TIDMCRE

RNS Number : 1797H

Conduit Holdings Limited

26 July 2023

Pembroke, Bermuda - 26 July 2023

Pembroke, Bermuda - 26 July 2023

Conduit Holdings Limited

("CHL" LSE ticker: CRE)

Interim Results for the six months ended 30 June 2023

Comprehensive income of $78.6 million; RoE of 9.1%

Strong year-on-year growth in gross premiums written of 52.9%;

Combined ratio of 72.5%

Efficient business model, strong capital base, positioned for

continued growth into favourable market conditions

CHL, the parent company of Conduit Re, a pure-play reinsurance

business based in Bermuda, today presents its interim results for

the six months ended 30 June 2023, on an IFRS 17 basis.

Trevor Carvey, Chief Executive Officer, commented: "This has

been a very successful half year for Conduit, and we are delivering

on the goals we set out when we founded the business in 2020. In a

half year which has seen high industry losses, our focused

underwriting strategy has delivered strong underwriting results

which, coupled with our low expense base, have delivered a very

attractive combined ratio of 72.5% (83.1% on undiscounted basis).

With no back years prior to 2021, we continue to look forward to

deploying capital effectively, taking maximum advantage of current

market conditions, which we see continuing for some time."

Neil Eckert, Executive Chairman, commented: "We are delighted to

announce our maiden interim profit. The low combined ratio and

highly attractive return on equity are testament to the

effectiveness of our strategy. This is one of the hardest insurance

markets in a generation and we are very well placed to capitalise

on that with our efficient business model."

Key financials ($m) Six months ended 30 June 2023 Six months ended 30 June 2022 Change

(re-stated)(1)

Estimated ultimate premiums written

(2) 762.2 492.2 54.9%

Gross premiums written (3) 542.2 354.5 52.9%

Reinsurance revenue 278.7 169.3 64.6%

Net reinsurance revenue 242.8 148.9 63.1%

Reinsurance service result 80.7 10.4 676.0%

Net investment result 22.6 (50.0) 145.2%

Comprehensive income (loss) 78.6 (39.4) 299.5%

Financial ratios (%) Six months ended 30 June 2023 Six months ended 30 June 2022 Change (pps)

(re-stated) (4)

Return on equity 9.1 (4.0) 13.1

Net loss ratio 57.5 85.0 (27.5)

Reinsurance operating expense ratio 9.3 8.0 1.3

Other operating expense ratio 5.7 6.9 (1.2)

Combined ratio (discounted) 72.5 99.9 (27.4)

Combined ratio (undiscounted) 83.1 105.8 (22.7)

Total net investment return 2.1 (4.7) 6.8

1 With the transition to IFRS 17, certain comparative amounts

have been re-stated as if the standard had always been in

effect.

2 Estimated ultimate premiums written now exclude reinstatement

premiums to ensure consistency with the IFRS 17 view of

revenue.

3 Gross premiums written now exclude reinstatement premiums to

ensure consistency with the IFRS 17 view of revenue

4 With the transition to IFRS 17, certain comparative amounts

have been re-stated as if the standard had always been in

effect.

Key highlights:

2023 H1 Results

-- Gross premiums written for the six months ended 30 June 2023

of $542.2 million, a 52.9% increase over the first six months of

2022

-- Overall portfolio risk-adjusted rate change for the first six

months of 2023, net of claims inflation, of 15%

-- Compounding impact of strong renewal book, with high quality

partners, in third year of trading

-- In an active natural catastrophe period for the industry, no

major event loss, individually or in aggregate, had an outsized or

material impact on our results for the period

-- Combined ratio of 72.5% for the first six months of 2023

compared with 99.9% for the same period in 2022

-- Sponsored the issuance of first $100 million three-year

catastrophe bond; resulting collateralised reinsurance cover

complements traditional retrocession programme

-- Total reinsurance and other operating expense ratio of 15.0%

for the first six months of 2023 compared with 14.9% for the same

period in 2022

-- High quality investment portfolio with average credit quality

of AA; book yield of 3.2%, and market yield of 5.5% (respectively

AA, 1.4% and 3.5% for the same period in 2022)

-- Total net investment return of $22.6 million for the six

months ended 30 June 2023 which includes a net unrealised gain of

$5.7 million, compared to a net investment loss of $50.0 million

which included $54.3 million of net unrealised loss in the same

period in 2022

-- Comprehensive income of $78.6 million, representing a 9.1% return on equity for the half year

-- Interim dividend of $0.18 (approximately 14 pence) per common share declared

Outlook

-- $1.9 billion of estimated ultimate premiums written from

launch in December 2020 up to 30 June 2023, with significant

pipeline of unearned premium of approximately $755 million which

will flow through in subsequent years

-- Market conditions remain very favourable with property and specialty leading the way

-- Capacity for continued growth into a hard market and benefiting from:

-- Our experienced team, which has rapidly developed a

reputation for being a responsive, reliable and relevant

counterparty - evidenced by the substantial growth we have been

able to achieve since launch

-- Established, efficient and scalable underwriting business model

-- Legacy-free balance sheet with ample capacity to support the

planned growth and beyond; AM Best A- (Excellent) rating, with

"very strong" balance sheet strength

Underwriting update

During the first six months of 2023, Conduit Re continued to

show growth across all segments, benefiting from new business, high

retention and underlying growth of renewal business, coupled with

improving rates. Client count and submission flow have increased in

line with Conduit Re's strategy, with the embedded renewing

portfolio providing the key profitable foundations.

Premiums

Estimated ultimate premiums written for the six months ended 30

June 2023:

2023 2022 re-stated Change Change 2022 published

Segment $m $m $m % $m

Property 371.9 228.8 143.1 62.5% 230.5

Casualty 237.7 171.0 66.7 39.0% 171.0

Specialty 152.6 92.4 60.2 65.2% 95.2

Total 762.2 492.2 270.0 54.9% 496.7

----------- ------ --------------- ------- ------- ---------------

Gross premiums written for the six months ended 30 June

2023:

2023 2022 re-stated Change Change 2022 published

Segment $m $m $m % $m

Property 308.4 186.6 121.8 65.3% 188.3

Casualty 140.6 111.6 29.0 26.0% 111.6

Specialty 93.2 56.3 36.9 65.5% 59.1

Total 542.2 354.5 187.7 52.9% 359.0

----------- ------ --------------- ------- ------- ---------------

Pricing

Pricing levels and terms and conditions continued to improve in

the first half of 2023 and we were presented with an increasing

number of opportunities to deploy our capital into the areas and

products that we target. The non-catastrophe elements of both

property and specialty in particular are providing ongoing

opportunities for selective growth.

Conduit Re's overall risk-adjusted rate change for the six

months ended 30 June 2023, net of claims inflation, was 15%, and by

segment was:

Property Casualty Specialty

30% 0% 12%

Net reinsurance revenue

For the six months ended 30 June 2023:

Property Casualty Specialty Total

$m $m $m $m

Reinsurance revenue 152.3 77.7 48.7 278.7

Ceded reinsurance expenses (31.2) (0.6) (4.1) (35.9)

Net reinsurance revenue 121.1 77.1 44.6 242.8

---------------------------- --------- --------- ---------- -------

For the six months ended 30 June 2022:

Property Casualty Specialty Total

$m $m $m $m

Reinsurance revenue 85.0 55.7 28.6 169.3

Ceded reinsurance expenses (16.6) (0.6) (3.2) (20.4)

Net reinsurance revenue 68.4 55.1 25.4 148.9

---------------------------- --------- --------- ---------- -------

Reinsurance revenue for the six months ended 30 June 2023 was

$278.7 million compared to $169.3 million for the same period in

2022. The increase in reinsurance revenue relative to the prior

period is due to continued growth in the business plus the earn-out

of premiums from prior underwriting years.

Ceded reinsurance expenses for the six months ended 30 June 2023

were $35.9 million compared to $20.4 million for the same period in

2022. The increase in cost relative to the prior period reflects

additional limits purchased due to the growth of the inwards

portfolio exposures plus price increases at the 1 January renewals.

During the second quarter of 2023, Conduit Re sponsored the first

issuance of a $100 million catastrophe bond by Stabilitas Re Ltd.,

which was placed successfully with strong investor demand. The

resulting three-year collateralised reinsurance cover complements

Conduits Re's traditional retrocession programme.

Net reinsurance service expenses

For the six months ended 30 June 2023:

Property Casualty Specialty Total

$m $m $m $m

Reinsurance losses and loss related amounts (63.2) (56.5) (27.6) (147.3)

Reinsurance operating expenses (13.6) (5.7) (3.2) (22.5)

Ceded reinsurance recoveries 7.6 - 0.1 7.7

Net reinsurance service expenses (69.2) (62.2) (30.7) (162.1)

--------------------------------------------- --------- --------- ---------- --------

For the six months ended 30 June 2022:

Property Casualty Specialty Total

$m $m $m $m

Reinsurance losses and loss related amounts (40.6) (48.2) (49.1) (137.9)

Reinsurance operating expenses (6.7) (3.2) (2.0) (11.9)

Ceded reinsurance recoveries 3.0 - 8.3 11.3

Net reinsurance service expenses (44.3) (51.4) (42.8) (138.5)

--------------------------------------------- --------- --------- ---------- --------

Net reinsurance losses and loss related amounts (5)

In an active natural catastrophe period for the industry, no

major event loss, individually or in aggregate, had an outsized or

material impact on Conduit during the first six months of 2023.

Our discounted net loss ratio for the six months ended 30 June

2023 was 57.5% compared with 85.0% for the same period in 2022,

while our undiscounted net loss ratio was 68.1% and 90.9%

respectively. The prior period loss ratio was impacted by our

estimated ultimate net impact, on an undiscounted basis, from the

Ukraine conflict of $24.6 million.

Our undiscounted ultimate loss estimates, net of ceded

reinsurance and reinstatement premiums, for previously reported

loss events remain stable.

Our loss and reserve estimates have been derived from a

combination of reports and statements from brokers and cedants,

modelled loss projections, pricing loss ratio expectations and

reporting patterns, all supplemented with market data and

assumptions. We will continue to review these estimates as more

information becomes available.

5 Reinsurance losses and loss related amounts less ceded

reinsurance recoveries

Reinsurance operating expenses and other operating expenses

For the six months ended 30 June 2023:

2023 2022 re-stated Change Change

$m $m $m %

Reinsurance operating expenses 22.5 11.9 10.6 89.1%

Other operating expenses 13.9 10.2 3.7 36.3%

Total reinsurance and other operating expenses 36.4 22.1 14.3 64.7%

------------------------------------------------ ----- --------------- ------- -------

2023 2022 Change

% % (pps)

Reinsurance operating expense ratio 9.3 8.0 1.3

Other operating expense ratio 5.7 6.9 (1.2)

Total reinsurance and other operating expense ratio 15.0 14.9 0.1

----------------------------------------------------- ----- ----- -------

Reinsurance operating expenses includes brokerage and operating

expenses deemed attributable to reinsurance contracts.

Total reinsurance and other operating expenses were $36.4

million for the six months ended 30 June 2023 compared with $22.1

million for the prior year. The increase is due to the continued

growth of the business and increased headcount.

The increase in the reinsurance operating expense ratio and

respective decrease in the other operating expense ratio were due

to a larger proportion of Conduit's operating expenses being deemed

attributable to reinsurance operating expense as the business

matures.

Net reinsurance finance income (expense)

The net reinsurance finance expense was $10.1 million for the

six months ended 30 June 2023 compared with income of $10.1 million

for the same period in the prior year. With the increase in yields

in the first quarter of this year broadly reversing in the second

quarter, the impact of re-measuring net losses to current discount

rates was minimal. The unwind of discount made up most of the

expense in the first six months of 2023, given the increasing net

reserve balances and rates in 2022. The opposite was true for the

income in the prior year as rates increased significantly but there

was little discount to unwind from the prior year.

Investments

In line with our stated strategy, we continue to maintain our

conservative approach to managing our invested assets with a strong

emphasis on preserving capital and liquidity. Our strategy remains

maintaining a short duration, highly-rated portfolio, with due

consideration of the duration of our liabilities. Our investment

portfolio does not hold any derivatives, equities, alternatives or

emerging market debt.

The investment return for the first six months of 2023 was 2.1%

driven primarily by investment income given a generally higher

yielding portfolio. Narrowing credit spreads also supported the

portfolio during a period of yield volatility. In the first six

months of 2022 the portfolio returned (4.7)% due to the significant

increase in treasury yields.

Net investment income, excluding realised and unrealised gains

and losses, was $17.2 million for the six months ended 30 June 2023

(30 June 2022 - $6.4 million). Total investment return, including

net investment income, net realised gains and losses, and net

change in unrealised gains and losses, was a gain of $22.6 million

(30 June 2022 - $50.0 million loss).

While we expect market volatility to remain elevated in the near

term, Conduit expects to be able to reinvest at higher rates as the

existing portfolio rolls over.

The breakdown of the managed investment portfolio is as

follows:

As at 30 June 2023 As at 30 June 2022 As at 31 December 2022

--------------------------- ------------------- ------------------- -----------------------

Fixed maturity securities 91.8% 91.7% 91.3%

Cash and cash equivalents 8.2% 8.3% 8.7%

Total 100.0% 100.0% 100.0%

--------------------------- ------------------- ------------------- -----------------------

Key investment portfolio statistics for our fixed maturities and

managed cash were:

As at 30 June 2023 As at 30 June 2022 As at 31 December 2022

---------------- ------------------- ------------------- -----------------------

Duration 2.4 years 2.4 years 2.2 years

Credit Quality AA AA AA

Book yield 3.2% 1.4% 2.4%

Market yield 5.5% 3.5% 5.2%

---------------- ------------------- ------------------- -----------------------

Capital & dividends

Total capital and tangible capital available was $0.92 billion

as at 30 June 2023 (30 June 2022 - $0.92 billion; 31 December 2022

- $0.87 billion).

Tangible net assets per share as at 30 June 2023 were $5.72 (30

June 2022 - $5.56; 31 December 2022 - $5.41).

On 25 July 2023, Conduit's Board of Directors declared an

interim dividend of $0.18 (approximately 14 pence) per common

share, resulting in an aggregate payment of $29.7 million. The

dividend will be paid in pounds sterling on 8 September 2023 to

shareholders of record on 18 August 2023 (the "Record Date") using

the pound sterling / US dollar spot exchange rate at 12 noon BST on

the Record Date.

Webcast

Conduit's management will host a virtual meeting for analysts

and investors via a webcast and conference call on Wednesday 26

July 2023 at 12.00 noon UK time / 8.00 am Bermuda time.

To access the webcast, please register in advance here:

https://www.lsegissuerservices.com/spark/ConduitHoldingsLtd/events/e1d7a6f0-afc8-4c85-9005-2b8c6e0683c1

To access the conference call, please register to receive unique

dial-in details here:

https://services.choruscall.za.com/DiamondPassRegistration/register?confirmationNumber=8220743&linkSecurityString=15183aa09b

A recording of the conference call will be made available later

in the day on the Investors section of Conduit Re's website at

www.conduitreinsurance.com.

Media contacts

H/Advisors Maitland - Vikki Kosmalska / Alistair de

Kare-Silver

+44 (0) 207 379 5151

conduitre@h-advisors.global

Investor relations and other enquiries:

info@conduitreinsurance.com

Panmure Gordon (UK) Limited (Joint Corporate Broker)

+44 (0) 207 886 2500

Berenberg (Joint Corporate Broker)

+44 (0) 203 207 7800

Peel Hunt (Joint Corporate Broker)

+44 (0) 207 418 8900

This announcement contains information, which may be of a price

sensitive nature, that Conduit is making public in a manner

consistent with the Market Abuse Regulation (EU) No. 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended, and other regulatory

obligations. The information was submitted for publication, through

the agency of the contact persons set out above, at 07:00 BST on 26

July 2026.

About Conduit Re

Conduit Re is a pure-play Bermuda-based reinsurance business

with global reach. Conduit Reinsurance Limited is licensed by the

Bermuda Monetary Authority as a Class 4 insurer. A.M. Best has

assigned a Financial Strength Rating of A- (Excellent) and a

Long-Term Issuer Credit Rating of a- (Excellent) to Conduit

Reinsurance Limited. The outlook assigned to these ratings is

stable.

Conduit Holdings Limited is the ultimate parent of Conduit

Reinsurance Limited and is listed on the London Stock Exchange

(ticker: CRE). References to "Conduit" include Conduit Holdings

Limited and all of its subsidiary companies.

Learn more about Conduit Re:

Website: https://conduitreinsurance.com/

LinkedIn: https://www.linkedin.com/company/conduit-re

Important information (disclaimers)

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements may be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"goals", "objective", "rewards", "expectations", "projects",

"anticipates", "expects", "achieve", "intends", "tends", "on

track", "well placed", "estimated", "projected", "may", "will",

"aims", "could" or "should" or, in each case, their negative or

other variations or comparable terminology, or by discussions of

strategy, plans, objectives, goals, targets, future events or

intentions. Forward-looking statements include statements relating

to the following: (i) future capital expenditures, expenses,

revenues, unearned premiums pricing rate changes, terms and

conditions, earnings, synergies, economic performance,

indebtedness, financial condition, dividend policy, claims

development, losses and loss estimates and future business

prospects; and (ii) business and management strategies and the

expansion and growth of Conduit's operations.

Forward-looking statements may and often do differ materially

from actual results. Forward-looking statements reflect Conduit's

current view with respect to future events and are subject to risks

relating to future events and other risks, uncertainties and

assumptions relating to Conduit's business, results of operations,

financial position, liquidity, prospects, growth and strategies.

These risks, uncertainties and assumptions include, but are not

limited to: the possibility of greater frequency or severity of

claims and loss activity than Conduit's underwriting, reserving or

investment practices have anticipated; the reliability of

catastrophe pricing, accumulation and estimated loss models; the

actual development of losses and expenses impacting estimates for

claims which arose as a result of recent loss activity such as the

Ukraine crisis, Hurricanes Ian and Ida, the European storms and

floods in 2021 and 2022, the earthquake in Turkey and wildfires in

Canada and Europe; the impact of complex causation and coverage

issues associated with attribution of losses to wind or flood

damage; unusual loss frequency or losses that are not modelled; the

effectiveness of Conduit's risk management and loss limitation

methods, including to manage volatility; the recovery of losses and

reinstatement premiums from our own reinsurance providers; the

development of Conduit's technology platforms; a decline in

Conduit's ratings with A.M. Best or other rating agencies; the

impact that Conduit's future operating results, capital position

and ratings may have on the execution of Conduit's business plan,

capital management initiatives or dividends; Conduit's ability to

implement successfully its business plan and strategy during 'soft'

as well as 'hard' markets; the premium rates which are available at

the time of renewals within Conduit's targeted business lines;

increased competition on the basis of pricing, capacity or coverage

terms and the related demand and supply dynamics as contracts come

up for renewal; the successful recruitment, retention and

motivation of Conduit's key management and the potential loss of

key personnel; the credit environment for issuers of fixed maturity

investments in Conduit's portfolio; the impact of swings in market

interest rates, currency exchange rates and securities prices;

changes by central banks regarding the level of interest rates and

the timing and extent of any such changes; the impact of inflation

or deflation in relevant economies in which Conduit operates;

Conduit becoming subject to income taxes in the United States or in

the United Kingdom; and changes in insurance or tax laws or

regulations in jurisdictions where Conduit conducts business.

Forward-looking statements contained in this interim update may be

impacted by the escalation or expansion of the Ukraine conflict on

Conduit's clients, the volatility in global financial markets and

governmental, regulatory and judicial actions, including coverage

issues.

Forward-looking statements speak only as of the date they are

made. No representation or warranty is made that any

forward-looking statement will come to pass. Conduit disclaims any

obligation or undertaking to update or revise any forward-looking

statements contained herein to reflect actual results or any change

in the assumptions, conditions or circumstances on which any such

statements are based unless required to do so by law or regulation.

All subsequent written and oral forward-looking statements

attributable to Conduit and/or the group or to persons acting on

its behalf are expressly qualified in their entirety by the

cautionary statements referred to above.

"Estimated ultimate premiums written" is the estimated total

gross premiums written (excluding reinstatement premiums) that is

expected to be earned assuming all bound contracts run to the end

of the period of cover, after management discount for prudence.

The Conduit renewal year on year indicative pricing change

measure is an internal methodology that management intends to use

to track trends in premium rates of a portfolio of reinsurance

contracts. The change measure reflects management's assessment of

relative changes in price, exposure and terms and conditions. It is

also net of the estimated impact of claims inflation. The

calculation involves a degree of judgement in relation to

comparability of contracts and the assessment noted above,

particularly in Conduit's initial years of underwriting. To enhance

the methodology, management may revise the methodology and

assumptions underlying the change measure, so the trends in premium

rates reflected in the change measure may not be comparable over

time. Consideration is only given to renewals of a comparable

nature so it does not reflect every contract in the portfolio of

Conduit contracts. The future profitability of the portfolio of

contracts within the change measure is dependent upon many factors

besides the trends in premium rates.

Additional Performance Measures (APMs)

Conduit presents certain APMs to evaluate, monitor and manage

the business and to aid readers' understanding of Conduit's

financial statements and methodologies used. These are common

measures used across the (re) insurance industry and allow the

reader of Conduit's financial reports to compare those with other

companies in the (re)insurance industry. The APMs should be viewed

as complementary to, rather than a substitute for, the figures

prepared in accordance with IFRS. Conduit's Audit Committee has

evaluated the use of these APMs and reviewed their overall

presentation to ensure that they were not given undue prominence.

This information has not been audited.

Management believes the APMs included in the condensed interim

consolidated financial statements are important for understanding

Conduit's overall results of operations and may be helpful to

investors and other interested parties who may benefit from having

a consistent basis for comparison with other companies within the

(re)insurance industry. However, these measures may not be

comparable to similarly labelled measures used by companies inside

or outside the (re)insurance industry. In addition, the information

contained herein should not be viewed as superior to, or a

substitute for, the measures determined in accordance with the

accounting principles used by Conduit for its condensed interim

consolidated financial statements or in accordance with IAS 34.

Below are explanations, and associated calculations, of the APMs

presented by Conduit:

APM Explanation Calculation

Gross premiums written For the majority of excess of loss Amounts payable by the cedant before

contracts, premiums written are any deductions, which may include

recorded based on the minimum taxes, brokerage and

and deposit or flat premium, as commission.

defined in the contract. Premiums

written for proportional

contracts on a risks attaching basis

are written over the term of the

contract in line with

the underlying exposures. Subsequent

adjustments, based on reports of

actual premium by the

ceding company, or revisions in

estimates, are recorded in the period

in which they are determined.

Reinstatement premiums are excluded.

--------------------------------------- ---------------------------------------

Net loss ratio Ratio of net losses and loss related Net losses and loss related

amounts expressed as a percentage of amounts/Net reinsurance revenue

net reinsurance

revenue in a period

--------------------------------------- ---------------------------------------

Reinsurance operating expense ratio Ratio of reinsurance operating Reinsurance operating expenses/Net

expenses, which includes acquisition reinsurance revenue

expenses charged by insurance

brokers and other insurance

intermediaries to Conduit, and

operating expenses paid that are

attributable to the fulfilment of

reinsurance contracts, expressed as a

percentage of net

reinsurance revenue in a period.

--------------------------------------- ---------------------------------------

Other operating expense ratio Ratio of other operating expenses Other operating expenses/Net

expressed as a percentage of net reinsurance revenue

reinsurance revenue in

a period.

--------------------------------------- ---------------------------------------

Combined ratio (KPI) The sum of the net loss ratio, Net loss ratio + Net reinsurance

reinsurance operating expense ratio operating expense ratio + Other

and other operating expense operating expense ratio

ratio. A combined ratio below 100%

generally indicates profitable

underwriting, whereas a

combined ratio over 100% generally

indicates unprofitable underwriting,

each prior to the

consideration of total net investment

return.

--------------------------------------- ---------------------------------------

Accident year loss ratio Ratio of the net losses & loss related Accident year net losses and loss

amounts of an accident year (or related amounts/Net reinsurance

calendar year) revalued revenue

at the current balance sheet date

expressed as a percentage of net

reinsurance revenue in

a period.

--------------------------------------- ---------------------------------------

Underwriting year loss ratio Ratio of net losses and loss related Underwriting year net losses and loss

amounts of an underwriting year adjustment expenses / Net reinsurance

expressed as a percentage revenue

of net reinsurance revenue in a

period.

--------------------------------------- ---------------------------------------

Total net investment return (KPI) Conduit's principal investment Net investment income + Net unrealised

objective is to preserve capital and gains (losses) on investments + Net

provide adequate liquidity realised gains

to support the payment of losses and (losses) on investments /

other liabilities. In light of this, Non-operating cash and cash

Conduit looks to equivalents + Fixed maturity

generate an appropriate total net securities,

investment return. Conduit bases its at beginning of period

total net investment

return on the sum of non-operating

cash and cash equivalents and fixed

maturity securities.

Total net investment return is

calculated daily and expressed as a

percentage.

--------------------------------------- ---------------------------------------

Return on equity (KPI) RoE enables Conduit to compare itself Profit (loss) after tax for the

against other peer companies in the period/Total shareholders' equity, at

immediate industry. beginning of period

It is also a key measure internally

and is integral in the

performance-related pay

determinations.

RoE is calculated as the profit for

the period divided by the opening

total shareholders'

equity.

--------------------------------------- ---------------------------------------

Total shareholder return (KPI) Total shareholder return allows Closing Common Share price - Opening

Conduit to compare itself against Common Share price + Common Share

other public peer companies. dividends during the

Total shareholder return is calculated period / Opening Common Share price

as the percentage change in Common

Share price over

a period, after adjustment for Common

Share dividends.

--------------------------------------- ---------------------------------------

Dividend yield Calculated by dividing the annual Annual dividends per Common Share /

dividends per Common Share by the Closing Common Share price

Common Share price on

the last day of the given year and

expressed as a percentage.

--------------------------------------- ---------------------------------------

Condensed interim consolidated statement of comprehensive loss

(unaudited)

Six months Six months Twelve months

ended ended ended

30 June 2023 30 June 2022 31 Dec 2022

(re-stated) (re-stated)

$m $m $m

-------------------------------------------------- -------------- -------------- --------------

Reinsurance revenue 278.7 169.3 392.4

Reinsurance service expenses (169.8) (149.8) (362.1)

Ceded reinsurance expenses (35.9) (20.4) (48.6)

Ceded reinsurance recoveries 7.7 11.3 28.7

Reinsurance service result 80.7 10.4 10.4

-------------------------------------------------- -------------- -------------- --------------

Net investment income 17.2 6.4 17.8

Net realised losses on investments (0.3) (2.1) (2.8)

Net unrealised gains (losses) on investments 5.7 (54.3) (67.8)

Net investment result 22.6 (50.0) (52.8)

Net reinsurance finance (expense) income (10.1) 10.1 20.8

Net foreign exchange gains 0.9 1.4 1.3

Net financial result 94.1 (28.1) (20.3)

-------------------------------------------------- -------------- -------------- --------------

Equity-based incentives (1.0) (0.7) (2.1)

Other operating expenses (13.9) (10.2) (20.7)

Results of operating activities 79.2 (39.0) (43.1)

-------------------------------------------------- -------------- -------------- --------------

Financing costs (0.6) (0.4) (0.8)

Total comprehensive income (loss) for the period 78.6 (39.4) (43.9)

-------------------------------------------------- -------------- -------------- --------------

Earnings (loss) per share

Basic and diluted $0.49 $(0.24) $(0.27)

Condensed interim consolidated balance sheet (unaudited)

As at 30 June 2023 As at 30 June 2022 As at 31 Dec 2022 As at 1 Jan 2022

(re-stated) (re-stated) (re-stated)

$m $m $m $m

------------------------------------- ------------------- ------------------- ------------------ -----------------

Assets

Cash and cash equivalents 118.1 92.0 112.9 67.5

Accrued interest receivable 6.7 4.0 5.5 3.7

Investments 1,118.7 952.7 1,021.7 1,008.4

Ceded reinsurance contract assets 72.6 48.2 67.3 41.0

Other assets 3.0 2.6 3.6 1.6

Right-of-use assets 1.9 2.4 2.2 2.9

Intangible assets - 1.2 1.4 1.1

Total assets 1,321.0 1,103.1 1,214.6 1,126.2

------------------------------------- ------------------- ------------------- ------------------ -----------------

Liabilities

Reinsurance contract liabilities 394.8 177.5 336.3 116.1

Other payables 7.0 6.2 8.7 19.0

Lease liabilities 2.1 2.6 2.4 2.9

Total liabilities 403.9 186.3 347.4 138.0

------------------------------------- ------------------- ------------------- ------------------ -----------------

Shareholders' equity

Share capital 1.7 1.7 1.7 1.7

Own shares (19.2) (3.2) (20.1) (0.2)

Other reserves 1,058.1 1,056.7 1,058.1 1,056.0

Retained loss (123.5) (138.4) (172.5) (69.3)

Total shareholders' equity 917.1 916.8 867.2 988.2

------------------------------------- ------------------- ------------------- ------------------ -----------------

Total liabilities and shareholders'

equity 1,321.0 1,103.1 1,214.6 1,126.2

------------------------------------- ------------------- ------------------- ------------------ -----------------

Condensed interim statement of consolidated cash flows

(unaudited)

Six months Six months Twelve months

ended ended ended

30 June 2023 30 June 2022 31 Dec 2022

(re-stated) (re-stated)

$m $m $m

------------------------------------------------------------------- -------------- -------------- --------------

Cash flows from operating activities

Comprehensive income (loss) 78.6 (39.4) (43.9)

Depreciation 0.3 0.7 0.9

Write-off of intangible asset 1.4 - -

Interest expense on lease liabilities - 0.1 0.1

Net investment income (17.8) (7.0) (18.7)

Net realised losses on investments 0.3 2.1 2.8

Net unrealised (gains) losses on investments (5.7) 54.3 67.8

Net unrealised foreign exchange gains (0.9) (1.5) (1.0)

Equity-based incentives 1.0 0.7 2.1

Change in operational assets and liabilities

- Reinsurance assets and liabilities 53.7 56.3 195.1

- Other assets and liabilities (1.1) (5.5) (2.0)

Net cash flows from operating activities 109.8 60.8 203.2

------------------------------------------------------------------- -------------- -------------- --------------

Cash flows used in investing activities

Purchase of investments (279.2) (155.6) (304.9)

Proceeds on sale and maturity of investments 187.8 143.5 206.2

Interest received 16.4 9.5 21.1

Purchase of intangible assets - (0.1) (0.3)

Net cash flows used in investing activities (75.0) (2.7) (77.9)

------------------------------------------------------------------- -------------- -------------- --------------

Cash flows used in financing activities

Lease liabilities paid (0.3) (0.3) (0.6)

Dividends paid (29.6) (29.7) (59.3)

Purchase of own shares - (3.0) (19.9)

Distributions from EBT (0.1) - -

Net cash flows used in financing activities (30.0) (33.0) (79.8)

------------------------------------------------------------------- -------------- -------------- --------------

Net increase in cash and cash equivalents 4.8 25.1 45.5

Cash and cash equivalents at the beginning of the year 112.9 67.5 67.5

Effect of exchange rate fluctuations on cash and cash equivalents 0.4 (0.6) (0.1)

Cash and cash equivalents at end of period 118.1 92.0 112.9

------------------------------------------------------------------- -------------- -------------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAFXSALNDEAA

(END) Dow Jones Newswires

July 26, 2023 02:00 ET (06:00 GMT)

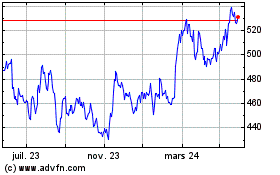

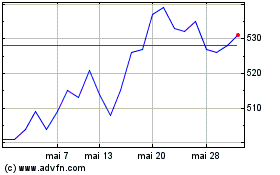

Conduit (LSE:CRE)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Conduit (LSE:CRE)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024