TIDMMAB1

RNS Number : 1039T

Mortgage Advice Bureau(Holdings)PLC

23 March 2021

MORTGAGE ADVICE BUREAU (HOLDINGS) PLC

("MAB", or "the Company", or "the Group")

23 March 2021

Final Results for the year ended 31 December 2020

Mortgage Advice Bureau (Holdings) PLC (AIM: MAB1.L) is pleased

to announce its final results for the year ended 31 December

2020.

Financial highlights

-- Revenue up 3% to GBP148.3m (2019: GBP143.7m), including

GBP14.7m of revenue generated by First Mortgage Direct

Limited ("First Mortgage")

-- Gross profit up 9% to GBP39.8m (2019: GBP36.4m)

-- Gross profit margin up 6% to 26.9% (2019: 25.3%)

-- Adjusted overheads ratio(1) of 14.5% (2019: 12.4%)

-- Adjusted profit before tax(2) down 5% to GBP17.8m (2019:

GBP18.7m)

-- Statutory profit before tax down 16% to GBP14.9m (2019:

GBP17.7m)

-- Adjusted profit before tax margin(2) of 12.0% (2019:

13.0%)

-- Reported profit before tax margin of 10.0% (2019: 12.3%)

-- Adjusted(2) EPS down 5% to 28.6p (2019: 30.1p)

-- Basic EPS down 16% to 23.7p (2019: 28.2p)

-- Continued high operating profit to adjusted cash conversion(3)

of 112% (2019: 119%)

-- Proposed final dividend of 19.2p (payout ratio of 75%

on adjusted profit after tax(2) ), making proposed total

dividends for the year of 25.6p (2019: 17.5p)

Operational highlights

-- Adviser numbers up 8% to 1,580(4) at 31 December 2020

(2019: 1,457), including 97 Advisers at First Mortgage

(2019: 82)

-- Average number of active Advisers(5) during the period

up 9% to 1,455 (2019: 1,341), and up 6% to 1,374 excluding

First Mortgage

-- Market share of new mortgage lending up 11% to 6.3% (2019:

5.7%)

-- Gross mortgage completions (including product transfers)

up 5% to GBP17.6bn (2019: GBP16.7bn)

-- Product transfer completions up 50% to GBP2.3bn (2019:

GBP1.5bn)

-- Revenue per active Adviser down 5%(6) , following housing

market shutdown in Q2 2020

-- GBP12m Revolving Credit Facility repaid in full

-- Government grant income of GBP0.5m from CJRS repaid in

full in December 2020

-- Australian Finance Group Ltd (ASX: AFG) becomes our new

joint venture partner in Australia

-- Acquisition of a 40% stake in our leading new build Appointed

Representative, Meridian Holdings Group Ltd ("Meridian")

-- Launch of "MAB Later Life", a leading new proposition

in the specialist later life lending market

Post year end

-- Very strong pipeline of written business and Adviser

recruitment

-- 1,637 Advisers as at 19 March 2021(4) , u p 4% since

year end

-- Acquisition of a 25% stake in M & R FM Ltd ("FM North

East") by First Mortgage

Peter Brodnicki, Chief Executive, commented on the 2020

results:

"These results once again demonstrate the resilience of our

operating model and the quality and dedication of our management

team and staff during a year of exceptional challenges. We took

quick and decisive action in response to the pandemic that resulted

in us not only coming through an incredibly difficult period in

great shape and ensuring that our 2020 strategic objectives were

met, but also putting ourselves in a strong position to start

accelerating growth over the next few years.

"In a market where gross new mortgage lending was down 9% on

prior year, our revenue grew by 3% to GBP148.3m and our mortgage

completions grew by 5% to GBP17.6bn. Our market share of new

mortgage lending increased 11% to 6.3%, thereby delivering our

strategy to achieve year-on-year growth, irrespective of prevailing

market conditions. Adviser numbers were up 8% to 1,580(4) by 31

December 2020.

"Despite the impact of the pandemic, our profitability and cash

generation profile remained strong, which enabled us to reimburse

all the Government furlough grant income received. Accordingly, we

are pleased to propose a final dividend of 19.2 pence per share, in

line with our policy of paying out a minimum of 75% of adjusted

earnings, making total proposed dividends for the year of 25.6

pence per share. This includes the 6.4 pence per share 'catch up'

interim dividend paid in December 2020."

Current trading and outlook

Despite the UK being in lockdown since the start of the current

year, activity levels have remained strong in terms of both written

business and Adviser recruitment. The Intermediary Mortgage Lenders

Association's ("IMLA") current estimate of gross new mortgage

lending for 2021, published in January 2021, is GBP283bn,

representing a 16% increase on 2020 (GBP243bn) and a 6% increase

compared to 2019 (GBP268bn).

The underlying fundamentals driving levels of consumer demand

for housing are strong. This level of demand, coupled with the

Chancellor's announcement earlier this month of the launch of a

"Mortgage Guarantee Scheme", an extension of the Stamp Duty holiday

until the end of June and the nil rate band being doubled until the

end of September, give us understandable optimism about the year

ahead, and what can be expected when restrictions are lifted.

Our strategy of consistent investment in people, technology and

extension of our business model, has put MAB in a strong position

to start accelerating growth over the next few years . Current

trading is in line with the Board's expectations.

(1) MAB uses adjusted results as key performance indicators as

the Directors believe that these provide a more consistent measure

of operating performance by adjusting for acquisition related

charges and significant one-off or non-cash items. Adjusted

overheads ratio in 2020 is stated before GBP0.4m amortisation of

acquired intangibles (2019: GBP0.2m) and GBP0.9m (2019: GBP0.4m) of

additional non-cash operating expenses relating to the put and call

option agreement to acquire the remaining 20% of First Mortgage. In

2019 GBP0.4m of one-off acquisition costs associated with First

Mortgage were also adjusted.

(2) Adjusted profit before tax is stated before the items in (1)

above and the loan write off and loan provision totalling GBP1.7m.

Adjusted earnings per share is also stated before these items, net

of any associated tax effects.

(3) Adjusted cash conversion is cash generated from operating

activities adjusted for movements in non-trading items, including

loans to AR firms and associates totalling GBP(1.5)m in 2020 (2019:

GBP0.9m) and increases in restricted cash balances of GBP0.5m in

2020 (2019: GBP2.2m), as a percentage of adjusted operating

profit.

(4) Includes the Advisers of a firm previously authorised under

an Appointed Representative agreement with MAB until 7 December

2020. MAB continues to provide services to this firm, now directly

authorised by the FCA.

(5) An active Adviser is an Adviser who had not been furloughed

and was therefore able to write business.

(6) Based on average number of active Advisers.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 ("MAR").

For further information please contact:

Mortgage Advice Bureau (Holdings) Plc Tel: +44 (0) 1332 525007

Peter Brodnicki - Chief Executive Officer

Ben Thompson - Deputy Chief Executive Officer

Lucy Tilley - Chief Financial Officer

Numis Securities Limited Tel: +44 (0)20 7260 1000

Stephen Westgate / Hugo Rubinstein / Laura White

Media Enquiries: investorrelations@mab.org.uk

Analyst presentation

There will be an analyst presentation via conference call to

discuss the results at 9:30am today.

Those analysts wishing to attend are asked to contact

investorrelations@mab.org.uk

Copies of this announcement are available at

www.mortgageadvicebureau.com/investor-relations.

Chief Executive's Review

Overview of 2020

I am very pleased with MAB's performance in 2020 given the

challenges presented by the pandemic. We continued to grow revenue,

mortgage completions, and market share, building on our consistent

track record of delivering growth. Once again, we comprehensively

outperformed both the UK housing and the new mortgage lending

markets.

Despite ongoing restrictions on lending and everyday life, new

business levels built up quickly from the start of summer,

resulting in a strong H2 2020 for written business. Although the

start of this new financial year saw the introduction of a very

tough third lockdown, housing and mortgage activity has held up

well. The underlying fundamentals driving levels of consumer demand

for housing are strong. This level of demand, coupled with the

Chancellor's announcements earlier this month of the launch of a

"Mortgage Guarantee Scheme", an extension of the Stamp Duty holiday

until the end of June and the nil rate band being doubled until the

end of September, and the signposted easing and removal of lockdown

restrictions, are likely to improve housing activity further.

Our growth in mortgage completions is set out below:

2020 2019 Increase

GBPbn GBPbn

New mortgage lending 15.3 15.2 +1%

-------- -------- ----------

Product Transfers 2.3 1.5 +50%

-------- -------- ----------

Gross mortgage lending 17.6 16.7 +5%

-------- -------- ----------

MAB's total gross mortgage completions (including Product

Transfers) increased by 5% to GBP17.6bn (2019: GBP16.7bn). Gross

mortgage completions excluding Product Transfers increased by 1% to

GBP15.3bn (2019: GBP15.2bn). This increase, together with the

contraction in overall new mortgage lending volumes in the UK, led

to an 11% increase in our share of UK new mortgage lending to 6.3%

(2019: 5.7%). Product Transfers increased by 50% to GBP2.3bn due to

the lending restrictions on re-mortgages during the year. Group

revenue increased by 3% to GBP148.3m, including GBP14.7m of revenue

generated by First Mortgage, and saw a 1% decrease excluding First

Mortgage. This growth was achieved in a year when the first

national lockdown closed the housing market in England for almost

two months and the markets in Scotland, Wales and Northern Ireland

for three months.

In terms of market environment, we saw a buoyant first quarter

resulting from the lift in consumer confidence post the December

2019 UK General Election, but then transaction volumes reduced

significantly as a result of the housing market shutdown in Q2

2020, with year-on-year drops in gross new mortgage lending and

housing transactions for the quarter of 32% and 47% respectively.

Q3 2020 mortgage completions continued to be impacted despite the

reopening of the housing market due to pipeline conversion

timeframes. However in Q4 2020, the continuing recovery translated

into a 5% increase year-on-year in gross new mortgage completions,

driven by the house purchase segment.

Overall for 2020, UK gross new mortgage lending activity fell by

9% to GBP243.1bn (2019: GBP267.9bn(1) ), excluding product

transfers. UK housing transactions fell by 11% over the same

period. MAB significantly outperformed the market in all four

quarters of the year.

We also achieved excellent progress on our strategic

initiatives. The campaigns we rolled out in support of our

Appointed Representative (" ARs") and their Advisers to ensure

opportunities were maximised during and after the housing market

shutdown were incredibly well received, and further cemented our

close relationships with our ARs.

Progression of our technology initiatives was a priority

throughout the period, thereby ensuring that investment in key

projects relating to increased operational efficiency, lead

generation and productivity continued to be delivered to plan. The

pandemic also triggered additional technology requirements,

enhancements and new growth initiatives. We strongly believe that

this is the time to continue investing in new technology and

extending our business model to fully leverage our leading

proposition and deliver operational efficiency.

Our recruitment of ARs and Advisers resumed at pace after the

housing market reopened and throughout the second half of the year.

By 31 December 2020, our total Adviser count stood at 1,580(2) , an

8% increase on last year, despite the very limited recruitment

achieved during the national lockdown in Q2 2020. Our recruitment

pipeline remains very healthy, and as at 19 March 2021 our Adviser

numbers had grown to 1,637(2) .

In terms of broadening our addressable market, 2020 was also a

year of significant progress, with the launch of MAB Later Life, a

new best-in-class proposition for brokers in the high growth later

life segment, in partnership with Key Group. We are also delighted

to have announced our new joint venture partner in Australia,

Australian Finance Group Ltd, helping us to accelerate the rollout

of our leading distribution and advice model in Australia.

During the year, we continued to strengthen our management team

with the addition of a Chief Commercial Officer, a new Chief

Information Officer, a Head of Partnerships, and a Head of Digital

Transformation. These are all key new roles that will help us to

achieve our growth ambitions, providing specific focus on lead

generation, the performance of our investments, and the delivery of

our technology developments.

I am proud of the way in which we have supported our staff, our

ARs and their Advisers, and our customers during exceptionally

difficult times. The health, safety and wellbeing of our employees

has been and continues to be our top priority, and I am

exceptionally grateful for their hard work and dedication. The

campaigns we launched to help support new and existing clients in

addressing the financial challenges brought about by the pandemic

were also extremely well received, including our National Mortgage

Information Support Service campaign.

As a result of strong written business in H2 2020, it was with

great satisfaction that the Board was able to approve the repayment

in full of all the precautionary pay cuts applied in Q2 2020, as

well as the Government furlough grants. In December 2020, the Group

also repaid the GBP12m Revolving Credit Facility in full, and paid

the 6.4 pence per share "catch-up" dividend to shareholders.

Delivering our strategy

We believe that the significant and ongoing investment being

made in the team, technology and infrastructure, combined with

maturing and new growth drivers, put MAB in a strong position to

capitalise on additional opportunities for continued and increased

levels of growth, as well as deliver operational leverage.

Clearly, increasing Adviser numbers remains a key growth driver,

and we do not expect that to change in the medium term. In fact,

our strategic initiatives are enhancing our proposition still

further and as a result are impacting positively on Adviser and AR

recruitment.

Recruitment of Advisers

The pandemic presented many challenges to MAB in 2020. During

the first national lockdown in Q2 2020, our ARs immediately put

their recruitment plans on hold which affected our organic growth

in Adviser numbers.

Since the housing market re-opened in England in mid May 2020

and then in Scotland, Wales and Northern Ireland at the end of June

2020, there has been a sharp recovery in written business. This in

turn meant that our recruitment activity also picked up strongly,

as our ARs grew increasingly confident and started strengthening

their teams again. This trend has continued for the remainder of

2020 and into 2021 despite continued social mobility

restrictions.

Despite the many challenges, the Group is pleased to report an

8% growth in new Advisers to 1,580(2) (2019: 1,457). The average

number of active Advisers(3) for 2020 rose from 1,341 to 1,455, an

increase of 9% (6% excluding First Mortgage).

We have seen the pipeline of new ARs build strongly. However,

since MAB's AR recruitment is mainly focused on larger ARs, given

the restrictions that have been in place for large parts of 2020

and since the beginning of the year, some of these discussions have

been delayed, and are unable to conclude at present. When

restrictions are lifted, we expect these discussions can be quickly

concluded.

Technology

We are very pleased with the progress we made in the last year.

The rollout of our new technology platform started in 2020 and

continues into 2021.

During the first national lockdown in 2020 we needed to

prioritise IT resource to focus on providing new solutions for the

various challenges that remote working presented at the time, and

as a result, new technology initiatives were and continue to be

implemented.

We also chose to bring forward the transformation of our risk

and compliance technology. This decision was made to support and

enable secure communication and the transfer of confidential

personal documents between customers and MAB, at a time when all

customer interaction had instantly become remote, as opposed to

face to face. We also further developed and successfully deployed

our proprietary risk management platform, to enable managers and

business owners to better identify and manage any potential

compliance risks, whilst working entirely remotely. In addition, we

integrated our MIDAS Pro platform with new and more secure payment

collection technology, again supporting remote working and ensuring

adherence to new and heightened regulatory requirements.

Our focus is now firmly on completing the platform rollout and

continuing to add many new features and improved functionality such

as our new lead management platform.

We are also excited to have established our new relationship

with the technology firm MQube, to explore the practical

applications of machine learning and artificial intelligence for

mortgages. The actual process of applying for a mortgage today

could be greatly simplified and made more efficient, benefitting

both the Adviser and customer. Through this new relationship, we

will be leveraging MQube's expertise and investment in data, to

help us to deliver efficiencies that benefit all stakeholders in

the mortgage process, including lenders.

Our plans to increase Adviser efficiency and productivity also

include the integration with lenders, however progression on that

front has been slower than we had hoped. This was solely due to the

impact of the pandemic and the entirely unforeseen operational

strain it placed on lenders. Towards the end of the year, we

completed our first full integration with a top ten lender. We have

now also seen integration become an urgent priority for lenders,

particularly as some of their operational strain has become more

manageable and they recognise the need to deliver new processes

that can be more operationally resilient and efficient in the

future. We expect more top ten lenders to follow in 2021.

Our digital plans will deliver enhanced customer engagement,

optimise existing income streams, generate new lead flow and

revenue, as well as service customers through the digital channels

they are choosing to use. For MAB and its ARs, it will also result

in greater efficiencies and better decisions informed by data. New

data and technology-enabled products and business models can change

the dynamics of our sector, which is why we remain of the view that

market leading technology combined with our unique business model

will further enhance MAB's competitive advantage.

Lead Generation

We expect our lead generation strategy to become a major new

contributor to MAB's growth plans. Although MAB AR firms have

typically sourced, acquired and serviced customers largely or

wholly through their own contacts and relationships (for example

through local estate agents or builders), MAB will now be playing

an increasingly important role in adding to that lead flow.

Reliability, quality and scalability of lead flow drives every

aspect of Adviser and firm performance, and MAB's unique business

model is key to our ability to drive meaningful lead flow through

our partner firms.

This strategy will in turn increase Adviser productivity, drive

organic Adviser growth and AR firm recruitment, and further enhance

consumer brand awareness.

Investment continues to be made in technology, extending our

business model and increased specialisation in our marketing team

in order to support this strategy, with further equity investment

also expected in distribution and strategically important lead

sources.

During the pandemic more customers have been forced to research

and transact digitally. The progress we have made over the last two

years, and in particular over the last 12 months, has positioned

the business well in this regard. This means making faster progress

using data and technology to significantly increase the number of

lead sources. This will increase the number of customers we engage

with, how and when we engage, and widen the range of products and

services that are offered to those customers. The development of

our new lead management platform will allow us to fully leverage

our unique business model and deliver this strategy.

Early customer capture is core to our strategy, and since the

year end MAB has secured contracts with two high profile brands in

line with that strategy, namely Moneybox, and the soon to launch

property portal, Boomin.

Moneybox, which is a saving and investing app, has launched its

app-integrated mortgage service, offering customers a simple way to

find the best mortgage for them supported by a telephone advice

team. Already helping hundreds of thousands of customers save for

their first home through its popular Lifetime ISAs and other

products, Moneybox now wants to help people on the next step of

their journey to home ownership and has partnered with MAB to do

so.

Boomin, the next generation property site, is partnering with

MAB to provide mortgage services across various parts of its

platform. Boomin will offer something different and will not only

appeal to the millions of home-movers in the UK with its unique

features but also to the much bigger passive audience of customers

who are early in their journey, looking for inspiration and who

have a deeper interest in everything property. MAB will be able to

connect with this audience earlier and in a more meaningful and

varied way and offer them a more integrated and seamless experience

as they move from passive to active.

Another new development is the launch of MAB's Home Buying Buddy

app as part of our strategic partnership with Life Moments, a

fintech business whose digital coaching technology engages and

nurtures consumers to achieve their life goals. The app is designed

to help existing and future customers develop a clear and informed

plan for the purchase of their home, as well as address the growing

complexity of the home buying landscape.

This strategic partnership seeks to empower consumers to better

understand financial products and equip MAB with customer insights

to inform future proposition development. This is major step

forward in terms of how we can further engage with our customers

and offer a more personalised experience. It allows us to deliver

tangible value to the customer from the early stages of their

research process and home buying journey. It is a great example of

how through collaborating with mission-aligned firms, we can help

more of our customers play life better.

As customers adapt and change how they research and buy mortgage

products and services, MAB plans to be firmly at the forefront of

this change, making lead generation a clear priority, thereby

ensuring the Group's future growth and success.

Larger Addressable Market

The Group's core market, comprising of people actively moving

home or re-financing, remains buoyant, with significant and

long-term upside growth potential for MAB. There are however other

addressable markets for MAB to extend into, and these opportunities

further support our lead generation strategy.

Firstly, there are tenants or younger people living at home with

their family, many of whom aspire to become homeowners for the

first time. Identifying and supporting future first time buyers to

become mortgage and purchase ready is an important strategic

priority for MAB, with much of that strategy achievable by

leveraging the extensive lettings, estate agency, and new build

distribution we have in the Group.

Broadening our addressable market to include products for the

over 55s is also an important part of our strategy, and towards the

end of 2020 we were delighted to launch MAB Later Life, an

exclusive strategic alliance with Key Group that provides brokers

with a best-in-class proposition in the specialist later life

market. Although the UK has remained almost entirely in lockdown

since then, we are pleased with the progress we have made.

The later life market is underpinned by strong factors such as

pension under-provision and the need for long term care and estate

planning. It also extends to cover products that are suitable for

people coming off interest only mortgages, as well as older

borrowers wanting to provide inter-generational support for their

families.

This is an important growth segment for MAB and is highly

intermediated, with customers needing comprehensive advice from

specialist brokers, and we aim to continue our learning and growth

in this market through 2021 and beyond.

Future first-time buyers and later life are just two elements of

our strategy to broaden our addressable market, and our continued

investment in the future of our digital strategy will allow MAB to

further leverage its unique business model. This will not only

drive new lead sources to our AR firms, but also generate new

income opportunities from future and existing mortgage

customers.

To support our plans to widen our customer offering, we will be

launching Be Money Sure as an additional consumer brand for all

non-mortgage related sales. The brand will be introduced to

existing customers as we extend the products and services that we

are able to offer them, but it will also be utilised with customers

we capture earlier in the mortgage research process, that may

consider our extended offering to be of more immediate

interest.

Investment Strategy

The Group continues to make strategic investments:

- to help existing or new distribution partners to accelerate their growth plans;

- to accelerate MAB's lead generation strategy; and

- to establish or enhance MAB's specialisms in key market segments (for example, new homes).

In October 2020, we completed a 40% investment in Meridian

Holdings Group Ltd ("Meridian"), our leading new build AR. Meridian

has a key role to play in our plans to achieve even stronger market

share growth in this specialist sector. In March 2021, Meridian

agreed to acquire Metro Finance Brokers Ltd, a leading shared

ownership firm based in Sheffield. This is an excellent strategic

fit for Meridian, with a complementary client base and route to

markets.

In Australia, Australian Finance Group Ltd ("AFG") has become

our new joint venture partner for MAB Broker Services Pty Ltd,

helping us to accelerate the rollout of our leading distribution

and advice model in Australia. Listed on the Australian Stock

Exchange, AFG is a leading mortgage network in Australia with

extensive distribution channels and a strong broker proposition.

This is an exciting development and a real step-change for our

Australian operations, that will allow us to attract the best

brokers into our differentiated model.

In January 2021, First Mortgage acquired a minority stake in M

& R FM Ltd ("First Mortgage North East"), a successful and

fast-growing broker based in Gateshead. Previously directly

authorised by the FCA, First Mortgage North East operated under the

First Mortgage franchise. This is the first investment by First

Mortgage as it seeks to leverage its strengths under MAB ownership

and further enhance its track record of profitable growth.

New Board appointment

On 1 March 2021, Mike Jones joined MAB as a Non-Executive

Director, having recently retired from Lloyds Banking Group. Mike's

leadership, vision and strategic thinking at the UK's leading

lender has shaped the intermediary and lending markets that exist

today. His appointment strengthens our Board and is a testament to

our huge ambition.

Summary

In a year of unprecedented challenges, MAB again delivered

growth in revenue, Adviser numbers, mortgage completions and market

share. One year after the onset of Covid-19, MAB has emerged a

stronger group, having continued to invest in its growth strategy,

including adapting and evolving its technology and lead generation

initiatives.

We are very pleased with our new investments, especially

considering the restrictions imposed over this period, as well as

with the performance and resilience of the majority of our existing

investments, which we expect to perform more strongly in 2021. As

previously highlighted, future investments and potential

acquisitions will include distribution and lead sources that we

believe are strategically important and scalable.

We have entered 2021 with a number of ongoing investment

discussions, which form part of our plans to fully leverage our

unique business model, and by doing so to start accelerating future

profit and market share growth over the next few years. This will

strengthen our market leading position still further.

Our new platform developments are a key enabler of our growth

plans and will deliver significant benefits in terms of our lead

generation strategy and operational efficiencies for MAB, its ARs,

Advisers and their customers.

We are delighted to have launched MAB Later Life, and in AFG we

have secured an exceptionally strong partner for MAB in Australia,

and we look forward to reporting success from there in due

course.

Broadening our addressable market extends our reach to a greater

number and wider profile of future customers and lead sources, and

supports our strategy of Adviser and productivity growth.

The pandemic and the successive lockdowns have brought about a

change in consumer sentiment, resulting in a greater focus and

prioritisation towards spending on current and new homes, and most

relevantly stimulating a greater number of home moves. This is

bolstered by the pent-up demand that built pre the General Election

in 2019 and only partially contributed to growth in 2020 due to

lockdown restrictions.

Looking ahead, we are confident that these key fundamentals

supporting the housing market combined with the return of greater

numbers of new mortgage products and less stringent lending

criteria, will lead to demand for housing remaining strong. Over

and above this, the recent Budget announcement and the Government's

housing policy will also prove positive for MAB.

Our maturing and new growth drivers, combined with the

significant investment continuing to be made in exceptionally high

calibre management, resource, and technology, put MAB in a very

strong position to start accelerating growth over the next few

years.

We look forward to what we hope are better times ahead for

everyone.

(1) UK Finance regularly updates its estimates. MAB previously

reported GBP267.6bn for 2019 but this figure has slightly increased

since.

(2) Includes the Advisers of a firm previously authorised under

an Appointed Representative agreement with MAB until 7 December

2020. MAB continues to provide services to this firm, now directly

authorised by the FCA.

(3) An active Adviser is an Adviser who had not been furloughed

and was therefore able to write business.

Market Review

After a buoyant Q1 2020 which saw a 4% year-on-year increase in

gross new mortgage lending after a lift in consumer confidence

following the December 2019 UK General Election, transaction

volumes plummeted when the housing market shut down in Q2 2020,

with gross new mortgage lending and housing transactions down 32%

and 47% respectively.

Q3 2020 remained heavily impacted despite the reopening of the

housing market due to pipeline conversion timeframes, with gross

new mortgage lending and housing transactions down 14% and 16%

respectively. However, the last quarter of the year rebounded well

with a 5% year-on-year increase in gross new mortgage

completions.

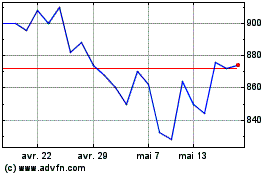

Overall for 2020, gross new mortgage lending activity fell by 9%

to GBP243.1bn (2019: GBP267.9bn(1) ), excluding product transfers.

UK housing transactions fell by 11% over the same period, with

monthly transactions shown in the graph below. Provisional figures

from HM Revenue & Customs show a 17% year-on-year increase in

property transactions in Q4 2020.

http://www.rns-pdf.londonstockexchange.com/rns/1039T_2-2021-3-22.pdf

Source: HM Revenue and Customs

In terms of segmental breakdown of gross new mortgage lending,

the purchase market was hit the hardest during the housing market

shutdown. During this time, there was a 46% drop in purchase

lending activity in Q2 2020, followed by a sharp return to growth

in Q4 2020 with a 28% year-on-year increase. UK quarterly house

price inflation(2) of 4% and 3% in the third and fourth quarters

respectively contributed to this growth. Overall, for the year,

house price inflation was c.9%, with the increase in average house

price in 2020 being c.3% higher than in 2019.

Re-financing activity held up better during the property

shutdown, partially driven by the strength in Product Transfers.

However, in both Q3 and Q4 2020, Home-owner and Buy-to-Let

re-mortgage lending values continued to experience year-on-year

decreases as the purchase segment dominated the market, which is

illustrated on the graph below. Product Transfers represented

GBP168bn of mortgage lending in 2020, a 1% increase compared to

2019.

http://www.rns-pdf.londonstockexchange.com/rns/1039T_1-2021-3-22.pdf

Source: UK Finance Regulated Mortgage Survey (excludes product

transfers with the same lender), Bank of England, UK Finance BTL

data (used for further analysis)

The pandemic has made it much more complex for people to obtain

a new mortgage. Lenders have struggled with significant operational

challenges, including the high number of payment holidays taken up

by borrowers and the need to consistently apply tight and

restrictive lending policies. Consumer reliance on mortgage

intermediaries therefore has increased, with intermediary market

share strengthening as a result. Approximately 79% of UK mortgage

transactions (excluding buy to let, where intermediaries have a

higher market share, and Product Transfers where intermediaries

have a lower market share) were via an intermediary in 2020 (2019:

77%). In addition, execution-only sales by lenders have not

meaningfully progressed during this period.

In response to the crisis, the Government and the Bank of

England announced a strong package of temporary measures in support

of both mortgage lenders and borrowers, including reduced capital

buffer requirements for banks. The Bank of England's base rate, cut

to a record low of 0.1% in March 2020, has stayed at the same level

since that date.

The increase in the stamp duty threshold, which took effect in

July 2020, has further supported the housing market recovery, as

have the Government's broader measures supporting housing

investment and the continued availability of the Help to Buy Equity

Loan and Shared Ownership schemes.

We remain confident that the fundamentals of house purchase

demand remain strong and are further supported by the launch of a

Mortgage Guarantee Scheme and extension of Stamp Duty relief

announced in the Budget earlier this month. The Intermediary

Mortgage Lenders Association's ("IMLA") current estimate of gross

new mortgage lending for 2021 (published in January 2021 before the

Budget announcement in March 2021) is GBP283bn, representing a 16%

increase compared to 2020 and a 6% increase compared to 2019. In

addition, we anticipate that the increased average pipeline

conversion timeframes that we have seen over the last year and has

pushed completions into 2021, will revert to usual timescales by

the end of the year.

(1) UK Finance regularly updates its estimates. MAB previously

reported GBP267.6bn for 2019 but this figure has slightly increased

since

(2) Land Registry House Price Index

Financial review

We measure the development, performance and position of our

business against a number of key indicators.

http://www.rns-pdf.londonstockexchange.com/rns/1039T_3-2021-3-22.pdf

Revenue

Group revenue increased by 3% to GBP148.3m (2019: GBP143.7m),

including GBP14.7m of revenue generated by First Mortgage.

Excluding First Mortgage, Group revenue decreased by 1%. Strong

growth in Q1 2020 was offset by the adverse impact of the first

national lockdown on Q2 and Q3 2020 revenue, followed by a

significant recovery in Q4 2020 where the housing market remained

open during the second national lockdown. Normally, a key driver of

revenue is the average number of Advisers during the year. However,

in Q2 and Q3 2020 certain ARs furloughed a number of their Advisers

(albeit a smaller number in Q3), and therefore the average numbers

of active Advisers(1) is a more appropriate figure during this

pandemic affected year. The housing market closure during the first

national lockdown adversely impacted active Adviser(1)

productivity, resulting in a GBP2.0m (1%) reduction in organic

revenue for the year.

In Q1 2020, revenue was up 25% on the prior year (14% excluding

First Mortgage), with average Adviser numbers up 19% (13% excluding

First Mortgage) and average revenue per Adviser up 5% (1% excluding

First Mortgage), reflecting the start of the impact of improving

market conditions and change in customer sentiment post the UK

General Election, as well as the success of our growth

strategy.

This trend was reversed in Q2 2020 as the adverse impact of the

first national lockdown on mortgage completions started to bite,

with revenue down 14% (22% excluding First Mortgage) compared to

the prior year. Average active Adviser(1) numbers were up 7% (1%

excluding First Mortgage) and average revenue per active Adviser(1)

decreased by 19% (23% excluding First Mortgage).

In Q3 2020, as a result of lower written house purchase business

in Q2 2020, and despite the considerable increase in written house

purchase activity in Q3 2020, revenue was down 7% on the prior year

(which included First Mortgage from Q3 2019 onwards) despite

average active Advisers being up 2% with average revenue per active

Adviser(1) decreasing by 9%.

Q4 2020 saw a marked increase in completions resulting from the

increase in written business activity in Q3 2020 and revenue was up

12% on the prior year with average Advisers up 7%; with average

revenue per Adviser up by 4%.

The Group continued to generate revenue from three core areas,

summarised as follows:

Group Excluding First

Mortgage

Income source 2020 2019 Change 2020 2019 Change

% %

------- ------- -------- ------- ------- --------

GBPm GBPm GBPm GBPm

------- ------- -------- ------- ------- --------

Mortgage Procuration Fees 67.2 64.3 +4 61.2 60.6 +1

------- ------- -------- ------- ------- --------

Protection and General Insurance

Commission 58.8 56.2 +5 50.8 52.3 -3

------- ------- -------- ------- ------- --------

Client Fees 19.0 20.2 -6 19.0 20.2 -6

------- ------- -------- ------- ------- --------

Other Income 3.3 3.0 +10 2.6 2.5 +1

------- ------- -------- ------- ------- --------

Total 148.3 143.7 +3 133.6 135.6 -1

------- ------- -------- ------- ------- --------

Despite the adverse impact of the pandemic on Q2 and Q3 2020

revenue, all key income sources for the Group, other than client

fees, continued to grow due to the positive contribution from First

Mortgage, which is summarised as follows:

Income source 2020 2 July Increase,

2019 - %

31 Dec

2019

GBPm GBPm

------ ---------- -----------

Mortgage procuration fees 6.0 3.8 +61

------ ---------- -----------

Protection and General Insurance

Commission 8.0 3.9 +105

------ ---------- -----------

Other Income 0.7 0.4 +72

------ ---------- -----------

Total 14.7 8.1 +81

------ ---------- -----------

Following H1 2020, when we saw a higher proportion of

refinancing business as lockdown severely restricted the completion

of purchase transactions in Q2, the mortgage mix mostly rebalanced

for the year overall due to the considerable increase in house

purchase activity in H2 2020, though we did have a higher

proportion of Product Transfers than in the prior year. Mortgage

procuration fees for the Group increased by 4% with mortgage

completions up 5% overall for the year, with Product Transfers

typically generating a lower procuration fee than purchase

mortgages and re-mortgages.

Excluding First Mortgage, gross mortgage completions increased

by 3% with mortgage procuration fees increasing by 1% primarily due

to the increased proportion of Product Transfers.

The increase of 5% in protection and general insurance

commission for the Group reflects the impact of the First Mortgage

acquisition and associated revenue synergies with procuration fees

up 4% and mortgage completions up 5% for the year. For the Group

excluding First Mortgage, protection and general insurance

commission decreased by 3% with a 1% increase in procuration fees

as Advisers focused on mortgages for purchase business in H2 2020

and protection sales also have a natural lag in terms of timing of

commission payment.

Client fees reduced by 6% in the year resulting from more

business being conducted remotely and the increase in Product

Transfers as a proportion of the mortgage mix, leading to a

reduction in the overall attachment rate of client fees for MAB

excluding First Mortgage, which does not charge client fees.

First Mortgage, which only started to contribute to Group

revenue in H2 2019, was impacted by a longer lockdown in Scotland

in Q2 2020. As a result, First Mortgage's contribution to Group

revenue increased by 81% to GBP14.7m with procuration fees up 61%

and protection and general insurance commission up 105% reflecting

in particular the product related synergies that the Group started

to benefit from in the latter part of H2 2019.

MAB's revenue, in terms of proportion, is split as follows:

Income source 2020 2019

Mortgage Procuration Fees 45% 45%

------ ------

Protection and General Insurance

Commission 40% 39%

------ ------

Client Fees 13% 14%

------ ------

Other Income 2% 2%

------ ------

Total 100% 100%

------ ------

Despite the fluctuation in mortgage mix during the year

resulting from the pandemic, the only notable change to the overall

mix for the year was an increase in Product Transfers. The slight

increase in the proportion of protection and general insurance

commission reflects the additional revenue synergies achieved in

First Mortgage. As anticipated, the proportion of client fees has

reduced following the acquisition of First Mortgage who do not

charge client fees, but the reduction in attachment rate of client

fees resulting from more business being conducted remotely has also

added to this. We expect client fees to become increasingly

dependent upon the type and complexity of the mortgage transaction,

as well as the delivery channel. This will lead to a broader spread

of client fees on mortgage transactions, which, by their nature,

are our lowest margin revenue stream.

Government grant income

Government grant income of GBP0.5m was received during the year

due to some employees being placed on furlough during the months of

April, May and June 2020. These amounts were repaid in full in

December 2020.

Gross profit margin

As anticipated, gross profit margin increased to 26.9% (2019:

25.3%) due to a full year of contribution from First Mortgage,

which has a higher gross margin of c.65% due to its Advisers being

directly employed. Excluding First Mortgage, gross profit margin

remained broadly stable at 22.7% (2019: 23.1%). The Group typically

receives a slightly reduced margin (revenue share) as its existing

ARs grow their revenue organically through increasing their Adviser

numbers. In addition, larger new ARs typically join the Group on

lower than average margins due to their existing scale and hence we

expect to see a degree of erosion of our underlying gross profit

margin due to the continued growth of our existing ARs and the

addition of new larger ARs.

MAB continues to provide services to a firm previously

authorised under an Appointed Representative agreement until 7

December 2020 but now directly authorised by the FCA. As a result,

going forward, the fees received by MAB will represent the total

income received by MAB in respect of this arrangement. No

commission will be paid out by MAB to this firm as it receives its

income direct. The effect of this will be to marginally increase

the gross profit margin going forward.

Overheads

Overheads increased by GBP3.8m to GBP22.7m, reflecting the full

year impact of the acquisition of First Mortgage which increased

overheads for the year by GBP2.7m. In addition there was an

increase of GBP0.5m in MAB (excluding First Mortgage) overheads and

a further GBP0.6m increase relating to a full year of the

amortisation of acquired intangibles and non-cash operating

expenses relating to the put and call option agreement to acquire

the remaining 20% of First Mortgage.

Adjusted(2) overheads as a percentage of revenue were 14.5%

(2019: 12.4%). The anticipated increase in overheads as a

percentage of revenue, due to the full year impact of First

Mortgage's operating model having a higher overheads ratio than

MAB, was exacerbated by curtailed growth in revenue as a result of

the pandemic with Group overhead savings not fully offsetting this.

Excluding First Mortgage, adjusted(2) overheads as a percentage of

revenue were 11.9% (2019: 10.8%).

MAB has been investing in its technology platform and extending

its business model and continues to do so. All development work on

MIDAS Pro platform is expensed. In addition, MAB continues to

invest in its marketing team to drive lead generation

opportunities.

Our FCA and FSCS regulatory fees and charges are usually closely

correlated to growth in revenue. Previously, in 2019 MAB had

benefitted from a reduction in its FSCS levies due to its

protection and general insurance commission moving from the Life

and Pensions Intermediation funding class of the FSCS (which had

borne increasing levies in recent years, primarily due to pension

transfer and self-invested personal pension (SIPP) related advice

claims in the wider market) to the General Insurance Distribution

funding class. In January 2021, the FSCS published its Plan and

Budget for 2021/22, which indicated that the 'retail pool'

contribution from both Home Finance Intermediation and General

Insurance Distribution will be substantially higher than in the

prior year, due to increased business failures as a result of the

pandemic, an increase in complex pension advice claims and further

failures of SIPP operators. As a result, MAB expects its FSCS levy

cost for the year ended 31 December 2021 to be c. GBP1.5m higher

than in the prior year. The reaction of other mortgage

intermediaries to this unfair allocation of levies has been widely

reported and MAB is supporting the challenge by the Association of

Mortgage Intermediaries (AMI), the trade association that

represents the views and interests of UK mortgage brokers, so that

future levies can become better signposted and fairer.

Despite this headwind, MAB continues to benefit from the

scalable nature of the remainder of its cost base, where those

costs typically rise at a slower rate than revenue, which will, in

part, counter the expected erosion of MAB's underlying gross margin

as the business continues to grow.

Associates

MAB's share of profits from associates was GBP0.04m (2019:

GBP0.3m). In addition, during the period MAB wrote off the GBP1.1m

loan balance due from Freedom 365 Mortgage Solutions Limited due to

the adverse impact of the pandemic on its financial results. MAB

has also made a provision of GBP0.6m against the full balance of

the loan due from Eagle & Lion Limited and reduced the value of

the investment in The Mortgage Broker Group Limited by GBP0.5m to

reflect the fair value carrying amount of the investment.

The remainder of the Group's associates have performed well

during the pandemic and whilst their profits in 2020 were adversely

impacted, they are in a strong position to contribute positively to

the Group's results in 2021. MAB considers that the value of a

number of these investments exceeds their balance sheet value as

accounted for using the equity accounting method under IAS 28.

Profit before tax and margin thereon

In a year heavily affected by the pandemic, adjusted(3) profit

before tax decreased by 5% to GBP17.8m (2019: GBP18.7m), with the

margin thereon decreasing to 12.0% (2019: 13.0%). Statutory profit

before tax reduced to GBP14.9m (2019: GBP17.7m) with the margin

thereon being 10.0% (2019: 12.3%).

Finance revenue

Finance income of GBP0.1m (2019: GBP0.1m) reflects continued low

interest rates and interest income accrued on loans to associates.

Finance expense of GBP0.2m (2019: GBP0.1m) reflects the interest

payable on MAB's Revolving Credit Facility of GBP12m, (drawn down

in full at the end of March) and interest expenses on lease

liabilities. MAB repaid its GBP12m Revolving Credit Facility in

full on 23 December 2020.

Taxation

The effective rate of tax reduced to 14.2% (2019: 16.8%),

principally due to the deduction arising from the exercise of

employee share options being higher than in the prior year. We

expect our effective tax rate to continue to be marginally below

the prevailing UK corporation tax rate, subject to tax credits for

MAB's research and development expenditure on the continued

development of MIDAS Pro platform, MAB's proprietary software,

still being available and further tax deductions arising from the

exercise of employee share options.

Earnings per share and dividend

Adjusted(3) earnings per share decreased by 5% to 28.6 pence

(2019: 30.1 pence). Basic earnings per share decreased by 16% to

23.7 pence (2019: 28.2 pence).

The Board is pleased to propose a final dividend of 19.2 per

share (2019: 6.4 pence), which represents a cash outlay of

GBP10.2m. Following payment of the dividend, the Group will retain

significant surplus regulatory reserves. The proposed final

dividend represents circa 75% of the Group's adjusted(4) post-tax

and minority interest profits for 2020 and reflects our ongoing

intention to distribute excess capital in line with our previously

announced dividend policy.

The record date for the final dividend will be 30 April 2021 and

the payment date 28 May 2021. The ex-dividend date will be 29 April

2021.

Cash flow and cash conversion

The Group's operations produce positive cash flow. This is

reflected in the net cash generated from operating activities of

GBP17.8m (2019: GBP20.4m).

Headline cash conversion(5) was:

2020 115%

2019 131%

-----------------

Adjusted cash conversion(6) was:

2020 112%

-----------------

2019 119%

-----------------

The Group's operations are capital-light, with the most

significant ongoing capital investment being in computer equipment.

Only GBP0.3m of capital expenditure on office and computer

equipment was required during the year (2019: GBP0.2m). Group

policy is not to provide company cars, and no other significant

capital expenditure is foreseen in the coming year. All development

work on MIDAS Pro platform is treated as expenditure.

The Group had no bank borrowings on 31 December 2020 (2019:

GBPnil). The Group had unrestricted bank balances of GBP18.6m on 31

December 2020 (31 December 2019: GBP7.0m).

The Group has a regulatory capital requirement amounting to 2.5%

of regulated revenue. On 31 December 2020 this regulatory capital

requirement was GBP3.4m (31 December 2019: GBP3.1m), with the Group

having a surplus of GBP17.7m (31 December 2019: GBP11.7m).

The following table demonstrates how cash generated from

operations was applied:

GBPm

Unrestricted bank balances at the beginning of the year 7.0

Cash generated from operating activities excluding movements in restricted balances and dividends

received from associates 21.4

Issue of shares 4.3

Dividends received from associates 0.2

Dividends paid (6.7)

Dividends paid to minority interest (0.1)

Tax paid (4.4)

Investment in associates (2.3)

Net interest paid and principal element of lease payments (0.5)

Capital expenditure (0.3)

Unrestricted net bank balances at the end of the year 18.6

---------------------------------------------------------------------------------------------------- -------

(1) An active Adviser is an Adviser who had not been furloughed

and was therefore able to write business.

(2) Adjusted for GBP0.4m (2019: GBP0.2m) of amortisation of

acquired intangibles and GBP0.9m (2019: GBP0.4m) of additional

non-cash operating expenses relating to the put and call option

agreement to acquire the remaining 20% of First Mortgage. 2019 also

excludes one-off costs associated with the acquisition of First

Mortgage of GBP0.4m

(3) Adjusted for the items in (2) above and the loan write off

and loan provision totalling GBP1.7m. Adjusted earnings per share

is also stated before these items, net of any associated tax

effects.

(4) Adjusted for non-cash First Mortgage acquisition related

items of GBP1.2m (2019: GBP0.6m).

(5) Headline cash conversion is cash generated from operating

activities adjusted for movements in non-trading items, including

loans to AR firms and associates totalling GBP(1.5)m in 2020 (2019:

GBP0.9m), as a percentage of adjusted operating profit.

(6) Adjusted cash conversion is headline cash conversion

adjusted for increases in restricted cash balances of GBP0.5m in

2020 (2019: GBP2.2m) as a percentage of adjusted operating

profit.

Independent auditor's report to the members of Mortgage Advice

Bureau (Holdings) PLC

Opinion on the financial statements

In our opinion:

-- the financial statements give a true and fair view of the

state of the Group's and of the Parent Company's affairs as at 31

December 2020 and of the Group's profit for the year then

ended;

-- the Group financial statements have been properly prepared in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006;

-- the Parent Company financial statements have been properly

prepared in accordance with United Kingdom Generally Accepted

Accounting Practice; and

-- the financial statements have been prepared in accordance

with the requirements of the Companies Act 2006.

We have audited the financial statements of Mortgage Advice

Bureau (Holdings) PLC (the 'Parent Company') and its subsidiaries

(the 'Group') for the year ended 31 December 2020 which comprise

the consolidated statement of comprehensive income, consolidated

and company statement of financial position, consolidated and

company statement of changes in equity, consolidated statement of

cash flows, and notes to the financial statements, including a

summary of significant accounting policies. The financial reporting

framework that has been applied in the preparation of the Group's

financial statements is applicable law and international accounting

standards in conformity with the requirements of the Companies Act

2006. The financial reporting framework that has been applied in

the preparation of the Parent Company's financial statements is

applicable law and United Kingdom Accounting Standards, including

Financial Reporting Standard 102 The Financial Reporting Standard

in the United Kingdom and Republic of Ireland (United Kingdom

Generally Accepted Accounting Practice).

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide

a basis for our opinion.

Independence

Following the recommendation of the Audit Committee we were

appointed by the Board to audit the financial statements for the

year ended 31 December 2020 and subsequent financial periods., In

respect of the year ended we were appointed at the Annual General

Meeting on 26 May 2020 to audit the financial statements for the

year ended 31 December 2020. The period of total uninterrupted

engagement is 7 years, covering the years ended 31 December 2014 to

31 December 2020.

We remain independent of the Group and the Parent Company in

accordance with the ethical requirements that are relevant to our

audit of the financial statements in the UK, including the FRC's

Ethical Standard as applied to listed entities, and we have

fulfilled our other ethical responsibilities in accordance with

these requirements.

The non-audit services prohibited by that standard were not

provided to the Group or the Parent Company.

Conclusions relating to going concern

In auditing the financial statements, we have concluded that the

Directors' use of the going concern basis of accounting in the

preparation of the financial statements is appropriate. Our

evaluation of the Directors' assessment of the Group's ability to

continue to adopt the going concern basis of accounting

included:

-- In evaluating whether the Group is a going-concern, we have

assessed the reasonableness of the assumptions within management's

forecast for liquidity and profitability for a period of 12 months

from the signing of these accounts, agreeing back to supporting

evidence. This involved considering the base and stress scenarios

testing undertaken by management to support the Going concern

assessment which included assumptions about the potential impact

this could have on revenue (mainly from purchase mortgages) and

possible cost saving measures. We focused on the cash and capital

position during this period.

-- We have also searched publicly available information on house

market and house price index to assess any impact on the Group's

business.

-- We enquired with management and assessing the implications of COVID-19 on the business

Based on the work we have performed, we have not identified any

material uncertainties relating to events or conditions that,

individually or collectively, may cast significant doubt on the

Group's ability to continue as a going concern for a period of at

least twelve months from when the financial statements are

authorised for issue.

Our responsibilities and the responsibilities of the Directors

with respect to going concern are described in the relevant

sections of this report.

Overview

Key audit matters 2020 2019

Revenue Recognition P P

Clawback Provision P P

Carrying value P P

of loans to associates

and joint ventures

Going concern O P

Acquisition of O P

First Mortgage

Direct Limited

(FMD)

The acquisition of FMD is no longer considered

to be a key audit matter because the acquisition

and the related acquisition accounting occurred

in 2019. Going concern is no longer considered

a key audit matter as there is no significant

risk identified from the Group's ability to

continue as a going concern.

Materiality Group financial statements as a whole

GBP804,000 (2019: GBP885,000) based on 5%

(2019: 5%) of Profit before tax, over a 3

year average (2019 - based on standalone year).

----------------------------------------------------

An overview of the scope of our audit

Our Group audit was scoped by obtaining an understanding of the

Group and its environment, including the Group's system of internal

control, and assessing the risks of material misstatement in the

financial statements. We also addressed the risk of management

override of internal controls, including assessing whether there

was evidence of bias by the Directors that may have represented a

risk of material misstatement.

The audit of the Group was conducted by BDO LLP directly at

Group level as all transactions are recorded in a common accounting

system, except for those of First Mortgage Direct Limited, which

has been consolidated within the Group. A full scope audit was

carried out in respect of First Mortgage Direct Limited. The audit

of the Group and all entities were conducted by the Group audit

team.

Key audit matters

Key audit matters are those matters that, in our professional

judgement, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) that we identified, including those which had the greatest

effect on: the overall audit strategy, the allocation of resources

in the audit, and directing the efforts of the engagement team.

These matters were addressed in the context of our audit of the

financial statements as a whole, and in forming our opinion

thereon, and we do not provide a separate opinion on these

matters.

Key audit matter How the scope of our audit

addressed the key audit matter

Revenue Recognition The Group's revenue We responded to this risk

comprises of commissions by performing the following

Management's (including procuration procedures:

associated fees), client fees * We tested that revenue is recognised in line with

accounting and other income. Group approved policies that are in accordance with

policies Revenue recognition accounting standards.

are detailed is considered to be

on page 27. a significant audit

risk as it is a key * We tested the operating effectiveness of the

driver of return to reconciliation controls in place between revenue and

investors and there cash banked and agreed back to third party reports.

is a risk that there

could be manipulation

or omission of amounts * For commission income we obtained the third party

recorded in the system. reports and tested a sample back to cash receipts.

* Using third party reports, we recalculated all the

procuration fees independently.

* For other income we agreed a sample to third party

statements and cash receipts.

* We agreed a sample of other income to third party

support

* We vouched a sample of revenue to third party reports

and bank to check that they have been accounted in

the proper period and considered the reasonableness

of assumptions used within the analysis.

Key observations:

Based on these procedures

we consider revenue to have

been recognised appropriately

in line with accounting standards.

------------------------------ --------------------------------------------------------------

Clawback The clawback provision We responded to this risk

provision relates to the estimated by performing the following

value of repaying procedures:

Management's commission received * We compared the relevant assumptions e.g. unearned

associated up front on life assurance commission, likely future lapse rates and lapse rate

accounting policies that may history used in the model with third party reports.

policies lapse in a period

are detailed of up to four years

on page 56 following inception * For other assumptions e.g. age profile of the

with detail of the policies. commission received, the Group's share of any

about judgements The clawback provision clawback, and the success of the Appointed

in applying is considered a significant Representatives in preventing lapses and/or

accounting audit risk due to generating new income at the point of a lapse, we

policies the management judgement validated these to management's supporting analysis

and critical and estimation applied of the Group's actual experience.

accounting in calculating the

estimates provision and we therefore

on page 32 considered this to * We tested the arithmetical accuracy of the

. a key audit matter. spreadsheet model.

* We agreed inputs back to supporting documentation.

Key observations:

Based on the procedures undertaken

we consider the judgments

and estimates made by management

in calculating the clawback

provision to be reasonable.

------------------------------ --------------------------------------------------------------

Carrying The group has granted We responded to this risk

value of loans to its associates. by performing the following

loans to These loans are held procedures:

associates at amortised cost.

Management's The carrying value * We checked that the classification of the loans to

associated of loans to associates associates was in line with the requirements of IFRS

accounting is considered a significant 9 by checking that they meet the requirements to be

policies risk due to the judgements held at amortised cost.

are detailed and estimates used

on page 25 by management in the

& 26 with preparation of the * We reviewed loan agreements to test for any movement

detail about expected credit loss in loan balances in the year.

judgements model as required

in applying by accounting standards.

accounting * We reviewed the Expected Credit Loss model in respect

policies of the loans to associates and checked if this is in

and critical compliance with accounting standards, which involved:

accounting

estimates

on page 51.

* Agreeing the key inputs to managements analysis and

where relevant external specific loan documentation,

including the level of credit risk, stage allocation,

exposure at default, probability of default and loss

given default; and

* Performing sensitivity analysis on the probability of

defaults and the credit risk staging.

Key observations:

There were no matters arising

from performing these procedures.

------------------------------ --------------------------------------------------------------

Our application of materiality

We apply the concept of materiality both in planning and

performing our audit, and in evaluating the effect of

misstatements. We consider materiality to be the magnitude by which

misstatements, including omissions, could influence the economic

decisions of reasonable users that are taken on the basis of the

financial statements.

We apply the concept of materiality both in planning and

performing our audit, and in evaluating the effect of

misstatements. We consider materiality to be the magnitude by which

misstatements, including omissions, could influence the economic

decisions of reasonable users that are taken on the basis of the

financial statements.

In order to reduce to an appropriately low level the probability

that any misstatements exceed materiality, we use a lower

materiality level, performance materiality, to determine the extent

of testing needed. Importantly, misstatements below these levels

will not necessarily be evaluated as immaterial as we also take

account of the nature of identified misstatements, and the

particular circumstances of their occurrence, when evaluating their

effect on the financial statements as a whole.

Based on our professional judgement, we determined materiality

for the financial statements as a whole and performance materiality

as follows:

Group financial statements Parent company financial statements

2020 2019 2020 2019

GBPm GBPm GBPm GBPm

--------------- -------------- -------------------- -------------------

Materiality GBP804,000 GBP885,000 GBP223,000 GBP191,000

--------------- -------------- -------------------- -------------------

Basis for 5% of profit before 5% of net assets

determining tax (2020 - 3 year

materiality average, 2019 - standalone

year)

------------------------------- -----------------------------------------

Rationale Selected as our benchmark Given that the entity is a

for the as the entity is listed holding company, it is appropriate

benchmark with profitability to determine materiality based

applied seen as the main interest off of net assets.

of investors.

------------------------------- -----------------------------------------

Performance 75% of materiality 75% of materiality

materiality 2020 - GBP603,000 2020 - GBP167,000 (2019 -GBP143,000)

(2019 - GBP664,000)

------------------------------- -----------------------------------------

Basis for Lower level of materiality Lower level of materiality

determining applied in performance applied in performance of the

performance of the audit when audit when determining the

materiality determining the nature nature and extent of testing

and extent of testing applied to individual balances

applied to individual and classes of transactions.

balances and classes

of transactions.

------------------------------- -----------------------------------------

Component materiality

The materiality used for the audit of First Mortgage Direct

Limited as a component of the Group has been set at GBP109,000

(2019 - GBP117,000), calculated on the same bases as at the group

above.

Reporting threshold

We agreed with the Audit Committee that we would report to them

all individual audit differences in excess of GBP16,000 (2019:

GBP17,000) for the Group and GBP4,000 (2019: GBP5,000) for the

parent company. We also agreed to report differences below this

threshold that, in our view, warranted reporting on qualitative

grounds.

Other information

The directors are responsible for the other information. The

other information comprises the information included in the report

and financial statements, other than the financial statements and

our auditor's report thereon. Our opinion on the financial

statements does not cover the other information and, except to the

extent otherwise explicitly stated in our report, we do not express

any form of assurance conclusion thereon. Our responsibility is to

read the other information and, in doing so, consider whether the

other information is materially inconsistent with the financial

statements or our knowledge obtained in the course of the audit, or

otherwise appears to be materially misstated. If we identify such

material inconsistencies or apparent material misstatements, we are

required to determine whether this gives rise to a material

misstatement in the financial statements themselves. If, based on

the work we have performed, we conclude that there is a material

misstatement of this other information, we are required to report

that fact.

We have nothing to report in this regard.

Other Companies Act 2006 reporting

Based on the responsibilities described below and our work

performed during the course of the audit, we are required by the

Companies Act 2006 and ISAs (UK) to report on certain opinions and

matters as described below.

Strategic In our opinion, based on the work undertaken

report and in the course of the audit:

Directors' * the information given in the Strategic report and the

report Directors' report for the financial year for which

the financial statements are prepared is consistent

with the financial statements; and

* the Strategic report and the Directors' report have

been prepared in accordance with applicable legal

requirements.

In the light of the knowledge and understanding

of the Group and Parent Company and its environment

obtained in the course of the audit, we have

not identified material misstatements in the

Strategic report or the Directors' report.

Matters on We have nothing to report in respect of the following

which we matters in relation to which the Companies Act

are required 2006 requires us to report to you if, in our

to report opinion:

by exception * adequate accounting records have not been kept by the

Parent Company, or returns adequate for our audit

have not been received from branches not visited by

us; or

* the Parent Company financial statements are not in

agreement with the accounting records and returns; or

* certain disclosures of Directors' remuneration

specified by law are not made; or

* we have not received all the information and

explanations we require for our audit.

------------------------------------------------------------------------

Responsibilities of Directors

As explained more fully in the Directors' responsibilities

statement, the Directors are responsible for the preparation of the

financial statements and for being satisfied that they give a true

and fair view, and for such internal control as the Directors

determine is necessary to enable the preparation of financial

statements that are free from material misstatement, whether due to

fraud or error.

In preparing the financial statements, the Directors are