TIDMJEGI

RNS Number : 1158V

JPMorgan European Grwth & Inc PLC

29 November 2023

LONDON STOCK EXCHANGE ANNOUNCEMENT

JPMORGAN EUROPEAN GROWTH & INCOME PLC

UNAUDITED HALF YEAR RESULTS FOR THE SIX MONTHSED

30TH SEPTEMBER 2023

Legal Entity Identifier: 549300D8SPJFHBDGXS57

Information disclosed in accordance with DTR 4.1.

CHAIR'S STATEMENT

Introduction

In this six month reporting period to the 30th September 2023 it

is pleasing to report that the Company continued to outperform its

benchmark. In what has been an uncertain period, the Board believes

the robust proposition of the Company allows the Investment

Managers the freedom to navigate European markets, whilst

delivering to our shareholders the best of capital growth combined

with a consistent income.

During this reporting period, very sadly the devastating

conflict in Ukraine rages on and as I write this, we witness the

terrible events in Israel and Palestine. It seems resolution and

peace are a long way off. Surprisingly global stock markets have

mostly taken these latest events in their stride. However other

factors are taking their toll on the growth of the European

economies. There has been a period of interest rate hikes by the

central banks of the main Western economies including the European

Central Bank (ECB) to bring inflation under control. Germany, the

region's largest economy, has been particularly affected. Tensions

with China persisted and the failure of Credit Suisse added to an

increasingly fragile geopolitical situation and negative economic

pressures.

Performance

Return on net assets (NAV) and return to shareholders

The Company's net assets outperformed its benchmark by 1.8% in

the period under review (debt at fair value). Despite the

favourable performance, the Company's net assets recorded a

negative return for the period, unable to completely offset the

broad decline of the benchmark.

The total return on net assets was -0.2% (debt at fair value).

As stated, both of these returns compare well with the benchmark

which recorded a total return in sterling terms of -2.0%. Strong

relative stock selection was the main reason for this. In their

Report on page 11 of the Company's half year report and financial

statements , the Investment Managers review in more detail some of

the factors underlying the performance of the Company as well as

commenting on the economic and market background over the period in

question.

For an explanation of the calculation of the Company's NAV,

please see the Glossary of Terms and Alternative Performance

Measures on page 27 of the Company's half year report and financial

statements .

The total return to shareholders, which takes into account the

movement of the share price over the period, outperformed the

benchmark though by a smaller margin delivering a return of

-1.2%.

The Company's restructuring in February 2022 has resulted in

some of the performance and dividend data for periods prior to this

reporting period being calculated on a transitional basis as

detailed in various footnotes throughout this report.

Dividends

One of the aims of the Company is to provide shareholders with a

predictable dividend income at a level that is consistent and

frequent. This has been set at 4% of the preceding year NAV payable

in July, October, January and March.

In line with the above aim, in respect of the year ending 31st

March 2024, the Company has paid the first interim dividend of 1.05

pence per Ordinary share and declared the second interim dividend

of 1.05 pence per Ordinary share. Between the end of this six month

reporting period and the release of this report, the Company's

Board declared a third interim dividend of 1.05 pence per Ordinary

share. The Board is expecting to declare the fourth interim

dividend in February 2024. As in 2023, brought forward revenue

reserves will be utilised to partially cover the dividend for the

financial year ending 31st March 2024.

Although not expected to be required in the financial year

ending 31st March 2024, the Company's Articles also permit the

Company's dividends to be paid from distributable capital

reserves.

Gearing

There has been no change in the Investment Manager's permitted

gearing range, as previously set by the Board, of between 10% net

cash to 20% geared. At 30th September 2023 the Company was modestly

geared at 3.3% (31st March 2023: 3.1%).

Discounts, Share Issuance and Repurchase

During the period under review, the average discount across the

Investment Trust sector has remained elevated. Particular signs of

stress are evident in those Trusts with significant unquoted assets

due to illiquidity concerns as investors deliberate their level of

confidence in underlying Net Asset Values. Despite the liquidity

and transparency of the markets in which your Company invests, its

sector and the Company itself have been tarred with this

nervousness. The Board remain vigilant and active, addressing

imbalances in the supply of and demand for the Company's shares

through a buy-back of shares. The Board does not wish to see the

discount widen beyond 10% under normal market conditions (using the

cum-income NAV with debt at fair) on an ongoing basis. The precise

level and timing of repurchases is dependent on a range of factors

including prevailing market conditions. In the period under review,

3,468,338 Ordinary shares were bought into Treasury. From 1st

October 2023 to 27th November 2023, 1,200,059 Ordinary shares were

bought into Treasury. No Ordinary shares were issued.

The Company's Ordinary share discount as at 30th September 2023

was 11.8% to NAV with debt at fair value. The average discount of a

peer group of six companies as at the same date was 10.1%. On 27th

November, 2023, the Company's Ordinary share discount was 10.2%,

which compares to an average discount of the same peer group of

10.0% as at the same date, though hides variation in strategy and

performance across the sector.

Board of Directors

In line with the Company's Board Succession Plan, Jutta af

Rosenborg will be retiring as Director and Audit Committee Chair on

reaching her nine-year tenure next year. An independent search

agency has been engaged to undertake a search for a suitable

replacement Director and Audit Chair, with the aim of appointment

in early 2024.

AIC Investment Week Award 2023

I am delighted that the Company was voted the best investment

company in the European sector at the annual AIC Investment Week

Award ceremony held on 16th November 2023. The judges commended the

Company's performance and the benefits provided by its simplified

and shareholder focused structure.

Outlook

The already fragile geopolitical outlook was further weakened in

October 2023 by the vicious escalation of hostilities between

Israel and Palestine. The economic impact that this latest tragedy

will have on European equity markets is uncertain but has the

potential to develop into a wider regional conflict which could

further exacerbate already elevated energy prices. The recent run

of increases in interest rates by the major economies central

banks, including the ECB, seems to have ended as the desired

reduction in inflation rates has so far been achieved. Whether the

current rates of interest will precipitate a global recession

remains to be seen.

Despite these challenges the Board has confidence the Company's

Investment Managers remain dedicated to their strategy and have the

agility to navigate these tricky times. Our optimism for European

equities over the long term remains undimmed.

Rita Dhut

Chair 29th November 2023

INVESTMENT MANAGERS' REPORT

Market Background

Following a strong finish to the Company's last financial year

our benchmark index fell 2.0% in the six months to the end of

September. It is clear that, as expected, inflation has peaked as

lower energy prices and the easing of supply chain issues helped.

By September the rate of consumer price increases in the Eurozone

had slowed to 4.3%.

By the end of the half year under review the European Central

Bank (ECB) had hiked interest rates for the tenth consecutive time

in its efforts to control inflation. While it has now indicated

that it may pause it also reiterated that it expects to keep rates

high for some time. Bank lending to households in the eurozone rose

by 1.3% year-on-year, the lowest growth rate since November 2015,

as the deceleration in credit demand persisted due to the

unprecedented policy tightening enforced by the ECB over the past

months.

Despite a growing belief that a recession in Europe had been

avoided, or at least pushed out into 2024 economic growth has

started to weaken. For example, the Eurozone Composite Purchasing

Managers' Index (PMI) fell to 47.2 in September, suggesting

economic contraction across the bloc's private sector economy.

While manufacturing has been weak for some time the decline in the

services side of the economy is a newer problem. Although the

employment backdrop remains robust consumer confidence has started

to decline again.

Portfolio Performance

The Company outperformed its benchmark index by 1.8% based on

NAV with debt valued at fair value, in the first half of its

financial year. Within pharmaceuticals Novo Nordisk was again a top

contributor to performance as its anti-obesity drugs continued to

exceed expectations. Various clinical trials have shown a positive

impact from its anti-obesity products on other conditions such as

major adverse cardiovascular events and chronic kidney disease in

diabetes patients. It has now raised earnings guidance three times

this year. The portfolio has also been overweight in the bank

sector with companies such as UniCredit in Italy contributing

positively to performance. As interest rates have risen net

interest margins have expanded leading to frequent earnings

upgrades. Despite this, valuations have remained modest and with

well capitalised balance sheets UniCredit, and others in the

sector, have been able to return money to shareholders by raising

dividends and buying back equity.

During the six months under review we increased the weighting to

the Materials sector by adding to our position in Air Liquide which

is the number two player in industrial and healthcare gases. The

top three companies control 70% of the market giving them a

quasi-oligopoly with rational pricing and often long term take or

pay contracts. The backlog is strong, and the growth rate is

accelerating. At a sector level the biggest reduction was in

Consumer Durables where we reduced overweight positions in LVMH and

Richemont. Both companies have seen earnings estimates stall with

concerns about Chinese growth resurfacing and both companies,

particularly LVMH, were on high valuations when bond yields were

continuing to rise.

By the end of the half year the Company's top three overweight

sectors were Banks, Energy and Semi-Conductors and the bottom three

underweights were Healthcare Equipment, Financial Services and

Food, Beverage and Tobacco. Overall, the portfolio remains cheaper

than the benchmark, with better quality and momentum

characteristics.

Outlook

Recent statements from both the ECB and the Federal Reserve have

given markets the hope that the monetary tightening phase is

drawing to an end, although it is too soon to expect interest rates

to be lowered again. It is likely that the economic data will be

somewhat contradictory for some time which may lead to further

volatility in both bond and equity markets. At some stage markets

will start to worry that Central Banks have tightened too much, and

recession fears will rise. As mentioned above there are signs that

both the manufacturing and services side of European economies are

slowing. However, we continue to find exciting investment

opportunities across a range of sectors. When yields, and

especially real yields, have peaked that will provide support for

valuations particularly of longer duration assets.

Alexander Fitzalan Howard

Zenah Shuhaiber

Tim Lewis

Investment Managers 29th November 2023

INTERIM MANAGEMENT REPORT

The Company is required to make the following disclosures in its

half year report:

Principal Risks and Uncertainties

The Principal Risks and uncertainties faced by the Company fall

into the following broad categories: investment; operational;

regulatory; discount/premium to NAV; strategy; pandemic risk;

climate change; geopolitical and economic concerns; artificial

intelligence ('AI'). Information on each of these areas is given in

the Business Review within the Annual Report and Accounts for the

year ended 31st March 2023.

Related Parties Transactions

During the first six months of the current financial year, no

transactions with related parties have taken place which have

materially affected the financial position or the performance of

the Company.

Going Concern

The Directors believe, having considered the Company's

investment objectives, future cash flow projections, risk

management policies, liquidity risk, principal and emerging risks,

capital management policies and procedures, nature of the portfolio

and expenditure projections and the economic and operational impact

of Russia's invasion of Ukraine other conflicts and geopolitical

tensions and Covid-19 that the Company has adequate resources, an

appropriate financial structure and suitable management

arrangements in place to continue in operational existence for the

foreseeable future and, more specifically, that there are no

material uncertainties relating to the Company that would prevent

its ability to continue in such operation existence for at least 12

months from the date of the approval of this half yearly financial

report. For these reasons, they consider there is reasonable

evidence to continue to adopt the going concern basis in preparing

the accounts.

Directors' Responsibilities

The Board of Directors confirms that, to the best of its

knowledge:

(i) the condensed set of financial statements contained within

the half yearly financial report has been prepared in accordance

with FRS 104 'Interim Financial Reporting' and gives a true and

fair view of the state of affairs of the Company and of the assets,

liabilities, financial position and net return of the Company, as

required by the UK Listing Authority Disclosure and Transparency

Rules 4.2.4R; and

(ii) the interim management report includes a fair review of the

information required by 4.2.7R and 4.2.8R of the UK Listing

Authority Disclosure and Transparency Rules.

In order to provide these confirmations, and in preparing these

financial statements, the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether applicable UK Accounting Standards have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business;

and the Directors confirm that they have done so.

For and on behalf of the Board

Rita Dhut

Chair 29th November 2023

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30th September 2023

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

30th September 30th September 2022 31st March 2023

2023

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- --------- ---------- -------- ---------- ---------- -------- -------- ---------

(Losses)/gains on

investments

and derivatives

held

at fair

value through

profit

or loss - (12,354) (12,354) - (47,326) (47,326) - 32,295 32,295

Foreign exchange

(losses)/gains on

liquidity

fund - (82) (82) - 877 877 - 1,141 1,141

Net foreign

currency

gains/(losses) - 334 334 - (2,268) (2,268) - (2,795) (2,795)

Income from

investments 12,026 - 12,026 10,942 - 10,942 15,138 - 15,138

Interest

receivable

and similar

income 128 - 128 34 - 34 48 - 48

------------------- --------- --------- ---------- -------- ---------- ---------- -------- -------- ---------

Gross

return/(loss) 12,154 (12,102) 52 10,976 (48,717) (37,741) 15,186 30,641 45,827

Management fee (356) (832) (1,188) (332) (775) (1,107) (668) (1,560) (2,228)

Other

administrative

expenses (276) - (276) (239) - (239) (557) - (557)

------------------- --------- --------- ---------- -------- ---------- ---------- -------- -------- ---------

Net return/(loss)

before finance

costs and taxation 11,522 (12,934) (1,412) 10,405 (49,492) (39,087) 13,961 29,081 43,042

Finance costs (172) (402) (574) (178) (416) (594) (359) (837) (1,196)

------------------- --------- --------- ---------- -------- ---------- ---------- -------- -------- ---------

Net return/(loss)

before taxation 11,350 (13,336) (1,986) 10,227 (49,908) (39,681) 13,602 28,244 41,846

Taxation (1,048) - (1,048) (1,127) - (1,127) (1,248) - (1,248)

------------------- --------- --------- ---------- -------- ---------- ---------- -------- -------- ---------

Net return/(loss)

after taxation 10,302 (13,336) (3,034) 9,100 (49,908) (40,808) 12,354 28,244 40,598

------------------- --------- --------- ---------- -------- ---------- ---------- -------- -------- ---------

Return/(loss) per

share: (note 3) 2.38p (3.08)p (0.70)p 2.08p (11.43)p (9.35)p 2.83p 6.48p 9.31p

------------------- --------- --------- ---------- -------- ---------- ---------- -------- -------- ---------

All revenue and capital items in the above statement derive from

continuing operations.

The 'Total' column of this statement is the profit and loss

account of the Company and the 'Revenue' and 'Capital' columns

represent supplementary information prepared under guidance issued

by the Association of Investment Companies. Net return/(loss) after

taxation represents the profit/(loss) for the period/year and also

the total comprehensive income

CONDENSED STATEMENT OF CHANGES IN EQUITY

Called Capital

up

share Share redemption Capital Revenue

capital premium reserve reserves(1) reserve(1) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- --------- -------- ----------- ------------ ----------- ----------

Six months ended 30th September

2023 (Unaudited)

At 31st March 2023 2,185 131,163 18,273 299,679 3,946 455,246

Repurchase of shares into

Treasury - - - (3,228) - (3,228)

Net (loss)/return - - - (13,336) 10,302 (3,034)

Dividend paid in the period

(note 4) - - - - (4,556) (4,556)

--------------------------------- --------- -------- ----------- ------------ ----------- ----------

At 30th September 2023 2,185 131,163 18,273 283,115 9,692 444,428

--------------------------------- --------- -------- ----------- ------------ ----------- ----------

Six months ended 30th September

2022 (Unaudited)

At 31st March 2022 4,605 131,163 15,853 273,876 13,837 439,334

Repurchase and cancellation

of the Company's

own shares (2) - 2 (258) - (258)

Repurchase of shares into

Treasury - - - (940) - (940)

Net return - - - (49,908) 9,100 (40,808)

Dividends paid in the period

(note 4) - - - - (9,181) (9,181)

--------------------------------- --------- -------- ----------- ------------ ----------- ----------

At 30th September 2022 4,603 131,163 15,855 222,770 13,756 388,147

--------------------------------- --------- -------- ----------- ------------ ----------- ----------

Year ended 31st March 2022

(Audited)

At 31st March 2022 4,605 131,163 15,853 273,876 13,837 439,334

Reclassification of shares

cancelled in respect of

the restructure in the prior

year (2,418) - 2,418 - - -

Repurchase and cancellation

of the Company's

own shares (2) - 2 (258) - (258)

Repurchase of shares into

Treasury - - - (2,183) - (2,183)

Net return - - - 28,244 12,354 40,598

Dividends paid in the year

(note 4) - - - - (22,245) (22,245)

--------------------------------- --------- -------- ----------- ------------ ----------- ----------

At 31st March 2023 2,185 131,163 18,273 299,679 3,946 455,246

--------------------------------- --------- -------- ----------- ------------ ----------- ----------

(1) These reserves form the distributable reserve of the Company

and may be used to fund distribution of profits to investors.

CONDENSED STATEMENT OF FINANCIAL POSITION

At 30th September 2023

(Unaudited) (Unaudited) (Audited)

30th September 30th September 31st March

2023 2022 2023

GBP'000 GBP'000 GBP'000

---------------------------------------- --------------- --------------- -----------

Fixed assets

Investments held at fair value through

profit or loss 459,127 400,475 469,173

---------------------------------------- --------------- --------------- -----------

Current assets

Derivative financial assets 216 292 12

Debtors 4,807 3,813 4,782

Cash and cash equivalents 23,980 28,881 25,523

---------------------------------------- --------------- --------------- -----------

29,003 32,986 30,317

Current liabilities

Creditors: amounts falling due within

one year (473) (1,576) (364)

Derivative financial liabilities (5) (20) (101)

---------------------------------------- --------------- --------------- -----------

Net current assets 28,525 31,390 29,852

Total assets less current liabilities 487,652 431,865 499,025

Creditors: amounts falling due after

more than one year (43,224) (43,718) (43,779)

---------------------------------------- --------------- --------------- -----------

Net assets 444,428 388,147 455,246

---------------------------------------- --------------- --------------- -----------

Capital and reserves

Called up share capital 2,185 4,603 2,185

Share premium 131,163 131,163 131,163

Capital redemption reserve 18,273 15,855 18,273

Capital reserves 283,115 222,770 299,679

Revenue reserve 9,692 13,756 3,946

---------------------------------------- --------------- --------------- -----------

Total shareholders' funds 444,428 388,147 455,246

---------------------------------------- --------------- --------------- -----------

Net asset value per share (note 5) 103.1p 89.1p 104.8p

CONDENSED STATEMENT OF CASH FLOWS

For the six months ended 30th September 2023

(Unaudited) (Unaudited) (Audited)

Six months Six months Year ended

ended ended

30th September 30th September 31st March

2023 20221 2023

GBP'000 GBP'000 GBP'000

(1)

-------------------------------------------- --------------- --------------- -----------

Cash flows from operating activities

Total (loss)/return on ordinary activities (1,412) (39,087) 43,042

Adjustment for:

Net (losses)/gains on investments

held at fair value through

profit or loss 12,354 47,326 (32,295)

Foreign exchange (losses)/gains on

Liquidity fund 82 (877) (1,141)

Net foreign currency gains/(losses) (334) 2,268 2,795

Dividend income (12,026) (10,942) (15,138)

Interest income (115) (1) (2)

Realised gain/(loss) on foreign exchange

transactions 6 (37) 494

Realised exchange gain/(loss) on Liquidity

fund 193 (26) 648

Decrease in accrued income and other

debtors 22 66 27

Decrease/(increase) in accrued expenses 25 (70) (41)

-------------------------------------------- --------------- --------------- -----------

(1,205) (1,380) (1,611)

Dividends received 10,842 9,733 12,264

Interest received 51 1 2

Overseas withholding tax recovered 153 47 661

-------------------------------------------- --------------- --------------- -----------

Net cash inflow from operating activities 9,841 8,401 11,316

-------------------------------------------- --------------- --------------- -----------

Purchases of investments and derivatives (67,519) (51,977) (120,395)

Sales of investments and derivatives 65,216 53,707 131,716

Settlement of foreign currency contracts (533) (887) (1,531)

-------------------------------------------- --------------- --------------- -----------

Net cash (outflow)/inflow from investing

activities (2,836) 843 9,790

-------------------------------------------- --------------- --------------- -----------

Equity dividends paid (4,556) (9,181) (22,245)

Repurchase of shares for Cancellation - (258) (258)

Repurchase of shares into Treasury (3,141) (940) (2,089)

Interest paid (576) (571) (1,170)

-------------------------------------------- --------------- --------------- -----------

Net cash outflow from financing activities (8,273) (10,950) (25,762)

-------------------------------------------- --------------- --------------- -----------

Decrease in cash and cash equivalents (1,268) (1,706) (4,656)

-------------------------------------------- --------------- --------------- -----------

Cash and cash equivalents at start

of period/year 25,523 29,685 29,685

Unrealised gain on foreign currency

cash and cash equivalents (275) 902 494

-------------------------------------------- --------------- --------------- -----------

Cash and cash equivalents at end of

period/year 23,980 28,881 25,523

-------------------------------------------- --------------- --------------- -----------

Cash and cash equivalents consist

of:

Cash and short term deposits 421 670 280

Cash held in JPMorgan Euro Liquidity

fund 23,559 28,211 25,243

-------------------------------------------- --------------- --------------- -----------

Total 23,980 28,881 25,523

-------------------------------------------- --------------- --------------- -----------

(1) The presentation of the Cash Flow Statement, as permitted

under FRS 102, has been changed so as to present the reconciliation

of 'net return/(loss) before finance costs and taxation' to 'net

cash inflow from operating activities' on the face of the Cash Flow

Statement. Previously, this was shown by way of note. Interest paid

has also been reclassified to financing activities, previously

shown under operating activities, as this relates to loans. Other

than consequential changes in presentation of the certain cash flow

items, there is no change to the cash flows as presented in

previous periods.

Analysis of changes in net (debt)/cash

As at As at

31st March Exchange Other 30th September

non-cash

2023 Cash flows movements charges 2023

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ----------- ----------- ---------- --------- ---------------

Cash and cash equivalents

Cash 280 141 - - 421

Cash equivalents - Liquidity

fund 25,243 (1,409) (275) - 23,559

------------------------------ ----------- ----------- ---------- --------- ---------------

25,523 (1,268) (275) - 23,980

------------------------------ ----------- ----------- ---------- --------- ---------------

Borrowings

Debt due after one year (43,779) - 561 (6) (43,224)

------------------------------ ----------- ----------- ---------- --------- ---------------

Total net debt (18,256) (1,268) 286 (6) (19,244)

------------------------------ ----------- ----------- ---------- --------- ---------------

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

For the six months ended 30th September 2023

1. Financial statements

The information contained within the condensed financial

statements in this half year report has not been audited or

reviewed by the Company's auditors.

The figures and financial information for the year ended 31st

March 2023 are extracted from the latest published financial

statements of the Company and do not constitute statutory accounts

for that year. Those financial statements have been delivered to

the Registrar of Companies and including the report of the auditors

which was unqualified and did not contain a statement under either

section 498(2) or 498(3) of the Companies Act 2006.

2. Accounting policies

The financial statements have been prepared in accordance with

the Companies Act 2006, FRS 102 'The Financial Reporting Standard

applicable in the UK and Republic of Ireland' of the United Kingdom

Generally Accepted Accounting Practice ('UK GAAP') and with the

Statement of Recommended Practice 'Financial Statements of

Investment Trust Companies and Venture Capital Trusts' (the revised

'SORP') issued by the Association of Investment Companies in July

2022.

FRS 104, 'Interim Financial Reporting', issued by the Financial

Reporting Council ('FRC') in March 2015 has been applied in

preparing this condensed set of financial statements for the six

months ended 30th September 2023.

All of the Company's operations are of a continuing nature.

The accounting policies applied to this condensed set of

financial statements are consistent with those applied in the

financial statements for the year ended 31st March 2023.

3. Return per share

(Unaudited) (Unaudited) (Audited)

Six months Six months ended Year ended

ended

30th September 30th September 31st March

2023 2022 2023

GBP'000 GBP'000 GBP'000

----------------------------------- --------------- ----------------- ------------

Return per share is based on the

following:

Revenue return 10,302 9,100 12,354

Capital (loss)/return (13,336) (49,908) 28,244

----------------------------------- --------------- ----------------- ------------

Total (loss)/return (3,034) (40,808) 40,598

----------------------------------- --------------- ----------------- ------------

Weighted average number of shares

in issue 433,129,680 436,629,740 435,967,427

Revenue return per share 2.38p 2.08p 2.83p

Capital (loss)/return per share (3.08)p (11.43)p 6.48p

----------------------------------- --------------- ----------------- ------------

Total (loss)/return per share (0.70)p (9.35)p 9.31p

----------------------------------- --------------- ----------------- ------------

4. Dividends

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

30th September 30th September 31st March

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------------------- ----------------- ----------------- -----------

Dividends paid

2022 Growth & Income first interim

dividend of 1.10p - 4,812 4,812

2024 Growth & Income first interim

dividend of 1.05p (2023: 1.00p) 4,556 4,369 4,369

2023 Growth & Income second interim

dividend of 1.00p - - 4,358

2023 Growth & Income third interim

dividend of 1.00p - - 4,354

2023 Growth & Income fourth interim

dividend of 1.00p - - 4,352

------------------------------------- ----------------- ----------------- -----------

Total dividends paid in the period 4,556 9,181 22,245

------------------------------------- ----------------- ----------------- -----------

All dividends paid and declared in the period have been funded

from the Revenue Reserve.

The Company's second interim dividend of 1.05p per share was

paid on 27th October 2023 at a cost of GBP4,529,000.

5. Net asset value per share

The net asset value per Ordinary share and the net asset value

attributable to the Ordinary shares at the period/year end are

shown below. These were calculated using 430,969,508 (30th

September 2022: 435,821,962; 31st March 2023: 434,437,846) Ordinary

shares in issue at the period/year end (excluding Treasury

shares).

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

30th September 30th September 31st March 2023

2023 2022

Net asset Net asset Net asset

value attributable value attributable value attributable

GBP'000 pence GBP'000 pence GBP'000 pence

------------------------------ ------------ ------- ----------- -------- ------------ -------

Net asset value - debt

at par 444,428 103.1 388,147 89.1 455,246 104.8

Add: amortised cost of

the Euro 50 million Private

Placement Note with Metlife,

repayable on

26th August 2035 43,224 10.0 43,718 10.0 43,779 10.1

Less: Fair Value of the

Euro 50 million Private

Placement Note with Metlife,

repayable on

26th August 2035 (39,005) (9.1) (43,366) (10.0) (41,579) (9.6)

------------------------------ ------------ ------- ----------- -------- ------------ -------

Net asset value - debt

at fair value 448,647 104.0 388,499 89.1 457,446 105.3

------------------------------ ------------ ------- ----------- -------- ------------ -------

6. Fair valuation of instruments

The fair value hierarchy analysis for Financial Instruments held

at fair value at the period end is as follows:

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

30th September 30th September 31st March 2023

2023 2022

Assets Liabilities Assets Liabilities Assets Liabilities

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ -------- ------------ -------- ------------ -------- ------------

Level 1 459,127 - 400,475 - 469,173 -

Level 2(1) 216 (5) 292 (20) 12 (101)

------------ -------- ------------ -------- ------------ -------- ------------

Total 459,343 (5) 400,767 (20) 469,185 (101)

------------ -------- ------------ -------- ------------ -------- ------------

(1) Forward foreign currency contracts.

JPMORGAN FUNDS LIMITED

29(th) November 2023

For further information, please contact:

Paul Winship

For and on behalf of

JPMorgan Funds Limited

0800 20 40 20

ENDS

A copy of the half year will be submitted to the National

Storage Mechanism and will shortly be available for inspection at

www.hemscott.com/nsm.do

The half year will also shortly be available on the Company's

website at www.jpmeuropean.co.uk where up to date information on

the Company, including daily NAV and share prices, factsheets and

portfolio information can also be found.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLBDBSSDDGXC

(END) Dow Jones Newswires

November 29, 2023 11:46 ET (16:46 GMT)

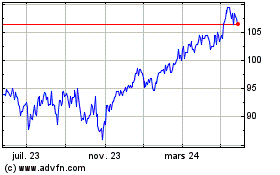

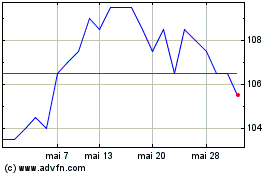

Jpmorgan European Growth... (LSE:JEGI)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Jpmorgan European Growth... (LSE:JEGI)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024