TIDMKRPZ

RNS Number : 0360O

Kropz PLC

28 September 2023

Kropz plc ("Kropz", the "Company") and its subsidiaries (the

"Group")

Unaudited Half Year Results for the Six Months ended 30 June

2023

Kropz plc (AIM: KRPZ), an emerging African phosphate developer

and producer, announces its unaudited results for the six months

ended 30 June 2023.

The financial report is available online at the Company's

website www.kropz.com .

FINANCIAL AND OPERATIONAL HIGHLIGHTS

Operational highlights

As the Company entered the new financial period it started with

the first sales being recorded from the trial production phase. The

group recorded revenue of US$ 14.1 million for the six months ended

30 June 2023.

During the first six months of the year, the Company faced

significant challenges due to unprecedented rainfall in the Western

Cape region. The heavy and persistent rains resulted in severely

wet mining conditions, posing obstacles to our operations. To

address this issue, the Company has undertaken various measures,

with a primary focus on increasing in-pit drainage to alleviate the

waterlogged conditions in our mining areas and implementing ore

stockpiling and blending strategies.

The extent of the ultra-fines (natural slimes) in the ore

encountered has also limited our production throughput. In

response, Elandsfontein is making strategic investments in new

equipment that will enable the plant to more effectively handle and

process the challenging slimes material. Elandsfontein aims to

increase its production throughput by more than 40% and enable the

achievement of steady state production.

In addition to addressing the wet mining conditions,

Elandsfontein continues separating and stockpiling the hard bank

material encountered in the ore. As the hard bank material is

phosphate rich and stockpiled, the Company has begun a process to

analyse the hard bank material to identify the appropriate method

of mining and processing to extract phosphate.

The Elandsfontein mine is still in its trial production phase

and further challenges can be expected as it progresses towards

full production.

Key financial indicators

-- The first sales revenues have been recognised by Kropz

Elandsfontein (Pty) Ltd ("Elandsfontein") of US$ 14.1 million for

the six months ended 30 June 2023 (period ended 30 June 2022:

nil);

-- While the Company is still ramping up to steady state

production a gross loss has been recognised in the period due to

discounted sales prices as a new market entrant and operating below

full production level resulting in a cost per tonne higher than

will be expected once in full production;

-- Property, plant, equipment and exploration assets carrying

value is US$ 64.2 million as at 30 June 2023 (31 December 2022: US$

69.0 million);

-- Cash at 30 June 2023 of US$ 2.1 million (31 December 2022: US$ 2.1 million);

-- Shareholder loans and derivative at 30 June 2023 of US$ 66.2

million (31 December 2022: US$ 55.1 million);

-- Trade and other payables at 30 June 2023 of US$ 5.4 million

(31 December 2022: US$ 7.3 million); and

-- In March 2023, Kropz Elandsfontein secured a further ZAR 285

million (approximately US$ 15.5 million) bridge loan facility with

The ARC Fund ("ARC") ("Loan 1") to meet immediate cash requirements

at Kropz Elandsfontein. ZAR 225 million has been drawn by 30 June

2023. The loan is unsecured, repayable on demand, with no fixed

repayment terms and is repayable by Kropz Elandsfontein on no less

than two business days' notice. Interest is payable at the South

African prime overdraft interest rate plus 6%, nominal per annum

and compounded monthly.

Key corporate and operational developments during the period

Corporate

-- As announced on 16 January 2023, Kropz appointed Louis

Loubser to the board of the Company as Chief Executive Officer

("CEO") and executive director;

-- The third drawdown on the ZAR 550 Million Equity Facility of

ZAR 60 million (approximately US$ 3.5 million) occurred on 25

January 2023; and

-- The fourth drawdown on the ZAR 550 Million Equity Facility of

ZAR 40 million (approximately US$ 2.2 million) occurred on 27

February 2023.

Elandsfontein

-- First bulk shipment and sale have been recorded with a total

of 130,000 tonnes of phosphate concentrate sales in the first half

of 2023 from Kropz Elandsfontein, Elandsfontein is managing to

achieve better prices in the market as quality and market

reputation improves.

Hinda

-- The Company has started to identify potential funding

solutions for the development of Hinda;

-- Continued engagement with local government regarding project development; and

-- Reduced sized project is currently being assessed to propose

a fit-for-purpose low capex project to prove the concept of

producing phosphate concentrate in the Congo and exporting it.

Key developments post the period end

Corporate

-- The Company previously announced that it is in the process of

refinancing the BNP loan facility (outstanding amount US$

18,750,000) and that a replacement loan was expected to be in place

in the third quarter of 2023, before expiry of the facility.

Discussions continue with potential lenders regarding a potential

replacement loan and it is now expected that a replacement loan

will be in place by the end of 2023 and the Company is in

discussion with BNP to extend its waiver period in line with this

timetable.

Elandsfontein

-- While several sales have been recorded in 2023, including a

further 63,900 tonnes in the current quarter, sales are below

forecast, due to mine production having been affected by recent

unprecedented seasonal rains;

-- A fifth and final drawdown on Loan 1 of ZAR R60 million was made on 17 August 2023; and

-- As announced on 14 September 2023, Kropz, Kropz Elandsfontein

and ARC Fund agreed to further ZAR 250 million (approximately US$

13.2 million) of bridge loan facility ("Loan 2") to meet immediate

cash requirements at Kropz Elandsfontein. A first draw down of ZAR

155 million (approximately US$ 8 million) was made on 18 September

2023.The loan is unsecured, repayable on demand, with no fixed

repayment terms and is repayable by Kropz Elandsfontein on no less

than two business days' notice. Interest is payable at the South

African prime overdraft interest rate plus 6%, nominal per annum

and compounded monthly. In the event that any amounts are

outstanding under the loan, together with interest thereon, are not

repaid within 6 months from the first utilisation date, the

interest rate will be increased with an additional 2%.

Hinda

-- The reduced sized project continues to be assessed to propose

a fit-for-purpose low capex project to prove the concept of

producing phosphate concentrate in the Congo and exporting it;

-- Good progress is continuing on the community project;

-- The coreshed construction is continuing and the 1st phase

verification of the status of the equipment stored in containers,

before transfer to site; and

-- The situation in the country appears to be under control

following recent rumours of a coup against President Denis Nguesso.

The local government have denied these rumours. The Company are

continuing to assess the situation and the safety of employees in

the country remains our top priority.

For further information visit www.kropz.com or contact:

Kropz Plc Via Tavistock

+44 (0) 207 920

Louis Loubser (CEO) 3150

Grant Thornton UK LLP Nominated Adviser

Samantha Harrison

Harrison Clarke +44 (0) 20 7383

Ciara Donnelly 5100

Hannam & Partners Broker

Andrew Chubb +44 (0) 20 7907

Ernest Bell 8500

Tavistock Financial PR &

IR (UK)

Nick Elwes +44 (0) 207 920

Jos Simson 3150

Emily Moss kropz@tavistock.co.uk

R&A Strategic Communications PR (South Africa)

Charmane Russell +27 (0) 11 880

Marion Brower 3924

charmane@rasc.co.za

marion@rasc.co.za

About Kropz plc

Kropz is an emerging African phosphate developer and producer

with phosphate projects in South Africa and the Republic of Congo

("RoC"). The vision of the Group is to become a leading independent

phosphate rock producer and to develop into an integrated,

mine-to-market plant nutrient company focusing on sub-Saharan

Africa.

CONDENSED INTERIM CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

30 June 31 December

2023 2022

Unaudited Audited

Notes US$'000 US$'000

Non-current assets

Property, plant, equipment and mine

development 8 64,284 68,965

Exploration assets 9 43,359 42,415

Other financial assets 783 860

----------- ------------

108,426 112,240

----------- ------------

Current assets

Inventories 5,602 3,273

Trade and other receivables 948 1,857

Cash and cash equivalents 2,078 2,120

----------- ------------

8,628 7,250

----------- ------------

TOTAL ASSETS 117,054 119,490

----------- ------------

Current liabilities

Trade and other payables 5,413 7,284

Shareholder loans and derivative 10 36,232 -

Other financial liabilities 11 19,241 26,808

Current taxation 626 597

61,512 34,689

----------- ------------

Non-current liabilities

Shareholder loans and derivative 10 29,963 55,102

Provisions 2,500 2,697

----------- ------------

32,463 57,799

----------- ------------

TOTAL LIABILITIES 93,975 92,488

----------- ------------

NET ASSETS 23,079 27,002

----------- ------------

Shareholders' equity

Share capital 1,212 1,212

Share premium 194,063 194,063

Merger reserve (20,523) (20,523)

Foreign exchange translation reserve (11,795) (11,195)

Share-based payment reserve 299 271

Accumulated losses (116,754) (116,972)

-----------

Total equity attributable to the owners

of the Company 46,502 46,856

Non-controlling interests (23,423) (19,854)

----------- ------------

23,079 27,002

----------- ------------

The accompanying notes form part of the Condensed Consolidated

Financial Statements.

CONDENSED INTERIM CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

FOR THE SIX MONTHSED 30 JUNE 2023

Six months Six months

ended ended

30 June 30 June

2023 2022

Unaudited Unaudited

Notes US$'000 US$'000

Revenue 12 14,053 -

Cost of Sales (16,436) -

----------- -----------

Gross loss (2,383) -

Other income 11 500

Selling and distribution expenses (1,647) -

Operating expenses (2,159) (4,796)

----------- -----------

Operating loss (6,178) (4,296)

Finance income 13 57 85

Finance expense 14 (9,720) (4,306)

Fair value gain / (loss) from derivative

liability 15 11,817 (7,637)

Impairment losses 16 - (44,700)

Loss before taxation (4,024) (60,854)

Taxation 17 - -

Loss for the period (4,024) (60,854)

----------- -----------

Profit / (loss) attributable to:

Owners of the Company 1,518 (46,794)

Non-controlling interests (5,542) (14,060)

----------- -----------

(4,024) (60,854)

----------- -----------

Loss for the period (4,024) (60,854)

Other comprehensive income:

Items that may be subsequently reclassified

to profit or loss:

* Exchange differences on translating foreign

operations 73 (3,636)

Total comprehensive loss (3,951) (64,490)

----------- -----------

Profit / (loss) attributable to:

Owners of the Company 918 (50,081)

Non-controlling interests (4,869) (14,409)

----------- -----------

(3,951) (64,490)

----------- -----------

Earnings per share attributable to

owners of the Company :

Basic and diluted (US cents) 18 0.16 (5.09)

----------- -----------

The accompanying notes form part of the Condensed Consolidated

Financial Statements.

CONDENSED INTERM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2023

Foreign

currency Share-based Total

Share Share Merger translation payment Retained attributable Non-controlling Total

capital premium reserve reserve reserve earnings to owners interest equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Unaudited

- six months

ended 30

June 2023

Balance

at 1 January

2023 1,212 194,063 (20,523) (11,195) 271 (116,972) 46,856 (19,854) 27,002

Total

comprehensive

loss for

the period - - - (600) - 1,518 918 (4,869) (3,951)

Share based

payment

charges - - - - 28 - 28 - 28

Investment

in

non-redeemable

preference

shares of

Kropz

Elandsfontein - - - - - (1,300) (1,300) 1,300 -

---------- -------- --------- ------------ ------------ ---------- -------------- ---------------- ---------

Transactions

with owners - - - - 28 (1,300) (1,272) 1,300 28

---------- -------- --------- ------------ ------------ ---------- -------------- ---------------- ---------

Balance

at 30 June

2023 1,212 194,063 (20,523) (11,795) 299 (116,754) 46,502 (23,423) 23,079

---------- -------- --------- ------------ ------------ ---------- -------------- ---------------- ---------

Unaudited

- six months

ended 30

June 2022

Balance

at 1 January

2022 1,194 193,524 (20,523) (7,807) 1,197 (45,626) 121,959 5,778 127,737

Total

comprehensive

loss for

the period - - - (3,287) - (46,794) (50,081) (14,409) (64,490)

Issue of

shares 18 503 - - - - 521 - 521

Share options

exercised - 730 - - (730) - - - -

Share based

payment

charges - - - - 119 - 119 - 119

Investment

in

non-redeemable

preference

shares of

Kropz

Elandsfontein - - - - - (1,999) (1,999) 1,999 -

---------- -------- --------- ------------ ------------ ---------- -------------- ---------------- ---------

Transactions

with owners 18 1,233 - - (611) (1,999) (1,359) 1,999 640

---------- -------- --------- ------------ ------------ ---------- -------------- ---------------- ---------

Balance

at 30 June

2022 1,212 194,757 (20,523) (11,094) 586 (94,419) 70,519 (6,632) 63,887

---------- -------- --------- ------------ ------------ ---------- -------------- ---------------- ---------

The accompanying notes form part of the Condensed Consolidated

Financial Statements.

CONDENSED INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2023

Six months Six months

ended ended

30 June 30 June

2023 2022

Unaudited Unaudited

US$'000 US$'000

Cash flows from operating activities

Loss before taxation (4,024) (60,854)

Adjustments for:

Depreciation of property, plant and

equipment 369 425

Amortisation of right-of-use assets - 18

Impairment losses - 44,700

Share-based payment 21 119

Interest income (57) (85)

Interest expense 5,671 2,414

Fair value (gain) / losses from derivative

liability (11,817) 7,637

Foreign currency exchange differences 4,048 1,884

Fair value (gain) / loss on game animals (24) 21

----------- -----------

Operating cash flows before working

capital changes (5,813) (3,721)

Decrease / (Increase) in trade and other

receivables 783 (478)

Increase in inventories (2,852) (1,117)

(Decrease) / Increase in payables (936) 4,832

Net cash flows used in operating activities (8,818) (484)

----------- -----------

Cash flows used in investing activities

Purchase of property, plant and equipment (1,616) (16,762)

Exploration and evaluation expenditure (190) (194)

Other financial asset (8) 70

Interest received 57 85

Transfers from restricted cash - 4,858

----------- -----------

Net cash flows used in investing activities (1,757) (11,943)

----------- -----------

Cash flows from financing activities

Finance cost paid (1,345) (1,072)

Shareholder loan received 20,183 11,730

Repayment of lease liabilities - (14)

(Repayment) / Proceeds of Other financial

liabilities (7,520) 25

Issue of ordinary share capital - 554

Net cash flows from financing activities 11,318 11,223

----------- -----------

Net increase / (decrease) in cash and

cash equivalents 743 (1,204)

Cash and cash equivalents at beginning

of the period 2,120 2,461

Foreign currency exchange losses on

cash (785) (250)

----------- -----------

Cash and cash equivalents at end of

the period 2,078 1,007

----------- -----------

The accompanying notes form part of the Condensed Consolidated

Financial Statements.

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2023

1. General information

Kropz and its subsidiaries (together "the Group") is an emerging

plant nutrient producer with an advanced stage phosphate mining

project in South Africa, Elandsfontein, and a phosphate project in

the RoC, Hinda. The principal activity of the Company is that of a

holding company for the Group, as well as performing all

administrative, corporate finance, strategic and governance

functions of the Group.

The Company was incorporated on 10 January 2018 and is a public

limited company, with its ordinary shares admitted to the AIM

Market of the London Stock Exchange on 30 November 2018 trading

under the symbol, "KRPZ". The Company is domiciled in England and

incorporated and registered in England and Wales. The address of

its registered office is 35 Verulam Road, Hitchin, SG5 1QE. The

registered number of the Company is 11143400.

2. Basis of preparation

These interim consolidated financial statements have been

prepared in accordance with IAS 34 Interim Financial Reporting and

the AIM rules and in accordance with the accounting policies of the

consolidated financial statements for the year ended 31 December

2022. They do not include all disclosures that would otherwise be

required in a complete set of financial statements and should be

read in conjunction with the 2022 annual report. The statutory

financial statements for the year ended 31 December 2022 were

prepared in accordance with UK adopted international accounting

standards and the Companies Act 2006 applicable to companies

reporting under the International Financial Reporting Standards

("IFRS"). They have been filed with the Registrar of Companies. The

auditors' reported on those financial statements was unqualified

but included a material uncertainty related to going concern.

The interim consolidated financial statements have been prepared

under the historical cost convention unless otherwise stated in the

accounting policies. They are presented in United States Dollars,

the presentation currency of the Group and figures have been

rounded to the nearest thousand.

The interim risk assessment is consistent with the assessment of

the annual financial report for 31 December 2022.

The interim financial information is unaudited and does not

constitute statutory accounts as defined in the Companies Act

2006.

The interim financial information was approved and authorised

for issue by the Board of Directors on 27 September 2023.

3. Going concern

During the six months ended 30 June 2023, the Group incurred a

loss of US$ 4 million (six months ended 30 June 2022: US$60.9

million) and experienced net cash outflows from operating

activities. Cash and cash equivalents totalled US$ 2.1 million as

at 30 June 2023 (31 December 2022: US$ 2.1 million)

Elandsfontein is currently the Group's only source of operating

revenue. As Elandsfontein is still in trial production and still

ramping up its operations an operating loss is also expected in the

full year following the date of these accounts. The Group is

consequently dependent on future fundraisings to meet any

production costs, overheads, future development and exploration

requirements and quarterly repayments on the BNP loan that cannot

be met from existing cash resources and sales revenue in trial

production phase.

The going concern assessment was performed using the Group's

15-month forecast. The Group's forecast cash flows are largely

driven by Elandsfontein and are in line with the 31 December 2022

going concern assessment, the Elandsfontein Life of Mine plan

("LOM" or "mine plan") used for the going concern assessment only

considers resources classified as measured and indicated, excluding

any inferred resources, as per the updated Mineral Resource

Estimate ("MRE"). As mining activities and further drilling work

progress, Elandsfontein expects to reclassify more of the resources

from inferred to either measured and indicated as announced on 10

January 2023.

Elandsfontein's forecast cashflows were estimated using

market-based commodity prices, exchange rate assumptions, estimated

quantities of recoverable minerals, production levels, operating

costs and capital requirements over a 15-month period.

The forecast cashflows include a number of estimates which if

the actual outcome were different could have a significant impact

on the financial outcome of the Elandsfontein mine operations and

the Group's funding needs.

The 15-month forecast assumes a refinancing in December 2023 to

repay the BNP loan facility and provide working capital.

Phosphate rock prices and grade : Forecast phosphate rock prices

are based on management's estimates of quality of production. The

forecast selling prices are derived from forward price curves and

long-term views of global supply and demand in a changing

environment, particularly with respect to climate risk, building on

past experience of the industry and consistent with external

sources.

The first bulk shipment and sale was recorded in January 2023

with a total of 130,000 tonnes of phosphate concentrate sales in

the first half of 2023 from Kropz Elandsfontein. Kropz is a new

entrant to the phosphate market and has to date produced variable

grade and has sold its shipments at a discount to prevailing market

prices. As quality and market reputation improves, Elandsfontein is

managing to achieve better prices in the market . The cashflow

model assumes a discount to the prevailing market price for 31%

P(2) O(5) phosphate concentrate for the period up to December 2024

largely due to variability in the grade of Elandsfontein's product

being produced during its ramp-up phase and considering that

Elandsfontein is a new market entrant. The mine plan forecasts

market prices for all shipments from the end of 2024 . The ability

to achieve market rates on sales is largely dependent on

Elandsfontein's ability to consistently produce 31% P(2) O(5)

concentrate. Failing this, the Group may continue to suffer a

discount to market rates.

Phosphate recoveries : Estimated production volumes are based on

detailed LOM plans of the measured and indicated resource as

defined in the MRE and take into account development plans for the

mine agreed by management as part of the long-term planning

process. Production volumes are dependent on a number of variables,

such as: the recoverable quantities; the production profile; the

cost of the development of the infrastructure necessary to extract

the reserves; the production costs; the contractual duration of

mining rights; and the selling price of the commodities

extracted.

Estimated production volumes are subject to significant

uncertainty given the ongoing ramp up. The production ramp-up has

been delayed largely by the need to re-engineer parts of the fine

flotation circuit proposed by the vendor. Mining and processing

have also been affected by early unpredicted ore variability and

lack of operator experience. The Company has begun a process to

analyse the hard bank material to identify the appropriate method

of mining and processing to extract phosphate. Also the Western

Cape has experienced unprecedented rain this season which has led

to severely wet mining conditions and has hindered ore delivery to

the plant and concentrate production during the six-months to June

2023. This is being addressed by increased drainage. Production

throughput is also being limited by the nature of slimes material

and, the Company is investing in new equipment to seek to overcome

this and aims to increase production throughput by more than

40%.

Reserves and resources: The LOM plan used for the impairment

testing and going concern assessment only includes the measured and

indicated resources as defined in the MRE. Excluding inferred

resources limits the forecast production to only around 4 years.

There was a significant reduction in the measured and indicated

resource in the MRE issued in January 2023 as set out in the

Strategic report in the Annual Report for the year ended 31

December 2022. The Directors believe that the inferred resources in

the MRE are capable of being accessed giving a mine life of around

15 years, but this has not been taken into account in the

cashflows. As drilling operations continue, and confidence

improves, Management expects more of the total resource will be

reclassified to measured and indicated.

Exchange rates : Foreign exchange rates are estimated with

reference to external market forecasts. The assumed average

long-term US dollar/ZAR exchange rate over LOM and for the forecast

cashflows is ZAR18.50/USD.

Operating cost : Operating costs are estimated with reference to

contractual and actual current costs adjusted for inflation. Key

operating cost estimates are mine and plant operating costs and

transportation and port costs. The forecast mine and plant costs

were based on the contracted rates with the current mine and plant

operators.

Transportation costs : Transnet has informed the Group that it

may have to export some shipments through Cape Town in 2023 and

2024 which would lead to higher transportation cost to Cape Town.

The transportation costs in the cashflows assume that 10% of 2023

and 2024 shipments are through Cape Town at the higher logistic

cost. To date all sales have been exported through the port of

Saldanha Bay. As production is still ramping up and the port access

agreement with Transnet has not yet been signed, the actual

operating costs may be higher than the estimates in the discounted

cash flows.

The Group is dependent on future fundraisings to meet any

production costs, overheads, future development and exploration

requirements and quarterly repayments on the BNP loan that cannot

be met from existing cash resources and sales revenue.

ARC Fund, on various occasions in the past provided funding to

support the Group's operations. In March 2023, Kropz, Kropz

Elandsfontein and the ARC Fund agreed to further ZAR 285 million

(approximately US$ 15.5 million) bridge loan facilities to meet

immediate cash requirements at Kropz Elandsfontein. In September

2023, Kropz Elandsfontein and ARC Fund signed a further ZAR 250

million (approximately US$ 13.2 million) bridge loan facility to

meet immediate cash requirements at Kropz Elandsfontein. A first

draw down of ZAR 155 million (approximately US$ 8 million) was made

on 18 September 2023. Management has confirmed with ARC that they

have no intention to call any outstanding loans over the next

12-months for cash repayment.

Management engages frequently with BNP regarding the capital

repayment and refinancing of the BNP debt facility. The Company did

not reach project completion as stipulated in the BNP facility

agreement by 31 December 2022. Considering the delay in achieving

sales, the Company also failed to fund the debt service reserve

account as required. BNP have, to date, waived these requirements,

preventing the Company from falling in default of its loan

terms.

At the end of the waiver period, the bank has the contractual

right to request the immediate repayment of the outstanding loan

amount of US$ 15,000,000. BNP has indicated their willingness to

extend the waivers to December 2023. Kropz Elandsfontein has made

all the capital and interest payments to BNP as required to the

date of this report.

Based on the current cashflow forecast additional funding will

be required over the 15 month forecast period.

Given that BNP Paribas is exiting South Africa, the Group was

unable to refinance the existing loan with them. Significant

progress has been made with the refinancing of the BNP loan

facility and Management, at the date of this report, are in

advanced discussions with several lenders to provide the required

funding to repay the BNP debt facility and provide working capital

and expects that a replacement loan will be in place in by 31

December 2023.

Based on the Group's current available reserves, recent

operational performance, forecast production and sales and

anticipated new borrowing based on discussions with a potential

lenders, coupled with Management's track record to successfully

raise additional funds as and when required, to meet its working

capital and capital expenditure requirements, the Board have

concluded that they have a reasonable expectation that the Group

will continue in operational existence for the foreseeable future

and at least to December 2024.

For these reasons, the financial statements have been prepared

on the going concern basis, which contemplates the continuity of

normal business activities and the realisation of assets and

discharge of liabilities in the normal course of business.

As there can be no guarantee that the required future funding

can be raised in the necessary timeframe, a material uncertainty

exists that may cast significant doubt on the Group's ability to

continue as a going concern and therefore it may be unable to

realise its assets and discharge its liabilities in the normal

course of business.

The financial report does not include adjustments relating to

the recoverability and classification of recorded asset amounts or

to the amounts and classification of liabilities that might be

necessary should the Group not continue as a going concern.

4. Significant accounting policies

The Company has applied the same accounting policies,

presentation, methods of computation, significant judgements and

the key sources of estimation uncertainties in its interim

consolidated financial statements as in its audited financial

statements for the year ended 31 December 2022, except for the

following amendments and revenue recognition and production start

date which apply for the first time in 2023. However, none of the

recent amendments to IFRS are expected to materially impact the

Group as they are either not relevant to the Group's activities or

require accounting which is consistent with the Group's current

accounting policies.

The following new standards and amendments are effective for the

period beginning 1 January 2023 :

-- Disclosure of Accounting Policies (Amendments to IAS 1

Presentation of Financial Statements and IFRS Practice Statement

2);

-- Definition of Accounting Estimates (Amendments to IAS 8

Accounting policies, Changes in Accounting Estimates and

Errors);

-- Deferred Tax related to Assets and Liabilities arising from a

Single Transaction (Amendments to IAS 12 Income Taxes); and

-- International Tax Reform - Pillar Two Model Rules (Amendment to IAS 12 Income Taxes).

5. Revenue recognition

The Group is principally engaged in the business of producing

phosphate concentrate. Revenue from contracts with customers is

recognised when control of the goods or services is transferred to

the customer at an amount that reflects the consideration to which

the Group expects to be entitled in exchange for those goods.

The Group has concluded that it is the principal in its revenue

contracts because it typically controls the goods or services

before transferring them to the customer.

6. Production start date

The Group assesses the stage of each mine under

development/construction to determine when a mine moves into the

production phase, this being when the mine is substantially

complete and ready for its intended use. The criteria used to

assess the start date are determined based on the unique nature of

the mine development. The Group considers various relevant criteria

to assess when the production phase is considered to have

commenced. At this point, all related amounts are reclassified from

"trial production" to "steady state production".

Some of the criteria used to identify the production start date

include, but are not limited to:

-- The percentage grade (phosphate concentrate) and volume of

ore being minded is sufficiently economic and consistent with the

plant design specifications;

-- Ability to produce phosphate in saleable form (within specifications); and

-- Ability to sustain ongoing production of phosphate.

When the mine moves into the steady state production, the

capitalisation of certain mine development costs ceases and costs

are either regarded as forming part of the cost of inventory or

expensed, except for the costs that qualify for capitalisation

relating to mining asset additions or improvements, or mineable

reserve development. It is also at this point that

depreciation/amortisation commences.

7. Segmental information

Operating segments

The Board of Directors consider that the Group has one operating

segment, being that of phosphate mining and exploration.

Accordingly, all revenues, operating results, assets and

liabilities are allocated to this activity.

Geographical segments

The Group operates in two principal geographical areas - South

Africa and the RoC.

The Group's revenues and non-current assets by location of

assets are detailed below.

Non-Current

Revenues Assets

30 June 2023 US$'000 US$'000

South Africa 14,053 65,032

Republic of Congo - 43,394

14,053 108,426

----------- ------------

Non-Current

Revenues Assets

31 December 2022 US$'000 US$'000

South Africa - 69,795

Republic of Congo - 42,445

----------- ------------

- 112,240

-------------------------------- ------------

8. Tangible assets - Property, plant, equipment and mine development

30 June 30 June 30 June 31 Dec 31 Dec 31 Dec

2023 2023 2023 2022 2022 2022

Accumulated Accumulated

depreciation Carrying depreciation Carrying

Cost and impairment value Cost and impairment value

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Buildings and

infrastructure

Land 1,280 (795) 485 1,418 (795) 623

Buildings 8,883 (5,028) 3,855 9,840 (5,597) 4,243

Capitalised road

costs 6,861 (5,356) 1,505 7,600 (5,709) 1,891

Capitalised electrical

sub-station costs 2,977 (2294) 683 3,297 (2,445) 852

Machinery, plant

and equipment

Critical spare

parts 1,750 (893) 857 1,786 (1,002) 784

Plant and machinery 85,857 (47,711) 38,146 95,061 (53,486) 41,575

Water treatment

plant 2,264 (1,167) 1,097 2,333 (1,308) 1,025

Furniture and fittings 51 (38) 13 56 (41) 15

Geological equipment 71 (47) 24 79 (48) 31

Office equipment 27 (27) - 30 (28) 2

Other fixed assets 1 (1) - 1 (1) -

Motor vehicles 84 (84) - 93 (93) -

Computer equipment 75 (49) 26 79 (45) 34

Mine development 17,121 (8,711) 8,410 17,724 (9,788) 7,936

Stripping activity

costs 20,127 (11,132) 8,995 22,257 (12,485) 9,772

Game animals 188 - 188 182 - 182

Total 147,617 (83,333) 64,284 161,836 (92,871) 68,965

-------- ---------------- --------- -------- ---------------- ---------

Reconciliation of property, plant, equipment and mine

development - Period ended 30 June 2023

Foreign

Opening Fair value Deprecia-tion exchange Closing

Balance Additions gain charge loss balance

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Buildings

and infrastructure

Land 623 - - - (138) 485

Buildings 4,243 - - (15) (373) 3,855

Capitalised

road costs 1,891 - - (237) (149) 1,505

Capitalised

electrical

sub-station

costs 852 - - (101) (68) 683

Machinery,

plant and equipment

Critical spare

parts 784 142 - - (69) 857

Plant and machinery 41,575 32 - (1) (3,460) 38,146

Water treatment

plant 1,025 164 - - (92) 1,097

Furniture and

fittings 15 - - (2) - 13

Geological

equipment 31 - - (3) (4) 24

Office equipment 2 - - (2) - -

Other fixed

assets - - - - - -

Motor vehicles - - - - - -

Computer equipment 34 4 - (8) (4) 26

-

Mine development 7,936 1,161 - - (687) 8,410

-

Stripping

activity costs 9,772 36 - - (813) 8,995

Game animals 182 - 24 - (18) 188

Total 68,965 1,539 24 (369) (5,875) 64,284

--------- ---------- ----------- -------------- ---------- ---------

Reconciliation of property, plant, equipment and mine

development - Year ended 31 December 2022

Foreign

Opening Fair value Impair- Deprecia-tion exchange Closing

Balance Additions loss ment charge loss balance

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Buildings and

infrastructure

Land 1,515 - - (795) - (97) 623

Buildings 10,458 - - (5,747) (33) (435) 4,243

Capitalised

road costs 5,143 - - (2,522) (527) (203) 1,891

Capitalised

electrical sub-station

costs 2,310 - - (1,137) (229) (92) 852

Machinery,

plant and equipment

Critical spare

parts 1,713 190 - (1,046) - (73) 784

Plant and machinery 86,180 14,911 - (55,775) (1) (3,740) 41,575

Water treatment

plant 2,435 56 - (1,366) - (100) 1,025

Furniture and

fittings 9 10 - - (4) - 15

Geological equipment 20 18 - - (6) (1) 31

Office equipment 11 - - - (9) - 2

Other fixed

assets - - - - - - -

Motor vehicles - - - - - - -

Computer equipment 24 24 - - (12) (2) 34

Mine development 18,938 - - (10,227) - (775) 7,936

Stripping activity

costs 6,126 17,178 - (13,035) - (497) 9,772

Game animals 217 - (21) - - (14) 182

Total 135,099 32,387 (21) (91,650) (821) (6,029) 68,965

--------- ---------- ------------- ---------- -------------- ---------- ---------

Kropz Elandsfontein has a fully drawn down project financing

facility with BNP Paribas for US$ 30 million (see Note 11). BNP has

an extensive security package over all the assets of Kropz

Elandsfontein and Elandsfontein Land Holdings (Pty) Ltd

("Elandsfontein Land Holdings") as well as the share investments in

those respective companies owned by Kropz SA (Pty) Ltd ("Kropz

SA").

9. Intangible assets - exploration and evaluation costs

30 June 31 December

2023 2022

US$'000 US$'000

Capitalised exploration costs

Cost 43,359 42,415

Amortisation - -

--------- ------------

Carrying value 43,359 42,415

--------- ------------

Reconciliation of exploration assets

Foreign

Opening exchange Closing

Balance Additions Disposals Gain balance

US$'000 US$'000 US$'000 US$'000 US$'000

Period ended 30 June 2023

Capitalised exploration

costs 42,415 199 - 745 43,359

------------- ---------- ------------ ---------- ---------

Reconciliation of exploration assets

Foreign

Opening exchange Closing

Balance Additions Disposals loss balance

US$'000 US$'000 US$'000 US$'000 US$'000

Year ended 31 December

2022

Capitalised exploration

costs 44,631 346 - (2,562) 42,415

------------- ---------- ------------ ---------- ---------

The costs of mineral resources acquired and associated

exploration and evaluation costs are not subject to amortisation

until they are included in the life-of-the-mine plan and production

has commenced.

Where assets are dedicated to a mine, the useful lives are

subject to the lesser of the asset category's useful life and the

life of the mine, unless those assets are readily transferable to

another productive mine. In accordance with the requirements of

IFRS 6, the Board of Directors assessed whether there were any

indicators of impairment. No indicators were identified (refer to

Note 16).

10. Shareholder loans and derivative liability

30 June 31 December

2023 2022

US$'000 US$'000

Shareholder loans - ARC Fund 29,963 17,010

Convertible debt - ARC Fund 21,066 15,055

Derivative liability 15,166 23,037

66,195 55,012

--------- ------------

Maturity

Non-current 29,963 55,012

Current 36,232 -

------- -------

Total 66,195 55,012

------- -------

Shareholder loans - ARC Fund

The loans are: (i) US$ denominated, but any repayments will be

made in ZAR at the then prevailing ZAR/US$ exchange rate; (ii)

carry interest at monthly SOFR plus 3%; and (iii) are repayable by

no later than 1 January 2035 (or such earlier date as agreed

between the parties to the shareholder agreements).

Convertible debt - ARC Fund

On 20 October 2021, the Company entered into a new convertible

equity facility of up to ZAR 200 million ("ZAR 200 Million Equity

Facility") with ARC, the Company's major shareholder. Interest is

payable at 14% nominal, compounded monthly. At any time during the

term of the ZAR 200 Million Equity Facility, repayment of the ZAR

200 Million Equity Facility capital amount will, at the election of

ARC, either be in the form of the conversion into ordinary shares

of 0.1 pence each ("Ordinary Shares") in the Company and issued to

ARC, at a conversion price of 4.5058 pence per Ordinary Share each,

representing the 30-day Volume Weighted Average Price ("VWAP") on

21 September 2021, and at fixed exchange rate of GBP 1 = ZAR 20.24

("Conversion"), or payable in cash by the Company at the end of the

term of the ZAR 200 Million Equity Facility which is 27 October

2026. The ZAR 200 Million Equity Facility is fully drawn at the

date of this report.

As announced on 11 May 2022, the Company entered into a new

conditional convertible equity facility of up to ZAR 177 million

("ZAR 177 Million Equity Facility") with ARC. Interest is payable

at 14% nominal, compounded monthly. At any time during the term of

the ZAR 177 Million Equity Facility, repayment of the ZAR 177

Million Equity Facility capital amount will, at the election of

ARC, either be in the form of the conversion into Ordinary Shares

in the Company and issued to ARC, at a conversion price of 9.256

pence per Ordinary Share each, representing the 30-day Volume

Weighted Average Price ("VWAP") on 4 May 2022, and at fixed

exchange rate of ZAR 1 = GBP 0.0504 ("Conversion"), or payable in

cash by the Company at the end of the term of the ZAR 177 Million

Equity Facility which is 2 June 2027. The ZAR 177 Million Equity

Facility is fully drawn at the date of this report.

As announced on 14 November 2022, the Company entered into a new

conditional convertible equity facility of up to ZAR 550 million

("ZAR 550 Million Equity Facility") with ARC. Interest is payable

at the South African prime overdraft interest rate plus 6%, nominal

per annum and compounded monthly. At any time during the term of

the ZAR 550 Million Equity Facility, repayment of the ZAR 550

Million Equity Facility capital amount will, at the election of

ARC, either be in the form of the conversion into Ordinary Shares

in the Company and issued to ARC, at a conversion price of 4.579

pence per Ordinary Share each, representing the 30-day Volume

Weighted Average Price ("VWAP") on 21 October 2022 and at fixed

exchange rate of ZAR 1 = GBP 0.48824 ("Conversion"), or payable in

cash by the Company at the end of the term of the ZAR 550 Million

Equity Facility which is 30 November 2027. The Company drew down a

further ZAR 100 million during the 6-month period ending 30 June

2023, with ZAR 7.5 million remaining undrawn on the ZAR 550 Million

Equity Facility at 30 June 2023.

Derivative liability

It was determined that the conversion option embedded in the

convertible debt equity facility be accounted for separately as a

derivative liability. Although the amount to be settled is fixed in

ZAR, when converted back to Kropz's functional currency will result

in a variable amount of cash based on the exchange rate at the date

of conversion. The value of the liability component and the

derivative conversion component were determined at the date of draw

down using a Monte Carlo simulation. The debt host liability was

bifurcated based on the determined value of the option.

Subsequently, the embedded derivative liability is adjusted to

reflect fair value at each period end with changes in fair value

recorded in profit and loss (refer to Note 21).

Fair value of shareholder loans

The carrying value of the loans approximates their fair

value.

11. Other financial liabilities

30 June 31 December

2023 2022

US$'000 US$'000

BNP Paribas ("BNP") 18,527 26,298

Greenheart Foundation 714 510

--------- ------------

Total 19,241 26,808

--------- ------------

BNP

A US$ 30,000,000 facility was made available by BNP Paribas to

Kropz Elandsfontein in September 2016.

In May 2020, Kropz Elandsfontein and BNP Paribas agreed to amend

and restate the term loan facility agreement entered into on or

about 13 September 2016 (as amended from time to time). The BNP

Paribas facility amendment agreement extends inter alia the final

capital repayment date to Q3 2024, with eight equal capital

repayments to commence in Q4 2022 and an interest rate of 6.5% plus

SOFR, up to project completion and 4.5% plus SOFR thereafter.

BNP Paribas has an extensive security package over all the

assets of Kropz Elandsfontein and Elandsfontein Land Holdings as

well as the share investments in those respective companies owned

by Kropz SA.

The BNP loan is subject to covenant clauses. Kropz Elandsfontein

did not reach project completion as stipulated in the agreement to

be 31 December 2022 and failed to fund the Debt Service Reserve

Account, however BNP Paribas has provided, a waiver to 30 September

2023. The outstanding balance is therefore presented as a current

liability.

Greenheart Foundation

A loan has been made to the Group by Greenheart Foundation which

is interest-free and repayable on demand. Louis Loubser, a Director

of the Kropz plc, is a Director of Greenheart Foundation.

Fair value of other nancial liabilities

The carrying value of the loans approximate their fair

value.

12. Revenue

Six months Six months

ended ended

30 June 30 June

2023 2022

US$'000 US$'000

Sales to region/Country

South Africa 1,836 -

Australia 1,489 -

Brazil 4,933 -

New Zealand 1,968 -

South Korea 3,827 -

14,053 -

----------- -----------

Timing of transfer of Goods

Delivery to port of departure 14,053 -

----------- -----------

14,053 -

----------- -----------

All revenue from phosphate is recognised at a point in time when

control transfers.

13. Finance income

Six months Six months

ended ended

30 June 30 June

2023 2022

US$'000 US$'000

Interest income 57 85

Total 57 85

----------- -----------

14. Finance expense

Six months Six months

ended ended

30 June 30 June

2023 2022

US$'000 US$'000

Shareholder loans 4,271 1,215

Foreign exchange losses 4,049 1,892

Bank debt 1,343 1,057

BNP Paribas - Debt modification present

value adjustment amortisation (104) (123)

BNP Paribas amendment fee amortisation 91 108

Finance leases - 3

Other 70 154

----------- -----------

Total 9,720 4,306

----------- -----------

15. Fair value gain / (loss) from derivative liability

Six months Six months

ended ended

30 June 30 June

2023 2022

US$'000 US$'000

Fair value gain / (loss) from derivative

liability 11,817 (7,637)

Total 11,817 (7,637)

----------- -----------

The Company has entered into three convertible equity facilities

with the ARC Fund. On 20 October 2021, the Company entered into the

first a convertible equity facility of up to ZAR 200 million ("ZAR

200 Million Equity Facility"). The second convertible equity

facility was entered into on 11 May 2022 of up to ZAR 177 million

("ZAR 177 Million Equity Facility"). On 14 November 2022, the

Company entered into its third conditional convertible equity

facility of up to ZAR 550 million ("ZAR 550 Million Equity

Facility.") with ARC Fund (refer to Note 10).

It was determined that the conversion option embedded in the

convertible debt equity facility be accounted for separately as a

derivative liability. Although the amount to be settled is fixed in

ZAR, when converted back to Kropz's functional currency will result

in a variable amount of cash based on the exchange rate at the date

of conversion. The value of the liability component and the

derivative conversion component was determined at the date of draw

down using a Monte Carlo simulation. The debt host liability was

bifurcated based on the determined value of the option.

Subsequently, the embedded derivative liability is adjusted to

reflect fair value at each period end with changes in fair value

recorded in profit and loss (refer to Note 21).

16. Impairment losses

The following impairment loss was recognised in the six-month

period ended 30 June 2022:

Six months Six months

ended ended

30 June 30 June

2023 2022

US$'000 US$'000

Property, plant, equipment and mine development

assets - 44,700

Total - 44,700

------------ -----------

A bi-annual impairment assessment was performed and it was

determined that no adjustment to the impairment provision for the

period to 30 June 2023 is required. The impairment loss for the

period to 30 June 2022 was recognised in relation to the

Elandsfontein mine. The triggers for the impairment test were

primarily related to the hard bank that was encountered in the pit,

which necessitated further drilling.

17. Taxation

Major components of tax charge Six months Six months

ended ended

30 June 30 June

2023 2022

US$'000 US$'000

Deferred

Originating and reversing temporary differences - -

Current tax

UK tax in respect of current period - -

----------- -----------

Total - -

----------- -----------

The Group had losses for tax purposes of approximately US$ 51.9

million (31 December 2022: US$ 57.5 million) which, subject to

agreement with taxation authorities, are available to carry forward

against future profits. A net deferred tax asset arising from these

losses has not been recognised as steady state production has not

been reached.

18. Earnings per share

The calculations of basic and diluted earnings per share have

been based on the following loss attributable to ordinary

shareholders and the weighted average number of ordinary shares

outstanding:

Six months Six months

ended ended

30 June 30 June

2023 2022

US$'000 US$'000

Profit / (Loss) attributable to ordinary

shareholders 1,518 (46,794)

Weighted average number of ordinary shares

in Kropz plc 926,718,223 920,069,356

Basic and diluted profit / (loss) per share

(US cents) 0.16 (5.09)

------------ ------------

19. Related party transactions

Details of share issues and shareholder loans are explained in

Notes 10 and 11. In addition, the following transactions were

carried out with related parties:

Related party balances

Loan accounts - Owed to related parties

30 June 31 December

2023 2022

US$'000 US$'000

Shareholder loans - ARC Fund 29,963 17,010

Convertible debt - ARC Fund 21,066 15,055

Derivative liability 15,166 23,037

Greenheart Foundation 714 510

--------- ------------

Total 66,909 55,612

--------- ------------

Related party balances

Interest paid to related parties

Six months Six months

ended ended

30 June 30 June

2023 2022

US$'000 US$'000

ARC Fund 4,271 1,215

----------- -----------

Total 4,271 1,215

----------- -----------

20. Seasonality of the Group's business

With the unexpected record rainfall experienced in the Western

Cape the mining plan was amended to consider higher rainfall in

winter periods to minimise the effects of wet mining conditions.

There are no other seasonal factors which materially affect the

operations of any company in the Group.

21. Fair value

The following table compares the carrying amounts and fair

values of the Group's financial assets and financial liabilities as

at 30 June 2023.

The Group considers that the carrying amount of the following

financial assets and financial liabilities are a reasonable

approximation of their fair value:

-- Trade receivables;

-- Trade payables;

-- Restricted cash; and

-- Cash and cash equivalents.

As at 30 June As at 31 December

2023 2022

Carrying Fair Carrying Fair

amount value amount value

US$'000 US$'000 US$'000 US$'000

Financial Assets

Other financial assets 783 783 860 860

Total 783 783 860 860

--------- --------- --------- ---------

Financial Liabilities

Shareholder loans 51,029 51,029 32,065 32,065

Derivative liability 15,166 15,166 23,037 23,037

Other financial liabilities 19,241 19,241 26,808 26,808

--------- --------- --------- ---------

Total 85,436 85,436 81,910 81,910

--------- --------- --------- ---------

This note provides an update on the judgements and estimates

made by the Group in determining the fair values of the financial

instruments.

(i) Financial instruments Measured at Fair Value

The financial instruments recognised at fair value in the

Statement of Financial Position have been analysed and classified

using a fair value hierarchy reflecting the significance of the

inputs used in making the measurements.

(ii) Fair value hierarchy

The fair value hierarchy consists of the following levels

-- Quoted prices in active markets for identical assets and liabilities (Level 1);

-- Inputs other than quoted prices included within Level 1 that

are observable for the asset or liability, either directly (as

prices) or indirectly (derived from prices) (Level 2); and

-- Inputs for the asset and liability that are not based on

observable market date (unobservable inputs) (Level 3).

Level Level Level

1 2 3 Total

US$'000 US$'000 US$'000 US$'000

30 June 2023

Derivative liability - - 15,166 15,166

---------- ---------- --------- ---------

31 December 2022

Derivative liability - - 23,037 23,037

---------- ---------- --------- ---------

There were no transfers between levels for recurring fair value

measurements during the year.

(iii) Reconciliation: Level 3 fair value measurement

Six months

ended Year ended

30 June 31 December

2023 2022

US$'000 US$'000

Derivative liability

Opening balance (23,037) (2,656)

Fair value at initial recognition (3,083) (31,852)

Fair value gain recognised in profit

and loss 11,817 10,807

Foreign exchange (863) 664

----------- -------------

Closing balance (15,166) (23,037)

----------- -------------

(iv) Valuation technique used to determine fair value

Derivative liability:

The fair value is calculated with reference to market rates

using industry valuation techniques and appropriate models from a

third-party provider. The Monte-Carlo model utilised includes a

high level of complexity and the main inputs are share price

volatility, risk margin, foreign exchange volatility and UK

risk-free rate. A number of factors are considered in determining

these inputs, including assessing historical experience but also

considering future expectations. The determined fair value of the

option is multiplied by the number of shares available for issue

pursuant to the ZAR 200 Million Equity Facility, ZAR 177 Million

Equity Facility and the ZAR 550 Million Equity Facility (refer to

Note 10).

Valuation results (as at 30 June 2023)

Total loan amount Value per Number of Total Value

Facility (ZAR) share (p) Shares (GBP)

----------------- ----------------- --------- ----------- ---------------

ZAR200m facility 200,000,000 1.18 219,272,938 2,594,239

ZAR177m facility 177,000,000 0.65 96,378,566 621,771

ZAR550m facility 542,500,000 1.51 578,445,513 8,744,119

----------------- ----------------- --------- ----------- ---------------

Total 894,097,017 11,960,129

----------------- ----------------- --------- ----------- ---------------

Sensitivity Valuation results (as at 30 June 2023) -

Volatility

Total Value

(GBP) -

100% Total Value

historical (GBP) - 50%

Base volatility volatility historical

Facility volatility

assumption (75%) (38%)

----------------- --------------- ----------- -----------

ZAR200m facility 63% 4,443,173 1,120,995

ZAR177m facility 63% 1,461,751 125.010

ZAR550m facility 63% 15,217,593 3,765,510

----------------- --------------- ----------- -----------

Total 21,122,517 5,011,515

----------------- --------------- ----------- -----------

Sensitivity Valuation results (as at 30 June 2023) - Risk

Margin

Total Value Total Value

Base risk margin (GBP) - 7% (GBP) - 3%

Facility assumption risk margin risk margin

----------------- ---------------- -------------- -----------

ZAR200m facility 5% 2,727,344 2,463,408

ZAR177m facility 5% 669,854 575,190

ZAR550m facility 5% 9,192,309 8,301,860

----------------- ---------------- -------------- -----------

Total 12,589,507 11,340,458

----------------- ---------------- -------------- -----------

Sensitivity Valuation results (as at 30 June 2023) - FX

volatility

Total Value Total Value

(GBP) -

20% (GBP) - 10%

Facility Base FX volatility FX volatility FX volatility

----------------- ------------------ ------------- -------------

ZAR200m facility 14% 2,367,251 2,755,410

ZAR177m facility 14% 530,650 687,339

ZAR550m facility 14% 7,982,928 9,265,707

----------------- ------------------ ------------- -------------

Total 10,880,829 12,708,456

----------------- ------------------ ------------- -------------

Sensitivity Valuation results (as at 30 June 2023) - UK

risk-free rate

Total Value Total Value

(GBP) - (GBP) - UK

UK rf rf

Base UK risk-free

Facility rate + 2% -2%

----------------- ----------------- ----------- -----------

ZAR200m facility 4.3% 2,727,344 2,463,408

ZAR177m facility 4.1% 669,854 575,190

zAR550m facility 3.6% 9,192,309 8,301,860

----------------- ----------------- ----------- -----------

Total 12,589,507 11,340,458

----------------- ----------------- ----------- -----------

22. Events after the reporting period

A further shipment and sale of 33,000 tonnes of phosphate

concentrate from Kropz Elandsfontein was recorded in July 2023 and

a further 30,900 tonnes in September 2023.

The fifth and final drawdown on the ZAR 285 million bridging

facility of ZAR 60 million was made on 17 August 2023.

As announced on 14 September 2023, Kropz, Kropz Elandsfontein

and ARC Fund agreed to further ZAR 250 million (approximately US$

13.2 million) bridge loan facilities ("Loan 2") to meet immediate

cash requirements at Kropz Elandsfontein. A first draw down of ZAR

155 million (approximately US$ 8 million) was made on 18 September

2023. The loan is unsecured, repayable on demand, with no fixed

repayment terms and is repayable by Kropz Elandsfontein on no less

than two business days' notice. Interest is payable on the Loan at

the South African prime overdraft interest rate plus 6%, nominal

per annum and compounded monthly. In the event that any amounts

outstanding under the Loan, together with interest thereon, is not

repaid within 6 months from the first utilisation date, the

interest rate will be increased with an additional 2%.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZGZLMRMGFZM

(END) Dow Jones Newswires

September 28, 2023 07:47 ET (11:47 GMT)

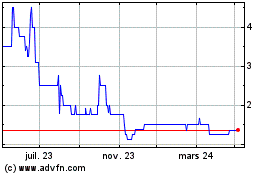

Kropz (LSE:KRPZ)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

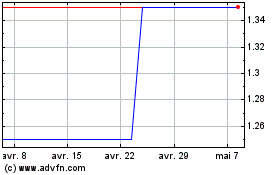

Kropz (LSE:KRPZ)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024