TIDMELCO

RNS Number : 0814M

Eleco PLC

12 September 2023

12 September 2023

Eleco Plc

("Eleco", the "Group" or the "Company")

Interim Results for the Six Months Ended 30 June 2023:

Recurring Revenue up 18%

Eleco plc (AIM: ELCO), the specialist software provider for the

built environment, has published its results for the six months

ended 30 June 2023, based on unaudited management accounts:

Financial highlights:

-- Annualised Recurring Revenue (ARR)(1) up 18% to GBP19.7m (at

30 June 2022: GBP16.7m); organic ARR growth of 24%

-- Total Recurring Revenue (TRR) up 18% to GBP9.7m (H1 2022:

GBP8.2m), representing 72% of total revenue (H1 2022: 61% of total

revenue); organic TRR growth of 21%

-- Revenues slightly ahead of expectations at GBP13.5m (GBP13.6m

in constant currency terms) (H1 2022: GBP13.4m) despite products'

end-of-life, and business disposal. Excluding these, revenues were

5% ahead organically, following the effects of the SaaS

transition

-- EBITDA (2) of GBP2.2m (H1 2022: GBP2.8m)

-- Adjusted EBITDA(3) of GBP2.6m (2022: GBP2.9m) as anticipated

-- Profit Before Taxation GBP1.3m (H1 2022: GBP1.7m)

-- Adjusted Profit Before Taxation(4) GBP1.8m (H1 2022: GBP2.0m)

-- Basic EPS of 1.2 pence per share (H1 2022: 1.6 pence per share)

-- Adjusted EPS(5) of 1.7 pence per share (H1 2022: 1.9 pence per share)

-- Cash at 30 June 2023 GBP9.4m (GBP11.3m at 30 June 2022;

GBP12.5m at 31 December 2022) after acquisition payment of

GBP3.6m

-- Interim dividend up 25% to 0.25 pence per share (H1 2022: 0.20 pence per share)

Operational highlights:

-- Execution of M&A strategy:

o Acquisition of profitable SaaS business, BestOutcome - a

leading UK provider of simple, scalable Project Portfolio

Management (PPM) software , to complement Building Lifecycle

products and broaden Eleco's customer base

o Profitable disposal of non-core German architectural CAD

business

-- Strategic partnerships announced with:

o C-Tech Club, partnerships with innovative construction

technology start-ups

o Nodes & Links, to bring AI into the world of construction

planning

-- Return of Asta brand, drawing on our innovation heritage

-- On-going improvements in ESG initiatives such as

environmental data gathering and monitoring; enhanced scores with

our Great Place to Work(R) certifications, and implemented training

and updated group policy framework for all employees

-- Elecosoft UK obtained ISO 27001 certification in continued

commitment to customer data security

Jonathan Hunter, Chief Executive Officer of Eleco plc said:

"We are extremely well-positioned within our markets with an

established loyal customer base, world-class technology, positive

market growth trends and drivers, and a clear customer-focussed

growth strategy. We are very pleased with our recent acquisition of

BestOutcome, which, through its integration into the Eleco family,

strengthens the existing Building Lifecycle offering and further

builds our SaaS recurring revenue portfolio with a wider, more

diverse customer base. We shall continue to identify appropriate

acquisitions that will widen our customer base, complement our

technological innovation, extend our geographic capabilities, and

further enhance our recurring revenues and overall financial

performance.

"Eleco is fundamentally delivering on its SaaS strategy which

will bring further significant operational and financial benefits.

We remain focussed on the continued growth of organic recurring

revenues, supplemented by further inorganic growth opportunities.

We are confident in continued progress and positive momentum for

the future, underpinned by our current trading tracking in line

with management's expectations for the full year."

The Company also announces that its nominated adviser and broker

finnCap Ltd, has changed its name to Cavendish Capital Markets

Limited.

(1) ARR is defined as normalised annualised recurring revenues

and includes revenues from subscription licences, contract values

of annual support and maintenance, and SaaS contracts.

Normalisation is calculated using the recurring revenue in the

final month of the period, multiplied by twelve. This ARR figure is

calculated prior to the inclusion of the forthcoming contribution

from the BestOutcome Ltd acquisition.

(2) EBITDA is defined as Earnings before Interest, Taxation,

Depreciation, Amortisation and Impairment of Intangible Assets.

This includes the gain on disposal of the ARCON business in H1

2023. See note 14.

(3) Adjusted EBITDA is adjusted for acquisition related expenses

and amortisation of acquired intangibles. See note 14.

(4) Adjusted profit before tax is adjusted for acquisition

related expenses and amortisation of acquired intangibles. See note

14.

(5) Adjusted earnings per share represents profit after tax as

adjusted for acquisition related expenses and amortisation of

acquired intangibles, divided by a weighted average number of

shares. See note 7 and note 14.

(6) Organic refers to the underlying financials after adjusting

for revenues from the disposed ARCON business and for adjusting for

the ending of life of several products.

For further information, please contact:

Eleco plc +44 (0)20 7422 8000

Jonathan Hunter, Chief Executive Officer

-------------------------

Neil Pritchard, Chief Financial Officer

-------------------------

Cavendish Capital Markets Limited (previously finnCap Limited) +44 (0)20 7220 0500

-------------------------

Geoff Nash/ Emily Watts/ Seamus Fricker (Corporate Finance)

-------------------------

Charlotte Sutcliffe/ Harriet Ward (ECM)

-------------------------

SEC Newgate UK +44 (0)20 3757 6882

-------------------------

Elisabeth Cowell/ Bob Huxford eleco@secnewgate.co.uk

-------------------------

About Eleco plc

Eleco plc is an AIM-listed (AIM: ELCO) specialist international

provider of software and related services to the built environment

through its operating brands Elecosoft, BestOutcome and Veeuze from

centres of excellence in the UK, Sweden, Germany, the Netherlands

and the USA.

The Group's software solutions are trusted by international

customers and used throughout the building lifecycle from early

planning and design stages to construction, interior fit out, asset

management and facilities management to support project management,

estimation, visualisation, Building Information Modelling (BIM) and

property management.

For further information please visit www.eleco.com

Chairman's Statement

Introduction

In an era of increased global instability and macroeconomic

headwinds, it is pleasing to report, in this first statement in my

capacity as Interim Chair, that Eleco continues to execute on its

strategy and deliver stable, more predictable and growing recurring

revenues as it successfully navigates through its SaaS

transition.

Eleco, alongside its customer centricity, continues to benefit

from international industry trends and drivers, such as

digitalisation and the incorporation of Artificial Intelligence

(AI) to improve productivity, the reduction of waste and carbon

footprint, efficient delivery models across the lifecycle utilising

greater data collaboration and integration.

Performance and future

Recurring revenue in the first half grew by 18 per cent to

GBP9.7m (H1 2022: GBP8.2m) and now accounts for 72 per cent of

total revenue (H1 2022: 61 per cent of total revenue). This

significant uplift in performance emphasises the benefits in our

SaaS transition. Similarly, annualised recurring revenues increased

by 18 per cent to GBP19.7m (H1 2022: GBP16.7m). Revenue was

slightly ahead of forecast, despite the absence of revenue from a

number of Swedish-based end-of-life products and a planned

disposal. Profitability was in line with management's

expectations.

For the full year 2023, we expect to see revenues in line with

our plan and as a result of the SaaS transition, longer term

sustainable growth and overall shareholder returns coming

through.

Strategic progress

These organic developments and overall prospects have been

supplemented by progress in other corporate activity. In February

2023, we sold the ARCON architectural CAD business, enabling

increased focus on our core Building Lifecycle businesses.

In June 2023, we acquired a UK provider of easy-to-use, scalable

Project Portfolio Management (PPM) software for a net consideration

of GBP3.6m. The value enhancing addition of the BestOutcome

business broadens our customer base and provides potential extended

cross fertilisation of solutions to our existing customers.

Environmental, Social and Governance (ESG)

As Chair of our ESG Committee, I am keen to ensure that Eleco is

at the forefront of initiatives that deliver on and fulfil our

important responsibilities and ESG commitments. Having adopted a

balanced scorecard approach, environmentally, we are measuring our

performance against KPIs, building on the short-term objective of

our Net Zero carbon offset. Internal measures continue to minimise

our own footprint and we are looking at other ways to assist our

customers' ability to measure and reduce their own emissions.

Socially, we have been building our Employee Value Proposition,

internal management training, and Eleco's impact in the community

through volunteering and wellness initiatives. We were pleased to

achieve higher scoring in the Great Place to Work(R) certifications

this year, deepening the bonds within and across the Group. Also,

in Governance, new Group policies are being progressively and

regularly rolled out to employees via an internal training

platform.

Dividend

Having regard to both the organic and inorganic needs of the

business and recent performance, the Board is increasing the

interim dividend by 25 per cent to 0.25 pence per share (H1 2022:

0.20 pence per share), payable on 6th October 2023 to shareholders

on the Register on 22 September 2023, and the ex-dividend date will

be 21st September 2023.

Employees

The key to any successful business, and our biggest asset, is

our people; the management and colleagues without whom the Group

cannot achieve the success it strives for. We are very fortunate in

having highly dedicated, talented and hardworking colleagues across

the world. On behalf of the Board, I wish to express my thanks for

their continued efforts and their support.

Board updates

We are currently at an advanced stage of recruiting a new Chair

and an Independent Non-Executive Director who will in turn become

Chair of the Audit & Risk Committee. Announcements on these two

roles are expected to be forthcoming prior to the year end.

Current trading and outlook

The Group's transformation to a high recurring revenue, SaaS

driven business is now well advanced and entering a new phase that

will bring further significant operational and financial

benefits.

We are confident that we will continue to weather economic and

market headwinds given our clearly defined and executed strategy

for growth. Our technological solutions help our customers drive

efficiencies in these challenging environments.

We continue to deliver organic growth and accelerate delivery of

our plan via complementary acquisitions that enable us to scale up

and exploit market opportunities.

We are well positioned to grow our international markets and see

continued progress and positive momentum for the future with

current trading in line with our internal expectations for the full

year.

Mark Castle

Interim Non-Executive Chairman

11 September 2023

Chief Executive's Statement

Introduction

We are encouraged by Eleco's trading performance for the first

six months of the financial year, in which we have continued to

deliver on our strategy. We previously flagged that H1 2023 would

be the low point of the temporary financial impact of the SaaS

transition. However, we are pleased to report we have grown

compared to H1 2022.

Despite continued macroeconomic pressures, which have negatively

impacted revenue streams, we remain resolute in our focus on our

growth strategy and delivery of business performance and in our

ambition to be the world-class, global leader in software for the

built environment. Building on the H1 2023 milestone of the SaaS

transition, we believe we have the people, technology, know-how and

culture to further execute on this successful journey.

Strategy and strategic developments

Eleco's vision is to solve the challenges of the built

environment for our customers through digital transformation. We do

this by providing best-of-breed software and living by our core

values, such as collaboration, excellence and customer-centricity:

in short, we aim to be our customers' trusted, proven technology

partner. The SaaS transition is but one major change in our

transformational journey. Artificial intelligence (AI) is another:

AI capabilities will provide greater reliability and programme

forecasting whilst improved risk management will reduce the time

and cost overruns that continue to impact projects, in turn

improving productivity.

The Group has a strong pedigree within an industry that is

currently increasing data adoption from historically low levels.

This is a long-term underlying trend to meet the demands of

population growth on housing and infrastructure, environmental

needs and targets, increased regulation and compliance, the need to

reduce time, cost and waste, modularised formats, data sharing, 4D

Building Information Modelling (BIM) demands and more. The growth

strategy is therefore focussed on go-to-market initiatives to

further develop the awareness of Eleco's best technical

capabilities, meeting the needs of customers and accordingly

delivering digital transformation.

Eleco's customer-focussed approach extends beyond simply knowing

the many inputs of a project; we understand what our customers are

seeking to achieve with their digital transformation and how

planning, estimating and maintenance management can be adjusted to

ensure they stay on course. This understanding informed strategic

decision to acquire BestOutcome in June 2023, providing greater

opportunities for our customers and widening our total addressable

market.

BestOutcome is a profitable, high quality SaaS business and

leading UK provider of easy-to-use, highly configurable, scalable

Project Portfolio Management (PPM) software. It strengthens our

Building Lifecyle portfolio in line with Eleco's growth strategy to

enhance its predictable recurring revenue (alongside our SaaS

transition) and to invest in synergistic software products and

technologies. The incumbent directors and owners of BestOutcome

have reinvested profits into doubling its world-class development

team over the last few years, enabling a highly secure and

practical solution for planning and managing programmes for

customers in public and private sectors. The integration process is

already progressing well.

During H1 2023, Eleco sold Eleco Software GmbH, the German

'ARCON' architectural CAD business, a non-core operation.

Business developments, operations and performance

We revisited our growth strategy in the US and reinitiated our

approach to direct sales in April, targeting general contractors in

the US and while our resellers commenced the SaaS transition. The

customer interest and increased level of new customers provided

confidence to incrementally investing in our US operation,

introducing marketing and sales resources in Q2 and a finance

resource in Q3.

The Group is proud to partner with the C-Tech Club - a

networking group of over 386 founders and CEOs of construction

technology start-ups - and in May 2023, we sponsored the C-Tech

Start-Up Village at the Digital Construction Week (DCW) 'Innovation

in the Built Environment' event in London's Excel Centre.

At DCW, we announced the reintroduction of the widely recognised

and respected Asta product brand in response to customer feedback

and in conjunction with the release of the lean planning module,

Asta Connect, and Version 17 of Asta Powerproject. Asta now covers

the whole suite of broader project scheduling solutions from

end-to-end visibility of project changes and progress reporting

across organisations and locations, to on-site task updates.

The Leadership team continued to evolve our technology roadmap

to drive targeted M&A search and to continue to steer our

investment in our innovative software solutions. Several product

development initiatives are underway, including those focusing on

document and data management, our customer portal, the Elecoverse,

as well as modularisation and enhancements in our core

offerings.

Though we have been using Artificial Intelligence (AI) and

Machine Learning (ML) in a number of our solutions for many years,

for example in our Veeuze visualisation configurators, we have

entered a new phase in this development. We have recently entered

into a strategic partnership with Nodes & Links where we will

draw upon their cumulative AI investments to offer enhanced

functionality as a next-gen enabler to our mutually held

end-customers.

We are also pleased that Elecosoft has obtained the sought-after

ISO 27001/27002 certifications in its continued commitment to

customer data security in the UK. ISO 27001 Information Security

Management standard (ISMS) details the requirements for businesses

to securely manage information assets and data to an

internationally recognised standard and 27002 has the detailed

controls that back this up. It provides a robust approach for

managing assets such as customer and employee details, intellectual

property, financial information, third-party data, and reducing the

risks of breaches and cybercrime.

As previously highlighted, many companies in SaaS transitions

see significant reductions in revenues, but the Group broadly

maintained revenues and in this first half of 2023, delivered a

slight increase over H1 2022. Total recurring revenues increased by

18 per cent (H1 2022: 9 per cent; and against 10 per cent for 2022

as a whole). Annualised recurring revenues at 30 June also grew 18

per cent; organic growth rates for continuing operations' for the

period showed a 21 per cent rise for total recurring revenue and 24

per cent increase for annualised recurring revenue.

These revenue growth levels are testament to the strength of our

customer software offerings. Within this total, we have seen a

reduction in service revenues due to macroeconomic market

pressures, which has caused purchasing delays in particular with

our CAD and Visualisation solutions. Revenues in Germany have

reduced following the disposal of our non-core German ARCON

business in February 2023. Furthermore there was a reduction in

Scandinavian revenues from the planned impact of the end-of-life of

the Group's Memmo and Sitecon products, and the announced

end-of-life of a third-party product resold in Sweden.

The move by our customers from upfront and one-off perpetual

licences to high-quality subscription and SaaS licences where

revenues are recognised over time, set against an operating cost

base subject to current inflationary factors, impacted

profitability, as anticipated. Nevertheless, with the benefit of

the profit on disposal of the ARCON business, Adjusted Profit

Before Taxation of GBP1.8m, adjusted for acquisition costs and

share based payments was as anticipated (H1 2022: Adjusted Profit

Before Taxation of GBP2.0m). With a lower tax charge, Adjusted

earnings per share was 1.7 pence per share (H1 2022: 1.9 pence per

share).

Underlying cash generation remains strong, despite the impact of

the SaaS transition, with free cash flow of GBP1.8m (H1 2022:

GBP2.1m). The overall cash balance of GBP9.4m (GBP11.3m at 30 June

2022; GBP12.5m at 31 December 2022) is after a net cash

consideration for BestOutcome of GBP3.5m and an increased final

dividend and one-off special dividend payments made in the first

half totalling GBP0.9m (H1 2022: GBP0.3m).

Appointments

We were pleased to welcome David Hughes as Regional Managing

Director, UK in March of this year, with his extensive background

in go-to-market and customer success through SaaS transitions,

drawing on his time as Managing Director at Excitech, the former

largest Autodesk reseller in the UK.

Mark Chapman also joined as Head of Innovation in April of this

year, bringing with him a wealth of experience as a construction

technology innovator and leader, with almost 30 years of planning

and delivering civil, building, rail and marine projects

internationally, as well as advising companies of all sizes on the

wider adoption of digital technology.

Summary

We continue to successfully execute on our growth strategy. We

are the trusted technology partner for our customers, who

increasingly look to us to help them solve their challenges and

provide certainty for the built environment. I am proud of our

world-class team of talented colleagues, their energy, collective

culture, enthusiasm and determination to drive our success into the

future. Eleco is a "Great Place to Work".

Although some customers are belt-tightening due to macroeconomic

pressures, we are extremely well-positioned within our markets with

an established and loyal customer base, outstanding technology,

positive market growth trends and drivers, and a clear

customer-focussed growth strategy. We are very pleased with our

recent acquisition of BestOutcome, which, through its integration

into the Eleco family, strengthens the existing Building Lifecycle

offering and further builds our SaaS recurring revenue portfolio

with a wider, more diverse customer base. We shall continue to

identify appropriate acquisitions that will strengthen our customer

relationships, complement our technological innovation, extend our

geographic capabilities, and further enhance our recurring revenues

and overall financial performance.

Eleco is fundamentally delivering on its SaaS strategy which

will bring further significant operational and financial benefits.

We remain focussed on the continued growth of organic recurring

revenues, supplemented by further inorganic growth opportunities.

We are confident in continued progress and positive momentum for

the future, underpinned by our current trading tracking in line

with expectations for the full year.

Jonathan Hunter

Chief Executive Officer

11 September 2023

Condensed Consolidated Income Statement

for the financial period ended 30 June 2023

Six months to 30 June Year ended

2023 2022 31 December

(unaudited) (unaudited) 2022

Notes GBP'000 GBP'000 GBP'000

================================================= ====== ============= ============ ===========

Revenue 3, 4 13,486 13,435 26,566

Cost of sales (1,440) (1,607) (3,087)

==================================================== ====== ============= ============ ===========

Gross profit 12,046 11,828 23,479

==================================================== ====== ============= ============ ===========

Amortisation and impairment of intangible assets (844) (744) (1,596)

Acquisition expenses and stamp duties (262) - -

Share-based payments (148) (69) (201)

Other selling and administrative expenses (9,722) (9,221) (18,699)

==================================================== ====== ============= ============ ===========

Selling and administrative expenses (10,976) (10,034) (20,496)

==================================================== ====== ============= ============ ===========

Operating profit 4, 5 1,070 1,794 2,983

Finance income / (expense) 6 35 (61) (39)

Gain on business disposal 16 150 - -

==================================================== ====== ============= ============ ===========

Profit before tax 1,255 1,733 2,944

Tax (236) (394) (549)

==================================================== ====== ============= ============ ===========

Profit for the period 1,019 1,339 2,395

==================================================== ====== ============= ============ ===========

Attributable to:

Equity holders of the parent 1,019 1,339 2,395

==================================================== ====== ============= ============ ===========

Earnings per share (pence per share)

Basic earnings per share 7 1.2p 1.6p 2.9p

Diluted earnings per share 7 1.2p 1.6p 2.9p

==================================================== ====== ============= ============ ===========

Condensed Consolidated Statement of Comprehensive Income

for the financial period ended 30 June 2023

Six months to 30 June Year ended

=============================================================== ===================== ============ ================

2023 2022 31 December 2022

(unaudited) (unaudited) GBP'000

GBP'000 GBP'000

=============================================================== ===================== ============ ================

Profit for the period 1,019 1,339 2,395

=============================================================== ===================== ============ ================

Other comprehensive income/(expense):

=============================================================== ===================== ============ ================

Items that will be reclassified subsequently to profit or loss:

Translation differences on foreign operations (376) (115) (107)

=============================================================== ===================== ============ ================

Other comprehensive (loss) net of tax (376) (115) (107)

=============================================================== ===================== ============ ================

Total comprehensive income for the period 643 1,224 2,288

=============================================================== ===================== ============ ================

Attributable to:

Equity holders of the parent 643 1,224 2,288

=============================================================== ===================== ============ ================

Condensed Consolidated Statement of Changes in Equity

for the financial period ended 30 June 2023

Share Share Merger Translation Other Retained

capital Premium reserve Reserve Reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January 2023 832 2,406 1,002 (386) 196 21,792 25,842

========================================================================= ======== ======= ============ ========== =========== ========

Dividends - - - - - (889) (889)

Share-based payments - - - - 148 - 148

Elimination of exercised share-based - - - - (6) 6 -

Payments

Issue of share capital - 12 - - - - 12

========================================================================= ======== ======= ============ ========== =========== ========

Transactions with owners - 12 - - 142 (883) (729)

========================================================================= ======== ======= ============ ========== =========== ========

Profit for the period - - - - - 1,019 1,019

Other comprehensive income/(expense):

Exchange differences on translation of net

investments in foreign operations - - - (376) - - (376)

------------------------------------------------------------------------- -------- ------- ------------ ---------- ----------- --------

Total comprehensive income for the period - - - (376) - 1,019 643

========================================================================= ======== ======= ============ ========== =========== ========

At 30 June 2023 (unaudited) 832 2,418 1,002 (762) 338 21,928 25,756

========================================================================= ======== ======= ============ ========== =========== ========

Share Share Merger Translation Other Retained

Capital Premium Reserve Reserve Reserve Earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January 2022 832 2,406 1,002 (279) (5) 19,890 23,846

========================================================================= ======== ======= ============ ========== =========== ========

Dividends - - - - - (329) (329)

Share-based payments - - - - 69 - 69

Elimination of exercised share-based -

payments - - - (69) 69 -

========================================================================= ======== ======= ============ ========== =========== ========

Transactions with owners - - - - - (260) (260)

========================================================================= ======== ======= ============ ========== =========== ========

Profit for the period - - - - - 1,339 1,339

Other comprehensive income/(expense):

Exchange differences on translation of net investments in foreign

operations - - - (115) - - (115)

========================================================================= ================= ============ ========== =========== ========

Total comprehensive income for the period - - - (115) - 1,339 1,224

========================================================================= ================= ============ ========== =========== ========

At 30 June 2022 (unaudited) 832 2,406 1,002 (394) (5) 20,969 24,810

========================================================================= ================= ============ ========== =========== ========

Share Share Merger Translation Other Retained

capital premium reserve reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============================= ============ ======== =========== ============== =========== ============ =======

At 1 January 2022 832 2,406 1,002 (279) (5) 19,890 23,846

============================= ============ ======== =========== ============== =========== ============ =======

Dividends - - - - - (493) (493)

Share-based payments - - - - 201 - 201

Transactions with owners - - - - 201 (493) (292)

============================= ============ ======== =========== ============== =========== ============ =======

Profit for the period - - - - - 2,395 2,395

Other comprehensive

income/(expense):

Exchange differences on

translation of net

investments in foreign

operations - - - (107) - - (107)

Total comprehensive income

for the period - - - (107) - 2,395 2,288

============================= ============ ======== =========== ============== =========== ============ =======

At 31 December 2022 832 2,406 1,002 (386) 196 21,792 25,842

============================= ============ ======== =========== ============== =========== ============ =======

Condensed Consolidated Balance Sheet

at 30 June 2023

30 June

2023 2022 31 December

(unaudited) (unaudited) 2022

Notes GBP'000 GBP'000 GBP'000

================================================== ====== ============= ============ ===========

Non-current assets

Goodwill 18,834 15,247 15,337

Other intangible assets 9 8,188 6,713 6,591

Property, plant and equipment 947 728 745

Right-of-Use assets 982 1,436 1,479

Deferred tax assets 85 85 51

================================================== ====== ============= ============ ===========

Total non-current assets 29,036 24,209 24,203

================================================== ====== ============= ============ ===========

Current assets

Inventories 89 26 44

Trade and other receivables 4,512 3,746 4,057

Current tax assets 288 305 356

Assets of disposal group held for sale 10 - 842 794

Cash and cash equivalents 9,410 10,926 12,137

================================================== ====== ============= ============ ===========

Total current assets 14,299 15,845 17,388

================================================== ====== ============= ============ ===========

Total assets 43,335 40,054 41,591

================================================== ====== ============= ============ ===========

Current liabilities

Lease liabilities (467) (402) (467)

Trade and other payables (1,788) (1,748) (1,523)

Current tax liabilities (109) - -

Liabilities of disposal group held for sale 10 - (184) (428)

Accruals and deferred income 12 (12,025) (9,831) (10,305)

================================================== ====== ============= ============ ===========

Total current liabilities (14,389) (12,165) (12,723)

================================================== ====== ============= ============ ===========

Non-current liabilities

Lease liabilities (1,002) (1,216) (1,215)

Deferred tax liabilities (2,162) (1,837) (1,785)

Non-current provisions (26) (26) (26)

================================================== ====== ============= ============ ===========

Total non-current liabilities (3,190) (3,079) (3,026)

================================================== ====== ============= ============ ===========

Total liabilities (17,579) (15,244) (15,749)

================================================== ====== ============= ============ ===========

Net assets 25,756 24,810 25,842

================================================== ====== ============= ============ ===========

Equity

Share capital 832 832 832

Share premium account 2,418 2,406 2,406

Merger reserve 1,002 1,002 1,002

Translation reserve (762) (394) (386)

Other reserve 338 (5) 196

Retained earnings 21,928 20,969 21,792

================================================== ====== ============= ============ ===========

Equity attributable to shareholders of the parent 25,756 24,810 25,842

================================================== ====== ============= ============ ===========

Condensed Consolidated Statement of Cash Flows

for the financial period ended 30 June 2023

Six months to 30 June Year ended

2023 2022 31 December

(unaudited) (unaudited) 2022

Notes GBP'000 GBP'000 GBP'000

=================================================================== ===== =============== =========== ============

Cash flows from operating activities

Profit before taxation 1,255 1,733 2,944

Net finance costs (35) 61 39

Depreciation charge 284 271 621

Amortisation charge 844 744 1,596

Profit on sale of property, plant and equipment (15) (6) (24)

Gain on business disposal 16 (150) - -

Share-based payment charge 148 69 201

Acquisition expenses 262 - -

Decrease in provisions - (25) (25)

=================================================================== ===== =============== =========== ============

Cash generated in operations before working capital movements 2,587 2,847 5,352

(Increase)/Decrease in trade and other receivables (428) 498 193

Increase in inventories and work in progress (45) (10) (27)

Increase in trade and other payables and accruals and deferred

income 706 206 755

=================================================================== ===== =============== =========== ============

Cash generated in operations 2,820 3,541 6,273

Interest received/(paid) 73 38 (27)

Net income tax paid (131) (470) (719)

=================================================================== ===== =============== =========== ============

Net cash inflow from operating activities 2,762 3,109 5,527

=================================================================== ===== =============== =========== ============

Investing activities

Purchase of intangible assets (996) (902) (1,631)

Purchase of property, plant and equipment (35) (134) (158)

Acquisition of subsidiary undertakings net of cash acquired 17 (3,827) - -

Proceeds from sale of property, plant, equipment and intangible

assets 21 15 53

Net proceeds on disposal of subsidiary undertakings 511 - -

=================================================================== ===== =============== =========== ============

Net cash outflow from investing activities (4,326) (1,021) (1,736)

=================================================================== ===== =============== =========== ============

Financing activities

Repayment of bank loans - (101) (102)

Repayments of leasing liabilities (270) (265) (556)

Issue of share capital 12 - -

Equity dividends paid (889) (329) (493)

=================================================================== ===== =============== =========== ============

Net cash (outflow) from financing activities (1,147) (695) (1,151)

=================================================================== ===== =============== =========== ============

Net (decrease)/increase in cash and cash equivalents (2,711) 1,393 2,640

=================================================================== ===== =============== =========== ============

Cash and cash equivalents at beginning of period 12,538 10,055 10,055

Effects of changes in foreign exchange rates (417) (110) (157)

=================================================================== ===== =============== =========== ============

Cash and cash equivalents at end of period 9,410 11,338 12,538

=================================================================== ===== =============== =========== ============

Notes to the Condensed Consolidated Interim Financial

Information

1. General information

The Company is a public limited company incorporated and

domiciled in the UK. The address of its registered office is Dawson

House, 5 Jewry Street, London, EC3N 2EX.

The Company is listed on AIM, a market operated by the London

Stock Exchange plc.

The condensed consolidated interim financial information does

not constitute statutory accounts as defined in section 435 of the

Companies Act 2006. The Group's consolidated financial statements

for the year ended 31 December 2022 have been filed at Companies

House. The audit report was not qualified and did not contain a

reference to any matter to which the auditor drew attention by way

of emphasis and did not contain a statement under section 498(2) or

section 498(3) of the Companies Act 2006.

2. Basis of preparation

The condensed consolidated interim financial statements for the

six months to 30 June 2023 have been prepared in accordance with

the accounting policies which will be applied in the twelve months

financial statements to 31 December 2023. These accounting policies

will be drawn up in accordance with applicable law and UK-adopted

International Accounting Standards (UK-IAS) that are effective at

31 December 2023.

The condensed consolidated interim financial statements are

unaudited. They do not include all the information and disclosures

required in the annual financial statements or for full compliance

with UK-IAS, and therefore should be read in conjunction with the

Group's published financial statements for the year ended 31

December 2022. The comparative figures for the year ended 31

December 2022 are not the Company's statutory accounts for that

period but have been extracted from these accounts.

The Directors, having considered the Group's current financial

resources, have concluded that they are adequate for the Group's

present requirements. Therefore, the condensed consolidated interim

financial information has been prepared on the going concern

basis.

Estimates

Application of the Group's accounting policies in preparing

condensed consolidated interim financial statements requires

management to make judgements and estimates that affect the

reported amount of assets and liabilities, revenues and expenses.

Actual results may ultimately differ from these estimates.

In preparing these condensed consolidated interim financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements for the year ended 31 December

2022 with the addition of fair values acquisition accounting for

BestOutcome Ltd.

Risks and uncertainties

A summary of the Group's principal risks and uncertainties was

set out on pages 16 to 19 of the 2022 Annual Report and Accounts.

The Board considers these risks and uncertainties are still

relevant to the current financial year and the impact of changes in

the UK economy is reviewed in the Chairman's statement contained in

this report.

The Interim Report was approved by the Directors on 11 September

2023.

3. Revenue

Revenue disclosed in the income statement is analysed as

follows:

Six months to 30 June Year to 31 December

================================

2023 2022 2022

GBP'000 GBP'000 GBP'000

=================================== ================ ============== ===========================

Perpetual licences 1,028 2,247 3,606

Recurring revenue - other licences 9,692 8,204 16,927

Services income 2,766 2,984 6,033

=================================== ================ ============== ===========================

13,486 13,435 26,566

=================================== ================ ============== ===========================

Revenue is recognised for each category as follows:

-- Perpetual licences - recognised at the point of transfer

(delivery) of the licence to a customer.

-- Recurring revenue: other licences: SaaS, maintenance, support

and subscriptions - as these services are provided over the term of

the contract, revenue is recognised over the life of the

contract.

-- Services - recognised on delivery of the service.

4. Segmental information

Operating Segments

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Group that are

regularly reviewed by the chief operating decision makers to

allocate resources to the segments and to assess their

performance.

The chief operating decision makers have been identified as the

Executive Directors. The Group revenue is derived entirely from the

sale of software licences, software maintenance and support and

related services. Consequently, the Executive Directors review the

three revenue streams, but as the costs are not recorded in the

same way, the information is presented as one segment and as such

the information is presented in line with management

information.

Year ended 31 December

Six months to 30 June

================================

2023 2022 2022

GBP'000 GBP'000 GBP'000

==================================================== ================ ============== ==============================

Revenue 13,486 13,435 26,566

==================================================== ================ ============== ==============================

Adjusted EBITDA 2,608 2,878 5,401

Share-based payments (148) (69) (201)

Amortisation and impairment of purchased intangible

assets (594) (494) (1,097)

Depreciation (284) (271) (621)

==================================================== ================ ============== ==============================

Adjusted operating profit 1,582 2,044 3,482

Amortisation of acquired intangible assets (250) (250) (499)

Acquisition expenses and stamp duties (262) - -

Operating profit 1,070 1,794 2,983

Net finance income/(cost) 35 (61) (39)

Gain on business disposal 150 - -

==================================================== ================ ============== ==============================

Segment profit before tax 1,255 1,733 2,944

Tax (236) (394) (549)

==================================================== ================ ============== ==============================

Segment profit after tax 1,019 1,339 2,395

==================================================== ================ ============== ==============================

Operating profit 1,070 1,794 2,983

Amortisation of intangible assets 844 744 1,596

Depreciation charge 284 271 621

---------------------------------------------------- ---------------- -------------- ------------------------------

EBITDA 2,198 2,809 5,200

EBITDA 2,198 2,809 5,200

Acquisition expenses 262 - -

Share-based payments 148 69 201

Adjusted EBITDA 2,608 2,878 5,401

==================================================== ================ ============== ==============================

Geographical, product and sales channel information

Revenue by geographical segment represents revenue from external

customers based upon the geographical location of the customer.

Year ended 31 December

Six months to 30 June

==================================================== ================================ ==============================

2023 2022 2022

GBP'000 GBP'000 GBP'000

==================================================== ================ ============== ==============================

UK 5,676 5,276 10,263

Scandinavia 3,035 3,354 6,388

Germany 1,767 2,180 4,449

USA 570 594 1,101

Rest of Europe 2,123 1,742 3,808

Rest of World 315 289 557

==================================================== ================ ============== ==============================

13,486 13,435 26,566

==================================================== ================ ============== ==============================

Revenue by product group represents revenue from

external customers.

Six months to 30 June Year ended 31 December

========================================== ================================ ==============================

2023 2022 2022

GBP'000 GBP'000 GBP'000

========================================== ================ ============== ==============================

Revenue from software & related services:

Building Lifecycle 9,328 8,883 17,248

CAD & Visualisation 3,499 3,638 7,432

Other - third party software 659 914 1,886

========================================== ================ ============== ==============================

13,486 13,435 26,566

========================================== ================ ============== ==============================

The Group utilises resellers to access certain markets. Revenue

by sales channel represents revenue from external customers.

Six months to 30 June Year ended

31 December

========= ============================ ====================================

2023 2022 2022 GBP'000

GBP'000 GBP'000

========= ============================ ============== ====================

Direct 12,958 12,749 25,317

Reseller 528 686 1,249

========= ============================ ============== ====================

13,486 13,435 26,566

========= ============================ ============== ====================

5. Operating profit

Operating profit for the period is after charging the following

items:

Year ended 31 December

Six months to 30 June

==============================

2023 2022 2022

GBP'000 GBP'000 GBP'000

==================================================== ================ ============ ==============================

Software product development expense 1,030 887 1,526

Depreciation of property, plant and equipment 76 98 147

Depreciation of Right-of-Use assets 208 173 474

Amortisation of acquired intangible assets 250 250 499

Amortisation of other intangible assets 594 494 1,097

Share-based payments 148 69 201

Profit on disposal of property, plant and equipment (15) (6) (24)

Foreign exchange losses/(gains) 39 10 (206)

Acquisition expenses and stamp duties 262 - -

==================================================== ================ ============ ==============================

6. Net finance cost

Finance income and costs disclosed in the income statement is

set out below:

Six months to 30 June Year ended 31 December

==============================

2023 2022 2022

GBP'000 GBP'000 GBP'000

===================================================== ================ ============ ==============================

Finance income:

Bank and other interest receivable 60 - 20

Finance costs:

Bank overdraft and loan interest - (1) (4)

Inputted interest expense for leasing arrangements (25) (60) (55)

===================================================== ================ ============ ==============================

Total net finance income/(cost) 35 (61) (39)

===================================================== ================ ============ ==============================

7. Basic and diluted earnings per share

The calculations of the earnings per share are based on profit

after tax attributable to the ordinary equity shareholders of the

Company and the weighted average number of shares in issue for the

reporting period.

Six months to

30 June

===================================== ============================================

2023 2022 Year to 31 December 2022

Profit Weighted Profit Weighted Profit Weighted

attributable average attributable average attributable average

to number of to number of to number of

shareholders shares EPS shareholders shares EPS shareholders shares EPS

(GBP'000) (millions) (p) (GBP'000) (millions) (p) (GBP'000) (millions) (p)

=========== ============ ========== ======== ============ =========== ======= ============ =========== ======

Basic

earnings

per share 1,019 82.3 1.2 1,339 82.2 1.6 2,395 82.2 2.9

Diluted

earnings

per share 1,019 83.7 1.2 1,339 82.7 1.6 2,395 83.0 2.9

Adjusted

earnings

per share 1,433 82.3 1.7 1,541 82.2 1.9 2,799 82.2 3.4

=========== ============ ========== ======== ============ =========== ======= ============ =========== ======

Shares held by the Employee Share Ownership Trust are excluded

from the weighted average number of shares in the period. Adjusted

profit attributable to shareholders is reconciled to reported

profit attributable to shareholders in note 14.

8. Dividends

Interim dividend

The Directors have recommended an interim dividend of 0.25 pence

per ordinary share (2022: interim dividend of 0.20 pence per

ordinary share).

Dividends paid in the period

Dividends paid in the six months to 30 June 2023, consisting of

a final and special dividend, were 1.08 pence per ordinary share

(2022: 0.40 pence per ordinary share). Cash dividends of GBP889,000

(2022: GBP329,000) were paid in the six months to 30 June 2023 as

follows:

Six months to 30 June Year to 31 December

2023 2023 2022 2022 2022 2022

Ordinary Shares per share GBP'000 per share GBP'000 per share GBP'000

================================== ========= ========== =========== ======= =========== ========

Declared and paid during the year

Interim - current year - - 0.20 164

Special - previous year 0.58 477 - - - -

Final - previous year 0.50 412 0.40 329 0.40 329

================================== ========= ========== =========== ======= =========== ========

1.08 889 0.40 329 0.60 493

================================== ========= ========== =========== ======= =========== ========

9. Other intangible assets

Other intangible assets comprise capitalised development costs,

acquired customer relationships and purchased intangible assets.

Additions in the six months to 30 June 2023 represent purchased

intangible assets of GBP1,448,000 relating to intangible assets

recognised on acquisition of BestOutcome (see Note 17) (2022 half

year: GBP164,000) and internal development costs capitalised of

GBP996,000 (2022 half year: GBP738,000). Internal development

relates to software development projects that meet the accounting

policy criteria for capitalisation. At the year ended 31 December

2022, purchased intangible assets comprised GBP81,000 of additions

and GBP1,550,000 of internal development cost additions.

10. Disposal Group held for sale

In line with our previously announced strategy to focus on our

core customer segments and businesses, we held our Eleco Software

GmbH, the German ARCON architectural CAD business, for sale at the

year end in accordance with the provisions of IFRS 5. Assets of the

disposal group held for sale.

The table below reflects assets of the disposal group held for

sale measured at the lower of carrying amount and fair value less

costs to sell in the Consolidated Balance Sheet. There was no

revaluation from reclassification required as a result of this

business classification under IFRS 5. Effective 1 January 2023, the

business was disposed of to an Austrian buyer (see note 16).

At 30 June 2023 At 31 December

============================== ================================== ================

2023 2022 2022

============================== ================ ================ ================

(unaudited) (unaudited)

Assets Held for Sale GBP'000 GBP'000 GBP'000

============================== ================ ================ ================

Goodwill - 336 336

Other intangible assets - 1 2

Property, plant and equipment - 9 9

Right-of-Use assets - 74 19

Trade and other receivables - 10 27

Cash and cash equivalents - 412 401

============================== ================ ================ ==============

Total Assets Held for sale - 842 794

============================== ================ ================ ==============

Liabilities of disposal group held for sale

Liabilities classified as held for sale on the face of the

Consolidated Balance Sheet are as follows:

Six months to 30 June Year ended 31 December

2023 2022 2022

(unaudited) (unaudited)

Liabilities Held for Sale GBP'000 GBP'000 GBP'000

================================ ================= ============ ======================

Lease liabilities - (76) (19)

Trade and other payables - (53) (350)

Accruals and deferred income - (55) (59)

================================ ================= ============ ======================

Total Liabilities Held for Sale - (184) (428)

================================ ================= ============ ======================

11. Cash and borrowings

The net cash position of the Group as at 30 June 2023 is set out

below:

At 30 June At

31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

==================================== ====================== ==================== ======================

Cash and cash equivalents 9,410 11,338 12,538

Bank loans - - -

Lease liabilities (1,469) (1,693) (1,682)

==================================== ====================== ==================== ======================

7,941 9,645 10,856

==================================== ====================== ==================== ======================

The UK banking facilities are with Barclays Bank plc and the Group facilities comprise a GBP1.0m

overdraft facility, carrying an interest rate of 2.75 percent over base rate (undrawn at 30

June 2023, 31 December 2023 and 30 June 2022).

==========================================================================================================

12. Accruals and deferred income

At 31 December

At 30 June

===================== =======

2023 2022 2022

GBP'000 GBP'000 GBP'000

=================================== ===================== ======= ==========================

Accruals 2,425 2,570 2,518

Deferred income 9,600 7,261 7,787

=================================== ===================== ======= ========================

12,025 9,831 10,305

=================================== ===================== ======= ========================

Deferred income represents income from the sale of software

subscription licences, SaaS licences and from software maintenance

and support contracts and is taken to revenue in the income

statement on a straight-line basis in line with the service and

obligations over the term of the contract.

13. Related party disclosures

Transactions between Group undertakings, which are related

parties, have been eliminated on consolidation and are not

disclosed in this note.

The Directors of the Company had no material transactions with

the Company during the period, other than a result of service

agreements.

14. Additional performance measures

The Group uses adjusted figures, which are not defined by

generally accepted accounting principles ("GAAP") such as UK-IAS.

Adjusted figures and underlying growth rates are presented as

additional performance measures used by management, as they provide

relevant information in assessing the Group's performance, position

and cash flows. We believe that these measures enable investors to

track more clearly the core operational performance of the Group,

by separating out items of income or expenditure relating to

acquisitions, disposals and capital items. Our management uses

these financial measures, along with UK- IAS financial measures, in

evaluating the operating performance of the Group.

Six months to 30 June Year ended 31 December

=========================================== =============================== ================================

2023 2022 2022

GBP'000 GBP'000 GBP'000

=========================================== ================ ============= ================================

Operating profit 1,070 1,794 2,983

Acquisition expenses and stamp duties 262 - -

Amortisation of acquired intangible assets 250 250 499

=========================================== ================ ============= ==============================

Adjusted operating profit 1,582 2,044 3,482

------------------------------------------- ---------------- ------------- ------------------------------

Profit before tax 1,255 1,733 2,944

Acquisition expenses and stamp duties 262 - -

Amortisation of acquired intangible assets 250 250 499

=========================================== ================ ============= ==============================

Adjusted profit before tax 1,767 1,983 3,443

=========================================== ================ ============= ==============================

Tax charge (236) (394) (549)

Acquisition expenses and stamp duties (50) - -

Amortisation of acquired intangible assets (48) (48) (95)

=========================================== ================ ============= ==============================

Adjusted tax charge (334) (442) (644)

=========================================== ================ ============= ==============================

Profit after tax 1,019 1,339 2,395

Acquisition expenses and stamp duties 212 - -

Amortisation of acquired intangible assets 202 202 404

=========================================== ================ ============= ==============================

Adjusted profit after tax 1,433 1,541 2,799

=========================================== ================ ============= ==============================

Cash generated in operations 2,820 3,541 6,273

Purchase of intangible assets (996) (902) (1,631)

Purchase of property, plant and equipment (35) (134) (158)

Acquisition expenses and stamp duties 262 - -

=========================================== ================ ============= ==============================

Adjusted operating cash flow 2,051 2,505 4,484

=========================================== ================ ============= ==============================

Adjusted operating cash flow 2,051 2,505 4,484

Net interest received/(paid) 73 38 (27)

Tax paid (131) (470) (719)

Proceeds from disposal of PPE 21 15 53

Acquisition expenses and stamp duties (262) - -

=========================================== ================ ============= ==============================

Free cashflow 1,752 2,088 3,791

=========================================== ================ ============= ==============================

15. Exchange rates

The following exchange rates have been applied in preparing the

condensed consolidated financial statements:

Income Statement Balance sheet

six months to 30 June as at 30 June Year to

31 December 2022

Income Balance

2023 2022 2023 2022 Statement sheet

========================== ===== ======== ========== ===== ========= =======

Swedish Krona to Sterling 13.00 12.41 13.71 12.45 12.46 12.61

Euro to Sterling 1.14 1.19 1.16 1.16 1.17 1.13

US Dollar to Sterling 1.24 1.30 1.27 1.22 1.24 1.21

========================== ===== ======== ========== ===== ========= =======

16. Disposal of subsidiary

The Company announced on 20(th) February 2023 the sale of its

wholly owned subsidiary Eleco Software GmbH, the German Arcon

architectural CAD business ("Arcon") to FirstInVision GesmbH, an

Austrian architectural software business, for a total consideration

of EUR600,000, effective 1 January 2023. Following deduction of net

assets, costs relating to the disposal and recycling of reserves, a

pre-tax gain on disposal of GBP150,000 was recognised in the

period.

17. Acquisition of BestOutcome Ltd

The Company announced on 27 June 2023 that it has acquired 100

per cent of Buckinghamshire-based BestOutcome Limited

("BestOutcome"), a UK provider of simple, scalable Project

Portfolio Management (PPM) software, for an initial consideration

of GBP4.825m in cash (and an adjusted initial value of GBP3.525m on

a cash-and-debt-free equivalent with GBP1.3m of cash in the

business at the time of the acquisition) ("the Acquisition"). The

Acquisition is exclusively financed by the Company's internal cash

resources.

The transaction includes a potential deferred outflow of GBP0.5m

by the end of the year ended 31 December 2024 with this

remuneration subject to the BestOutcome management team attaining

specific performance targets in 2023 and 2024.

BestOutcome's core products PM3 and PM3 Time are used to manage

strategic programmes and multiple portfolio management projects.

The Acquisition strengthens Eleco's Building Lifecycle portfolio,

representing further progress in Eleco's growth strategy to enhance

its predictable recurring revenue and to increase value to its

shareholders by investing in synergistic software products and

technologies, scalable and building on and with its existing

Building Lifecycle portfolio. BestOutcome has a particular strength

in winning public sector business, including the NHS, universities

and county councils. This gives Eleco Group a greater foothold in

the wider built environment, while also complementing its private

sector exposure.

For the above reasons, combined with the anticipated

profitability of BestOutcome's products in other Group markets,

synergies arising, plus the ability to hire the assembled workforce

of BestOutcome (including the founders and management team), the

Group understandably paid a premium over the acquisition net

assets, giving rise, aside from other valued intangibles

(principally values of brands), to goodwill. All intangible assets,

in accordance with IFRS3 Business Combinations, were recognised at

their provisional fair values on acquisition date, with the

residual excess over net assets being recognised as brands and

goodwill. Intangibles arising from the acquisition consist of brand

values, and along with an assessment of other potential intangibles

such as customer relationships, intellectual property and R&D,

have been independently valued by professional advisors.

The following table summarises the consideration and provisional

fair values of assets acquired and liabilities assumed at the date

of acquisition:

GBP'000

================================== ===============

Intangible fixed assets:

Brands 770

Development expenditure 675

Other intangibles 3

Property, plant and equipment 18

Trade receivables and prepayments 179

Cash and cash equivalents 1,266

Trade and other payables (162)

Deferred income (1,047)

Corporation tax (72)

Deferred tax liabilities (342)

----------------------------------- ---------------

Net assets acquired 1,288

Goodwill 3,543

Acquisition cost 4,831

=================================== ===============

There are no non-controlling interests in relation to the

BestOutcome Ltd acquisition. Fair values in the above table have

only been determined provisionally and may be subject to change in

the light of any subsequent new information becoming available in

time. The review of the fair value of assets and liabilities

acquired will be completed within twelve months of the acquisition

date. Receivables at the acquisition date are expected to be

collected in accordance with the gross contractual amounts.

The acquisition cost was satisfied by:

GBP'000

==================== ===============

Cash 4,831

Share consideration -

Total consideration 4,831

===================== ===============

The net cash outflow arising on acquisition was:

GBP'000

========================================================================= ===============

Cash consideration paid 4,831

Acquisition related costs 262

Cash and cash equivalents within the BestOutcome business on acquisition (1,266)

Total net cash outflow on acquisition 3,827

========================================================================== ===============

Other costs relating to the acquisition have not been included

in the consideration cost. Directly attributable acquisition costs

include external legal and accounting costs incurred in compiling

the acquisition legal contracts and the performance of due

diligence activity and the fair value exercise, together with stamp

duty, and total GBP262,000. These costs have been charged in

distribution and administrative expenses in the consolidated income

statement.

BestOutcome Ltd, in common with other Group companies, has a 31

December calendar year end. In the preceding financial year 2022

BestOutcome Ltd generated revenue of GBP2.0m and net profit before

taxation of GBP0.2m based on figures and accounting policies prior

to Eleco plc Group control.

Had the acquisition taken place from the start of the Group's

financial year (from 1 January 2023) and based on figures and

accounting policies prior to Eleco plc Group control, management

estimate that BestOutcome Ltd would have contributed revenue of

GBP1.0m and profit before taxation of GBP0.2m to the Group results

in this first half year.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFEAAVILLIV

(END) Dow Jones Newswires

September 12, 2023 02:00 ET (06:00 GMT)

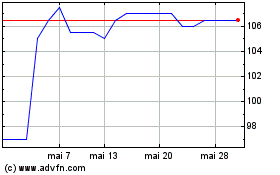

Eleco Public (LSE:ELCO)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Eleco Public (LSE:ELCO)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024