TIDMHCFT

RNS Number : 9785M

Highcroft Investments PLC

25 August 2011

HIGHCROFT INVESTMENTS PLC

Interim report

30 June 2011

Chairman's Statement for the six months ended 30 June 2011

Highlights

-- Rental income up 3.7% to GBP1,040,000 (2010

GBP1,002,000).

-- Profit before tax increased by 7.2% to GBP1,299,000 (2010

GBP1,212,000).

-- Basic earnings per share on all activities was 25.1p (2010

25.4p).

-- Net asset value per share increased to 724p (June 2010 676p

and December 2010 716p).

-- Interim property income distribution increased 4.5% to 11.5p

per share compared with 11.0p in 2010.

-- Net cash GBP3,306,000 (2010 GBP3,065,000) equivalent to 64p

per share (2010 59p per share).

-- During the period three residential properties were disposed

of and one lease extended yielding a total of GBP1,300,000 (2010

GBP297,000).

-- Contracts now exchanged for one further residential disposal

and one commercial acquisition.

Dear Shareholder

The results for the 6 months ended 30 June 2011 are, in the

circumstances of significant economic uncertainty, solid and

reassuring. They show a steady income position and a slight

increase in net asset value.

Gross rental income rose a little compared with 2010, reflecting

improved commercial rental revenue - including that from our new

property in Warwick - offset to a degree by the decline in rent

from residential properties as they become vacant and are sold. Net

rental income fell as a result of necessary expenditure -

particularly in Yeovil - associated with new leases. Dividend

income from our equity portfolio was helped by a special one off

dividend resulting in an increase to GBP126k (2010: GBP101k). The

net effect of this was that the revenue account profits reduced to

GBP832k (2010: GBP862k) resulting in earnings per share of 16.1p

(2010: 16.7p). I can also report that, notwithstanding the GBP19k

costs associated with the general meeting requisitioned by certain

shareholders, our administrative expenses have reduced slightly to

GBP165k (2010: GBP168k).

In capital terms, a mixture of net valuation gains on our

investment properties and a small valuation loss on our equity

portfolio produced a capital profit of GBP467k (2010: GBP453k),

resulting in earnings per share of 9.0p (2010: 8.7p).

Importantly, given the economic uncertainties with which the

world is faced, our balance sheet remains very strong with cash at

the half year end of GBP3.3m, no borrowings, and net assets per

share of 724p (June 2010: 676p, December 2010: 716p). We still

believe that it is right to take a cautious view but continue to

look at properties that fit our criteria for the medium term. We

have recently exchanged contracts for the purchase of an industrial

unit in Andover and this purchase is expected to be completed in

November 2011. The initial yield is 6.4% with an unexpired lease

term of 23 years let to a strong covenant and is representative of

the sort of purchases that we seek. In the first half of 2011 we

have also completed on the sale of three of our residential

properties and completed one lease extension. This has resulted in

net proceeds of GBP1.3m being received. A further residential

property became vacant in February on which we exchanged contracts

for the sale in July and this sale is expected to complete next

month. We have not disposed of any equities in the 6 months and

have made a modest further investment into the market of

GBP378k.

We believe that shareholders can take comfort in these difficult

economic times from the quality of our property portfolio. Our

confidence in the medium term is reflected in our decision to

declare an interim dividend of 11.5p per share (2010 11p per share)

payable on 20 October 2011.

Yours sincerely

J Hewitt

Chairman

25 August 2011

For further information, contact:

Highcroft Investments PLC

John Hewitt / Roberta Miles 01865 840 023

Charles Stanley Securities

Dugald Carlean / Karri Vuori 0207 149 6000

Condensed consolidated interim statement of comprehensive income

(unaudited)

for the six months ended 30 June 2011

First First Full

Half Half Year

2011 2010 2010

Note Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Continuing

operations

Gross rental income 1,040 - 1,040 1,002 - 1,002 2,053 - 2,053

Property operating

expenses (173) - (173) (76) - (76) (245) 0 (245)

-------- -------- -------- -------- -------- -------- -------- -------- --------

Net rental income 867 - 867 926 - 926 1,808 - 1,808

Realised gains on

investment property - 58 58 - 42 42 - 108 108

Realised losses on

investment property - (23) (23) - - - - (8) (8)

-------- -------- -------- -------- -------- -------- -------- -------- --------

Net gain on disposal of

investment property - 35 35 - 42 42 - 100 100

-------- -------- -------- -------- -------- -------- -------- -------- --------

Valuation gains on

investment property - 563 563 - 755 755 - 1,735 1,735

Valuation losses on

investment property - (100) (100) - (25) (25) - (158) (158)

-------- -------- -------- -------- -------- -------- -------- -------- --------

Net valuation

gains/(losses) on

investment property - 463 463 - 730 730 - 1,577 1,577

-------- -------- -------- -------- -------- -------- -------- -------- --------

Dividend income 126 - 126 101 - 101 234 - 234

Gains on investments - 195 195 - 105 105 - 718 718

Losses on investments - (226) (226) - (527) (527) - (209) (209)

-------- -------- -------- -------- -------- -------- -------- -------- --------

Net investment

income/(loss) 126 (31) 95 101 (422) (321) 234 509 743

-------- -------- -------- -------- -------- -------- -------- -------- --------

Administrative expenses (165) - (165) (168) - (168) (330) - (330)

-------- -------- -------- -------- -------- -------- -------- -------- --------

Operating

profit/(loss)

before net

financing costs 828 467 1,295 859 350 1,209 1,712 2,186 3,898

Finance income 7 - 7 5 - 5 10 - 10

Finance expenses (3) 0 (3) (2) - (2) (1) - (1)

------ ----- ------ ------ ----- ------ ------ ------ ------

Net finance costs 4 - 4 3 - 3 9 - 9

------ ----- ------ ------ ----- ------ ------ ------ ------

Profit/(loss)

before tax 832 467 1,299 862 350 1,212 1,721 2,186 3,907

Income tax

credit/(expense) 4 - - - - 103 103 144 (89) 55

------ ----- ------ ------ ----- ------ ------ ------ ------

Total

profit/(loss)

and

comprehensive 832 467 1,299 862 453 1,315 1,865 2,097 3,962

------ ----- ------ ------ ----- ------ ------ ------ ------

income/(expense)

for the

financial

period

Basic and diluted 6 16.1p 9.0p 25.1p 16.7p 8.7p 25.4p 36.0p 40.7p 76.7p

earnings/(loss)

per share

Condensed consolidated interim statement of financial position

(unaudited)

as at 30 June 2011

30 June 30 June 31 December

2011 2010 2010

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Investment property 7 29,902 28,300 30,705

Equity investments 8 5,954 5,221 5,608

-------- -------- ------------

Total non-current assets 35,856 33,521 36,313

-------- -------- ------------

Current assets

Trade and other receivables 101 83 93

Cash at bank and in hand 3,306 3,065 2,472

-------- -------- ------------

Total current assets 3,407 3,148 2,565

-------- -------- ------------

Total assets 39,263 36,669 38,878

-------- -------- ------------

Liabilities

Current liabilities

Interest-bearing loans

and borrowings - - -

Current income tax 213 286 215

Trade and other payables 894 792 897

-------- -------- ------------

Total current liabilities 1,107 1,078 1,112

-------- -------- ------------

Non-current liabilities

Interest-bearing loans

and borrowings - - -

Deferred tax liabilities 764 668 764

-------- -------- ------------

Total non-current liabilities 764 668 764

-------- -------- ------------

Total liabilities 1,871 1,746 1,876

-------- -------- ------------

Net assets 37,392 34,923 37,002

-------- -------- ------------

Equity

Issued share capital 1,292 1,292 1,292

Revaluation reserve -

property 5,904 6,442 6,670

Revaluation reserve -

other 1,720 1,630 1,750

Capital redemption reserve 95 95 95

Realised capital reserve 21,099 19,238 19,810

Retained earnings 7,282 6,226 7,385

-------- -------- ------------

Total equity 37,392 34,923 37,002

-------- -------- ------------

Condensed consolidated interim statement of changes in

equity

for the six months ended 30 June 2011

a) First half 2011

-Unaudited

Revaluation

Equity reserves Capital Realised Retained

Property Other Redemption Capital Earnings Total

Reserve Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2011 1,292 6,670 1,750 95 19,810 7,385 37,002

Dividends - - - - - (909) (909)

-------- --------- -------- ----------- --------- --------- --------

Transactions with

owners - - - - - (909) (909)

Total

comprehensive

profit for the

period - - - - - 1,299 1,299

Identification of

non-distributable

items recognised

in income

statement:

Revaluation

gains/(losses) - 463 (30) - - (433) -

Tax on revaluation

gains and losses - - - - - - -

Realised gains - - - - 35 (35) -

(Surplus)/deficit

attributable to

assets sold - (1,254) - - 1,254 - -

Excess of cost

over revalued

amount taken to

retained

earnings - 25 - - - (25) -

-------- --------- -------- ----------- --------- --------- --------

Total

comprehensive

income for the

period - (766) (30) - 1,289 806 1,299

-------- --------- -------- ----------- --------- --------- --------

At 30 June 2011 1,292 5,904 1,720 95 21,099 7,282 37,392

-------- --------- -------- ----------- --------- --------- --------

b) First half 2010

- Unaudited

Revaluation

Equity reserves Capital Realised Retained

Property Other Redemption Capital Earnings Total

Reserve Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2010 1,292 5,696 2,656 95 18,229 6,467 34,435

Dividends - - - - - (827) (827)

-------- --------- -------- ----------- --------- --------- --------

Transactions with

owners - - - - - (827) (827)

Total

comprehensive

profit for the

period - - - - - 1,315 1,315

Identification of

non-distributable

items recognised

in income

statement:

Revaluation

gains/(losses) - 730 (27) - - (703) -

Tax on revaluation

gains and losses - - 69 - - (69) -

Realised losses - - - - (95) 95 -

(Surplus)/deficit

attributable to

assets sold - (9) (1,095) - 1,104 - -

Excess of cost

over revalued

amount taken to

retained

earnings - 25 27 - - (52) -

-------- --------- -------- ----------- --------- --------- --------

Total

comprehensive

income for the

period - 746 (1,026) - 1,009 586 1,315

-------- --------- -------- ----------- --------- --------- --------

At 30 June 2010 1,292 6,442 1,630 95 19,238 6,226 34,923

-------- --------- -------- ----------- --------- --------- --------

c) Full year 2010

- Audited

Revaluation

Equity reserves Capital Realised Retained

Property Other Redemption Capital Earnings Total

Reserve Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2010 1,292 5,696 2,656 95 18,229 6,467 34,435

Dividends - - - - - (1,395) (1,395)

-------- --------- -------- ----------- --------- --------- --------

Transactions with

owners - - - - - (1,395) (1,395)

Total

comprehensive

profit for the

period - - - - - 3,962 3,962

Identification of

non-distributable

items recognised

in income

statement:

Revaluation

gains/(losses) - 1,577 572 - - (2,149) -

Tax on revaluation

gains and losses - - (93) - - 93 -

Realised gains - - - - (58) 58 -

(Surplus)/deficit

attributable to

assets sold - (254) (1,385) - 1,639 - -

Excess of cost

over revalued

amount taken to

retained

earnings - (349) - - - 349 -

-------- --------- -------- ----------- --------- --------- --------

Total

comprehensive

income for the

year - 974 (906) - 1,581 2,313 3,962

-------- --------- -------- ----------- --------- --------- --------

At 31 December

2010 1,292 6,670 1,750 95 19,810 7,385 37,002

-------- --------- -------- ----------- --------- --------- --------

Condensed consolidated interim statement of cash flows

(Unaudited)

for the six months ended 30 June 2011

First Half First Half Full Year

2011 2010 2010

GBP'000 GBP'000 GBP'000

Operating activities

Profit/(loss) for the period 1,299 1,315 3,962

Adjustments for:

Net valuation (gains)/losses

on investment property (463) (730) (1,577)

Gain on disposal of investment

property (35) (42) (100)

Net losses/(gains) on investments 31 422 (509)

Finance income (7) (5) (10)

Finance expense 3 2 1

Income tax (expense)/credit - (103) (55)

----------- ----------- ----------

Operating cash flow before changes

in working capital and provisions 828 859 1,712

(Increase)/decrease in trade

and other receivables (8) 20 10

(Decrease)/increase in trade

and other payables (3) 13 120

----------- ----------- ----------

Cash generated from operations 817 892 1,842

Finance income 7 5 10

Finance expense (3) (2) (1)

Income tax paid - - (25)

----------- ----------- ----------

Cash flows from operating activities 821 895 1,826

----------- ----------- ----------

Investing activities

Purchase of fixed assets - investment

property - - (1,558)

- equity investments (378) (727) (1,028)

Sale of fixed assets - investment

property 1,300 297 355

- equity investments - 2,481 3,326

----------- ----------- ----------

Cash flows from investing activities 922 2,051 1,095

Financing activities

Loan repayments - - -

Dividends paid (909) (827) (1,395)

----------- ----------- ----------

Cash flows used in financing

activities (909) (827) (1,395)

----------- ----------- ----------

Net increase in cash and cash

equivalents 834 2,119 1,526

Cash and cash equivalents at

1 January 2011 2,472 946 946

----------- ----------- ----------

Cash and cash equivalents at

30 June 2011 3,306 3,065 2,472

NOTES (unaudited)

1. Nature of operations and general information

Highcroft Investments PLC ('Highcroft') and its subsidiary

(together 'the group') principal activities are investment in

property and equities. It is incorporated and domiciled in Great

Britain. The address of Highcroft Investments PLC's registered

office, which is also its principal place of business, is Thomas

House, Langford Locks, Kidlington, OX5 1HR. Highcroft's condensed

consolidated interim financial statements are presented in Pounds

Sterling (GBP), which is also the functional currency of the group.

These condensed consolidated interim financial statements have been

approved for issue by the directors on 25 August 2011. The

financial information for the year ended 31 December 2010 set out

in this interim report does not constitute statutory accounts as

defined in Section 404 of the Companies Act 2006. The group's

statutory financial statements for the year ended 31 December 2010

have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified and did not

contain statements under Section 498(2) or Section 498(5) of the

Companies Act 2006.

2. Basis of preparation

These condensed consolidated interim financial statements are

for the six months ended 30 June 2011. They have been prepared in

accordance with IAS 34, Interim Financial Reporting. They do not

include all of the information required for full annual financial

statements, and should be read in conjunction with the consolidated

financial statements of the Group for the year ended 31 December

2010.

These condensed consolidated interim financial statements have

been prepared under the historical cost convention, as modified by

the revaluation of investment properties and the measurement of

equity investments at fair value. These condensed consolidated

interim financial statements have been prepared in accordance with

the accounting policies adopted in the last annual financial

statements for the year to 31 December 2010.

The accounting policies have been applied consistently

throughout the group for the purposes of preparation of these

condensed consolidated interim financial statements.

3. Segmental reporting

Segmental information is presented in the condensed consolidated

interim financial statements in respect of the group's business

segments. The business segment reporting format reflects the

group's management and internal reporting structure. Segment

results include items directly attributable to a segment as well as

those that can be allocated on a reasonable basis. All gross income

is from external tenants or external investments.

The group is comprised of the following main business

segments:

* Commercial property comprising retail outlets, offices and

warehouses.

* Residential property comprising mainly single-let houses.

* Financial assets comprising exchange-traded equity

investments.

3. Segmental reporting (continued)

First First

Half Half Full Year

2011 2010 2010

GBP'000 GBP'000 GBP'000

Commercial property

Gross income 1,020 970 1,995

Profit/(loss) for the period 859 1,212 2,690

Assets 31,560 29,024 28,655

Liabilities 713 630 743

Residential property

Gross income 20 32 58

Profit for the period 365 338 654

Assets 1,742 2,423 2,695

Liabilities 10 10 23

Financial assets

Gross income 126 101 234

Profit/(loss) for the period 75 (235) 618

Assets 5,961 5,222 7,528

Liabilities 1,148 1,106 1,110

Total

Gross income 1,166 1,103 2,287

Profit for the period 1,299 1,315 3,962

Assets 39,263 36,669 38,878

Liabilities 1,871 1,746 1,876

The largest tenant represents 10% of gross commercial property

income.

4. Income tax (credit) / expense

First First

Half Half Full Year

2011 2010 2010

GBP'000 GBP'000 GBP'000

Current tax:

On revenue profits - - (60)

On capital profits - (34) (19)

Prior year underprovision - - (69)

-------- -------- ----------

- (34) (148)

Deferred tax - (69) 93

-------- -------- ----------

- (103) (55)

-------- -------- ----------

The taxation charge has been based on the estimated effective

tax rate for the full year. As a Real Estate Investment Trust the

group does not pay corporation tax on its profits and gains from

its commercial and residential property activities.

5. Dividends

On 25 August 2011, the directors declared a property income

dividend of 11.50p per share (2010 11.00p interim dividend) payable

on 20 October 2011 to shareholders registered at 23 September

2011.

The following property income distributions have been paid by

the company.

First First Full

Half Half Year

2011 2010 2010

GBP'000 GBP'000 GBP'000

2010 final: 17.60p per ordinary

share (2009 final 16.00p ) 909 827 827

2010 interim: 11.00p per ordinary

share - - 568

-------- -------- --------

909 827 1,395

-------- -------- --------

6. Earnings per share

The calculation of earnings per share is based on the profit for

the period of GBP1,295,000 (2010 GBP1,315,000) and on 5,167,240

shares (2009 5,167,240) which is the weighted average number of

shares in issue during the period ended 30 June 2011 and throughout

the period since 1 January 2010.

The allocation differs to that disclosed in the year end

published accounts to better reflect the designation of realised

investment gains as capital in nature and to ensure consistency

with prior years. There is no impact on the total year end

results.

In order to draw attention to the impact of valuation gains and

losses which are included in the income statement but not available

for distribution under the company's articles of association, an

adjusted earnings per share based on the profit available for

distribution of GBP828,000 (2010 GBP862,000) has been

calculated.

First First Full

Half Half Year

2011 2010 2010

GBP'000 GBP'000 GBP'000

Earnings:

Basic earnings 1,299 1,315 3,962

Adjustments for:

Net valuation (profits)/losses

on investment property (498) (772) (1,677)

Gains and losses on investments 31 422 (509)

Income tax on (gains)/losses - (103) 89

-------- -------- --------

Adjusted earnings 832 862 1,865

-------- -------- --------

Per share amount:

Basic earnings per share 25.1p 25.4p 76.7p

Adjustments for:

Net valuation gains on investment

property (9.6)p (14.9)p (32.5)p

Gains and losses on investments 0.6p 8.2p (9.9)p

Income tax on gains and losses 0.0p (2.0)p 1.7p

-------- -------- --------

Adjusted earnings per share 16.1p 16.7p 36.0p

-------- -------- --------

7. Investment property

First First Full

Half Half Year

2011 2010 2010

GBP'000 GBP'000 GBP'000

Valuation at 1 January 2011 30,705 27,825 27,825

Additions - - 1,558

Disposals (1,266) (255) (255)

Gain on revaluation 463 730 1,577

-------- -------- --------

Valuation at 30 June 2011 29,902 28,300 30,705

-------- -------- --------

The directors have used an external independent valuation of

properties at 30 June 2011 which has been carried out consistently

with the annual valuation.

8. Equity Investments

First First Full

Listed and unlisted Half Half Year

2011 2010 2010

GBP'000 GBP'000 GBP'000

Valuation at 1 January 2011 5,608 7,397 7,397

Additions 378 727 1,028

Disposals - (2,601) (3,393)

(Deficit)/surplus on revaluation

in excess of cost (30) (290) 572

Revaluation decrease below cost (11) (27) (6)

Revaluation increase still below

cost 9 15 10

-------- -------- --------

Valuation at 30 June 2011 5,954 5,221 5,608

-------- -------- --------

9. Related party transactions

Kingerlee Holdings Limited owns, through its wholly owned

subsidiaries, 25.4% (2010: 25.4%) of the company's shares and D H

Kingerlee and J C Kingerlee are directors of the company, Kingerlee

Holdings Limited and its wholly owned subsidiaries and shareholders

of the company and Kingerlee Holdings Limited.

During the period, the group made purchases from Kingerlee

Holdings Limited or its subsidiaries, being a service charge in

relation to services at Thomas House, Kidlington of GBP7,000 (2010:

GBP7,000). The amount owed at 30 June 2011 was nil (2010: nil). All

transactions were undertaken on an arm's length basis.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BUGDIBBDBGBS

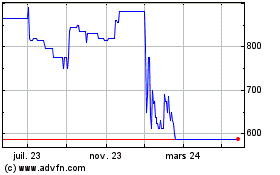

Highcroft Investments (LSE:HCFT)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Highcroft Investments (LSE:HCFT)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024