TIDMPCT

RNS Number : 4032W

Polar Capital Technology Trust PLC

12 December 2023

POLAR CAPITAL TECHNOLOGY TRUST PLC

UNAUDITED RESULTS ANNOUNCEMENT FOR THE SIX MONTHS TO 31 OCTOBER

2023

(Audited)^

(Unaudited) As at 30

As at 31 April Movement

October 2023 2023 %

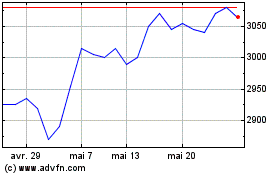

Total net assets GBP3,093,037,000 GBP2,828,141,000 9.4

Net Asset Value (NAV) per

ordinary share 2,509.58p 2,239.48p 12.1

Price per ordinary share 2,145.00p 1,940.00p 10.6

Benchmark

Dow Jones Global Technology

Index (total return, Sterling

adjusted, with the removal

of relevant withholding

taxes) 4,064.67 3,604.43 12.8

Discount of ordinary share

price to NAV per ordinary

share (14.5%) (13.4%)

Ordinary shares in issue* 123,249,257 126,285,544 -2.4

Ordinary shares held in

treasury* 14,065,743 11,029,456 27.5

* The issued share capital on 8 December 2023 (latest practicable

date) was 137,315000 ordinary shares of which 14,655,401 were

held in treasury.

KEY DATA

For the six months to

31 October 2023

Local Currency Sterling

% Adjusted

%

Benchmark (see above) 8.9 12.8

Other Indices over the

period (total return)

FTSE World -1.4 2.0

FTSE All-share -5.9

S & P 500 composite 1.4 5.0

Nikkei 225 7.9 0.4

Eurostoxx 600 -5.5 -6.2

As at As at

Exchange rates 31 October 30 April

2023 2023

US$ to GBP 1.2135 1.2569

Japanese Yen to GBP 183.77 171.15

Euro to GBP 1.1480 1.1385

No interim dividend has been declared for the period ended 31

October 2023, nor were there for periods ended 31 October 2022 or

30 April 2023, and there is no intention to declare a dividend for

the year ending 30 April 2024.

See Alternative Performance Measure below.

^The financial information for the six-month periods ended 31

October 2023 and 31 October 2022 have not been audited. The figures

and financial information above and in the following pages, for the

year ended 30 April 2023 are an extract from the latest published

Financial Statements and do not constitute statutory accounts for

that year.

References throughout this document to "the Company" or "the

Trust" relate to Polar Capital Technology Trust PLC while

references to "the portfolio" relate to the assets managed on

behalf of the Company.

For further information please contact:

Jumoke Kupoluyi, ACG - Company Ed Gascoigne-Pees

Secretary

Polar Capital Technology Trust Camarco

PLC

Tel: 020 7227 2700 Tel: 020 3757

4984

INVESTMENT MANAGER'S REPORT

Market Review

The fiscal half year from 30 April to 31 October 2023 saw global

markets continue to rebound from lows in March, to almost recover

their December 2021 highs by the end of July. Investors were pulled

back into the market as the US regional banking and Credit Suisse

turmoil appeared contained and economic growth remained firm,

supported by tight labour markets and a resilient consumer.

However, the market recovery proved short-lived and gave back about

half the gains by the end of October as financial conditions

continued to tighten and geopolitical risks increased.

The US once again led global markets, in Sterling terms, as the

S&P 500 Index returned +5%, ahead of Europe (Eurostoxx 600

-6.2%), Japan (TOPIX -3%) and Asia ex-Japan (MSCI All Country Asia

ex-Japan Index -2.8%). Local currency returns ex-US were even

weaker as the trade-weighted dollar (DXY) strengthened by 5.9%.

Within the US, large caps continued to dominate returns as the

Russell 1000 Index (large cap) returned +4.9% against the Russell

2000 Index's (small cap) -2%. In only one year since 1990 has there

been a greater positive return spread between the S&P 500

cap-weighted (+10.2%) and equal-weighted (-2.8%) indices' returns

year to date. The Russell 2000 Index broke 2022 lows, revisiting

November 2020 levels when Pfizer's vaccine data first emerged.

Breadth weakened through the period, as the percentage of companies

outperforming the NYSE declined by 34.5% to just 20.7%, and the

concentration of the largest seven (primarily technology) companies

reached almost 30% of the S&P 500 by the end of October. This

phenomenon has been felt in global indices: while the US accounts

for 62.7% of the MSCI All Country World Index, it is only 45.6% if

the so-called 'Magnificent Seven' companies are excluded.

Despite widespread pessimism at the start of the calendar year,

global growth came in ahead of expectations, supported by resilient

consumer spending and strong labour markets. Even as central banks

hiked rates aggressively, inflation came down without triggering a

recession or even an increase in the unemployment rate, which still

sits below pre-pandemic levels in many countries. Decisive central

bank tightening actions were important to ensure that price

increases were not embedded in higher inflationary expectations.

However, the drag on growth from monetary factors was offset by the

post-Covid improvement in goods and labour supply and a sustained

rebound in services demand. Central bank balance sheets contracted

during the period but remain significantly larger than they were

pre-Covid, which supported liquidity even as financial conditions

tightened.

The US economy was particularly strong during the fiscal half

year. Q1 US economic growth was revised up, with Q1 real GDP growth

of +2.2% on a q/q (quarter-on-quarter) seasonally adjusted annual

rate (SAAR) basis, which accelerated to +4.9% in Q3. The US economy

added an average of 205,000 jobs each month during the fiscal half

year, although the 'quits rate', (when an employee voluntarily

leaves their job) nearly returned to pre-pandemic levels and

average hourly earnings growth trended lower.

Inflation continued to trend down despite the stronger economy,

albeit frustratingly slowly from a policymaker's perspective. US

core PCE (personal consumer expenditure, which excludes volatile

items such as food and energy and is the Fed's preferred measure)

fell from 4.8% in April to 3.7% in September and core CPI (consumer

price inflation) declined from 5.5% to 4.1% over the same period.

This eased concerns about the need for more aggressive rate rises

and longer-term measures of inflation expectations; both inflation

swap markets and consumer surveys suggest these remain well

anchored.

After a June pause, at its July meeting the Fed raised the

benchmark interest rate by 25 basis points (bps) to a 5.25-5.5%

target range, a 22-year high. Although the Fed did not raise the

fed funds rate thereafter, financial conditions continued to

tighten with the equivalent effect of a further 75bps of rate hikes

as 10-year Treasury yields climbed to touch 5%, the highest point

since 2007. The scale of the move in yields was highly significant

and, by the end of September, Treasury yields had posted their

largest quarterly rise since 1Q09 (bond yields move inversely to

prices). This was driven by a number of factors, including

increased Treasury issuance after the debt ceiling was raised,

ongoing quantitative tightening (lower demand for government bonds

from the Federal Reserve) and a US credit rating downgrade by Fitch

Ratings, as well as concerns about China potentially offloading US

Treasuries to bolster the yuan.

Commentary from some Federal Reserve board members suggested

they expected interest rates to stay higher for longer, and the

Fed's September meeting projections indicated the expectation for

only 50bps of cuts in 2024 (down from 100bps in the June

projections). Oil prices also increased during the period,

surpassing $95 in late September and up from the low-$70s in June,

which may have been responsible for an uptick in consumer inflation

expectations given the importance of gas prices to this metric.

Markets were buffeted by elevated levels of political risk. The

narrowly averted US government shutdown and downgrade by US rating

agency Fitch focused investors' attention from monetary

policymakers (central bankers) towards their fiscal counterparts

(politicians). These included a hard-fought battle over raising the

debt ceiling (the maximum amount of debt the US government can

hold) which concluded in June and narrowly averted a government

shutdown, and the ousting of the House Speaker for the first time

in history. President Biden became the first sitting President to

walk a picket line with the United Automobile Workers, and striking

Hollywood writers only agreed to go back to work following a deal

with the studios regarding working conditions and rules governing

the adoption of artificial intelligence (AI).

Technology review

The technology sector outperformed the broader market during the

fiscal half-year period as the Dow Jones Global Technology Index

returned +12.8% against the FTSE World Index's +2.0%. The two major

technology market themes during the period were the continued

dominance of the largest technology companies and the

proliferation, evolution and investment implications of AI.

Large-cap technology stocks once again significantly

outperformed their small and mid-cap peers as the Russell 1000

Technology Index and Russell 2000 Technology Index delivered

returns of +16.1% and +3.8% respectively. For the calendar year

through to the end of October, the gap between the two extended to

an extraordinary 40 percentage points (ppts) as the Russell 1000

Technology Index's +41.7% return has dwarfed the Russell 2000

Technology Index's +1.9%. Returns were led by the largest

technology companies which in part explains why the S&P 500

Information Technology Sector saw its valuation premium to the

S&P 500 Index expand to 1.36x from 1.21x at the start of the

calendar year, against a 10-year average of 1.1x. However, this

valuation expansion was not experienced beyond the US; the Dow

Jones World ex-US Technology sector (W2TEC) which has no mega-cap

constituents, significantly underperformed (+1.8%). In the US, all

tech subsectors performed strongly: the Philadelphia Semiconductor

Index (SOX) returned +11.9% while the NASDAQ Internet Index and

Bloomberg Americas Software Index delivered +10.6% and 11.3%

respectively.

AI dominated proceedings across most technology subsectors.

Semiconductor investors focused on the AI-related semiconductor

supply chain as cloud providers invest in advance of the

anticipated scaling of AI workloads. NVIDIA returned +52.2% after

an extraordinary April quarterly earnings report and next quarter

revenue guide ($11bn versus $7.2bn expected), whereupon the stock

added the largest single-day market-cap gain in US stock market

history and touched a $1trn market cap. A number of smaller-cap

semiconductor supply chain and semiconductor capital equipment

stocks performed well as alternative ways to gain exposure to the

AI/parallel computing trend. In the real world, strength in

AI-related data centre spending 'crowded out' non-AI spending in

areas such as CPU (central processing unit)/cloud servers,

reinforcing the divergence in semiconductor stock price returns.

Beyond AI/data centre, semiconductor fundamentals were mixed;

communications infrastructure spending remained weak, PC and

smartphone inventory cycles appeared to bottom while automotive and

industrial end markets held up well (although this was challenged

during Q3 earnings announcements in early November).

Given the strategic importance of AI, the US government took

further steps to curtail China's ability to compete, including

banning the export of some leading-edge semi-cap equipment (putting

pressure on other governments to undertake similar actions) and

preventing the sale of the most advanced AI chips to China. These

rules will be updated every year as technology advances continue.

Wafer fabrication equipment (WFE) spending is now expected to reach

$80bn this year, up from previous expectations in the low $70bn

range, with the incremental upside coming from China (perhaps in

anticipation of tighter regulations). US government subsidy also

played a major part; structures and investments related to the

Inflation Reduction Act (IRA) and CHIPS Act have accounted for

essentially all the growth in US non-residential fixed investment

this year.

During the fiscal half year, aggregate public cloud revenue

growth stabilised at c19% for the second quarter running after

eight consecutive quarters of year-over-year (y/y) deceleration.

Amazon Web Services (AWS) growth appeared to have bottomed, while

AI-driven strength at Microsoft contrasted with some softness at

Google. Customers continued to 'optimise' their spend across all

cloud providers, but new initiatives began ramping up to help

offset this. Ongoing optimisations weighed on 'cloud consumption'

software models such as Snowflake and Datadog, which saw further

downward resets to growth expectations.

In application software, larger enterprise-focused companies

such as ServiceNow and Adobe continued to deliver steady results in

a challenging environment while the demand backdrop for SMB (small

and medium-sized business)-focused players such as HubSpot and

Paycom Software appeared to deteriorate. Application software

companies announced (and in some cases brought to market) a slew of

'AI-powered' products, although few appear to be given the full

benefit of the doubt by investors (or customers) thus far. Revenue

growth in the software sector overall has been decelerating for two

years (since mid-2021), and the sector rallied from May lows as

companies rerated on the hope of a growth inflection. However,

higher rates and macro concerns soon reasserted themselves and

companies have been reluctant to guide for a meaningful

reacceleration while IT budgets remain under such tight

scrutiny.

Cybersecurity was a bright spot as budgets remain strong and the

increasingly sophisticated and ever-evolving nature of cyberattacks

enabled by AI will require new tools and capabilities to defend

against them. We have also seen the first movements on AI

regulation. The European Union announced the AI Act in June 2023,

which seeks to take a risk-based approach to AI regulation,

including the banning of "unacceptable risk" activities such as

cognitive manipulation of people, social scoring and facial

recognition. President Biden issued an executive order at the end

of the period which established new standards for safety and

security, in an attempt to reduce risks posed by AI and establish a

threshold for chip processing power above which there are

disclosure requirements.

In the internet sector, the largest e-commerce players (Amazon

and Shopify) continued to consolidate market share gains and

deliver strong results as the online consumer remained resilient

while a higher cost of capital has decimated smaller peers (a

dynamic which helped other 'vertical leaders' such as Uber

Technologies). Similarly, the largest advertising networks (Meta

Platforms (Facebook)), Alphabet (Google) benefited from easy

year-over-year comparators and the ongoing impact of their AI

investments, for example in ad targeting and campaign optimisation.

Profitability also notably improved for the larger players as the

effect of earlier workforce reductions and tighter cost management

had a positive impact on margins. Smaller players struggled,

especially those with weaker balance sheets or aggressive online

Chinese competition, such as Match.com and Etsy. Travel spending

was robust as the post-Covid boom showed little sign of subsiding

during the summer months, although both Booking.com and Expedia

Group called out some weakness in travel trends in early

October.

Interest rate-sensitive subsectors such as fintech were most

challenged during the half year. The Global X Fintech ETF declined

-7% as both cyclical factors (higher rates; credit cycle concerns)

and structural questions (elevated competitive intensity;

sustainability of growth) weighed on the sector.

The IPO market tentatively reopened during the half-year period,

as the high profile ARM IPO raised c$5.2bn. There was a smattering

of other noteworthy technology IPOs (Instacart; Klaviyo; Kokusai

Electric) but capital markets activity remained fairly subdued

overall. Venture capital funding is trending to be c40% down y/y in

2023, although AI-based venture funding has been robust.

Portfolio performance

The Trust modestly underperformed its benchmark, with the net

asset value (NAV) per share increasing by +12.1% during the first

half versus +12.8% for the sterling-adjusted Dow Jones Global

Technology Index. While growth outperformed value during the

period, this largely reflected the remarkable performance of a

select group of US mega-cap stocks which delivered strong positive

returns in contrast with moribund or even negative returns in other

geographies and market-cap tiers. Although the Trust benefited from

large absolute positions in a number of these stocks, it remains

structurally underweight in large-caps in favour of growthier small

and mid-caps. We were pleased the Trust delivered top quartile

performance versus our Lipper peer group for the fiscal half year

and calendar year to date, although this undoubtedly speaks to a

challenging environment for most active managers against a

cap-weighted benchmark firing on most cylinders. Beyond the

divergence in large and small-cap stocks, the most significant

detractor to relative performance was our average cash position of

5.5% and NDX (NASDAQ 100) put options which cost 56bps and 24bps

respectively. However, stock selection was positive in both the US

and Europe - helped by significant exposure to AI-related names -

despite pronounced outperformance of mega-cap stocks. The Trust's

share price advanced by 10.6%, reflecting the 12.1% higher NAV,

offset by the discount widening from -13.4% to -14.5% during the

period. We continue to monitor the discount and the Trust bought

back 3.04 million shares during the period.

The half year proved an active one for the portfolio as we

rotated decisively towards AI as a primary investment theme. This

was mainly focused within the semiconductor subsector where we

initiated new positions in memory-related assets (such as Micron

Technology and Rambus), advanced packaging (BE Semiconductor

Industries), testing (Advantest; Camtek) and EDA software (Cadence

Design Systems; Synopsys). We also made a series of investments in

smaller Asian component and materials companies that we believe

have a more significant role to play in AI chip and server

manufacturing than they did during the cloud era. In addition, we

recalibrated our software exposure towards companies which appear

able to monetise AI within their existing offerings (Adobe;

Monday.com) as well as adding several data-related assets (Datadog;

Teradata) that should benefit from the growth in AI-related

workloads and the need for better data. We also initiated positions

in several idiosyncratic longer-duration assets with an AI angle

(Evotec; Oxford Nanopore Technologies) following significant share

price weakness largely related to higher risk-free rates.

In contrast with AI-related assets, where demand for servers,

chips and related components increased significantly, sharply

higher interest rates and a disappointing Chinese post-Covid

recovery trajectory began to negatively impact demand in a number

of other subsectors. As a result, we significantly reduced our

exposure to interest rate-sensitive areas such as fintech (exited

Adyen, GMO Payment Gateway), and alternative energy (sold Enphase

Energy, SolarEdge Technologies). We also reduced our exposure to

electric vehicle (EV) and related assets as higher interest rates

began to negatively impact EV demand via increased financing costs.

We exited Chinese EV maker BYD and several auto-exposed

semiconductor suppliers (Infineon Technologies; ON Semiconductor).

The faltering Chinese economic recovery resulted in us also exiting

Alibaba Group Holding as well as reducing our exposure to

robotics-related companies (Cognex; Nabtesco). We also exited a

number of software application companies (Freshworks; Paycom

Software; Smartsheet) due to nascent concerns that AI might pose a

meaningful risk to so-called 'point solutions' relative to larger

platforms. Towards the period's end, conflict in the Middle East

and some concerns around the health of the US consumer led us to

reduce travel-related names including Airbnb.

At the stock level, our zero-weight position in Broadcom* (+39%)

proved the most significant detractor to relative performance as we

opted for alternative ways to gain exposure to AI-related

semiconductors. Likewise, our underweight position in Adobe (+46%)

dragged on performance following the introduction of its Firefly AI

image generation offering. Strong absolute performances from other

mega-cap holdings weighed on relative performance too, with the

combination of Alphabet (+20%), Meta Platforms (Facebook) (+30%)

and Microsoft (+14%) dragging by a combined 43bps. The combination

of increased cyclical headwinds and a crowding out of non

AI-related spending (as budgets were reallocated) resulted in

weakness at a number of semiconductor and component companies

including Lattice Semiconductor (-28%) and Unimicron Technology

(-3%). The same dynamic, together with faltering Chinese demand,

also impacted robotics and automation stocks such as Keyence (-11%)

and Harmonic Drive Systems (-27%). Higher risk-free rates weighed

on alternative energy holdings such as First Solar (-19%) and Ceres

Power Holdings (-43%) as yields associated with solar and hydrogen

projects became relatively less attractive. However, weakness

associated with this dramatic change of fortunes for clean tech

companies was mitigated by timely reductions and complete exits of

related holdings. Likewise, interest rate-related weakness in

fintech companies including Adyen (-57%) and GMO Payment Gateway

(-48%) was ameliorated by timely sales, although both Visa (+5%)

and Mastercard (+2%) both dragged on relative performance. As ever,

there were also a few genuine disappointments at the likes of

Cognex and Ceres Power Holdings, although these were largely

contained to the portfolio tail.

Although the significant outperformance of mega-cap stocks

during the period represented a meaningful headwind to our

growth-centric investment approach, the Trust benefited from

positive stock selection and an overweight exposure to the AI theme

that rightly dominated returns and investment discourse during the

period. Our 6.9% average position in GPU (graphics processing unit)

chipmaker NVIDIA (+52%) versus a benchmark weighting of 6.4%

delivered a remarkable 240bps of absolute performance during the

half year. However, other AI-related assets delivered greater

relative performance as the likes of Disco (+58%) and Fabrinet

(+69%) benefited from new processes and products required by

AI-related chips and modules. The portfolio also benefited from

companies exposed to AI-related data centre spending such as Arista

Networks (+29%) and Pure Storage (+53%). Cybersecurity also proved

a relative bright spot within software as budgets proved relatively

robust amid several high-profile breaches and concerns that AI is

already increasing the so-called 'attack surface' available to

cyber-criminals. This, together with some valuation recovery,

resulted in strong performance contributions from a number of

cybersecurity holdings including CrowdStrike Holdings (+52%),

CyberArk Software (+36%) and Palo Alto Networks (+38%). Likewise,

stabilisation of cloud workload optimisation together with strong

fundamentals and the potential for future AI-related demand saw

both MongoDB (+49%) and Amazon (+31%) deliver strong positive

returns. Finally, relative performance benefited from a rare period

of underperformance from Apple (+4%) as iPhone fell short of

expectations, largely a function of a particularly weak smartphone

market.

Market outlook

Recent months have offered investors an environment where

economic growth and index level returns have been strong but there

has been a great deal of volatility and even outright weakness

beneath the surface. While the range of macroeconomic outcomes has

likely narrowed as risks around inflation and higher rates have

been (somewhat) assuaged by the decisive actions of central

bankers, political and company-specific risk have moved higher. We

have seen this clearly in third-quarter numbers where negative

surprises have been punished to the harshest degree in the past

five years.

The bearish case for the market outlook has multiple strands.

The most important aspect is the potential for a recession in 2024

as the lagged impact of aggressive central bank tightening finally

weighs on consumers and companies. The duration and nature of the

'long and variable lag' with which monetary policy is thought to

act is hotly debated. There has only been one occasion since the

mid-1950s where a recession began within 18 months of a Fed

tightening cycle, the most recent of which started on 17 March

2022. A recession before this point would be historically early -

especially as fiscal expansion, excess consumer savings and unusual

post-Covid employment dynamics have provided significant support to

growth. The next six months are empirically the most likely

recessionary period, according to Deutsche Bank. Viewed through

another lens, the difference between six-month and 10-year US

government bond yields turned negative (an 'inverted' yield curve)

in July 2022, which, on a median basis, has historically signalled

a recession 11 months ahead.

The impact of the most aggressive rate hike cycle for a

generation and quantitative tightening (the shrinking of the Fed's

balance sheet) is weighing on a wide range of forward-looking

economic indicators. The Conference Board Leading Economic

Indicators have moved into recession territory and year-over-year

money supply growth (M2) is still firmly negative. Lending

standards as measured by the Fed's Senior Loan Office Opinion

Survey are still at levels typically only seen when a recession is

imminent and junk bond yields have touched 9%. As funding costs

remain high, marginal investments become less attractive and

nominal growth will be slower. At the time of writing, the Fed

futures market is pricing in -c100bps of rate cuts in 2024 as the

Fed cuts rates in response to softening incoming data to stave off

or at least limit the severity of a recession.

Geopolitical risk represents another potential headwind to

market sentiment as the Russia/Ukraine and Israel/Hamas conflicts

are unlikely to be resolved quickly. The Covid experience laid bare

the fragility of global supply chains and the Ukraine war reminded

policymakers and market participants alike of the economy's

sensitivity to higher energy prices. As much as 17% of global oil

production and 19% of global liquid natural gas flows through the

Strait of Hormuz between Iran and Oman, so a broadening of conflict

in the Middle East could have significant ramifications. China/US

relations remain under strain, especially regarding the

availability of leading-edge AI technology. Disappointing Chinese

economic recovery post-reopening and a highly levered property

market bring further political and economic fragility.

Expanding fiscal deficits (partly due to higher interest

servicing costs) could continue to put upward pressure on rates

globally and downward pressure on sovereign bonds. Goldman Sachs

estimates US federal interest expense will increase from 2% of GDP

in 2022 to 3% in 2024 and 4% by 2030, and (unlike when interest

costs rose in the 1980s and early 1990s), there is little appetite

to reduce the primary (ex-interest) deficit given congressional

gridlock and other policy priorities mainly at odds with balanced

budgets. At current prices, 2023 would be the first time in the

history of the US republic that the value of US Treasuries has

fallen for three consecutive years. Indeed, the US government

deficit was 8% of GDP in 3Q23, the largest in history outside

periods of war or recession, and the debt-to-GDP ratio is the same

as at the end of World War Two. The US is also going into an

election year (as are countries covering 80% of the global equity

market cap), which have not been that supportive of equity returns

in recent decades: since 1984, US election year returns have

averaged 4%, with technology the worst performing sector.

Significantly higher risk-free rates have also begun to

challenge business models built on the availability of cheap debt.

This has already been reflected in the equity market, as high

quality, low leverage and low volatility factors have led under the

surface. Higher rates have also created greater competition to

equity that were less appealing during the recent low interest rate

era, including cash on deposit, money market funds and financial

instruments sitting higher up the capital structure, such as

corporate debt and convertible bonds.

Nor are equities particularly cheap, with the S&P 500

trading at 17.8x forward earnings estimates versus the 10-year

average of 17.5x. This might be the higher end of the future range

if we are entering a period of structurally higher interest rates,

which is possible given structurally higher fiscal deficits,

structurally higher investment levels (reshoring; balkanisation of

supply chains; clean energy transition) and aging populations

(potentially lower savings rates; higher social and healthcare

costs).The equity market may also be overearning given cycle-high

operating margins and debt refinancing rates are now more than

double the coupon of debt that has already been issued.

However, all is not lost. To date, the Fed has so far been able

to rebalance the labour market without driving up unemployment

significantly or sending the economy into recession, strengthening

the case for so-called 'immaculate disinflation'. For example, the

'jobs/workers gap' (the difference between the number of job

openings in the previous month and unemployed workers in the

current month) has declined to reach c2.6 million from c5 million

at the start of the calendar year and is trending towards the

roughly two million level consistent with 2% inflation, as

estimated by Goldman Sachs. US wage growth has fallen by more than

1.5pts to 4.2% annualised. Softer October payrolls also helped as

headline jobs missed and the number of industries seeing employment

decline stepped up to 44% from 32% in September.

There is also limited evidence of significant distress brought

on by the lagged impact of rate rises on corporate balance sheets,

even if delinquencies and defaults are ticking higher. This may

reflect the fact that three-quarters of S&P 500 debt is

long-term fixed (almost double pre-Global financial crisis levels),

as are 85% of US mortgages, suggesting the lag from rate rises to

real world impact may have extended or become less direct.

Borrowing costs, defaults and the percentage of companies rated BBB

or lower by Moody's are rising, but from extremely low levels,

while less than $150bn of the $3trn junk bond and leveraged loan

market needs to be refinanced in the next two years.

Sentiment remains supportive too, with the most recent Bank of

America's Global Fund Manager Survey indicating that average cash

levels remain above 5%, which has historically been a good

contrarian 'buy' signal. Negative sentiment is not limited to

professional investors. The American Association of Individual

Investors (AAII) bull/bear ratio sits below 0.5, which has

historically presaged average returns of +8.3% and +13% for the

S&P 500 for the following six and 12-month periods

respectively.

It would also be remiss of us not to mention some potential

early signs that technology adoption is having a positive impact on

macroeconomic prospects. Third-quarter productivity (a measure of

output per labour hour) positively surprised for the second

consecutive quarter. Strong economic growth is not inflationary if

it is driven by productivity and trend productivity growth of

1.5-2% means a target of 3.5-4% wage growth would be consistent

with the Fed's 2% inflation target. Goldman Sachs has estimated

generative AI will affect productivity sufficiently within their

10-year forecast horizon to bring a potential boost of 10-15% to

global GDP cumulatively. A combination of the advent of AI and

structural labour shortages as developed economy populations age

might be sufficient to stimulate a productivity boom and produce

disinflationary economic growth - a supportive backdrop for

equities.

More importantly, whether there is a recession or not and what

equity markets do over the next six to 12 months perhaps misses the

point. Astounding new innovations such as AI and the advances

brought by GLP-1 drugs augur well for a longer-term innovation-led

growth and prosperity cycle. Perhaps the post-WW2 period provides a

helpful analogy. At that time, there was a period of economic

rebalancing including a shallow recession in 1948-49 as the US

economy transitioned from a wartime economy to a peacetime one. The

slowdown was brief and mild, and there was a significant shift to a

new rates regime as long-term bonds - capped during wartime - were

allowed to trade freely from 1951. However, the combination of

economic rebalancing and a shift to a higher rate environment in

the context of a US government debt-to-GDP peak in 1946 at 118%,

did not preclude strong equity market returns over the next five

(+55%) and 10 years (+203%). This was a time of rapid technological

and social change, and a transition to a structurally higher rate

environment, but 1949-1956 and 1957-1961 delivered two strong

equity bull markets. Longer term, there is a good case that the

same will prove true of the post-Covid period.

Technology outlook

A more uncertain economic environment and the stronger US dollar

are exerting downward pressure on worldwide IT spending this year,

which is now expected to grow 3.5% in 2023, in dollar terms,

compared to 5.5% anticipated in April. This moderating outlook has

been evident in recent corporate results with the S&P

technology sector now expected to deliver revenue and earnings

growth of 2% and 3.5% in 2023. However, early forecasts for 2024

look significantly more encouraging with current expectations for

IT spending (+8%) commensurate with S&P 500 technology revenue

and earnings forecasts of 8.8% and 15.8% respectively. While these

expectations are likely to remain macroeconomic-sensitive, AI

spending should prove more resilient given 70% of CIOs believe (as

we do) that generative AI (GenAI) is a game-changing technology,

with 55% of them planning to deploy it over the next two years

compared to only 9% today. Net profit margins are likely to remain

a key focus for earnings as they remain above long-term averages,

while recent dollar strength represents a potential headwind for

technology estimates given the sector's international exposure of

58% (the highest of any sector) versus 40% for the market.

The outperformance of technology and excitement around GenAI has

seen the forward P/E of the technology sector meaningfully expand

from c20x at the start of the calendar year to c24x at the end of

October - ahead of both five (23x)) and 10-year (20x) averages. The

premium enjoyed by the sector has also expanded, with technology

stocks today trading at 1.4x the market multiple, slightly above

the post-bubble range of between 0.9-1.4x. While this may suggest

less valuation upside in the near term, relative downside risk may

also prove limited in a post-ChatGPT world with market setbacks

bought by investors later to this important investment theme. In

addition to AI as a driver, the technology sector remains

exceptionally well capitalised which, in a challenging rate

environment, should insulate it against refinancing and/or

bankruptcy risk. It is also worth noting that despite the

excitement around GenAI, we remain far from valuations levels seen

during the dot.com bubble, when the technology sector traded at

more than twice the S&P 500 multiple.

We are also encouraged by the remarkable valuation retracement

of next-generation technology stocks that has characterised the

post-pandemic, post-Fed pivot world. Within software, the average

EV/NTM (enterprise value/next 12-month) sales multiple of above 30%

revenue growth companies has fallen back to 6.7x, down from a peak

of 34.5x and below both pre-Covid five and 10-year averages of 8.6x

and 8.1x respectively. With the overall software market trading at

c5.5x EV/NTM sales, the c20% premium for this much faster growing

group of companies is significantly below the five and 10-year

pre-Covid average premium of 53% and 68% respectively. While we are

excited about the longer-term opportunity presented by this

valuation convergence, it also reflects today's more hostile market

environment which has shortened investment duration and

recalibrated investor preference towards profits over revenue

growth. This is apparent when looking at the subset of unprofitable

software companies which today trade at just 3.2x EV/NTM sales - a

c40% discount to overall software valuations, a stark contrast to

the large premium they enjoyed during 2020-21 when interest rates

were near zero. We are also mindful of the risk posed by AI to

'point solution' companies relative to incumbents/platform

companies that look better placed to absorb the

costs and get monetisable AI products to market. This unusual

dynamic (empirically, unencumbered newer companies have tended to

benefit most from technology change) might explain the unusual

absence of strategic M&A despite the material valuation

correction.

AI continues to dominate technology performance at both headline

and stock level. While it is still early days, we are seeing

encouraging signs for the adoption of AI and the impact of the AI

transformation on companies up and down the supply chain. AI

services accounted for 3pts of Microsoft Azure's y/y growth,

compared to just 1pt last quarter, indicating a $1.5bn revenue

run-rate. Microsoft Azure-OpenAI customers increased to 18,000 from

11,000 last quarter, and 40% of the Fortune 100 are trialling the

M365 Copilot product (which launched on 1 November). Meta Platforms

spoke to a mid-single digit increase in time spent on their main

platforms due to AI-powered recommendation improvements. Meanwhile

Alphabet said generative AI projects on its AI Vertex platform were

up 7x from last quarter.

This is unsurprising to us given early productivity gains across

a range of tasks and applications (estimated at between 30-50%) and

broad GenAI applicability since a majority of jobs in advanced

economies are knowledge workers. Despite this, there has been a

healthy tempering of expectations for some of the leading suppliers

into the AI infrastructure buildout after earlier exuberance. While

tighter US export restrictions may have played a part in this, we

anticipate continued strong demand and as such see this as a buying

opportunity given the build out of the new AI computing stack

remains in its infancy. According to Gartner, 73% of CIOs plan to

increase AI investments in 2024.

During Q3 earnings season, we moved to a slightly more fully

invested position (c.4% cash at the end of November). Given

elevated levels of geopolitical risk and the fact that our

portfolio beta is naturally higher than the benchmark due to our

growth-focused investment approach, we continue to hold NASDAQ

Index put options (to help bring the beta of the portfolio closer

to the benchmark in the event of a sharp drawdown, rather than to

hedge absolute downside risk). However, our overarching focus

remains on positioning the portfolio in favour of companies that

should prove important AI enablers and beneficiaries. At the time

of writing, we believe that more than three-quarters of the

portfolio is explained by AI enablers and beneficiaries.

Technology risks

In addition to market-related risks already highlighted, there

are other risks to our constructive medium-term view. As in

previous years, there are downside risks to technology spending in

the event of weaker macroeconomic trends or should CEO confidence

meaningfully deteriorate. Likewise, earnings estimates are likely

to remain subject to macroeconomic turbulence with margins

potentially at risk given their recent recovery following earlier

cost-cutting. A weaker macroeconomic environment and/or higher

interest rates could extend the current semiconductor downturn,

particularly within rate-sensitive areas such as automotive. It

might also challenge cloud spending growth that has finally begun

to stabilise following multiple quarters of post-pandemic

optimisation.

Valuation remains a key risk too, particularly following the

rerating in technology stocks this year, while higher risk-free

rates are likely to constrain the magnitude of any recovery in

longer-duration stocks. As in previous years, regulation remains a

risk, with the current antitrust case brought against Alphabet by

the Department of Justice (DoJ) potentially an important moment for

both Apple and Alphabet, as well as having implications for other

natural monopolies within our sector. We remain hopeful that

worst-case outcomes will continue to be averted, reflecting a

divided Congress and the fact that US technology companies

represent the vanguard in the emerging AI battleground with China.

Instead, deteriorating US/Sino relations may represent a more

significant risk, coalescing around the supply of AI chips to

China. We are hopeful this remains contained, but Taiwan -

responsible for producing c90% of leading-edge semiconductors -

represents a critical geopolitical fault line and could potentially

impact a significant portion of our portfolio.

Finally, we should highlight the risk associated with

disappointing AI adoption given its centrality to technology

performance during 2023. This could come in the form of regulation

designed to stymie change associated with generative AI or, more

likely, in the event that AI monetisation at Microsoft, Adobe and

other software companies proves disappointing. Although a

monetisation delay is unlikely to derail the AI story, it would

represent a significant setback and would likely dampen excitement

around the timing, if not the ultimate size, of the AI

opportunity.

Concentration risk

In our last Annual Report, we reminded our shareholders of the

concentration risk both within the Trust and the

market-cap-weighted index around which we construct the portfolio.

After another period of pronounced large-cap outperformance, this

risk has not diminished. At the half year, our three largest

holdings - Apple, Microsoft, and Alphabet - represent c28% and c42%

of our NAV and benchmark respectively, while our top five holdings

(which includes NVIDIA and Meta Platforms (Facebook)) represent

c39% and c53% of our NAV and benchmark respectively. As a large

team with a growth-centric investment approach, we would welcome

the opportunity to move materially underweight positions in the

largest index constituents should we become concerned about their

growth prospects, or if we believe there are more attractive

risk/reward profiles elsewhere. However, concentration does not

appear to be entirely driven by ebullient valuations; the

Magnificent Seven represents 29% of the S&P 500 market cap but

account for 18.7% of 2023 consensus EPS and 20% of 2024 consensus

EPS. Likewise, according to Bloomberg, the 'Magnificent Seven'

Index trades at 27.5x 2024 P/E ratio, which does not seem excessive

for c20% earnings growth CAGR.

The past six months support our earlier view that AI plays well

into mega-caps given their significant scale advantages. That said,

we still find it very difficult to argue for holding much above 10%

in any individual stock as we struggle with the idea that we are

reducing risk by making the portfolio evermore concentrated.

Instead, we continue to believe that a diversified portfolio of

growth stocks and themes capable of outperformance, and constructed

to withstand investment setbacks, will deliver superior returns

over the medium to long term, particularly on a risk-adjusted

basis.

Conclusion

Twelve months ago, we argued that the current inflationary

period might not represent a change in investment regime as others

were arguing at the time. Instead, we suggested it might be akin to

the immediate post-WW2 years - a Covid rather than war-related

disequilibrium resolvable with time and enough policymaker

'medicine'. With inflation heading lower without yet taking the

global economy with it, the case for 'immaculate disinflation'

looks stronger than it did last year. While debate remains about

whether the rate tightening cycle is complete, the proverbial 'wall

of worry' has shifted towards geopolitics and primary fiscal

deficits, both of which could delimit policymaker latitude to

deliver the monetary adjustments necessary to avoid a hard landing.

We are hopeful that decisive US action in the eastern Mediterranean

will prevent the Israel/Hamas conflict from broadening, while the

Saudi/Iran divide makes a 1973 rerun meaningfully less likely.

The case for renewed disinflation has also received a

significant boost in the form of generative AI. We believe that

after years of impressive gains in narrow fields, the recent advent

of the transformer model is likely to prove the 'Bessemer moment'

for AI. If so, we are likely to experience remarkable productivity

gains over the coming years which may exert significant downward

pressure on prices. Following the advent of cheap steel, thanks to

Henry Bessemer, US prices fell on average by 4% per annum during

the 1870s, a period known as the Great Deflation. However, what

followed was a pronounced and prolonged rise in real wages so

profound that it "gave birth to the middle class". Today,

policymakers are focused on stubbornly tight labour markets just as

AI threatens to disrupt as many as 300 million jobs. While this

could yet take the form of dystopic science fiction and even

civilisational decline, remarkable early gains from GenAI and the

broad applicability of this nascent GPT (general purpose

technology) suggests to us that we might instead be on the cusp of

the "best decade ever" for productivity growth.

Ben Rogoff & Ali Unwin

11 December 2023

PORTFOLIO BREAKDOWN

Market Capitalisation of underlying investments

Less than

% of invested assets $1bn $1bn-$10bn Over $10bn

-------------------------- ----------- ------------ -----------

as at 31 October 2023 0.7 9.9 89.4

as at 30 April 2023 0.4 7.5 92.1

% of Net Assets as at

Breakdown of Investments by Geographic 31 October 30 April

Region* 2023 2023

----------------------------------------- ----------- ---------

North America 75.3 72.8

Asia Pacific (ex-Japan) 9.4 10.4

Japan 4.4 4.4

Europe (inc - UK) 3.8 3.9

Middle East & Africa 1.3 1.2

Latin America 0.0 0.7

* % of Net Assets, totals do not add up to 100 due to the

exclusion of other net assets.

Classification of Investments as at 31 October 2023**

North Pacific

America (inc. Total Total

(inc. Middle 31 October 30 April

Latin America) Europe East) 2023 2023

% % % % %

------------------ ------------------ --------------------- ------------------ ------------------

Software 25.4 - 1.3 26.7 24.1

Semiconductors &

Semiconductor

Equipment 15.6 3.2 5.7 24.5 24.0

Interactive Media &

Services 12.1 - 1.3 13.4 11.7

Technology

Hardware, Storage

& Peripherals 9.5 - 3.0 12.5 13.4

IT Services 3.8 0.2 0.2 4.2 4.0

Broadline Retail 2.3 - - 2.3 3.3

Electronic

Equipment,

Instruments

& Components - - 2.1 2.1 1.4

Communications

Equipment 2.0 - - 2.0 1.4

Entertainment 1.2 - - 1.2 1.0

Financial Services 1.0 - - 1.0 3.3

Machinery - - 0.9 0.9 0.9

Automobiles 0.7 - - 0.7 1.1

Healthcare

Equipment &

Supplies 0.2 - 0.4 0.6 1.0

Aerospace & Defence 0.5 - - 0.5 0.2

Healthcare

Technology 0.5 - - 0.5 0.4

Ground

Transportation 0.5 - - 0.5 0.9

Life Sciences Tools

& Services - 0.3 - 0.3 -

Hotels, Restaurants

& Leisure - - 0.1 0.1 1.2

Chemicals - - 0.1 0.1 -

Electrical

Equipment - 0.1 - 0.1 0.1

Total investments

(GBP2,912,344,000) 75.3 3.8 15.1 94.2 93.4

-------------------- ------------------ ------------------ --------------------- ------------------ ------------------

Other net assets

(excluding

loans) 6.8 - 0.7 7.5 8.4

Loans (1.0) - (0.7) (1.7) (1.8)

-------------------- ------------------ ------------------ --------------------- ------------------ ------------------

Grand total (net

assets

of

GBP3,093,037,000) 81.1 3.8 15.1 100.0 -

-------------------- ------------------ ------------------ --------------------- ------------------ ------------------

At 30 April 2023

(net assets

of

GBP2,828,141,000) 78.9 4.8 16.3 - 100.0

-------------------- ------------------ ------------------ --------------------- ------------------ ------------------

* * Classifications derived from Benchmark as far as possible.

The categorisation of each investment is shown in the portfolio

available on the Company's website. Not all sectors of the

Benchmark are shown, only those in which the Company has an

investment at the period end or in the comparative period.

PORTFOLIO OF INVESTMENTS

Ranking Value of

holding % of net

GBP'000 assets

31 30 31 30 31 30

Oct Apr October April October April

2023 2023 Stock Sector Region* 2023 2023 2023 2022

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

1 (1) Microsoft Software North America 336,621 302,791 10.9 10.7

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Technology

Hardware,

Storage &

2 (2) Apple Peripherals North America 252,687 284,199 8.2 10.0

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Interactive

3 (3) Alphabet Media & Services North America 229,483 174,388 7.4 6.2

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

4 (4) Nvidia Equipment North America 219,855 130,855 7.1 4.6

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Interactive

5 (7) Meta Platforms Media & Services North America 125,692 82,047 4.1 2.9

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

Advanced & Semiconductor

6 (5) Micro Devices Equipment North America 96,889 94,299 3.1 3.3

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Technology

Hardware,

Samsung Storage &

7 (6) Electronics Peripherals Asia Pacific 87,960 83,894 2.8 3.0

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

Taiwan & Semiconductor

8 (8) Semiconductor Equipment Asia Pacific 77,516 61,421 2.5 2.2

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

9 (11) Amazon.com Broadline Retail North America 69,876 46,756 2.3 1.7

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

10 (9) ServiceNow Software North America 61,156 51,884 2.0 1.8

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Top 10 investments 1,557,735 50.4

------------------- -------------- ------------ -------- ----------- -------

Communications

11 (13) Arista Networks Equipment North America 57,037 38,201 1.8 1.4

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

12 (14) CrowdStrike Software North America 56,685 36,041 1.8 1.3

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

13 (10) ASML Equipment Europe 51,760 49,941 1.7 1.8

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Palo Alto

14 (18) Networks Software North America 45,849 34,847 1.5 1.2

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

15 (35) MongoDB IT Services North America 43,402 22,107 1.4 0.8

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

16 (29) Disco Corporation Equipment Asia Pacific 42,805 26,960 1.4 1.0

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Technology

Hardware,

Storage &

17 (59) Pure storage Peripherals North America 41,295 10,694 1.3 0.4

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

18 (28) Snowflake IT Services North America 41,103 27,622 1.3 1.0

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

19 (-) Synopsys Software North America 37,059 - 1.2 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

20 (16) KLA-Tencor Equipment North America 33,259 35,072 1.1 1.2

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Top 20 investments 2,007,989 64.9

------------------- -------------- ------------ -------- ----------- -------

21 (-) Adobe Software North America 31,400 - 1.0 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

Monolithic & Semiconductor

22 (24) Power Systems Equipment North America 28,030 32,453 0.9 1.1

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Interactive

23 (15) Tencent Media & Services Asia Pacific 27,950 35,666 0.9 1.3

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

24 (60) Intuit Software North America 26,240 10,538 0.8 0.4

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

CyberArk

25 (31) Software Software Asia Pacific 25,419 24,330 0.8 0.9

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

26 (-) Micron Technology Equipment North America 25,388 - 0.8 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

27 (-) NetFlix.Com Entertainment North America 24,818 - 0.8 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

28 (-) Zscaler Software North America 24,491 - 0.8 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

29 (64) ASM International Equipment Europe 23,648 9,614 0.8 0.3

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

30 (12) HubSpot Software North America 23,498 45,203 0.8 1.6

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Top 30 investments 2,268,871 73.3

------------------- -------------- ------------ -------- ----------- -------

31 (26) Shopify IT Services North America 23,230 29,497 0.8 1.0

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

32 (23) Qualcomm Equipment North America 22,893 32,525 0.7 1.2

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

33 (50) Tesla Motors Automobiles North America 21,769 13,358 0.7 0.5

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

34 (27) Salesforce.com Software North America 21,657 27,910 0.7 1.0

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

Marvell & Semiconductor

35 (49) Technology Equipment North America 21,412 13,879 0.7 0.5

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Electronic

Equipment,

Instruments

36 (-) Fabrinet & Components Asia Pacific 20,267 - 0.7 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

37 (-) Rambus Equipment North America 20,157 - 0.7 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

eMemory & Semiconductor

38 (47) Technology Equipment Asia Pacific 19,737 14,524 0.6 0.5

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Electronic

Equipment,

Unimicron Instruments

39 (-) Technology & Components Asia Pacific 18,695 - 0.6 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Interactive

40 (46) Pinterest Media & Services North America 17,683 15,134 0.6 0.5

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Top 40 investments 2,476,371 80.1

------------------- -------------- ------------ -------- ----------- -------

41 (17) Mastercard Financial Services North America 16,994 34,908 0.5 1.2

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

42 (38) Dynatrace Software North America 16,240 19,644 0.5 0.7

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Aerospace &

43 (74) Axon Enterprise Defence North America 15,955 5,357 0.5 0.2

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

44 (-) Datadog Software North America 15,375 - 0.5 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Healthcare

45 (61) Veeva Systems Technology North America 15,063 10,390 0.5 0.4

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

46 (-) Advantest Equipment Asia Pacific 14,534 - 0.5 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Ground

47 (30) Uber Technologies Transportation North America 13,503 25,788 0.5 0.9

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Healthcare

Equipment

48 (48) Hoya & Supplies Asia Pacific 13,392 14,264 0.4 0.5

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Electronic

Equipment,

Instruments

49 (57) E Ink & Components Asia Pacific 13,370 12,028 0.4 0.4

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

BE Semiconductor & Semiconductor

50 (-) Industries Equipment Europe 13,168 - 0.4 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Top 50 investments 2,623,965 84.8

------------------- -------------- ------------ -------- ----------- -------

51 (21) Workday Software North America 13,087 33,429 0.4 1.2

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

52 (66) Elastic Software North America 12,518 9,134 0.4 0.3

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

53 (42) Roblox Entertainment North America 12,418 17,444 0.4 0.6

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Interactive

54 (43) Baidu Media & Services Asia Pacific 11,758 16,616 0.4 0.6

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

Lattice & Semiconductor

55 (37) Semiconductor Equipment North America 11,455 20,572 0.4 0.7

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

56 (79) GitLab Software North America 11,218 4,063 0.4 0.1

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Harmonic

57 (53) Drive Systems Machinery Asia Pacific 10,536 12,777 0.4 0.5

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

58 (82) Braze Software North America 10,495 3,668 0.3 0.1

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

59 (25) Cloudflare IT Services North America 10,060 29,973 0.3 1.0

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

60 (-) Teradata Software North America 9,488 - 0.3 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Top 60 investments 2,736,998 88.5

------------------- -------------- ------------ -------- ----------- -------

Cadence

61 (-) Design System Software North America 9,327 - 0.3 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

62 (33) Tokyo Electron Equipment Asia Pacific 9,302 23,016 0.3 0.8

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

63 (41) Confluent Software North America 8,867 18,140 0.3 0.6

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

64 (-) STMicroelectronics Equipment Europe 8,707 - 0.3 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

65 (-) Minebea Machinery Asia Pacific 8,295 - 0.3 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

66 (65) Flywire Financial Services North America 8,048 9,503 0.3 0.3

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

67 (58) Kinaxis Software North America 7,560 11,909 0.2 0.4

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Healthcare

Intuitive Equipment

68 (51) Surgical & Supplies North America 7,555 13,230 0.2 0.5

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

69 (-) Monday.com Software Asia Pacific 7,478 - 0.2 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

70 (-) DoubleVerify Software North America 7,160 - 0.2 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Top 70 investments 2,819,297 91.1

------------------- -------------- ------------ -------- ----------- -------

71 (22) Visa Financial Services North America 6,739 33,156 0.2 1.2

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Electronic

Equipment,

Instruments

72 (32) Keyence & Components Asia Pacific 6,643 23,561 0.2 0.8

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Fuji Machine

73 (71) Manufacturing Machinery Asia Pacific 6,642 5,680 0.2 0.2

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Technology

Hardware,

Lite-On Storage &

74 (-) Technology Peripherals Asia Pacific 6,521 - 0.2 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

75 (-) JFrog Software Asia Pacific 6,182 - 0.2 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

76 (76) Zuken IT Services Asia Pacific 5,253 5,187 0.2 0.2

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

77 (-) Wise IT Services Europe 4,858 - 0.2 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Communications

78 (-) Ciena Equipment North America 4,565 - 0.2 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Oxford Nanopore Life Sciences

79 (-) Technologies Tools & Services Europe 4,443 - 0.2 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

80 (69) First Solar Equipment North America 4,328 7,708 0.1 0.3

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Top 80 investments 2,875,471 93.0

------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

81 (-) Ferrotec Equipment Asia Pacific 3,940 - 0.1 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Hotels,

Restaurants

82 (45) Trip.Com & Leisure Asia Pacific 3,853 15,415 0.1 0.5

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

Micronics & Semiconductor

83 (-) Japan Equipment Asia Pacific 3,613 - 0.1 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Electronic

Equipment,

Hamamatsu Instruments

84 (-) Photonics & Components Asia Pacific 3,562 - 0.1 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

85 (-) MEC Chemicals Asia Pacific 3,502 - 0.1 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

86 (56) Atlassian Software Asia Pacific 3,115 12,039 0.1 0.4

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

& Semiconductor

87 (-) Camtek Equipment Asia Pacific 3,031 - 0.1 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

88 (-) Ansys Software North America 3,001 - 0.1 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Electronic

Equipment,

Instruments

89 (84) Seeing Machines & Components Asia Pacific 2,885 3,265 0.1 0.1

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Semiconductors

Kokusai & Semiconductor

90 (-) Electric Equipment Asia Pacific 2,556 - 0.1 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Top 90 investments 2,908,529 94.0

------------------- -------------- ------------ -------- ----------- -------

Life Sciences

91 (-) Evotec OAI Tools & Services Europe 2,282 - 0.1 -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Electrical

92 (85) Ceres Power Equipment Europe 1,532 2,703 0.1 0.1

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Electronic

Equipment,

Cermetek Instruments

93 (87) Microelectronics & Components North America 1 1 - -

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Total equities 2,912,344 94.2

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Other net

assets* 180,693 5.8

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Total net

assets 3,093,037 100.0

------ ------------------- ------------------- -------------- ------------ -------- ----------- -------

Note: Asia Pacific includes Middle East and North America

includes Latin America.

*Refer to Balance Sheet below for more details.

CORPORATE MATTERS

THE BOARD

There have been no changes to the membership of the Board in the

six months ended 31 October 2023.

As noted in the Company's Annual Report for the year ended 30

April 2023, Charlotta Ginman stepped down as Audit Chair of the

Company on 31 October 2023 and was succeeded by Jane Pearce as part

of a smooth and orderly transition. Charlotta remains on the Board

as a non-executive Director of the Company and will step down from

the Board following nine years' service at the AGM in September

2024.

Biographical details of all Directors are available on the

Company's website and are provided in the Company's latest Annual

Report for the year ending 30 April 2023.

GEARING

As at 31 October 2023, the Company had two, two-year fixed rate,

term loans with ING Bank N.V expiring in September 2024 (JPY 3.8bn

and USD36m). The JPY loan has been fixed at an all-in rate of 1.13%

pa and the USD loan has been fixed at an all-in rate of 5.43% pa.

The prior loans were repaid in full at expiry.

SHARE BUY-BACKS

As described in the full year report and accounts for the year

ending 30 April 2023, the Board continually monitors the discount

at which the Company's ordinary shares trade in relation to the

Company's underlying NAV. Discounts across the whole of the

investment trust sector continue to widen due to the challenging

market conditions and, unfortunately, the discount of the Company

has also been impacted. The Board discusses the market factors

giving rise to any discount or premium, the long or short-term

nature of those factors and the overall benefit to Shareholders of

any actions. The Company does not have an absolute target discount

level at which it buys back shares but will continue to buy back

shares when deemed appropriate.

In the six months to 31 October 2023, the Company has

repurchased a total of 3,036,287 shares into treasury representing

2.2% of the total issued capital. Since the period end to 8

December 2023, we have bought back a further 589,658 shares. The

number of repurchased shares now in treasury is 14,655,401

representing 10.7% of issued share capital.

AUDITOR

KPMG LLP were re-appointed as the Company's external auditor at

the AGM held on 7 September 2023.

PRINCIPAL RISKS AND UNCERTAINTIES

The Directors consider that the principal risks and

uncertainties faced by the Company for the remaining six months of

the financial year, which could have a material impact on

performance, remain consistent with those outlined in the Annual

Report for the year ended 30 April 2023. A detailed explanation of

the Company's principal risks and uncertainties, and how they are

managed through mitigation and controls, can be found on pages 62

to 65 of the Annual Report for the year ended 30 April 2023. The

Company has a risk management framework that provides a structured

process for identifying, assessing and managing the risks

associated with the Company's business.

We continue to consider the impact of the Russian war on Ukraine

as well as the effects of the Middle East crisis which has created

further market volatility. Geopolitical events such as these are

captured within the Company's risk map and will be periodically

assessed by the Board in light of how they may affect the Company's

portfolio and the economic and geopolitical environment in which

the Company operates.

The investment portfolio is diversified by geography which

mitigates risk but is focused on the technology sector and has a

high proportion of non-Sterling investments. Further detail on the

Company's performance and portfolio can be found in the Investment

Managers' Review.

RELATED PARTY TRANSACTIONS

In accordance with DTR 4.2.8R there have been no new related

party transactions during the six-month period to 31 October 2023

and therefore nothing to report on any material effect by such

transactions on the financial position or performance of the

Company during that period. There have therefore been no changes in

any related party transaction described in the last Annual Report

that could have a material effect on the financial position or

performance of the Company in the first six months of the current

financial year or to the date of this report.

GOING CONCERN

As detailed in the notes to the financial statements and in the

Annual Report for the year ended 30 April 2023, the Board

periodically monitors the financial position of the Company and has

considered for the six months ending 31 October 2023 a detailed

assessment of the Company's ability to meet its liabilities as they