RNS Number : 6298U

Renew Holdings PLC

16 May 2008

The following replaces the Renew Holdings plc announcement released today at 7am RNS 6056U. The announcement was released under the

wrong headline. All other details remain unchanged.

Renew Holdings plc

("Renew" or the "Group")

International Financial Reporting Standards

In prior years, Renew Holdings plc ("Renew" or "the Group") prepared its financial statements under UK Generally Accepted Accounting

Practice ("UK GAAP"). The Group has prepared for the adoption of International Financial Reporting Standards("IFRS"), following the adoption

of a European Union Regulation issued on 19 July 2002. The date of transition to IFRS for Renew was 1 October 2006 and from that date the

Group is required to prepare its consolidated financial statements in accordance with IFRS. Consequently the Group's first results to be

reported under IFRS will be the interim results for the period ended 31 March 2008 which will be issued on Tuesday 20 May 2008. These

interim results will include comparative results for the period ended 31 March 2007 and for the year ended 30 September 2007 which will be

restated to IFRS from UK GAAP.

Overview of impact

The effect of adoption of IFRS in respect of the Group's 2007 financial statements is set out in detail later in this announcement. The

following table summarises the impact of IFRS on key elements of the Group's results. There will be other differences principally in

disclosures of various financial information.

Reconciliation on transition to IFRS 30 Sept 31 March 01 Oct

2007 2007 2006

£000 £000 £000

Total equity under UK GAAP 10,145 6,977 5,316

Employee benefits (626) (500) (512)

Amortisation of goodwill 356 159 -

Amortisation of intangible asset (41) - -

Income taxes 175 154 154

Equity under IFRS 10,009 6,790 4,958

Profit under UK GAAP 7,098 3,077

Amortisation of goodwill 356 159

Amortisation of intangible asset (41) -

Employee benefits (114) 12

Income taxes 21 -

Profit under IFRS 7,320 3,248

The principal elements contributing to changes in the reported financial results and position for the year ended 30 September 2007 are:

* The recognition of holiday pay liabilities in respect of employee benefits and the related deferred tax liability.

* The recognition of certain intangible assets arising from the acquisition of Seymour (C.E.C.) Holdings Limited ("Seymour"), their

amortisation and the related deferred tax liability.

* The reduction in goodwill amortisation charges.

The measurement and presentation of the Group's financial performance and position is altered by the adoption of IFRS, however, there is

no change to cash flows of the Group. The Group's strategy is unaltered by the adoption of IFRS.

To explain how Renew's reported performance and financial position have been affected by these changes, information previously published

under UK GAAP has been restated under IFRS. This includes:

* Preliminary consolidated income statements for the period ended 31 March 2007 and for the year ended 30 September 2007.

* Preliminary consolidated statement of recognised income and expenditure for the period ended 31 March 2007 and for the year ended

30 September 2007.

* Preliminary consolidated balance sheets at 31 March 2007 and 30 September 2007.

* Preliminary consolidated cash flow statements for the period ended 31 March 2007 and for the year ended 30 September 2007.

* Preliminary statement of changes in equity at 31 March 2007 and 30 September 2007.

* Reconciliations of equity under UK GAAP to equity under IFRS at 1 October 2006, 31 March 2007 and 30 September 2007.

* Reconciliations of profit for the period ended 31 March 2007 and for the year ended 30 September 2007.

* Accounting policies adopted by Renew Holdings plc under IFRS.

Basis of preparation

The financial information presented in this document has been prepared in accordance with IFRS as adopted for use in the EU. The Group

has applied all accounting standards and interpretations issued by the International Accounting Standards Board ("IASB") and International

Financial Reporting Interpretations Committee ("IFRIC") relevant to its operations and expected to be effective for the date of the Group's

first IFRS financial statements (30 September 2008). These are set out in the basis of preparation in the accounting policies below and

include using estimates consistent with those made in the UK GAAP financial statements after adjustments to reflect differences in

accounting policies.

In conjunction with our auditors, KPMG Audit Plc, the Group has reviewed the accounting changes necessary to comply with IFRS. The

financial information and accounting policies related to the year ended 30 September 2007 contained in this Regulatory News Statement is

extracted from the preliminary financial statements for the year ended 30 September 2007 which have been audited. The financial information

relating to the period ended 31 March 2007 is unaudited.

Transitional arrangements

IFRS 1 "First-time Adoption of International Financial Reporting Standards" sets out the procedures that the Group must follow when it

adopts IFRS for the first time as the basis for preparing its consolidated financial statements. In general, the Group is required to

determine its IFRS accounting policies and apply these retrospectively to determine its opening balance sheet at the transition date under

IFRS. The standard allows a number of exceptions to this general principle to assist groups in the transition to reporting under IFRS. Where

Renew has taken advantage of these exemptions they are noted below.

Business Combinations that occurred before the opening IFRS balance sheet date (IFRS 3 "Business Combinations").

Renew has elected not to apply IFRS 3 retrospectively to business combinations that took place before the date of 1 October 2006. As a

result, all prior business combination accounting has been frozen at the transition date. This includes any goodwill that was previously

recognised as a deduction from equity.

Exchange differences arising on consolidation (IAS 21 "Foreign Currencies")

Renew has elected to deem the cumulative amount of exchange differences arising on consolidation of the net investments in subsidiaries

at 1 October 2006 to be zero.

Key impact analysis

The analysis below sets out the most significant adjustments arising from the transition to IFRS.

Presentation of financial statements

The format of the Group's primary financial statements has been presented in accordance with IAS 1 "Presentation of Financial

Statements".

Intangible assets and business combinations

IFRS 3 requires the separate identification and determination of the fair value of assets acquired in a business combination. Where such

intangible assets have a finite useful life, amortisation of the fair value is charged to the income statement over that useful life.

Intangible assets which have an indefinite life are not amortised but are reviewed annually for impairment. In respect of the acquisition of

Seymour, Renew has identified one of Seymour's contractual relationships with a customer as an intangible asset with a finite life and is

amortising that asset over its useful life of approximately four years. The goodwill arising on the Seymour acquisition is no longer

amortised.

Employee benefits

IAS 19 requires that a liability be recorded for any short term and long term employee benefits accrued. Renew operates holiday pay

arrangements for certain employees and an appropriate accrual has been recorded to reflect this liability.

Cash flow statement

Although there is no effect on the underlying cash receipts and expenditure of the Group, there are some presentational changes. The

format of the cash flow statement shows cash flows analysed between operating, investing and financing activities. Cash flows relating to

tax are classified within operating cash flows whereas under UK GAAP these items were classified separately from operating activities.

Board approval

The financial information related to the year ended 30 September 2007 and prepared in accordance with IFRS was approved by the Board on

15 May 2008.

Roy Harrison OBE

Chairman

15 May 2008

For further information contact:

Renew Holdings plc

John Samuel, Group Finance Director 0113 281 4200

College Hill

Mark Garraway 020 7457 2020

Adam Aljewicz 020 7457 2020

preliminary consolidated income statement Year 6 months ended

ended

30-Sep 31-Mar

2007 2007

£000 £000

Group revenue from continuing activities 348,149 172,971

Cost of sales (311,486) (153,654)

Gross profit 36,663 19,317

Administrative expenses (31,445) (17,075)

Operating profit 5,218 2,242

Finance income 2,199 895

Finance costs (768) (239)

Other finance income - IAS 19 pension 745 350

Profit before income tax 7,394 3,248

Income tax expense (74) -

Profit for the year attributable to equity holders 7,320 3,248

of the parent company

Basic earnings per share 12.22p 5.42p

Diluted earnings per share 11.99p 5.35p

Year 6 months ended

ended

30-Sep 31-Mar

2007 2007

preliminary consolidated statement of recognised £000 £000

income and expense

Profit for the year attributable to equity holders 7,320 3,248

of the parent company

Exchange movement in reserves (150) (96)

Movement in actuarial deficit (1,804) (890)

Movement on deferred tax relating to the defined 427 -

benefit pension scheme

Total recognised income and expense for the year 5,793 2,262

attributable to equity holders of the parent

company

preliminary consolidated balance sheet 30 Sept 31 March

2007 2007

£000 £000

Non-current assets

Intangible assets - goodwill 8,516 4,527

- other 868 -

Property, plant and equipment 5,188 3,513

Deferred tax assets 4,987 4,329

19,559 12,369

Current assets

Inventories 6,391 5,222

Trade and other receivables 85,319 72,989

Cash and cash equivalents 24,565 27,022

116,275 105,233

Total assets 135,834 117,602

Non-current liabilities

Obligations under finance leases (118) (202)

Retirement benefit obligations (3,559) (3,955)

Deferred tax liabilities (418) (90)

Provisions (1,172) (1,277)

(5,267) (5,524)

Current liabilities

Trade and other payables (116,954) (102,309)

Obligations under finance leases (429) (151)

Current tax liabilities (480) -

Borrowings (165) (298)

Provisions (2,530) (2,530)

(120,558) (105,288)

Total liabilities (125,825) (110,812)

Net assets 10,009 6,790

Share capital 5,990 5,990

Share premium account 5,893 5,893

Capital redemption reserve 3,896 3,896

Cumulative translation adjustment (150) (96)

Share based payments reserve 97 49

Retained earnings (5,717) (8,942)

Total equity 10,009 6,790

Approved by the Board and signed on its behalf by:

R Harrison OBE

Chairman

15 May 2008

preliminary consolidated cash flow statement Year ended 6 months ended

30-Sep 31-Mar

2007 2007

£000 £000

Profit for period 7,320 3,248

Amortisation of intangible assets 41 -

Depreciation 1,326 563

Profit on sale of property, plant & equipment (85) (37)

Decrease in inventories 11,909 12,966

(Increase)/decrease in receivables (1,766) 7,205

Increase/(decrease) in payables 6,360 (4,827)

Current service costs 79 48

Cash contribution to defined benefit scheme (1,534) (588)

Expense in respect of share options 97 49

Financial income (2,944) (1,245)

Financial expenses 768 239

Interest paid (768) (239)

Income taxes paid (107) -

Income tax expense 74 -

Net cash inflow from operating activities 20,770 17,382

Investing activities

Interest received 2,199 895

Proceeds on disposal of property, plant and 309 145

equipment

Purchases of property, plant and equipment (1,060) (365)

Acquisition of subsidiary net of cash acquired (5,932) -

Net cash (outflow)/inflow from investing activities (4,484) 675

Financing activities

Dividends paid (839) (479)

Repayments of obligations under finance leases (542) (319)

Repayment of development loans (9,795) (9,795)

Net cash outflow from financing activities (11,176) (10,593)

Net increase in cash and cash equivalents 5,110 7,464

Cash and cash equivalents at beginning of period 19,570 19,570

Effect of foreign exchange rate changes (280) (310)

Cash and cash equivalents at end of period 24,400 26,724

Bank balances and cash 24,565 27,022

Bank overdrafts (165) (298)

24,400 26,724

preliminary statement of changes in total equity Year ended 6 months ended

30 Sept 31 March

2007 2007

£000 £000

Profit for the period as previously reported under UK GAAP 7,098 3,077

Adjustments under IFRS 222 171

Profit for the period under IFRS 7,320 3,248

Dividends (839) (479)

6,481 2,769

Movement in share based payments reserve 97 49

Other recognised gains and losses for the period (1,527) (986)

Net movement in total equity 5,051 1,832

Opening total equity 4,958 4,958

Closing total equity 10,009 6,790

There are no changes to movements in total equity under IFRS as compared to UK GAAP other than

those resulting from changes to the profit for the period.

Explanatory note on adoption of IFRS for the year ended 30 September 2007

A1 Presentation of consolidated financial statements

The preliminary consolidated financial statements have been prepared in accordance with the International Financial Reporting Standards

(IFRS) as adopted for use in the EU expected to be applied as of the date of the Group's first IFRS statements and the basis of preparation

is set out below. The financial statements are presented in sterling since this is the currency in which the majority of the Group's

transactions are denominated.

A2 First-time adoption of international financial reporting and accounting standards

The Group has applied IFRS 1 "First Time Adoption of International Financial Reporting Standards" to provide a starting point for

reporting under IFRS. The date of transition to IFRS was 1 October 2006. The adoption of IFRS has resulted in the following transition

adjustments to the Group's accounting policies:

Intangible assets - goodwill

Under UK GAAP goodwill was amortised over its useful economic life. Under IFRS 3 "Business Combinations" goodwill is not amortised but

is carried at cost with impairment reviews being undertaken annually or when there is an indication that the carrying value has been

reduced. Under IFRS1 the Group has applied the change from the date of transition as opposed to full application to all business

combinations prior to that date. The goodwill in the balance sheet at the date of transition to IFRS was £4,527,000. The impact on the 2007

profit for the financial year is a reversal of the amortisation previously charged under UK GAAP of £356,000.

Intangible assets - other

IFRS 3 "Business Combinations" requires the measurement of intangible assets and their annual amortisation. The Group acquired

£909,000 in relation to contractual rights on the acquisition of Seymour, which are being amortised over 44 months giving rise to a charge

of £41,000 in 2007. Deferred tax has been provided on these intangible assets.

Employee benefits

IAS 19 "Employee Benefits" requires that liabilities for employee benefits should be recognised in the period in which services are

provided by the employee. This includes specific guidance on dealing with short-term employee benefits such as holiday pay for which there

is no equivalent under UK GAAP. Consequently the 2007 profit for the year is reduced by £114,000 being the increase in accrual to £626,000

from the opening position at 1 October 2006 of £512,000. Deferred tax has been provided on these employee benefits.

Explanatory note on adoption of IFRS for the year ended 30 September 2007 (continued)

IFRS 1 Transition exemptions

IFRS 1 provides certain exemptions which the Group has decided to utilise. Under IFRS 3 "Business Combinations", the Group has elected

not to apply the standard retrospectively to business combinations prior to the date of transition. Accordingly, the classification of such

business combinations remains unchanged from that under UK GAAP. Assets and liabilities are recognised at the date of transition if they

would be recognised under IFRS and are measured using their UK GAAP carrying amount immediately following acquisition as deemed cost under

IFRS, unless IFRS requires fair value measurement. IFRS 1 permits revaluations of property, plant and equipment which had been carried out

under UK GAAP to be treated as the deemed cost at the date of transition and the Group has applied this exemption.

Cumulative translation differences

The Group has taken advantage of the exemption whereby the cumulative translation differences are deemed to be zero at the date of

transition to IFRS.

Share based payments

The Group has applied IFRS 2 "Share based payment" from the date of transition to IFRS as at 1 October 2006. In preparing its opening

IFRS balance sheet, the Group has not adjusted amounts previously reported in financial statements prepared in accordance with its old basis

of accounting (UK GAAP).

An explanation of how the transition from UK GAAP to adopted IFRS has effected the Group's financial position, performance and cash flow

is set out below.

Key Results Comparison Year Ended Period Ended

30 Sept 31 March

2007 2007

Consolidated Income Statement £000 £000

Revenue - both IFRS and UK GAAP 348,149 172,971

Operating profit - IFRS 5,218 2,242

Operating profit - UK GAAP 5,017 2,071

Profit for the year - IFRS 7,320 3,248

Profit for the year - UK GAAP 7,098 3,077

Earnings per share - IFRS 12.22p 5.42p

Earnings per share - UK GAAP 11.85p 5.14p

Diluted earnings per share - IFRS 11.99p 5.35p

Diluted earnings per share - UK GAAP 11.63p 5.07p

Reconciliation on transition to IFRS 30 Sept 31 March 01 Oct

2007 2007 2006

£000 £000 £000

Total equity under UK GAAP 10,145 6,977 5,316

Employee benefits (626) (500) (512)

Amortisation of goodwill 356 159 -

Amortisation of intangible asset (41) - -

Income taxes 175 154 154

Equity under IFRS 10,009 6,790 4,958

Profit under UK GAAP 7,098 3,077

Amortisation of goodwill 356 159

Amortisation of intangible asset (41) -

Employee benefits (114) 12

Income taxes 21 -

Profit under IFRS 7,320 3,248

A3 Explanation of material adjustments to the cash flow statement for 2007

Interest paid of £768,000 during 2007 is classified as operating cash flow under IFRS, but was included in a separate category of

returns on investments and servicing of finance under previous GAAP.

Accounting policies

(i) Basis of accounting and preparation

The accounts have been prepared on the going concern basis and in accordance with applicable accounting standards under the historical

cost convention. The consolidated financial statements have been prepared in accordance with IFRS as adopted for use in the EU. The Group

has applied all accounting standards and interpretations issued by the International Accounting Standards Board ("IASB") and International

Financial Reporting Interpretations Committee ("IFRIC") relevant to its operations and expected to be effective for the date of the Group's

first IFRS financial statements. Certain accounting standards and interpretations had been issued but were not effective. These include IAS

23, IFRS 7, IFRS 8, IFRIC 10, IFRIC 11, IFRIC 12 and IFRIC 14. The Group does not consider that any of these standards will have a

significant impact on future financial statements although some will result in additional or different disclosures. The Group has elected

not to adopt any of these standards or interpretations early.

The adopted IFRS that will be effective (or available for early adoption) in the annual financial statements for the year ending 30

September 2008 are still subject to change and to additional interpretations and therefore cannot be determined with certainty. Accordingly,

the accounting policies for that annual period will be determined finally only when the annual financial statements are prepared for the

year ending 30 September 2008.

The Group has prepared the preliminary IFRS financial statements for the year to 30 September 2007 to establish the financial position,

results of operations and cash flows of the Group necessary to provide the comparative financial information expected to be included in the

Group's first set of IFRS financial statements for the year to 30 September 2008.

A summary of the more important Group accounting policies, which have been applied consistently, is set out below:

(ii) Basis of consolidation

The group accounts consolidate the accounts of the Company and its subsidiary undertakings.

The results and net assets of undertakings acquired are included in the consolidated income statement and balance sheet using the

acquisition method of accounting from the effective date of acquisition. The results of undertakings disposed of are included to the

effective date of disposal. Subsidiary undertakings have been consolidated using the acquisition method of accounting.

(iii) Revenue

Revenue, which excludes intra-group revenue and Value Added Tax, comprises:

- value of work executed during the year on construction contracts based on monthly valuations.

- sales of developments and land which are recorded upon legal completion.

Accounting policies (continued)

(iv) Construction contracts

Long-term contracts are stated at cost plus attributable profit after providing for anticipated future losses and contingencies.

Progress payments received are deducted from these amounts. Cost includes attributable overheads. Long-term contract work in progress is

recorded in revenue on a monthly basis as the contract proceeds and therefore is included in debtors as amounts recoverable on contracts. No

profit is recognised until the outcome of the contract can be foreseen with reasonable certainty.

Profit on contracts is calculated in accordance with accounting standards and industry practice. The principal estimation technique used

by the Group in attributing profit on contracts to a particular period is the preparation of forecasts on a contract-by-contract basis.

These focus on revenues and costs to complete and enable an assessment to be made of the final out-turn on each contract.

(v) Segment reporting

Segment reporting is based on two segment formats, of which the primary format is for business streams in accordance with the Group's

internal reporting structure and strategic plan. The secondary format is for geographical areas. Transactions between segments are conducted

on an arm's length basis. Segment results show the contribution directly attributable to each segment in arriving at the Group's operating

profit. Segment assets and liabilities comprise those assets and liabilities directly attributable to each segment. Group eliminations

represents such consolidation adjustments that are necessary to determine the Group's consolidated assets and liabilities.

(vi) Accounting estimates and judgments

The key assumptions concerning the future and other key sources of estimation uncertainty at the balance sheet date that have a

significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year relate to

the recognition of revenue and profit, the recoverability of amounts recoverable under contract, the estimation of provisions and the

valuation of the assets and liabilities of the defined benefit pension scheme.

(vii) Intangible assets

a) Goodwill arising on consolidation represents the excess of the cost of acquisition over the Group's interest in the fair value of the

identifiable assets, liabilities and contingent liabilities of a subsidiary, associate or jointly-controlled entity at the date of

acquisition. Goodwill is recognised as an asset and is tested for impairment annually, or on such other occasions that events or changes in

circumstances indicate that it might be impaired. On disposal of a subsidiary undertaking, the attributable amount of unamortised goodwill

which has not been subject to impairment is included in the determination of the profit or loss on disposal.

b) Other intangible assets are stated at cost less accumulated amortisation and impairment losses. The cost of intangible assets is

amortised over their expected useful lives, which is approximately four years.

Accounting policies (continued)

(viii) Property, plant and equipment

Property, plant and equipment are recorded at cost less provision for impairment if required. Depreciation is provided on all property,

plant and equipment, other than freehold land. Provision is made at rates calculated to write off the cost of each asset, less estimated

residual value, evenly over its expected useful life as follows:

* Group occupied property

* Freehold land - no depreciation charge

* Long leasehold land and buildings - shorter of fifty years and the remainder of the lease

* Plant and vehicles - three to ten years

* Office equipment - two to seven years

(ix) Impairments

Goodwill arising on acquisitions and other assets that have an indefinite useful life and are not subject to amortisation are reviewed

at least annually for impairment. Other intangible assets and property, plant and equipment are reviewed for impairment whenever there is

any indication that the carrying amount of the asset may not be recoverable. If the recoverable amount of any asset is less than its

carrying amount, a loss on impairment is recognised. Recoverable amount is the higher of the fair value of the asset less any costs which

would be incurred in selling the asset and its value in use. Value in use is assessed by discounting the estimated future cash flows that

the asset is expected to generate. For this purpose, assets are grouped into cash generating units which represent the lowest level for

which there are separately identifiable cash flows. Impairment losses in respect of goodwill are not reversed in future accounting periods.

Reversals of other impairment losses are recognised in income when they arise.

(x) Inventories

Inventories comprise developments and land held for development and raw materials and are stated at the lower of cost and net realisable

value. Cost includes appropriate attributable overheads and excludes interest. Where necessary, provision is made for obsolete, slow moving

and defective inventories.

(xi) Trade receivables

Trade receivables do not carry any interest and are stated at their nominal value as reduced by appropriate allowances for estimated

irrecoverable amounts.

(xii) Trade payables

Trade payables on normal terms are not interest bearing and are stated at their nominal value.

Accounting policies (continued)

(xiii) Cash and cash equivalents

Cash and cash equivalents in the cash flow statement comprise cash at bank and in hand, including bank deposits with original

maturities of less than three months, net of bank overdrafts. Bank overdrafts are included within financial liabilities within current

liabilities in the balance sheet.

(xiv) Provisions

Provisions are recognised when the Group has a present legal or constructive obligation as a result of a past event and where it is

probable that an outflow will be required to settle that obligation and where the amount can be reliably estimated.

(xv) Leasing commitments

Assets held under finance leases, where substantially all the benefits and risks of ownership of an asset have been transferred to the

Group, are capitalised and are depreciated in accordance with the depreciation policy for the relevant class of asset or the remaining lease

term if shorter. The interest element of the rental obligation is charged to the income statement and represents a constant proportion of

the balance of capital repayments outstanding. Rentals under operating leases are charged to the income statement on a straight-line basis

over the term of the lease.

(xvi) Defined benefit pension scheme

The Group has adopted the requirements of IAS 19 "Employee Benefits". The pension scheme assets are measured using market values.

Pension scheme liabilities are measured using the projected unit actuarial method and are discounted at the current rate of return on a high

quality corporate bond of equivalent term and currency to the liability. Any increase in the present value of liabilities within the Group's

defined benefit scheme expected to arise from employee service in the period is charged to operating profit. The expected return on the

scheme's assets and the increase during the period in the present value of the scheme's liabilities arising from the

passage of time are included in other finance income. Actuarial gains and losses are recognised in the consolidated statement of

recognised income and expense. Pension scheme surpluses, to the extent they are considered recoverable (under the guidance of IAS 19), or

deficits are recognised in full and presented on the face of the balance sheet.

(xvii) Defined contribution pension scheme

Contributions to the defined contribution scheme are charged to the income statement as incurred.

Accounting policies (continued)

(xviii) Taxation

The tax charge is composed of current tax and deferred tax, calculated using tax rates that have been enacted or substantively enacted

by the balance sheet date. Current tax and deferred tax are charged or credited to the income statement, except when they relate to items

charged or credited directly to equity, in which case the relevant tax is also dealt with in equity. Current tax is based on the profit for

the year. Deferred tax is provided in full, using the liability method, on temporary differences arising between the tax bases of assets and

liabilities and their carrying amounts in the financial statements. Deferred tax on such assets and liabilities is not recognised if the

temporary difference arises from the initial recognition (other than in a business combination) of other assets and liabilities in a

transaction that affects neither the taxable profit nor the accounting profit.

Deferred tax assets are recognised to the extent that it is probable that future taxable profit will be available against which the

temporary differences can be utilised. The carrying amount of deferred tax assets is reviewed at each balance sheet date. Deferred tax is

provided on temporary differences arising on investments in subsidiary undertakings, except where the timing of the reversal of the

temporary difference can be controlled and it is probable that that the temporary difference will not reverse in the foreseeable future.

Deferred tax assets and liabilities are offset when they relate to income taxes levied by the same taxation authority and the Group intends

to settle its current assets and liabilities on a net basis.

(xix) Foreign currencies

Transactions in foreign currencies are recorded at the rate ruling at the date of the transaction or at the contracted rate if the

transaction is covered by a forward exchange contract. Monetary assets and liabilities denominated in foreign currencies are retranslated at

the rate of exchange ruling at the balance sheet date or, if appropriate, at the forward contract rate. The accounts of overseas subsidiary

undertakings are translated at the rate of exchange ruling at the balance sheet date. The exchange difference arising on the retranslation

of the opening net assets is taken directly to reserves. All other exchange differences are taken to the income statement.

Accounting policies (continued)

(xx) Financial instruments

Financial assets are divided into the following categories: trade receivables, financial assets at fair value and financial assets which

are available for sale. The Board assigns financial assets to each category on initial recognition dependant on the purpose for which the

asset was acquired. The categorisation of these assets is reconsidered at each reporting date at which a choice of categorisation or

accounting treatment is available.

All financial assets are recognised whenever the Group becomes party to the contractual provisions of the financial instrument. All such

assets are initially recognised at fair value. Derecognition of such assets occurs when the Group's right to receive cash flows from the

asset ceases or the rights and rewards of ownership have been transferred. All such assets are reviewed for impairment at least annually.

Interest and other cash flows which arise from holding a financial asset is recognised in the income statement in accordance with IAS39.

Financial assets at fair value include assets classified as held for trading, and changes in fair value are recognised through the

income statement. Trade receivables are non-derivative financial assets with expected receipts which are not quoted in an active market and

they arise when the Group provides goods or services. Any change in their fair value is recognised through the income statement. Provision

against trade receivables is made when evidence arises that the Group is not likely to receive the fair value of the amounts due to it. The

amount of any write down is determined as the difference between the asset's carrying amount and the present value of estimated cash flows

arising from the asset.

Financial liabilities are recognised when the Group becomes a party to the contractual provisions of the financial instrument. All

interest related charges are recognised as an expense in the income statement. Bank loans and hire purchase liabilities are entered into to

provide financing for the Group's operations and are recognised as funds are received. Financial liabilities are measured at amortised

cost.

(xxi) Share based payments

IFRS 2 Share Based Payment requires a fair value to be established for any equity settled share based payments. Fair value has been

independently measured using a Black Scholes valuation model. The fair value determined at the grant date of the equity settled share based

payments is expensed on a straight-line basis over the vesting period based on the Group's estimate of shares that will eventually vest.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGUUCUAUPRUBQ

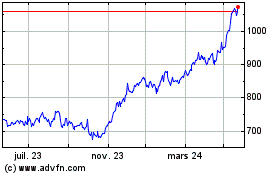

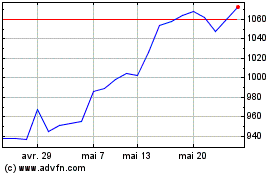

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024