TIDMEMR

RNS Number : 9911J

Empresaria Group PLC

22 August 2023

22 August 2023

Empresaria Group plc ("Empresaria" or the "Group")

Unaudited interim results for the six months ended 30 June

2023

Challenging market conditions impacting results

Empresaria Group plc (AIM: EMR), the global specialist staffing

group, announces its unaudited interim results for the six months

ended 30 June 2023.

Overview of the half year

% change

(constant

2023 2022 % change currency)(2)

----------------------------------- ---------- ---------- ----------- --------------

Revenue GBP125.7m GBP129.8m -3% -6%

Net fee income GBP29.7m GBP32.6m -9% -10%

Adjusted operating profit(1) GBP1.3m GBP4.5m -71% -71%

Operating profit GBP0.6m GBP3.8m -84%

Adjusted profit before tax(1) GBP0.5m GBP4.0m -88%

(Loss)/profit before tax GBP(0.2)m GBP3.3m -106%

Adjusted, diluted (loss)/earnings

per share(1) (0.8)p 3.7p -122%

Diluted (loss)/earnings per

share (2.0)p 2.7p -174%

-- Challenging market conditions from H2 2022 continued into 2023 impacting net fee income

o Reduced by 9% year-on-year to GBP29.7m against a strong

comparator

o Offshore services up 15%

o Permanent placement down 24%

o Temporary and contract down 8%

-- Adjusted operating profit down 71% to GBP1.3m year-on-year

reflecting a higher cost base at the start of 2023 following 2022

investment and inflationary pressures

-- Measures to manage cost base taken in Q2 2023, with benefit due to be seen in H2 2023

-- Adjusted, diluted loss per share of 0.8p reflecting the

strong contribution from Offshore Services where there is 28%

non-controlling interest

-- Adjusted net debt increased slightly to GBP8.7m (31 December

2022: GBP7.9m) with headroom increased to GBP18.4m

-- Adjusted profit before tax for the full year expected to be

in line with current market expectations

1 Adjusted to exclude amortisation of intangible assets

identified in business combinations, impairment of goodwill and

other intangible assets, exceptional items, fair value charge on

acquisition of non-controlling shares and, in the case of earnings,

any related tax.

2 The constant currency movement is calculated by translating

the 2022 results at the 2023 exchange rates.

Chief Executive Officer, Rhona Driggs, commented:

"The challenging market conditions that developed during the

second half of 2022 remained through the first half of 2023. The

market has yet to show any significant or sustained signs of

improvement as client and candidate confidence remains at lower

levels across the majority of our markets and sectors.

Our cost base at the start of 2023 was elevated compared to the

first half of 2022 reflecting inflationary pressures and targeted

investments we made in headcount during 2022 in response to client

demand in the first half of that year. As a result, the fall in net

fee income has had a material impact on our profits. We have taken

action to make appropriate reductions to our cost base which will

benefit the second half of the year and we will continue cost

control measures until we see sustained signs of improvement.

While we are disappointed with the start to 2023, w e are making

progress on our key strategic actions to deliver growth. Given

current market conditions we continue to review our operational and

investment priorities to ensure the Group is best placed to realise

our medium-term ambition. "

Investor presentation

In line with Empresaria's commitment to ensuring appropriate

communication structures are in place for all shareholders,

management will deliver an online presentation, available to all

existing and potential shareholders, on the interim results for the

six months ended 30 June 2023 via the Investor Meet Company

platform on Tuesday 22 August 2023 at 4:30pm UK time.

Questions can be submitted pre-event through the platform or at

any time during the live presentation. Management may not be in a

position to answer every question it receives but will address

those it can while remaining within the confines of information

already disclosed to the market.

Q&A responses will be published at the earliest opportunity

on the Investor Meet Company platform.

Investors can sign up for free via:

https://www.investormeetcompany.com/empresaria-group-plc/register-investor

. Those who have already registered and requested to meet the

Company will be automatically invited.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the UK version of the EU Market Abuse Regulation (2014/596) which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended and supplemented from time to time.

- Ends -

Enquiries:

Empresaria Group plc via Alma PR

Rhona Driggs, Chief Executive Officer

Tim Anderson, Chief Financial Officer

Singer Capital Markets (Nominated Adviser

and Joint Broker)

Shaun Dobson / James Moat 020 7496 3000

Cenkos Securities plc (Joint Broker)

Katy Birkin / Charlie Combe (Corporate

Finance)

Michael Johnson / Jasper Berry (Sales) 020 7397 8900

Alma PR (Financial PR) 020 3405 0205

Sam Modlin empresaria@almapr.com

Rebecca Sanders-Hewett

Hilary Buchanan

The investor presentation of these results will be made

available during the course of today on Empresaria's website:

www.empresaria.com.

Notes for editors:

-- Empresaria Group plc is a global specialist staffing group.

We are driven by our purpose to positively impact the lives of

people, while delivering exceptional talent to our clients

globally. We offer temporary and contract recruitment, permanent

recruitment and offshore services across six sectors: Professional,

IT, Healthcare, Property, Construction & Engineering,

Commercial and Offshore Services.

-- Empresaria is structured in four regions (UK & Europe,

APAC, Americas and Offshore Services) and operates from locations

across the world including the four largest staffing markets of the

US, Japan, UK and Germany along with a strong presence elsewhere in

Asia Pacific and Latin America.

-- Empresaria is listed on AIM under ticker EMR. For more

information visit www.empresaria.com.

Cautionary statement regarding forward-looking statements

This document may contain forward-looking statements which are

made in good faith and are based on current expectations or

beliefs, as well as assumptions about future events. You can

sometimes, but not always, identify these statements by the use of

a date in the future or such words as "will", "anticipate",

"estimate", "expect", "project", "intend", "plan", "should", "may",

"assume" and other similar words. By their nature, forward-looking

statements are inherently predictive and speculative and involve

risk and uncertainty because they relate to events and depend on

circumstances that will occur in the future. You should not place

undue reliance on these forward-looking statements, which are not a

guarantee of future performance and are subject to factors that

could cause our actual results to differ materially from those

expressed or implied by these statements. Except as required by

applicable law or regulation, Empresaria undertakes no obligation

to update any forward-looking statements contained in this

document, whether as a result of new information, future events or

otherwise.

Finance and operating review

The Group has been impacted by challenging market conditions in

the six months ended 30 June 2023 with net fee income falling by 9%

to GBP29.7m and adjusted operating profit reducing by 71% to

GBP1.3m. This performance has been driven by a number of factors as

set out below.

Challenging market conditions

The softening of demand and slowing of hiring decisions seen

across the Group's businesses in the second half of 2022 have

continued into 2023. These difficult market conditions have been

experienced across the Group, but particularly in the US where both

IT and Healthcare have seen significant declines. The greatest

impact has been on permanent recruitment, with net fee income down

24% year-on-year, with the greatest falls in the US and UK.

Temporary and contract was down 8% and, although this has been more

resilient, we have not seen the improvements we expected to see in

this market.

Managing our cost base

In 2022, the Group made targeted investments in its teams in

order to meet customer demand in the first half of that year. This,

combined with inflationary impacts, meant that the Group started

2023 with a higher cost based than in the first half of 2022. As

market conditions developed and the ongoing impact became clear,

the Group implemented a number of targeted measures to manage this

cost base. As a result, headcount as at 30 June 2023, excluding our

offshore services operation, has reduced by 5% from 31 December

2022, and the full benefit of these actions will be seen in the

second half of the year. We will maintain cost control measures

while ensuring that we have the resources in place to maximise

opportunities as and when market confidence returns.

Continued strength in Offshore Services

Our Offshore Services operation delivered year-on-year net fee

income growth of 15% against the first half of 2022. Our sales to

US clients, the majority of which support the IT sector, have been

impacted by the wider market conditions in the US and the fall in

client demand seen in the second half of 2022 has continued into

2023. Growth in sales to our UK clients, the majority of which are

in Healthcare, remains strong and we have not seen the same

challenges in UK Healthcare as have been seen in the US. As a

result, adjusted operating profit has increased by 6% year-on-year

and headcount has grown by 4% in the period. We continue to see

strong growth opportunities and are investing in the future of this

business, including in the infrastructure to support ongoing

growth.

Continuing to deliver on strategic initiatives

Despite overall market conditions we continue to be focussed on

delivering on our strategic initiatives. We have now officially

launched our Professional operation in the US, under our lead

Professional brand, LMA Recruitment. As part of this launch, we

took the opportunity to refresh the positioning and identity of

this brand which will also benefit operations elsewhere in the

Group. In line with our strategy, we are focussed on leveraging our

existing US client base and are already seeing some good early

success from this.

Our other key strategic priority for 2023 is Empresaria

Solutions, focussed on delivering a wider breadth of services to

our clients as well as leveraging our expertise in delivering to

MSP clients, across multiple disciplines and locations. We are

continuing to make progress on developing this solution and expect

a soft launch by the end of the year.

Outlook

The first half of 2023 has been challenging and we expect the

current market conditions to continue to impact through the rest of

the year. Underlying drivers, such as relatively low levels of

unemployment and skills shortages, remain across our markets, and

we expect these to underpin and accelerate recovery as and when

confidence returns.

Regional Performance

Net fee income by region:

6 months 6 months

ended ended % change

30 June 30 June (constant

GBP'm 2023 2022 % change currency)

------------------------- --------- --------- --------- -----------

UK & Europe 12.6 14.5 -13% -15%

APAC 7.3 7.9 -8% -8%

Americas 3.4 4.6 -26% -31%

Offshore Services 7.0 6.1 +15% +17%

Intragroup eliminations (0.6) (0.5)

--------- ---------

Total 29.7 32.6 -9% -10%

--------- ---------

Performance in each of the regions is analysed below.

UK & Europe

6 months 6 months

ended ended % change

30 June 30 June (constant

GBP'm 2023 2022 % change currency)

--------------------------- --------- --------- --------- -----------

Revenue 58.7 63.2 -7% -10%

Net fee income 12.6 14.5 -13% -15%

Adjusted operating profit 0.9 2.0 -55% -55%

% of Group net fee income 42% 44%

In UK & Europe revenue was down 7%, with net fee income down

13% reflecting a greater decline in permanent placements compared

to temporary and contract. Adjusted operating profit was down

55%.

The UK saw the weakest results with net fee income down 25%,

driven by reductions in permanent hiring. The impact was across all

of our UK operations with our Professional and IT sectors seeing

the most significant reductions in demand.

The performance in Germany was more solid with net fee income

down just 1% reflecting year-on-year growth in our logistics

business which partially offset reductions elsewhere.

APAC

6 months 6 months

ended ended % change

30 June 30 June (constant

GBP'm 2023 2022 % change currency)

---------------------------------- --------- --------- --------- -----------

Revenue 26.0 23.0 +13% +15%

Net fee income 7.3 7.9 -8% -8%

Adjusted operating (loss)/profit (0.6) 0.5 -220% -220%

% of Group net fee income 24% 24%

In APAC, revenues increased by 13% reflecting revenue growth in

our aviation business. However, this is lower margin business and

net fee income for the region was down 8% reflecting performances

elsewhere. There were pockets of net fee income growth with

aviation, China and Philippines all showing strong year-on-year

increases. However, in Japan IT demand fell sharply at the start of

the year and in Thailand political uncertainty has significantly

impacted client confidence while Singapore also performed poorly

during the first half of the year. Our performance in Australia

continues to be of concern with net fee income down significantly

on the prior year and stringent actions have been taken on cost to

stabilise the business.

Overall, the region has made a loss in the first half of the

year reflecting results in Australia, Singapore and ongoing losses

in aviation. We believe that the right actions are in place to

address these and bring those operations back to profitability.

Americas

6 months 6 months

ended ended % change

30 June 30 June (constant

GBP'm 2023 2022 % change currency)

---------------------------------- --------- --------- --------- -----------

Revenue 28.4 32.7 -13% -19%

Net fee income 3.4 4.6 -26% -31%

Adjusted operating (loss)/profit (0.3) 0.8 -138% -133%

% of Group net fee income 11% 14%

In the Americas, revenue was down 13%, with a sharp drop in

permanent hiring reflected in a 26% reduction in net fee income.

The region generated an adjusted operating loss, driven by the

performance in the US.

In the US we operate primarily in the Healthcare and IT sectors,

both of which experienced sharp declines in demand in the period.

In IT, we were impacted by a combination of the general decline in

permanent IT demand, alongside the collapse of Silicon Valley Bank

which impacted a large number of our clients. Healthcare has also

dropped significantly from the high levels during COVID, with

demand, particularly for travel nurses, dropping significantly and

pay rates, which had been at elevated levels, also falling.

In LATAM, we delivered solid increases in both net fee income

and adjusted operating profit with demand for our retail

outsourcing services remaining strong.

Offshore Services

6 months 6 months

ended ended % change

30 June 30 June (constant

GBP'm 2023 2022 % change currency)

--------------------------- --------- --------- --------- -----------

Revenue 13.2 11.7 +13% +16%

Net fee income 7.0 6.1 +15% +17%

Adjusted operating profit 3.7 3.5 +6% +9%

% of Group net fee income 23% 18%

Offshore Services delivered solid growth with revenue up 13% and

net fee income up 15%. Investment in infrastructure is reflected in

the 6% growth in adjusted operating profit.

The first half of 2023 has continued in the same vein as the

second half of 2022 with sales to our UK Healthcare clients

remaining the main driver of growth with the number of billable

seats increasing by 17% compared to 31 December 2022. Sales to our

US clients, who mainly operate in the IT sector, have continued to

be impacted by weak demand resulting in an 11% fall in billable

seat numbers compared to 31 December 2022. We have continued to

invest in the infrastructure of the business to ensure it remains

well positioned for future growth.

Financing

Net finance costs have increased significantly to GBP0.8m (2022:

GBP0.5m) reflecting higher interest rates across the Group's

facilities offset by lower average levels of borrowings and the

benefit of actions taken to improve cash efficiency.

Net cash inflow from operating activities was GBP4.6m (2022:

GBP7.3m), while free cash flow, which excludes movements related to

pilot bonds and includes cash outflows on leases, was an inflow of

GBP2.0m (2022: GBP4.8m).

Capital expenditure in the first half of 2023 was GBP0.9m (2022:

GBP0.8m) and mainly reflected infrastructure investment to support

growth in Offshore Services. The Group's dividend to its

shareholders resulted in a GBP0.7m outflow (2022: GBP0.6m),

dividends to non-controlling interests were GBP0.4m (2022:

GBP0.4m), while a cash outflow of GBP0.1m (2022: GBP0.2m) is shown

for Empresaria shares purchased and transferred into the Employee

Benefit Trust.

Adjusted net debt (which excludes GBP0.5m cash held in respect

of pilot bonds and does not include lease liabilities recognised

under IFRS 16) was GBP8.7m as at 30 June 2023, an increase of

GBP0.8m from 31 December 2022. Average month end adjusted net debt

was GBP7.9m during the period (six months ended 30 June 2022:

GBP12.9m).

As at 30 June 2023, the Group had financing facilities totalling

GBP54.0m (31 December 2022: GBP54.8m). Excluding invoice financing,

undrawn facilities have increased to GBP18.4m (31 December 2022:

GBP17.9m) reflecting the small increase in the overall net debt

position being more than offset by improvements in cash

management.

The Group's revolving credit facility covenants are tested on a

quarterly basis. The covenants, and our performance against them as

at 30 June 2023, are as follows:

Measure Target Actual

Net debt to EBITDA < 2.5 times 0.6 times

Interest cover > 4.0 times 6.6 times

Dividend

In line with prior years, the Board is not recommending the

payment of an interim dividend for 2023 (2022: nil).

22 August 2023

Condensed consolidated income statement

Six months ended 30 June 2023

Year

6 months 6 months ended 31

ended 30 ended 30 December

June 2023 June 2022 2022

Unaudited Unaudited

Notes GBPm GBPm GBPm

Revenue 3 125.7 129.8 261.3

Cost of sales (96.0) (97.2) (195.9)

----------- ----------- ----------

Net fee income 3 29.7 32.6 65.4

Administrative costs (28.4) (28.1) (55.2)

----------- ----------- ----------

Adjusted operating profit 3 1.3 4.5 10.2

Fair value charge on acquisition

of non-controlling shares (0.1) - -

Amortisation of intangible assets

identified in business combinations (0.6) (0.7) (1.4)

----------- ----------- ----------

Operating profit 0.6 3.8 8.8

----------- ----------- ----------

Finance income 4 0.2 0.1 0.3

Finance costs 4 (1.0) (0.6) (1.5)

----------- ----------- ----------

Net finance costs 4 (0.8) (0.5) (1.2)

----------- ----------- ----------

(Loss)/profit before tax (0.2) 3.3 7.6

Taxation 6 (0.1) (1.3) (2.8)

(Loss)/profit for the period (0.3) 2.0 4.8

----------- ----------- ----------

Attributable to:

Owners of Empresaria Group plc (1.0) 1.4 3.4

Non-controlling interests 0.7 0.6 1.4

----------- ----------- ----------

(0.3) 2.0 4.8

----------- ----------- ----------

Pence Pence Pence

Unaudited Unaudited

Earnings per share

Basic 7 (2.0) 2.8 6.9

Diluted 7 (2.0) 2.7 6.7

Details of adjusted earnings per share are shown in note 7.

Condensed consolidated statement of comprehensive income

Six months ended 30 June 2023

6 months 6 months Year

ended ended ended 31

30 June 30 June December

2023 2022 2022

Unaudited Unaudited

GBPm GBPm GBPm

(Loss)/profit for the period (0.3) 2.0 4.8

---------- ---------- ----------

Other comprehensive income

Items that may be reclassified subsequently

to the income statement:

Exchange differences on translation

of foreign operations (2.0) 2.2 2.6

Items that will not be reclassified

to the income statement:

Exchange differences on translation

of non-controlling interests in foreign

operations (0.2) 0.2 0.3

---------- ---------- ----------

Other comprehensive (loss)/income for

the period (2.2) 2.4 2.9

---------- ---------- ----------

Total comprehensive (loss)/income for

the period (2.5) 4.4 7.7

---------- ---------- ----------

Attributable to:

Owners of Empresaria Group plc (3.0) 3.6 6.0

Non-controlling interests 0.5 0.8 1.7

---------- ---------- ----------

(2.5) 4.4 7.7

---------- ---------- ----------

Condensed consolidated balance

sheet

As at 30 June 2023

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited

Notes GBPm GBPm GBPm

Non-current assets

Property, plant and equipment 2.8 2.2 2.8

Right-of-use assets 5.2 6.7 7.5

Goodwill 31.1 31.3 31.9

Other intangible assets 7.5 8.7 8.2

Deferred tax assets 5.2 4.2 4.4

---------- ---------- ------------

51.8 53.1 54.8

---------- ---------- ------------

Current assets

Trade and other receivables 10 44.4 48.8 46.7

Cash and cash equivalents 9 19.6 23.1 22.3

---------- ---------- ------------

64.0 71.9 69.0

---------- ---------- ------------

Total assets 115.8 125.0 123.8

---------- ---------- ------------

Current liabilities

Trade and other payables 11 33.2 35.0 33.3

Current tax liabilities 1.2 1.6 1.5

Borrowings 8 18.8 22.7 29.1

Lease liabilities 2.2 3.3 5.3

---------- ------------

55.4 62.6 69.2

---------- ---------- ------------

Non-current liabilities

Borrowings 8 9.0 10.5 0.5

Lease liabilities 3.4 3.7 2.6

Deferred tax liabilities 2.5 2.5 2.5

---------- ------------

14.9 16.7 5.6

---------- ---------- ------------

Total liabilities 70.3 79.3 74.8

---------- ---------- ------------

Net assets 45.5 45.7 49.0

---------- ---------- ------------

Equity

Share capital 2.5 2.5 2.5

Share premium account 22.4 22.4 22.4

Merger reserve 0.9 0.9 0.9

Retranslation reserve 2.9 4.7 5.1

Equity reserve (10.2) (10.2) (10.2)

Other reserves 0.1 (0.4) (0.3)

Retained earnings 20.6 20.5 22.4

---------- ---------- ------------

Equity attributable to owners of Empresaria

Group plc 39.2 40.4 42.8

Non-controlling interests 6.3 5.3 6.2

---------- ---------- ------------

Total equity 45.5 45.7 49.0

---------- ---------- ------------

Condensed consolidated statement of changes in

equity

Six months ended

30 June 2023

Equity attributable to owners of Empresaria Group

plc

-------------------------------------------------------------------------------------

Share

Share premium Merger Retranslation Equity Other Retained Non-controlling Total

capital account reserve reserve reserve reserves earnings Total interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 31 December

2021 2.5 22.4 0.9 2.5 (10.2) (0.6) 19.9 37.4 4.9 42.3

----------------- -------- -------- --------- -------------- -------- --------- --------- ------ ---------------- -------

Profit for the

period - - - - - - 1.4 1.4 0.6 2.0

Exchange

differences on

translation

of foreign

operations - - - 2.2 - - - 2.2 0.2 2.4

----------------- -------- -------- --------- -------------- -------- --------- --------- ------ ---------------- -------

Total

comprehensive

income for

the period - - - 2.2 - - 1.4 3.6 0.8 4.4

Dividend paid to

owners of

Empresaria

Group plc - - - - - - (0.6) (0.6) - (0.6)

Dividend paid to

non-controlling

interests - - - - - - - - (0.4) (0.4)

Purchase of own

shares in

Employee

Benefit Trust - - - - - - (0.2) (0.2) - (0.2)

Share-based

payments - - - - - 0.2 - 0.2 - 0.2

At 30 June 2022

(Unaudited) 2.5 22.4 0.9 4.7 (10.2) (0.4) 20.5 40.4 5.3 45.7

----------------- -------- -------- --------- -------------- -------- --------- --------- ------ ---------------- -------

At 31 December

2021 2.5 22.4 0.9 2.5 (10.2) (0.6) 19.9 37.4 4.9 42.3

----------------- -------- -------- --------- -------------- -------- --------- --------- ------ ---------------- -------

Profit for the

year - - - - - - 3.4 3.4 1.4 4.8

Exchange

differences on

translation

of foreign

operations - - - 2.6 - - - 2.6 0.3 2.9

----------------- -------- -------- --------- -------------- -------- --------- --------- ------ ---------------- -------

Total

comprehensive

income for

the year - - - 2.6 - - 3.4 6.0 1.7 7.7

Dividend paid to

owners of

Empresaria

Group plc - - - - - - (0.6) (0.6) - (0.6)

Dividend paid to

non-controlling

interests - - - - - - - - (0.4) (0.4)

Purchase of own

shares in

Employee

Benefit Trust - - - - - - (0.3) (0.3) - (0.3)

Share-based

payments - - - - - 0.3 - 0.3 - 0.3

At 31 December

2022 2.5 22.4 0.9 5.1 (10.2) (0.3) 22.4 42.8 6.2 49.0

----------------- -------- -------- --------- -------------- -------- --------- --------- ------ ---------------- -------

(Loss)/profit

for the period - - - - - - (1.0) (1.0) 0.7 (0.3)

Exchange

differences on

translation

of foreign

operations - - - (2.2) - 0.2 - (2.0) (0.2) (2.2)

----------------- -------- -------- --------- -------------- -------- --------- --------- ------ ---------------- -------

Total

comprehensive

(loss)/income

for the period - - - (2.2) - 0.2 (1.0) (3.0) 0.5 (2.5)

Dividend paid to

owners of

Empresaria

Group plc - - - - - - (0.7) (0.7) - (0.7)

Dividend paid to

non-controlling

interests - - - - - - - - (0.4) (0.4)

Purchase of own

shares in

Employee

Benefit Trust - - - - - - (0.1) (0.1) - (0.1)

Share-based

payments - - - - - 0.2 - 0.2 - 0.2

----------------- -------- -------- --------- -------------- -------- --------- --------- ------ ---------------- -------

At 30 June 2023

(Unaudited) 2.5 22.4 0.9 2.9 (10.2) 0.1 20.6 39.2 6.3 45.5

----------------- -------- -------- --------- -------------- -------- --------- --------- ------ ---------------- -------

Condensed consolidated

cash flow statement

Six months ended 30 June

2023

6 months ended 30 June 2023 6 months ended 30 June 2022 Year ended 31 December 2022

Unaudited Unaudited

GBPm GBPm GBPm

(Loss)/profit for the

period (0.3) 2.0 4.8

Adjustments for:

Depreciation and software

amortisation 0.7 0.5 1.1

Depreciation of

right-of-use assets 2.7 2.6 5.4

Fair value charge on

acquisition of

non-controlling shares 0.1 - -

Amortisation of

intangible

assets

identified in

business

combinations 0.6 0.7 1.4

Share-based payments 0.2 0.2 0.3

Net finance costs 0.8 0.5 1.2

Taxation 0.1 1.3 2.8

---------------------------- ---------------------------- ----------------------------

4.9 7.8 17.0

Decrease in trade and

other receivables 0.6 1.9 6.9

Increase in trade and

other payables (including

pilot bonds outflow of

GBP0.1m (30 June 2022:

GBPnil, 31 December 2022:

GBP0.1m)) 1.1 0.2 (3.5)

---------------------------- ---------------------------- ----------------------------

Cash generated from

operations 6.6 9.9 20.4

Interest paid (1.0) (0.5) (1.5)

Income taxes paid (1.0) (2.1) (4.2)

---------------------------- ---------------------------- ----------------------------

Net cash inflow from

operating activities 4.6 7.3 14.7

---------------------------- ---------------------------- ----------------------------

Cash flows from investing

activities

Purchase of property, plant

and equipment, and

software (0.9) (0.8) (2.1)

Finance income 0.2 0.1 0.3

---------------------------- ---------------------------- ----------------------------

Net cash outflow from

investing activities (0.7) (0.7) (1.8)

---------------------------- ---------------------------- ----------------------------

Cash flows from financing

activities

Decrease in overdrafts (2.0) (0.8) (1.8)

Proceeds from bank loans 0.7 - -

Repayment of bank loans - (0.7) (2.7)

Decrease in invoice

financing ( 0.2) (0.1) (1.2)

Payment of obligations

under leases (2.7) (2.5) (5.3)

Purchase of shares in

existing subsidiaries (0.1) - (0.1)

Purchase of own shares in

Employee Benefit Trust (0.1) (0.2) (0.3)

Dividends paid to owners of

Empresaria Group plc (0.7) (0.6) (0.6)

Dividends paid to

non-controlling interests (0.4) (0.4) (0.4)

---------------------------- ---------------------------- ----------------------------

Net cash outflow from

financing activities (5.5) (5.3) (12.4)

---------------------------- ---------------------------- ----------------------------

Net (decrease)/increase in

cash and cash equivalents (1.6) 1.3 0.5

Foreign exchange movements (1.1) 0.7 0.7

Cash and cash equivalents

at beginning of the period 22.3 21.1 21.1

---------------------------- ---------------------------- ----------------------------

Cash and cash equivalents

at end of the period 19.6 23.1 22.3

---------------------------- ---------------------------- ----------------------------

Bank overdrafts at

beginning of the period (17.1) (18.2) (18.2)

Decrease in the period 2.0 0.8 1.8

Foreign exchange movements 0.2 (0.3) (0.7)

---------------------------- ---------------------------- ----------------------------

Bank overdrafts at end of

the period (14.9) (17.7) (17.1)

---------------------------- ---------------------------- ----------------------------

Cash, cash equivalents and

bank overdrafts at period

end 4.7 5.4 5.2

---------------------------- ---------------------------- ----------------------------

Notes to the interim financial statements

Six months ended 30 June 2023

1 Basis of preparation and general information

Empresaria Group plc is the Group's ultimate parent company. It is incorporated and domiciled

in England and its registered office address is Old Church House, Sandy Lane, Crawley Down,

Crawley, West Sussex, RH10 4HS, United Kingdom, its company registration number is 03743194

and its shares are listed on AIM, a market of London Stock Exchange plc.

The condensed set of financial statements have been prepared using accounting policies consistent

with UK-adopted International Accounting Standards. The same accounting policies, presentation

and methods of computation are followed in this condensed set of financial statements as applied

in the Group's latest annual audited financial statements. The Group does not anticipate any

change in these accounting policies for the year ended 31 December 2023. While the financial

information included in these interim financial statements has been prepared in accordance

with UK-adopted International Accounting Standards applicable to interim periods, these interim

financial statements do not contain sufficient information to constitute an interim financial

report as that term is defined in IAS 34.

The information for the year ended 31 December 2022 has been derived from audited statutory

accounts for the year ended 31 December 2022. The information for the year ended 31 December

2022 included herein does not constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for that year has been delivered to the

Registrar of Companies. The auditors reported on those accounts: their report was unqualified,

did not draw attention to any matters by way of emphasis and did not contain a statement under

section 498(2) or (3) of the Companies Act 2006. The interim financial information for 2023

and 2022 has been neither audited nor reviewed.

Going concern

The Group's activities are funded by a combination of long-term equity capital, revolving

credit facilities, term loans, invoice financing and bank overdraft facilities. The day-to-day

operations are funded by cash generated from trading, invoice financing and overdraft facilities.

The Board has reviewed the Group's profit and cash flow projections and applied sensitivities

to the underlying assumptions. These projections suggest that the Group will meet its obligations

as they fall due with the use of existing facilities.

The terms of the Group's principal overdraft facilities are reviewed on an annual basis, and

based on informal discussions the Board has had with its lenders, has no reason to believe

that sufficient facilities will not continue to be available to the Group for the foreseeable

future. As a result, the going concern basis continues to be appropriate in preparing the

financial statements.

2 Accounting estimates and judgements

The preparation of interim financial statements requires management to make judgements, estimates

and assumptions that affect the application of accounting policies and the reported amount

of income, expense, assets and liabilities. The significant estimates and judgements made

by management were consistent with those applied to the consolidated financial statements

for the year ended 31 December 2022.

Notes to the interim financial statements

Six months ended 30 June 2023

3 Segment analysis

Information reported to the Group's Executive Committee, considered to be the chief operating

decision maker of the Group for the purpose of resource allocation and assessment of segment

performance, is based on the Group's four regions.

The Group has one principal activity, the provision of staffing and recruitment services delivered

across a number of service lines being permanent placement, temporary and contract placement,

and offshore services.

The analysis of the Group's business by region is set out below:

Six months to 30 June 2023 Adjusted operating

Revenue Net fee income profit/(loss)

GBPm GBPm GBPm

UK & Europe 58.7 12.6 0.9

APAC 26.0 7.3 (0.6)

Americas 28.4 3.4 (0.3)

Offshore Services 13.2 7.0 3.7

Central costs - - (2.4)

Intragroup eliminations (0.6) (0.6) -

--------- -------------------------- --------------------------

125.7 29.7 1.3

--------- -------------------------- --------------------------

Six months to 30 June 2022 Adjusted operating

Revenue Net fee income profit/(loss)

GBPm GBPm GBPm

UK & Europe 63.2 14.5 2.0

APAC 23.0 7.9 0.5

Americas 32.7 4.6 0.8

Offshore Services 11.7 6.1 3.5

Central costs - - (2.3)

Intragroup eliminations (0.8) (0.5) -

--------- -------------------------- --------------------------

129.8 32.6 4.5

--------- -------------------------- --------------------------

Year ended 31 December 2022 Adjusted operating

Revenue Net fee income profit/(loss)

GBPm GBPm GBPm

UK & Europe 124.9 28.4 4.7

APAC 49.9 15.8 0.8

Americas 62.7 8.7 1.5

Offshore Services 25.3 13.5 7.1

Central costs - - (3.9)

Intragroup eliminations ( 1.5) ( 1.0) -

--------- -------------------------- --------------------------

261.3 65.4 10.2

--------- -------------------------- --------------------------

Notes to the interim financial statements

Six months ended 30 June 2023

Finance income and

4 costs

Year

6 months ended 30 6 months ended 30 ended 31 December

June 2023 June 2022 2022

Unaudited Unaudited

GBPm GBPm GBPm

Finance income

Bank interest receivable 0.2 0.1 0.3

0.2 0.1 0.3

--------------------- --------------------- ---------------------

Finance costs

Invoice financing (0.1) - (0.1)

Bank loans and overdrafts (0.7) (0.4) (1.1)

Interest on lease

liabilities (0.2) (0.2) (0.3)

(1.0) (0.6) (1.5)

--------------------- --------------------- ---------------------

Net finance costs (0.8) (0.5) (1.2)

--------------------- --------------------- ---------------------

5 Reconciliation of profit before tax to adjusted profit before tax

Year

6 months ended 30 6 months ended 30 ended 31 December

June 2023 June 2022 2022

Unaudited Unaudited

GBPm GBPm GBPm

(Loss)/profit before tax (0.2) 3.3 7.6

Fair value charge on

acquisition of

non-controlling shares 0.1 - -

Amortisation of

intangible assets

identified in business

combinations 0.6 0.7 1.4

Adjusted profit before

tax 0.5 4.0 9.0

--------------------- --------------------- ---------------------

6 Taxation

The tax charge for the six month period is GBP0.1m (6 months ended 30 June

2022: GBP1.3m,

year ended 31 December 2022: GBP2.8m). On an adjusted basis (excluding

adjusting items as

set out in note 5 and their tax effect), the effective tax rate is 40% (6

months ended 30

June 2022: 38%). The tax charge for the period is assessed using the best

estimate of the

effective tax rates expected to be applicable for the full year, applied to

the pre-tax income

of the six month period.

Notes to the interim financial statements

Six months ended 30 June 2023

7 Earnings per share

Basic earnings per share is assessed by dividing the earnings

attributable to the owners of Empresaria Group plc by the weighted

average number of shares in issue during the year. Diluted earnings

per share is calculated as for basic earnings per share but adjusting

the weighted average number of shares for the diluting impact

of shares that could potentially be issued. For 2023 and 2022

these are all related to share options. Reconciliations between

basic and diluted measures are given below.

The Group also presents adjusted earnings per share which it considers

to be a key measure of the Group's performance. A reconciliation

of earnings to adjusted earnings is provided below.

6 months 6 months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

Unaudited Unaudited

GBPm GBPm GBPm

Earnings

Earnings attributable to owners of

Empresaria Group plc (1.0) 1.4 3.4

Adjustments:

Fair value charge on acquisition of

non-controlling shares 0.1 - -

Amortisation of intangible assets identified

in business combinations 0.6 0.7 1.4

Tax on the above (0.1) (0.2) (0.3)

Adjusted earnings (0.4) 1.9 4.5

-------------- ----------- -------------

Number of shares Millions Millions Millions

Weighted average number of shares -

basic 49.5 49.5 49.4

Dilution effect of share options 1.4 1.9 1.5

-------------- ----------- -------------

Weighted average number of shares -

diluted 50.9 51.4 50.9

-------------- ----------- -------------

Earnings per share Pence Pence Pence

Basic (2.0) 2.8 6.9

Dilution effect of share options - (0.1) (0.2)

-------------- ----------- -------------

Diluted (2.0) 2.7 6.7

-------------- ----------- -------------

Adjusted earnings per share Pence Pence Pence

Basic (0.8) 3.8 9.1

Dilution effect of share options - (0.1) (0.3)

-------------- ----------- -------------

Diluted (0.8) 3.7 8.8

-------------- ----------- -------------

For the six months ended 30 June 2023, all share options are anti-dilutive

for the purpose of assessing diluted earnings per share in accordance

with IAS 33 Earnings Per Share. As a result, diluted earnings

per share and basic earnings per share are equal.

The weighted average number of shares (basic) has been calculated

as the weighted average number of shares in issue during the year

plus the weighted average number of share options already vested

less the weighted average number of shares held by the Empresaria

Employee Benefit Trust. The Trustees have waived their rights

to dividends on the shares held by the Empresaria Employee Benefit

Trust.

Notes to the interim financial

statements

Six months ended 30 June 2023

8 Borrowings

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited

GBPm GBPm GBPm

Current

Bank overdrafts 14.9 17.7 17.1

Invoice financing 3.4 4.5 3.5

Bank loans 0.5 0.5 8.5

---------- ------------

18.8 22.7 29.1

---------- ---------- ------------

Non-current

Bank loans 9.0 10.5 0.5

---------- ---------- ------------

9.0 10.5 0.5

---------- ---------- ------------

Borrowings 27.8 33.2 29.6

---------- ---------- ------------

The UK revolving credit facility is secured by a first fixed

charge over all book and other debts given by the Company and

certain of its s ubsidiaries. It is also subject to financial

covenants and these are disclosed in the finance and operating

review. The UK invoice financing facility is also secured by

a fixed and floating charge over trade receivables.

Notes to the interim financial statements

Six months ended 30 June 2023

9 Adjusted net debt

30 June 30 June 31 December

a) Adjusted net debt 2023 2022 2022

Unaudited Unaudited

GBPm GBPm GBPm

Cash and cash equivalents 19.6 23.1 22.3

Less cash held in respect of pilot

bonds (0.5) (0.7) (0.6)

----------- ----------- -------------

Adjusted cash 19.1 22.4 21.7

Borrowings (27.8) (33.2) (29.6)

Adjusted net debt (8.7) (10.8) (7.9)

----------- ----------- -------------

The Group presents adjusted net debt as its principle debt measure.

Adjusted net debt excludes cash held in respect of pilot bonds

within our aviation business. Where required by the client,

pilot bonds are taken at the start of the pilot's contract and

are repayable to the pilot or the client during the course of

the contract or if it ends early. There is no legal restriction

over this cash, but given the requirement to repay it over a

three year period, and that to hold these is a client requirement,

cash equal to the amount of the bonds is excluded in calculating

adjusted net debt.

6 months 6 months Year ended

ended 30 ended 30 31 December

b) Movement in adjusted net debt June 2023 June 2022 2022

Unaudited Unaudited

GBPm GBPm GBPm

At 1 January (7.9) (14.0) (14.0)

Net (decrease)/increase in cash

and cash equivalents per consolidated

cash flow statement (1.6) 1.3 0.5

Net decrease in overdrafts and

loans 1.3 1.5 4.5

Decrease in invoice financing 0.2 0.1 1.2

Foreign exchange movements (0.8) 0.3 (0.2)

Adjusted for decrease in cash

held in respect of pilot bonds 0.1 - 0.1

(8.7) (10.8) (7.9)

----------- ----------- -------------

Notes to the interim financial

statements

Six months ended 30 June 2023

10 Trade and other receivables

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited

GBPm GBPm GBPm

Gross trade receivables 32.0 36.2 34.1

Less provision for impairment of

trade receivables (0.7) (1.1) (0.8)

---------- ---------- ------------

Trade receivables 31.3 35.1 33.3

Prepayments 3.5 2.4 2.4

Accrued income 6.3 7.3 7.4

Corporation tax receivable 0.7 1.1 0.9

Other receivables 2.6 2.9 2.7

---------- ------------

44.4 48.8 46.7

---------- ---------- ------------

11 Trade and other payables

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited

GBPm GBPm GBPm

Current

Trade payables 2.4 2.4 2.4

Other tax and social security 5.5 6.1 5.1

Pilot bonds 0.5 0.7 0.6

Client deposits 0.3 0.4 0.4

Other payables 5.2 5.3 5.0

Accruals 19.3 20.1 19.8

33.2 35.0 33.3

---------- ---------- ------------

Pilot bonds represent unrestricted funds held by our aviation

business at the request of clients that are repayable to the pilot

over the course of a contract, typically three years. If the pilot

terminates their contract early, the outstanding bond is payable

to the client. For this reason, the bonds are shown as a current

liability.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIGDIRDDDGXB

(END) Dow Jones Newswires

August 22, 2023 02:00 ET (06:00 GMT)

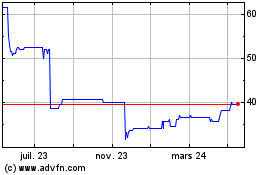

Empresaria (LSE:EMR)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

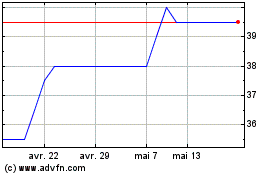

Empresaria (LSE:EMR)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024