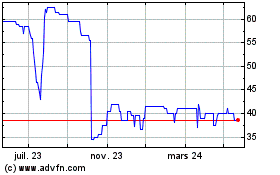

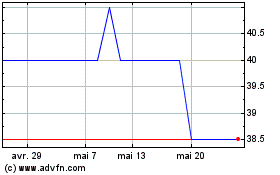

TIDMMIND

RNS Number : 4675C

Mind Gym PLC

13 June 2023

Mind Gym PLC

("MindGym", the "Group" or the "Company")

Full year results for the year ended 31 March 2023

Double-digit revenue growth and return to profitability

MindGym (AIM: MIND), the global provider of human capital and

business improvement solutions, is pleased to announce its audited

results for the year ended 31 March 2023.

Financial highlights

12 months 12 months Change

to 31 Mar to 31 Mar

2023 (FY23) 2022 (FY22)

----------------------------------

Revenue GBP55.0m GBP48.7m +13%

-------------- -------------- -----------

Digitally-enabled revenues

(1) GBP37.6m GBP37.4m +1%

-------------- -------------- -----------

Gross profit margin 88.4% 87.1% +1.3% pts

-------------- -------------- -----------

Statutory profit/(loss) GBP3.0m GBP(0.5)m +GBP3.4m

before tax

-------------- -------------- -----------

Diluted EPS 2.84p 1.59p +1.25p

-------------- -------------- -----------

Cash generation from operations GBP4.4m GBP1.2m +GBP3.2m

-------------- -------------- -----------

Cash at bank GBP7.6m GBP10.0m - GBP2.4m

-------------- -------------- -----------

Capital expenditure GBP5.1m GBP6.1m -16%

-------------- -------------- -----------

EBITDA cash conversion (2) 83% 95% -12% pts

-------------- -------------- -----------

(1) Digitally enabled revenues are virtual live delivery

(including virtual licensing), and digital products (currently

eWorkouts and Performa).

(2) EBITDA cash conversion defined as cash generated from

operations/EBITDA.

Financial and operating highlights

-- Double-digit revenue growth:

o Revenues of GBP55.0m were up 13% on FY22 (+5% in constant

currency):

-- H2 FY23 revenues benefitted from (amongst other drivers) our

largest ever framework agreement awarded in H1 FY23 with a global

energy company, with revenues anticipated to be in excess of GBP10m

over the next 24 months

-- H2 FY23 also saw an initial framework win with an automotive

manufacturer which has the potential to generate significant

revenues over the next 18 months

o Digitally-enabled revenues of GBP37.6m up 1% vs. FY22;

representing 68% of revenues (FY22: 77%) following an increase in

face-to-face deliveries with the lifting of COVID restrictions

o Pure digital revenues which are a growing segment of this,

increased their product mix to 13% of Group revenue vs 11% in FY22,

reflecting:

-- A minor refresh and increased accessibility supporting growth

in the eWorkouts portfolio

-- Early revenues from the initial launch of Performa, MindGym's

1:1 digital coaching platform

-- Operational leverage driving improvement in financial performance:

o PBT of GBP3.0m is up by GBP3.4m on FY22's loss before tax,

driven by operational gearing, ongoing savings initiatives, and

returns from prior year investments in scalable operations

including MindGym's new shared service centre. We anticipate the

benefits of these will continue into FY24 and FY25

o EBITDA margins increased to 10% (FY22: 3%)

o Diluted EPS of 2.84p per share is up on FY22 by 1.25p

reflecting PBT growth

-- MindGym retains a strong financial position to support investment in future growth:

o Capex of GBP5.1m is GBP1.0m lower than FY22, reflecting the

organisational redesign in Q4 FY22 which further integrated the

business, and at the same time increased the pace of product

development

o Cash at bank of GBP7.6m is down GBP2.4m on the prior year (31

March 2022: GBP10.0m). This reflects Capex spend of GBP5.1m,

partially offset by PBT and continued improvement in aged

receivables. H2 FY23 cash generation of GBP3.1m compares to a

GBP2.0m cash burn in H2 FY22

o MindGym's GBP10m debt facility remains undrawn

-- Continued progress with MindGym's Digital strategy to build

an integrated Behavioural Change Platform ('BCP') - the digital

journey through which all members engage with MindGym and its

content.

o Continued development of our digital products and our journey

to integrate them as we build our BCP:

-- 85% of live delivery continues to be delivered virtually,

minor investments have supported increased growth in eWorkouts and

interactive tools

-- Early data on the Performa platform and methodology are

positive

o Entering the diagnostics market offering both organisational

and individual assessments and surveys:

-- MindGym will both diagnose the client's needs and provide the

solution, rather than being just one of many possible solutions

providers today, enabling a fully integrated journey

-- In January 2023, MindGym acquired the rights to a diagnostics

platform that will be launched by the end of FY24

-- This will enable clients to self-serve and provide the basis

for MindGym to centralise all data, whilst removing the use of

third party providers

-- The acquisition accelerates the go-live date for a client

ready diagnostics platform by 18 months and reduces the required

uplift in Capex spend in FY24 and FY25

o At the end of FY22, MindGym acquired the 10X individual

psychometric IP for GBP0.1m, which had been a circa GBP10m/7-year

investment by Peter Saville (arguably the leading psychometrician

of the 20(th) century and co-founder of SHL, and Saville

Consulting)

o This was recently integrated into the Performa coaching

platform to provide insight so that coaching can focus and have the

most impact

o In FY25, a standalone psychometric assessment tool (based on

10X) will be built into our recently acquired diagnostics platform,

which will be linked to MindGym's broader portfolio of

solutions.10X has been proven in a large-scale co-validation study

to be more accurate at predicting behaviour than the leading

personality questionnaires on the market

Current Trading and Outlook

-- Despite continued macro-economic headwinds we expect to make further progress in FY24:

o Underpinned by significant framework agreements, which are

expected to scale up in H2

o Improving EBITDA margins in FY24 as we progress towards our

medium term target of 15%-20%

-- MindGym retains a strong balance sheet with net cash expected to grow after planned Capex

-- Our confidence in the Group's prospects is underpinned by the

investments we have made to date delivering scalable growth and the

accelerating pace of our digital pipeline development

Octavius Black, Chief Executive Officer of MindGym, said:

MindGym delivered a robust performance during FY23 both in terms

of revenue growth and an encouraging return to profitability.

The award of significant new framework agreements in the year

from major corporations, highlights the growing demand in the

market as well as MindGym's capability.

Our Digital strategy is delivering well, including our Performa

coaching product and refreshed eWorkouts. With the addition of

diagnostics products in FY24 we are accelerating our journey

towards a fully integrated Behavioural Change Platform ('BCP').

We have had a solid start to the new financial year and,

notwithstanding continued economic uncertainty, have confidence

that organisations are increasingly turning to MindGym and our

unique portfolio of proven solutions to address their talent and

culture challenges."

The Company will host a webcast and conference call for analysts

and investors at 9:00am BST today. If you would like to attend the

webcast and conference call, please contact mindgym@mhpgroup.com

.

Enquiries

Mind Gym plc +44 (0) 20 7376 0626

Octavius Black (CEO)

Dominic Neary (CFO)

Liberum (Nominated Adviser and

Broker) +44 (0) 20 3100 2000

Nick How

Edward Mansfield

Cara Murphy

MHP (for media enquiries) +44 (0) 20 3128 8100

Reg Hoare mindgym@mhpgroup.com

Katie Hunt

Veronica Farah

About Mind Gym

Mind Gym is a company that delivers business improvement

solutions using scalable, proprietary products which are based on

behavioural science. The Group operates in three global markets:

business transformation, human capital management and learning

& development.

Mind Gym is listed on the London Stock Exchange Alternative

Investment Market (ticker: MIND) and headquartered in London. The

business has offices in London, New York and Singapore.

Further information is available at www.themindgym.com

Statement of the Board Chair

MindGym's purpose is to partner with the world's best companies

and help them optimise their Human Capital.

This year, has seen broad economic headwinds across many

industries arising from cost of living pressures, rising interest

rates, high inflation and low economic growth. Whilst this creates

pressure and uncertainty for our clients and their employees, the

resultant restructuring and reorganization by businesses has

created opportunities for MindGym, evidenced by the significant

framework activity we have secured, and MindGym has continued to

prosper accordingly.

At the start of the year we moved into an endemic state of

COVID-19 and welcomed a return to more face-to-face gatherings,

both internally and also with our clients who represent 60% of the

FTSE100 and 55% of the S&P100. We have also increased the level

of engagement with our investors and wider stakeholders with the

addition of an 'Investor Meet Company' event in December 2022.

Return to profitability despite the uncertain environment

I am pleased to report a return to profitability driven by

scalable growth and operational efficiencies in FY23, even amidst

the uncertainty of the current environment. Our data and strategic

focus lead us to believe that these trends will continue into FY24

and beyond.

Accelerating both our Core and Digital strategies

We have made significant strategic progress, focusing on both

Core and Digital products.

MindGym has leveraged its innovative, ever-growing science-based

IP in Human Behavioural Change, and our close working relationships

with the world's leading businesses to increase our share of

Learning and Development ('L&D') budgets with notable large

framework wins driving growth. FY23 also saw some important

strengthening of the leadership team in EMEA, which has shown

increased growth rates in the second half, and recently in the

Americas.

Additionally, we expanded our digital offerings as we continue

to build an integrated Behaviour Change Platform ('BCP') to better

serve our clients' data and learning needs. We saw steady progress

as we continue to build the BCP. Digitally-enabled revenues of

GBP37.6m grew by 1 per cent vs FY22, representing 68% of revenues

(FY22: 77%) as we saw increases in face-to-face deliveries with the

lifting of COVID restrictions. Pure digital revenues are a growing

segment of this, and increased their product mix to 13% of Group

revenue vs 11% in FY22.

The Board

We maintain a significant breadth of experience across our

Board, which has remained unchanged since the prior year. We would

like to extend congratulations to our Independent Non-Executive

Director Sir Trevor Phillips, who received a knighthood for his

services to equality and human rights in the 2023 New Year Honours

list, and to Octavius Black, our Co-Founder & CEO, who received

a CBE for his services to entrepreneurship, business, life sciences

and community during the year.

Dividend

No dividend has been paid or proposed for the year ended 31

March 2023. The Board will continue to keep the appropriateness of

dividend payments under periodic review and will next provide an

update at the time of the H1 FY24 interim results announcement.

Outlook

The long term drivers of the Global 'human performance' market

are very attractive. In the short to medium term, given the

macro-economic challenges, we anticipate some cautiousness from

clients, however our data-backed insights and solutions continue to

demonstrate value to our diversified client base. We expect to make

further progress in FY24, with the investments we have made to date

delivering scalable growth.

Ruby Mcgregor-Smith

Board Chair

12 June 2023

CEO's review

The talent agenda has never been more central. Companies are

facing a shifting macro environment and fundamental changes due to

globalisation, COVID's transformation of the workplace, the

navigation of the great resignation, and increasing stakeholder

pressures on issues such as ESG and corporate behaviour. These

factors are impacting our clients' core business KPI's such as

engagement, retention, and quality, and therefore, represent a

significant business challenge to their success.

MindGym has a strong reputation built over 21 years of IP and

content, tested on over five million members, and consistently

delivers programmes to client populations in excess of 10,000

members at a time, in over 40 countries across the world. Along

with an incredible team generating market-leading IP, our digital

products journey is progressing well, providing greater access, and

more data, as we head towards the BCP.

Growing profitably

MindGym partners with the world's foremost companies to optimise

their human capital. The market for our services is vast, growing

rapidly, and highly fragmented.

Our historic strategic investments are now seeing scalable

growth and increasing profitability, and the pace of our digital

pipeline development has accelerated with a reduction in the

required uplift in Capex spend in FY24 .

Strategic

In FY23, we made significant progress with our strategy of

growing our share of L&D budgets and building the digital

BCP.

Growth in our core business

Crystal Metcalfe joined as Managing Director of our EMEA

business in Q1 FY23 which has seen regional growth reach 20% in

FY23. This reflects general improvements across all practices, and

notable recent successes in large framework agreements - in

particular the +GBP10m global energy framework we announced at the

half year.

More recently, Cindy Steagall joined our US business as

Executive Vice President at the end of the financial year. In FY23,

the US business grew by 8%, benefitting from FX impact. We have

every confidence that US performance will continue to improve, and

note that there are some early favourable tailwinds, including the

award of an initial framework agreement with a large automotive

company at the end of the year.

We continue to lead in innovation and remain the global leader

with our clients

At the end of FY22 we launched our Leadership Point of View

('POV') with the related whitepaper launched at the start of FY23.

Our new Wellbeing POV ('Wellworking') was launched during H1 FY23;

the whitepaper will be published during H1 FY24, when we will also

be launching a series of new Wellworking live and eWorkout

products.

In May, we hosted the world's largest gathering of c.160 CHROs

and their deputies at our 'CHRO Summit' at the Royal Opera House in

London, where we discussed the latest trends in the HCM market. The

depth and breadth of attendance underscores the value our clients

see in the innovative solutions that MindGym brings to this sector.

At this event, we also launched our Precision coaching whitepaper,

in line with the full scale launch of Performa.

We are leveraging our investment to grow more profitably

In FY23, the Company returned to profit before tax, with EBITDA

margins of 10% (FY22: 3%). Our investments of prior years in

people, processes and systems are expected to support continuing

financial performance improvement through FY24 and beyond.

A great example of this is our new shared service centre ('SSC')

in Gateshead, which has been enabled by our operations and system

investments. This is significantly improving the quality of our

deliveries, whilst increasing the scalability of our business

model. Enhanced client satisfaction and freed up resources pave the

way for greater value creation and improved profitability.

Accelerated digital product development

We have made considerable progress as we continue to build

MindGym's BCP:

-- 100+ bite size eWorkouts for self-paced digital learning

enhanced to deliver greater accessibility with further content and

UX improvement in FY24

-- Performa, our 1:1 coaching product supported by our

proprietary coaching methodology and custom digital platform, was

fully launched at our CHRO summit alongside the publication of our

new research paper 'Precision Coaching: better, faster, always

whatever your goal'. We will continue to add new features and UX

enhancement through FY24

-- We are developing MindGym proprietary organisational

diagnostics which we will be beta testing in FY24 with a view to

launch in FY25. This is alongside integration of our 10X individual

diagnostics

-- By acquiring the rights to a diagnostics platform, we have

enabled an accelerated journey to our self-serve platform, which we

plan to launch by the end of FY24 - 18 months ahead of schedule

-- We continue to anticipate the integration of live delivery

and all our digital solutions in our Behavioural Change Platform,

which is the critical key to unlocking Data and the significant

value proposition that this represents

High-performance culture

I am immensely grateful to our determined team whose spirit,

ingenuity and generosity has set MindGym up not only for the

success of today, but to transform how millions of people employed

by our clients will think, feel and behave for years to come. We

strive to make sure our people work with a resilient mindset whilst

we also empower them by ensuring we invest significantly in

learning and development, using internal and external resources

where appropriate. We also sponsor colleagues in their masters,

doctorates and a range of other external qualifications.

We benefit from and remain deeply committed to the diversity of

our organisation. We maintain an internal DE&I committee

consisting of employees across the business, geared at implementing

best practice across MindGym as a whole.

ParentGym

MindGym has a strong track record with all our stakeholders. In

2009, we launched ParentGym, a programme providing free training to

parents of children aged 2-11, and in FY23, we ran sessions with

over 650 families with the aim of helping them to grow our next

generation. This included a partnership with the Prison Advice and

Care Trust (PACT) and running a bespoke programme to support

parents in prison and their families. Many of our employees use

their charity days to support PACT and other charities.

Looking ahead

Notwithstanding continued economic uncertainty, our investments

made to date for scalable growth are starting to provide a return,

underpinned by the award of significant framework agreements and

the pace of our digital pipeline development. With the addition of

diagnostics products in FY24 we are accelerating our journey

towards a fully integrated Behavioural Change Platform ('BCP'). We

are confident that organisations will increasingly turn to MindGym

and our unique portfolio of proven solutions to address their

talent and culture challenges.

The opportunity is immense and we are ready to realise it.

Octavius Black

Chief Executive Officer

Financial review

The market for Human Capital Management continues to grow,

driven by the increasing rate of change in society over the last

three years. In FY23, we saw revenues grow at +13% (+5% constant

FX) to GBP55.0m.

Digitally-enabled revenues of GBP37.6m grew by 1 per cent vs

FY22, representing 68% of revenues (FY22: 77%) as we saw increases

in face-to-face deliveries with the lifting of COVID restrictions.

Whilst the margin percentage on face-to-face delivery is lower than

for virtual delivery, the absolute profit per session for

face-to-face is higher. We do not anticipate a fundamental change

in the current mix of delivery going forward, but the financial

implications of this would be unlikely to be significant.

Pure digital revenues which are a growing segment of digitally

enabled revenues, increased their product mix to 13% of Group

revenue vs 11% in FY22, following a minor refresh of and increased

accessibility within the eWorkouts portfolio, coupled with the

early impact of Performa revenues.

We anticipate that large corporate frameworks will be an

increasingly important part of our growth strategy; notably, the

large energy framework win in H1 FY23 as well as that of, an

attractive opportunity in the automotive sector in H2 FY23.

Earnings before interest, taxation, depreciation and

amortisation ('EBITDA') has increased to 10% (FY22: 3%). Profit

before tax ('PBT') has increased by GBP3.4m from GBP(0.5)m in FY22

and this, coupled with ongoing R&D tax savings, resulted in a

diluted EPS of 2.84p which is ahead of prior year (FY22: 1.59p). We

anticipate future benefits from our ongoing savings programmes and

the scalability of our operations, as we progress towards our

medium term target of 15%-20%.

Our balance sheet position remains strong with cash at GBP7.6m.

The overdue debt balance at the year-end of GBP0.4m is at an

all-time low and in line with previous years, bad debt is

negligible. We retain an undrawn credit facility of GBP10m, which

provides flexibility for future opportunities.

Improved performance and profitability

Revenue growth of 13% for the full year

MindGym saw +20% growth achieved across EMEA fueled by the

impact of the significant framework agreement won in H1 FY23, as

well as the strengthening of the management team at the start of

the year. The US saw single-digit growth of 8%, reflecting the

beneficial impact of FX; ongoing improvements to the US management

team in H2 FY23 are anticipated to drive revenue growth in

FY24.

GBP000's Year to Year to

March 31(st) March 31(st) Change

2023 2022 %

Group Statutory

View 55,011 48,668 + 13%

EMEA 23,742 19,715 + 20%

US 31,269 28,953 + 8%

Delivery revenues have continued to grow throughout FY23, albeit

their relative contribution has been overshadowed by the significant

growth of Design and Advisory, which reflects the large framework

agreements won by MindGym in FY23. High D&A revenues are a strong

signal for future delivery revenues as the first 6-9 months of

these frameworks are often scoping, which is followed by delivery

revenue thereafter as the projects are implemented.

Digital revenues continue to demonstrate robust growth, with

the revenue mix increasing versus FY22, reflecting underlying

strong performance in digital eWorkouts and interactive tools,

and the increasing take up of Performa. Other services have been

impacted by lower translation-related revenues versus FY22.

Revenue mix by type compared to previous year

FY23 FY22 % change

Delivery 60.3% 63.7% -3.4%

Design 17.2% 11.2% 6.0%

Advisory 1.4% 1.4% -

Digital 13.1% 11.2% 1.9%

Licensing and certification 5.6% 6.0% -0.4%

Other services 2.4% 6.5% -4.1%

Total 100% 100%

---------- --------- -------------

Gross profit

Gross margin at 88.4% was ahead of prior year (FY22 87.1%). This

was reflected in both regions with gross margin in the US of 88.4%

(FY21: 87.2%) and in EMEA of 88.5% (FY22: 87.0%).

The improvement in margin reflects some ongoing savings

initiatives, but is largely the result of the increased mix of

Design work, the costs of which are included within administrative

costs. In FY24, we anticipate a shift in revenues from Design to

Delivery, particularly as our significant framework agreements from

H1 FY23 moves into the delivery phase in FY24. We have seen a

moderate shift back towards in-person delivery - to date this shift

has been somewhat slower than anticipated (in-person percentage

margins are lower than virtual delivery, but absolute profit per

in-person delivery is higher).

Year ended 31 March 2023

Revenue type EMEA US Global

Delivery 60.2% 60.6% 60.3%

Design 19.0% 15.7% 17.2%

Digital 13.4% 12.8% 13.1%

Licensing and certification 3.3% 7.5% 5.6%

Other services 2.4% 2.3% 2.4%

Advisory 1.7% 1.1% 1.4%

--------- -------- ---------

Total 100% 100% 100%

--------- -------- ---------

Year ended 31 March 2022

Revenue type EMEA US Global

Delivery 60.2% 66.0% 63.7%

Design 13.4% 9.8% 11.2%

Digital 11.9% 10.7% 11.2%

Licensing and certification 5.8% 6.3% 6.0%

Other services 6.8% 6.2% 6.5%

Advisory 1.9% 1.0% 1.4%

--------- -------- ---------

Total 100% 100% 100%

--------- -------- ---------

Profitability and investment

PBT of GBP3.0m is a +GBP3.4m increase on the loss before tax of

GBP0.5m in FY22. FY23 PBT margins were up +638 bpts on FY22,

reflecting in equal parts, operational gearing, ongoing savings

programmes across the business, and the implementation of a shared

service centre midway through the year. Management's ongoing

actions will continue to see margin improvement in FY24 and FY25

from these three levers.

CAPEX

MindGym's capex levels fell to GBP5.1m in FY23 (from GBP6.1m in

FY22). This reflects the organisational redesign in Q4 FY22 which

further integrated the business, and at the same time increased the

pace of product development. We continue to target more efficient

ways of delivering the BCP, and the recent acquisition of the

rights to a diagnostics platform, has accelerated this by 18

months, whilst reducing the required uplift in Capex spend in FY24

and FY25.

Taxation

In FY23, MindGym has submitted further claims to ensure it

obtains the benefit of R&D tax credits relating to FY23. At the

end of FY23 we recorded a deferred tax asset of GBP5.3m in relation

to these R&D credits. This is offset by a GBP2.2m deferred tax

liability being the timing difference linked to capitalised

development costs.

FY23 FY22

Reported Reported

GBP'000 GBP'000

---------- ----------

Profit/(loss) before

tax 2,964 (482)

Tax credit/(charge) (29) 2,084

---------- ----------

PAT (earnings) 2,935 1,602

---------- ----------

ETR % 0.98% 432.4%

---------- ----------

In FY23, the Effective Tax Rate (ETR) continues to be distorted

by the application of the R&D credits noted above. MindGym has

factored these credits in as part of the current year tax charge

and related deferred tax balances. The effect of these tax credits

in the UK is offset by the tax profitability of the US entity,

resulting in overall ETR of 0.98%.

Earnings per share

Diluted earnings per share increased by 1.25 pence to 2.84 pence

(2022: 1.59 pence). Basic earnings per share were 2.93 pence

(2022:1.60 pence).

Dividends

No dividend has been paid or proposed for the year ended 31

March 2023. The Board will continue to keep the appropriateness of

dividend payments under periodic review and will next provide an

update at the time of the H1 FY24 interim announcement.

Operational efficiencies and enablement

We have recently launched a new operational centre of

excellence, our shared service centre ('SSC') based in Gateshead,

UK. The creation of the SSC drives increased efficiency in our

business processes and focus on seamless delivery for our clients.

The SSC will also use data analytics to assist with our strategic

decision-making and shape our operational leverage. The continued

focus on automation and AI technology will help deliver increased

efficiency and client satisfaction overall.

Cash flow and balance sheet

Cash and cash equivalents have decreased from GBP10.0m in FY22

to GBP7.6m at the end of FY23, including the FY23 GBP4.9m

investment in digital capital expenditure.

EBITDA was GBP5.3 million, 331% up on FY22 EBITDA of GBP1.2

million, with cash generated from operations of GBP4.4 million,

which was 278% up on the GBP1.2 million cash generated from

operations in the prior year. Cash generation in H2 FY23 was

GBP3.1m vs.GBP2.0m cash consumption in H2 FY22.The working capital

reduction resulted in cash conversion, defined as cash generated

from operations as a percentage of EBITDA, of 83% (FY22: 95%).

Cash conversion

31 March 31 March

2023 2022

GBP'000 GBP'000

Cash generated from operations 4,393 1,164

Reported EBITDA 5,294 1,228

Cash conversion (Cash from operations /EBITDA) 83% 95%

Over the year, we again reduced the time taken to invoice

clients and improved the collection of overdue receivables which

contributed to the favourable Net Trade Receivables movement of

GBP1.2m. Overdue debt as a percentage of total trade receivables

fell to 7% at the year end (FY22: 9%), with the amount of overdue

debt reducing GBP0.3 million to GBP0.4 million (FY22: GBP0.7

million). Deferred income decreased by 6% to GBP4.4m (FY22:

GBP4.7m) as clients continue to secure budgets for their following

financial year. Trade and other payables reduced by GBP1.3m,

reflecting greater utilisation of holiday and lower commission

payments.

Tax paid in the year was GBP0.8 million (FY22: GBP0.8 million)

mainly related to US activity .

Capital expenditure was GBP5.1 million (FY22: GBP6.1 million)

which included GBP4.9 million of costs capitalised on developing

our new digital products and GBP0.2m on other tangible fixed

assets.

Lease payments on our offices in the UK and the USA were GBP1.3

million (FY22: GBP1.2m). No dividends were paid in the year (FY22:

GBPnil).

At the year end, the Group had cash of GBP7.6 million (2022:

GBP10.0 million) and net cash of GBP4.5m (FY22: GBP7.8 million)

after deducting the lease liability included on the balance

sheet.

Going concern

The Board has reviewed scenario analysis to help assess their

forward-looking assessment of the viability of the Group. The

Directors are confident that the Group has adequate resources to

continue in operational existence for the foreseeable future. The

Board has reviewed scenarios including a range of revenues and

cost-reduction actions that could be taken to mitigate a downturn.

This is supported by a strong balance sheet, cash management and

financial controls.

Financial risk management

The Group has a diverse portfolio in excess of 600 clients

across many industrial sectors and countries. The largest client

accounted for less than 6% of Group revenue in the year.

The Group has translational foreign currency exposure arising on

the consolidation of overseas company results into Sterling. Where

possible the exposure is naturally hedged, for example by matching

US Dollar revenues with US Dollar costs in the US subsidiary. The

Group does not currently use forward exchange contracts or currency

options to hedge currency risk.

Forward-looking statements

Certain statements in this announcement constitute

forward-looking statements. Any statement in this announcement that

is not a statement of historical fact including, without

limitation, those regarding the Company's future expectations,

operations, financial performance, financial condition and business

is a forward-looking statement. Such forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially. These risks and uncertainties include, among

other factors, changing economic, financial, business or other

market conditions. These and other factors could adversely affect

the outcome and financial effects of the plans, and events

described in this announcement and the Company undertakes no

obligation to update its view of such risks and uncertainties or to

update the forward-looking statements contained herein. Nothing in

this announcement should be constructed as a profit forecast.

Dominic Neary

Chief Financial Officer

12 June 2023

MIND GYM PLC CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Year to Year to

31 March 31 March

2023 2022

Note GBP'000 GBP'000

Continuing operations

Revenue 4 55,011 48,668

Cost of sales (6,360) (6,284)

----------- -----------

Gross profit 48,651 42,384

Administrative expenses (45,568) (42,733)

----------- -----------

Operating profit/(loss) 4, 5 3,083 (349)

Finance income 8 55 19

Finance costs 8 (174) (152)

----------- -----------

Profit/(loss) before tax 2,964 (482)

Tax on profit/(loss) 9 (29) 2,084

----------- -----------

Profit for the financial period from

continuing operations attributable to

owners of the parent 2,935 1,602

=========== ===========

Items that may be reclassified subsequently

to profit or loss

Exchange translation differences on consolidation 297 192

----------- -----------

Other comprehensive income for the period

attributable to the owners of the parent 298 192

----------- -----------

Total comprehensive income for the period

attributable to the owners of the parent 3,232 1,794

=========== ===========

Earnings per share (pence)

Basic 10 2.93 1.60

Diluted 2.84 1.59

MIND GYM PLC CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31 March 31 March

2023 2022

Note GBP'000 GBP'000

Non-current assets

Intangible assets 12 12,320 8,175

Property, plant and equipment 13 3,691 2,815

Deferred tax assets 9 3,229 2,846

Other receivables 15 230 217

----------- ----------

19,470 14,053

Current assets

Inventories 14 53 7

Trade and other receivables 15 9,527 10,063

Current tax receivable 779 494

Cash and cash equivalents 7,587 10,021

----------- ----------

17,964 20,585

----------- ----------

Total assets 37,416 34,638

=========== ==========

Current liabilities

Trade and other payables 16 11,423 12,729

Lease liability 17 1,121 856

Redeemable preference shares 18 50 50

Current tax payable 20 28

----------- ----------

12,614 13,663

----------- ----------

Non-current liabilities

Lease liability 17 1,988 1,349

Total liabilities 14,602 15,012

----------- ----------

Net assets 22,814 19,626

=========== ==========

Equity

Share capital 21 1 1

Share premium 242 213

Share option reserve 496 608

Retained earnings 22,075 18,804

----------- ----------

Equity attributable to owners of the

parent company 22,814 19,626

=========== ==========

The financial statements were approved and authorised for issue

by the Board of Directors on 12 June 2023 and were signed on its

behalf by:

Dominic Neary

Chief Financial Officer

MIND GYM PLC CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share

Share Share option Retained Total

capital premium reserve earnings equity

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2021 1 157 674 16,620 17,452

========== ========== ========== =========== =========

Profit for the period - - - 1,602 1,602

Other comprehensive income:

Exchange translation differences

on consolidation - - - 192 192

---------- ---------- ---------- ----------- ---------

Total comprehensive income

for the period - - - 1,794 1,794

Exercise of options - 56 (407) 407 56

Credit to equity for share-based

payments 22 - - 341 - 341

Tax relating to share-based

payments 9 - - - (17) (17)

At 31 March 2022 1 213 608 18,804 19,626

========== ========== ========== =========== =========

Profit for the period - - - 2,935 2,935

Other comprehensive income:

Exchange translation differences

on consolidation - - - 297 297

--- ----- ------ -------- --------

Total comprehensive income

for the period - - - 3,232 3,232

Exercise of options - 29 (39) 39 29

Debit to equity for share-based

payments 22 - - (73) - (73)

At 31 March 2023 1 242 496 22,075 22,814

=== ===== ====== ======== ========

MIND GYM PLC CONSOLIDATED STATEMENT OF CASH FLOWS

Year to Year to

31 March 31 March

2023 2022

Note GBP'000 GBP'000

Cash flows from operating activities

Profit for the financial period 2,935 1,602

Adjustments for:

Amortisation of intangible assets 12 743 325

Depreciation of property, plant and equipment 13 1,468 1,252

Net finance costs 8 119 133

Taxation (credit)/charge 9 29 (2,084)

(Increase) in inventories (46) (7)

Decrease in trade and other receivables 524 686

(Increase) in payables and provisions (1,306) (1,084)

Share-based payment (credit)/charge 22 (73) 341

-----------

Cash generated from operations 4,393 1,164

Net tax (paid)/received (766) (812)

-----------

Net cash generated from operating activities 3,627 352

----------- -----------

Cash flows from investing activities

Purchase of intangible assets 12 (4,888) (5,623)

Purchase of property, plant and equipment 13 (240) (514)

Interest received 8 54 12

----------- -----------

Net cash used in investing activities (5,074) (6,125)

----------- -----------

Cash flows from financing activities

Cash repayment of lease liabilities (1,298) (1,226)

Issuance of ordinary shares 29 56

Interest paid (52) (27)

Net cash used in financing activities (1,321) (1,197)

----------- -----------

Net decrease in cash and cash equivalents (2,768) (6,970)

Cash and cash equivalents at beginning

of period 10,021 16,833

Effect of foreign exchange rate changes 334 158

----------- -----------

Cash and cash equivalents at the end

of period 7,587 10,021

=========== ===========

Cash and cash equivalents at the end

of period comprise:

Cash at bank and in hand 7,587 10,021

=========== ===========

MIND GYM PLC NOTES TO THE GROUP FINANCIAL STATEMENTS

1. General information

The financial information for the year ended 31 March 2023 and

the year ended 31 March 2022 does not constitute the company's

statutory accounts for those years.

Statutory accounts for the year ended 31 March 2022 have been

delivered to the Registrar of Companies. The statutory accounts for

the year ended 31 March 2023 will be delivered to the Registrar of

Companies in due course.

The auditors' reports on the accounts for 31 March 2023 and 31

March 2022 were unqualified, did not draw attention to any matters

by way of emphasis, and did not contain a statement under 498(2) or

498(3) of the Companies Act 2006.

Mind Gym plc ('the Company') is a public limited company

incorporated in England and Wales, and its ordinary shares are

traded on the Alternative Investment Market of the London Stock

Exchange ('AIM'). The address of the registered office is 160

Kensington High Street, London W8 7RG. The group consists of Mind

Gym plc and its subsidiaries, Mind Gym (USA) Inc., Mind Gym

Performance (Asia) Pte. Ltd, and Mind Gym (Canada) Inc. (together

'the Group').

The principal activity of the Group is to apply behavioural

science to transform the performance of companies and the lives of

the people who work in them. The Group does this primarily through

research, strategic advice, management and employee development,

employee communication and related services.

2. Summary of significant accounting policies

Basis of preparation

These consolidated financial statements have been prepared in

accordance with UK adopted international accounting standards and

within the requirements of the Companies Act 2006 as applicable to

companies reporting under those standards, including

interpretations issued by the International Financial Reporting

Interpretations Committee ('IFRIC'), and within the Companies Act

2006 applicable to companies reporting under IFRS.

The consolidated financial statements have been prepared on a

going concern basis under the historical cost convention.

The consolidated financial statements are presented in Pounds

Sterling. All values are rounded to GBP1,000 except where otherwise

indicated.

The principal accounting policies in the preparation of these

financial statements are set out below. These policies have been

consistently applied to all the years presented unless otherwise

stated.

Going concern

The Group meets its day-to-day working capital requirements from

the cash flows generated by its trading activities and its

available cash resources. As at 31 March 2023, the Group had GBP7.6

million of cash and GBP3.1m of lease liabilities.

The Group prepares cash flow forecasts and re-forecasts

regularly as part of the business planning process. The Directors

have reviewed forecasted cash flows for the forthcoming 12 months

for the Group from the date of the approval of the financial

statements and consider that the Group will have sufficient cash

resources available to meet its liabilities as they fall due. These

cash flow forecasts have been analysed in light of inflationary

pressure and other medium-term macro-economic impacts and subjected

to stress testing and scenario modelling which the Directors

consider sufficiently robust. The impact of these inflationary

pressures are further discussed in the Board Chair's report. The

scenario modelling has assessed the impact of various degrees of

downturn in medium-term revenues generated. The Directors note that

in a downturn scenario the Group also has the option to rationalise

its cost base, including cuts to discretionary capital and overhead

expenditure. The Directors consider that the required level of

change to the Group's forecasted cash flows to give rise to a

material risk over going concern is

sufficiently remote.

As a result of these assessments, the Group's strong cash

position and its clients predominantly comprising blue-chip

corporates, the Directors have a reasonable expectation that the

Group has adequate resources to continue in operational existence

for the foreseeable future. Accordingly, they continue to adopt the

going concern basis in preparing the Annual Report and

Accounts.

New standards and interpretations applied for the first time

The Group did not adopt any new or amended IFRSs and IFRIC

interpretations from 1 April 2022.

New standards and interpretations not yet applied

At the date of authorisation of these financial statements the

following standards and interpretations were in issue but not yet

effective for the financial period and have not been applied. The

Directors plan to adopt these standards in line with their

effective dates.

Applicable

for periods

starting on

or after

Amendments to IAS 1: Classification of Liabilities 1 January

as Current or Non-current 2023

Amendments to IAS 8: Definition of Accounting 1 January

Estimates 2023

Amendments to IAS 1 and IFRS Practice Statement 1 January

2 - Disclosure of Accounting policies 2023

Amendments to IAS 12 - Deferred Tax related to 1 January

Assets and Liabilities arising from a Single Transaction 2023

Amendments to IFRS 17 - Initial Application of 1 January

IFRS 17 and IFRS 9 - Comparative information 2023

Amendments to IAS 1: Classification of Liabilities 1 January

as Current or Non-current 2024

Amendments to IFRS 16: Lease Liability in a Sale 1 January

and Leaseback 2024

The Directors anticipate that the adoption of these standards

and amendments will have no material impact on the financial

statements.

Basis of consolidation

The consolidated financial statements incorporate those of Mind

Gym plc and its subsidiary undertakings (i.e. entities that the

Group controls when the Group is exposed to, or has rights to,

variable returns from its involvement with the entity and has the

ability to affect those returns through its power over the entity).

Subsidiaries are fully consolidated from the date on which control

is transferred to the Group.

All intra-group transactions, balances and unrealised gains on

transactions between group companies are eliminated on

consolidation. Where necessary, amounts reported by subsidiaries

have been adjusted to conform with the Group's accounting

policies.

Foreign currency translation

The Group's presentation currency is Pound Sterling. The results

and financial position of subsidiaries that have a functional

currency different from Sterling are translated into Sterling as

follows:

-- Assets and liabilities are translated at the closing rate at the balance sheet date

-- Income and expenses are translated at average rates of exchange prevailing during the year

All resulting exchange differences are recognised in equity.

Foreign currency transactions are initially recorded at the

exchange rate at the date of the transaction. Foreign exchange

gains and losses resulting from settlement of such transactions,

and from the translation at exchange rates at the balance sheet

date of monetary assets or liabilities denominated in foreign

currencies, are recognised in profit or loss.

Revenue recognition

Revenue is recognised when control over a product or service is

transferred to a customer. Due to the short-term nature of the

trade receivables, the Group measures them at the original

transaction price invoiced without discounting.

The Group generates revenue from business-to-business customers

by satisfying the following performance obligations:

-- Delivering coach-led face-to-face and virtual training

sessions. Revenue is recognised at a point in time on the date of

delivery of the session.

-- Developing training programmes customised to specific needs.

Revenue is recognised at a point in time on the completion of all

development work or at the end of a stage of work when the contract

provides an enforceable right to payment on completion of a

stage.

-- Licensing digital training modules to clients. When

non-cancellable digital modules are provided to the client and

hosted on the client's servers, revenue is recognised at a point in

time on the date the modules are provided to the client. Where the

client has a right to cancel, revenue is recognised at the start of

each committed period. When digital modules are hosted on the

Group's servers, revenue is recognised over time across the life of

the agreement.

-- Training and certifying client staff to act as coaches.

Revenue is recognised at a point in time on the date of delivery of

the certification course.

-- Digital coaching platform and coaching sessions. Revenue is

recognised over time, across the life of the agreement and in line

with expected customer usage levels.

Any advance consideration received from clients represents a

contract liability and is disclosed in Note 16 under the heading

deferred income. When the performance obligation has been satisfied

but the income has not yet been invoiced, the amount represents a

contract asset and is disclosed in Note 15 as accrued income.

The incremental costs of obtaining a contract principally

consist of commissions paid to the Group's sales team. The sales

team earn commission over time as the revenue they have generated

is recognised. Commission costs are not therefore capitalised.

Borrowing costs

Borrowing costs directly attributable to the acquisition,

construction or production of a qualifying asset are capitalised

during the period of time that is necessary to complete and prepare

the asset for its intended use or sale. Other borrowing costs are

expensed in the period in which they are incurred and reported in

finance costs.

Share-based payments

Where share options are awarded to employees, the fair value of

the options at the date of grant is charged to the Consolidated

Statement of Comprehensive Income over the vesting period.

Non-market performance conditions are taken into account by

adjusting the number of equity instruments expected to vest at each

Statement of Financial Position date so that, ultimately, the

cumulative amount recognised over the vesting period is based on

the number of options that eventually vest. Market performance

conditions are factored into the fair value of the options granted.

The cumulative expense is not adjusted for failure to achieve a

market performance condition.

The fair value of the award also takes into account non-vesting

conditions. These are either factors beyond the control of either

party (such as a target based on an index) or factors that are

within the control of one or other of the parties (such as the

Group keeping the scheme open or the employee maintaining any

contributions required by the scheme).

Where the terms and conditions of options are modified before

they vest, the increase in the fair value of the options, measured

immediately before and after the modification, is also charged to

the Consolidated Statement of Comprehensive Income over the

remaining vesting period.

Defined contribution pension plan

The Group operates a defined contribution plan for its

employees. A defined contribution plan is a pension plan under

which the Group pays fixed contributions into a separate entity.

Once the contributions have been paid the Group has no further

payment obligations.

The contributions are recognised as an expense in the Statement

of Comprehensive Income when they fall due.

Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax.

The current tax payable is based on taxable profit for the year.

Taxable profit differs from accounting profit as reported in the

Consolidated Statement of Comprehensive Income because it excludes

items of income or expense that are taxable or deductible in other

years, and it further excludes items that are never taxable or

deductible. The Group's liability for current tax is calculated

using tax rates that have been enacted or substantively enacted at

the period-end date.

Deferred tax is provided using the liability method on temporary

differences between the tax bases of assets and liabilities and

their carrying amounts in the financial statements. Deferred tax is

not recognised on temporary differences arising from the initial

recognition of goodwill or other assets and liabilities in a

transaction, other than a business combination, that affects

neither the accounting nor the taxable profit.

Deferred tax is measured on a non-discounted basis using tax

rates and laws that have been enacted or substantively enacted by

the balance sheet date and are expected to apply when the related

deferred tax asset is realised, or deferred tax liability is

settled. Deferred tax assets are recognised to the extent that it

is probable that future taxable profit will be available against

which the temporary differences can be utilised.

Deferred tax assets and liabilities are offset when the Group

has a legally enforceable right to offset current tax assets and

liabilities, and the deferred tax assets and liabilities relate to

taxes levied by the same tax authority.

The Group has taken advantage of HMRC's Small-Medium Enterprise

(SME) Research and Development tax relief scheme. This has resulted

in an enhanced deduction on eligible activities and is a

significant component of both the tax credit in the Consolidated

Statement of Comprehensive Income and deferred tax asset recognised

in the balance sheet.

Tax is charged or credited in the Consolidated Statement of

Comprehensive Income, except when it relates to items charged or

credited directly to equity, in which case the deferred tax is also

recognised in equity.

Intangible assets

Externally acquired intangible assets are initially recognised

at cost. Expenditure on internally developed assets is capitalised

if it can be demonstrated that it is technically feasible to

develop the product for it to provide expected future economic

benefits, adequate resources are available to complete the

development, there is an intention to complete the project and

expenditure on the project can be measured reliably.

Other research and development costs that do not meet the above

criteria are recognised as expenses as incurred. Development costs

previously recognised as an expense are not recognised as an asset

in a subsequent period.

After recognition, intangible assets are measured at cost less

any accumulated amortisation and impairment losses. Amortisation is

charged to administrative expenses on a straight-line basis from

the date on which the asset is available for use. Intangible assets

are amortised over their estimated useful lives as follows:

-- Internally developed software Three to five years

-- Other intangible assets One to five years

-- Trademarks 10 years

The assets' residual values, useful lives and amortisation

methods are reviewed and adjusted prospectively if appropriate at

each reporting date.

Property, plant and equipment

Property, plant and equipment is stated at historical cost less

accumulated depreciation and any accumulated impairment losses.

Historical cost includes expenditure that is directly attributable

to bringing the asset to the location and condition necessary for

it to be capable of operating in the manner intended by management.

Subsequent costs are included in the asset's carrying amount only

when it is probable that future economic benefits associated with

the item will flow to the Group. All other repairs and maintenance

costs are charged to profit or loss during the period in which they

are incurred.

Assets are depreciated to their estimated residual value using

the straight-line method over their estimated useful lives as

follows :

-- Leasehold improvements Over the period of the lease

-- Fixtures, fittings and equipment Two to five years

The assets' residual values, useful lives and depreciation

methods are reviewed, and adjusted prospectively if appropriate at

each balance sheet date.

Gains and losses on disposals are determined by comparing the

proceeds with the carrying amount and are recognised in the

Consolidated Statement of Comprehensive Income.

Impairment of property, plant and equipment and intangible

assets

At each reporting date, the Group reviews the carrying amounts

of its property, plant and equipment and intangible assets to

determine whether there is any indication that those assets have

suffered an impairment loss. If any such indication exists, the

recoverable amount of the asset is estimated in order to determine

the extent of the impairment loss (if any).

The recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset, for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an asset is estimated to be less

than its carrying amount, the carrying amount of the asset is

reduced to its recoverable amount. An impairment loss is recognised

as an expense immediately, unless the relevant asset is carried at

a revalued amount, in which case the impairment loss is treated as

a revaluation decrease.

Leases

Lease identification

At inception of a contract, the Group assesses whether a

contract is, or contains, a lease. A contract is, or contains, a

lease if the contract conveys the right to control the use of an

identifiable asset for a period of time in exchange for

consideration.

Right-of-use asset

The right-of-use asset is initially measured at cost, which

comprises the initial amount of the lease liability adjusted for

any lease payments made at or before the commencement date, plus

any initial direct costs incurred, and an estimate of costs to

dismantle and remove the underlying asset or to restore the

underlying asset or the site on which it is located, less any lease

incentives received.

The right-of-use asset is depreciated on a straight-line basis

over the shorter of the estimated useful life of the asset and the

lease term. In addition, the right-of-use asset is periodically

reduced by impairment losses, if any, and adjusted for certain

re-measurements of the lease liability.

Lease liability

At the commencement date of the lease, the Group recognises

lease liabilities measured at the present value of lease payments

to be made over the lease term. The lease payments include fixed

payments (including in-substance fixed payments) less any lease

incentives receivable.

The lease liability is measured at amortised cost using the

effective interest method.

Short-term leases and leases of low-value assets

The Group applies the short-term lease recognition exemption to

those leases that have a lease term of 12 months or less from the

commencement date and do not contain a purchase option. It also

applies the low-value assets recognition exemption to leases of

assets below $5,000. Lease payments on short-term leases and leases

of low-value assets are recognised as an expense on a straight-line

basis over the lease term.

As a lessor

When the Group acts as a lessor, it determines at lease

inception whether each lease is a finance lease or an operating

lease.

When the Group is an intermediate lessor, it accounts for its

interests in the head lease and the sub-lease separately. It

assesses the lease classification of a sub-lease with reference to

the right-of-use asset arising from the head lease, not with

reference to the underlying asset.

Amounts due from lessees under finance leases are recognised as

finance lease receivables at the amount of the Group's present

value of the lease receipts. The finance lease receivable is

subsequently measured by increasing the carrying amount to reflect

interest on the finance lease receivable (using the discount rate

used at commencement) and by reducing the carrying amount to

reflect the lease payments received.

Inventories

Inventories comprise pack materials used in the delivery of

courses and are stated at the lower of cost and net realisable

value. Cost is based on the cost of purchase on a first in, first

out basis. Work in progress and finished goods include labour and

attributable overheads. Net realisable value is the estimated

selling price less costs to complete and sell.

At each reporting date, inventories are assessed for impairment.

If stock is impaired, the carrying amount is reduced to its

realisable value. The impairment loss is recognised immediately in

profit or loss.

Financial instruments

Financial instruments are recognised when the Group becomes

party to the contractual provisions of the instrument. The Group

only enters into basic financial instruments and does not have any

hedging instruments.

Financial assets and liabilities are offset, with the net

amounts presented in the Financial Statements, when there is a

legally enforceable right to set off the recognised amounts and

there is an intention to settle on a net basis or to realise the

asset and settle the liability simultaneously.

Financial assets - loans and receivables

All of the Group's financial assets fall into the loans and

receivables category. Loans and receivables are non-derivative

financial assets with fixed or determinable payments that are not

quoted in an active market. Financial assets included in loans and

receivables are recognised initially at fair value. Subsequent to

initial recognition they are measured at amortised cost, using the

effective interest rate method, less any impairment losses.

Financial assets are assessed for indicators of impairment at

each reporting date.

A provision for impairment of trade receivables is made for

expected lifetime credit losses based on past experience and

general economic factors. Further provisions are made against

specific trade and other receivables when there is objective

evidence that one or more loss events that occurred after the

initial recognition of the financial asset, have had an impact on

the estimated future cash flows of the financial asset. The amount

of the loss is measured as the difference between the asset's

carrying amount and the present value of estimated future cash

flows discounted at the financial asset's original effective

interest rate. Impaired debts are derecognised when they are

assessed as uncollectible.

Financial assets are derecognised only when the contractual

rights to the cash flows from the asset expire or are settled, or

when the Group transfers the financial asset and substantially all

the risks and rewards of ownership to another entity, or if some

significant risks and rewards of ownership are retained but control

of the asset has transferred to another party that is able to sell

the asset in its entirety to an unrelated third party.

Financial liabilities - other financial liabilities

All of the Group's financial liabilities fall into the other

financial liabilities category. Such financial liabilities are

initially measured at fair value less any directly attributable

transaction costs. Subsequent to initial recognition, these

liabilities are measured at amortised cost using the effective

interest method.

The effective interest method is a method of calculating the

amortised cost of a financial liability and of allocating interest

expense over the relevant period. The effective interest rate is

the rate that exactly discounts estimated future cash payments

through the expected life of the financial liability to the net

carrying amount on initial recognition.

Financial liabilities are derecognised when the Group's

contractual obligations expire or are discharged or cancelled.

Cash and cash equivalents

In the Statement of Cash Flows, cash and cash equivalents

comprise cash in hand, deposits held at call with banks, other

short-term highly liquid investments with original maturities of

three months or less, and bank overdrafts. In the Statement of

Financial Position, bank overdrafts are shown within borrowings in

current liabilities.

Dividends

Dividend income is recognised when the right to receive payment

is established.

Dividends payable are recognised when paid, or as a liability in

the period in which the dividends are approved by the shareholders

of the Company.

3. Use of judgements and estimates

In preparing these consolidated Financial Statements, management

has made judgements and estimates that affect the application of

the Group's accounting policies and the reported amounts of assets,

liabilities, income and expenses. Actual results may differ from

these estimates. Estimates and underlying assumptions are reviewed

on an ongoing basis. Revisions to estimates are recognised

prospectively.

Judgements

Judgements made in applying accounting policies that have the

most significant effects on the amounts recognised in the financial

statements are:

Going concern

As noted in Note 2, the financial statements have been prepared

on a going concern basis, following detailed scenario testing and

review.

Capitalisation of internally developed intangibles

Costs of GBP4.8 million incurred on developing software and new

digital products have been capitalised in the year (see Note 12).

Initial capitalisation is based on management's judgement on which

costs meet the definition of development costs. Costs capitalised

include directly attributable labour costs and purchases of

directly attributable products and services. No overheads have been

capitalised. Initial capitalisation and any subsequent impairment

is also based on management's judgement that technological and

economic feasibility is demonstrated and assumptions regarding the

expected future cash generation of the projects and the expected

period of benefits.

Assumptions and estimation uncertainties

Assumptions and estimation uncertainties at 31 March 2023 that

have a significant risk of resulting in a material adjustment to

the carrying amounts of assets and liabilities in the next

financial year are:

Useful economic life of intangible assets

The useful economic lives of capitalised development costs,

which are key estimates, are assessed by management. In assessing

the useful economic lives of the coaching platform, Performa,

management took factors into account such as the speed of change in

technology used across these types of Digital products. Initially

management assessed the useful economic life of Performa as 3

years, however, following a detailed review of the underlying code

base management have determined that a 5-year useful economic life

is more appropriate. The policy has been amended accordingly and

implemented from 1 April 2022. The useful economic lives have been

benchmarked against the market and are deemed reasonable. A 3 or 4

year useful economic life would have increased the amortisation

charge for the year ending 31 March 2023 by GBP501,000 or

GBP317,000 respectively.

Recognition of deferred tax asset

The availability of future taxable profits against which tax

losses carried forward can be used is an estimation uncertainty.

Management has determined that it is likely that the carried

forward losses of GBP21 million (generating a GBP5.3 million

deferred tax asset) will be utilised against future taxable

profits. Based on latest management forecasts, the Group is

expecting to generate taxable profits over the next 5 years. There

is no expiration date on the losses. These losses have mainly

arisen on enhanced deductions arising from claims under the UK

Research and Development regime for small and medium-sized

companies, and not from day-to-day operations. Supporting this

assertion is the existence of a deferred tax liability on the

associated intangible assets of GBP2.4 million and new business

opportunities and framework agreements which have been secured.

4. Segmental analysis

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker,

who is responsible for allocating resources and assessing

performance of the business. The chief operating decision-maker has

been identified as the Board. The Group has two operating segments:

EMEA (comprising the United Kingdom and Singapore) and America

(comprising the United States and Canada).

Both segments derive their revenue from a single business

activity, the provision of human capital and business improvement

solutions.

The Group's business is not highly seasonal, and the Group's

customer base is diversified with no individually significant

customer.

Segment results for the year ended 31 March 2023

Segment result

EMEA America Total

GBP'000 GBP'000 GBP'000

Revenue 23,742 31,269 55,011

Cost of sales (2,740) (3,620) (6,360)

Administrative expenses (23,092) (22,476) (45,568)

---------- ---------- ----------

(Loss)/profit before inter-segment charges (2,090) 5,173 3,083

Inter-segment charges 5,067 (5,067) -

---------- ---------- ----------

Operating profit - segment result 2,977 106 3,083

Finance income 55

Finance costs (174)

----------

Profit before taxation 2,964

==========

Management does not report segmental assets and liabilities

internally and as such an analysis is not reported.

The mix of revenue for the year ended 31 March 2023 is set out

below.

EMEA America Group

Delivery 60.2% 60.6% 60.3%

Design 19.0% 15.7% 17.2%

Digital 13.4% 12.8% 13.1%

Licensing and certification 3.3% 7.5% 5.6%

Other 2.4% 2.3% 2.4%

Advisory 1.7% 1.1% 1.4%

The vast majority of the Group's contracts are for the delivery

of services within the next 12 months. The Group has therefore

taken advantage of the practical expedient in paragraph 121(a) of

IFRS 15 not to disclose information about remaining performance

obligations.

Segment results for the year ended 31 March 2022

Segment result

EMEA America Total

GBP'000 GBP'000 GBP'000

Revenue 19,715 28,953 48,668

Cost of sales (2,572) (3,712) (6,284)

Administrative expenses (23,705) (19,028) (42,733)

---------- ---------- ----------

(Loss)/profit before inter-segment charges (6,562) 6,213 (349)

Inter-segment charges 5,084 (5,084) -

---------- ---------- ----------

Operating (loss)/profit - segment result (1,478) 1,129 (349)

Finance income 19

Finance costs (152)

----------

Loss before taxation (482)

==========

Management does not report segmental assets and liabilities

internally and as such an analysis is not reported.

The mix of revenue for the year ended 31 March 2022 is set out

below.

EMEA America Group

Delivery 60.2% 66.0% 63.7%

Design 13.4% 9.8% 11.2%

Digital 11.9% 10.7% 11.2%

Licensing and certification 5.8% 6.3% 6.0%

Other 6.8% 6.2% 6.5%

Advisory 1.9% 1.0% 1.4%

The vast majority of the Group's contracts are for the delivery

of services within the next 12 months. The Group has therefore

taken advantage of the practical expedient in paragraph 121(a) of

IFRS 15 not to disclose information about remaining performance

obligations.

5. Operating profit

Operating profit/(loss) is stated after charging:

31 March 31 March

2023 2022

GBP'000 GBP'000

Coach costs 4,960 5,025

Staff costs (Note 7) 34,962 32,977

Amortisation of intangible assets 743 325

Depreciation of property, plant and equipment 1,468 1,252

Short-term and low-value lease expense 18 23

Write-back of trade receivables (106) (11)

============ ==========

6. Auditor remuneration

31 March 31 March

2023 2022

GBP'000 GBP'000

Fees for audit of the Company and consolidated

financial statements 134 97

Fees for audit of the Company's subsidiaries

pursuant to legislation 24 16

------------ ----------

Total audit fees 158 113

Tax compliance services 20 69

Tax advisory services - 6

Other services 15 11

Total fees payable to the auditor 193 199

============ ==========

7. Employees

Staff costs were as follows:

31 March 31 March

2023 2022

GBP'000 GBP'000

Wages and salaries 31,036 28,828

Social security costs 2,944 2,825

Pension costs - defined contribution plans 1,055 983

Share-based payments (73) 341

34,962 32,977

============ ==========

The average number of the Group's employees by function was:

31 March 31 March

2023 2022

Delivery 218 196

Support 79 86

Digital 44 50

341 332

============ ==========

The year-end number of the Group's employees by function

was:

31 March 31 March

2023 2022

Delivery 241 206

Support 86 88

Digital 46 41

373 335

============ ==========

Key management personnel include all Directors and a number of

senior managers across the Group who together have responsibility

and authority for planning, directing and controlling the

activities of the Group. The compensation paid to key management

personnel for services provided to the Group was:

31 March 31 March

2023 2022

GBP'000 GBP'000

Salaries, bonuses and other short-term employee

benefits 2,624 2,955

Post-employment benefits 72 130

Termination benefits - 311

Share-based payments (109) 111

Total compensation 2,587 3,507

============ ==========

Details of Directors' remuneration and share options are set out

in the Annual Report on Remuneration on pages 87 to 92.

8. Net finance costs

31 March 2023 31 March 2022

GBP'000 GBP'000

Finance income

Bank interest receivable 54 12

Finance lease income 1 7

----------------- ---------------

55 19

----------------- ---------------

Finance costs

Bank interest payable (52) (27)

Lease interest (122) (125)

----------------- ---------------

(174) (152)

----------------- ---------------

(119) (133)

================= ===============

9. Tax

The tax (credit)/charge for the year comprises:

31 March 31 March

2023 2022

GBP'000 GBP'000

UK current tax - -

UK adjustment in respect of prior periods - (42)

Withholding tax 8 -

Foreign current tax 73 326

Foreign adjustment in respect of prior periods 322 19

------------ ----------

Total current tax charge 403 303

------------ ----------

Deferred tax - current year (131) (1,317)

Deferred tax - adjustment in respect of prior

periods (R&D claims) (154) (429)

Effect of changes in tax rates (89) (641)

------------ ----------

Total deferred tax credit (374) (2,387)

------------ ----------

Total tax (credit)/charge 29 (2,084)

============ ==========

Tax on items credited to equity:

31 March 31 March

2023 2022

GBP'000 GBP'000

Current tax credit on share-based payments - -

Deferred tax (credit)/charge on share-based

payments - 17

------------- ----------

Total tax credit in equity - 17

============= ==========

The tax charge for the year can be reconciled to accounting

profit as follows:

31 March 31 March

2023 2022

GBP'000 GBP'000

Profit/(loss) before tax 2,964 (482)

------------ ----------

Expected tax charge/(credit) based on the standard

rate of tax in the UK of 19% (2022: 19%) 563 (91)

Differences in overseas tax rates 11 91