TIDMEOG

Europa Oil & Gas (Holdings) plc / Index: AIM / Epic: EOG / Sector: Oil & Gas

10 October 2019

Europa Oil & Gas (Holdings) plc ('Europa' or 'the Company')

Final Results for the year to 31 July 2019

Europa Oil & Gas (Holdings) plc, the UK and Ireland focussed oil and gas

exploration, development and production company, announces its final results

for the 12 month period ended 31 July 2019.

The full Annual Report and Accounts will be available shortly on the Company's

website at www.europaoil.com and will be mailed in November 2019 to those

shareholders who have requested a paper copy.

Operational highlights

Offshore Ireland

* LO 16/20, which holds Inishkea, Europa's flagship gas prospect, converted

to 15 year exploration licence FEL 4/19

* 1.5 trillion cubic feet ('tcf') gross mean un-risked prospective gas

resources and 1 in 3 chance of success assigned to Inishkea

* Progressing regulatory consent for site surveys over Inishkea, Kiely East

and Edgeworth as part of drill site preparations

* Continuing farm-out discussions with respect to Frontier Exploration

Licence ("FEL") 4/19, FEL 1/17 and FEL 3/13. FEL 4/19 now expected to be

prioritised

* Secured a 12 month extension to the first phase of FEL 2/13 to 4 July 2020

UK

* Average of 91 barrels of oil equivalent per day ('boepd') (2018: 94 boepd)

recovered from three UK onshore fields

* Workover of the West Firsby 6 well utilising a drain hole jetting technique

- the well is currently producing 7 boepd net to Europa having previously

produced nothing

* Wressle planning appeal scheduled for 5 November 2019 - subject to a

positive outcome, development would more than double Europa's net

production to around 240 bopd

* Sold interest in PEDL143 to UK Oil & Gas PLC

Financial

* 6% increase in Group revenue to GBP1.7m (2018: GBP1.6m)

* Zero exploration write-off (2018: GBP1.3m)

* Narrowing of pre-tax loss to GBP0.7m (2018: loss GBP2.3m)

* Post-tax loss of GBP0.7m (2018: loss GBP2.6m)

* 16% reduction in administrative expenses to GBP811,000 (2018: GBP967,000)

* Cash used in operating activities GBP0.66m (2018: cash used GBP0.48m)

* Net cash balance as at 31 July 2019 GBP2.9m (31 July 2018: GBP1.8m)

Post reporting date events

* Award of Inezgane Offshore licence on Atlantic coast of Morocco.

* Irish Government announced intent to phase out future licensing for oil

exploration, but not gas exploration; later confirmed that all existing

exploration licences for both oil and gas remain valid.

Europa's CEO, Hugh Mackay, said "Having de-risked multiple hundred million

barrel plus prospects offshore Ireland and embarked on farm-out discussions

with suitable partners, we have been keen to add a third territory to Europa's

portfolio, specifically one that complements the team's technical

capabilities. The post period end award of the Inzeghane Permit offshore

Morocco represents the culmination of an extensive process and considerable

work over the course of the year. Similar to Atlantic Ireland, Europa's entry

into Morocco is low cost and early stage. Like Ireland, with 250 million plus

barrel prospects already identified, Inzeghane has the potential to move the

needle in the event of drilling success.

"Inzeghane does not represent the sum of our new venture activity. Our aim is

to build a full cycle oil and gas company and our priority is to add a late

stage appraisal/development project to our licence base. At the same time, we

are working hard to advance our existing assets, specifically securing funding

to drill wells offshore Ireland and supporting the operator's efforts to obtain

planning consent for the development of the Wressle oil field, which promises

to more than double our UK onshore production to around 240bopd. At this rate

and based on current oil prices, Europa's revenue profile would leap to GBP

3-4million a year, a figure that represents almost half our current market

capitalisation. Together with a low cost base, Europa would be transformed into

a profitable oil and gas company, at least at the underlying level, with a

prospect inventory that has significant company-making potential."

Chairman's statement

New Ventures

Our portfolio currently comprises two main business areas:

* Very high impact exploration offshore Atlantic margin in Ireland and (as

recently announced) Morocco, and

* Oil development and production onshore UK.

It is a priority for the Board to add a third area in the appraisal/development

part of the business cycle. Following a strategy review in October 2018 a

dedicated Board Strategy Committee was set up, meeting monthly to track

progress and review new venture opportunities against a continuously evolving

business environment. We are seeking projects in different stages of the

business cycle, in new basins, in countries with low political and regulatory

risk. Our approach is to review many candidates and progress only those which

meet strict suitability criteria. Our target is to have identified and likely

added this third area within the next period.

Ireland - Inishkea

Inishkea is our flagship prospect in Ireland. This is "infrastructure-led"

exploration next to the 1tcf Corrib gas field in the Slyne basin and is

unaffected by well results in the South Porcupine basin.

We reported gross unrisked prospective resources of 1.5tcf and an estimated

geological chance of success of 1 in 3. LO 16/20 was converted to a 15 year

Frontier Exploration Licence FEL 4/19 effective 1 August 2019. We have

submitted a site survey application for a drilling location. The process began

on 31 January and we hope to obtain regulatory approval during Q4 2019. As a

consequence of the time taken by the regulatory authorities, site survey

operations will be in 2020 subject to regulatory approval. We believe that

there is a compelling technical and commercial case for gas exploration in the

vicinity of the Corrib gas infrastructure and there are positive signs for a

farmout.

Ireland - Porcupine

Though the Iolar exploration well on the western flank of the South Porcupine

was unsuccessful, we believe that the geological fundamentals of the undrilled

eastern flank are different and better. New technical work on FEL 1/17 and FEL

3/13 has enhanced our appreciation and understanding of the Edgeworth, Ervine,

Egerton prospect complex and we will be presenting this to the industry at the

Atlantic Ireland conference in October 2019. We have secured a 12-month

extension for FEL 2/13 and await a similar extension for FEL 3/13. We have a

site survey application in process for a location on the Edgeworth prospect in

FEL 1/17. We hope to obtain regulatory approval during Q4 2019. As a

consequence of the time taken, any site survey operations will be in 2020 and

subject to regulatory approval.

Ireland - general

Two headwinds have adversely affected the oil and gas industry in Ireland:

* The Climate Emergency Measures Bill. Though the Bill did not proceed, it

threatened substantial investments in Atlantic Ireland and was a

significant concern.

* The time taken to obtain regulatory approvals for licence renewals and

conversions, and for operational activities such as site surveys, has been

extended substantially.

These factors have slowed the pace of industry activity and the farmout market

and it is against this backdrop that our work continues with operations and

farmouts.

The previously flagged farmout discussions continue, but given the time elapsed

and the changing local market conditions the Board now considers it more likely

that the farmin for the Inishkea licence FEL 4/19 will be concluded first

rather than three licenses simultaneously as originally envisaged.

Morocco

Post the reporting date, we announced the award of the Inezgane licence

offshore Morocco. This licence is in an under-explored basin with the key

elements of a working hydrocarbon system in the Lower Cretaceous. Morocco has

an active oil and gas industry and a supportive Government, with a desire to

grow the sector. Offshore, ENI and Genel are exploring just to the south of our

licence. Shell, Repsol, Sound and SDX Energy are amongst the companies active

onshore. Morocco has good fiscal terms. Entry costs, political, regulatory and

security risks are all low.

During the initial two-year phase of the licence, Europa will reprocess 1,300

km2 of 3D seismic data. This continues a workflow process that we thoroughly

understand having reprocessed 3,500 km2 in three seismic surveys offshore

Ireland with very positive results. The forward plan is to reprocess,

interpret, build a prospect inventory and farmout to drill.

Our decision to enter Morocco was predicated on using the skills which our

technical team have developed in working up prospects in areas covered with

modern 3D seismic in a prospective offshore setting and presenting these to the

industry in order to attract capital investment from larger industry players.

We looked for a country where the entry costs were low, 3D was available at low

cost, and the prospectivity, and consequential industry interest was high. We

are delighted to have secured a large and prospective block, in an area which

is of keen interest to the industry, as the presence of major oil and gas

companies in adjacent acreage demonstrates. Given the sometimes difficult

operating environment in other jurisdictions, it is a pleasure for us to be

operating in an area where the Government and the regulators are keen to work

with industry in making progress for the country.

UK - Wressle

Our focus is on getting the Wressle oil discovery into production. The Wressle

oil development Planning Inquiry takes place in November 2019 and the news that

North Lincolnshire Council have withdrawn from the inquiry is positive. The

operator Egdon is working hard to present a strong case to the planning

inspector and we are more hopeful than ever that we will have the well, which

was drilled in 2014, producing oil in 2020.

Gross oil production on Wressle startup is forecast to be 500 bopd and Europa's

30% share will more than double our current production providing an important

part of our financial resilience.

UK - Production

We are trying to maximise our existing production from fields that we operate.

At West Firsby a workover of well WF6 was successful and achieved oil

production from a reservoir interval which has never previously produced. We

gained invaluable insights into the practicalities of deploying drain-hole

jetting technology and this will enable us to exploit other opportunities in

our portfolio.

Conclusions

This has been a challenging year for the company in Ireland where there have

been delays beyond our control in both farmout and operational activities. On

the positive side our further studies on Inishkea confirm it to be a potential

company maker which fits well with the existing gas producing infrastructure

and importantly with Ireland's short to medium term energy and environmental

requirements. I am optimistic that the Wressle development in the UK will

finally be completed and brought on stream within the next period. I am also

confident that adding a new venture in the appraisal/development part of the

business will diversify the asset portfolio and provide greater protection for

the company from extraneous delays and unforeseen events.

I would like on behalf of the Board to thank the management, employees and

consultants for their work and commitment throughout the year.

Finally, may I thank our shareholders for their support and confidence in the

company going forward.

Simon Oddie

Chairman

Operations

Offshore Ireland: Exploration

Slyne Basin: FEL 4/19 (Inishkea)

The Inishkea gas prospect in FEL 4/19 has been the focus of substantial

technical, commercial and operations work during the year and remains the

Company's flagship project. Inishkea is a large, low risk gas prospect close to

gas infrastructure and in a country with a robust demand for gas.

Ireland has a growing economy and its demand for energy and electricity is

forecast to rise. The Government has announced its firm commitment to phase out

coal from the Irish generating mix by 2025, and the 915 MW currently generated

by coal at the Moneypoint power station is likely to be replaced by gas-fired

power generation. Gas will be a key part of the Irish energy transition

providing baseload and back up to renewables. As Minister Bruton said on 25

July 2019 in www.thejournal.ie "There's no doubt if we had a gas find beside

Corrib and could continue to supply from Corrib that would be of immense

benefit to us in that transition, it would allow us to have gas as a transition

fuel because when the wind doesn't blow and the sun doesn't shine you need a

transition fuel".

The Irish Government approved the Company's application to convert Licensing

Option 16/20 in the Slyne basin in Atlantic Ireland to FEL 4/19. The 100% owned

licence has a 15-year term commencing from 1 August 2019.

During the year, substantial technical work was undertaken to further de-risk

and quantify prospective resources for Inishkea. This work included Pre-Stack

Depth Migration ('PSDM') reprocessing of 770 km2 of 3D seismic data over

Inishkea and the Corrib gas field. The geophysical interpretation arising from

the PSDM data has been benchmarked and calibrated against newly released Ocean

Bottom Cable 3D seismic data over Corrib. That work assigned the Inishkea

prospect an estimated Gross Mean Un-Risked Prospective Resource ('GMUPR') of

1.5 tcf.

Licence Prospect Play Gross Un-risked Prospective

Resources

(billion cubic feet)

Low Best High Mean

FEL 4/19 Inishkea Triassic gas 244 968 3,606 1,528

Inishkea is a large fault bounded Triassic structure that lies northwest of the

Corrib gas field. The reservoir is Triassic age sandstone sourced from the

underlying Carboniferous. The trap is provided by a combination of Triassic

Uilleann Halite top seal and fault seal. Engineering studies demonstrate strong

positive economics for a range of porosity outcomes, including outcomes

significantly poorer than Corrib. Europa's view of porosity at Inishkea is

supported by velocity data from the new PSDM data. Given the Company's

confidence in trap and reservoir quality and the nearby Corrib gas field, the

Company assigned Inishkea a one-in-three chance of success.

Inishkea is in relatively shallow water in a proven gas play 18km from the

Corrib infrastructure connecting it to the 350 million cubic feet of gas per

day Bellanaboy gas processing plant. Corrib field production is in decline.

During Q2 2019 average production was 245 mmscf/d and there is growing spare

capacity in the infrastructure that a new discovery could potentially take

advantage of. Inishkea offers a low risk, high impact exploration prospect that

can be potentially fast tracked to commercialisation.

A drilling location for a first exploration well on Inishkea (18/20-H) has been

identified and the well engineering design is completed. There is a robust, low

risk seismic tie for the Corrib Sandstone reservoir back to the Corrib gas

field. Europa intended to acquire a site survey in summer 2019 and began the

regulatory consent process in January 2019. We remain hopeful that regulatory

consent will be obtained during Q4 2019. Unfortunately, the delay in granting

permission for this survey means that site survey operations will likely take

place in 2020 and that any drilling will be from 2021 at the earliest.

Elsewhere on FEL 4/19 the Corrib North structure containing the 18/20-7 gas

discovery well drilled by Shell in 2010 may be upgraded to contingent resources

pending further engineering evaluation. Discovered Gas Initially In Place

("GIIP") is provided in the table below:

Licence Prospect Play Gross discovered GIIP

(billion cubic feet)

Low Best High

FEL 4/19 Corrib North Triassic gas 5 41 208

South Porcupine Basin: FELs 1/17, 2/13 and 3/13

Europa holds four licences in the South Porcupine Basin. These include three

operated licences, FELs 1/17, 2/13 and 3/13, which are estimated to hold gross

mean un-risked prospective resources of 4.3 billion barrels of oil equivalent

('boe') across our top nine prospects, including firm drilling targets

Edgeworth in FEL 1/17, Wilde in 3/13 and Kiely East in 2/13. The volumetrics

are based on prospect mapping utilising the 2017 and 2018 reprocessed PSDM 3D

seismic data that we originally acquired in 2013. This has resulted in a marked

improvement in seismic quality and a substantial de-risking of the prospect

inventory.

The table below summarises the GMUPR across selected prospects in FELs 1/17, 2/

13 and 3/13:

Licence Prospect Play Gross Un-risked Prospective

Resources

(mmboe) *

Low Best High Mean

FEL 1/17 Ervine Pre-rift 63 159 363 192

FEL 1/17 Edgeworth Pre-rift 49 156 476 225

FEL 1/17 Egerton Syn-rift 59 148 301 167

FEL 3/13 Beckett mid-Cretaceous 111 758 4,229 1,719

Fan

FEL 3/13 Shaw + mid-Cretaceous 20 196 1,726 747

Fan

FEL 3/13 Wilde Early 45 241 1,082 462

Cretaceous Fan

FEL 2/13 Kiely East + Pre-rift 52 187 612 280

FEL 2/13 Kiely West + Pre-rift 23 123 534 225

FEL 2/13 Kilroy + Cret. Slope 37 177 734 312

Apron

Total 4,329

*million barrels of oil equivalent. The hydrocarbon system is considered an

oil play and mmboe is used to take account of associated gas. However, due to

the significant uncertainties in the available geological information, there

is a significant possibility of gas charge.

+prospect extends outside licence, volumes are on-licence

FEL 3/13 and FEL 1/17 are considered our most prospective licences in the South

Porcupine and our top ranked prospects are the Edgeworth Ervine fault block

complex in FEL 1/17. The application process for a site survey on Edgeworth

commenced in February 2019 and remains ongoing.

The Government approved the Company's application for a 12 month extension to

the First Phase of FEL 2/13 to 4 July 2020. The Company's application for a 12

month extension to the First Phase of FEL 3/13 remains under Government

consideration.

The next steps for FEL 2/13 include integration of recently purchased CREAN 3D

seismic data with particular focus on mapping the extension of Kiely East into

open acreage to the south of the licence. The application process for a site

survey on Kiely East commenced in February 2019 and remains ongoing.

South Porcupine Basin: LO 16/19

Europa holds a 30% interest in the Cairn-operated LO 16/19 on the west side of

the South Porcupine. 3D seismic was acquired in mid-2017 and a final processed

product was delivered in Q4 2018. Following the farmout in April 2017, Europa

is carried on this work programme by Cairn Energy up to a cap of US$6 million.

Prospect mapping is in progress and the prospect inventory is expected later in

2019.

The Iolar well

The South Porcupine basin is a large basin (circa 50,000 km2) with only four

exploration wells drilled since 1988. The most recent well is the CNOOC

operated Iolar well in FEL 3/18 on the west flank of the basin and drilled

during summer 2019. On 22 August 2019 CNOOC advised that the well had been

plugged and abandoned as a dry hole. The pre-drill public domain information

indicated the well was to be drilled in 2,162 m water depth, with a forecast TD

of 6,174 mtvdss and with a primary target of Middle Jurassic sandstones. The

well was drilled as a "tight hole" which means that the partners have not

released any detailed information on its results post drilling. Consequently,

there is no information available as yet regarding actual stratigraphy,

formation tops, source rocks, reservoir and hydrocarbon indications encountered

in the well.

Europa believes that its Middle Jurassic prospects in FEL 3/13 and FEL 1/17 on

the undrilled east flank of the South Porcupine are more prospective, and lower

risk than prospects on the west flank of the basin. Whilst the 417 mmbo

Edgeworth Ervine fault block complex is also targeting marine Middle Jurassic

sandstone reservoirs crucially at this location we expect to encounter top seal

provided by Upper Jurassic mudstones, and the basinward dipping fault blocks

are likely to be in communication with mature, oil prone Upper Jurassic source

rocks.

Farmout

As previously announced, we have negotiated farmout agreements in respect of

FEL 4/19, FEL 1/17 and FEL 3/13 with the NW Europe division of a major oil

company (the 'Major'). Europa is in regular contact with the Major and

continues to await a final investment decision from the Major's head office.

However, owing to the length of time it has taken to complete the farmout

agreement, we have continued to market the licences to other potential

partners. We are focused on being in a position to drill Inishkea at the

earliest opportunity and farmout discussions are ongoing with a number of

parties, including the Major. We believe that the 'Major' is considering

prioritising conclusion of the FEL 4/19 Inishkea farmout and in advance of the

South Porcupine licences FEL 1/17 and FEL 3/13.

The Future of Exploration in Ireland

On 23 September 2019 at the UN Climate Action Summit in New York An Taoiseach

Leo Varadkar stated the Irish Government's intention to phase out oil

exploration licences in the future, but not gas exploration. The Irish Offshore

Operators Association (IOOA), the representative organisation for the

Irish offshore oil and gas industry, sought clarification from the Government

on behalf of its members. On 24 September the Government confirmed to IOOA that

its proposals 'will relate to future applications' and that its 'existing

licences will remain valid'.

All of Europa's existing licences in Atlantic Ireland are therefore valid, and

will continue to be valid, irrespective of whether exploration is for oil or

gas.

IOOA are awaiting a meeting with Government to outline their proposals on how

future licensing rounds will be implemented. We understand that future

applications for gas exploration licences may be permitted.

Our flagship project in Atlantic Ireland is the 1.5 tcf Inishkea gas prospect

and we note in the letter of 20 September from Ireland's Climate Change

Advisory Council and tweeted by Minister Bruton at the UN on 23 September the

comment that "Recovery of newly discovered gas reserves may lead to improved

energy security, lower energy costs, and facilitate reductions in greenhouse

gas emissions during the transition to a low carbon economy". We consider this

a positive statement for Irish gas exploration.

UK - Onshore Production

Our oil production in onshore UK and the revenue streams that it generates is

an important part of the company's portfolio. We are actively maximising

production from our existing fields and most importantly we are finally making

positive progress towards obtaining planning approval for the Wressle oil

development.

East Midlands: West Firsby; Crosby Warren; Whisby-4

During the period, initiatives were undertaken to maximise production at the

West Firsby oil field including a workover of the WF6 well utilising a drain

hole jetting technique for the first-time onshore UK. The workover involved

jetting sixteen 90m length drain holes and setting a new record for hole angle.

Having previously produced zero oil, WF6 is currently producing 7 bopd net to

Europa. Whilst a comparatively small quantum of oil at $60 per barrel oil price

it is an increase of around 8% in our UK production. Most importantly we have

gained unique insights into utilisation and deployment of the technology and we

are seeking other opportunities where the quantum increase in production will

be more substantial.

An average of 91 boepd (2018: 94 boepd) was recovered from the three UK onshore

fields. Production was down as a result of natural decline, but partially

offset by the contribution from the WF6 well.

East Midlands: PEDL180 (Wressle); PEDL182 (Broughton North)

Europa has a 30% working interest in licence PEDL 180 in the East Midlands

which holds the Wressle oil discovery, alongside Egdon (operator, 30%), Union

Jack Oil (27.5%), and Humber Oil & Gas Limited (12.5%).

An inquiry to hear the Company's appeal against the refusal of planning consent

for the development of the Wressle oil field by the planning committee of North

Lincolnshire Council ('NLC') is scheduled to commence on 5 November 2019.

Following a closed meeting held on 17 July 2019, we learnt that NLC will not

present evidence at the inquiry and has withdrawn its case following agreement

of acceptable planning conditions.

We welcome the NLC decision and look forward to continuing to support the

operator Egdon, as it seeks to obtain planning permission via the appeal and

prepares to present the case for the development of the Wressle oil field to

the independent professional Planning Inspector.

The Wressle oil field was discovered in 2014 by the Wressle-1 well. During

testing, a total of 710 boepd were recovered from three separate reservoirs,

the Ashover Grit, the Wingfield Flags and the Penistone Flags. In September

2016, a Competent Person's Report ('CPR') provided independent estimates of

reserves and contingent and prospective oil and gas resources for the Wressle

discovery of 2.15 million stock tank barrels classified as discovered (2P+2C).

Under the proposed development plan, Wressle is anticipated to produce at an

initial gross rate of 500 bopd. If that were achieved, Europa would receive a

net 150 bopd from Wressle and Europa's UK production would increase to around

240 bopd. Most importantly our revenue from production would more than double

and make an important contribution to the financial stability of the company.

East Midlands: PEDL181

PEDL181 provides exposure to the hydrocarbon potential of the Humber basin. The

licence has technical synergy with the adjacent PEDL334 which was awarded to an

Egdon Resources-led group in the 14th Round for the purpose of conventional and

unconventional exploration.

East Midlands: PEDL299 (Hardstoft)

PEDL299 contains the Hardstoft oil field which was discovered in 1919 by the

UK's first ever exploration well. Hardstoft produced 26,000 barrels of oil

from Carboniferous limestone reservoirs in the 1920s. We believe there is more

oil to be recovered from the Hardstoft structure. Gross 2C contingent resources

of 3.1 mmboe and gross 3C contingent resources of 18.5 mmboe were identified in

a CPR issued by joint operation partner Upland Resources. We believe that

application of modern production testing and drilling methodologies could well

lead to commercial oil flowrates being achieved. Europa's interest in PEDL299,

which is restricted to the conventional prospectivity including Hardstoft, is

25%, alongside Upland 25% and INEOS, the operator, 50%.

Cleveland Basin: PEDL343 (Cloughton)

PEDL343 contains the Cloughton gas discovery, which was drilled by Bow Valley

in 1986 and flowed gas to surface on production test from conventional

Carboniferous sandstone reservoirs. Europa regards Cloughton as a gas appraisal

opportunity with the critical challenge being to obtain commercial flowrates

from future production testing operations. Europa holds a 35% interest in

PEDL343 alongside Arenite 15%, Third Energy 20% (operator), Egdon Resources

17.5% and Petrichor Energy 12.5%.

Weald Basin: PEDL143 (Holmwood)

We completed the sale of our 20% interest in the UK onshore PEDL143 exploration

licence to AIM-traded UK Oil & Gas PLC ('UKOG') for a consideration of GBP

300,000, satisfied through the issue of 25,951,557 shares ('Consideration

Shares') in UKOG. The Consideration Shares are subject to a six-month orderly

market provision.

New Ventures

In Morocco we have signed the Inezgane Offshore exploration permit with ONHYM

(The National Office of Hydrocarbons and Mines) on 17 September. Inezgane is on

the Atlantic Margin of Morocco and represents a new high impact exploration

component to our portfolio of licences.

The next step is formal ratification by the Ministry of Energy and Ministry of

Finance. This is expected to be obtained during November and the eight-year

licence will formally be given its start date. In the interim period work has

already started. ONHYM is already providing Europa with the relevant 3D, 2D,

well data and regional geological information.

The first phase of the licence is for two years during which time we will

reprocess 1,300 km2 3D seismic, build the prospect inventory, define a

drillable prospect and farmout to drill in Phase 2. The cost of the first phase

programme is expected to be around GBP500,000.

Inezgane Offshore is located in the Agadir Basin on the Atlantic Coast of

Morocco. Water depths vary from 600-2,000m and the licence is very large;

11,288 km2 in area. Morocco's Atlantic coastline is 1,800 km in length, only

10 deep-water wells have been drilled and only three of them have penetrated

the Lower Cretaceous reservoir interval that we are interested in, none of them

optimally. We consider the Atlantic Coast to be underexplored and that the

potential of the Lower Cretaceous play has been previously overlooked by the

industry. The Atlantic region of Morocco has already demonstrated world class

source rocks. Good quality lower Cretaceous reservoirs are exposed on the

surface in the nearby Canary Islands and in the Moroccan onshore. We believe

that there is an optimal combination of thick reservoir, source rock and trap

in our licence with potential to host prospects with resources in excess of 250

mmbo. Morocco has amongst the best fiscal terms in the world and whilst deep

water the operating environment is more benign compared to West of Shetland or

Atlantic Ireland.

We have been provided with a large volume of modern 3D seismic data and we will

be reprocessing around 1,300 km2 focused on maturing the Falcon, Sandpiper

prospects (amongst others) to drillable status.

This region of the Atlantic Coast in Morocco is already a focus for industry

interest. To the south of Inezgane Genel has acquired 3,500 km2 of 3D seismic

in Sidi Moussa Offshore and ENI have farmed out a 30% interest to Qatar

Petroleum in Tarfaya Offshore. Immediately to the north of and abutting

Inezgane is the Mogador Offshore licence which is under active negotiation. We

await with interest the announcement of an award of an exploration licence

here. We consider that in Inezgane, we have a very prospective licence in an

area that is re-emerging as an industry exploration hotspot.

We believe that the main reason that the exploration industry's major oil and

gas companies have turned their interest to offshore Morocco again is that it

shares similar geology and prospectivity to other Atlantic margin countries

like Guyana and Senegal. Like Morocco these countries also had intermittent

exploration drilling since the 1960s and were also "off radar" until very

recent discoveries changed that mindset. In offshore Guyana in excess of 5

billion barrels of oil has been discovered and in offshore Senegal/Mauritania

in excess of 50TCF and 1 billion barrels of oil has been discovered in recent

years. We are optimistic that the Moroccan offshore can become a similar

resurgence story.

Our work programme is one that plays to our technical strengths given our

previous experience reprocessing three 3D surveys in Ireland against a tight

timeframe and with excellent results. In due course we will be seeking to bring

in a farmin partner and even at this early stage there is significant industry

interest in our licence.

Non-financial Key Performance Indicators ('KPIs')

There were no reportable accidents or incidents in the year (2018: zero).

There were no new licence awards in the year, the Morocco Inezgane Offshore

exploration permit was signed post year end. (2018: zero).

Financials

Revenue was GBP1.7 million (2018: GBP1.6 million). The average oil price achieved

was US$66.7/bbl (2018: US$64.5/bbl) and the average Sterling exchange rate was

US$1.29 (2018: US$1.35). An average of 91 boepd (2018: 94 boepd) was recovered

from our three UK onshore fields. Production was down as a result of natural

decline, but partially offset by a contribution from the West Firsby WF6 well

following the workover.

Stringent cost controls continue to be implemented but additional one-off cost

was incurred during the WF6 workover. Cost of sales was GBP1,682,000 (2018: GBP

1,365,000).

Administrative expenses of GBP811,000 (2018: GBP967,000) included GBP102,000 on new

licence evaluations (2018: GBP230,000).

The placing and open offer announced in November 2018 raised combined GBP

4,299,000 gross and GBP3,962,000 after expenses (including GBP17,000 of non-cash

expenses).

Net cash spent on operating activities was GBP661,000 (2018: cash spent GBP

479,000).

Purchase of intangible fixed assets of GBP1,973,000 (2018: GBP1,336,000) was

largely spent advancing the Irish portfolio.

The Group's cash balance at 31 July 2019 was GBP2.9 million (31 July 2018: GBP1.8

million).

The Group's cash flow forecast up to 31 December 2020 considers the continuing

and forecast cash inflow from the Group's producing assets, the cash held by

the Group at the year end, less administrative expenses and planned capital

expenditure. Based on that forecast, the Directors have concluded that Group

will be able to continue as a going concern and meet its obligations as and

when they fall due. The critical assumption in reaching that conclusion is that

the Wressle planning appeal scheduled for 5 November 2019 has a positive

outcome and production commences at the forecasted rate in 2020. In the absence

of incremental production from Wressle in 2020 then additional funding by the

issuance of shares or sale of assets would be required. If additional funding

was not available there is a risk that commitments could not be fulfilled, and

assets would be relinquished.

HGD Mackay

Chief Executive Officer

The financial information set out below does not constitute the company's

statutory accounts for 2019 or 2018. The financial information has been

prepared in accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union on a basis that is consistent with the

accounting policies applied by the group in its audited consolidated financial

statements for the year ended 31 July 2019. Statutory accounts for the years

ended 31 July 2018 and 31 July 2017 have been reported on by the Independent

Auditors.

The Independent Auditors' Report on the Annual Report and Financial Statements

for 2019 and 2018 were unqualified, but included a material uncertainty in

relation to going concern, and did not contain a statement under 498(2) or 498

(3) of the Companies Act 2006.

Statutory accounts for the year ended 31 July 2018 have been filed with the

Registrar of Companies. The statutory accounts for the year ended 31 July 2019

will be delivered to the Registrar in due course.

Consolidated statement of comprehensive income

For the year ended 31 July 2019 2018

Note GBP000 GBP000

Revenue 1,713 1,634

Cost of sales (1,682) (1,365)

Impairment of producing fields 2 - (142)

Exploration write-back / (write-off) 1 270 (1,289)

Total cost of sales (1,412) (2,796)

-------- --------

Gross profit/(loss) 301 (1,162)

Administrative expenses (811) (967)

Finance income 43 10

Finance expense (187) (171)

-------- --------

Loss before taxation (654) (2,290)

Taxation charge - (341)

-------- --------

Loss for the year (654) (2,631)

=========== =========

Other comprehensive income

Items which will not be reclassified to profit /(loss)

Loss on investment revaluation (59) -

-------- --------

Total other comprehensive loss (59) -

=========== =========

Total comprehensive loss for the year attributable to (713) (2,631)

the equity shareholders of the parent

=========== =========

Consolidated statement of financial position

As at 31 July 2019 2018

Note GBP000 GBP000

Assets

Non-current assets

Intangible assets 1 7,818 5,959

Property, plant and equipment 2 575 668

-------- --------

Total non-current assets 8,393 6,627

-------- --------

Current assets

Investments 241 -

Inventories 19 20

Trade and other receivables 315 471

Restricted cash 251 -

Cash and cash equivalents 2,905 1,771

-------- --------

3,731 2,262

-------- --------

Total assets 12,124 8,889

======== ========

Liabilities

Current liabilities

Trade and other payables (1,086) (1,299)

-------- --------

Total current liabilities (1,086) (1,299)

-------- --------

Non-current liabilities

Long-term provisions (2,917) (2,735)

-------- --------

Total non-current liabilities (2,917) (2,735)

-------- --------

Total liabilities (4,003) (4,034)

-------- --------

Net assets 8,121 4,855

======== ========

Capital and reserves attributable to equity holders

of the parent

Share capital 4,447 3,014

Share premium 21,010 18,481

Merger reserve 2,868 2,868

Retained deficit (20,204) (19,508)

-------- --------

Total equity 8,121 4,855

======== ===========

These financial statements were approved by the Board of Directors and

authorised for issue on 9 October 2019 and signed on its behalf by:

P Greenhalgh, Finance Director

Company registration number 5217946

Consolidated statement of changes in equity

Attributable to the equity holders of the parent

Share Share Merger Retained Total

capital premium reserve deficit equity

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 August 2017 3,014 18,481 2,868 (16,888) 7,475

Comprehensive loss for the

year

Loss for the year

attributable to the equity - - - (2,631) (2,631)

shareholders of the parent

-------- -------- -------- -------- ---------

Total comprehensive loss

for the year - - - (2,631) (2,631)

-------- -------- -------- -------- ---------

Contributions by and

distributions to owners

Share based payment (note - - - 11 11

21)

-------- -------- -------- -------- --------

Total contributions by and - - - 11 11

distributions to owners

-------- -------- -------- -------- ---------

Balance at 31 July 2018 3,014 18,481 2,868 (19,508) 4,855

======== ======== ======== ======== ========

Share Share Merger Retained Total

capital premium reserve deficit equity

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 August 2018 3,014 18,481 2,868 (19,508) 4,855

Comprehensive loss for the

year

Loss for the year (654) (654)

attributable to the equity - - -

shareholders of the parent

Other comprehensive loss (59) (59)

attributable to the equity - - -

shareholders of the parent

-------- -------- -------- -------- ---------

Total comprehensive loss - - - (713) (713)

for the year

-------- -------- -------- -------- ---------

Contributions by and

distributions to owners

Issue of share capital 1,433 2,546 - - 3,979

Issue of share options - (17) - 17 -

(note 21)

Share based payment (note - - - - -

21)

-------- -------- -------- -------- --------

Total contributions by and 1,433 2,529 - 17 3,979

distributions to owners

-------- -------- -------- -------- ---------

Balance at 31 July 2019 4,447 21,010 2,868 (20,204) 8,121

======== ======== ======== ======== ========

Consolidated statement of cash flows

For the year ended 31 July 2019 2018

Note GBP000 GBP000

Cash flows used in operating activities

Loss after tax from continuing operations (654) (2,631)

Adjustments for:

Share based payments - 11

Depreciation 2 94 72

Impairment of producing field 2 - 142

Exploration (write back)/ write-off 1 (270) 1,289

Finance income (43) (10)

Finance expense 187 171

Taxation charge - 341

Decrease in trade and other receivables 7 69

Decrease/(increase) in inventories 1 (6)

Increase in trade and other payables 17 73

-------- --------

Net cash used in operations (661) (479)

Income taxes paid - -

-------- --------

Net cash used in operating activities (661) (479)

=========== ===========

Cash flows used in investing activities

Purchase of property, plant and equipment (1) -

Purchase of intangible assets (1,973) (1,336)

Cash guarantee re Morocco (251) -

Sale of part interest in licence - associated costs (8) -

Interest received 16 10

-------- --------

Net cash used in investing activities (2,217) (1,326)

=========== ===========

Cash flows from/(used in) financing activities

Gross proceeds from issue of share capital 4,299 -

Costs incurred on issue of share capital (320) -

Decrease in payables relating to share capital issue - (16)

costs

Finance costs (5) (3)

-------- --------

Net cash from/(used in) financing activities 3,974 (19)

=========== ===========

Net increase/(decrease) in cash and cash equivalents 1,096 (1,824)

Exchange gain on cash and cash equivalents 38 4

Cash and cash equivalents at beginning of year 1,771 3,591

-------- --------

Cash and cash equivalents at end of year 2,905 1,771

=========== ===========

Notes to the financial statements

1. Intangible assets

2019 2018

GBP000 GBP000

At 1 August 5,959 5,276

Additions 1,869 1,972

Disposal (10) -

Exploration write-off - (1,289)

-------- --------

At 31 July 7,818 5,959

========= =========

Intangible assets comprise the Group's pre-production expenditure on licence

interests as follows:

2019 2018

GBP000 GBP000

Ireland FEL 2/13 (Doyle A, B, C, Kilroy, Keane & 1,280 799

Kiely)

Ireland FEL 3/13 (Beckett, Wilde, Shaw) 1,255 1,093

Ireland FEL 1/17 636 453

Ireland LO 16/19 89 71

Ireland FEL 4/19 (Inishkea) 1,259 454

Ireland LO 16/22 213 125

UK PEDL143 (Holmwood) - 10

UK PEDL180 (Wressle) 2,867 2,745

UK PEDL181 101 95

UK PEDL182 (Broughton North) 29 26

UK PEDL299 (Hardstoft) 12 12

UK PEDL343 (Cloughton) 77 76

---------- ----------

Total 7,818 5,959

========= =========

Disposal

UK PEDL143 (Holmwood) 10 -

========= =========

Exploration write-off

UK PEDL143 (Holmwood) - 1,145

Ireland LO 16/21 - 97

UK Block 41/24 - 47

-------- --------

Total - 1,289

======== ==========

Exploration write-back

On 8 May 2019 the Group sold its interest in PEDL143 (Holmwood) to UK Oil & Gas

Plc ('UKOG') for 25,951,557 shares in UKOG at 1.156p per share.

2019 2018

GBP000 GBP000

Consideration for the PEDL143 interest 300 -

Disposal costs (20) -

Book value of remaining interest (10) -

-------- --------

Exploration write-back 270 -

========= =========

If the Group is not able to or elects not to continue in any other licence,

then the impact on the financial statements will be the impairment of some or

all of the intangible assets disclosed above.

2. Property, plant & equipment

Furniture Producing Total

& fields

computers

GBP000 GBP000 GBP000

Cost

At 1 August 2017 52 10,790 10,842

Additions - - -

--------- --------- ---------

At 31 July 2018 52 10,790 10,842

Additions 1 - 1

--------- --------- ---------

At 31 July 2019 53 10,790 10,843

======== ======== ========

Depreciation, depletion and

impairment

At 1 August 2018 49 9,911 9,960

Charge for year 2 70 72

Impairment in year - 142 142

--------- --------- ---------

At 31 July 2018 51 10,123 10,174

Charge for year 1 93 94

Impairment in year - - -

--------- --------- ---------

At 31 July 2019 52 10,216 10,268

======== ======== ========

Net Book Value

At 31 July 2017 3 879 882

======== ======== ========

At 31 July 2018 1 667 668

======== ======== ========

At 31 July 2019 1 574 575

======== ======== ========

The producing fields referred to in the table above are the production assets

of the Group, namely the oilfields at Crosby Warren and West Firsby, and the

Group's interest in the Whisby W4 well, representing the Group's three cash

generating units.

The carrying value of each producing field was tested for impairment by

comparing the carrying value with the value-in-use. The value-in-use was

calculated using a discounted cash flow model with production decline rates of

7-12%, Brent crude prices rising from US$70 per barrel in 2020 to US$74 per

barrel in 2022 increasing by inflation from 2022 onwards and a pre-tax discount

rate of 20%. The pre-tax discount rate is derived from a post-tax rate of 10%

and is high because of the applicable rates of tax in the UK. Cash flows were

projected over the expected life of the fields which is expected to be longer

than 5 years. There was no impairment in the year (2018: GBP142,000 impairment

relating to the West Firsby site).

Sensitivity to key assumption changes

Variations to the key assumptions used in the value-in-use calculation would

cause impairment of the producing fields as follows:

Further

impairment of

producing

fields

GBP000

Production decline rate (current assumption 7-12%)

12% 312

15% 602

Brent crude price per barrel (current assumption

US$70/bbl in 2020 rising to US$74/bbl in 2022)

$70 flat 168

$65 flat 392

Pre-tax discount rate (current assumption 20%)

25% 62

30% 29

* * ENDS * *

This announcement contains inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014.

For further information please visit www.europaoil.com or contact:

Hugh Mackay Europa + 44 (0) 20 7224

3770

Phil Greenhalgh Europa + 44 (0) 20 7224

3770

Matt Goode finnCap Ltd + 44 (0) 20 7220

0500

Simon Hicks finnCap Ltd + 44 (0) 20 7220

0500

Camille Gochez finnCap Ltd + 44 (0) 20 7220

0500

Frank Buhagiar St Brides Partners Ltd + 44 (0) 20 7236

1177

Susie Geliher St Brides Partners Ltd + 44 (0) 20 7236

1177

END

(END) Dow Jones Newswires

October 10, 2019 02:00 ET (06:00 GMT)

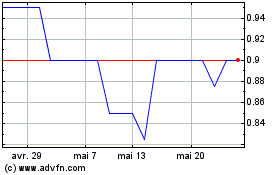

Europa Oil & Gas (holdin... (LSE:EOG)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024