Dianomi PLC Trading Statement (1410G)

17 Juillet 2023 - 8:00AM

UK Regulatory

TIDMDNM

RNS Number : 1410G

Dianomi PLC

17 July 2023

17 July 2023

Dianomi plc

("Dianomi", the "Company" or the "Group")

Trading Update

Dianomi , a leading provider of native digital advertising

services to premium clients in the Business, Finance and Lifestyle

sectors, announces the following trading update for the year to 31

December 2023.

As has been widely reported, the decline in traffic volumes has

been a key challenge for publishers in 2023. This trend is clear

across Dianomi's direct publisher inventory with traffic levels

across key publishers down by between 10-30% in the six months to

30 June 2023 vs the same period in 2022. As a consequence, while

demand from Dianomi's 400+ premium financial and lifestyle

advertisers has remained consistent with the backdrop announced at

full year 2022 results, the reduced traffic across its publishers

naturally impacts Dianomi's ability to generate revenue from the

adverts it places on their digital properties. Furthermore, certain

new publisher partnerships did not materialise in the expected

timeframe to offset the decline in traffic across existing

publishers, though they remain future opportunities.

Readership levels are also perhaps finding a new 'normal' level

post pandemic.

Reflecting these lower traffic levels, revenue for the six

months to 30 June 2023 is expected to show a c.18% decrease on the

same period in the previous year which benefitted from a strong Q1

before advertiser caution set in in Q2 2022. As a result, the Group

expects revenue for the year ended 31 December 2023 to be lower

than market expectations and is providing new revenue guidance of

between GBP30.5 and GBP32.5 million (2022: GBP35.9 million).

Importantly, from a Company perspective, Dianomi continues to

expand its distribution channels in order to generate increased and

more predictable future income streams through:

-- Further developing programmatic distribution, a key driver of future growth; and

-- Continuing to scale both existing and new publisher partnerships.

Dianomi's continues to develop its programmatic distribution

capability with a 6 fold growth in programmatic revenue in the six

months to 30 June 2023 compared to the same period last year,

albeit from a relatively modest base. This provides opportunities

for Dianomi to unlock further demand from its premium advertisers

and scale the budgets they spend via the Company's trusted and

brand safe platform. Alongside programmatic, scaling its core

direct publisher inventory through expanding existing relationships

and attracting new publishers remains a key priority for

Dianomi.

Retention of both publishers and advertisers has remained strong

in 2023 and year to date the Company has continued to attract new

publishers and advertisers to the platform providing the

opportunity to scale these new relationships alongside converting

new pipeline opportunities.

The operational cost base of the Group has been significantly

improved following the restructuring of the Group's global

management and sales teams in March, resulting in the cost base

reducing by GBP1 million on an annualised basis. Given the

challenging market backdrop, the Group continues to carefully

monitor its cost base whilst ensuring that sufficient investment is

made to support future growth. Cash as at 30 June 2023 was GBP7.1

million (31 December 2022: GBP11.7 million), reflecting the

unwinding of the working capital benefit highlighted at the time of

the Company's final results for the year ended 31 December 2022,

the delay in receipt of certain overdue debtor balances amounting

to c. GBP1.2 million (received shortly after the period end),

one-off restructuring costs of GBP0.8 million and foreign exchange

movement as a result of the strengthening of the pound against the

dollar during the period. The Company remains debt free and expects

improved cash generation in the second half of the year.

CEO of Dianomi, Rupert Hodson, commented : "The fall in traffic

levels will impact our business and the wider industry this year,

nevertheless, it also serves to highlight the importance of

developing our ability to scale distribution on a programmatic

basis through the intelligent use of our deep understanding of

context and engagement. As mentioned, we are continuing to attract

new customers and expanding distribution through programmatic

initiatives. We are therefore in a solid position with a strong

balance sheet but as a business we are looking beyond the near term

and focusing on our future ability to offer our existing customer

base the option to substantially increase their spend with us."

For further information contact:

Dianomi Tel: +44 (0)207 802 5530

Rupert Hodson (Chief Executive Officer)

Charlotte Stranner (Chief Financial Officer)

Panmure Gordon (Nominated Adviser and Broker) Tel: +44 (0)207 886 2500

Emma Earl/ Freddy Crossley, Corporate Finance

Rupert Dearden, Corporate Broking

Novella Communications Tel: +44 (0)203 151 7008

Tim Robertson

Claire de Groot

Safia Colebrook

About Dianomi

Dianomi, established in 2003, is a leading provider of native

digital advertising services to premium clients in the Financial

Services and Business sectors. The Group operates from its offices

in London, New York and Sydney. The Group enables premium brands to

deliver native advertisements to a targeted audience on the desktop

and mobile websites, mobile and tablet applications of premium

publishers. It provides over 400 advertisers, including blue chip

names such as abrdn, Invesco and Baillie Gifford, with access to an

international audience of over 400 million devices per month

through its partnerships with over 300 premium publishers of

business and finance content, including blue chip names such as

Reuters, Bloomberg and WSJ. Adverts served are contextually

relevant to the content of the webpages on which they appear and

mirror the style of the page, which enhances reader engagement.

http://www.dianom i.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPUMCMUPWGRC

(END) Dow Jones Newswires

July 17, 2023 02:00 ET (06:00 GMT)

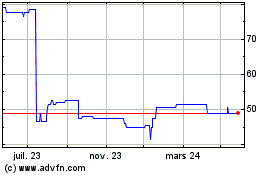

Dianomi (LSE:DNM)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

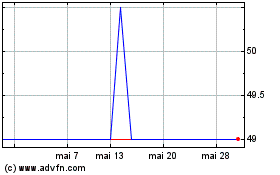

Dianomi (LSE:DNM)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025