NBPE Announces 2024 ZDP Repayment Date

28 Octobre 2024 - 8:00AM

UK Regulatory

NBPE Announces 2024 ZDP Repayment Date

| THE INFORMATION CONTAINED HEREIN IS NOT FOR RELEASE,

PUBLICATION OR DISTRIBUTION IN OR INTO AUSTRALIA, CANADA, ITALY,

DENMARK, JAPAN, THE UNITED STATES, OR TO ANY NATIONAL OF SUCH

JURISDICTIONS |

NBPE Announces 2024 ZDP Repayment Date

28 October 2024

NB Private Equity Partners (NBPE), the

$1.3bn1, FTSE 250, listed private equity investment

company managed by Neuberger Berman, today announces the 2024 Zero

Dividend Preference Shares (“2024 ZDPs”) will be repaid on 30

October 2024. Shareholders of the 2024 ZDPs will receive a final

capital entitlement of 130.63 pence per 2024 ZDP, based on a record

date of 23 October 2024.

For further information, please contact:

NBPE Investor

Relations +44 (0)

20 3214 9002

Luke

Mason

NBPrivateMarketsIR@nb.com

Kaso Legg Communications +44

(0)20 3882 6644

Charles

Gorman

nbpe@kl-communications.com

Luke Dampier

Charlotte Francis

About NB Private Equity Partners

Limited

NBPE invests in direct private equity investments alongside market

leading private equity firms globally. NB Alternatives Advisers LLC

(the “Investment Manager”), an indirect wholly owned subsidiary of

Neuberger Berman Group LLC, is responsible for sourcing, execution

and management of NBPE. The vast majority of direct investments are

made with no management fee / no carried interest payable to

third-party GPs, offering greater fee efficiency than other listed

private equity companies. NBPE seeks capital appreciation through

growth in net asset value over time while paying a bi-annual

dividend.

LEI number: 213800UJH93NH8IOFQ77

About Neuberger Berman

| This press release appears as a matter of record only and does

not constitute an offer to sell or a solicitation of an offer to

purchase any security. NBPE is established as a closed-end

investment company domiciled in Guernsey. NBPE has received the

necessary consent of the Guernsey Financial Services Commission.

The value of investments may fluctuate. Results achieved in the

past are no guarantee of future results. This document is not

intended to constitute legal, tax or accounting advice or

investment recommendations. Prospective investors are advised to

seek expert legal, financial, tax and other professional advice

before making any investment decision. Statements contained in this

document that are not historical facts are based on current

expectations, estimates, projections, opinions and beliefs of

NBPE's investment manager. Such statements involve known and

unknown risks, uncertainties and other factors, and undue reliance

should not be placed thereon. Additionally, this document contains

"forward-looking statements." Actual events or results or the

actual performance of NBPE may differ materially from those

reflected or contemplated in such targets or forward-looking

statements. |

Neuberger Berman is an employee-owned, private, independent

investment manager founded in 1939 with over 2,800 employees in 26

countries. The firm manages $509 billion of equities, fixed income,

private equity, real estate and hedge fund portfolios for global

institutions, advisors and individuals. Neuberger Berman’s

investment philosophy is founded on active management, fundamental

research and engaged ownership. The PRI identified the firm as part

of the Leader’s Group, a designation awarded to fewer than 1% of

investment firms for excellence in environmental, social and

governance practices. Neuberger Berman has been named by Pensions

& Investments as the #1 or #2 Best Place to Work in Money

Management for each of the last ten years (firms with more than

1,000 employees). Visit www.nb.com for more information. Data as of

September 30, 2024.

1 Based on net asset value.

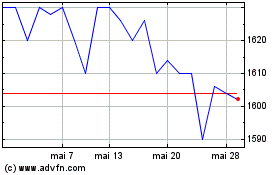

Nb Private Equity Partners (LSE:NBPE)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

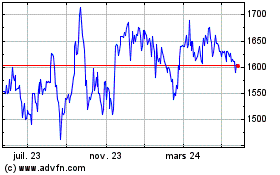

Nb Private Equity Partners (LSE:NBPE)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024