M&G Credit Income Investment Trust plc (MGCI) 2022 Interim

Results 23-Sep-2022 / 07:00 GMT/BST Dissemination of a Regulatory

Announcement, transmitted by EQS Group. The issuer is solely

responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

LEI: 549300E9W63X1E5A3N24

M&G Credit Income Investment Trust plc

Half Year Report and unaudited Condensed Financial

Statements for the six months ended 30 June 2022

Copies of the Half Year Report can be obtained from the

following website:

www.mandg.co.uk/creditincomeinvestmenttrust

The Directors present the results of the Company for the period

ended 30 June 2022.

Financial highlights

As at As at

Key data 30 June 2022 31 December 2021

(unaudited) (audited)

Net assets (GBP'000) 136,679 143,759

Net asset value (NAV) per Ordinary Share 95.49p 101.44p

Ordinary Share price (mid-market) 98.0p 99.5p

Premium/(Discount) to NAV[a] 2.6% (1.9)%

Ongoing charges figure[a] 1.20% 1.10%

Six months ended Year ended

Return and dividends per Ordinary Share 30 June 2022 31 December 2021

(unaudited) (audited)

Capital return (5.2)p 1.5p

Revenue return 1.8p 2.7p

NAV total return[a] (3.4)% 4.3%

Share price total return[a] 1.1% 13.0%

Total dividends declared 1.78p 4.04p

[a] Alternative performance measure.

Investment objective and policy

Investment objective

The Company aims to generate a regular and attractive level of

income with low asset value volatility.

Investment policy

The Company seeks to achieve its investment objective by

investing in a diversified portfolio of public and private debt and

debt-like instruments ("Debt Instruments"). Over the longer term,

it is expected that the Company will be mainly invested in private

Debt Instruments, which are those instruments not quoted on a stock

exchange.

The Company operates an unconstrained investment approach and

investments may include, but are not limited to:

Asset-backed securities, backed by a pool of loans secured on, amongst other things, residential and

. commercial mortgages, credit card receivables, auto loans, student loans, commercial loans and corporate

loans;

. Commercial mortgages;

. Direct lending to small and mid-sized companies, including lease finance and receivables financing;

. Distressed debt opportunities to companies going through a balance sheet restructuring;

. Infrastructure-related debt assets;

. Leveraged loans to private equity owned companies;

. Public Debt Instruments issued by a corporate or sovereign entity which may be liquid or illiquid;

. Private placement debt securities issued by both public and private organisations; and

. Structured credit, including bank regulatory capital trades.

The Company invests primarily in Sterling denominated Debt

Instruments. Where the Company invests in assets not denominated in

Sterling, it is generally the case that these assets are hedged

back to Sterling.

Investment restrictions

There are no restrictions, either maximum or minimum, on the

Company's exposure to sectors, asset classes or geography. The

Company, however, achieves diversification and a spread of risk by

adhering to the limits and restrictions set out below.

The Company's portfolio comprises a minimum of 50

investments.

The Company may invest up to 30% of Gross Assets in below

investment grade Debt Instruments, which are those instruments

rated below BBB- by S&P or Fitch or Baa3 by Moody's or, in the

case of unrated Debt Instruments, which have an internal M&G

rating below BBB-.

The following restrictions will also apply at the individual

Debt Instrument level which, for the avoidance of doubt, does not

apply to investments to which the Company is exposed through

collective investment vehicles:

Secured Debt Instruments Unsecured Debt Instruments

Rating (% of Gross Assets) [a] (% of Gross Assets)

AAA 5% 5%[b]

AA/A 4% 3%

BBB 3% 2%

Below investment grade 2% 1%

[a] Secured Debt Instruments are secured by a first or secondary

fixed and/or floating charge.

[b] This limit excludes investments in G7 Sovereign

Instruments.

For the purposes of the above investment restrictions, the

credit rating of a Debt Instrument is taken to be the rating

assigned by S&P, Fitch or Moody's or, in the case of unrated

Debt Instruments, an internal rating by M&G. In the case of

split ratings by recognised rating agencies, the second highest

rating will be used.

The Company typically invests directly, but it also invests

indirectly through collective investment vehicles which are managed

by an M&G Entity. The Company may not invest more than 20% of

Gross Assets in any one collective investment vehicle and not more

than 40% of Gross Assets in collective investment vehicles in

aggregate. No more than 10% of Gross Assets may be invested in

other investment companies which are listed on the Official

List.

Unless otherwise stated, the above investment restrictions are

to be applied at the time of investment.

Borrowings

The Company is managed primarily on an ungeared basis although

the Company may, from time to time, be geared tactically through

the use of borrowings. Borrowings will principally be used for

investment purposes, but may also be used to manage the Company's

working capital requirements or to fund market purchases of Shares.

Gearing represented by borrowing will not exceed 30% of the

Company's Net Asset Value, calculated at the time of draw down, but

is typically not expected to exceed 20% of the Company's Net Asset

Value.

Hedging and derivatives

The Company will not employ derivatives for investment purposes.

Derivatives may however be used for efficient portfolio management,

including for currency hedging.

Cash management

The Company may hold cash on deposit and may invest in cash

equivalent investments, which may include short-term investments in

money market-type funds ('Cash and Cash Equivalents').

There is no restriction on the amount of Cash and Cash

Equivalents that the Company may hold and there may be times when

it is appropriate for the Company to have a significant Cash and

Cash Equivalents position. For the avoidance of doubt, the

restrictions set out above in relation to investing in collective

investment vehicles do not apply to money market type funds.

Changes to the investment policy

Any material change to the Company's investment policy set out

above will require the approval of Shareholders by way of an

ordinary resolution at a general meeting and the approval of the

Financial Conduct Authority (FCA).

Investment strategy

The Company seeks to achieve its investment objective by

investing in a diversified portfolio of public and private debt and

debt-like instruments of which at least 70% is investment grade.

The Company is mainly invested in private debt instruments. This

part of the portfolio generally includes debt instruments which are

nominally quoted but are generally illiquid. Most of these will be

floating rate instruments, purchased at inception and with the

intention to be held to maturity or until prepaid by issuers;

shareholders can expect their returns from these instruments to

come primarily from the interest paid by the issuers.

The remainder of the Company's portfolio is invested in cash,

cash equivalents and quoted debt instruments, which are more

readily available and which can generally be sold at market prices

when suitable opportunities arise. These instruments may also be

traded to take advantage of market conditions. Fixed rate

instruments will often be hedged in order to protect the portfolio

from adverse changes in interest rates. Shareholders can expect

their returns from this part of the portfolio to come from a

combination of interest income and capital movements.

Investment process

The investment process for the Company consists principally of

three stages: the decision to invest, monitoring and ongoing

engagement and finally divestment.

Investment decision-making is undertaken by the Investment

Manager, based on extensive research and credit analysis by the

Investment Manager's large and experienced teams of 135 in-house

analysts who specialise in public and private debt markets. This

rigorous in depth analysis is fundamental to understanding the risk

and return profile of potential investments.

Regular monitoring is carried out to ensure that continued

holding of an investment remains appropriate. This includes

monitoring the performance of investments by fund managers,

analysts and internal control and governance processes. The

Investment Manager engages with relevant stakeholders on any issues

which may, potentially, affect an investment's ability to deliver

sustainable performance in line with those expectations.

At some point, the Investment Manager may decide to divest from

an investment (or the investment may complete in line with agreed

terms, including pre- payment), although typically, private

investments are held to their full maturity. Divestment can occur

for a variety of reasons including; the investment being no longer

suitable for the investment mandate, the outcome of engagement

being unsatisfactory or as a result of the investment team's

valuation assessment. Investment decision making is only undertaken

by the fund managers designated by the Investment Manager.

As part of the investment process, full consideration is given

to sustainability risks, which are set out in more detail on pages

35 to 36 of the Annual Report and audited financial statements for

the year ended 31 December 2021.

Chairman's statement

Performance

Your Company performed robustly through a very difficult period

for bond and equity markets. It was the worst first half of the

year for developed market equities in over fifty years, whilst

sovereign and corporate U.S. and European bonds experienced record

losses. The Company's NAV total return for the half year to 30 June

2022 was -3.4% which compared favourably to the performance of

fixed income indices such as the ICE BofA Sterling and

Collateralised Index (-14.17%) and the ICE BofA European Currency

Non-Financial High Yield 2% Constrained Index (-15.25%).

The beginning of 2022 had already been dominated by sharply

higher inflation in developed economies prior to the Russian

invasion of Ukraine. However, the invasion greatly compounded the

global inflation problem given the economic importance of both

countries in food and energy supply chains. A combination of the

conflict, inflation and higher official rates drove government bond

yields higher and saw credit spreads move wider over the first

quarter. Our Investment Manager continued to hedge interest rate

risk and maintain low duration which negated the effect of rising

risk-free rates. That said, the wider credit spreads lead to

modestly negative portfolio returns.

The second quarter saw market sentiment vary between growth and

inflation concerns. The combination of growth concerns and an

uncertain path for monetary policy saw both investment grade and

high yield credit spreads continue to sell off notably as the

quarter progressed, which impacted valuations and saw most

government and credit indices end the period with sharply negative

year-to-date returns. The low duration and investment grade credit

quality of your Company's portfolio contributed to its significant

outperformance of the relevant indices.

Share buybacks and discount management

Your board remains committed to seek to ensure that the Ordinary

Shares trade close to NAV in normal market conditions through

buybacks and issuance of Ordinary Shares. Since the start of the

year, the Company has undertaken a number of share buybacks and

share issuances pursuant to the 'zero discount' policy initially

announced on 30 April 2021. The first quarter saw the share price

trade at a discount to NAV although it moved to trade at a premium

from mid-April until the period end. The Company issued a net

1,415,000 shares from treasury in order to satisfy demand in the

market. The Company's Ordinary Share price traded at an average

discount to NAV of 0.5% during the period ended 30 June 2022. On 30

June 2022 the Ordinary Share price was 98p, representing a 2.6%

premium to NAV as at that date. As at 30 June 2022, 1,607,749

shares were held in treasury with an additional net 650,000 shares

repurchased since the period end.

Dividends

Your Company is currently paying three, quarterly interim

dividends at an annual rate of SONIA plus 3%, calculated by

reference to the adjusted opening NAV as at 1 January 2022. In

addition your Company will pay a variable, fourth interim dividend

to be determined after the year end, which will take into account

the net income over the whole financial year and, if appropriate,

any capital gains, together with the board's view of the ability of

the portfolio to deliver our longer-term objectives. The Company

paid dividends of 0.82p and 0.96p per Ordinary Share in respect of

the quarters to 31 March 2022 and 30 June 2022 respectively.

Your Company's Investment Manager continues to believe that an

annual total return, and thus ultimately a dividend yield, of SONIA

plus 4% will continue to be achievable although there can be no

guarantee that this will occur in any individual year.

Outlook

Even though the Company's year-to-date NAV total return has been

affected by the volatility in credit markets, our Investment

Manager believes that current market conditions provide a good

opportunity to position the portfolio to deliver increased yield

over the longer term. Your board notes that this was also achieved

with great success after the market setback in 2020.

Your Company's portfolio (including irrevocable commitments) is

now 62% invested in private (not listed) assets, with an additional

investment of some 12% in illiquid publicly listed assets which are

intended to be held to maturity. Whilst our Investment Manager will

continue to grow the private asset portion of the portfolio in line

with the Company's longer term strategy, it currently sees

opportunity to add public bonds into the portfolio at yields that

are attractive, relative to the target return of the Company. The

Investment Manager recently drew GBP4 million of the Company's

available GBP25 million revolving credit facility in order to take

advantage of the pronounced volatility and enhanced returns

available in the public bond market. Subsequently, a further GBP1

million was drawn down.

Your board believes that the Company remains well positioned to

achieve its return and dividend objectives, as set out above in the

section entitled 'Dividends'.

David Simpson

Chairman

22 September 2022

Investment manager's report

We are pleased to provide commentary on the factors that have

impacted our investment approach since the start of the year,

looking in particular at the performance and composition of the

portfolio built in accordance with the Company's investment

policy.

So far 2022 has been one of the worst years on record for bond

markets. In fact, financial markets ended the first half of the

year with nearly all asset classes (public bonds, sovereign bonds,

equities) suffering material losses. The market narrative thus far

and one set to extend through the remainder of the year can best be

characterised in one word- inflation. 2021 saw extraordinary demand

for goods and services as countries emerged from winter lockdowns

with record levels of household savings accumulated during 2020 as

consumers stockpiled spending firepower. At the same time, ongoing

measures to contain the spread of the Covid-19 virus had caused

disruption to global supply chains which resulted in a shortage of

available goods and commodities. These simultaneous supply and

demand shocks created considerable upwards inflationary pressure.

Additionally, the post-pandemic reaction of central banks was to

allow inflation temporarily to overshoot their well-established

long term target of 2% in order to boost economic growth and reduce

unemployment. This confluence of factors saw 2022 begin with

inflation across developed economies already at multi-year highs,

albeit with a path of interest rate hikes plotted to bring this

supposedly "transitory" inflation under control. However, inflation

has proved more entrenched and persistent than anticipated,

confirming the fears of many market participants - that central

banks had fallen behind the curve (i.e. not raising interest rates

at a pace fast enough to keep up with inflation). The situation was

greatly exacerbated following Russia's shocking invasion of

neighbouring Ukraine in February. Economic damage from the war in

Ukraine has been a significant factor in the slowdown in global

growth in 2022 and has greatly compounded the global inflation

problem. Fuel and food prices have increased rapidly, hitting

vulnerable populations in low-income countries hardest. The end

result is an inflation problem far starker than previously forecast

and populations facing a cost of living crisis that has crushed

consumer confidence and seen companies slash profit guidance for

2022.

Against this backdrop, central banks have been forced to embark

on more aggressive paths of monetary policy normalisation despite

the risk of leading economies into stagflation or recession. Market

expectations of future official interest rate increases have

changed substantially since the start of the year both in the

magnitude and timing of the expected rate rises, with multiple

increases now anticipated across major markets throughout the

remainder of the year, alongside a faster run-down of asset

purchase programmes. Market sentiment has become split between

growth and inflation concerns, driving volatility in government

bond markets as investors grapple with constantly changing forward

guidance and an uncertain outlook. The combination of growth

concerns and an uncertain path for monetary policy has seen both

investment grade and high yield credit spreads sell off (widen)

notably in the first half of the year, significantly decreasing

bond valuations.

Portfolio positioning

We entered the year with the Company's portfolio relatively

defensively positioned, as credit spreads remained at levels where,

in our opinion, investors were not being compensated adequately for

taking on risk. Simply put, bond valuations looked expensive in the

context of the prevailing economic headwinds and heightened

macroeconomic uncertainty. In light of this, portfolio activity in

the early part of the year saw us sell down BBB and BB bonds that

offered very little spread over risk free rates. We redeployed

proceeds into a handful of credit specific public opportunities as

well as adding further private exposure via a senior secured term

loan to the UK's leading and only full-service provider of

temporary traffic lights and related products. Investor concerns

over inflation had already caused credit spreads to widen notably

prior to Russia's invasion of Ukraine, and the economic

implications of the invasion accelerated the sell off. With bond

returns beginning to look attractive again, we reduced holdings in

AAA cash proxy ABS and redeployed proceeds into higher yielding,

BBB-rated public bonds with good credit fundamentals. We were able

to purchase these bonds at valuations which appeared attractive

relative to historical levels. In our opinion, the most compelling

risk-adjusted returns were to be found in Real Estate Investment

Trusts, banking and insurance subordinated debt and hybrid bonds.

Our flexibility in being able to invest across different markets

and fixed income asset classes saw us add selectively in investment

grade dollar credit which, given the more aggressive path of

interest rate hikes signalled by the Federal Reserve, looked cheap

on a relative value basis (vs sterling credit). We hedged our US

rate exposure using 30 year Treasury futures, in accordance with

the wider portfolio strategy of running with low interest rate

sensitivity (duration). In line with the Company's core investment

objective we have continued to increase the portfolio's allocation

to private assets over the period. These assets are not immune to

the headwinds faced by public bonds but typically provide greater

stability of capital via stronger structural protections,

particularly during times of market stress. Private debt can also

be an important diversifier to returns available in public fixed

income markets. GBP5.6m (c.3% of NAV) was invested into a diverse

range of private opportunities during the first half of the year,

including a facility for a leading provider of high end audio

systems; a bilateral real estate loan for the acquisition and

refurbishment of an office block in London Victoria; and the

mezzanine tranche in a regulatory capital transaction backed by a

diversified portfolio of UK small and medium enterprise business

loans.

Outlook

It is now clear that inflation is more embedded and broad-based

than previously forecast and can no longer be considered

transitory. We believe contributors such as rent and wage growth

along with structural factors in the economy are supportive of

persistently higher inflation for the foreseeable future. In the

UK, the fastest rate of real wage destruction since 1997 has

contributed to political and worker unrest, with forecasts

predicting the fall in mean disposable income will be the worst for

at least a century. Soaring energy prices are creating

unprecedented challenges for businesses already facing a

convergence of input cost pressures, whilst simultaneously

impairing household finances, affecting both sides of the

supply-demand dynamic. Businesses will need to adapt to a new

operating environment where margins are squeezed by higher input

costs and consumer demand is lower as inflation diminishes

household purchasing power.

At a global level, geopolitical developments remain central to

the economic outlook given the inextricable link with the path of

inflation. The economic implications of the ongoing Russia-Ukraine

war are widespread, whilst tensions between China and the U.S. over

Taiwan continue to escalate. The consequences of both situations

should see an acceleration in the trend toward deglobalisation,

which will only serve to create additional inflationary pressure.

There is also a risk of EU political fragmentation on issues such

as the relationship with Russia, particularly given the uneven

distribution of economic vulnerability amongst member states, which

could create dissent within the bloc and complicate the path of

future policy.

Central banks continue to ramp up their hawkish rhetoric, with

policy makers from Europe and the U.S. unequivocal in their message

that fighting inflation is the primary mandate and they will do

what is required to bring it under control. Uncertainty being the

nemesis of markets means the lack of clarity over future monetary

policy should see volatility in both sovereign and corporate bond

markets continue for some time whilst seeking to achieve that goal.

In the short to medium term it is difficult to foresee a return to

the type of ultra-loose monetary policy that has underpinned the

financial system in developed markets over the past decade or so.

Undoubtedly, a prolonged period of higher all-in bond yields and

wider credit spreads would be attractive for income investors,

albeit selectivity and detailed credit analysis will remain

key.

Although credit spreads have widened out notably since the start

of the year, in our opinion the market isn't fully pricing in the

toxic cocktail of restrictive financing conditions, lower corporate

profitability, and an extended period of low or no growth. In the

current environment we favour going up in credit quality rather

than reaching for yield. We have been opportunistically purchasing

recent public new issues which were attractively priced to

secondary curves, with some issuers paying up to meet financing

needs and to manage future debt profiles.

The predominantly floating rate nature of our underlying

portfolio and low modified duration means the Company is well

positioned for a rising interest rate environment, or one in which

rates remain elevated. We expect current market conditions to

provide attractive opportunities to deploy capital as we continue

to be both patient and selective in our approach.

M&G Alternatives Investment Management Limited

22 September 2022

Portfolio analysis

Top 20 holdings

Percentage of portfolio of investments

(including cash on deposit and derivatives)

As at 30 June 2022

M&G European Loan Fund 11.92

Delamare Finance FRN 2.5112% 19 Feb 2029 1.73

Westbourne 2016 1 WR Senior Var. Rate 30 Sep 2023 1.69

Hall & Woodhouse Var. Rate 30 Dec 2023 1.63

Lewisham Var. Rate 12 Feb 2023 1.56

PE Fund Finance III Var. Rate 16 Dec 2022 1.51

RIN II FRN 3.3377% 10 Sep 2030 1.50

Millshaw SAMS No. 1 Var. Rate 15 Jun 2054 1.49

Hammond Var. Rate 28 Oct 2025 1.41

Atlas 2020 1 Trust Var. Rate 30 Sep 2050 1.38

Finance for Residential Social Housing 8.569% 4 Oct 2058 1.38

Income Contingent Student Loans 1 2002-2006 FRN 2.76% 24 Jul 2056 1.36

Regenter Myatt Field North Var. Rate 31 Mar 2036 1.35

Signet Excipients Var. Rate 20 Oct 2025 1.32

Luminis 4.9268% 23 Sep 2025 1.21

Gongga 5.6849% 2 Aug 2025 1.20

CIFC European Funding Var. Rate 23 Nov 2034 1.20

Citibank FRN 0.01% 25 Dec 2029 1.19

Pumpkin Finance Var. Rate 15 Dec 2031 1.17

Dragon Finance FRN 1.8303% 13 Jul 2023 1.13

Total 38.33

Source: State Street.

Geographical exposure

Percentage of portfolio of investments

As at 30 June 2022

(excluding cash on deposit and derivatives)

United Kingdom 54.85%

United States 9.39%

European Union 7.51%

Australia 2.59%

France 2.45%

Other 23.21%

Source: M&G and State Street as at 30 June 2022

Portfolio overview

As at 30 June 2022 %

Public 40.86

Asset-backed securities 19.72

Bonds 21.14

Private 59.35

Asset-backed securities 7.38

Bonds 2.11

Investment funds 11.92

Loans 23.82

Private placements 2.21

Other 11.91

Derivatives (0.21)

Debt derivatives 0.25

Forwards (0.46)

Total 100.00

Source: State Street.

Credit rating breakdown

As at 30 June 2022 %

Unrated (0.21)

Derivatives (0.21)

Cash and investment grade 74.12

AAA 5.70

AA+ 0.17

AA 3.54

AA- 0.97

A+ 1.61

A 1.78

A- 2.69

BBB+ 8.89

BBB 18.21

BBB- 21.26

M&G European Loan Fund (ELF) (see note) 9.30

Sub-investment grade 26.09

BB+ 3.73

BB 4.05

BB- 3.24

B+ 5.20

B 4.40

B- 1.68

CCC+ 0.47

CCC- 0.45

D 0.25

M&G European Loan Fund (ELF) (see note) 2.62

Total 100.00

Source: State Street.

Note: ELF is an open-ended fund managed by M&G that invests

in leveraged loans issued by, generally, substantial private

companies located in the UK and Continental Europe. ELF is not

rated and the Investment Manager has determined an implied rating

for this investment, utilising rating methodologies typically

attributable to collateralised loan obligations. On this basis, 78%

of the Company's investment in ELF has been ascribed as being

investment grade, and 22% has been ascribed as being sub-investment

grade. These percentages have been utilised on a consistent basis

for the purposes of determination of the Company's adherence to its

obligation to hold no more than 30% of its assets in below

investment grade securities.

Top 20 holdings %

Company description

as at 30 June 2022

Open-ended fund managed by M&G which invests in leveraged loans issued by, generally,

M&G European Loan Fund substantial private companies located in the UK and Continental Europe. The fund's objective

is to create attractive levels of current income for investors while maintaining relatively

11.92% low volatility of NAV. (Private)

Delamare Finance FRN Floating-rate, senior tranche of a CMBS secured by the sale and leaseback of 33 Tesco

2.5112% 19 Feb 2029 superstores and 2 distribution centres. (Public)

1.73%

Westbourne 2016 1 WR Westbourne provides working capital finance to SMEs in the UK. The company is focused on

Senior Var. Rate 30 Sep small borrowers and has employed an advanced technology platform for the application,

2023 underwriting and monitoring of loans. (Private)

1.69%

Hall & Woodhouse Var. Rate

30 Dec 2023 Bilateral loan to a regional UK brewer that manages a portfolio of 219 freehold and

leasehold pubs. (Private)

1.63%

Lewisham Var. Rate 12 Feb Senior secured, fixed-rate term loan funding the costs of acquiring and developing a site in

2023 Lewisham to provide 758-bed purpose-built student accommodation and 67 affordable housing

units. (Private)

1.56%

PE Fund Finance III Var.

Rate 16 Dec 2022 Senior secured commitment providing NAV facility financing to a private equity firm

investing in debt and equity special situations across Europe. (Private)

1.51%

RIN II FRN 3.3377% 10 Sep

2030 Mixed CLO (AAA). Consists primarily of senior secured infrastructure finance loans managed

by RREEF America L.L.C. (Public)

1.50%

Millshaw SAMS No. 1 Var. Floating-rate, single tranche of an RMBS backed by shared-appreciation mortgages. (Public)

Rate 15 Jun 2054

1.49%

Hammond Var. Rate 28 Oct Secured, bilateral real estate development loan backed by a combined portfolio of 2 office

2025 assets leased to an underlying roster of global corporate tenants. (Private)

1.41%

Atlas 2020 1 Trust Var. Floating-rate, senior tranche of a bilateral RMBS transaction backed by a pool of Australian

Rate 30 Sep 2050 equity release mortgages. (Private)

1.38%

Finance for Residential

Social Housing 8.569% 4 High grade (AA/Aa3), fixed-rate bond backed by cash flows from housing association loans.

Oct 2058 (Public)

1.38%

Income Contingent Student

Loans 1 2002-2006 FRN Floating-rate, mezzanine tranche of a portfolio comprising of income- contingent repayment

2.76% 24 Jul 2056 student loans originally advanced by the UK Secretary of State for Education. (Public)

1.36%

Regenter Myatt Field North PFI (Private Finance Initiative) floating-rate, amortising term loan relating to the already

Var. Rate 31 Mar 2036 completed refurbishment and ongoing maintenance of residential dwellings and communal

infrastructure in the London borough of Lambeth. (Private)

1.35%

Signet Excipients Var. Fixed-rate loan secured against 2 large commercial premises in London, currently leased to 2

Rate 20 Oct 2025 FTSE listed UK corporations. (Public)

1.32%

Luminis 4.9268% 23 Sep

2025 Floating-rate, mezzanine tranche of a regulatory capital transaction backed by a portfolio

of predominantly revolving facilities extended to blue chip corporates in the Americas and

1.21% EMEA. (Private)

Gongga 5.6849% 2 Aug 2025 Structured Credit trade by Standard Chartered referencing a USUSD2bn portfolio of loans to

companies domiciled in 36 countries. (Private)

1.20%

CIFC European Funding Var.

Rate 23 Nov 2034 Mixed CLO (AAA) backed by a portfolio of senior loan obligations, mezzanine loan obligations

and high yield bonds managed by CIFC Asset Management Europe Ltd. (Public)

1.20%

Citibank FRN 0.01% 25 Dec Floating-rate, mezzanine tranche of a regulatory capital transaction backed by a portfolio

2029 of loans to large global corporates, predominantly in North America. (Private)

1.19%

Pumpkin Finance Var. Rate Senior secured, floating rate facility granted within the context of the UK Government's

15 Dec 2031 CBILS scheme to support UK small businesses through the COVID pandemic. (Private)

1.17%

Dragon Finance FRN 1.8303% Floating-rate, subordinated tranche of a securitisation of the sale and leaseback of 10

13 Jul 2023 supermarket sites sponsored by J Sainsbury plc ("Sainsbury's"). (Public)

1.13%

Interim management report and statement of directors'

responsibilities

Interim management report

The important events that have occurred during the period under

review, the key factors influencing the financial statements and

the principal factors that could impact the remaining six months of

the financial period are set out in the Chairman's statement and

the Investment Manager's report.

Principal risks

The principal risks faced by the Company during the remaining

six months of the year can be divided into various areas as

follows:

. Market risk;

. Credit risk;

. Investment management performance risk;

. Liquidity risk;

. Dividend policy risk;

. Operational risk;

. Regulatory, legal and statutory risk: changes in laws, government policy or regulations;

. Sustainability risk; and

. Russia - Ukraine risk.

These are consistent with the principal risks described in more

detail in the Company's Annual Report and Financial Statements for

the year ended 31 December 2021, which can be found in the

Strategic Report on pages 18 to 24 and in note 13 on pages 97 to

101 and which are available on the website at:

www.mandg.co.uk/creditincomeinvestmenttrust

Since the writing of the Annual Report and Financial Statements,

the geo-political and macro-economic environment has been impacted

by commodity price inflation in Europe, influenced by tactical

constraints in flows of natural gas from Russia. The key mitigants

and controls remain in place for the Company.

Going concern In accordance with the latest guidance issued by

the Financial Reporting Council, the Directors have undertaken and

documented a rigorous assessment of whether the Company is a going

concern. The Directors considered all available information when

undertaking the assessment.

The Directors believe that the Company has appropriate financial

resources to enable it to meet its day-to-day working capital

requirements and the Directors believe that the Company is well

placed to continue to manage its business risks.

In assessing the going concern basis of accounting, the

Directors have also considered the Russian invasion of Ukraine and

the impact this may have on the Company's investments and the

Company's NAV.

The Directors consider that the Company has adequate resources

to continue in operational existence for the next 12 months. For

this reason they continue to adopt the going concern basis of

accounting in preparing these condensed financial statements.

Related party disclosure and transactions with the Investment

Manager M&G Alternatives Investment Management Limited, as

Investment Manager, is a related party to the Company. The

management fee due to the Investment Manager for the period is

disclosed in the condensed income statement and in note 3, and

amounts outstanding at the period end are shown in note 8. The

Company holds an investment in M&G European Loan Fund which is

managed by M&G Investment Management Limited. At the period end

this was valued at GBP16,101,058 and represented 11.92% of the

Company's investment portfolio.

The Directors of the Company are related parties. The Chairman

receives an annual fee of GBP43,000, the Chairman of the Audit

Committee receives an annual fee of GBP37,500 and each

non-executive Director receives an annual fee of GBP32,250.

There are certain situations where the Company undertakes

purchase and sale transactions with other M&G managed funds.

All such transactions are subject to the provisions of M&G's

fixed income dealing procedures and prior approval by senior fixed

income managers authorised by M&G to approve such trades.

Trades are conducted on liquidity and pricing terms which at the

relevant time are no worse than those available to the Company from

dealing with independent third parties.

Statement of directors' responsibilities

The Directors confirm that to the best of their knowledge:

the condensed set of financial statements has been prepared in accordance with Financial Reporting

Standard 104 (Interim Financial Reporting) and give a true and fair view of the assets, liabilities,

. financial position and profit or loss of the Company; and

this Interim management report, together with the Chairman's statement, Investment Manager's report and

. the condensed set of financial statements include a fair review of the information required by:

DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being an indication of important events

that have occurred during the six months ended 30 June 2022 and their impact on the condensed set of

a. financial statements; and a description of the principal risks for the remaining six months of the

period; and

DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being related party transactions that

b. have taken place during the six months ended 30 June 2022 and that have materially affected the

financial position or performance of the Company during that period; and any changes in the related

party transactions that could do so.

The Half Year Report and unaudited condensed set of financial

statements were approved by the Board of Directors on 22 September

2022 and the above responsibility statement was signed on its

behalf by:

David Simpson

Chairman

22 September 2022

Condensed financial statements (unaudited)

Condensed income statement

Six months ended Six months ended Year ended

30 June 2022 30 June 2021 31 December 2021

(unaudited) (unaudited) (audited)

Note Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Net (losses)/gains on 7 - (5,875) (5,875) - 541 541 - (545)

investments (545)

Net (losses)/gains on 7 - (1,164) (1,164) 2,428 - 2,837 2,837

derivatives 2,428

Net currency gains/ 216 (278) (62) (140) (176) (51) (145) (196)

(losses) (36)

Income 3 3,174 - 3,174 2,735 - 2,735 5,565 - 5,565

Investment management (487) - (487) (451) - (451) (965) - (965)

fee

Other expenses (351) - (351) (254) - (254) (548) - (548)

Net return on ordinary

activities before 2,552 (7,317) (4,765) 1,994 2,829 4,823 4,001 2,147 6,148

finance costs and

taxation

Finance costs 5 (57) - (57) (61) - (61) (122) - (122)

Net return on ordinary

activities before 2,495 (7,317) (4,822) 1,933 2,829 4,762 3,879 2,147 6,026

taxation

Taxation on ordinary - - - - - - - - -

activities

Net return attributable

to Ordinary Shareholders 2,495 (7,317) (4,822) 1,933 2,829 4,762 3,879 2,147 6,026

after taxation

Net return per Ordinary

Share (basic and 2 1.77p (5.19)p (3.42)p 1.34p 1.96p 3.30p 2.70p 1.49p 4.19p

diluted)

The total column of this statement represents the Company's

profit and loss account. The 'Revenue' and 'Capital' columns

represent supplementary information provided under guidance issued

by the Association of Investment Companies.

All revenue and capital items in the above statement derive from

continuing operations.

The Company has no other comprehensive income and therefore the

net return on ordinary activities after taxation is also the total

comprehensive income for the period.

The accompanying notes form an integral part of these condensed

financial statements.

Condensed statement of financial position

As at 30 June As at 30 June 2021 As at 31

2022 December

(unaudited) (unaudited) 2021 (audited)

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Non-current assets

Investments at fair value through profit or loss 7 135,398 139,439 139,501

Current assets

Derivative financial assets held at fair value through 7 - - 631

profit or loss

Receivables 8 1,534 1,798 1,241

Cash and cash equivalents 8 4,221 3,473

6,944

5,755 8,742 5,345

Current liabilities

Derivative financial liabilities held at fair value 7 (293) (408) -

through profit or loss

Payables 8 (4,181) (1,476) (1,087)

(4,474) (1,884) (1,087)

Net current assets 1,281 6,858 4,258

Net assets 136,679 146,297 143,759

Capital and reserves

Called up share capital 9 1,447 1,447 1,447

Share premium 42,257 42,217 42,217

Special distributable reserve 97,027 97,296 95,670

Capital reserve 9 (5,473) 4,313 3,473

Revenue reserve 1,421 1,024 952

Total shareholders' funds 136,679 146,297 143,759

Net Asset Value per Ordinary Share (basic and diluted) 2 95.49p 102.04p 101.44p

The accompanying notes form an integral part of these condensed

financial statements.

Approved and authorised for issue by the Board of Directors on

22 September 2022 and signed on its behalf by:

David Simpson

Chairman

Company registration number: 11469317

22 September 2022

Condensed statement of changes in equity

Called up Special

Six months ended 30 June 2022 Ordinary Share Share distributable Capital Revenue Total

(unaudited) premium reserve reserve reserve

capital

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2021 1,447 42,217 95,670 3,473 952 143,759

Ordinary Shares issued from - 40 2,681 - - 2,721

treasury

Purchase of Ordinary Shares to be - - (1,324) - - (1,324)

held in treasury

Net return attributable to - - - (7,317) 2,495 (4,822)

shareholders

Dividends paid 6 - - - (1,629) (2,026) (3,655)

Balance at 30 June 2022 1,447 42,257 97,027 (5,473) 1,421 136,679

Called up Special

Six months ended 30 June 2021 Ordinary Share Share distributable Capital Revenue Total

(unaudited) premium reserve reserve reserve

capital

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2020 1,447 42,217 98,499 3,349 1,116 146,628

Purchase of Ordinary Shares to be (1,203) - - (1,203)

held in treasury

Net return attributable to - - - 2,829 1,933 4,762

shareholders

Dividends paid 6 - - (1,865) (2,025) (3,890)

Balance at 30 June 2021 1,447 42,217 97,296 4,313 1,024 146,297

Called up Special

Year ended 31 December 2021 Note Ordinary Share Share distributable Capital Revenue Total

(audited) premium reserve reserve reserve

capital

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2020 1,447 42,217 98,499 3,349 1,116 146,628

Purchase of Ordinary Shares to be - - (2,829) - - (2,829)

held in treasury

Net return attributable to - - - 2,147 3,879 6,026

shareholders

Dividends paid 6 - - - (4,043) (6,066)

(2,023)

Balance at 31 December 2021 1,447 42,217 95,670 3,473 143,759

952

The accompanying notes form an integral part of these condensed

financial statements.

Condensed cash flow statement

Note Six months ended Six months ended Year ended

30 June 2022 30 June 2021 31 December 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flows

from operating

activities

Net (loss)/

profit before (4,765) 4,823 6,148

finance costs

and taxation

Adjustments

for:

Net losses/

(gains) on 7 5,875 (541) 545

investments

Net losses/

(gains) on 7 1,164 (2,428) (2,837)

derivatives

(Increase)/

decrease in (293) 133 104

receivables

Increase/

(decrease) in 517 (165) 130

payables

Purchases of 7 (21,608) (19,439) (42,088)

investments[a]

Sales of 7 22,173 22,437 43,210

investments[a]

Net cash

inflow/

(outflow) from 3,063 4,820 5,212

operating

activities

Financing

activities

Finance costs 5 (57) (61) (122)

Ordinary

Shares issued 2,721 - -

from treasury

Purchase of

Ordinary

Shares to be (1,324) (1,203) (2,829)

held in

treasury

Dividend paid 6 (3,655) (3,890) (6,066)

Net cash

(outflow)/

inflow from (2,315) (5,154) (9,017)

financing

activities

Increase/

(decrease) in 748 (334) (3,805)

cash and cash

equivalents

Cash and cash

equivalents at

the start of 3,473 7,278 7,278

the period/

year

Increase/

(decrease) in

cash and cash 748 (334) (3,805)

equivalents as

above

Cash and cash

equivalents at 8 4,221 6,944 3,473

the end of the

period/year

[a] Receipts from the sale of, and payments to acquire,

investment securities have been classified as components of cash

flows from operating activities because they form part of the

Company's dealing operations.

The accompanying notes form an integral part of these condensed

financial statements.

Notes to the condensed financial statements

1 Accounting policies

The condensed financial statements have been prepared on a going

concern basis under the historical cost convention, modified to

include certain items at fair value, and in accordance with United

Kingdom Accounting Standards, including Financial Reporting

Standard 104 (FRS 104) Interim Financial Reporting issued by the

Financial Reporting Council and the Statement of Recommended

Practice (SORP) issued by the Association of Investment Companies

(AIC) in July 2022 'Financial Statements of Investment Trust

Companies and Venture Capital Trusts'.

The annual Financial Statements have been prepared in accordance

with the Financial Reporting Standard 102 (FRS 102) and the AIC

SORP.

The accounting policies applied to this condensed set of

financial statements are consistent with those applied in the

Annual Report and Financial Statements for the year ended 31

December 2021.

In the current period the Company has started reissuing shares

held in Treasury. Where Ordinary Shares held in Treasury shares are

subsequently reissued, the sales proceeds up to the purchase price

of the shares will be transferred to the special distributable

reserve or capital reserve and the excess of the sales proceeds

over the purchase price will be transferred to the share

premium.

The functional and presentational currency of the Company is

pounds sterling because that is the currency of the primary

economic environment in which the Company operates.

All values are recorded to nearest thousands, unless otherwise

stated.

2 Returns and net asset value (NAV)

Six months ended Six months ended Year ended

30 June 2022 30 June 2021 31 December 2021

Revenue return

Revenue return attributable to Ordinary Shareholders (GBP'000) 2,495 1,933 3,879

Weighted average number of shares in issue during the period/year 141,027,443 144,490,744 143,757,774

Revenue return per Ordinary Share (basic and diluted) 1.77p 1.34p 2.70p

Capital return

Capital return attributable to Ordinary Shareholders (GBP'000) (7,317) 2,829 2,147

Weighted average number of shares in issue during the period/year 141,027,443 144,490,744 143,757,774

Capital return per Ordinary Share (basic and diluted) (5.19)p 1.96p 1.49p

Net return

Net return per Ordinary Share (basic and diluted) (3.42)p 3.30p 4.19p

NAV per Ordinary Share

Net assets attributable to Ordinary Shareholders (GBP'000) 136,679 146,297 143,759

Number of shares in issue at period/year end 143,138,022 143,367,771 141,723,022

NAV per Ordinary Share 95.49p 102.04p 101.44p

3 Income

Six months Six months ended Year ended

ended

30 June 2022 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

Income from investments

Interest income from Debt 2,809 2,421 4,936

Instruments

Distributions from investment funds 306 260 521

Management fee rebate 51 51 105

3,166 2,732 5,562

Other income

Interest from cash and cash 8

equivalents 3 3

3,174 2,735 5,565

4 Expenses

There were no Non-audit fees payable to the auditor as of 30

June 2022. Non-audit fees (including VAT) payable to the auditor in

respect of the agreed upon procedures on the Half Year Report as of

30 June 2021 were GBP12,600. The agreed upon procedures did not

constitute an audit engagement or a review of the Half Year

Report.

5 Finance costs

Six months ended Six months ended Year ended

30 June 2022 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

Commitment fee 37 37 75

Arrangement fees 6 6 13

Legal fees 14 18 34

57 61 122

On 19 October 2020 the Company entered into a GBP25 million

revolving credit facility agreement with State Street Bank

International GmbH. On 18 October 2021 the Company renewed the

credit facility on the existing terms, with the new credit facility

expiring on 17 October 2022. As at 30 June 2022 no amounts were

drawn down.

Subsequent to the period end on 6 July 2022, GBP4 million was

drawn down from the revolving credit facility agreement, and a

further GBP1 million was drawn down on 13 September 2022. Both were

at a daily rate of SONIA plus a spread of 1.25%.

6 Dividends

Six months ended Six months ended Year ended

30 June 2022 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

Revenue

2020 fourth interim interest distribution of 0.77p - 1,114 1,114

2021 first interim interest distribution of 0.63p - 911 911

2021 second interim interest distribution of 0.71p - - 1,017

2021 third interim interest distribution of 0.70p - - 1,001

2021 fourth interim interest distribution of 0.67p 941 - -

2022 first interim interest distribution of 0.77p 1,085 - -

2,026 2,025 4,043

Capital

2020 fourth interim dividend of 1.18p - 1,706 1,706

2021 first interim dividend of 0.11p - 159 159

2021 second interim dividend of 0.05p - - 72

2021 third interim dividend of 0.06p - - 86

2021 fourth interim dividend of 1.11p 1,558 - -

2022 first interim dividend of 0.05p 71 - -

1,629 1,865 2,023

On 26 July 2022 the Board declared a second interim dividend of

0.96p per Ordinary Share for the year ended 31 December 2022, which

was paid on 26 August 2022 to Ordinary Shareholders on the register

on 5 August 2022. The ex-dividend date was 4 August 2022.

In accordance with FRS 102, Section 32, 'Events After the End of

the Reporting Period', the 2022 second interim dividend has not

been included as a liability in this condensed set of financial

statements.

7 Investments held at fair value through profit or loss

(FVTPL)

As at As at As at

30 June 2022 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

Opening valuation 140,132 140,316 140,316

Analysis of transactions made during the period/year

Purchases at cost 24,185 18,769 40,734

Sale proceeds (22,173) (23,023) (43,210)

(Losses)/gains on investments (7,039) 2,969 2,292

Closing valuation 135,105 139,031 140,132

Closing cost 141,583 138,251 139,848

Closing investment holding (losses)/gains (6,478) 780 284

Closing valuation 135,105 139,031 140,132

The Company received GBP22,173,000 from investments sold in the

six month period ended 30 June 2022 (six months ended 30 June 2021:

GBP23,023,000). The book cost of these investments when they were

purchased was GBP22,209,000 (six months ended 30 June 2021:

GBP21,836,000). These investments have been revalued over time and

until they were sold any unrealised gains/losses were included in

the fair value of the investments.

As at As at As at

30 June 2022 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

Gains on investments

Net (losses)/gains on investments (5,875) 541 (545)

Net (losses)/gains on derivatives (1,164) 2,428 2,837

Net (losses)/gains on investments (7,039) 2,969 2,292

As at As at As at

30 June 2022 30 June 2021 31 December

2021

GBP'000 GBP'000 GBP'000

Closing valuation

Investments at fair value through profit or loss 135,398 139,439 139,501

Derivative financial (liabilities)/assets held at fair value through profit or (293) (408) 631

loss

Closing valuation 135,105 139,031 140,132

8 Receivables, Cash and cash equivalents and Payables

As at As at As at

30 June 2022 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

Receivables

Sales for future settlement - 586 -

Accrued income 1,380 1,128 1,108

Prepaid expenses 23 33 53

Management fee rebate 131 51 80

Total receivables 1,534 1,798 1,241

Cash and cash equivalents

Cash at bank 3,670 1,302 2,526

Amounts held at futures clearing houses 551 1,041 345

Cash on deposit - 4,601 602

Total cash and cash equivalents 4,221 6,944 3,473

Payables

Purchases for future settlement 2,577 684 -

Expenses payable and deferred income 344 351 314

Management fee payable 1,258 438 771

Other payables 2 3 2

Total payables 4,181 1,476 1,087

9 Called up share capital

As at 30 June 2022 As at 30 June 2021 As at 31 December 2021

Number of shares Nominal value GBP'000 Number of shares Nominal value Number of shares Nominal value

GBP'000 GBP'000

Ordinary

Shares of 1p

Ordinary

Shares in

issue at the 141,723,022 1,417 144,605,771 1,446 144,605,771 1,446

beginning of

the period/

year

Ordinary

Shares issued --

during the 2,765,000 28 - - -

period/ year

Purchase of

Ordinary (1,350,000) (14) (1,238,000) (12) (2,882,749) (29)

Shares held

in treasury

Ordinary

Shares in

issue at the 143,138,022 1,431 143,367,771 1,434 141,723,022 1,417

end of the

period/year

Treasury

Shares

(Ordinary

Shares of 1p)

Treasury

Shares at the

beginning of 3,022,749 30 140,000 1 140,000 1

the period/

year

Ordinary

Shares issued

from treasury (2,765,000) (28) - - - -

during the

period/year

Purchase of

Ordinary 1,350,000 14 1,238,000 12 2,882,749 29

Shares held

in treasury

Treasury

Shares at the 1,607,749 16 1,378,000 13 3,022,749 30

end of the

period/year

Total

Ordinary

Shares in

issue and in 144,745,771 1,447 144,745,771 1,447 144,745,771 1,447

treasury at

the end of

the period/

year

The analysis of the capital reserve is as follows:

Six months ended 30 June 2022 Six months ended 30 June 2021 Year ended 31 December 2021

Realised Investment Total Realised Investment Total Realised Investment Total

capital holding capital capital holding capital capital holding capital

reserve (losses) reserve reserve (losses) reserve reserve (losses) reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Capital reserve at

the beginning of the 3,189 284 3,473 1,290 2,059 3,349 1,290 2,059 3,349

period/year

(Losses)/gains on

realisation of (277) - (277) 4,248 - 4,248 4,067 - 4,067

investments at fair

value

Realised currency

losses during the (278) - (278) (140) - (140) (145) - (145)

period/year

Movement in - (6,762) (6,762) - (1,279) (1,279) - (1,775) (1,775)

unrealised losses

Dividends paid (1,629) - (1,629) (1,865) - (1,865) (2,023) - (2,023)

Capital reserve at

the end of the 1,005 (6,478) (5,473) 3,533 780 4,313 3,189 284 3,473

period/year

The above split in capital reserve is shown in accordance with

provisions of the Statement of Recommended Practice 'Financial

Statements of Investment Trust Companies and Venture Capital

Trusts', 2022.

10 Related party transactions

M&G Alternatives Investment Management Limited, as

investment manager is a related party to the Company. The

management fee payable to the Investment Manager for the period is

disclosed in the condensed income statement and in note 3, amounts

outstanding at the period end are shown in note 8.

The Company holds an investment in M&G European Loan Fund

which is managed by M&G Investment Management Limited. At the

period end this was valued at GBP16,101,058 (30 June 2021:

GBP17,458,741) and represented 11.92% (30 June 2021: 12.16%) of the

Company's investment portfolio.

The Directors of the Company are related parties. For further

details of the annual fees payable to the Directors, please refer

to the Related party disclosure and transactions with the

Investment Manager section above.

11 Fair value hierarchy

Under FRS 102 an entity is required to classify fair value

measurements using a fair value hierarchy that reflects the

significance of the inputs used in making the measurements. The

fair value hierarchy shall have the levels stated below.

-- Level 1: quoted prices (unadjusted) in active markets for

identical assets or liabilities.

-- Level 2: other significant observable inputs (including

quoted prices for similar investments, interest rates, prepayments,

credit risk, spread premium, credit ratings etc).

-- Level 3: significant unobservable inputs (including the

Company's own assumptions in determining the fair value of

investments, discounted cashflow model or single broker quote).

The financial assets measured at FVTPL are grouped into the fair

value hierarchy as follows:

As at 30 June 2022 As at 30 June 2021 As at 31 December 2021

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Financial assets

at FVTPL

Debt Instruments - 47,723 71,574 119,297 - 60,039 61,941 121,980 - 54,382 67,599 121,981

Investment in - 16,101 - 16,101 - 17,459 - 17,459 - 17,520 - 17,520

funds

Derivatives 338 65 - 403 - 151 - 151 - 667 - 667

Financial

liabilities at

FVTPL

Derivatives - (696) - (696) (238) (321) - (559) (36) - - (36)

Net fair value 338 63,193 71,574 135,105 (238) 77,328 61,941 139,031 (36) 72,569 67,599 140,132

Valuation techniques for Level 3

The debt investments within the Company utilise a number of

valuation methodologies such as a discounted cash flow model, which

will use the relevant credit spread and underlying reference

instrument to calculate a discount rate. Unobservable inputs

typically include spread premiums and internal credit ratings.

Some debt instruments are valued at par and are monitored to

ensure this represents fair value for these instruments. On a

monthly basis these instruments are assessed to understand whether

there is any evidence of market price movements, including

impairment or any upcoming refinancing.

In addition, some are priced by a single broker quote, which is

typically the traded broker, who provides an indicative mark.

12 Capital commitments

There were outstanding unfunded investment commitments of

GBP2,812,000 (30 June 2021: GBP4,821,000) at the period/year

end.

As at As at As at

30 June 2022 30 June 2021 31 December 2021

GBP'000 GBP'000 GBP'000

Bayswater RD Mercury Var. Rate 31 May 2024 1,293 2,235 1,862

Project Grey Var. Rate 30 Apr 2025 (Senior) 642 - -

Project Grey Var. Rate 30 Apr 2025 (Junior) 371 - -

Intu (SGS) Finco Limited Var. Rate 31 Mar 2024 229 - 229

Bayswater RD Mercury Var. Rate 1 May 2024 137 201 173

Kaveh Ventures LLC Var. Rate 22 Mar 2024 82 323 163

Jamshid Ventures Var. Rate 23 Jul 2023 58 328 125

Lewisham Var. Rate 12 Feb 2023 - 519 -

Greensky Var. Rate 11 Dec 2023 - 476 -

Harmoney Warehouse No 2 Var. Rate 31 Dec 2026 - 301 -

Sonovate Var. Rate 12 Apr 2022 - 280 -

Valentine Senior Var. Rate 7 Mar 2022 - 133 133

Alchemy Copyrights Var. Rate 16 Dec 2022 - - 109

Bread Holdings Var. Rate 1 Sep 2028 - - 72

Gate 1 Var. Rate 4 Jun 2022 (Junior) - 21 -

Gate 1 Var. Rate 4 Jun 2022 (Senior) - 4 -

2,812 4,821 2,866

13 Half Year Report

The financial information contained in this Half Year Report

does not constitute statutory accounts as defined in section 434 -

436 of the Companies Act 2006.

The financial information for the six months ended 30 June 2022

and 30 June 2021 has not been reviewed or audited by the Company's

auditors.

The figures and financial information for the year ended 31

December 2021 have been extracted from the latest published audited

financial statements, which have been filed with the Registrar of

Companies. The report of the Auditor on those accounts was

unqualified and did not contain a statement under sections 498(2)

or (3) of the Companies Act 2006.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BFYYL325, GB00BFYYT831

Category Code: IR

TIDM: MGCI

LEI Code: 549300E9W63X1E5A3N24

OAM Categories: 1.2. Half yearly financial reports and audit reports/limited reviews

Sequence No.: 189995

EQS News ID: 1448725

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1448725&application_name=news

(END) Dow Jones Newswires

September 23, 2022 02:00 ET (06:00 GMT)

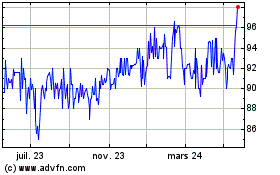

M&g Credit Income Invest... (LSE:MGCI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

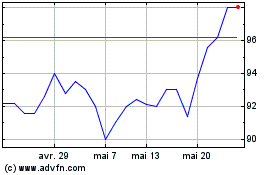

M&g Credit Income Invest... (LSE:MGCI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025