TIDMMAB1

RNS Number : 7119A

Mortgage Advice Bureau (Hldgs) PLC

27 September 2022

MORTGAGE ADVICE BUREAU (HOLDINGS) PLC

("MAB" or "the Group")

27 September 2022

Interim Results for the six months ended 30 June 2022

Mortgage Advice Bureau (Holdings) Plc (AIM: MAB1.L) is pleased

to announce its interim results for the six months ended 30 June

2022.

Financial highlights

H1 2022 H1 2021 Change vs

2021

Revenue GBP96.5m GBP92.4m +4%

--------- --------- ----------

Gross profit GBP25.4m GBP24.6m +3%

--------- --------- ----------

Gross profit margin 26.4% 26.7% -0.3pp(1)

--------- --------- ----------

Adjusted overheads ratio(2) 14.7% 14.8% -0.1pp(1)

--------- --------- ----------

Adjusted profit before tax(3) GBP11.5m GBP11.6m -

--------- --------- ----------

Statutory profit before tax GBP10.1m GBP10.8m -6%

--------- --------- ----------

Adjusted profit before tax

margin(3) 12.0% 12.5% -0.5pp(1)

--------- --------- ----------

Adjusted profit before tax

as a percentage of net revenue(4) 39% 41% -2pp(1)

--------- --------- ----------

Reported profit before tax

margin 10.5% 11.7% -1.2pp(1)

--------- --------- ----------

Adjusted(3) EPS 16.4p 17.9p -8%

--------- --------- ----------

Basic EPS 14.0 p 16.5p -15%

--------- --------- ----------

Operating profit to adjusted

cash conversion(5) 124% 120% +4pp(1)

--------- --------- ----------

Interim dividend(6) 13.4p 13.4p -

--------- --------- ----------

Operational highlights

-- Adviser numbers up 8% to 2,034 (7) at 30 June 2022 (31

December 2021: 1,885)

-- Average number of mainstream advisers(8) up 19% to 1,890

(H1 2021: 1,584)

-- Revenue per mainstream adviser down 13%(9) with pipelines

taking longer to convert and against a very strong comparative

in H1 2021 as a result of stamp duty holiday changes

accelerating house purchase mortgage completions in that

year

-- Gross mortgage completions (including product transfers)

up 11% to GBP12.2bn (H1 2021: GBP11.0bn)

-- Gross new mortgage completions (excluding product transfers)

up 7% to GBP10.3bn (H1 2021: GBP9.6bn)

-- Market share of new mortgage lending up 13% to 6.8% (H1

2021: 6.0% (10) )

-- Proportion of revenue from re-financing at 30 % (H1 2021:

24%)

Post period end

-- Completed the acquisition of The Fluent Money Group,

which is transformational for the Group's lead generation

strategy

-- Increased stake in leading protection and general insurance

advice firm Vita Financial Ltd from 49% to 75%

-- 2,160(7) advisers at 23 September 2022, including 156(11)

advisers from The Fluent Money Group

Peter Brodnicki, Chief Executive, commented:

"This is a strong set of results when compared to the

exceptional results reported for the same period last year,

particularly given the increasingly difficult macro environment

that developed during the period. I am especially pleased that we

have delivered a large gain in market share during the first

half.

"The integration of Fluent is progressing very well. Lead flow

has been growing strongly, ahead of our expectations, and we expect

it to continue to do so despite the purchase market starting to

slow. Accordingly, recruiting new advisers to ensure this strong

consumer demand is met remains a high priority for Fluent.

"The well documented congestion of property and mortgage

pipelines has resulted in transactions taking a month longer to

complete than in H1 2021, with the anticipated improvement still to

materialise. A more cautious market outlook typically leads to

broker firms seeking a partner that can help them optimise income

and support continued business growth. Our pipeline of new

appointed representatives ("AR") and adviser recruitment remains

strong, and MAB is well positioned to attract those firms focused

on achieving growth in an increasingly challenging economic

climate."

Current Trading and Outlook

Due to extended completion timeframes, the Group started the

second half with a pipeline of written new business that was over

30% higher than expected, allowing for adviser growth, compared to

the start of the year. Re-financing activity continues to increase,

as advisers, lenders, and customers focus on making the most of

securing new mortgage deals as mortgage rates rise. Whilst consumer

demand has cooled a little, housing transaction levels are expected

to remain steady. It remains clear that those who have built up

strong savings and equity over recent years are sufficiently well

positioned and confident to move home. In addition, mortgage

lenders are well capitalised with ample liquidity, meaning product

availability and price competition for mortgages is very strong

despite the increasing interest rate environment. In this

increasing interest rate environment, advisers have experienced

constant change in mortgage products as well as short notice

withdrawal of those products, and we expect this to continue whilst

interest rate uncertainty continues.

A continuation of slow pipeline conversion, a further softening

of purchase activity, and an increasingly cautious approach to

recruitment by some ARs is likely to lead to a slight reduction in

the Group's financial result for the year against previous

expectations.

We expect the recent mini budget to support the housing and

mortgage markets. The Stamp Duty changes that help aspiring first

time buyers are particularly welcome, demonstrating the

Government's ongoing commitment towards maintaining a healthy and

active housing market.

We were delighted to complete the acquisition of The Fluent

Money Group on 12 July 2022. The acquisition is expected to be

significantly earnings accretive in 2023 and will allow the

enlarged Group to rapidly benefit from a far greater level of

national lead generation. Since Q2 2022, Fluent has delivered

faster than expected lead growth in its mortgage division,

requiring additional investment in the recruitment of new advisers

and associated administrative staff to handle the strong consumer

demand. This reinforces our confidence in the outlook for 2023 and

beyond.

For further information please contact:

Mortgage Advice Bureau (Holdings) Plc Tel: +44 (0) 1332 525007

Peter Brodnicki - Chief Executive Officer

Ben Thompson - Deputy Chief Executive Officer

Lucy Tilley - Chief Financial Officer

Numis Securities Limited Tel: +44 (0)20 7260 1000

Stephen Westgate / Giles Rolls

Media enquiries: investor.relations@mab.org.uk

Analyst presentation

There will be an analyst presentation to discuss the results at

9:30am today.

Those analysts wishing to attend are asked to contact

investor.relations@mab.org.uk

Copies of this interim results announcement are available at

www.mortgageadvicebureau.com/investor-relations

(1) Percentage points.

(2) MAB uses adjusted results as key performance indicators as

the Directors believe that these provide a more consistent measure

of operating performance by adjusting for acquisition related

charges and significant one-off or non-cash items. Adjusted

overheads ratio is stated before GBP1.5m (H1 2021: GBPnil) of costs

relating to the acquisition of The Fluent Money Group, GBP0.4m (H1

2021: GBP0.6m) of costs relating to the First Mortgage option, and

GBP0.2m (H1 2021: GBP0.2m) of amortisation of acquired

intangibles.

(3) Adjusted profit before tax is stated before the items in (2)

above and GBP0.7m of net fair value gains on deferred

considerations (H1 2021: GBPnil), and GBP0.03m (H1 2021: GBPnil) of

net fair value losses on derivative financial instruments. Adjusted

earnings per share is stated on the same basis, net of any

associated tax effects.

(4) Net revenue is revenue less commissions paid.

(5) Adjusted cash conversion is cash generated from operating

activities adjusted for movements in non-trading items, including

loans to AR firms and associates totalling GBP(0.3)m in H1 2022 (H1

2021: GBP(0.9)m), and increases in restricted cash balances of GBP

0.5m in H1 2022 (H1 2021: GBP1.2m), as a percentage of adjusted

operating profit.

(6) Dividend policy based on a minimum payout ratio of 75% of

annual adjusted profit after tax post minority interests.

(7) Includes a total of 67 advisers at 30 June 2022 and 73

advisers at 23 September 2022 who are either directly authorised or

later life advisers. The directly authorised advisers are employees

of a firm previously authorised under an Appointed Representative

agreement with MAB until 7 December 2020. MAB continues to provide

services to this firm, which is now directly authorised by the FCA.

For both later life and directly authorised advisers the fees

received by MAB represent the net income received by MAB as there

are no commission payouts made by MAB. The 30 June 2022 and 23

September 2022 figures also include 14 advisers from associates,

who are in the process of being onboarded under MAB's AR

arrangements. These advisers will shortly become mainstream

advisers. Until these 14 advisers become onboarded fully as

mainstream advisers, MAB currently only recognises its share of

profit after tax from these associates.

(8) Excludes directly authorised advisers, later life advisers,

and advisers from associates in the process of being onboarded

under MAB's AR arrangements.

(9) Based on average number of mainstream advisers.

(10) For H1 2021, market share stated for the seven months ended

31 July 2021 due to the distortion effect around 30 June 2021 with

the tapering of the stamp duty holiday thereafter.

(11) Fluent's 156 advisers as at 23 September 2022 include 78

advisers in the first charge mortgages division, 60 in the secured

personal loans division, 13 in the later life division, and 5 in

the bridging finance division.

Chief Executive's Review

Despite a 29% drop in UK housing transactions in the period

compared to H1 2021, when stamp duty holiday changes accelerated

house purchase completions, the Group grew its revenue by 4% to

GBP96.5m (H1 2021: GBP92.4m), its mortgage completions by 11% to

GBP12.2bn (H1 2021: GBP11.0bn), and its market share by 13% to 6.8%

(H1 2021: 6.0%). This once again demonstrates the strength and

resilience of the Group's business model, with adjusted profit

before tax in line with the prior period at GBP11.5m (H1 2021:

GBP11.6m).

Our growth in mortgage completions is analysed as follows:

H1 2022 H1 2021 Increase

GBPbn GBPbn vs 2021

-------- -------- ---------

New mortgage

lending 10.3 9.6 +7%

-------- -------- ---------

Product Transfers 1.9 1.4 +36%

-------- -------- ---------

Gross mortgage

lending 12.2 11.0 +11%

-------- -------- ---------

UK mortgage lending activity returned to more normal levels

during the first half of this year, after the unprecedented surge

seen in H1 2021. In addition, the time taken to complete a property

purchase increased by approximately one month compared to the

equivalent period last year, adversely impacting the number of

mortgage completions. Compared to H1 2021, UK mortgage completions

in the purchase segment saw a 30% drop. UK gross mortgage

completions as a whole were down 10% at GBP151.4bn (H1 2021:

GBP168.5bn(1) ), and up 20% compared to pre-Covid-19 levels in 2019

(H1 2019: GBP126.2bn).

A number of factors are delaying property transactions and

mortgage pipelines, including conveyancing backlogs, local

authority capacity constraints, and also expiring mortgage offers

that need to be reconsidered and reissued by lenders due to the

frequency of UK base rate increases in the period. Consequently,

our pipeline of written but unbanked business has grown to larger

than usual levels.

Delivering our growth strategy

Adviser growth

Adviser growth continues to be a major focus for the Group,

boosted by the need to service new lead flow whilst using

technology to help maximise opportunities from existing customers

and lead sources.

Adviser numbers grew by 8% to 2,034 during the period. Every

year, MAB helps its ARs replace 300+ advisers, and overall growth

in adviser numbers is derived from organic growth in these existing

firms and also new ARs being onboarded with their existing

advisers. Over the summer months, MAB saw a significant fall in the

number of new advisers onboarded with a far higher than usual

summer holiday slowdown experienced. This is an unfortunate break

in strong momentum in adviser growth this year, which has now

resumed and is expected to remain strong for the remainder of the

year. As a result, adviser numbers were 2,160 as at 23 September

2022, including 156 Fluent advisers.

We have a strong pipeline of new advisers and ARs and, combined

with Fluent's rapidly growing adviser base in the Mortgage

division, we expect to continue to deliver further adviser

growth.

As trading conditions are likely to become more challenging,

some existing firms will take a more cautious view on organic

growth whilst others, including newly onboarded growth-focussed

firms, expect to continue with their plans for adviser and market

share growth.

With increasing expectations and even higher standards expected

from the regulator, more directly authorised firms are seeking

greater support from a strategic partner like MAB. We expect the

recruitment of growth-driven firms to remain strong, supported by

the continued development of our technology platform.

Investment strategy

The acquisition of Fluent has further strengthened our portfolio

of invested-in businesses(2) . These businesses are integral to the

future success of the Group as we pursue a greater level of adviser

productivity, primarily based on a clear and strong lead generation

strategy.

The average productivity of advisers in our invested-in

businesses is circa 25% greater than our other ARs' advisers, and

recent investments have increased that differential further. This

includes the acquisition of Fluent, which is a leader in the

provision of centralised telephone-based mortgage advice and is

delivering high levels of adviser performance by combining strong

and reliable lead flow with streamlined technology-driven

processes.

Fluent has formed relationships with leading third-party brands

including aggregators and other national lead sources. Fluent helps

customers to access Mortgages, Secured Personal Loans, Later Life

Lending and Bridging Finance, and broadens the Group's revenue mix

and customer proposition. Since the acquisition, Fluent has

experienced strong growth in lead flow and adviser numbers in its

fast-growing mortgage division, providing a rapid scale-up of the

Group's adviser base and fulfilment capability.

Separately, MAB has also targeted the fast-growing national lead

source sector and has already formed a number of strong

relationships. Combined, MAB and Fluent can grow this new market

share opportunity quickly and effectively, complementing the

local/regional strategy delivered by the rest of the Group's

growing distribution.

If activity in the housing market was to fall from current

levels, this lead supply would further support revenue and profit

growth despite more challenging trading conditions.

Although the contribution from some of our smaller early-stage

investments has taken time to build, these are now starting to

mature. Our investment strategy in the last few years has

increasingly focused on established and profitable firms,

strengthening our new build proposition and market share, in

addition to ensuring we have the expertise and scale to establish a

market leading position in the national lead source sector.

We expect the additional lead flow that MAB can generate for its

invested-in businesses, combined with their existing growth

trajectory, strong protection success, and growing productivity per

adviser, will contribute significant profit growth over the next

five years.

Vita Financial Ltd ("Vita") has performed exceptionally well in

supporting MAB's AR firms who wish to outsource some of their

protection or general insurance leads. As part of MAB's wider

protection strategy, we intend to extend Vita's proposition into a

wider addressable market to fully leverage its expertise.

Accordingly, we have acquired a further 26% stake in Vita,

increasing our overall stake to 75%.

Customer lead generation

In our sector, securing a quality and reliable lead flow

underpins both the growth and stability of every firm, and gives

more predictability and control over trading. This is why MAB has

focused technology developments and prioritised investments in this

area.

MAB is already a leader in local lead generation through estate

agencies and builders, and new technology developments will help us

optimise lead flow in these two key sectors. The addition of

Fluent, which has rapidly achieved a dominant position with

national lead sources, has given the enlarged Group a market

leading proposition in the three largest lead source sectors.

Driven by this acquisition and the fulfilment capacity of the

Group, we are now in an even stronger position to secure additional

national lead generation partners to support further productivity

and adviser growth in 2023 and beyond.

Significant upside can also be achieved through improved

customer retention. This has been a major strategic focus for the

Group and we will be launching new initiatives and technology in Q4

2022 to help optimise these opportunities at a time when consumers

are highly focused on managing their expenditure.

In addition, capturing and nurturing customers who are in the

early research stages of their home buying journey is also a new

and integral part of the Group's strategy. This gives us access to

a new and wider group of lead sources.

Summary

MAB's market share model has delivered year-on-year growth in

all market conditions and is better positioned than ever to keep

doing so.

Our management team has strengthened further this year, and

MAB's technology investments and lead generation strategy have

progressed very well. We continue to onboard recent investments

following FCA approval, and our invested-in businesses are set to

perform strongly, benefitting from lead generation and streamlined

processes.

Our acquisition of Fluent will bring significant earnings

enhancement to the Group, derived in part from the delivery of

commercial synergies. We will also help Fluent to accelerate growth

through sharing best practice, primarily in customer retention and

the provision of protection and general insurance.

2022 has proved to be a difficult year for advisers, due to a

constant withdrawal and re-pricing of mortgage rates at short

notice. Combined with a significant fall in, and delays to housing

transactions and completions compared to H1 2021, productivity has

understandably been affected.

The longer-term fundamentals for the property and mortgage

markets look very strong, and there is also scope for further

growth through setting higher standards and helping firms with the

important new regulatory requirements being introduced by the

FCA.

Our strategy underpins our confidence in the outlook for 2023

and beyond .

(1) MAB previously reported GBP169.9bn of gross new mortgage

completions in H1 2021, in line with UK Finance estimates at the

time. UK Finance regularly updates its estimates.

(2) Invested-in businesses include the Group's associate

companies, First Mortgage, The Fluent Money Group and Vita

Financial.

Market review

During the period, the housing market returned to more normal

levels after an unprecedented surge in house purchase activity last

year driven by the stamp duty holiday. Compared to H1 2021, the

number of property transactions fell by 29%. However, property

transactions still trended above pre-Covid-19 levels, having grown

by 8% compared to H1 2019, as illustrated in the following

graph.

http://www.rns-pdf.londonstockexchange.com/rns/7119A_3-2022-9-26.pdf

Source: HM Revenue and Customs

Gross new mortgage lending activity in the purchase segment

experienced a similar trend during the period, falling by 30%

compared to H1 2021 but increasing by 28% compared to H1 2019. The

drop in home-owner mover activity was the sharpest (-39% compared

to H1 2021, +24% compared to H1 2019) as a result of the

exceptional peak in that segment last year. First-time buyer

activity was down by a more modest 17% compared to the peak in H1

2021, but up 27% compared to pre-Covid-19 levels in H1 2019.

Re-financing activity in H1 2022 showed strong year-on-year

growth. External re-mortgage lending values increased by 37%

compared to H1 2021, reflecting the exceptionally busy housing

market last year, and 7% compared to H1 2019. Whilst product

transfers values decreased by 4% in H1 2022 compared to H1 2021,

they increased by 12% compared to H1 2019. We expect re-financing

activity to continue to be strong, as consumers seek better

mortgages rates in a rising interest rate environment and high

levels of fixed rate mortgages arriving at maturity in the near

term.

Buy-to-let activity was steady during the period largely driven

by buy-to-let re-mortgage activity. Buy-to-let values increased by

9% compared to H1 2021 and 26% compared to H1 2019.

Overall, gross new mortgage lending (excluding product

transfers) in H1 2022 decreased by 10% compared to H1 2021 and

increased by 20% compared to pre-Covid-19 levels in H1 2019.

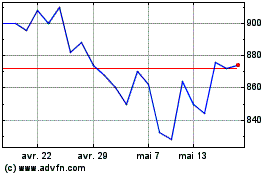

The trends in gross new mortgage lending are illustrated in the

graph below.

http://www.rns-pdf.londonstockexchange.com/rns/7119A_2-2022-9-26.pdf

Source: UK Finance

During the period, average house prices increased by 10%

year-on-year, similar to the increases seen throughout 2021. This

is likely to start slowing in the coming months due to fears of

recession and the rising cost of living.

The share of UK residential mortgage transactions via

intermediaries (excluding buy to let, where intermediaries have a

higher market share, and product transfers where intermediaries

have a lower market share) grew to 84% (H1 2021: 79%), with the

expected increase reflecting how consumers increasingly want

choice, advice, and support in making major financial decisions.

The increase in intermediary market share also reflects the lower

footfall in bank and building society branches, a change that was

accelerated in part by Covid-19. We expect this increased

intermediary market share to remain stable in the short term.

Despite inflationary pressures and further national and

geopolitical uncertainty, the level of consumer demand for housing

remains strong, supported by UK full employment, high levels of

household savings, and, for those who are subsequent movers, rising

housing equity levels over recent years. Lenders also have strong

liquidity levels, meaning mortgage availability is now close to

pre-pandemic highs, thereby helping market activity to remain

healthy.

Although interest rates have risen and will most likely continue

to rise over the next 12 months, current interest rates remain near

historical lows. We expect this to continue to stimulate

re-financing activity. We are confident that this, coupled with

strong demand for housing, will continue to drive sustained

transaction activity in the mortgage market.

(1) Land Registry House Price Index

Financial review

We measure the development, performance, and position of our

business against several key indicators.

http://www.rns-pdf.londonstockexchange.com/rns/7119A_1-2022-9-26.pdf

Revenue

Group revenue for the six months ended 30 June 2022 increased to

GBP96.5m (H1 2021: GBP92.4m), up 4% on a comparative period in

which house purchase mortgage completions were boosted by the stamp

duty holiday changes at the end of March and June 2021. In

addition, H1 2022 revenue was negatively impacted by delays in the

conversion of pipeline to completions and a change in mortgage mix

with an increase in re-financing compared to the prior period.

The average number of mainstream advisers(1) during the period

increased by 19% to 1,890 (H1 2021: 1,584), with lower average

revenue per mainstream adviser of GBP51,041 (H1 2021: GBP58,451) as

a consequence of the factors set out above.

The Group continued to generate revenue from three core areas,

summarised as follows:

Group

Income source H1 2022 H1 2021 Change vs

2021

-------- -------- ----------

GBPm GBPm %

-------- -------- ----------

Mortgage Procuration Fees 44.9 42.7 +5

-------- -------- ----------

Protection and General Insurance

Commission 37.2 35.8 +4

-------- -------- ----------

Client Fees 11.8 11.6 +2

-------- -------- ----------

Other Income 2.6 2.3 +13

-------- -------- ----------

Total 96.5 92.4 +4

-------- -------- ----------

MAB's banked mortgage mix saw a lower proportion of house

purchase business compared to the prior year with an increase in

re-financing. In particular, the proportion of product transfer

completions, which have a lower average procuration fee and see

lower protection, general insurance and client fee attachment

rates, increased to 18% (H1 2021: 14%). Consequently, while the

Group's gross mortgage completions increased by 6%(2) , mortgage

procuration fees increased by 5%, protection and general insurance

commissions increased by 4% and client fees increased by 2%.

MAB's average mortgage size increased by 2% compared to the

prior period, with average house prices increasing by 10%

year-on-year, reflecting the increased proportion of re-financing

completions where the average mortgage size is lower than for

purchase transactions.

MAB's overall revenue from re-financing (including both

re-mortgages and product transfers) represented circa 30% of total

revenue (H1 2021: 24%, H1 2019: 32%), with the prior period

reflecting a particularly high level of purchase transactions in H1

2021.

The proportion of revenue derived from each of the Group's core

revenue streams has remained relatively stable, with small

movements reflecting the change in banked mortgage mix during the

period illustrated as follows:

Income source H1 2022 H1 2021

Mortgage Procuration Fees 47% 46%

-------- --------

Protection and General Insurance Commission 38% 39%

-------- --------

Client Fees 12% 13%

-------- --------

Other Income 3% 2%

-------- --------

Total 100% 100%

-------- --------

Gross profit margin

Gross profit margin was 26.4% (H1 2021: 26.7%), with the slight

fall during the period reflecting the increased proportion of

re-financing transactions and the slightly reduced margin received

by the Group (revenue share) as existing ARs grow their revenue

organically by increasing their adviser numbers. In addition,

larger new ARs typically join the Group on lower-than-average

margins due to their existing scale, hence we expect to see a

degree of erosion of our underlying gross profit margin (prior to

the impact of the Fluent acquisition) due to the continued growth

of our existing ARs and the addition of new larger ARs.

Looking ahead, before the impact of the Fluent acquisition (as

set out below), we expect any further erosion in underlying gross

margin to be offset by a reduction in the Group's overheads ratio

through economies of scale.

Administrative expenses

Administrative expenses in the period increased by GBP0.5m (+4%)

to GBP14.2m. MAB has continued to invest in its technology platform

and marketing team to drive lead generation opportunities. All

development work on our technology platform is expensed.

Administrative expenses as a percentage of revenue remained

stable at 14.7% (H1 2021: 14.8%). This excludes GBP1.5m (H1 2021:

GBPnil) of costs associated with the acquisition of The Fluent

Money Group, GBP0.2m (H1 2021: GBP0.2m) of amortisation of acquired

intangibles and GBP0.4m (H1 2021: GBP0.6m) of additional non-cash

operating expenses relating to the put and call option agreement to

acquire the remaining 20% of First Mortgage.

Prior to the impact of the acquisition of Fluent as set out

below, MAB continues to benefit from the scalable nature of most of

its cost base, where those costs typically rise at a slower rate

than revenue, which will, in part, counter the expected erosion of

MAB's underlying gross margin as the business continues to grow. In

recognition of the current inflationary environment MAB awarded pay

rises effective from 1 July 2022 to a number of staff to help with

the increasing costs of living.

Associates and investments

MAB's share of profits from associates was GBP0.3m (H1 2021:

GBP0.7m) with a slower start to the year for a number of the

Group's associates resulting primarily from delays in conversion of

pipeline to completion. MAB also realised a further GBP0.1m profit

on the sale of its minority investment in the sales progression

platform Yourkeys Technology Ltd .

MAB considers the value of a number of these investments exceeds

their balance sheet value as accounted for using the equity

accounting method under IAS 28.

Profit before tax and margin thereon

Adjusted(3) profit before tax as a percentage of net revenue(4)

reduced to 39% (H1 2021: 41%), primarily due to the change in

banked mortgage mix.

Adjusted(3) profit before tax was GBP11.5m (H1 2021: GBP11.6m),

with the margin thereon being 12.0% (H1 2021: 12.5%). Statutory

profit before tax was GBP10.1m (H1 2021: GBP10.8m) with the margin

thereon being 10.5% (H1 2021: 11.7%).

Finance income and expense

Finance income of GBP0.04m (H1 2021: GBP0.03m) reflects

continued low interest rates and interest income accrued or

received on loans to associates. Finance expense of GBP0.1m (H1

2021: GBP0.1m) reflects the non-utilisation fee payable on a

Revolving Credit Facility ("RCF") of GBP12m repaid in December

2020, interest expense on lease liabilities and commitment fees on

the new debt facilities as set out below.

On 28 March 2022 MAB entered into new four-year debt facilities

with NatWest, comprising a GBP20m Term Loan (the "Term Loan") and a

GBP15m RCF (the "New RCF") to be used in connection with the

acquisition of Fluent. The New RCF is also available for general

corporate purposes. There is an option to extend the New RCF and

the Term Loan for a further year.

Taxation

The effective rate of tax increased to 21.9% (H1 2021: 16.8%),

primarily due to costs associated with the acquisition of Fluent

being disallowable for tax purposes, no share option exercises in

the period and a lower tax credit on research and development

expenditure on the continued development of MAB's proprietary

software platform, MIDAS. We expect the effective tax rate in

future years to be materially in line with the prevailing UK

corporation tax rate.

Issue of new ordinary shares, earnings per share and

dividend

On 28 March 2022 the Group placed 3,809,524 new ordinary shares

with investors, raising GBP40m to part fund the acquisition of The

Fluent Money Group (the "Placing"), representing a 7% increase in

the Group's issued share capital. The new ordinary shares were

issued at GBP10.50 per ordinary share. The share premium recognised

was GBP38.4m after deduction of GBP1.6m of costs directly

associated with the Placing.

Adjusted(3) earnings per share was 16.4 pence (H1 2021: 17.9

pence) reflecting the dilutive impact of the Placing throughout Q2

2022 while the acquisition did not complete until after the period

end, so that no earnings from Fluent were recognised in H1 2022.

Basic earnings per share was 14.0 pence (H1 2021: 16.5 pence).

The Board is pleased to confirm an interim dividend for the year

ending 31 December 2022 of 13.4 pence per share (H1 2021: 13.4

pence per share), reflecting the Group's dividend policy based on a

minimum payout ratio of 75% of the Group's annual adjusted(3)

post-tax and minority interest profits. This represents a cash

outlay of GBP7.6m (H1 2021: GBP7.1m). MAB requires circa 10% of its

profit after tax to fund increased regulatory capital and other

regular capital expenditure. Following payment of the dividend, the

Group will continue to maintain significant surplus regulatory

reserves.

The record date for the interim dividend is 7 October 2022 and

the payment date is 4 November 2022. The ex-dividend date will be 6

October 2022.

Cash flow and cash conversion

The Group's operations produce positive cash flow. This is

reflected in the net cash generated from operating activities of

GBP11.5m (H1 2021: GBP14.7m).

Headline cash conversion(5) was:

H1 2022 128%

H1 2021 130%

------------

Adjusted cash conversion(6) was:

H1 2022 124%

------------

H1 2021 120%

------------

The Group's operations are typically capital-light, with the

most significant ongoing capital investment being in computer

equipment. Only GBP0.1m of capital expenditure on office and

computer equipment was required during the period (H1 2021:

GBP0.1m). Group policy is not to provide company cars. The Group is

currently undertaking a refurbishment of its head office in Derby,

which it anticipates will cost c. GBP3m. No other significant

capital expenditure is foreseen in the coming year.

The Group had no bank borrowings at 30 June 2022 (31 December

2021: GBPnil). The Group had adjusted unrestricted bank balances(7)

of GBP19.0m at 30 June 2022 (31 December 2021: GBP17.5m).

On 11 July 2022 MAB drew down the GBP20m Term Loan and GBP5.3m

under the New RCF to part-fund the acquisition of Fluent.

The Group has a regulatory capital requirement amounting to 2.5%

of regulated revenue. At 30 June 2022 this regulatory capital

requirement was GBP4.3m (31 December 2021: GBP4.3m), with the Group

having a surplus of GBP20.1m (31 December 2021: GBP18.9m).

The following table demonstrates how cash generated by the Group

was applied:

GBPm

Unrestricted bank balances at the beginning of the year 17.5

Cash generated from operating activities excluding movements in restricted balances and dividends

received from associates 12.6

Dividends received from associates 0.6

Dividends paid (8.8)

Tax paid (2.1)

Investment in associates (0.5)

Disposal of unlisted investment 0.1

Issue of shares (net of expenses) 38.4

Net interest paid and principal element of lease payments (0.2)

Capital expenditure (0.2)

Unrestricted bank balances at the end of the period 57.4

-------------------------------------------------------------------------------------------------- -----

Financial effects of the acquisition of The Fluent Money

Group

Fluent has a higher gross margin than MAB of c.35% because it

directly employs its advisers. However, overheads as a proportion

of revenue are also higher than MAB's, resulting in Fluent's profit

before tax margin being slightly above that of MAB's. The effect of

Fluent's operating model on the enlarged Group will be to slightly

increase gross profit margin, which will be partially offset by an

increase in overheads as a proportion of revenue.

MAB entered into the Term Loan and New RCF in part to fund the

acquisition of Fluent. MAB plans to repay approximately half of the

Term Loan over the next four years with the remainder repayable at

maturity. There is an option to extend the New RCF and the Term

Loan for a further year. There will be no change to MAB's dividend

policy.

(1) Excludes directly authorised advisers, later life advisers,

and advisers from associates in the process of being onboarded

under MAB's AR arrangements.

(2) Stated before completions from associates in the process of

being onboarded under MAB's AR arrangements to produce more

appropriate comparisons against revenue metrics.

(3) Adjusted profit before tax is stated before GBP0.6m (H1

2021: GBP0.7m) of costs associated with the acquisition of First

Mortgage, GBP1.5m (H1 2021: GBPnil) of costs relating to the

acquisition of The Fluent Money Group, GBP0.4m (H1 2021: GBP0.6m)

of costs relating to the First Mortgage option, GBP0.2m (H1 2021:

GBP0.2m) of amortisation of acquired intangibles, GBP0.7m of net

fair value gains on deferred considerations (H1 2021: GBPnil), and

GBP0.03m (H1 2021: GBPnil) of net fair value losses on derivative

financial instruments. Adjusted earnings per share is stated on the

same basis, net of any associated tax effects.

(4) Net revenue is revenue less commissions paid.

(5) Headline cash conversion is cash generated from operating

activities adjusted for movements in non-trading items, including

loans to AR firms and associates totalling GBP(0.3) in H1 2022 (H1

2021: GBP(0.9)m), as a percentage of adjusted operating profit.

(6) Adjusted cash conversion is headline cash conversion

adjusted for increases in restricted cash balances of GBP 0.5m in

H1 2022 (H1 2021: GBP1.2m) as a percentage of adjusted operating

profit.

(7) Unrestricted cash balance at 30 June 22 excludes net

proceeds from the GBP40m equity placing (GBP38.4m net of expenses)

to part fund the acquisition of The Fluent Money Group that

completed 12 July 2022.

INDEPENT REVIEW REPORT TO MORTGAGE ADVICE BUREAU (HOLDINGS)

PLC

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2022 is not prepared, in all material respects, in accordance

with UK adopted International Accounting Standard 34 and the London

Stock Exchange AIM Rules for Companies.

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2022 which comprises the interim condensed

consolidated statement of financial position, interim condensed

consolidated statement of comprehensive income, interim condensed

consolidated statement of changes in equity and interim condensed

consolidated statement of cash flows.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with UK adopted International Accounting Standard 34,

"Interim Financial Reporting.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with

the London Stock Exchange AIM Rules for Companies which require

that the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the Company's annual

accounts having regard to the accounting standards applicable to

such annual accounts.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange AIM Rules for Companies for no

other purpose. No person is entitled to rely on this report unless

such a person is a person entitled to rely upon this report by

virtue of and for the purpose of our terms of engagement or has

been expressly authorised to do so by our prior written consent.

Save as above, we do not accept responsibility for this report to

any other person or for any other purpose and we hereby expressly

disclaim any and all such liability.

BDO LLP

Chartered Accountants

London

United Kingdom

26 September 2022

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Interim condensed consolidated statement of comprehensive income

for the six months ended 30 June 2022

Six months ended

30 June

Note 2022 2021

Unaudited Unaudited

GBP'000 GBP'000

-------------------------------------- ----- ----------- -----------

Revenue 2 96,468 92,432

Cost of sales 3 (71,032) (67,783)

-------------------------------------- ----- ----------- -----------

Gross profit 25,436 24,649

Administrative expenses (14,214) (13,659)

Costs relating to the First Mortgage

option 4 (423) (550)

Amortisation of acquired intangibles 4 (183) (183)

Costs relating to the acquisition

of The Fluent Money Group 4 (1,453) -

Impairment of loans to related

parties - (14)

Net fair value gains on deferred

consideration 10 650 -

Net fair value losses on derivative

financial instruments 10 (25) -

Share of profit from associates,

net of tax 10 314 723

Profit on sale of non-listed

equity investment 11 59 309

Impairment of associate 10 - (400)

-------------------------------------- ----- ----------- -----------

Operating profit 10,161 10,875

-------------------------------------- ----- ----------- -----------

Finance income 5 42 27

Finance expense 5 (96) (67)

Profit before tax 10,107 10,835

Tax expense 6 (2,214) (1,820)

-------------------------------------- ----- ----------- -----------

Profit for the period 7,893 9,015

-------------------------------------- ----- ----------- -----------

Total comprehensive income 7,893 9,015

-------------------------------------- ----- ----------- -----------

Profit is attributable to:

Equity owners of Parent Company 7,698 8,763

Non-controlling interests 195 252

-------------------------------------- ----- ----------- -----------

7,893 9,015

-------------------------------------- ----- ----------- -----------

Earnings per share attributable

to the owners of the Parent Company

Basic 7 14.0p 16.5p

Diluted 7 13.8p 16.4p

Interim condensed consolidated statement of financial

position

as at 30 June 2022 and 31 December 2021

30 June 2022 31 Dec

Note Unaudited 2021

GBP'000 Audited

GBP'000

---------------------------------- ------ ------------- ---------

Assets

Non-current assets

Property, plant and equipment 2,569 2,667

Right of use assets 2,259 2,457

Goodwill 9 15,155 15,155

Other intangible assets 2,573 2,704

Investments in associates and

joint venture 10 12,147 12,433

Investments in non-listed equity

shares 11 2,783 2,783

Derivative financial instruments 170 220

Other receivables 12 1,197 1,098

Deferred tax asset 1,726 1,871

---------------------------------- ------ ------------- ---------

Total non-current assets 40,579 41,388

---------------------------------- ------ ------------- ---------

Current assets

Trade and other receivables 12 7,284 6,341

Derivative financial instruments 134 142

Cash and cash equivalents 13 74,743 34,411

---------------------------------- ------ ------------- ---------

Total current assets 82,161 40,894

---------------------------------- ------ ------------- ---------

Total assets 122,740 82,282

---------------------------------- ------ ------------- ---------

Interim condensed consolidated statement of financial

position

as at 30 June 2022 and 31 December 2021 (continued)

Note 30 June 2022 31 Dec

Unaudited 2021

GBP'000 Audited

GBP'000

---------------------------------- ----- ------------- ---------

Equity and liabilities

Share capital 17 57 53

Share premium 48,155 9,778

Capital redemption reserve 20 20

Share option reserve 4,080 3,523

Retained earnings 24,724 25,408

---------------------------------- ----- ------------- ---------

Equity attributable to owners

of Parent Company 77,036 38,782

Non-controlling interests 1,985 2,205

---------------------------------- ----- ------------- ---------

Total equity 79,021 40,987

---------------------------------- ----- ------------- ---------

Liabilities

Non-current liabilities

Provisions 6,403 5,716

Lease liabilities 1,997 2,202

Derivative financial instruments 1 34

Deferred tax liability 672 757

---------------------------------- ----- ------------- ---------

Total non-current liabilities 9,073 8,709

---------------------------------- ----- ------------- ---------

Current liabilities

Trade and other payables 14 33,986 31,925

Lease liabilities 403 394

Corporation tax liability 257 267

---------------------------------- ----- ------------- ---------

Total current liabilities 34,646 32,586

---------------------------------- ----- ------------- ---------

Total liabilities 43,719 41,295

---------------------------------- ----- ------------- ---------

Total equity and liabilities 122,740 82,282

---------------------------------- ----- ------------- ---------

Interim condensed consolidated statement of changes in equity

for the six months ended 30 June 2022

Attributable to the holders of the

Parent Company

----------------------------------------------------------------------

Share

Capital option Non-controlling

Share Share redemption reserve Retained Interest Total

capital premium reserve GBP'000 earnings Total GBP'000 equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- --------- ------------ --------- ----------- ---------- ----------------- ----------

Balance at

1 January

2021 53 9,778 20 1,807 23,882 35,540 1,908 37,448

Profit for the

period - - - - 8,763 8,763 252 9,015

Total

comprehensive

income - - - - 8,763 8,763 252 9,015

--------------- --------- --------- ------------ --------- ----------- ---------- ----------------- ----------

Transactions

with owners

Issue of

shares - - - - - - - -

Share based

payment

transactions - - - 693 - 693 - 693

Deferred tax

assets

recognised

in equity - - - 717 - 717 - 717

Reserve

transfer - - - (143) 143 - - -

Dividends paid - - - - (10,210) (10,210) (253) (10,463)

--------------- --------- --------- ------------ --------- ----------- ---------- ----------------- ----------

Total

transactions

with owners - - - 1,267 (10,067) (8,800) (253 ) (9,053)

--------------- --------- --------- ------------ --------- ----------- ---------- ----------------- ----------

Balance at

30 June 2021

(unaudited) 53 9,778 20 3,074 22,578 35,503 1,907 37,410

--------------- --------- --------- ------------ --------- ----------- ---------- ----------------- ----------

Balance at

1 January

2022 53 9,778 20 3,523 25,408 38,782 2,205 40,987

Profit for the

period - - - - 7,698 7,698 195 7,893

--------------- --------- --------- ------------ --------- ----------- ---------- ----------------- ----------

Total

comprehensive

income - - - - 7,698 7,698 195 7,893

--------------- --------- --------- ------------ --------- ----------- ---------- ----------------- ----------

Transactions

with owners

Issue of

shares 4 38,377 - - - 38,381 - 38,381

Share based

payment

transactions - - - 532 - 532 - 532

Deferred tax

asset

recognised

in equity - - - 25 - 25 - 25

Reserve - - - - - - -

transfer -

Dividends paid - - - - (8,382) (8,382) (415) (8,797)

--------------- --------- --------- ------------ --------- ----------- ---------- ----------------- ----------

Total

transactions

with owners 4 38,377 - 557 (8,382) 30,556 (415) 30,141

Balance at

30 June 2022

(unaudited) 57 48,155 20 4,080 24,724 77,036 1,985 79,021

--------------- --------- --------- ------------ --------- ----------- ---------- ----------------- ----------

Interim condensed consolidated statement of cash flows for the

six months ended 30 June 2022

Six months ended

30 June

Note 2022 2021

Unaudited Unaudited

GBP'000 GBP'000

------------------------------------------- ----- ------------ -----------

Cash flows from operating activities

Profit for the period before tax 10,107 10,835

Adjustments for

Depreciation of property, plant

and equipment 175 185

Depreciation of rights of use assets 198 191

Amortisation of intangibles 282 279

Profit on sale of non-listed equity

investment 11 (59) (309)

Share based payments 532 693

Share of profit from associates,

net of tax 10 (314) (723)

Impairment of associate 10 - 400

Dividends received from associates 10 600 88

Net fair value gains on deferred

consideration 10 (650) -

Net fair value losses on derivative

financial instruments 10 25 -

Finance income 5 (42) (27)

Finance expense 5 96 67

10,950 11,679

Changes in working capital

(Increase) in trade and other receivables 12 (1,086) (6,730)

Increase in trade and other payables 14 3,120 9,986

Increase in provisions 687 694

Cash generated from operating activities 13,671 15,629

Income taxes paid (2,141) (893)

------------------------------------------- ----- ------------ -----------

Net cash generated from operating

activities 11,530 14,736

------------------------------------------- ----- ------------ -----------

Cash flows from investing activities

Purchase of property, plant and

equipment (77) (109)

Purchase of Intangibles (151) -

Acquisition of associates 10 (457) (822)

Disposal of non-listed equity investment 11 114 329

Acquisition of non-listed equity

investment - (2,500)

------------------------------------------- ----- ------------ -----------

Net cash used in investing activities (571) (3,102)

------------------------------------------- ----- ------------ -----------

Cash flows from financing activities

Interest received 5 32 41

Interest paid 5 (48) (67)

Principal element of lease payments (195) (177)

Issue of shares 17 40,000 -

Costs relating to the issue of shares 17 (1,619) -

Dividends paid 8 (8,382) (10,210)

Dividends paid to minority interest (415) (253)

------------------------------------------- ----- ------------ -----------

Net cash generated/(used) in financing

activities 29,373 (10,666)

------------------------------------------- ----- ------------ -----------

Net Increase in cash and cash equivalents 40,332 968

Cash and cash equivalents at the

beginning of the period 34,411 32,981

------------------------------------------- ----- ------------ -----------

Cash and cash equivalents at the

end of the period 74,743 33,949

------------------------------------------- ----- ------------ -----------

Notes to the interim condensed consolidated financial statements

for the six months ended 30 June 2022

1 Accounting policies

Corporate information

The interim condensed consolidated financial statements of

Mortgage Advice Bureau (Holdings) plc and its subsidiaries

(collectively, "the Group") for the six months ended 30 June 2022

were authorised for issue in accordance with a resolution of the

directors on 26 September 2022.

Mortgage Advice Bureau (Holdings) plc ("the Company") is a

limited company incorporated and domiciled in England whose shares

are publicly traded on the Alternative Investment Market ("AIM").

The registered office is located at Capital House, Pride Place,

Pride Park, Derby, DE24 8QR. The Group's principal activity is the

provision of financial services.

Basis of preparation

These condensed consolidated interim financial statements for

the six months ended 30 June 2022 have been prepared in accordance

with IAS 34 'Interim financial reporting' and also in accordance

with the measurement and recognition principles of UK adopted

international accounting standards. They do not include all of the

information required for full annual financial statements and

should be read in conjunction with the 2021 Annual Report and

Accounts, which were prepared in accordance with UK - adopted

international accounting standards.

The comparative figures for the six months ended 30 June 2021

are not the Group's statutory accounts for that financial period.

The accounts for the year ended 31 December 2021 have been reported

on by the Group's auditors and delivered to the registrar of

companies. The report of the auditor was (i) unqualified, (ii) did

not include a reference to any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006.

Going concern

The Directors have assessed the Enlarged Group's prospects until

31 December 2023, taking into consideration the current operating

environment, including the impact of geopolitical and macroeconomic

uncertainty and inflationary pressures on property and lending

markets. The Directors' financial modelling considers the Enlarged

Group's profit, cash flows, regulatory capital requirements,

borrowing covenants and other key financial metrics over the

period.

These metrics are subject to sensitivity analysis, which

involves flexing a number of key assumptions underlying the

projections, including the effect of geopolitical and macroeconomic

uncertainty and inflationary pressures and their impact on the UK

property and lending markets and the Group's revenue mix, which the

Directors consider to be severe but plausible stress tests on the

Enlarged Group's cash position, banking covenants and regulatory

capital adequacy. The Group's financial modelling shows that the

Enlarged Group should continue to be cash generative, maintain a

surplus on its regulatory capital requirements and be able to

operate within its current financing arrangements.

Based on the results of the financial modelling, the Directors

expect that the Enlarged Group will be able to continue in

operation and meet its liabilities as they fall due over the 12

months from the approval of the financial statements. Accordingly,

the Directors continue to adopt the going concern basis for the

preparation of the financial statements.

Significant estimates and judgements

Other than as set out below, the judgements, estimates and

assumptions applied in the interim financial statements, including

the key sources of estimation uncertainty, were the same as those

applied in the Group's last annual financial statements for the

year ended 31 December 2021. There have been no material revisions

to the nature and amount of estimates of amounts reported in prior

periods.

Significant accounting policies

The accounting policies applied are consistent with those

described in the Annual Report and Group financial statements for

the year ended 31 December 2021. New or amended standards effective

in the period have not had a material impact on the condensed

consolidated interim financial statements.

The Group has not early adopted any standards, interpretations

or amendments that have been issued but are not yet effective.

New standards with no impact on the Group

-- Annual improvements 18-20 cycle amending IFRS 1, IFRS 9, IAS

41. In May 2020, the IASB made minor amendments to IFRS 1, IFRS 9

and IAS 41 as part of their annual improvement cycle. The amendment

to IFRS 1 permits first time adopting subsidiaries to measure

cumulative translation differences using amounts reported by its

parent. The amendment to IFRS 9 clarifies the fees that an entity

includes when assessing whether the terms of a new or modified

financial liability are substantially different from the original

financial liability. Amendments to IAS 41 removed a requirement to

exclude cashflows for taxation when measuring the fair value of

biological assets. These amendments were applicable for annual

reporting periods beginning on or after 1 January 2022, with early

application permitted.

-- Amendments to IAS 37 Onerous contracts - Cost of fulfilling a

contract. In May 2020, the IASB amended IAS 37 Onerous contracts to

further specify the costs that are considered to be directly

related to a contract when assessing for onerous or loss-making

contracts. This amendment is applicable for annual reporting

periods beginning on or after 1 January 2022, with early

application permitted.

-- Amendments to IAS 16 Property, plant and equipment - Proceeds

before intended use. In May 2020, the IASB amended IAS 16 Property,

plant and equipment, to prohibit entities from deducting from the

cost of an item of property, plant and equipment any proceeds of

the sale of items produced while bringing that asset to the

location and condition necessary for it to be capable of operating

in the manner intended by management. This amendment is applicable

for annual reporting periods beginning on or after 1 January 2022,

with early application permitted.

-- Amendments to IFRS 3 - Reference to the conceptual framework.

In May 2020, the IASB amended IFRS 3 Business combinations to

update references to the current IASB conceptual framework, as well

as add an exception to the recognition principle for gains or

losses on acquired liabilities and contingent liabilities in a

business combination. The amendment also clarified the recognition

criteria of contingent assets on acquisition under IFRS 3. This

amendment is applicable for annual reporting periods beginning on

or after 1 January 2022, with early application permitted.

Future new standards and interpretations

A number of new standards and amendments to standards and

interpretations will be effective for future annual and interim

periods, and therefore have not been applied in preparing these

condensed consolidated interim financial statements. At the date of

authorisation of these financial statements, the following

standards and interpretations which have not been applied in these

financial statements were in issue but not yet effective:

Standard or Interpretation Periods commencing

on or after

IFRS 17 - Insurance contracts 1 January 2023

-------------------

Amendments to IAS 1 and IFRS Practice Statement 1 January 2023

2 - Disclosure of accounting policies

-------------------

Amendments to IAS 8 - Definition of accounting 1 January 2023

estimates

-------------------

Amendments to IAS 12 - Deferred tax related to 1 January 2023

assets and liabilities arising from a single transaction

-------------------

Amendments to IAS 1 Presentation of financial 1 January 2023

statements - On classification of liabilities

-------------------

Other than to expand certain disclosures within the Financial

Statements, the Directors do not expect the adoption of these

standards and interpretations listed above to have a material

impact on the Financial Statements of the Group in future

periods.

Basis of consolidation

Where the Company has control over an investee, it is classified

as a subsidiary. The Company controls an investee if all three of

the following elements are present: power over the investee,

exposure to variable returns from the investee, and the ability of

the investor to use its power to affect those variable returns.

Control is reassessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control.

The consolidated financial statements present the results of the

Company and its subsidiaries ("the Group") as if they formed a

single entity. Intercompany transactions and balances between group

companies are therefore eliminated in full.

The consolidated financial statements incorporate the results of

business combinations using the acquisition method. In the

statement of financial position, the acquiree's identifiable

assets, liabilities and contingent liabilities are initially

recognised at their fair values at the acquisition date. The

results of acquired operations are included in the consolidated

statement of comprehensive income from the date on which control is

obtained. They are deconsolidated from the date on which control

ceases.

Entities that are not subsidiaries but where the Group has

significant influence (i.e. the power to participate in the

financial and operating policy decisions) are accounted for as

associates. The results and assets and liabilities of the

associates are included in the consolidated accounts using the

equity method of accounting.

Segment reporting

An operating segment is a distinguishable segment of an entity

that engages in business activities from which it may earn revenues

and incur expenses and whose operating results are reviewed

regularly by the entity's chief operating decision maker ("CODM").

The Board reviews the Group's operations and financial position as

a whole and therefore considers that it has only one operating

segment, being the provision of financial services operating solely

within the UK. The information presented to the CODM directly

reflects that presented in the financial statements and they review

the performance of the Group by reference to the results of the

operating segment against budget.

Operating profit is the profit measure, as disclosed on the face

of the consolidated statement of comprehensive income, that is

reviewed by the CODM.

During the six month period to 30 June 2022, there have been no

changes from the prior periods in the measurement methods used to

determine operating segments and reported segment profit or

loss.

2 Revenue

The Group operates in one segment being that of the provision of

financial services in the UK.

Revenue is derived as follows:

Six months ended 30

June

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

Mortgage procuration fees 44,928 42,721

Protection and general insurance commission 37,197 35,803

Client fees 11,766 11,624

Other income 2,577 2,284

--------------------------------------------- ----------- -----------

96,468 92,432

--------------------------------------------- ----------- -----------

3 Cost of sales

Costs of sales are as follows:

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

Commission paid 66,573 63,924

Impairment of trade receivables 9 (5)

Wages and salary costs 4,450 3,864

--------------------------------- ------------ ------------

71,032 67,783

--------------------------------- ------------ ------------

There is no significant seasonality to income which arises

fairly evenly throughout the year and therefore profits also arise

fairly evenly throughout the financial year.

4 Acquisition costs

Costs relating to current year acquisitions

The Fluent Money Group Limited

On 28 March 2022 Mortgage Advice Bureau (Holdings) plc announced

that it had agreed to acquire 75.4% of Project Finland Topco

Limited, which indirectly owns 100% of The Fluent Money Group

Limited ("Fluent" or the "Business"), from its shareholders

including Beech Tree Private Equity and founders for a total cash

consideration of GBP72.7 million (the "Acquisition"). The

Acquisition completed on 12 July 2022 and the cash consideration

was funded from the Company's existing cash resources, a drawdown

on new debt facilities of GBP25 million and the proceeds of a

proposed placing of new ordinary shares in the Company, conducted

on 28 March 2022, which raised GBP40 million gross, and GBP38.4

million net of expenses directly associated with the placing.

Other costs incurred in the period in relation to the

Acquisition amounted to GBP1,452,721.

Costs relating to prior year acquisitions

First Mortgage Direct Limited

On 2 July 2019 Mortgage Advice Bureau (Holdings) Plc acquired 80

per cent of the entire issued share capital of First Mortgage

Direct Limited ("First Mortgage" or the "Business").

Costs relating to the amortisation of acquired intangibles

amounted to GBP183,000 in the six months ended 30 June 2022 and

2021. The option (comprising the put and the call option) over the

remaining 20% of the issued share capital of First Mortgage has

been accounted for under IAS 19 Employee Benefits and IFRS 2 Share

Based Payments due to its link to the service of First Mortgage's

Managing Director. In accordance with IAS 19, GBP217,936 (2021:

GBP212,303) has been included within costs relating to the First

Mortgage Option, and in accordance with IFRS 2, GBP204,726 (2021 -

GBP338,118) of share-based payments costs has also been included

within costs relating to the First Mortgage Option (see note

19).

5 Finance income and expense

Six months ended 30

June

2022 2021

Unaudited Unaudited

Finance income GBP'000 GBP'000

------------------------------------------------ ------------ -----------

Interest income 32 18

Interest income accrued on loans to associates 10 9

------------------------------------------------ ------------ -----------

42 27

------------------------------------------------ ------------ -----------

Finance expenses

--------------------------------------- --- ---

Interest expense 68 37

Interest expense on lease liabilities 28 30

--------------------------------------- --- ---

96 67

--------------------------------------- --- ---

Included within interest expense is interest accrued on the

Group's Revolving Credit Facility (which has been replaced by the

Group's new facilities (see note 15)) of GBP48,000 (2021: GBPnil).

During the period, interest accrued on loans to associates in

previous years of GBPnil was received (2021: GBP23,602).

6 Income tax

The Group calculates the period income tax expense using the tax

rate that would be applicable to the expected total annual

earnings. The major components of income tax expense in the interim

condensed statements of comprehensive income are:

Six months ended 30

June

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

------------------------------------------------ ------------ -----------

Current tax expense

UK corporation tax charge on profit for

the period 2,129 1,937

Total current tax 2,129 1,937

------------------------------------------------ ------------ -----------

Deferred tax expense

Origination and reversal of timing differences (95) (30)

Temporary difference on share based payments 180 (170)

Adjustment due to rate change - 83

Total deferred tax 85 (117)

------------------------------------------------ ------------ -----------

Total tax expenses 2,214 1,820

------------------------------------------------ ------------ -----------

For the period ended 30 June 2022, the deferred tax recognised

in equity was GBP24,513 (2021: GBP717,160). A change to the

corporation tax rate was substantively enacted on 24 May 2021 to

increase it to 25% from 1 April 2023 rather than the previously

enacted 19%.

The deferred tax asset is recognised after being assessed as

recoverable on the basis of available evidence including projected

profits, capital and liquidity position. The deferred tax asset is

only recognised to the extent that it is probable that future

taxable profits will be available against which the asset can be

utilised. The deferred tax asset is reviewed at each reporting date

and reduced to the extent that it is no longer probable that the

related tax benefit will be realised.

7 Earnings per share

Both the basic and diluted earnings per share have been

calculated using the profit attributable to shareholders of the

Parent Company, Mortgage Advice Bureau (Holdings) plc, as the

numerator.

The weighted average number of shares for the purposes of the

calculation of diluted earnings per share can be reconciled to the

weighted average number of ordinary shares used in the calculation

of basic earnings per share as follows:

Six months ended 30 June

2022 2021

Unaudited Unaudited

---------------------------------------- ------------- ------------

Weighted average number of shares used

in basic earnings per share 55,140,943 53,165,081

Potential ordinary shares arising from

options 456,243 349,327

---------------------------------------- ------------- ------------

Weighted average number of shares used

in diluted earnings per share 55,597,186 53,514,408

---------------------------------------- ------------- ------------

The Group uses adjusted results as key performance indicators,

as the Directors believe that these provide a more consistent

measure of operating performance. Adjusted profit is therefore

stated before one-off acquisition costs relating to the acquisition

of The Fluent Money Group, ongoing non-cash items relating to the

option in connection with the acquisition of First Mortgage Direct

Limited and amortisation of acquired intangibles. Adjusted profit

is also stated before net fair value gains on deferred

consideration paid and estimated to be paid to Associate

businesses, net fair value losses on financial instruments relating

to options to increase shareholdings in Associate businesses, and

impairment of loans to related parties, net of tax.

The reconciliation between the basic and adjusted figures is as

follows:

Six months ended 30 June Six months ended 30 June

2022 2021 2022 2021 2022 2021

Unaudited Unaudited Basic Basic Diluted Diluted

GBP'000 GBP'000 earnings earnings earnings earnings

per share per share per share per share

pence pence pence pence

Profit for the period 7,698 8,763 14.0 16.5 13.8 16.4

Adjustments:

Amortisation of acquired

intangibles 183 183 0.3 0.4 0.3 0.4

Costs relating

to the First Mortgage

option 423 550 0.8 1.0 0.8 1.0

Costs relating

acquisition of

The Fluent Money

Group 1,453 - 2.6 - 2.6 -

Impairment of loans

to related parties - 14 - 0.0 - 0.0

Net fair value

gains on deferred

consideration (657) - (1.2) - (1.2) -

Net fair value

losses on derivative

financial instruments 25 - 0.0 - 0.0 -

Tax effect of adjustments (70) (3) (0.1) 0.0 (0.1) 0.0

---------------------------- ----------- ----------- ----------- ----------- ----------- -------------

Adjusted earnings 9,055 9,507 16.4 17.9 16.2 17.8

---------------------------- ----------- ----------- ----------- ----------- ----------- -------------

Net fair value gains on deferred consideration of GBP656,794

represents amounts attributable to the equity owner of the parent

company and excludes GBP6,581 attributable to non-controlling

interests included in the amounts shown in the consolidated

statement of comprehensive income.

8 Dividends

Six months Six months Year ended

ended 30 ended 30 31 December

June June 2021

2022 2021 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Dividends paid and declared during

the period:

On ordinary shares at 14.7p per share

(2021: 19.2p) 8,382 10,210 10,210

Interim dividend for 2021: 13.4p per

share - - 7,129

8,382 10,210 17,339

--------------------------------------- ----------- ----------- -------------

Equity dividends on ordinary shares:

Declared:

Interim dividend for 2022: 13.4p per