unaudited Unaudited Audited

6 months 6 months year end

end end 31/03/21

30/09/21 30/09/20 GBP'000

GBP'000 Restated

GBP'000

-------------------------------------------------- ---------- ---------- ----------

Profit for the period 809 791 23,564

Other comprehensive income/(expense):

Items that will not be reclassified subsequently

to profit or loss:

Re-measurement of benefit obligation - - (897)

Deferred tax on actuarial loss - - 170

-------------------------------------------------- ---------- ---------- ----------

Items reclassified subsequently to profit

or loss upon derecognition:

Foreign exchange differences 410 123 (312)

Reclassification of foreign exchange differences

on discontinued operations - - (1,100)

-------------------------------------------------- ---------- ---------- ----------

Other comprehensive income/(expense) for

the period net of taxation attributable

to the equity holders of the parent 410 123 (2,139)

-------------------------------------------------- ---------- ---------- ----------

Total comprehensive income for the period

attributable to the equity holders of the

parent 1,219 914 21,425

Total comprehensive income for the year

attributable to the equity owners of the

parent:

Continuing operations 1,219 (155) (237)

Discontinued operations - 1,069 21,662

------------------------------------------- ------ ------ -------

1,219 914 21,425

------------------------------------------- ------ ------ -------

Condensed consolidated statement of financial position

as at 30 September 2021

Unaudited Unaudited Audited

30/09/21 30/09/20 31/03/21

GBP'000 GBP'000 GBP'000

--------------------------------------------- ---------- ---------- ----------

Assets

Non-current assets

Goodwill 7,282 10,735 7,072

Other intangible assets 1,198 1,679 1,276

Development costs 10,727 17,999 9,191

Property, plant and equipment 5,576 4,903 4,864

Right-of-use assets 524 779 409

Investment properties 3,775 3,192 3,775

Investment - 83 -

Deferred tax assets 1,822 1,188 1,531

--------------------------------------------- ---------- ---------- ----------

30,904 40,558 28,118

--------------------------------------------- ---------- ---------- ----------

Current assets

Inventories 1,532 2,768 1,450

Trade receivables and prepayments 2,433 5,043 2,434

Current tax assets 1,479 787 1,046

Cash and cash equivalents 22,587 9,014 32,196

--------------------------------------------- ---------- ---------- ----------

28,031 17,612 37,126

--------------------------------------------- ---------- ---------- ----------

Total assets 58,935 58,170 65,244

--------------------------------------------- ---------- ---------- ----------

Liabilities

Current liabilities

Bank loans and borrowings - 1,661 282

Trade and other payables 3,122 4,277 3,081

Lease liabilities 174 333 183

Current tax liabilities 42 224 80

--------------------------------------------- ---------- ---------- ----------

3,338 6,495 3,626

--------------------------------------------- ---------- ---------- ----------

Non-current liabilities

Deferred tax liabilities 3,207 5,145 2,339

Lease liabilities 220 382 262

Retirement benefit obligation 5,570 4,697 5,570

--------------------------------------------- ---------- ---------- ----------

8,997 10,224 8,171

--------------------------------------------- ---------- ---------- ----------

Total liabilities 12,335 16,719 11,797

--------------------------------------------- ---------- ---------- ----------

Net assets 46,600 41,451 53,447

--------------------------------------------- ---------- ---------- ----------

Capital and reserves attributable to equity

owners of the parent

Share capital 863 859 859

Share premium 1,222 9,286 1,039

Capital redemption reserve 9 9 9

Treasury shares - own share reserve (1,670) (1,670) (1,670)

Share-based payments reserve 497 662 570

Foreign exchange reserve 712 1,837 302

Retained earnings 44,967 30,468 52,338

--------------------------------------------- ---------- ---------- ----------

Total shareholders' equity 46,600 41,451 53,447

Condensed consolidated cash flow statement

for the six months ended 30 September 2021

Unaudited Unaudited Audited

6 months 6 months year end

end end 31/03/21

30/09/21 30/09/20 GBP'000

GBP'000 Restated

GBP'000

-------------------------------------------------- ---------- ---------- ----------

Operating activities

Profit/(loss) for the period before taxation

- continuing operations 1,011 (304) 10

Profit for the period before taxation -

discontinued operations - 1,075 22,762

Adjustments for:

Depreciation - on property, plant and equipment 171 192 370

Depreciation - on right-of-use assets 126 263 438

Impairment of development costs - - 701

Amortisation of development costs 673 2,988 3,789

Amortisation of intangibles recognised

on acquisition and purchased 136 117 212

Loss/(profit) on disposal of property,

plant and equipment - - 16

Revaluation of investment properties - - (579)

Gain on disposal of discontinued operations - - (21,740)

Movement in non-cash items (retirement

benefit obligation and non-refundable PPP

loan) (190) 90 201

Share-based payments 45 80 143

Finance income (57) (40) (75)

Finance expense 13 18 37

Movement in working capital (560) 695 1,388

-------------------------------------------------- ---------- ---------- ----------

Cash flows from operating activities 1,368 5,174 7,673

Income tax (paid)/received (118) 509 494

-------------------------------------------------- ---------- ---------- ----------

Net cash flows from operating activities 1,250 5,683 8,167

-------------------------------------------------- ---------- ---------- ----------

Investing activities

Disposal of business (net of expenses) - - 33,261

Acquisition of subsidiary, net of cash

acquired - (100) (100)

Purchase of property, plant and equipment (882) (127) (390)

Investment in development costs (2,161) (3,834) (7,270)

Investment in intangibles - 25 25

Finance income 57 40 75

Net cash flows used in investing activities (2,986) (3,996) 25,601

-------------------------------------------------- ---------- ---------- ----------

Financing activities

Lease liability repayments (142) (302) (556)

Proceeds from bank loans and borrowings - 1,661 282

Issue of ordinary shares (net of expenses) 186 - 29

Purchase of own shares for treasury - (1,590) (1,590)

Dividends paid to shareholders (8,298) (343) (674)

Share capital redemption - - (8,276)

Finance expense 3 (16) (15)

-------------------------------------------------- ---------- ---------- ----------

Net cash flows used in financing activities (8,251) (590) (10,800)

-------------------------------------------------- ---------- ---------- ----------

Increase/(decrease) in cash and cash equivalents (9,987) 1,097 22,968

-------------------------------------------------- ---------- ---------- ----------

Movement in cash and cash equivalents:

At start of period/year 32,196 8,479 8,479

Increase/(decrease) in cash and cash equivalents (9,987) 1,097 22,968

Effects of exchange rate changes 378 (562) 749

-------------------------------------------------- ---------- ---------- ----------

At end of period 22,587 9,014 32,196

Cash flows presented exclude sales taxes. Further cash-related

disclosure details are provided in notes 6 and 7.

Changes in liabilities arising from financing activities relate

to lease liabilities and borrowings only.

Condensed consolidated statement of changes in equity

for the six months ended 30 September 2021

Unaudited Share Share Capital Treasury Share- Foreign Retained Total

capital premium redemption shares based exchange earnings GBP'000

GBP'000 GBP'000 reserve GBP'000 payments reserve GBP'000

GBP'000 GBP'000 GBP'000

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

At 31 March

2020 859 9,286 9 (80) 582 1,714 30,020 42,390

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

Profit for period 791 791

Other comprehensive

income net of

taxes

Foreign exchange

differences 123 123

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

Total comprehensive

income for the

period - - - - - 123 791 914

Transactions

with owners

in their capacity

as owners

Dividend paid (343) (343)

Use of own shares

for treasury (1,590) (1,590)

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

Total of transactions

with owners

in their capacity

as owners - - - (1,590) - - (343) (1,933)

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

Share-based

payment charge 80 80

At 30 September

2020 859 9,286 9 (1,670) 662 1,837 30,468 41,451

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

Profit for period 22,773 22,773

Other comprehensive

income net of

taxes

Foreign exchange

differences (435) (435)

Reclassification

of foreign exchange

differences

on discontinued

operations (1,100) (1,100)

Re-measurement

of defined benefit

obligations (897) (897)

Deferred tax

on actuarial

loss 170 170

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

Total comprehensive

income for the

period - - - - - (1,535) (727) (2,262)

Transactions

with owners

in their capacity

as owners

Issue of ordinary

shares - exercise

of share options 29 29

Share capital

redemption (8,276) (8,276)

Dividend paid (331) (331)

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

Total of transactions

with owners

in their capacity

as owners - (8,247) - - - - (331) (8,578)

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

Share-based

payment charge 63 63

Cancellation/transfer

of share-based

payments (155) 155 -

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

At 31 March

2021 859 1,039 9 (1,670) 570 302 52,338 53,447

Unaudited Share Share Capital Treasury Share- Foreign Retained Total

capital premium redemption shares based exchange earnings GBP'000

GBP'000 GBP'000 reserve GBP'000 payments reserve GBP'000

GBP'000 GBP'000 GBP'000

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

At 31 March

2021 859 1,039 9 (1,670) 570 302 52,338 53,447

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

Profit for period 809 809

Other comprehensive

income net of

taxes

Foreign exchange

differences 410 410

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

Total comprehensive

income for the

period - - - - - 410 809 1,219

Transactions

with owners

in their capacity

as owners

Issue of ordinary

shares - exercise

of share options 4 183 187

Dividend paid (8,298) (8,298)

Total of transactions

with owners

in their capacity

as owners 4 183 - - - - (8,298) (8,111)

Share-based

payments 45 45

Cancellation/transfer

of share-based

payments (118) 118 -

----------------------- --------- --------- ------------ --------- ---------- ---------- ---------- ---------

At 30 September

2021 863 1,222 9 (1,670) 497 712 44,967 46,600

Notes to the condensed consolidated financial statement

for the six months ended 30 September 2021

1 Segmental analysis

Reported segments and their results, in accordance with IFRS 8,

are based on internal management reporting information that is

regularly reviewed by the Chief Operating Decision Maker (Chris

Gurry). The measurement policies the Group uses for segmental

reporting under IFRS 8 are the same as those used in its financial

statements.

The Group is focused for management purposes on one primary

reporting segment, being the semiconductor segment, with similar

economic characteristics, risks and returns and the Directors

therefore consider there to be one single segment, being

semiconductor components for the communications industry.

Geographical segments (by origin)

Unaudited UK Rest Americas Far East Total

GBP'000 of Europe GBP'000 GBP'000 GBP'000

GBP'000

--------------------------------- --------- ----------- --------- --------- ---------

Six months ended 30 September

2021

Revenue to third parties

- by origin 1,837 - 916 5,248 8,001

Property, plant and equipment 5,475 - 17 84 5,576

Right-of-use assets 100 - 226 198 524

Investment properties 3,775 - - - 3,775

Development costs 9,175 - - 1,552 10,727

Intangible assets - software

and

intellectual property 254 - - 98 352

Goodwill 1,531 - - 5,751 7,282

Other intangible assets arising

on acquisition 197 - - 649 846

Total assets 46,109 - 1,606 11,220 58,935

Unaudited UK Rest Americas Far East Total

GBP'000 of Europe GBP'000 GBP'000 GBP'000

GBP'000

--------------------------------- --------- ----------- --------- --------- ---------

Six months ended 30 September

2020

Revenue to third parties

- by origin 3,100 - 829 2,209 6,138

Property, plant and equipment 4,662 175 - 66 4,903

Right-of-use assets 108 174 357 140 779

Investment properties 3,192 - - - 3,192

Development costs 6,629 10,298 - 1,072 17,999

Intangible assets - software

and

intellectual property 550 - - - 550

Goodwill 1,531 3,512 - 5,692 10,735

Other intangible assets arising

on acquisition - - - 1,129 1,129

Total assets 24,443 17,831 2,127 13,769 58,170

Audited UK Rest Americas Far East Total

GBP'000 of Europe GBP'000 GBP'000 GBP'000

GBP'000

--------------------------------- --------- ----------- --------- --------- ---------

Year ended 31 March 2021

Revenue to third parties

- by origin 5,867 - 1,624 4,979 12,470

Property, plant and equipment 4,753 - 22 89 4,864

Right-of-use assets 90 - 255 64 409

Investment properties 3,775 - - - 3,775

Development costs 7,942 - - 1,249 9,191

Intangible assets - software

and intellectual property 264 - - 101 365

Goodwill 1,531 - - 5,541 7,072

Other intangible assets arising

on acquisition 210 - - 701 911

Total assets 52,228 - 2,467 10,549 65,244

Revenue

The geographical classification of business turnover (by

destination) is as follows:

Unaudited Unaudited Audited

6 months 6 months year end

end end 31/03/21

30/09/21 30/09/20 GBP'000

GBP'000 Restated

GBP'000

---------- ---------- ---------- ----------

Europe 1,927 1,259 2,996

Far East 4,837 3,718 7,005

Americas 986 926 2,000

Other 251 235 469

---------- ---------- ---------- ----------

8,001 6,138 12,470

The operational classification of business turnover (by market)

is as follows:

Unaudited Unaudited Audited

6 months 6 months year end

end end 31/03/21

30/09/21 30/09/20 GBP'000

GBP'000 Restated

GBP'000

------------------------ ---------- ---------- ----------

Semiconductor 7,652 5,694 11,622

Design and development 349 444 848

------------------------ ---------- ---------- ----------

8,001 6,138 12,470

Semiconductor products, goods and services are transferred at a

point in time, design and development over the period of the

contract on a percentage basis of contract completion, as detailed

in the Group's revenue recognition policy within its published

Annual Report.

The Group does not have any contract assets at 30 September 2021

(GBPNil at 31 March 2021) as the Group does not fulfil any of its

performance obligations in advance of invoicing to its customer.

The Group however does have contractual balances in the form of

trade receivables. See note 21 for disclosure of this in the Annual

Report and Accounts for year ended 31 March 2021. The Group does

not have any contractual liabilities at 30 September 2021 (GBPNil

at 31 March 2021).

The Group also does not have any contractual costs capitalised

or any outstanding performance obligations at 30 September 2021 and

31 March 2021.

2 Dividend paid and interim dividend

The Board is declaring an interim dividend of 4.0p per ordinary

share of 5p for the half year ended 30 September 2021, payable on

17 December 2021 to shareholders on the Register on 3 December

2021.

A final special dividend of 50.0p per ordinary share of 5p was

paid on 13 August 2021 and an interim dividend of 2.0p per ordinary

share of 5p was paid on 18 December 2020, totalling 52.0p per

ordinary share of 5p paid for the year ended 31 March 2021 (2020:

2.0p per ordinary share of 5p paid for the year ended 31 March

2020).

3 Income tax expense/(credit)

Unaudited Unaudited Audited

6 months 6 months year end

end end 31/03/21

30/09/21 30/09/20 GBP'000

GBP'000 Restated

GBP'000

------------------------------------- ---------- ---------- ----------

UK income tax credit (461) (495) (1,126)

Overseas income tax charge 89 141 248

------------------------------------- ---------- ---------- ----------

Total current tax credit (372) (354) (878)

Deferred tax charge 574 328 86

------------------------------------- ---------- ---------- ----------

Reported income tax charge/(credit) 202 (26) (792)

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of its subsidiary

undertakings and have provided on that basis.

The tax charge for the six months ended 30 September 2021 has

been calculated by applying the effective tax rate which is

expected to apply to the Group for the year ended 31 March 2022,

using rates substantially enacted by 30 September 2021 as required

by IAS 34 - Interim Financial Reporting.

4 Earnings per share

Unaudited Unaudited Audited

6 months 6 months year end

end end 31/03/21

30/09/21 30/09/20 GBP'000

GBP'000 Restated

GBP'000

---------------------------------------------------- ---------- ---------- ----------

Earnings per share from continuing operations

attributable to the ordinary

equity holders of the Company:

Basic earnings per share 4.87p (1.67)p 4.81p

Diluted earnings per share 4.80p (1.67)p 4.79p

Earnings per share from total operations

attributable to the ordinary equity holders

of the Company (comparatives include discontinued

operations):

Basic earnings per share 4.87p 4.74p 141.13p

Diluted earnings per share 4.80p 4.73p 140.56p

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year, as

explained below:

Ordinary 5p shares

------------------------

Weighted Diluted

average number

number

------------------------------------ ----------- -----------

Six months ended 30 September 2021 16,608,977 16,855,132

Six months ended 30 September 2020 16,692,935 16,718,813

Year ended 31 March 2021 16,696,060 16,763,946

5 Investment properties

Investment properties are measured at fair value and are

revalued annually by the Directors and in every third year by

independent Chartered Surveyors on an open market basis. No

depreciation is provided on freehold investment properties or on

long leasehold investment properties. In accordance with IAS 40,

gains and losses arising on revaluation of investment properties

are shown in the income statement. At 31 March 2021 the investment

properties were professionally valued by Fenn Wright and Lambert

Smith Hampton, Commercial Property Consultants, on an open market

basis.

6 Cash and cash equivalents

Unaudited Unaudited Audited

6 months 6 months year end

end end 31/03/21

30/09/21 30/09/20 GBP'000

GBP'000 GBP'000

----------------- ---------- ---------- ----------

Cash on deposit 16,869 4,183 20,438

Cash at bank 5,718 4,831 11,758

----------------- ---------- ---------- ----------

22,587 9,014 32,196

7 Bank loans and borrowings

Unaudited Unaudited Audited

6 months 6 months year end

end end 31/03/21

30/09/21 30/09/20 GBP'000

GBP'000 GBP'000

------------ ----------- ---------- ----------

Bank loan - 1,661 -

Borrowings - - 282

------------ ----------- ---------- ----------

- 1,661 282

8 Retirement benefit obligations

The Directors have not obtained an actuarial IAS 19 Employee

Benefits report in respect of the defined benefit pension scheme

for the purpose of this Half Yearly Report.

9 Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with

foreign currencies and customer dependency. With the majority of

the Group's earnings being linked to the US Dollar, a decline in

this currency will have a direct effect on revenue, although since

the majority of the cost of sales are also linked to the US Dollar,

this risk is reduced at the gross profit line. Additionally, though

the Group has a very diverse customer base in certain market

sectors, key customers can represent a significant amount of

revenue. Key customer relationships are closely monitored, however

changes in buying patterns of a key customer could have an adverse

effect on the Group's performance.

Key risks of a non-financial nature

The Group is a small player operating in a highly competitive

global market that is undergoing continual and geographical change.

The Group's ability to respond to many competitive factors

including, but not limited to, pricing, technological innovations,

product quality, customer service, raw material availabilities,

manufacturing capabilities and employment of qualified personnel

will be key in the achievement of its objectives. The Group's

ultimate success will depend on the demand for its customers'

products since the Group is a component supplier.

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve

its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements (including

the UK's withdrawal from the European Union, or "Brexit"),

political risk, the enforceability of laws and contracts, changes

in the tax laws, terrorist activities, natural disasters or health

epidemics.

COVID-19

During the pandemic the Group has ensured that its critical

infrastructure, resources and activities are organised to provide

continuity of our operations which has enabled us to implement a

responsive approach to COVID-19 with all non-essential operational

employees working from home.

The Group is following the guidance of the World Health

Organization and other government health agencies and has

implemented a return-to-work strategy which is closely monitored to

enable prudent steps to be mitigated in case of further potential

impacts to our employees, customers, suppliers and other

stakeholders. The Group continues to carry out regular assessments

of the modelled scenarios based on management's current

understanding of potential income and mitigating actions within the

control of management, including reductions in discretionary spend

along with tighter internal controls, but no fixed costs reductions

have been assumed.

Given the nature of the markets we operate within, we anticipate

the majority of our end customers being insulated from a consumer

downturn to some extent, although the roll-out of some of the new

products may be delayed, dampening demand for our semiconductors.

Despite these difficult times, we still maintain the belief that

the Group is well placed to move positively forward in the medium

to long term. This belief is underpinned by a strong balance sheet

and no debt, along with a product portfolio that addresses markets

that have a positive outlook.

10 Directors' statement pursuant to the Disclosure and

Transparency Rules

The Directors confirm that, to the best of their knowledge:

-- the condensed set of financial statements have been prepared

on a consistent basis with the financial statements for the year

ended 31 March 2021 and should be read in conjunction with the FY21

Annual Report and Accounts. The annual consolidated financial

statements of the Group are prepared in accordance with IFRS and

IFRIC pronouncements as adopted by the EU;

-- the condensed set of financial statements have been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the EU; and

-- the Chairman's Statement and Group Managing Director's

Operational and Financial Review include a fair review of the

development and performance of the business and the position of the

Company, and the undertakings included in the consolidation taken

as a whole together with a description of the principal risks and

uncertainties that they face.

The Directors are also responsible for the maintenance and

integrity of the CML Microsystems Plc website. Legislation in the

UK governing the preparation and dissemination of the financial

statements may differ from legislation in other jurisdictions.

11 Basis of preparation

The basis of preparation and accounting policies used in

preparation of this Half Year Report have been prepared in

accordance with the same accounting policies set out in the year

ended 31 March 2021 financial statements.

12 Adjusted EBITDA

Adjusted earnings before interest, tax, depreciation and

amortisation ("Adjusted EBITDA") is defined as profit from

operations before all interest, tax, depreciation and amortisation

charges and before share-based payments. The following is a

reconciliation of the Adjusted EBITDA for the three periods

presented:

Unaudited Unaudited Audited

6 months 6 months year end

end end 31/03/21

30/09/21 30/09/20 GBP'000

GBP'000 Restated

GBP'000

------------------------------------------------ ---------- ---------- ----------

Profit/(loss) before taxation (earnings) 1,011 (304) 10

Adjustments for:

Finance income (57) (40) (75)

Finance expense 13 18 37

Depreciation 171 151 310

Depreciation - right-of-use assets 126 138 202

Impairment of development costs - - 701

Amortisation of development costs 673 1,317 1,191

Amortisation of intangibles of purchased

and

acquired intangibles recognised on acquisition 136 117 212

Share-based payments 45 80 143

------------------------------------------------ ---------- ---------- ----------

Adjusted EBITDA 2,118 1,477 2,731

13 Disposal of the Storage Division

The Company announced on 5 February 2021 that it had

successfully completed the sale of Hyperstone, the Group's Storage

Division ("the Disposal"), for US$49m. The Disposal had not been

previously reported in the unaudited accounts ended 30 September

2020, these results have been restated to take this into account.

In the audited accounts ended 31 March 2021 this was reported as a

discontinued operation.

This reflected a deliberate decision made by the Board to

refocus exclusively on the global communications market, with all

efforts directed at capturing the exciting growth opportunities

that it presents.

Financial information relating to the discontinued operation for

the period to the date of disposal and unaudited accounts ended 30

September 2020 is set out below.

Unaudited Audited

6 months end year

30/09/20 end

GBP'000 31/03/21

GBP'000

----------------------------------------- -------------- ----------

Revenue 6,763 9,505

Cost of sales (2,191) (3,043)

----------------------------------------- -------------- ----------

Gross profit 4,572 6,462

Distribution and administration (3,478) (5,396)

----------------------------------------- -------------- ----------

1,094 1,066

Other operating income 7 8

----------------------------------------- -------------- ----------

Profit from operation 1,101 1,074

Finance income - -

Finance expenses (26) (42)

----------------------------------------- -------------- ----------

Profit before tax 1,075 1,032

Income tax expense (6) (10)

----------------------------------------- -------------- ----------

Profit after income tax of discontinued

operation 1,069 1,022

Gain on sale of subsidiary after income

tax - 21,740

----------------------------------------- -------------- ----------

Profit from discontinued operation 1,069 22,762

----------------------------------------- -------------- ----------

Further information can be found in the Annual Report and

Accounts ended 31 March 2021 which can be viewed on the Company

website: www.cmlmicroplc.com or obtained from Companies House.

14 Move to the AIM Market of the London Stock Exchange

("AIM")

The Company announced on 25 June 2021 the proposed cancellation

of the listing of the Company's ordinary shares of 5p each on the

standard segment of the London Stock Exchange's main market for

listed securities and its intention to apply for the admission of

the ordinary shares to trading on AIM. This was approved at the AGM

on 4 August 2021, with the effective date of the Cancellation and

Admission taking place on the 3 September 2021. Within the

unaudited six months ended 30 September 2021 a cost of GBP248,000

is attributable to this move.

15 General

Other than already stated within the Chairman's Statement and

Group Managing Director's Operational and Financial Review, there

have been no important events during the first six months of the

financial year that have impacted this Half Yearly Report.

There have been no related party transactions or changes in

related party transactions described in the latest Annual Report

that could have a material effect on the financial position or

performance of the Group in the first six months of the financial

year.

The principal risks and uncertainties within the business are

contained within this report in note 9 above.

This Half Yearly Report does not include all the information and

disclosures required in the Annual Report and should be read in

conjunction with the consolidated Annual Report for the year ended

31 March 2021.

The financial information contained in this Half Yearly Report

has been prepared in accordance with UK adopted International

Accounting Standards. This Half Yearly Report does not constitute

statutory accounts as defined by Section 434 of the Companies Act

2006. The financial information for the year ended 31 March 2021 is

based on the statutory accounts for the financial year ended 31

March 2021 that have been filed with the Registrar of Companies and

on which the auditor gave an unqualified audit opinion.

The auditor's report on those accounts did not contain a

statement under Section 498(2) or (3) of the Companies Act 2006.

This Half Yearly Report has not been audited or reviewed by the

Group auditor.

A copy of this Half Yearly Report can be viewed on the Company

website: https://www.cmlmicroplc.com .

16 Approvals

The Directors approved this Half Yearly Report on 23 November

2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GZMZMLZKGMZM

(END) Dow Jones Newswires

November 23, 2021 02:00 ET (07:00 GMT)

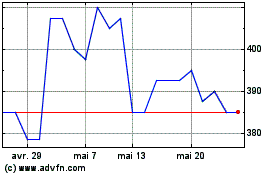

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024