TIDMMGCI

RNS Number : 4275A

M&G Credit Income Investment Trust

24 May 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO, THE UNITED STATES OF

AMERICA, CANADA, AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN OR ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO

DISTRIBUTE THIS ANNOUNCEMENT.

This announcement contains inside information.

24 May 2023

M&G Credit Income Investment Trust plc

Notice of General Meeting

The Board of M&G Credit Income Investment Trust plc (the

"Company") has today published a circular (the "Circular"),

including a notice of meeting convening a general meeting

("Meeting") to be held at 12:00 p.m. on 15 June 2023, which will

shortly be sent to the Company's shareholders ("Shareholders").

The Circular sets out details of the following proposals:

i. an amendment to the Company's articles of association (the

"Articles") such that the Board will be required to submit to

Shareholders proposals (which may constitute a tender offer or

other method of distribution) to provide Shareholders with an

opportunity to realise the value of some or all of their Ordinary

Shares at the Net Asset Value per Ordinary Share less costs (a

"Liquidity Opportunity") at, or within the twelve months prior to,

the annual general meeting of the Company to be held in 2028, and

at, or within the twelve months prior to, each annual general

meeting of the Company held every fifth year thereafter, in each

case unless the Board is directed by Shareholders by way of a

special resolution not to offer such Liquidity Opportunity; and

ii. a direction to the Board not to offer to Shareholders a

Liquidity Opportunity in 2024 (the "Initial Liquidity Opportunity")

(together, the "Proposals").

The Proposals require the approval of Shareholders, which will

be sought at the Meeting. Since the Proposals constitute a change

to the Articles they are required by law to be proposed as a

special resolution ("Resolution"), which requires at least 75% of

those votes cast at a general meeting to be cast in favour. In the

event that Shareholders do not approve the Resolution to be

proposed to implement the Proposals, or were the Proposals to be

approved but only by a narrow margin, the Board will reconsider

offering the Initial Liquidity Opportunity.

The Board has consulted with a broad group of Shareholders who

have all indicated their support for the Proposals.

The Board believes that the Proposals are in the best interests

of the Company and the Shareholders as a whole and recommends that

Shareholders vote in favour of the Resolution at the Meeting.

Rationale for the Proposals

In the prospectus for the Company's initial public offer in 2018

(the "IPO") the Board set out, as part of its approach to discount

management, its intention to present the Initial Liquidity

Opportunity to Shareholders before the fifth AGM of the Company,

which is to be held in 2024. The Initial Liquidity Opportunity was

intended to provide Shareholders with an opportunity to realise the

value of some or all of their holdings in the Company, principally

in the event that either the Company had not performed well or the

Shares had traded at a prolonged discount to their Net Asset

Value.

The Board is pleased that the Company has since IPO delivered on

its return target of an annualised dividend yield of LIBOR plus

2.5% in respect of the Company's first financial period to 31

December 2019 and an annualised dividend yield of SONIA (which

replaced LIBOR) plus 4% (on the opening NAV per Share) in respect

of each financial year thereafter. Additionally, given the recent

increases in interest rates, the dividend yield on the opening NAV

for the Company's financial year 2023 (adjusted for the payment of

the fourth quarter dividend for financial year 2022) is

approximately 8%.

Despite the Company's NAV underperforming the benchmark in 2022,

the Board believes this was due to an increase in credit spreads to

levels above those typically seen in public investment grade debt

markets and a consequential reduction in the market prices of some

of the Company's underlying portfolio holdings. As these spreads

normalise, the Company's NAV can be expected to rise again. The

Company's investment manager, M&G Alternatives Investment

Management Limited (the "Investment Manager") believes that an

annual total return of SONIA plus 4% continues to be

achievable.

In recognition of the share price discount to NAV at the time,

the Board introduced a zero discount policy in April 2021, since

when the Company's share price discount to NAV has averaged 1.9%

(up to the close of business on 19 May 2023. Where required, in

implementing its discount policy, the Board has repurchased Shares,

with 2.6 million Shares currently held in treasury as a result and

available to be resold into the market. Since the introduction of

the zero discount policy the Shares have also traded at times at a

premium to NAV per Share and the Company has been able to sell from

treasury 2.8 million Shares to satisfy market demand.

Consequently, given that the original objectives of the Initial

Liquidity Opportunity have been addressed through the Company

having achieved its performance objective and discount management

objective through the establishment of an active zero discount

policy, the Board does not believe offering the Initial Liquidity

Opportunity would be in the best interests of the Company and

Shareholders as a whole.

While the Company might have left any decision about the Initial

Liquidity Opportunity until closer to the AGM in 2024, the

Company's Investment Manager is seeing attractive opportunities for

deploying capital in the current environment, particularly in

public markets. The Board believes it would be beneficial to the

Company to place the Investment Manager in a position to be seeking

new investments for the Company with the benefit of certainty as to

a longer term horizon and, consequently, has determined that it

would be appropriate to bring forward its decision in respect of

the Initial Liquidity Opportunity.

Terms used in this announcement shall, unless the context

otherwise requires, bear the meanings given to them in the

Circular.

A copy of the Circular and Articles of Association will shortly

be available to view on the Company's website at

www.mandg.co.uk/creditincomeinvestmenttrust and will also be

submitted shortly to the National Storage Mechanism ("NSM") and

available for inspection at the NSM, which is situated at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

For further information please contact:

M&G Credit Income Investment Trust plc 07936 332 503

Paula O'Reilly, Link Company Matters Limited,

Company Secretary

Winterflood Securities Limited 020 3100 0000

Neil Morgan

M&G Credit Income Investment Trust plc LEI:

549300E9W63X1E5A3N24

The content of this announcement has been prepared by, and is

the sole responsibility of, M&G Credit Income Investment Trust

plc.

Neither the content of the Company's website nor any website

accessible by hyperlinks to the Company's website is incorporated

in, or forms part of, this announcement.

Winterflood Securities Limited ("Winterflood"), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting only for the Company in connection

with the matters described in this announcement and is not acting

for or advising any other person, or treating any other person as

its client, in relation thereto and will not be responsible for

providing the regulatory protection afforded to clients of

Winterflood or advice to any other person in relation to the matter

contained herein.

None of M&G Alternatives Investment Management Limited (the

"Investment Manager") or Winterflood, or any of their respective

affiliates, accepts any responsibility or liability whatsoever for

or makes any representation or warranty, express or implied, as to

this announcement, including the truth, accuracy or completeness of

the information in this announcement (or whether any information

has been omitted from the announcement) or for any loss howsoever

arising from any use of the announcement or its contents aside from

the responsibilities and liabilities, if any, which may be imposed

by FSMA, as amended, or the regulatory regime established

thereunder or any other applicable regulatory regime. The

Investment Manager and Winterflood and their respective affiliates

accordingly disclaim all and any liability whether arising in tort,

contract or otherwise which they might otherwise have in respect of

this announcement or its contents or otherwise arising in

connection therewith.

This announcement is not a prospectus and is not an offer to

sell or a solicitation of any offer to buy any securities in the

United States or in any other jurisdiction. The Shares have not

been, and will not be, registered under the U.S. Securities Act of

1933, as amended, and the Company has not been, and will not be,

registered under the U.S. Investment Company Act of 1940, as

amended.

The distribution of this announcement in certain jurisdictions

may be restricted by law and/or regulation. Persons receiving this

announcement are required to inform themselves about and to observe

any such restrictions.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGXXLLLXELLBBE

(END) Dow Jones Newswires

May 24, 2023 02:00 ET (06:00 GMT)

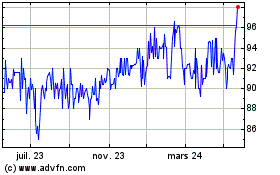

M&g Credit Income Invest... (LSE:MGCI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

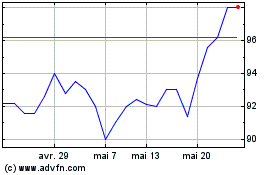

M&g Credit Income Invest... (LSE:MGCI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025