TIDMHFEL

RNS Number : 1249V

Henderson Far East Income Limited

30 November 2023

LEGAL ENTITY IDENTIFIER: 2138008DIQREOD38O596

HERSON FAR EAST INCOME LIMITED

Financial results for the year ended 31 August 2023

This announcement contains regulated information

Investment Objective

The Company seeks to provide shareholders with a growing total annual

dividend per share, as well as capital appreciation, from a diversified

portfolio of investments from the Asia Pacific region.

Total return performance to 31 August 2023 (including dividends reinvested)

1 year 3 years 5 years 10 years

% % % %

--------------------------------------------- ------- -------- -------- ---------

NAV(1, 5) -13.0 -4.9 -8.9 41.7

Share price(2, 5) -14.8 -10.3 -10.9 38.4

FTSE All-World Asia Pacific ex Japan

Index(3) -7.2 5.1 15.4 96.2

MSCI AC Asia Pacific ex Japan High Dividend

Yield Index(3) 0.1 25.4 18.4 72.3

--------------------------------------------- ------- -------- -------- ---------

Financial highlights at 31 August 2023 at 31 August 2022

--------------------------------------- -------------------- -------------------

Shareholders' funds

Net assets (GBP'000) 362,032 435,576

NAV per ordinary share 222.12p 281.11p

Share price 218.00p 281.00p

--------------------------------------- -------------------- -------------------

Year ended Year ended

31 August 2023 31 August 2022

Profit/(loss) for year

Revenue return (GBP'000)

Capital return (GBP'000) 33,219 37,102

(89,459) (29,145)

------------ ------------

Net total (loss)/profit (56,240) 7,957

======= =======

Total earnings/(loss) per ordinary

share

Revenue 20.92p 24.41p

Capital (56.35p) (19.18p)

------------ ------------

Total (loss)/earnings per ordinary

share (35.43p) 5.23p

Ongoing charge (4) 0.97% 1.01%

--------------------------------------- -------------------- -------------------

1. Net asset value (NAV) total return performance including dividends

reinvested

2. Share price total return using closing price including dividends

reinvested

3. The Company does not have a benchmark and uses these indices for

comparison purposes only

4. Calculated using the methodology prescribed by the Association of

Investment Companies

5. NAV total return, share price total return and the ongoing charge

are considered alternative performance measures. More information on

these can be found in the Company's annual report.

Sources: Morningstar Direct, Janus Henderson Investors

Chairman's Statement

Introduction

2023 has been a very difficult year for investors with rapidly increasing

interest rates shifting expectations dramatically and undermining what

many hoped would be a strong post-Covid recovery period in the Asia

Pacific region. This was not to be. Instead, we have faced geopolitical

shocks, ongoing supply chain disruptions and new juxtapositions in

market behaviour. Against this backdrop, our investment results are

easier to understand, however disappointing they may be.

Performance

Whilst the Company has once again achieved our high income objective,

the investment performance from a capital growth perspective over the

past financial year has been unsatisfactory. The NAV total return performance

for the period ended 31 August 2023 was -13.0%, versus the FTSE All-World

Asia Pacific ex Japan Index of - 7.2% and MSCI All Country Asia Pacific

ex Japan High Dividend Yield Index of 0.1%. The year-end dividend yield

of 11.1% was not enough to compensate for a falling share price, with

the share price total return standing at -14.8% for the period. Since

the year-end, investment performance has deteriorated further and this

represents a three-year period of underperformance, where capital returns

have suffered when compared to both market indices and many of our

competitors.

Against this backdrop, the Board has looked often and hard at the reasons

for these results and I will use this opportunity to present both an

analysis of the factors which shaped this outcome and an outline of

what your Company is doing to address them.

What happened?

* Investment styles go through periods of being both in

and out of fashion. In the low interest rate

environment, valuation tended to matter less, and our

Fund Managers valuation-focused investment style has

therefore been out of favour.

* China weightings, China stock selection and the

timing of our exposure to this important economy and

market have been the most significant contributing

factors. Since the lifting of Covid restrictions, the

pace of China's recovery fell short of expectations

and the negative impact of global supply chain shifts

on how Chinese companies would prosper has been more

severe. An over allocation to China was exacerbated

by our exposure to Hong Kong which has increasingly

moved in lockstep with the mainland over the Covid

period and beyond.

-- The low combined weighting in India, Japan and Taiwan in our portfolio

has also had a negative influence.

Our strong income bias has historically justified this absence but

these markets have performed strongly over the period.

* Our overweight exposures to the energy and materials

sectors, the latter including investments in copper

and lithium which will be in demand to meet 'green'

targets, have been held back by questions about the

rate of economic recovery.

Our Fund Managers' report expands on all these points in further detail

and outlines their forward thinking alongside the current positioning

of the portfolio.

Strategy

Working closely with the investment manager, your Board holds a formal

review of the Company's investment strategy at least annually. This

year we have spent a substantial amount of extra time outside of formal

board meetings considering this matter - the impact of that strategy

on performance and its appropriateness both over the long term and

in the current market conditions. We also focused on the yield of the

portfolio, projections for dividends from the Asia Pacific region,

and our investment prospects for the portfolio and the region in general.

In light of this re-examination, several points can be made:

First, that our strategy to provide an attractive, growing dividend

without giving up the potential for a degree of

long-term capital growth remains both appropriate and achievable. As

we have in the past, we aim to achieve this objective by identifying

a combination of companies with high and sustainable cash flow generation

and dividends, and those achieving growth that are predicted to be

the high yielding companies of the future. As dividend growth in the

region slowly returns to its historic trend next year, we believe that

prospects for the future will be much improved.

Second, while we believe our broader strategy remains correct, we have

sought to refine the process used to achieve our objectives. Given

our income focus, income returns from stocks has been significantly

undermined by the strength of sterling, especially over the last year.

Our Fund Managers had sought to enhance income and offset sterling

strength through portfolio rebalancing but this had a negative impact

on capital growth. Our analysis has now led us to revise the way in

which we capture dividends, an approach that has too often led to diminished

capital growth. We have now largely restructured the portfolio to allow

the renewed growth in portfolio company dividends to come through along

with better capital growth returns. Through this transition period,

we will use our distributable reserves to supplement your Company's

dividend. In addition to maintaining a progressive dividend, re-establishing

the Company's long-term record of capital growth will be a critical

factor in restoring shareholder confidence. The Fund Managers' report

will comment on this in more detail.

Third, strong sentiment around China's reopening prospects in the fourth

quarter of 2022 reinforced our long-term investment case for the market

and supported a significant position. While the economic power and

potential of many Chinese sectors remains compelling, macroeconomic

influences have ultimately overwhelmed some robust fundamentals, with

broader market sentiment now muted on the market. Further, there is

increasing homogeneity between the markets of Hong Kong and China.

With this in mind, and with the dividend culture in other markets including

India improving rapidly, we are broadening our scope to include more

companies from elsewhere in the region.

We have worked closely with our Fund Managers to address our capital

performance challenges and devise an effective path forward. As part

of this process, we have agreed that now is the right time to pass

the fund management leadership role to Sat Duhra. The Board has full

confidence in Sat's ability to manage the portfolio going forward,

and he has been part of a long-standing succession plan having been

co-manager since 2019. Mike Kerley will be retiring from the asset

management industry in June 2024 and will support Sat to ensure a smooth

transition process. Mike has played a critical role in the Company's

historical development and the Board would like to thank him for his

many contributions over the years and wish him well in all his future

endeavours.

We believe it is in the best interests of all shareholders to support

these changes while benefitting from a revised investment implementation

approach.

The Board remains committed to its historic progressive dividend policy

together with capital growth and we will continue to monitor performance

closely, taking additional action if we believe our revised implementation

approach is not improving investment returns as we expect.

Dividend

The Board has again increased its dividend to shareholders, marking

16 consecutive years of uninterrupted dividend progress. A total dividend

of 24.20p has been paid in respect of the year ended 31 August 2023,

representing a 1.7% increase on the dividend paid last year.

In keeping with the outcome of our discussions on strategy and implementation,

we have opted to augment our fourth interim dividend using the Company's

substantial reserves. We have therefore covered GBP5.7m of the dividend

from distributable reserves. Doing so enables our Fund Managers to

better position the portfolio, with scope to invest in a greater number

of companies with higher growth characteristics.

Board refreshment

I was pleased to announce the appointment of two new directors on 19

September 2023. Susie Rippingall and Carole Ferguson will join as members

of the Board with effect from 1 December 2023. Both are outstanding

investment professionals with strong backgrounds in areas that will

enhance your Board's future decision-making while giving us a better

overall balance.

Susie is an investment professional with more than 25 years of fund

management experience in Asian markets. Carole has extensive experience

in the financial services sector in research, finance and sustainability.

We believe both will contribute meaningfully to our discussions and

bring new perspectives. Indeed, they have already made important contributions

to our discussions of strategy and implementation. We invite shareholders

to join us at the next annual general meeting to meet Susie and Carole,

along with the rest of the Board. Both will offer themselves to shareholders

for election.

Having successfully completed this recruitment process, David Mashiter

will be retiring at the conclusion of the forthcoming annual general

meeting. I would very much like to thank David for his many years'

service to the Company, his thorough and thoughtful contemplation of

the matters for discussion in and out of Board meetings, as well as

his robust, but always courteous, challenge to all of us. His views

will be missed.

AGM

The Company's 17th Annual General Meeting is due to be held at 12.00

pm am on 24 January 2024 at the offices of our investment manager,

201 Bishopsgate, London, EC2M 3AE. The Notice of Meeting has been posted

to shareholders with a copy of this annual report and I encourage all

shareholders to submit their votes to the registrar or their share

dealing platform accordingly.

The Fund Managers will provide their usual update on the Company's

performance and their outlook for the region. They and all directors

will be available to answer any questions you may have.

Recent results & outlook

While the underlying business performance of our portfolio holdings

has been much as expected, their stock prices have not generally reflected

these gains. Since our financial year-end in August, our high exposure

to Greater China has been an unhappy experience, reflecting a far less

robust rate of recovery than we earlier expected. Some new holdings

have benefitted results but not enough to offset the damage from elsewhere.

As I have noted above, we are in the process of making changes that

we believe will lead to improved results over the balance of the year

and beyond. The economic fundamentals of the Asia Pacific region remain

attractive and will look increasingly so when compared to the slowing

performance of western markets. As our portfolio re-captures its capital

growth and with our commitment to the Company's progressive dividend

policy, we look forward to reporting more satisfactory results in the

future. Our focus and commitment are determined and unwavering. The

opportunities are still very much evident and at more attractive valuations

than we have seen in many years.

The Fund Managers' report that follows will give you a more detailed

discussion of both past events and future expectations. I believe it

underscores many good reasons for optimism about the future.

Ronald Gould

Chairman

29 November 2023

Fund mANAGERS' REPORT

The period under review was dominated by global inflationary pressures,

conjecture on the path of interest rates and the war in Ukraine amongst

other factors. The scars of the Covid-19 pandemic continued to be uncovered

as evidenced by the magnitude of the shock to supply chains, which

was unanticipated by investors and contributed to the initial rise

in inflation data. However, it was manner of the response to Covid-19

in China and the subsequent weak recovery once restrictions had been

lifted that produced the greatest impact on our performance. We had

expected to capitalise on a strong recovery in China once the economy

re-opened after a period of strictly enforced restrictions, however,

this failed to materialise and our China consumer holdings suffered

as a result. In addition to that, a steady flow of negative macroeconomic

data, property sector defaults and concerning levels of leverage at

local governments impacted sentiment towards our other holdings in

the country. Our performance in China in recent years has been unsatisfactory

and we are in the process of re-positioning this part of our portfolio

towards higher quality growth names, which are now attractive on valuation,

and come with a genuine domestic advantage and growing dividends.

Our investment style aims to take advantage of market mis-pricings

where we believe the Net Present Value of future cashflows is not reflected

in the current share price. However, this style has been distinctly

out of favour in recent times as demonstrated by the outperformance

of growth over value in most markets. Despite interest rates rising

and therefore the cost of capital increasing in equity valuations,

the emergence of themes such as Artificial Intelligence ('AI') have

supported the thesis of higher growth into the future boosting the

valuation of many expensive stocks. We expect this to reverse as rates

remain higher for longer, pressuring the high valuation of many growth

names. However, this may not transpire to the same degree in China

where value names are more intrinsically tied to the fortunes of the

economy versus underlying operational trends given that much of the

high dividend universe are State Owned Enterprises ('SOEs'). The structural

issues faced by China, amplified by the collapse of the heavily indebted

China Evergrande Group and subsequent defaults, combined with the collapse

in property volumes and the ensuing impact on local government fiscal

positions, have dampened our enthusiasm for high yield value names

in China. We have begun the process of adding more attractive growth

and yield names in other markets such as Indonesia and India where

there is less regulatory risk and a much clearer path to growth without

the structural impediments currently faced by China. Notwithstanding

this we expect to continue uncovering opportunities in China, especially

at the current depressed valuations.

More generally the rapid rise in interest rates has, unsurprisingly,

created problems most notably in the regional banks in the US and the

UK pension industry where the belief that interest rates would remain

low indefinitely, were brutally exposed by the dramatic central bank

moves. Consumer spending has slowed but remained more resilient than

many expected as savings accumulated during the pandemic have offset

the higher cost of food, energy and mortgages. This, though, has probably

delayed the economic slowdown rather than postponed it. The World Bank

expects global growth to be 2.4% in 2024 with the contribution from

developed economies only 1.2%. The US is expected to grow by 0.8% and

the EU, by 1.3%. All recent revisions have seen 2023 adjusted upwards

and 2024 downwards, reflecting the lagging nature of this cycle's monetary

tightening.

The inflationary impact in Asia has been less pronounced. Most countries

in the region did not receive the same fiscal support as the western

world during the pandemic and, as a result, excess liquidity did not

push up asset prices and wages in the same way as elsewhere. Labour

shortages and supply disruptions were also less pronounced. As a result,

the rise in inflation was caused mostly by rising food and energy prices

and, as these have fallen, central banks in the region have started

to ease rates. In short, Asian economies have had to raise rates less

than their western peers and will be reducing them sooner. However,

there are exceptions. Australia, New Zealand and Japan are three as

they share greater similarities with advanced economies, compared to

developing Asia.

Despite superior fundamentals, the performance of the region has been

disappointing with Asian markets significantly lagging the 5.3% positive

return from the S&P 500 and 7.9% return from the FTSE 100 over the

Company's financial year. The weakness of China is partly to blame,

but the strength of the US dollar and a tightening of liquidity from

higher interest rates has prompted flows away from equities as there

are now attractive returns to be achieved on cash and lower risk bonds.

The other phenomenon that has distracted growth investors is the rise

to prominence of AI. A large proportion of positive returns, especially

in 2023, have been derived in this area as borne out by the strong

performance of the 'Big 7' US technology stocks (Microsoft, Apple,

Google, Meta, Amazon, Nvidia and Tesla) compared to the rest of the

market. Although Asia has some beneficiaries of this trend, most notably

in Korea and Taiwan, the region as a whole could be seen as a net loser

from AI as funds flow to more attractive, if less quantifiable, growth

alternatives.

China was the weakest market in the region, although it rallied over

40% in local currency terms following the removal of the Covid restrictions

at the end of October 2022. It has subsequently fallen almost 15% by

the end of August. Although there are clearly headwinds associated

with slower global trade and US sanctions/ geo-political risk, a number

of problems within the China economy are self-imposed. The clampdown

on the property and education sectors, in a valiant attempt to address

wealth inequality, together with regulatory probes on private enterprises

in the technology sector, have sapped confidence. After being locked-down

for almost three years during the pandemic, while their largest asset

(property) decreased in value, the Chinese consumer is reluctant to

spend and, unlike their counterparts in the west, have continued to

save. The Chinese government has begun introducing various measures

to stimulate demand and to shore-up the finances of property developers,

local governments and households. All the while cutting interest rates

and bank reserve requirements to ensure the system is sufficiently

liquid. As yet, there are no meaningful improvements. Having said that,

the industrial production, manufacturing PMI (purchasing managers index)

and industrial profits data in September suggest a mild improvement

while anecdotal evidence of travel expenditure and consumer trends

during the Golden Week holiday at the beginning of October, are somewhat

encouraging.

In local currency terms, the FTSE All-World Asia Pacific ex Japan Index

rose 3.0%. However, with sterling appreciating 10.2% over the period

this translated into a total return performance of -7.2%, impacting

returns for the UK based investor. The best performing market in local

currency terms was Taiwan, where the AI beneficiaries, mostly in the

server and data centre arena, were particularly strong. The weakness

of the Taiwan dollar though resulted in a small negative return in

sterling terms leaving Singapore as the only country in the region

to post a positive return in sterling terms, mainly due to currency

resilience. China and Hong Kong were the worst performing countries,

while basic materials, technology and financials headed the sector

list.

Performance

The Company's NAV total return was -13.0% over the period while the

share price total return was -14.8%, as the share price moved to a

small discount at the financial year-end. For comparison purposes the

FTSE All-World Asia Pacific ex Japan index was -7.2% while the MSCI

Asia Pacific ex Japan High Dividend Yield Index for the same period

was 0.1%.

Without doubt, it has been a disappointing period for the Company's

capital performance. Although the high level of yield has partly impacted

capital returns, a far greater proportion of underperformance can be

attributed to stock selection and country allocation, especially through

the Covid period, but also more recently in calendar year 2023. We

have highlighted below the key areas impacting performance and our

assumptions that prompted this positioning.

At the start of 2023, we expected three events to dictate market performance.

Firstly, we expected China to stage a broad-based recovery from Covid

with the consumer leading the way as excess savings accumulated through

the pandemic would be spent. Secondly, we expected slower global growth,

especially in developed markets, would lead to lower demand for technology

products such as personal computers, laptops and smartphones as consumers

felt the squeeze from higher living costs. As a result, we avoided

Taiwanese contract manufacturers and hence were under-represented relative

to the index and peers when the AI theme took hold. Finally, we believed

that materials and energy, and especially green transition materials,

would be resilient, partly because of a recovery in China and emerging

markets, but more importantly because of a lack of supply and new avenues

of growth, namely electric vehicles and grid upgrades.

The biggest positive contributions over the period were Bank Mandiri

in Indonesia, Lenovo and Samsonite in China and Hong Kong, NTPC in

India and Goodman Group in Australia. Detractors from performance were

predominantly China based consumer discretionary stocks; JD.com (e-commerce)

and Li Ning (sports goods) fell over 50%, while China Yongda (passenger

vehicles) over 40%, China buildings material company CNBM also fell

over 50% while Digital Telecommunications in Thailand fell more than

30%.

Revenue

Dividend income from companies held in the portfolio fell 8.2% and

income from options was flat compared to last year. The fall in revenue

was partly due to the strength of sterling, but also from the lower

levels of distribution from energy and materials companies as the price

of oil and industrial metals declined.

In sterling terms, the level of dividend growth in Asia in recent years

has been below our expectations. The volatility in sterling in recent

years has had a significant impact given that dividend growth in local

currencies has been positive in the last decade with the exception

of 2020. The ability of corporates in the Asia Pacific region to pay

dividends is certainly not in question with record levels of cash held

on balance sheets and one of the lowest net debt to equity ratios globally.

It is the unwillingness of corporates to increase dividends in periods

of elevated global volatility that has contributed to a recent lack

of meaningful growth in dividends. In addition, we had an elevated

contribution from materials and energy holdings last year, amounting

to approximately 31% of our total income. The subsequent weakness in

commodities led to a marked reduction in dividends from this sector.

However, we expect that Asia will return to a growth profile in line

with historical trends and nominal Gross Domestic Product, but in the

meantime the Company intends to utilise distributable reserves to meet

its objective of a progressive dividend policy.

Strategy

The Board has reaffirmed its commitment to the dividend and has made

it clear that utilising distributable reserves is preferable to chasing

yield at the expense of capital growth. This will allow greater exposure

to compelling capital growth opportunities where absolute dividend

per share is growing but the current dividend yield is yet relatively

low. This has also contributed to the lower portfolio turnover this

year relative to the last financial year as genuine structural dividend

growth opportunities were balanced with high sustainable yield names.

Whilst a number of growth opportunities in markets where we have been

underweight in recent years such as India, Indonesia and Taiwan have

already performed well, there are still significant opportunities in

the years ahead. The nascent improvement in Indian and Indonesian macro-economics

has the potential for a long pathway of growth, the resilience of the

Indian rupee and Indonesian rupiah versus the US dollar this year is

a testament to improved sentiment. Indonesia has begun posting a current

account surplus, growth is strong and the country is set to reap the

benefits of significant infrastructure completion. India is seeing

the benefit of earlier reforms such as the Bankruptcy Code, which has

helped to de-risk the banking system speeding up recovery of bad debts.

In addition, corporates are deleveraging, real estate asset prices

are rising and the uptick in private sector capital expenditure alongside

higher government investment, bodes well for the outlook. Investments

in India have already appeared in our top contributors list for the

period despite the current low positioning. We have added to both markets

and observe more opportunities.

At the overall portfolio level, we retain a balance between stable

high yielding companies and those with strong cash flow and dividend

growth. The weakness in share prices and resilient earnings have seen

Asian companies de-rate to valuation levels that are attractive relative

to their own history and to other markets. This applies both to high

yielding and dividend growth companies, allowing for plenty of opportunity

to accumulate propositions at attractive valuations. In previous years

some of the best regional and global themes have been outside the remit

of a value-based investment process due to elevated valuations. Recent

underperformance has made some of these areas much more attractive

and the portfolio now has exposure to Chinese e-commerce, Indian renewable

energy, consumption in Indonesia and China as well as mining companies

that provide the raw materials for the transition to electric vehicles

and clean energy. An example of the opportunities available is Samsonite,

the global luggage brand, which we have just added to the portfolio.

The Hong Kong listed company is experiencing a strong demand recovery

following Covid, but the shares have languished relative to peers with

earnings upgrades outstripping share price performance. As a result,

the stock is trading at 11x forward earnings despite having 20% earnings

growth forecast for the next few years and dividend yield which is

forecast to go from zero to 6% within three years.

At the country level, our highest weighting at the year-end was in

China at 19.7%, the companies we own have exposure to consumption,

insurance, wealth management, electricity grid upgrades, technology

and an improvement in infrastructure spending. We do not have any exposure

to property developers or banks. Our exposure in Australia is predominantly

in mining companies as we have a cautious outlook on the domestic economy.

In India, the power sector is dominated by state owned companies, but

following the push to transition to cleaner energy, opportunities have

arisen for some of these companies to embrace this new area of growth.

We own NTPC and Power Grid which provide exposure to this theme at

a significant valuation discount to the market and bring with them

an attractive dividend yield. We have also added HDFC Bank which provides

us with exposure to domestic credit and mortgage growth at half the

valuations it once traded at following a degree of uncertainty following

a merger with its finance arm.

ESG

Environmental, social and governance ('ESG') concerns are an important

part of our investment approach, but we believe in a pragmatic stance

that looks to engage rather than avoid. We believe that the transition

from where we are to where we want to be is the most important part

of this process. What this means in practice is that we don't exclude

any sector, with the exception of munitions, from our investment universe

but look to invest in companies with an awareness of their environmental

and social impact, as well as an approach to managing them, and work

with them to set and achieve targets for improvement. Our belief is

that these companies will take market share away from the those which

don't commit to change over time, improving the environment and working

conditions for all. As responsible investors, it is our duty to help

this transition rather than to divest and hand that responsibility

to someone else.

We regularly engage with the companies we invest in to ensure that

the targets set are viable and that there is a clear and coherent strategy

on how to achieve them.

Outlook

We are focused on re-establishing the capital performance of the Company

alongside our long- standing income mandate and whilst the headlines

around China, some fair and some unfair, have dominated news flows,

this has masked the strong performance in several of our other markets.

The strength of a number of themes which are unique to our region and

are yet to fully play out, creates an exciting time for investors.

We are witnessing the build-out of green infrastructure, strong consumption

trends, technology supply chains supporting global innovation and financial

inclusion as household wealth increases, amongst others.

Asian markets have, however, struggled over the last five years and

are now at attractive valuations relative to other regions. Record

low interest rates and supportive fiscal policies have encouraged money

flows into alternative risk assets such as housing, private equity,

special purpose acquisition companies and crypto currency, to name

a few, at the expense of Asia and Emerging Markets. The return of inflation

and higher interest rates has called into question some of these investment

destinations and should lead to a focus on fundamentals now that the

cost of capital is well above zero.

There are, though, some headwinds. Higher for longer interest rates

in the US will most likely lead to a stronger US dollar, which historically

has been a challenge for Asia, and the relationship between the US

and China around Taiwan and access to technology continues to have

the potential to escalate. There is also considerable risk in China

with local governments facing significant bond maturities this year

and property volumes still weak. We believe that the Chinese government

still has the monetary and fiscal tools to address these issues, but

it is sure to be a bumpy ride. In light of this, we have reduced the

Company's exposure to China notably since the financial year-end. New

positions have been initiated in high quality dividend growth names

in other markets where the macro-economics are tailwinds rather than

headwinds. We do not anticipate these changes to impact the level of

income the portfolio will generate.

As the developed world slows over the next couple years, the growth

differentials between Asia Pacific and the US, EU and UK will look

increasingly attractive, which we believe will prompt positive flows

to the region and be supportive of equity market returns.

Mike Kerley and Sat Duhra

Fund Managers

29 November 2023

Investment portfolio as at 31 August 2023

Country Value

Ranking Ranking of 2023 % of

2023 2022 Company incorporation Sector GBP'000 portfolio

-------- -------- ------------------------------- --------------- ----------------------- --------- ------------

Taiwan Semiconductor

1 16 Manufacturing(1) Taiwan Technology 14,365 3.73

2 12 Hon Hai Precision Industry Taiwan Technology 14,265 3.70

Macquarie Korea Infrastructure

3 7 Fund South Korea Financials 14,100 3.66

4 26 Samsung Electronics(2) South Korea Technology 13,512 3.51

VinaCapital Vietnam

5 8 Opportunity Fund Vietnam(3) Financials 12,476 3.24

6 - Midea Group China Consumer discretionary 11,231 2.92

7 21 Bank Mandiri Indonesia Financials 11,109 2.88

8 10 Rio Tinto Limited Australia Basic Materials 10,650 2.76

9 1 BHP Group Limited Australia Basic Materials 10,462 2.72

10 - Ping An Insurance China Financials 10,261 2.66

Top Ten Investments 122,431 31.78

-------- -------- ------------------------------- --------------- ----------------------- --------- ------------

11 5 Santos Australia Energy 9,748 2.53

12 4 Macquarie Group Australia Financials 9,706 2.52

13 3 Woodside Energy Australia Energy 9,619 2.50

14 - Goodman Group Australia Real Estate 9,352 2.43

15 18 CITIC Securities China Financials 8,829 2.29

16 - Samsonite International Hong Kong Consumer discretionary 8,815 2.29

17 - Lenovo China Technology 8,182 2.12

18 - Anta Sports China Consumer discretionary 8,111 2.10

19 29 Mapletree Logistics Singapore Real Estate 7,897 2.05

20 22 AIA Group Hong Kong Financials 7,652 1.98

Top Twenty Investments 210,342 54.59

-------- -------- ------------------------------- --------------- ----------------------- --------- ------------

21 14 United Overseas Bank Singapore Financials 7,634 1.99

22 - Nari Technology China Industrials 7,570 1.97

23 - HSBC Hong Kong Financials 7,356 1.91

24 15 Spark New Zealand New Zealand Telecommunications 7,335 1.90

25 - HDFC Bank India Financials 7,329 1.90

26 - Oversea-Chinese Banking Singapore Financials 7,328 1.90

27 17 SK Telekom(1) South Korea Telecommunications 7,159 1.86

28 - Astra International Indonesia Consumer discretionary 7,117 1.85

29 - Sumitomo Metal Mining Japan Basic Materials 7,018 1.82

30 - Pilbara Minerals Australia Basic Materials 6,800 1.76

Top Thirty Investments 282,988 73.45

-------- -------- ------------------------------- --------------- ----------------------- --------- ------------

31 - Oil & Natural Gas India Energy 6,542 1.70

32 35 Sun Hung Kai Properties Hong Kong Real Estate 6,469 1.68

33 2 HKT Trust & HKT Hong Kong Telecommunications 6,260 1.63

34 33 LG Corp South Korea Industrials 6,257 1.62

35 - Swire Properties Hong Kong Real Estate 6,208 1.61

CapitaLand Integrated

36 23 Commercial Trust Singapore Real Estate 6,204 1.61

37 6 JD.com China Consumer discretionary 6,096 1.58

38 11 PT Telkom Indonesia Telecommunications 6,006 1.56

39 - Power Grid India Utilities 5,934 1.54

40 - Alibaba Group China Consumer discretionary 5,792 1.50

Top Forty Investments 344,756 89.48

-------- -------- ------------------------------- --------------- ----------------------- --------- ------------

41 27 MediaTek Taiwan Technology 5,765 1.50

42 - ASE Technology Taiwan Technology 5,509 1.43

Digital Telecommunications

43 9 Infrastructure Fund Thailand Telecommunications 5,140 1.34

44 36 Mega Financial Taiwan Financials 5,127 1.33

45 - NTPC India Utilities 4,904 1.27

China National Building

46 28 Material China Industrials 4,710 1.22

47 39 Guangdong Investment Hong Kong Utilities 4,683 1.21

48 37 Li-Ning China Consumer discretionary 3,593 0.93

49 41 China Yongda Automobiles China Consumer discretionary 2,680 0.70

50 42 China Forestry China Basic Materials - -

Top Fifty Investments 386,867 100.41

-------- -------- ------------------------------- --------------- ----------------------- --------- ------------

Alibaba Group Put 89

51 - (expiry 26/10/23) China Consumer discretionary (48) (0.01)

Pilbara Minerals Put

52 - 4.41 (expiry 07/09/23) Australia Basic Materials (259) (0.07)

CITIC Securities Call

53 - 16.6 (expiry 29/11/23) China Financials (272) (0.07)

Li-Ning Put 39.9 (expiry

54 - 28/09/23) China Consumer discretionary (475) (0.12)

JD.com Put 138 (expiry

55 - 08/11/23) China Consumer discretionary (528) (0.14)

Total Investments 385,285 100.00

-------- -------- ------------------------------- --------------- ----------------------- --------- ------------

1 American Depositary Receipts

2 Preferred Shares

3 Incorporated in Guernsey with 100% exposure to Vietnam

4 Unquoted investment valued at GBPnil

Sector exposure at 31 August 2023

(% of portfolio excluding cash)

2023 2022

% %

------------------------ ------ ------

Financials 28.2 25.8

Technology 16.0 9.7

Consumer Discretionary 13.6 5.9

Real Estate 9.4 8.6

Basic Materials 9.0 15.6

Telecommunications 8.3 19.9

Energy 6.7 9.6

Industrials 4.8 3.7

Utilities 4.0 1.2

------

100% 100.0

Geographic exposure at 31 August

2023

(% of portfolio excluding cash)

2023 2022

% %

------------------ -------- --------

China 19.7 17.1

Australia 17.2 24.3

Hong Kong 12.3 9.4

Taiwan 11.7 9.3

South Korea 10.7 13.4

Singapore 7.5 10.2

India 6.4 1.9

Indonesia 6.3 5.2

Vietnam 3.2 3.2

New Zealand 1.9 2.9

Japan 1.8 -

Thailand 1.3 3.1

-------- --------

100.0

MANAGING RISKS

Principal risks and emerging risks

Investing, by its nature, carries inherent risk. The Board, with the

assistance of the investment manager, carries out a robust assessment

of the principal and emerging risks and uncertainties facing the Company

which could threaten the business model and future performance, solvency

and liquidity of the portfolio. A matrix of these risks, along with

the steps taken to mitigate them, is maintained and kept under regular

review. The mitigating measures include a schedule of investment limits

and restrictions within which the Fund Managers must operate. We do

not believe these principal risks to have changed over the course of

the year.

Alongside the principal risks, the Board considers emerging risks,

which are defined as potential trends, sudden events or changing risks

which are characterised by a high degree of uncertainty in terms of

the probability of them happening and the possible effects on the Company.

Should an emerging risk become sufficiently clear, it may be classified

as a principal risk.

Our assessment includes consideration of the possibility of severe

market disruption and some of the areas which we reviewed over the

course of the year are outlined in the table below. The principal risks

which have been identified and the steps we have taken to mitigate

these are set out below:

* Investment and strategy

An inappropriate investment strategy, for example, in terms of asset

allocation or level of gearing, may result in underperformance against

the companies in the peer group, and in the Company's shares trading

on a wider discount.

Investments in Asian markets may be impacted by political, market and

financial events resulting in changes to the market value of the Company's

portfolio.

We manage these risks by ensuring a diversification of investments

and a regular review of the extent of borrowings. The investment manager

operates in accordance with investment limits and restrictions determined

by the Board, which include limits on the extent to which borrowings

may be employed. We review compliance with limits and monitor performance

at each Board meeting.

The Board receives an update from the Fund Managers on market conditions

in the region at each meeting. During the year, the Board considered

the global economic and geopolitical environment including the repercussions

of the Covid-19 pandemic, the ongoing war in Ukraine and recent conflict

in the Middle East, the impact of this and the pandemic on supply chains,

as well as tensions between China and the US, including over Taiwan.

Consideration was also given to whether climate change could impact

the value of the portfolio, but the Board concluded that this was not

the case at present as the investments continued to be valued based

on quoted market prices.

* Accounting, legal and regulatory

The Company is regulated by the Jersey Financial Services Commission,

under the Collective Investment Funds (Jersey) Law 1998, and is required

to comply with the Companies (Jersey) Law 1991, the Financial Conduct

Authority's Listing Rules, Transparency Guidance and Disclosure Rules

and Prospectus Rules and the Listing Rules of the New Zealand Stock

Exchange. To retain investment trust status, the Company must comply

with the provisions of s.1158 of the Corporation Tax Act 2010. A breach

of company law could result in the Company being subject to criminal

proceedings or financial and reputational damage. A breach of the listing

rules could result in the suspension of the Company's shares. A breach

of s.1158 could result in capital gains realised within the portfolio

being subject to corporation tax.

The investment manager provides investment management, company secretarial,

administration and accounting services through qualified professionals.

We receive quarterly internal control reports from the Manager which

demonstrate compliance with legal and regulatory requirements and assess

the effectiveness of the internal control environment in operation

at the investment manager and our key third-party service providers

at least annually.

* Operational

Disruption to, or the failure of, the investment manager's or the administrator's

accounting, dealing, or payment systems or the custodian's records

could prevent the accurate reporting or monitoring of the Company's

financial position.

The Company may be exposed to cyber risk through vulnerabilities at

one or more of its service providers.

The Board engages reputable third-party service providers and formally

evaluates their performance, and terms of appointment, at least annually.

The Audit Committee assesses the effectiveness of internal controls

in place at the Company's key third-party services providers through

review of their reports on the effectiveness of internal controls,

quarterly internal control, reports from the investment manager and

monthly reporting on compliance with the investment limits and restrictions

established by the Board.

* Financial

The financial risks faced by the Company include market risk (comprising

market price, currency risk and interest rate risk), liquidity risk

and credit risk.

We determine the investment parameters and monitor compliance with

these at each meeting. We review the portfolio liquidity at each meeting

and periodically consider the appropriateness of hedging the portfolio

against currency risk. The Company is denominated in sterling, but

receives dividends in a wide range of currencies from the Asia Pacific

region. The income received is therefore subject to the impact of movements

in exchange rates. The portfolio remains unhedged.

The Board reviews the portfolio valuation at each meeting.

Investment transactions are carried out by a large number of approved

brokers whose credit standard is periodically reviewed and limits are

set on the amount that may be due from any one broker, cash is only

held with the depositary/custodian or reputable banks.

We review the broad structure of the Company's capital including the

need to buy back or allot ordinary shares and the extent to which revenue

in excess of that which is required to be distributed, should be retained.

Further detail on how we mitigate these risks are set out in note 13

in the annual report.

VIABILITY STATEMENT

In keeping with provisions of the Code of Corporate Governance issued

by the Association of Investment Companies (the 'AIC Code'), we have

assessed the prospects of the Company over a period longer than the

12 months required by the going concern provision.

We consider the Company's viability over a five-year period as we believe

this is a reasonable timeframe reflecting the longer-term investment

horizon for the portfolio, but which acknowledges the inherent shorter

term uncertainties in equity markets. As part of the assessment, we

have considered the Company's financial position, as well as its ability

to liquidate the portfolio and meet expenses as they fall due. The

following aspects formed part of our assessment:

-- the Company's purpose and investment approach which means we remain

a medium to long term investor;

* consideration of the principal risks and

uncertainties facing the Company (set out in the

table above) and determined that no significant

issues had been identified;

* the nature of the portfolio which remained diverse

comprising a wide range of stocks which are traded on

major international exchanges meaning that, in normal

market conditions, over 80% of the portfolio can be

liquidated in 2 to 7 days;

-- the closed end nature of the Company which does not need to account

for redemptions;

-- the level of the Company's revenue reserves and size of the banking

facility; and

* the expenses incurred by the Company, which are

predictable and modest in comparison with the assets

and the fact that there are no capital commitments

currently foreseen which would alter that position.

As well as considering the principal risks and financial position of

the Company, the Board has made the following assumptions:

-- an aging population will continue to seek income opportunities through

investing;

-- investors will continue to wish to have exposure to investing in

the Asia Pacific region;

-- investors will continue to invest in closed-end funds;

-- the Company's performance will improve following an in-depth review

of strategy; and

-- the Company will continue to have access to adequate capital when

required.

Based on the results of the viability assessment, we have a reasonable

expectation that the Company will be able to continue its operations

and meet its expenses and liabilities as they fall due for our assessment

period of five years. Forecasting over a longer period is imprecise

given investments are bought and sold regularly. We revisit this assessment

annually and report the outcome to shareholders in the annual report.

RELATED PARTY TRANSACTIONS

The Company's current related parties are its directors and the investment

manager. There have been no material transactions between the Company

and the directors during the year, with the only amounts paid to them

being in respect of remuneration. In relation to the provision of services

by the investment manager, other than fees payable by the Company in

the ordinary course of business and the provision of marketing services,

there have been no material transactions with the investment manager

affecting the financial position of the Company during the year under

review. More details on transactions with the investment manager, including

amounts outstanding at the year end, are given in note 19 in the annual

report.

Directors' responsibility STATEMENTS

Each of the directors in office at the date of this report confirms

that, to the best of their knowledge:

* the Company's financial statements, which have been

prepared in accordance with IFRS as adopted by the

European Union on a going concern basis, give a true

and fair view of the assets, liabilities, financial

position and profit of the Company; and

* the annual report and financial statements include a

fair review of the development and performance of the

business and the position of the Company, together

with a description of the principal risks and

uncertainties that it faces.

For and on behalf of the Board

Ronald Gould

Chairman

29 November 2023

Statement of Comprehensive Income

Year ended 31 August Year ended 31 August 2022

2023

Revenue Capital Revenue Capital

return return Total return return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- --------- ---------- ----------- --------- ---------- -----------

Investment income (note 3) 37,331 - 37,331 40,646 - 40,646

Other income (note 4) 2,937 - 2,937 2,925 - 2,925

Losses on investments held

at fair value through profit

or loss - (87,446) (87,446) - (22,592) (22,592)

Net foreign exchange profit/(loss)

excluding foreign exchange

losses on investments - 318 318 - (4,552) (4,552)

--------- ---------- ----------- --------- ---------- -----------

Total (loss)/income 40,268 (87,128) (46,860) 43,571 (27,144) 16,427

Expenses

Management fees (1,456) (1,456) (2,912) (1,679) (1,679) (3,358)

Other expenses (525) (524) (1,049) (567) (567) (1,134)

--------- ---------- ----------- --------- ---------- ----------

(Loss)/profit before finance

costs and taxation 38,287 (89,108) (50,821) 41,325 (29,390) 11,935

Finance costs (766) (766) (1,532) (200) (200) (400)

--------- ---------- ----------- --------- -------- ---------

(Loss)/profit before taxation 37,521 (89,874) (52,353) 41,125 (29,590) 11,535

Taxation (4,302) 415 (3,887) (4,023) 445 (3,578)

--------- ---------- ----------- --------- --------- ----------

(Loss)/profit for the year

and total comprehensive income 33,219 (89,549) (56,240) 37,102 (29,145) 7,957

====== ====== ====== ====== ====== ======

(Losses)/earnings per ordinary

share - basic and diluted

(note 5) 20.92p (56.35p) (35.43p) 24.41p (19.18p) 5.23p

====== ====== ====== ====== ====== ======

The total column of this statement represents the Statement of Comprehensive

Income, prepared in accordance with IFRS as adopted by the European

Union. The revenue return and capital return columns are supplementary

to this and are prepared under guidance published by the Association

of Investment Companies.

Statement of CHANGES IN EQUITY

Year ended 31 August 2023

Stated

share Distributable Capital Revenue

capital reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ------------- ---------------- ------------- ------------- -------------

Total equity at 31 August

2022 246,997 180,471 (18,558) 26,696 435,576

Total comprehensive income:

(Loss)/profit for the year - - (89,459) 33,219 (56,240)

Transactions with owners,

recorded directly to equity:

Dividends paid - - - (38,345) (38,345)

Shares issued 21,083 - - - 21,083

Share issue costs (42) - - - (42)

------------ ------------ ------------ ------------ ------------

Total equity at 31 August

2023 268,038 180,471 (108,047) 21,570 362,032

======= ======= ======= ======= =======

Year ended 31 August 2022

Stated

share Distributable Capital Revenue

capital reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ------------- ---------------- ------------- ------------- -------------

Total equity at 31 August

2021 235,955 180,471 10,557 25,661 452,644

Total comprehensive income:

(Loss)/profit for the year - - (29,145) 37,102 7,957

Transactions with owners,

recorded directly to equity:

Dividends paid - - - (36,067) (36,067)

Shares issued 11,064 - - - 11,064

Share issue costs (22) - - - (22)

------------ ------------ ------------ ------------ ------------

Total equity at 31 August

2022 246,997 180,471 (18,588) 26,696 435,576

======= ======= ======= ======= =======

BALANCE SHEET

31 August 31 August

2023 2022

GBP'000 GBP'000

----------------------------------------------- ------------ -------------

Non current assets

Investments held at fair value through profit

or loss 386,867 438,527

Current assets

Other receivables 2,587 3,673

Cash and cash equivalents 3,944 14,310

------------ ------------

6,531 17,983

------------ ------------

Total assets 393,398 456,510

------------ ------------

Current liabilities

Investments held at fair value through profit

or loss - written options (1,582) (1,031)

Deferred taxation (149) (155)

Other payables (1,444) (2,542)

Bank loans (28,191) (17,206)

------------ ------------

(31,366) (20,934)

------------ ------------

Net assets 632,032 435,576

======= =======

Equity attributable to equity shareholders

Stated share capital 268,038 246,997

Distributable reserve 180,471 180,471

Retained earnings:

Capital reserves (108,047) (18,588)

Revenue reserves 21,570 26,696

------------ ------------

Total equity 362,032 435,576

======= =======

Net asset value per ordinary share 222.21p 281.11p

======= =======

STATEMENT OF CASH FLOWS

Year ended Year ended

31 August 31 August

2023 2022

GBP'000 GBP'000

----------------------------------------------------- ---------- -----------

Cash flows from operating activities

(Loss)/profit before taxation (52,353) 11,535

Add back finance costs payable 1,532 400

Losses on investments held at fair value through

profit or loss 87,446 22,592

Withholding tax on investment income (3,727) (3,662)

Net foreign exchange (profit)/loss excluding

foreign exchange losses on investments (318) 4,552

Decrease in prepayments and accrued income 839 1,876

Decrease/(increase) in amounts due from brokers 37 (37)

Decrease in other payables (1,064) (435)

---------- ----------

Net cash inflow from operating activities 32,392 36,821

---------- ----------

Cash flows from investing activities:

Sales of investments 348,721 449,586

Purchases of investments (383,956) (447,589)

---------- ----------

Net cash (outflow)/inflow from investing activities (35,235) 1,997

---------- ----------

Cashflow from financing activities

Loan drawdown 211,162 88,078

Loan repayment (199,302) (100,658)

Equity dividends paid (38,345) (36,067)

Share issue proceeds 21,083 11,064

Share issue costs (42) (22)

Interest paid (1,522) (376)

---------- ----------

Net cash outflow from financing activities (6,966) (37,981)

---------- ----------

(Decrease)/increase in cash and cash equivalents (9,809) 837

---------- ----------

Cash and cash equivalents at the start of the

year 14,310 13,693

Exchange movements (557) (228)

---------- ----------

Cash and cash equivalents at the end of the

year 3,944 14,310

====== ======

NOTES TO THE FINANCIAL STATEMENTS

1. General information

The entity is a closed end company, registered as a no par value company

under the Companies (Jersey) Law 1991, with its shares listed on the

London and New Zealand stock exchanges. The Company's registered office

is IFC1, The Esplanade, St Helier, Jersey JE1 4BP and its principal

place of business is 201 Bishopsgate, London EC2M 3AE.

The Company was incorporated on 6 November 2006.

2. Accounting policies

The Company's financial statements for the year ended 31 August 2023

have been prepared in accordance with International Financial Reporting

Standards as adopted by the European Union ('IFRS'). These comprise

standards and interpretations approved by the International Accounting

Standards Board ('IASB'), together with interpretations of the International

Accounting Standards and Standing Interpretations Committee approved

by the International Accounting Standards Committee ('IASC') that remain

in effect, to the extent that IFRS have been adopted by the European

Union.

The financial statements have been prepared on a going concern basis

and on the historical cost basis, except for the revaluation of financial

assets and liabilities designated as held at fair value through profit

and loss.

The financial statements are presented in sterling and all values are

rounded to the nearest thousand pounds (GBP000) except where otherwise

indicated.

3. Investment income

2023 2022

GBP'000 GBP'000

------------------------------------------------------ ------------- ------------

Overseas investment income 37,304 40,570

Stock dividends 27 76

---------- ----------

37,331 40,646

====== ======

Analysis of investment income by geography:

------------------------------------------------------ ------------- ------------

Australia 6,154 7,966

China 10,561 13,571

Hong Kong 2,653 2,899

India 347 972

Indonesia 2,271 547

Japan 181 -

New Zealand 579 907

Singapore 2,583 1,722

South Korea 5,488 3,759

Taiwan 5,351 6,926

Thailand 836 1,016

Vietnam 327 361

---------- ----------

37,331 40,646

====== ======

All of the above income is derived from equity related

investments.

4. Other income

2023 2022

GBP'000 GBP'000

------------------------- --------- ---------

Bank and other interest 68 3

Option premium income 2,869 2,922

-------- --------

2,937 2,952

===== =====

5. Earnings/(losses) per ordinary share

The earnings/(losses) per ordinary share figure is based on the net

loss for the year of GBP56,240,000 (2022: profit GBP7,957,000) and

on the weighted average number of ordinary shares in issue during the

year of 158,745,879 (2022: 152,008,180).

The earnings/(losses) per ordinary share figure can be further analysed

between revenue and capital, as below:

2023 2022

GBP'000 GBP'000

---------------------------------------------------------------- ------------------------ --------------------------

Net Revenue profit attributable to ordinary

shares 33,219 37,102

(89,459) (29,145)

Net Capital loss attributable to ordinary shares ----------- -----------

(Loss)/profit attributable to ordinary shares (56,240) 7,957

====== ======

Weighted average number of ordinary shares in

issue during the year 158,745,879 152,008,180

2022

Pence

---------------------------------------------------------------- ------------------------ --------------------------

Revenue earnings per ordinary share 20.92 24.41

(56.35) (19.17)

Capital losses per ordinary share --------- ---------

Total (loss)/earnings per ordinary share (35.43) 5.23

===== =====

The Company has no securities in issue that could dilute the return

per ordinary share. Therefore the basic and diluted earnings per ordinary

share are the same.

6. Dividends

2023 2022

Dividend Record date Pay date GBP'000 GBP'000

--------------------------------- ----------------- -------------------- ------------------- -------------------

Fourth interim dividend 5.90p 29 October 26 November

for the year ended 2021 2021 2021 - 8,914

First interim dividend 5.90p 28 January 25 February

for the year ended 2022 2022 2022 - 8,931

Second interim dividend 5.90p

for the year ended 2022 29 April 2022 27 May 2022 - 8,943

Third interim dividend 6.00p

for the year ended 2022 29 July 2022 26 August 2022 - 9,279

Fourth interim dividend 6.00p 28 October 25 November 9,319 -

for the year ended 2022 2022 2022

First interim dividend 6.00p 27 January 24 February 9,461 -

for the year ended 2023 2023 2023

Second interim dividend 6.00p 28 April 2023 26 May 2023 9,650 -

for the year ended 2023

Third interim dividend 6.10p 28 July 2023 25 August 2023 9,915 -

for the year ended 2023 ---------- ----------

38,345 36,067

====== ======

The fourth interim dividend for the year ended 31 August 2023 has not

been included as a liability in these financial statements as it was

announced and paid after the year end. The table which follows sets

out the total dividends paid and to be paid in respect of the financial

year and the previous year. The revenue available for distribution

by way of dividend for the year is GBP33,219,000 (2022: GBP37,102,000).

The total dividends payable in respect of the financial year which

form the basis of s.1158 of the Corporation Tax Act 2010 are set out

below:

2023 2022

GBP'000 GBP'000

------------------------------------------------------------------------------------ ---------------- --------------

Revenue available for distribution by way of dividend

for the year 33,219 37,102

First interim dividend of 6.00p (2022: 5.90p) paid 24

February 2023 (25 February 2022) (9,461) (8,931)

Second interim dividend of 6.00p (2022: 5.90p) paid 26

May 2023 (27 May 2022) (9,650) (8,943)

Third interim dividend of 6.10p (2022: 6.00p) paid 25

August 2023 (26 August 2022) (9,915) (9,279)

Fourth interim dividend for the year ended 31 August

2023 of 6.10p (2022: 6.00p) (based on 162,988,564 shares (9,942) (9,319)

in issue at 24 November 2023) (2022: 155,323,564) ---------- ----------

(Transfer from reserves)/undistributed revenue for s.1158 (5,749) 630

purposes ====== ======

7. Net asset value per share

The basic net asset value per ordinary share and the net asset value

attributable to ordinary shareholders at the year-end calculated in

accordance with the articles of association were as follows:

2023 2022

Net asset Net asset Net asset Net asset

value per value attributable value per value attributable

share GBP'000 share GBP'000

pence pence

------------------------ ----------- -------------------- -------------- ----------------------------

Ordinary shares 222.12p 362,032 281.11p 435,576

======= ====== ====== ======

The basic net asset value per ordinary share is based on 162,988,564

(2022: 154,948,564) ordinary shares, being the number of ordinary shares

in issue. This is considered to be an Alternative Performance Measure,

please see the annual report for further details.

The movements during the year in net assets attributable to the ordinary

shares were as follows:

2023 2022

GBP'000 GBP'000

----------------------------------------------------------------------- ---------------- --------------

Net assets attributable to ordinary shares at beginning

of year 435,576 452,644

Total net (loss)/profit after taxation (56,240) 7,957

Dividends paid (38,345) (36,067)

21,041 11,042

Issue of ordinary shares net of issue costs ------------ ------------

632,032 435,576

======= =======

8. Stated share capital

2023 2022

Issued Issued and

Authorised and fully GBP'000 fully paid GBP'000

paid

------------------------- -------------- ----------------- ----------- ---------------- ------------

Opening balance at 1

September

Ordinary shares of no

par value Unlimited 154,948,564 246,997 151,093,564 235,955

Issued during the year 8,040,000 21,083 3,855,000 11,064

Share issue costs - (42) - (22)

---------------- ----------- ---------------- ------------

Closing balance at 31 162,988,564 268,038 154,948,564 246,997

August ========= ====== ========= =======

The holders of ordinary shares are entitled to all the capital growth

in the Company and all the income from the Company that is resolved

by the directors to be distributed. Each shareholder present at a general

meeting has one vote on a show of hands and on a poll every member

present in person or by proxy has one vote for each share held. The

Company has no significant or controlling shareholders.

During the year, the Company issued 8,040,000 (2022: 3,855,000) shares

for proceeds of GBP21,041,000 (2022: GBP11,042,000) net of costs.

9. Subsequent events

On 17 October 2023, the Company announced an interim dividend of 6.10p

per ordinary share in respect of the year ended 31 August 2023. The

dividend will be paid on 24 November 2023 to shareholders on the register

at 27 October 2023. The shares will be quoted ex-dividend on 26 October

2023.

10. Going concern statement

Notwithstanding the net current liability position at 31 August 2023,

the directors have determined that it is appropriate to prepare the

financial statements on a going concern basis and have concluded that

the Company has adequate resources to continue in operational existence

for at least twelve months from the date of approval of the financial

statements.

In coming to this conclusion, the directors have considered the nature

of the portfolio, which consists almost entirely of securities which

are listed and regularly traded on recognised exchanges, the size of

the Company's bank facility and the strength of its distributable reserves.

The directors have reviewed cash flow forecasting, covenant compliance

for the loan facility, the ability to make repayments on this facility

and the liquidity of the portfolio. They have further considered the

global economic and geopolitical environment including the repercussions

of the Covid-19 pandemic, ongoing tensions between China and the US,

as well as the war in Ukraine and recent conflict in the Middle East,

the impact of these on supply chains and the possible impact of climate

change risk on the value of the portfolio.

11. Financial information for 2023

The figures and financial information for the year ended 31 August

2023 are compiled from an extract of the latest financial statements

and do not constitute statutory accounts. These financial statements

included the report of the auditors which was unqualified.

12. Financial information for 2022

The figures and financial information for the year ended 31 August

2022 are compiled from an extract of the published accounts and do

not constitute the statutory accounts for that year.

13. Annual Report 2023

The annual report and financial statements will be posted to shareholders

in December 2023 and copies will be available on the Company's website

at: www.hendersonfareastincome.com.

14. Annual General Meeting

The 17th Annual General Meeting will be held at the offices of Janus

Henderson Investors at 201 Bishopsgate, London EC2M 3AE at 12.00 pm

on 24 January 2024. The Notice of the Meeting will be sent to shareholders

with the Annual Report 2023.

15. General Information

Company Status

The Company was incorporated in Jersey in 2006, number 95064, and is

a closed-end investment company. The Company is regulated by the Jersey

Financial Services Commission under the Collective Investment Funds

(Jersey) Law 1998. It is listed on the London and New Zealand stock

exchanges and became UK tax resident with effect from 1 September 2018.

SEDOL/ISIN: B1GXH75/JE00B1GXH751

London Stock Exchange (TIDM) code: HFEL

New Zealand Stock Exchange code: HFL

Global Intermediary Identification Number (GIIN): NTTIYP.99999.SL.832

Legal Entity Identifier (LEI): 2138008 DIQRE00380596

Directors and Secretary

The directors of the Company are Ronald Gould (Chairman), Nicholas

George (Chairman of the Audit Committee), Julia Chapman, Timothy Clissold

and David Mashiter. With effect from 1 December 2023, Susie Rippingall

and Carole Ferguson will be appointed as directors. The Corporate Secretary

is Janus Henderson Secretarial Services UK Limited. The registered

office is IFC1, The Esplanade, St Helier, Jersey, JF1 4BP. The Company's

principal place of business is 201 Bishopsgate, London, EC2M 3AE.

Website

Details of the Company's share price and net asset value, together

with general information about the Company, monthly factsheets and

data, copies of announcements, reports and details of general meetings

can be found at www.hendersonfareastincome.com

For further information please contact:

Sat Duhra Mike Kerley

Fund Manager Fund Manager

Henderson Far East Income Limited Henderson Far East Income Limited

Telephone: +658 388 3175 Telephone: 020 7818 5053

Dan Howe Harriet Hall

Head of Investment Trusts PR Manager

Janus Henderson Investors Janus Henderson Investors

Telephone: 020 7818 4458 Telephone: 020 7818 2919

Neither the contents of the Company's website nor the contents of

any website accessible from hyperlinks on the Company's website (or

any other website) is incorporated into, or forms part of, this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FEDFWUEDSEDF

(END) Dow Jones Newswires

November 30, 2023 02:00 ET (07:00 GMT)

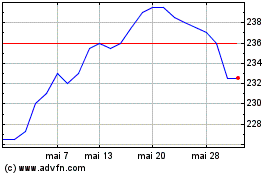

Henderson Far East Income (LSE:HFEL)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Henderson Far East Income (LSE:HFEL)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024