For the year ended 31 December 2014

Share Share Equalisation Revaluation Translation Retained

capital premium reserve reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January 2014 120,477 4,632 25,837 700 14,340 328,157 494,143

Profit for the year - - - - - 40,317 40,317

Other net

income/(expense) - - - 40 (1,697) (10,547) (12,204)

--------- -------- ------------- ------------ ------------ --------- ---------

Total comprehensive

income - - - 40 (1,697) 29,770 28,113

Dividends - - - - - (9,181) (9,181)

Gross charitable

grant - - - - - (23,500) (23,500)

Tax relief on

charitable grant - - - - - 5,053 5,053

Group tax relief in

excess of standard

rate - - - - - 5 5

Reserve transfers - - (538) (199) - 737 -

--------- -------- ------------- ------------ ------------ --------- ---------

At 31 December 2014 120,477 4,632 25,299 541 12,643 331,041 494,633

--------- -------- ------------- ------------ ------------ --------- ---------

At 1 January 2013 120,477 4,632 25,590 752 24,411 279,795 455,657

Profit for the year - - - - - 62,118 62,118

Other net expense - - - (52) (10,071) (1,094) (11,217)

--------- -------- ------------- ------------ ------------ --------- ---------

Total comprehensive

income - - - (52) (10,071) 61,024 50,901

Dividends - - - - - (9,181) (9,181)

Gross charitable

grant - - - - - (4,000) (4,000)

Tax relief on

charitable grant - - - - - 930 930

Group tax relief in

excess of standard

rate - - - - - (164) (164)

Reserve transfers - - 247 - - (247) -

--------- -------- ------------- ------------ ------------ --------- ---------

At 31 December 2013 120,477 4,632 25,837 700 14,340 328,157 494,143

The equalisation reserve is not distributable and must be kept in compliance with the insurance

companies' reserves regulations. The revaluation reserve represents cumulative net fair value

gains on owner-occupied property. The translation reserve arises on consolidation of the Group's

foreign operations.

------------------------------------------------------------------------------------------------------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

For the year ended 31 December 2014

2014 2013

GBP000 GBP000

Assets

Goodwill and other intangible assets 28,998 23,684

Deferred acquisition costs 31,117 34,757

Deferred tax assets 1,295 3,261

Pension assets 21,068 32,288

Property, plant and equipment 6,405 7,292

Investment property 69,775 45,099

Financial investments 886,186 946,452

Reinsurers' share of contract liabilities 157,465 132,593

Current tax recoverable - 135

Other assets 119,394 124,464

Cash and cash equivalents 107,526 107,241

Current assets classified as held for sale 6,204 -

----------- -----------

Total assets 1,435,433 1,457,266

----------- -----------

Equity

Share capital 120,477 120,477

Share premium account 4,632 4,632

Retained earnings and other reserves 369,524 369,034

----------- -----------

Total shareholders' equity 494,633 494,143

----------- -----------

Liabilities

Insurance contract liabilities 820,328 848,267

Finance lease obligations 1,259 1,624

Provisions for other liabilities 3,588 6,710

Pension liabilities 250 -

Retirement benefit obligations 12,547 11,744

Deferred tax liabilities 36,014 40,116

Current tax liabilities 5,767 2,463

Deferred income 16,432 14,231

Other liabilities 44,615 37,968

----------- -----------

Total liabilities 940,800 963,123

----------- -----------

Total shareholders' equity and liabilities 1,435,433 1,457,266

----------- -----------

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 31 December 2014

2014 2013

GBP000 GBP000

Profit before tax 48,154 66,937

Adjustments for:

Depreciation of property, plant and equipment 1,638 1,930

(Profit)/loss on disposal of property, plant and equipment (32) 112

Amortisation and impairment of intangible assets 1,751 2,770

Loss on disposal of intangible assets 19 7

Net fair value gains on financial instruments and investment property (8,918) (36,072)

Dividend and interest income (34,709) (38,364)

Finance costs 86 117

Changes in operating assets and liabilities:

Net decrease in insurance contract liabilities (21,413) (8,689)

Net (increase)/decrease in reinsurers' share of contract liabilities (26,814) 5,275

Net decrease/(increase) in deferred acquisition costs 3,327 (1,075)

Net decrease in other assets 3,792 16,385

Net increase/(decrease) in operating liabilities 8,814 (777)

Net (decrease)/increase in other liabilities (3,498) 48

---------- ----------

Cash (used)/generated by operations (27,803) 8,604

Dividends received 8,624 9,923

Interest received 26,889 27,388

Interest paid (86) (117)

Tax recovered/(paid) 1,127 (225)

---------- ----------

Net cash from operating activities 8,751 45,573

---------- ----------

Cash flows from investing activities

Purchases of property, plant and equipment (1,369) (1,017)

Proceeds from the sale of property, plant and equipment 677 54

Purchases of intangible assets (1,548) (2,232)

Acquisition of business, net of cash acquired (5,000) -

Purchases of financial instruments and investment property (152,899) (269,766)

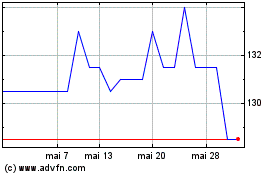

Ecclesiastl.8fe (LSE:ELLA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Ecclesiastl.8fe (LSE:ELLA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025