TIDMMAB1

RNS Number : 4645W

Mortgage Advice Bureau(Holdings)PLC

27 April 2016

Mortgage Advice Bureau (Holdings) plc

Not for publication, distribution or release directly or

indirectly, in whole or in part, into or in the United States

(including its territories and possessions, any state of the United

States and the District of Columbia) (the "United States"),

Australia, Canada, Japan, the Republic of South Africa or any other

jurisdiction in which offers for sale would be prohibited by

applicable law.

This announcement is not an offer to sell or a solicitation to

buy securities in any jurisdiction, including the United States,

Australia, Canada, Japan or the Republic of South Africa. Neither

this announcement nor anything contained herein shall form the

basis of, or be relied upon in connection with, any offer or

commitment whatsoever in any jurisdiction.

27 April 2016

Proposed secondary placing of existing ordinary shares in

Mortgage Advice Bureau (Holdings) plc ("MAB" or the "Company")

MAB announces today that it has been advised by certain

individual shareholders (and some of their respective spouses and

SIPPs) of the Company (the "Selling Shareholders"), including

certain board directors of the Company, of their intention to sell

up to 7,569,240 ordinary shares in the Company (the "Placing

Shares") via an accelerated bookbuild to institutional investors

(the "Placing"). This represents up to 15.0 per cent of the

Company's issued share capital.

Details of the maximum number of Placing Shares to be sold by

the Selling Shareholders are as follows:

Shareholding Maximum Resultant holding

pre-placing(1) number of assuming

Placing all Placing Shares

Shares to sold(1)

be sold

Selling Number Percentage Number Percentage

Shareholders of ordinary of issued of ordinary of issued

shares share shares share capital

capital

Peter Brodnicki(2) 18,126,400 35.92 4,015,490 14,110,910 27.96

David Preece(3) 2,574,800 5.10 1,050,000 1,524,800 3.02

Paul Robinson(4) 2,574,400 5.10 1,500,000 774,400 1.53

Michelle

Draycott 1,365,000 2.71 341,250 1,023,750 2.03

Simon Blunt 845,000 1.67 211,250 633,750 1.26

Richard

Palmer 844,000 1.67 211,000 633,000 1.25

Gareth Herbert 557,000 1.10 105,750 451,250 0.89

Simon A

Frankish 538,000 1.07 134,500 403,500 0.80

(1) Including those shares held by members of the shareholder's

family as defined in the AIM Rules for Companies and those held in

the Company's Share Incentive Plan.

(2) Peter Brodnicki also holds options over 325,000 ordinary shares.

(3) David Preece also holds options over 275,000 ordinary shares.

(4) Concurrently with completion of the Placing, Paul Robinson

intends to gift for nil consideration 300,000 ordinary shares in

the Company to a third party who does not constitute a family

member for the purposes of the AIM Rules and Paul Robinson will

therefore no longer have any disclosable interest in those ordinary

shares.

The Placing will be managed by Canaccord Genuity Limited as

joint bookrunner and settlement agent and Zeus Capital Limited as

joint bookrunner, together acting as the joint bookrunners (the

"Bookrunners"). The books for the Placing will open with immediate

effect and are expected to close no later than 4.30 p.m. on 27

April 2016. The timing of the closing of the books and the

distribution of allocations may be accelerated or delayed by the

Bookrunners at their discretion. The final number of Placing Shares

to be placed and the Placing price will be agreed by the

Bookrunners and the Selling Shareholders at the close of the

bookbuild process, and the results of the Placing will be announced

as soon as practicable thereafter.

Prior to the close of the bookbuild process, Peter Brodnicki

intends to gift for nil consideration 676,000 ordinary shares in

the Company, representing approximately 1.34 per cent. of the

issued share capital of the Company, to his wife, Stephanie

Brodnicki. All of these shares are intended to be sold in the

Placing.

Proposed grant of options

The Company intends to grant options to Peter Brodnicki and

David Preece (as well as other proposed recipients who are not

Selling Shareholders, including Lucy Tilley who is a director)

pursuant to its executive share plan. It is intended that each of

Peter Brodnicki, David Preece and Lucy Tilley will be granted

options to the value of twice their basic salary at the prevailing

market price at the time of such grant of options. These options

will be subject to performance conditions based on total

shareholder return and earnings per share criteria and are expected

to be exercisable after 3 years from grant in normal circumstances.

They will thus have a different vesting profile to the options

granted at the time of the Company's IPO in November 2014.

Concert Party membership

As disclosed in the Company's Admission Document, dated 11

November 2014, Peter Brodnicki, Paul Robinson, David Preece and

Michelle Draycott (together with their respective connected

persons) were treated as persons acting in concert for the purposes

of the City Code (the "Concert Party"). It has been accepted by the

Takeover Panel that Michelle Draycott should no longer be treated

as acting in concert with Peter Brodnicki, David Preece and Paul

Robinson and, accordingly, she no longer forms part of the Concert

Party.

Lock-in

The Selling Shareholders have agreed with the Bookrunners

(subject to certain limited exceptions including transfers to

connected persons (within the meaning of section 252 of the

Companies Act 2006) or to trustees for their benefit and disposals

by way of acceptance of a recommended takeover offer for the entire

issued share capital of the Company) not to directly or indirectly,

dispose or agree to dispose of any remaining shares (or any

economic interest in them) held or controlled by them for a period

of 12 months from the completion of Placing without the prior

written consent of the Bookrunners.

Enquiries:

Mortgage Advice Bureau (Holdings) plc +44 (0)1332 525007

Peter Brodnicki, Chief Executive Officer

David Preece, Chief Operating Officer

Lucy Tilley, Finance Director

Zeus Capital +44 (0)20 3829 5000

Martin Green

Nicholas How

Mike Cuthbert

Benjamin Robertson

Pippa Underwood

Canaccord Genuity +44 (0)20 7523 8350

Roger Lambert

Kit Stephenson

Richard Andrews

Media Enquiries:

investorrelations@mab.org.uk

MEMBERS OF THE GENERAL PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN

THE PLACING. THIS ANNOUNCEMENT AND ANY OFFER OF SECURITIES TO WHICH

IT RELATES ARE ONLY ADDRESSED TO AND DIRECTED AT (1) IN ANY MEMBER

STATE OF THE EUROPEAN ECONOMIC AREA, PERSONS WHO ARE QUALIFIED

INVESTORS WITHIN THE MEANING OF ARTICLE 2(1)(E) OF EU DIRECTIVE

2003/71/EC AND ANY RELEVANT IMPLEMENTING MEASURES (THE "PROSPECTUS

DIRECTIVE"); AND (2) IN THE UNITED KINGDOM, PERSONS WHO (I) HAVE

PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS WHO FALL

WITHIN ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000

(FINANCIAL PROMOTION) ORDER 2005 (AS AMENDED) (THE "ORDER"); OR

(II) FALL WITHIN ARTICLE 49(2)(A) TO (D) OF THE ORDER; OR (III) ARE

PERSONS TO WHOM AN OFFER OF THE PLACING SHARES MAY OTHERWISE

LAWFULLY BE MADE (ALL SUCH PERSONS REFERRED TO IN (1) AND (2)

TOGETHER BEING REFERRED TO AS "RELEVANT PERSONS"). THE INFORMATION

REGARDING THE PLACING SET OUT IN THIS ANNOUNCEMENT MUST NOT BE

ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. ANY

INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS ANNOUNCEMENT

RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED

IN ONLY WITH RELEVANT PERSONS.

This announcement does not constitute an offer to sell, or a

solicitation of an offer to buy, securities in the United States.

Securities may not be offered or sold in the United States absent

(i) registration under the U.S. Securities Act of 1933, as amended

(the "Securities Act") or (ii) an available exemption from

registration under the Securities Act. The Placing Shares may not

be offered or sold in the United States unless registered under the

Securities Act or offered in a private transaction exempt from, or

not subject to, the registration requirements of the US Securities

Act and the securities laws of any relevant state or other

jurisdiction of the United States. The Placing Shares will not be

offered to the public in the United States.

This announcement and the information contained herein is for

information purposes only and does not constitute or form part of

any offer of, or the solicitation of an offer to acquire or dispose

of securities in Australia, Canada, Japan, the Republic of South

Africa or in any other jurisdiction in which such an offer or

solicitation is unlawful.

The Placing Shares have not been, and will not be, registered

under the applicable securities laws of any state or other

jurisdiction of Australia, Canada, Japan or the Republic of South

Africa. There will be no public offering of the Placing Shares in

Australia, Canada, Japan or the Republic of South Africa or

elsewhere.

(MORE TO FOLLOW) Dow Jones Newswires

April 27, 2016 02:01 ET (06:01 GMT)

No prospectus or offering document has been or will be prepared

in connection with the Placing. Any investment decision to buy

securities in the Placing must be made solely on the basis of

publicly available information. Such information is not the

responsibility of and has not been independently verified by the

Selling Shareholders, Canaccord Genuity Limited or Zeus Capital

Limited or any of their respective affiliates.

Neither this announcement nor any copy of it may be taken,

transmitted or distributed, directly or indirectly, in or into or

from the United States, Australia, Canada, Japan or the Republic of

South Africa. Any failure to comply with this restriction may

constitute a violation of United States, Australian, Canadian,

Japanese or South African securities laws.

The distribution of this announcement and the offering or sale

of the Placing Shares in certain jurisdictions may be restricted by

law. No action has been taken by the Selling Shareholders,

Canaccord Genuity Limited or Zeus Capital Limited, or any of their

respective affiliates that would, or which is intended to, permit a

public offer of the Placing Shares in any jurisdiction or

possession or distribution of this announcement or any other

offering or publicity material relating to the Placing Shares in

any jurisdiction where action for that purpose is required. Persons

into whose possession this announcement comes are required by the

Selling Shareholders, Canaccord Genuity Limited and Zeus Capital

Limited to inform them about and to observe any applicable

restrictions.

Canaccord Genuity Limited and Zeus Capital Limited, who are

regulated by the Financial Conduct Authority in the United Kingdom,

are acting exclusively on behalf of the Selling Shareholders and no

one else in connection with any offering of the Placing Shares and

will not be responsible to anyone other than the Selling

Shareholders for providing the protections offered to the clients

of Canaccord Genuity Limited and Zeus Capital Limited, nor for

providing advice in relation to the Placing or any matters referred

to in this announcement.

This announcement has been issued by, and is the sole

responsibility of, the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by

Canaccord Genuity Limited or Zeus Capital Limited or by any of

their affiliates or agents as to, or in relation to, the accuracy

or completeness of this announcement or any other written or oral

information made available to or publicly available to any

interested party or their advisers, and any liability therefore is

expressly disclaimed.

This document includes statements that are, or may be deemed to

be, forward-looking statements. These forward-looking statements

may be identified by the use of forward-looking terminology,

including the terms "intends", "expects", "will", or "may", or, in

each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives,

goals, future events or intentions. These forward-looking

statements include all matters that are not historical facts. Any

forward-looking statements are subject to risks relating to future

events and assumptions relating to MAB's business, in particular

from changes in political conditions, economic conditions, evolving

business strategy, or the mortgage intermediary industry. No

assurances can be given that the forward-looking statements in this

document will be realised. As a result, no undue reliance should be

placed on these forward-looking statements as a prediction of

actual results or otherwise.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLIFSESVIDFIR

(END) Dow Jones Newswires

April 27, 2016 02:01 ET (06:01 GMT)

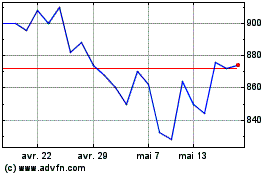

Mortgage Advice Bureau (... (LSE:MAB1)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Mortgage Advice Bureau (... (LSE:MAB1)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024