When an operation is classified as a discontinued operation, the

comparative income statement is represented as if the operation had

been discontinued from the start of the comparative period.

Government grants

Capital-based government grants are included within other

financial liabilities in the balance sheet and credited to

operating profit over the estimated useful economic lives of the

assets to which they relate.

Expenses

Operating lease payments

Payments made under operating leases are recognised in the

income statement on a straight-line basis over the term of the

lease. Lease incentives received are recognised in the income

statement as an integral part of the total lease expense.

Finance lease payments

Minimum lease payments are apportioned between the finance

charge and the reduction of the outstanding liability. The finance

charge is allocated to each period during the lease term so as to

produce a constant periodic rate of interest on the remaining

balance of the liability.

Finance income and expenses

Finance expenses comprise interest payable, finance charges on

finance leases and unwinding of the discount on provisions and

deferred consideration. Finance income comprises interest

receivable on funds invested and dividend income.

Net movements in the fair value of derivatives are also included

within finance income or expense.

Interest income and interest payable is recognised in profit or

loss as it accrues, using the effective interest method. Dividend

income is recognised in the income statement on the date the

entity's right to receive payments is established. Foreign currency

gains and losses are reported on a net basis.

Taxation

Tax on the profit or loss for the year comprises current and

deferred tax. Tax is recognised in the income statement except to

the extent that it relates to items recognised in other

comprehensive income or directly in equity, in which case it is

recognised in other comprehensive income or equity

respectively.

Current tax is the expected tax payable on the taxable income

for the year, using tax rates enacted or substantively enacted at

the balance sheet date and any adjustment to tax payable in respect

of previous years.

Deferred tax is provided on temporary differences between the

carrying amounts of assets and liabilities for financial reporting

purposes and the amounts used for taxation purposes. The following

temporary differences are not provided for: the initial recognition

of goodwill; the initial recognition of assets or liabilities that

affect neither accounting nor taxable profit other than in a

business combination; and differences relating to investments in

subsidiaries to the extent that they will probably not reverse in

the foreseeable future. The amount of deferred tax provided is

based on the expected manner of realisation or settlement of the

carrying amount of assets and liabilities, using tax rates enacted

or substantively enacted at the balance sheet date.

A deferred tax asset is recognised only to the extent that it is

probable that future taxable profits will be available against

which the asset can be utilised.

Dividend distribution

Final dividends to shareholders of International Greetings plc

are recognised as a liability in the period that they are approved

by shareholders.

Employee benefits

Pensions

The Group operates a defined contribution personal pension

scheme. The assets of this scheme are held separately from those of

the Group in an independently administered fund. The pension charge

represents contributions payable by the Group to the fund.

The Netherlands subsidiary operates an industrial defined

benefit fund, based on average wages, that has an agreed maximum

contribution. The pension fund is a multi-employer fund and there

is no contractual or constructive obligation for charging the net

defined benefit cost of the plan to participating entities other

than an agreed maximum contribution for the period, that is shared

between employer (4/7) and employees (3/7). The Dutch Government is

not planning to make employers fund any deficits in industrial

pension funds; accordingly the Group treats the scheme as a defined

contribution scheme for disclosure purposes. The Group recognises a

cost equal to its contributions payable for the period.

Share-based payment transactions

The cost of equity-settled transactions with employees is

measured by reference to the fair value at the date on which they

are granted and is recognised as an expense over the vesting

period, which ends on the date on which the relevant employees

become fully entitled to the award. Fair value is determined by

using an appropriate pricing model. In valuing equity-settled

transactions, no account is taken of any service and performance

(vesting conditions), other than performance conditions linked to

the price of the shares of the Company (market conditions). Any

other conditions which are required to be met in order for an

employee to become fully entitled to an award are considered to be

non-vesting conditions. Like market performance conditions,

non-vesting conditions are taken into account in determining the

grant date fair value.

No expense is recognised for awards that do not ultimately vest,

except for awards where vesting is conditional upon a market

vesting condition or a non-vesting condition, which are treated as

vesting irrespective of whether or not the market vesting condition

or non-vesting condition is satisfied, provided that all other

non-market vesting conditions are satisfied.

At each balance sheet date before vesting, the cumulative

expense is calculated, representing the extent to which the vesting

period has expired and management's best estimate of the

achievement or otherwise of non-market vesting conditions and of

the number of equity instruments that will ultimately vest or, in

the case of an instrument subject to a market condition or a

non-vesting condition, be treated as vesting as described above.

The movement in cumulative expense since the previous balance sheet

date is recognised in the income statement, with a corresponding

entry in equity.

Borrowing costs

Borrowing costs directly attributable to the acquisition,

construction or production of an asset that necessarily takes a

substantial period of time to get ready for its intended use or

sale are capitalised as part of the cost of the respective assets.

All other borrowing costs are expensed in the period they occur.

Borrowing costs consist of interest and other costs that an entity

incurs in connection with the borrowing of funds.

New standards adopted early

The Group has elected to adopt early the amendments to IAS 36

Recoverable Amounts Disclosure for Non-Financial Assets.

New standards and interpretations not applied

Management continually reviews the impact of newly published

standards and amendments and considers, where applicable,

disclosure of their impact on the Group.

The following standards, interpretations and amendments issued

by the IASB have an effective date after the date of these

financial statements:

To be

Effective adopted by

New pronouncement date the Group

----------------------------------------------------------------------------------- ---------- ----------

IFRS 10 Consolidated Financial Statements 1 Jan 2014 1 Apr 2014

IFRS 11 Joint Arrangements 1 Jan 2014 1 Apr 2014

IFRS 12 Disclosure of Interests in Other Entities 1 Jan 2014 1 Apr 2014

IFRS 10, IFRS 12 and IAS 27 Investment Entities (Amendments) 1 Jan 2014 1 Apr 2014

IAS 32 Offsetting Financial Assets and Financial Liabilities - Amendments to IAS 32 1 Jan 2014 1 Apr 2014

IAS 39 Novation of Derivatives and Continuation of Hedge Accounting

- Amendments to IAS 39 1 Jan 2014 1 Apr 2014

IFRIC 21 Levies* 1 Jan 2014 1 Apr 2014

IAS 19 Defined Benefits Plans - Employee Contributions - Amendments to IAS 19* 1 Jan 2014 1 Apr 2014

Annual Improvements 2010-2012 Cycle* 1 Jul 2014 1 Apr 2015

Annual Improvements 2011-2013 Cycle* 1 Jul 2014 1 Apr 2015

IFRS 14 Regulatory Deferral Accounts* 1 Jan 2016 1 Apr 2016

Amendments to IAS 16 and IAS 38: Clarification of acceptable methods

of depreciation and amortisation* 1 Jan 2016 1 Apr 2016

Amendments to IFRS 11 Accounting for Acquisitions of Interest in Joint Operations* 1 Jan 2016 1 Apr 2016

IFRS 15 Revenue from Contracts with Customers* 1 Jan 2017 1 Apr 2017

IFRS 9 Financial Instruments* 1 Jan 2018 1 Apr 2018

----------------------------------------------------------------------------------- ---------- ----------

* Not yet endorsed by EFRAG.

IFRS 9 does not yet have a mandatory effective date. The IASB

have tentatively agreed an effective date of 1 January 2018.

None of the above standards are anticipated to significantly

impact the Group's results or assets and liabilities and are not

expected to require significant disclosure.

The new standards, interpretations and amendments which are

considered most relevant to the Group are as follows:

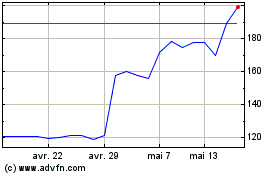

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024