Ecclesiastical Insurance Office PLC Annual -5-

24 Mars 2015 - 5:33PM

UK Regulatory

The risk of actual claims payments consequence of incurring insurance levels are closely monitored. Claims

exceeding the amount we are holding claims. Throughout the reserving risk primarily

in relation to our lifecycle of a claim the estimated arises from longer-tail liability

long-tail liability risks. ultimate cost will vary as business. For statutory and

additional information becomes financial reporting purposes

available. margins are added to a best estimate

outcome to allow for uncertainties.

This approach generally

results in a favourable release of

previous year's provisions within

the current financial

year. Claims reserves are reviewed

and signed off by the Board acting

on the advice and recommendations

of the Group Reserving Actuary and

the Group Audit Committee.

Further information on this risk is

given in notes 2, 3 and 27 to the

full financial statements.

Uncertainty around our long-tail

liability claims means that this

risk has increased during

the year.

-------------------------------------- -------------------------------------- --------------------------------------

Reinsurance risk Reinsurance is a central component This risk is managed by taking a

The risk of failing to access and of our business model, enabling us long-term relationship view towards

manage reinsurance capacity at a to insure a portfolio reinsurance purchases

reasonable price. of large risks in relation to our to deliver sustainable capacity

capital base. The Board appetite for rather than opportunistic results.

our strategic exposure Strict criteria exist which

to the reinsurance market is well relate to the ratings of the

established. reinsurers and a Reinsurance

The global reinsurance market is Security Forum approves all of our

beginning to see a reshaping of the reinsurance partners.

market, with diversification The size of this risk has remained

by territory and/or class seen as broadly similar over the year.

the way forward. As a consequence,

merger and acquisition

activity is now beginning to take

place. Not all reinsurers have been

prepared to follow pricing

down and accept wider terms and

conditions and have actively scaled

back their portfolios

including breaking long-standing

relationships with insurers or

standing firm on terms.

-------------------------------------- -------------------------------------- --------------------------------------

Concentration and model error risk Exposure measures are fundamental to

This is the failure to manage risk determining our reinsurance

concentrations across our different purchases. Errors within

business and risk areas the models could fail to identify Risk appetite limits have been

and includes the reliance on models significant concentrations of risk established to manage our

which if found to be wrong could and lead to the Group concentration of risk and these are

give rise to significant having net retentions which are in reviewed regularly by the Group Risk

unplanned losses. excess of our risk appetite. Committee.

The risk is mitigated through the

use of industry recognised models

alongside our scenario

and stress testing framework.

-------------------------------------- -------------------------------------- --------------------------------------

Market Risk Market risk principally arises from A robust investment risk management

Market risk investments held by the Group. We framework is in place to mitigate

The risk of adverse movements in net accept such risks to the impact of changes

asset values arising from a change seek enhanced returns on these in financial markets.

in interest rates, investments. Our fund manager, EIM, manages our

equity and property prices and Our investment strategy for assets funds in accordance with the

foreign exchange rates. backing reserves is primarily investment strategy and guidelines

focused on fixed income stocks. agreed by the Finance and Investment

This gives us exposure to interest Committee of the Board.

rate risk. We also hold some of our Interest rate risk is partly managed

investments in corporate through selecting stocks of an

bonds, which expose us to credit appropriate duration that

spread risk, for which higher will match the expected cash flows

expected yields are obtained. from longer-term liabilities, and

Market risk also arises as we have a partly through holding

significant equity portfolio. stocks with a relatively short

A proportion of our equity portfolio period to maturity, that are not

is invested in overseas equities. exposed to significant volatility

This gives us exposure upon changes in interest rates.

to wider investment opportunities Credit spread risk is risk is

and diversified returns, but also controlled through the investment

introduces currency risk. strategy and guidelines agreed

by the Finance and Investment

Committee of the Board. It is

managed by our investment manager's

assessments of risk and by limiting

our exposure to both non-rated and

lower rated bonds and

ensuring that we adhere to the

limits set for exposure to any

single issuer.

We hold a relatively significant

equity portfolio in order to deliver

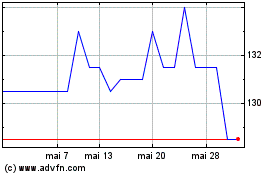

Ecclesiastl.8fe (LSE:ELLA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Ecclesiastl.8fe (LSE:ELLA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025