TIDMKLR

RNS Number : 9103Z

Keller Group PLC

17 January 2024

17 January 2024

Keller Group plc

Post Close Trading Update

2023 underlying operating profit expected to be significantly

ahead of market expectations(1)

Keller Group plc ('Keller' or 'the Group'), the world's largest

geotechnical specialist contractor, issues a post close trading

update for the year ended 31 December 2023.

The positive trading momentum and strong operational performance

seen in the first nine of months of the year continued in the

fourth quarter, with a particularly strong end to the year.

Accordingly, we now expect to report an underlying operating profit

for the year significantly ahead of current market expectations(1)

. The underlying operating profit margin for the year is expected

to be significantly ahead of recent years.

In North America, management actions to improve performance in

the foundations business in the second half of 2022 generated a

material and sustainable improvement in operational performance,

with a resultant uplift in operating margin. In addition, the

division benefited from better than expected pricing resilience at

Suncoast, which is now unwinding and the contribution from three

large projects in the foundations business that were particularly

well executed and delivered materially higher than normal levels of

contract profitability. These two material, non-recurring benefits

are considered one-off in nature and are not expected to repeat in

2024.

In Europe, the macro-economic environment remained a challenge

in the second half, with weak demand and competitive pricing

impacting profitability. In addition, some challenging projects in

the Nordic region created a further drag on margins in the year. As

a result of these combined issues, the division will deliver a full

year performance below our original expectations and we are taking

appropriate corrective actions to drive an improved performance in

2024.

In Asia-Pacific, Middle East and Africa (AMEA), Keller Australia

is expected to report a record performance for the year, following

very high levels of demand and improved operational execution.

Austral returned to a sustainable profit in the second half, albeit

insufficient to offset the loss experienced in the first half of

the year. At NEOM, we continue to take a measured and disciplined

approach to the opportunities provided by the project. Whilst we

remain in constructive discussions with the client in respect of

future work on The Line, we do not have a current works order and

have redeployed resources in the short term. However, we have

recently been awarded a work package worth c.USD$80m in respect of

Trojena, the winter resort development at NEOM, for which we are

currently preparing to mobilise to site with work expected to be

completed by the end of 2024.

As a result of the significant increase in underlying operating

profits in North America, the Group's underlying effective tax rate

in 2023 is expected to be c.25%, versus our previous guidance of

c.22%.

The strong earnings performance, together with the continued

focus on working capital management, is expected to result in the

Group's cash generation for the year being a considerable

improvement on the prior year and ahead of our previous

expectations. We expect the year-end net debt/EBITDA leverage ratio

to be c.0.6x, at the lower end of our target range of 0.5x - 1.5x

(2022: 1.2x).

Commenting, Michael Speakman, CEO of Keller, said:

"We are very encouraged by the Group's strong progress in 2023.

The combination of management actions to improve operational

performance in project execution, commercial agility in the face of

a dynamic market, and the one-off benefits in North America will

result in Keller delivering a record performance in 2023 that has

significantly exceeded our original expectations. The fundamental

strengths of the business, together with the continued positive

outlook and our strong order book, give us confidence in further

progress in 2024."

The Group will announce its full year results for 2023 on 5

March 2024.

(1) Analyst consensus underlying operating profit for 2023:

GBP150m.

For further information, please contact:

Keller Group plc www.keller.com

020

7616

Michael Speakman, Chief Executive Officer 7575

David Burke, Chief Financial Officer

Caroline Crampton, Head of Investor Relations

FTI Consulting

020

3727

Nick Hasell 1340

Matthew O'Keeffe

Notes to editors:

Keller is the world's largest geotechnical specialist contractor

providing a wide portfolio of advanced foundation and ground

improvement techniques used across the entire construction sector.

With around 10,000 staff and operations across five continents,

Keller tackles an unrivalled 6,000 projects every year, generating

annual revenue of cGBP3bn.

Cautionary statements:

This document contains certain 'forward-looking statements' with

respect to Keller's financial condition, results of operations and

business and certain of Keller's plans and objectives with respect

to these items.

Forward-looking statements are sometimes, but not always,

identified by their use of a date in the future or such words as

'anticipates', 'aims', 'due', 'could', 'may', 'should', 'expects',

'believes', 'intends', 'plans', 'potential', 'reasonably possible',

'targets', 'goal' or 'estimates'. By their very nature forward

looking statements are inherently unpredictable, speculative and

involve risk and uncertainty because they relate to events and

depend on circumstances that will occur in the future. There are a

number of factors that could cause actual results and developments

to differ materially from those expressed or implied by these

forward-looking statements. These factors include, but are not

limited to, changes in the economies and markets in which the Group

operates; changes in the regulatory and competition frameworks in

which the Group operates; the impact of legal or other proceedings

against or which affect the Group; and changes in interest and

exchange rates. For a more detailed description of these risks,

uncertainties and other factors, please see the Principal risks and

uncertainties section of the Strategic report in the Annual Report

and Accounts. All written or verbal forward looking-statements,

made in this document or made subsequently, which are attributable

to Keller or any other member of the Group or persons acting on

their behalf are expressly qualified in their entirety by the

factors referred to above. Keller does not intend to update these

forward-looking statements. Nothing in this document should be

regarded as a profits forecast. This document is not an offer to

sell, exchange or transfer any securities of Keller Group plc or

any of its subsidiaries and is not soliciting an offer to purchase,

exchange or transfer such securities in any jurisdiction.

Securities may not be offered, sold or transferred in the United

States absent registration or an applicable exemption from the

registration requirements of the US Securities Act of 1933 (as

amended).

LEI number: 549300QO4MBL43UHSN10 Classification: 3.1 Additional

regulated information

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUNSWRSSUAAAR

(END) Dow Jones Newswires

January 17, 2024 02:00 ET (07:00 GMT)

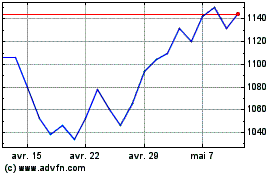

Keller (LSE:KLR)

Graphique Historique de l'Action

De Mar 2025 à Mar 2025

Keller (LSE:KLR)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025