RNS Number : 8205U

Renew Holdings PLC

20 May 2008

Renew Holdings plc

("Renew" or the "Group")

Interim results for the half year ended 31 March 2008

Renew, the specialist construction services business, announces strong interim results, with operating profits up 38% and a 66% increase

in the interim dividend.

Financial Highlights

(Nb results reported under International Financial Reporting Standards ('IFRS'))

H1 2008 H1 2007

Revenue £192.9m £173.0m +11%

Operating profit £3.1m £2.2m +38%

Profit before tax £3.9m £3.2m +21%

Earnings per share* 5.61p 5.42p +4%

Dividend per share 1.0p 0.6p +66%

(* impacted by return to taxation @ 14.5% during period)

Operational Highlights

· Growth in revenue and operating profit in both main business streams

o Specialist Building operating profit up 38%

o Specialist Engineering operating profit up 30%

· Strategic focus reflected in order book

o 80% of orders from specialist sectors and 67% repeat business

o Forward order book remains strong at £247.7m, up 8%

· Nuclear MDSW framework delivered 50% increase over expected revenues

· New land remediation frameworks with North West Development Agency and Lancashire County Council

· Northumbrian Water framework extended to 2011

· Social Housing framework order pipeline in excess of £100m

· Net cash balance £25.7m

Roy Harrison OBE, Chairman, commented:

"Renew continues to report improving profits resulting from our strategy to provide specialist construction services to selected robust

sectors. The Group is strongly positioned with substantial cash resources to react quickly to market opportunities as they arise."

20 May 2008

Enquiries:

Renew Holdings plc Tel: 0113 281 4200

Brian May, Chief Executive

John Samuel, Group Finance Director

College Hill Tel: 020 7457 2020

Mark Garraway

Adam Aljewicz

CHAIRMAN'S STATEMENT

The first half of the year produced strong results in line with both internal and market expectations. The results also illustrate the

quality and sustainability of earnings with over two-thirds of orders coming in the form of repeat business in our specialist sectors and

under negotiated forms of contract.

Group revenue for the six months ended 31 March 2008 was £192.9m (2007: £173.0m), an 11% increase over the corresponding period last

year. Profit before tax for the period was up 21% to £3.9m (2007: £3.2m).

The Group expects to incur a tax charge for the year ending 30 September 2008 and the applicable rate has been estimated at 14.5%. As a

result of the tax charge, the growth in earnings per share was restricted to 4% but nevertheless improved to 5.61p (2007: 5.42p).

The Group's net cash position stood at £25.7m, an increase of £1.3m compared to 30 September 2007. This strong, ungeared position

enables the Group to take advantage of opportunities quickly as they arise in an economic environment which may become more challenging.

In accordance with the Group's progressive policy, an interim dividend of 1.0p per share (2007: 0.6p) is being declared. This is an

increase of 66% and reflects the Board's confidence of delivering further progress in the remainder of the year. The dividend will be paid

on 7 July 2008 to shareholders on the register as at 6 June 2008.

Our declared strategy of focusing on two distinct business streams, Specialist Engineering and Specialist Building, is allowing us to

secure sustainable and higher margin work with customers who are increasingly looking to develop longer-term relationships.

Our specialist sectors are demonstrating resilience in the current economic environment. Our order book remains strong and we are

continuing to secure good quality opportunities to tender and negotiate. The Board believes that this will enable the Group to deliver

further progress in the second half of the year.

Roy Harrison OBE

Chairman

20 May 2008

CHIEF EXECUTIVE'S REVIEW

OVERVIEW

Our strategy of seeking growth in Specialist Engineering whilst maintaining target margins combined with increasing margins in

Specialist Building continues to provide increasing profits for the Group.

In Specialist Engineering, revenue increased by 32%, reflecting the acquisition of Seymour. Operating profit has grown by 30% to £2.2m

and margins have been maintained within our target range at 4.6%.

We saw continued margin improvement in Specialist Building, up from 1.3% to 1.5% alongside a 16% increase in revenue. Operating profit

increased by 38% to £2.1m.

Our order book remains strong at £247.7m (2007: £228.7m) with 80% being in our specialist sectors, 70% of orders negotiated and 67% in

the form of repeat business. These key performance indicators remain ahead of our targets of 66% in each case.

Part of the strategy of developing our Specialist Engineering activities is to consider complementary acquisitions. The Group continues

to look at a number of potential opportunities but is mindful of only making acquisitions that meet our demanding criteria. We have a proven

acquisition and integration track record following the PPS Electrical and Seymour transactions in the last two financial years. Both these

businesses have reported improved performance in revenue and margin since acquisition.

For the first time, the Group is reporting its results under International Financial Reporting Standards ('IFRS').

Review of operations

Specialist Engineering

Nuclear:

Shepley Engineers continues to be the largest mechanical and electrical contractor at Sellafield operating in the fields of asset

support and decommissioning, with the majority of work carried out under three framework agreements. We have just completed the first year

of a two year Multi Disciplined Site Wide framework, from which revenues were 50% above forecast levels. Discussions have commenced

regarding a two year extension to this framework.

Land Remediation:

VHE Construction was awarded five projects during the period including the Diesel Depot remediation project in Bristol for the South

West of England Regional Development Agency. VHE has also been appointed to frameworks with the North West Development Agency and Lancashire

County Council in addition to our longstanding framework with National Grid. In December 2007, VHE opened an office in Northern Ireland to

access the growing number of opportunities there.

Water:

The Seymour acquisition has been fully integrated into the Group and is performing in line with our expectations. The Northumbrian Water

framework has recently been extended until 2011. This framework will provide a reliable earnings stream over the next three years and is a

good example of our strategic goal of winning repeat business with blue chip clients. The Shiremoor Flood Alleviation project, which was

awarded under this framework, secured three awards at the Constructing Excellence Awards for innovation, integration and collaborative

working. In addition to a number of flood alleviation schemes secured during the period, Seymour was also awarded a coastal protection

contract at Whitby Marina.

Specialist Building

Social Housing:

We currently have six framework agreements in place, all with leading Housing Associations in the South East of England for the delivery

of their new build programmes. We successfully completed six projects during the period and also commenced work on five new enabling

projects which we expect to lead to confirmed orders over the next three months. The pipeline of future projects with our existing framework

partners remains in excess of £100m.

Retail:

Britannia Construction's first project with Marks & Spencer is nearing completion. Tesco continues to provide opportunities with a new

store at Aston, Birmingham recently completed and another at Cullompton, Devon under construction. Allenbuild is constructing a £25m

negotiated hotel and mixed retail development at Southport which includes the refurbishment of the adjacent Floral Hall Theatre.

Science and Education:

Allenbuild was awarded its first project under a new framework with Wigan Council and also secured three further school projects

including the contract for the Kingfisher School, Solihull. This is the eighth year of our DEFRA framework at Weybridge where Walter Lilly

has received a further award of a new building which has a major emphasis on environmental specifications. Allenbuild has also secured the

contract to construct the Yorkshire Environmental Energy Technology Centre near Sheffield, which is aiming to have the lowest carbon

footprint of any building in the UK.

Restoration and Refurbishment:

The high-end residential sector in London has been extremely busy during the period with Walter Lilly securing six awards. The largest

of these was a prestigious £37m scheme in Grosvenor Crescent. This project is to refurbish and convert several listed buildings into high

quality residential apartments and includes substantial temporary engineering works to form an underground stacking car park. We also

continue to be awarded further projects from our Grosvenor Estates framework.

Summary

We are continuing to make progress on the implementation of our strategy. Our operating businesses are recognised for their excellent

skills and experience across our chosen specialist sectors and are seen as long-term partners by our customers. Our specialist markets

remain robust within the broader context of the current economic environment. Through our high level of negotiated work, we are managing

risk effectively and securing a higher quality of earnings. This strategy has enabled us to improve Group operating margins to 1.6% from

1.3% a year ago, indicating further progress towards our objective of an operating profit margin of at least 2.5% by 2010.

Brian May

Chief Executive

20 May 2008

Group Income Statement Notes Six months ended Year ended

for the six months ended 31 March 31 March 30 September

2008

2008 2007 2007

Unaudited Unaudited Audited

£000 £000 £000

Group revenue from continuing 2 192,850 172,971 348,149

activities

Cost of sales (170,142) (153,654) (311,486)

Gross profit 22,708 19,317 36,663

Administrative expenses (19,622) (17,075) (31,445)

Operating profit 2 3,086 2,242 5,218

Finance income 800 895 2,199

Finance costs (207) (239) (768)

Other finance income - IAS 19 250 350 745

pension

Profit before income tax 2 3,929 3,248 7,394

Income tax expense 3 (569) - (74)

Profit for the period attributable 3,360 3,248 7,320

to equity holders of the parent

company

Basic earnings per share 4 5.61p 5.42p 12.22p

Diluted earnings per share 4 5.47p 5.35p 11.99p

Proposed dividend 5 1.00p 0.60p 1.20p

Group Statement of Recognised Income Year ended

and Expense

for the six months ended 31 March 2008 Six months ended 30 September

2008 2007 2007

Unaudited Unaudited Audited

£000 £000 £000

Profit for the period attributable to 3,360 3,248 7,320

equity holders of the parent company

Exchange movements in reserves 20 (96) (150)

Movements in actuarial deficit (857) (890) (1,804)

Movement on deferred tax relating to - - 427

the defined pension scheme

Total recognised income and expense 2,523 2,262 5,793

Group Balance Sheet

at 31 March 2008

Notes 31 March 30 September

2008 2007 2007

Unaudited Unaudited Audited

£000 £000 £000

Non-current assets

Intangible assets: goodwill 8,516 4,527 8,516

Intangible assets: other 744 - 868

Property, plant and equipment 5,035 3,513 5,188

Deferred tax assets 4,987 4,329 4,987

19,282 12,369 19,559

Current assets

Inventories 8,499 5,222 6,391

Trade and other receivables 94,149 72,989 85,319

Cash and cash equivalents 25,817 27,022 24,565

128,465 105,233 116,275

Total assets 147,747 117,602 135,834

Non-current liabilities

Obligations under finance leases (59) (202) (118)

Retirement benefit obligations (3,559) (3,955) (3,559)

Deferred tax liabilities (418) (90) (418)

Provisions (1,172) (1,277) (1,172)

(5,208) (5,524) (5,267)

Current liabilities

Trade and other payables (126,751) (102,309) (116,954)

Obligations under finance leases (243) (151) (429)

Current tax liabilities (1,049) - (480)

Borrowings (85) (298) (165)

Provisions (2,530) (2,530) (2,530)

(130,658) (105,288) (120,558)

Total liabilities (135,866) (110,812) (125,825)

Net assets 11,881 6,790 10,009

Share capital 5,990 5,990 5,990

Share premium account 5,893 5,893 5,893

Capital redemption reserve 3,896 3,896 3,896

Cumulative translation adjustment (130) (96) (150)

Share based payments reserve 6 165 49 97

Profit and loss account (3,933) (8,942) (5,717)

Total equity 7 11,881 6,790 10,009

Group Cash Flow Statement

for the six months ended 31 March 2008

Six months ended Year ended

31 March 30

September

2008 2007 2007

Unaudited Unaudited Audited

£000 £000 £000

Profit for the period 3,360 3,248 7,320

Amortisation of intangible assets 124 - 41

Depreciation 834 563 1,326

Profit on sale of property, plant and (94) (37) (85)

equipment

(Increase)/decrease in inventories (2,015) 12,966 11,909

(Increase)/decrease in receivables (8,806) 7,205 (1,766)

Increase/(decrease) in payables 9,891 (4,827) 6,360

Current service costs 36 48 79

Cash contribution to defined benefit scheme (893) (588) (1,534)

Expense in respect of share options 68 49 97

Finance income (1,050) (1,245) (2,944)

Finance costs 207 239 768

Interest paid (207) (239) (768)

Income taxes paid - - (107)

Income tax expense 569 - 74

Net cash inflow from operating activities 2,024 17,382 20,770

Investing activities

Interest received 800 895 2,199

Proceeds on disposal of property, plant and 194 145 309

equipment

Purchases of property, plant and equipment (781) (365) (1,060)

Acquisition of subsidiary net of cash - - (5,932)

acquired

Net cash inflow/(outflow) from investing 213 675 (4,484)

activities

Financing activities

Dividends paid (719) (479) (839)

Repayment of obligations under finance (245) (319) (542)

leases

Repayment of development loans - (9,795) (9,795)

Net cash outflow from financing activities (964) (10,593) (11,176)

Net increase in cash and cash equivalents 1,273 7,464 5,110

Cash and cash equivalents at the beginning 24,400 19,570 19,570

of the period

Effect of foreign exchange rate changes 59 (310) (280)

Cash and cash equivalents at the end of the 25,732 26,724 24,400

period

Bank balances and cash 25,817 27,022 24,565

Bank overdrafts (85) (298) (165)

25,732 26,724 24,400

NOTES TO THE ACCOUNTS

Note 1 Accounting policies

Explanatory note on adoption of IFRS for the 6 months ended 31 March 2008

A1 Presentation of consolidated financial statements

The consolidated financial statements have been prepared in accordance with the International Financial Reporting Standards (IFRS) as

adopted for use in the EU. The Group has applied all accounting standards and interpretations issued by the IASB and International Financial

Reporting Interpretations Committee relevant to its operations and expected to be effective for the date of the Group's first IFRS financial

statements. In accordance with IFRS 1, estimates consistent with those made in the UK GAAP financial statements for the year ended 30

September 2007 have been used.

The financial statements are presented in sterling since this is the currency in which the majority of the Group's transactions are

denominated.

A2 First time adoption of international financial reporting and accounting standards

The Group has applied IFRS 1 "First time adoption of International Financial Reporting Standards" to provide a starting point for

reporting under IFRS. The date of transition to IFRS was 1 October 2006 and all comparative information in these financial statements has

been restated to reflect the Group's adoption of IFRS.

The adoption of IFRS has resulted in the following transition adjustments to the Group's accounting policies:

Goodwill

Under UK GAAP goodwill was amortised over its useful economic life. Under IFRS 3 "Business Combinations" goodwill is not amortised but

is carried at cost with impairment reviews being undertaken annually or when there is an indication that the carrying value has been

reduced. Under IFRS 1 the Group has applied the change from the date of transition as opposed to full application to all business

combinations prior to that date. The goodwill in the balance sheet at the date of transition to IFRS was £4,527,000. The impact on the 2007

profit for the financial year is a reversal of the amortisation previously charged under UK GAAP of £356,000.

Intangible assets

IFRS 3 "Business Combinations" requires the measurement of intangible assets and their annual amortisation. The Group acquired £909,000

in relation to contractual rights on the acquisition of Seymour, which are being amortised over 44 months giving rise to a charge of

£41,000 in 2007. Deferred tax has been provided on these intangible assets.

Employee benefits

IAS 19 "Employee Benefits" requires that liabilities for employee benefits should be recognised in the period in which services are

provided by the employee. This includes specific guidance on dealing with short-term employee benefits such as holiday pay for which there

is no equivalent under UK GAAP. Consequently the 2007 profit for the year is reduced by £114,000 being the increase in accrual to £626,000

from the opening position at 1 October 2006 of £512,000. Deferred tax has been provided on these employee benefits.

IFRS 1 Transition exemptions

IFRS 1 provides certain exemptions which the Group has decided to utilise. Under IFRS 3 "Business Combinations", the Group has elected

not to apply the standard retrospectively to business combinations prior to the date of transition. Accordingly, the classification of such

business combinations remains unchanged from that under UK GAAP. Assets and liabilities are recognised at the date of transition if they

would be recognised under IFRS and are measured using their UK GAAP carrying amount immediately following acquisition as deemed cost under

IFRS, unless IFRS requires fair value measurement.

IFRS 1 permits revaluations of property, plant and equipment which had been carried out under UK GAAP to be treated as the deemed cost

at the date of transition and the Group has applied this exemption.

Cumulative translation differences

The Group has taken advantage of the exemption whereby the cumulative translation differences are deemed to be zero at the date of

transition to IFRS.

Share based payments

The Group has applied IFRS 2 "Share based payment" from the date of transition to IFRS as at 1 October 2006.

In preparing its opening IFRS balance sheet, the Group has adjusted amounts previously reported in financial statements prepared in

accordance with its old basis of accounting (UK GAAP). An explanation of how the transition from UK GAAP to adopted IFRS has affected the

Group's financial position, performance and cash flow is set out below.

Reconciliation on transition to IFRS

1 October 30 September

2006 2007

£000 £000

Total equity as presented under UK GAAP 5,316 10,145

Employee benefits (512) (626)

Amortisation of goodwill - 356

Amortisation of intangible asset - (41)

Deferred tax 154 175

Equity as presented under IFRS 4,958 10,009

30 September

2007

£000

Profit as presented under UK GAAP 7,098

Amortisation of goodwill 356

Amortisation of intangible asset (41)

Employee benefits (114)

Income taxes 21

Profit as presented under IFRS 7,320

A3 Explanation of material adjustments to the cash flow statement for 2007

Interest paid of £768,000 during 2007 is classified as operating cash flow under IFRS, but was included in a separate category of

returns on investments and servicing of finance under previous GAAP.

Note 2 Segmental analysis

For management purposes the Group is organised into three business streams: Building, Engineering, and Property and central activities.

These operating segments are the basis on which the Group reports its primary segmental information.

Segmental information about the Group's continuing operations is presented below:

Six months ended Six months ended Year ended

31 March 31 March 30 September

2008 2007 2007

Unaudited Unaudited Audited

Revenue is analysed as £000 £000 £000

follows:

Building 142,886 122,910 265,668

Engineering 47,231 35,795 68,777

Inter divisional revenue (2,941) (2,943) (3,265)

Property and central 5,674 17,209 16,969

activities

Group revenue from continuing 192,850 172,971 348,149

operations

Analysis of operating profit

Building 2,137 1,554 3,652

Engineering 2,176 1,678 3,294

Property and central (1,227) (990) (1,728)

activities

Operating profit 3,086 2,242 5,218

Net finance income 843 1,006 2,176

Profit before income tax 3,929 3,248 7,394

Note 3 Income tax expense

Six months ended Year ended

31 March 31 March 30 September

2008 2007 2007

Unaudited Unaudited Audited

£000 £000 £000

Current tax:

UK corporation tax on profits for the (569) - (291)

period

Foreign tax - - (107)

Total current tax (569) - (398)

Deferred tax - - 324

Income tax expense (569) - (74)

The Group has unused tax losses available to carry forward against future taxable profits, although a significant element of these

losses relates to activities which are not forecast to generate the level of profits needed to utilise these losses. A related deferred tax

asset of £3,990,000 has been recognised to the extent considered reasonable by the directors.

Note 4 Earnings per share

Six months ended Six months ended Year ended

31 March 2008 31 March 2007 30 September 2007

Weighted Weighted Weighted

average average average

number number number

Earnings of shares EPS Earnings of shares EPS Earnings of shares EPS

£000 '000 Pence £000 '000 Pence £000 '000 Pence

Basic earnings 3,360 59,899 5.61 3,248 59,899 5.42 7,320 59,899 12.22

per share

Dilutive effect - 1,493 (0.14) - 765 (0.07) - 1,154 (0.23)

of share options

Diluted earnings 3,360 61,392 5.47 3,248 60,664 5.35 7,320 61,053 11.99

per share

Note 5 Dividends

The proposed interim dividend is 1.0p per share (2007 0.6p). This will be paid out of the Company's available distributable reserves to

shareholders on the register on 6 June 2008, payable on 7 July 2008. In accordance with IAS 1, dividends are recorded only when paid and are

shown as a movement in equity rather than as a charge in the income statement.

Note 6 Share based payments reserve

IFRS 2 "Share based payment" requires a fair value to be established for any equity settled share based payments. Fair value has been

independently measured using a Black-Scholes valuation model. The fair value determined at the grant date of the equity settled share based

payments is expensed on a straight-line basis over the vesting period, based on the Group's estimate of shares that will eventually vest. In

total 1,702,156 share options are in issue with a vesting period of 3 years. 417,960 of these options were issued during the period and

£68,000 has been charged to administrative expenses. There is no impact on total equity since an equivalent amount is credited to the share

based payments reserve.

Note 7 Reconciliation of movements in total equity

Six months ended Year ended

31 March 31 March 30 September

2008 2007 2007

Unaudited Unaudited Audited

£000 £000 £000

Profit for the period 3,360 3,248 7,320

Dividends (719) (479) (839)

2,641 2,769 6,481

Movement in share based payments reserve 68 49 97

Other recognised gains and losses for the (837) (986) (1,527)

period [net]

Net movement on total equity 1,872 1,832 5,051

Opening total equity 10,009 4,958 4,958

Closing total equity 11,881 6,790 10,009

Note 8 Basis of preparation

(a) The accounts for the six months ended 31 March 2008 and the equivalent period in 2007 have not been audited or reviewed by the

Company's auditors. They have been prepared on a going concern basis in accordance with IFRS as set out in Note 1. The interim report was

approved by the Directors on 20 May 2008.

(b) The accounts for the year ended 30 September 2007 were prepared under UK GAAP and the auditors issued an unqualified opinion on

them. They did not contain a statement under S237(2) of the Companies Act 1985 and were delivered to the Registrar of Companies. The

comparative figures for the year ended 30 September 2007 have been audited as part of the conversion to IFRS. The comparative figures for

the period ended 31 March 2007 are unaudited.

(c) The Directors are satisfied that the Group has adequate resources to continue in operational existence for the foreseeable future.

This interim statement is being sent to all shareholders and is also available upon request from the Company Secretary, Renew Holdings

plc, Yew Trees, Main Street North, Aberford, West Yorkshire LS25 3AA, or via the website www.renewholdings.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SFFFMUSASEII

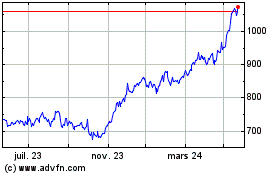

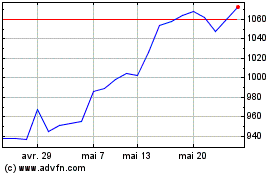

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024