TIDMMAST

RNS Number : 8288F

Mast Energy Developments PLC

12 July 2023

Mast Energy Developments PLC

(Incorporated in England and Wales)

(Registration Number: 12886458)

Share code on the LSE: MAST

ISIN: GB00BMBSCV12

('MED' or 'the Company')

Dated: 12 July 2023

Mast Energy Developments PLC ('MED' or 'the Company')

MED Announces Execution of Definitive and Binding Joint Venture

Agreement

Mast Energy Developments PLC, the UK-based multi-asset owner,

developer, and operator in the rapidly growing flexible power

market, is pleased to announce that further to its previous

announcement dated 18 May 2023, it has finalised and entered into a

first definitive and binding Joint Venture Agreement ('JVA') with

an institutional investor-led consortium (the 'Institutional

Investor'), led by Seira Capital Ltd ('Seira').

Under the JVA, the Institutional Investor will inject all

required investment capital into the Joint Venture ('JV'), with an

initial expected total investment value of c. GBP5.9m, with no

funding contribution required from MED.

The JVA also commits both parties , as set out in MED's

announcement dated 18 May 2023, to promptly finalise terms on a

second joint venture which would increase the envisaged total

investment value to c. GBP31m, with a total portfolio of low-carbon

flexible gas generation peaker plants with a total combined

generation output of up to c. 33 MW, to be developed and/or

acquired, constructed and in production and income generating under

the two joint ventures ('Secondary JVA'). Such terms are subject to

a Reverse-Takeover derogation clearance from the FCA, and MED is

not bound to enter into any agreement prior to such clearance

having been obtained. The derogation clearance has been granted

in-principle by the FCA, pending their guidance publication

expected shortly.

An overview of the key highlights and terms of the JVA and

Secondary JVA are provided below.

JVA Key Highlights

The key terms of the JV agreement comprise the following:

-- Institutional Investor will inject all required investment

capital into the JV with an initial expected total investment value

of c. GBP5.9m, rising to potentially c. GBP31m upon completion of

the Secondary JVA, (including repayment of MED past costs as

detailed below) , with no funding contribution required from

MED.

-- Institutional Investor holding 74.9% of the JV and MED

holding 25.1%, with the Institutional Investor recognising and

reimbursing to MED a portion of its actual historic project

acquisition and development related costs (the 'Cost Refund'), as

detailed below, and no requirement on MED to provide any further

funding.

-- MED have joint control of the JV SPV Board and full

operational control of the relevant sites' management and

operations.

-- The JVA will initially consist of one project with a

generation capacity of c. 9 MW that MED will provide to the JV, the

Institutional Investor will then pay MED c. GBP3.4m in terms of the

Cost Refund, and inject c. GBP2.5m into the JV SPV to cover future

capex on this project. Following the binding JVA that has now been

executed, exchange and completion is expected by 28 July 2023.

-- The Secondary JVA, is expected to consist of up to four

projects with a combined generation capacity of a minimum 17 MW and

up to 24 MW that MED will provide to the JV, the Institutional

Investor will then pay MED c. GBP3.8m in terms of the Cost Refund,

and inject c. GBP21.3m into the JV SPV to cover future capex on

these projects.

-- The Institutional Investor will receive a preferential

entitlement to 90% of the profit of the JV until the investment

provided has been recovered in full, at which point any

distribution of profits will return to the equity split.

-- Therefore, it is envisaged that MED will receive a c. 25%

stake in a portfolio of up to c. 33 MW of assets that are expected

to be fully funded, constructed and revenue generating within the

next 12 months.

-- In addition, the JV have granted MED a five-year management

services agreement ('MSA') and associated fee to manage the sites,

which will further bolster MED's share of income from the JV, and

calculated as GBP7,200 per MW per annum.

-- It is MED's intention and plan to use the bulk of the Cost

Refund from the JV investment tranches to further develop and

acquire projects that will be used within the JV, as well as

further bolster its own wholly owned portfolio of assets (outside

of the JV), by way of further development, construction and new

acquisitions.

Part Settlement of Loans

Further to the announcement dated 18 May 2023, MED has

previously granted senior fixed and floating security over its

assets by way of debenture, save to the extent that any relevant

MED Project SPV subsidiary companies that will be party to the

above referred JV agreement being considered by the Company will be

excluded, provided the monies due to the Institutional Lender from

the Company is reduced to the aggregate of GBP300k, which the

Company is permitted to do pursuant to the terms of the agreement

or otherwise waived by the Institutional Lender.

As such, MED has satisfied the Institutional Lender's

requirement in this regard, and the security has been released.

A part repayment of GBP800k to its majority shareholder, Kibo

Energy PLC ('Kibo') with regards to the shareholder loan owing.

Resultingly, this will reduce the total amount owing to Kibo to c.

GBP432k.

Arrangement Fee

MED has agreed to make a payment to Mr. Ajay Saldanha, a

director of Kibo, in relation to consulting fees with regards to

the JV transaction, based on a contractual agreements that were

entered into in February and June 2022 well before he joined the

Kibo Board, being 2.8% of the total investment value of Investment

Tranche 1, and 0.5% of the total investment value of Investment

Tranche 2 respectively, each due and payable upon completion of

each investment tranche.

Pieter Krügel, CEO of MED, commented: "We are very pleased to

have finalised and entered into this definitive and binding JVA

with the Institutional Investor consortium, led by Seira

Capital.

"In addition to MED's wholly-owned portfolio of assets, which we

will continue to grow in parallel, the JV provides the Company with

both a significant cash injection and stake in a portfolio of

assets totaling an expected 33 MW that will be fully funded,

constructed, in production and income-generating in the next 12

months. MED's share of income from the JV portfolio revenue, as

well as its 5-year MSA fee, will provide the Company with a crucial

long-term recurring income stream.

"The JV deal has been long in the making and follows a robust

investment due diligence and negotiation process, all of which MED

clearly passed with distinction. The willingness of the

Institutional Investor consortium to enter into the JVA with MED is

testament of their confidence in the Company's strategy and

long-term development plans to deliver flexible energy projects

that are commercially viable."

ENDS

This announcement contains inside information for the purposes

of the UK version of the Market Abuse Regulation (EU No. 596/2014)

as it forms part of United Kingdom domestic law by virtue of the

European Union (Withdrawal) Act 2018 ('UK MAR'). Upon the

publication of this announcement, this inside information is now

considered to be in the public domain.

For further information please visit www.med.energy or

contact:

Pieter Krügel Info@med.energy Mast Energy CEO

Developments

PLC

Jon Belliss +44 (0)20 7399 9425 Novum Securities Corporate Broker

------------------------------ -------------------- -----------------

Zainab Slemang zainab@lifacommunications.com Lifa Communications Investor &

van Rijmenant Media Relations

Advisor

------------------------------ -------------------- -----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

JVESFEFEEEDSESW

(END) Dow Jones Newswires

July 12, 2023 08:15 ET (12:15 GMT)

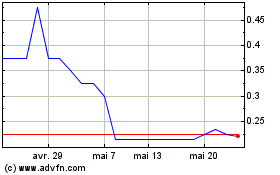

Mast Energy Developments (LSE:MAST)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Mast Energy Developments (LSE:MAST)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024