1st Quarter Results

14 Juin 2024 - 10:33AM

UK Regulatory

1st Quarter Results

14 June 2024

Oxford

Technology 2 VCT Plc (the "Company")

Legal Entity Identifier:

2138002COY2EXJDHWB30

1st Quarter Results

Oxford Technology 2 VCT Plc presents its quarterly update for

the 3 month period ending 31 May 2024. The Directors have reviewed

the valuation of its entire portfolio as at that date. The

unaudited net asset value (NAV) per share for each Class (and other

associated data) as at 31 May 2024 is shown in the table below:

|

|

Unaudited NAV p per share 31/5/24 |

Audited NAV p per share 29/2/24 |

Change in NAV % |

Cumulative Dividends p per share to 31/5/24 |

Total Nav Return p per share |

Shares in issue |

|

Share Class |

|

|

|

|

|

|

|

OT1 |

38.5 |

39.7 |

-2.9% |

55.0 |

93.5 |

5,431,655 |

|

OT2 |

20.8 |

20.4 |

2.0% |

22.5 |

43.3 |

5,331,889 |

|

OT3 |

23.3 |

22.4 |

4.0% |

42.0 |

65.3 |

6,254,596 |

|

OT4 |

26.3 |

25.3 |

4.3% |

48.0 |

74.3 |

10,826,748 |

The primary driver of these changes (net of

running costs) was an increase in the share price of Arecor

Therapeutics Plc (“Arecor”) following the release of excellent

headline results from their Phase 1 clinical trial of AT278 (its

highly concentrated fast acting insulin) in overweight and obese

people with Type 2 diabetes. At 31 May 2024, Arecor’s share price

was 155p.

However, subsequent to the period end, Arecor

has noted that it will need to raise funds in the next 3 months,

earlier than market expectations, and as a result, its share price

has reduced and is currently 125p. Post period end, Scancell

Holdings Plc (“Scancell”) has also announced that it has signed an

agreement with a major international biotechnology company to

evaluate an antibody from its Glymab® Portfolio: Scancell has

granted that company seven months exclusivity for evaluation, which

includes an $1M exclusivity payment. Despite this, Scancell’s share

price has dropped slightly from 9.7p at 31 May 2024 to 9.5p.

Taking these reductions into account, the latest

NAV per share for each Share Class are 38.1p, 19.2p, 20.9p and

24.0p respectively. Shareholders are reminded that the Chairman’s

statement in the Company’s 2024 Annual Financial Statements (“2024

Annual Report”) included details of how each Share Class’s net

asset value per share changes with movements in the share prices of

the Company’s primary AIM investments.

No dividends were paid during the period under

review and no shares were bought or sold in any the portfolio

companies in any of the four Share Classes.

As further noted in the 2024 Annual Report, the

Company will need to realise a small portion of its quoted

portfolio over the next few months to cover operating costs. The

Company currently holds 11.3m Scancell shares and 1.6m Arecor

shares.

The Directors are not aware of any other events

or transactions which have taken place between 31 May 2024 and the

publication of this statement which have had a material effect on

the financial position of the Company.

At 31 May 2024, the Company’s issued share

capital by Share Class is shown in the table above. The Company

holds no shares in treasury and the total voting rights in the

Company are 27,844,888. This figure of 27,844,888 may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

Enquiries: Lucius Cary Oxford Technology

Management 01865 784466

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation No 596/2014

which is part of English Law by virtue of the European (Withdrawal)

Act 2018, as amended. Upon the publication of this announcement via

a Regulatory Information Service, this information is now

considered to be in the public domain.

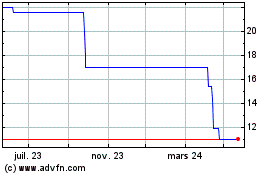

Oxford Technology 2 Vent... (LSE:OXH)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Oxford Technology 2 Vent... (LSE:OXH)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025