TIDMSOHO

RNS Number : 6335L

Triple Point Social Housing REIT

07 September 2023

7 September 2023

Triple Point Social Housing REIT plc

(the "Company" or, together with its subsidiaries, the

"Group")

RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

The Board of Triple Point Social Housing REIT plc (ticker: SOHO)

is pleased to announce its unaudited results for the six months

ended 30 June 20 23 .

Chris Phillips, Chair of Triple Point Social Housing REIT plc,

commented:

"The Company has continued to demonstrate strong rental growth

and valuation resilience during the first half of 2023, despite the

uncertain macro-economic backdrop. We were pleased to announce the

recent portfolio sale of properties principally in line with book

value, demonstrating continued liquidity and the resilience of

valuations in the sector.

The Investment Grade rating of our long-term fully fixed priced

debt was reaffirmed last month and our focus remains on the

operating performance of our portfolio. Our proactive approach to

asset management, paired with the inflation protection offered

through our rental income, and the growing demand for specialised

supported housing, means that we are well positioned to ensure the

sustainability of our investments over the long-term."

Six months Six months Year ended

to 30 June to 30 June 31 December

20 23 20 22 2022

Portfolio value

* IFRS basis GBP675.1m GBP 669.6 GBP6 69.1

m m

EPRA Net Tangible Assets ("NTA")

per share

(equal to IFRS NAV per share

) 111.31p 111.80 p 10 9.06 p

EPRA Net Initial Yield (NIY) 5.65% 5.28% 5.46%

Loan to Value 37.5% 36.8% 37.4%

Earnings per share (basic and

diluted) 3.65p 6.19 p 6.18 p

* IFRS basis 2.18p 2.43p 4 .78 p

2.21p 2.57p 5.03p

* EPRA basis

* Adjusted earnings

Total annualised rental income GBP40.5m GBP 37.4 GBP 39.0

m m

Weighted average unexpired 24.8 yrs 25.9 yrs 2 5.3 yrs

lease term

Dividend per share 2.73p 2.73 p 5.46 p

Financial highlights

-- EPRA NTA per share up 2. 1 % to 111.31 pence at 30 June 2023

(31 December 2022: 109.06 pence) , reflecting an increase in the

value of the Group's property portfolio and the accretive impact of

the GBP5 million share buyback programme over the period.

-- Portfolio valued as at 30 June 2023 at GBP675.1 million on an

IFRS basis , up from GBP669.1 million as at 31 December 2022 and

reflecting a valuation uplift of 12. 2 % against total invested

funds of GBP 601.9 million (1) . The positive impact of strong

rental growth on valuations was part i ally offset by an outward

movement in yields reflecting wider market conditions.

-- The fair value gain on investment properties for the six

months ended 30 June 2023 amounted to GBP5.9 million (30 June 2022:

GBP17.1 million). Net profit for the six months ended 30 June 2023

was GBP14.6 million (30 June 2022: GBP24.9 million). The reduction

relative to the comparable period in 2022 was principally

reflective of the impact of a lower fair value gain on investment

properties being recognised during the period. The Expected Credit

Loss adjustment made (relating to unpaid rent) also had a negative

impact on net profit.

-- The portfolio's total annualised contracted rental income was

GBP40.5 million as at 30 June 2023 (31 December 2022: GBP39.0

million). IFRS Gross Revenue for the period was GBP19.6 million

(GBP18.2 million for the six months ended 30 June 2022).

-- 100% of contracted rental income was either CPI ( 92.4 %) or

RPI ( 7.6 %) linked. 4.9% of the Group's leases are capped

(excluding the temporary rent cap of 7% applied to the Group's rent

increases for the year of 2023) .

-- Ongoing Charges Ratio of 1.63% as at 30 June 2023 (31

December 2022: 1.60%; 30 June 2022: 1.57%), with the marginal

increase primarily due the impact of inflation on the Group's cost

base .

-- A ll drawn debt is fixed (weighted average coupon of 2.74%)

and long-term (10.1 years), which continues to offer strong

protection against increasing interest rates.

-- Maintained an Investment Grade Issuer Default Rating from

Fitch of 'A-' (Stable Outlook) with a senior secured rating of

'A'.

Successful portfolio sale demonstrating the value of the Group's

assets and dividend in line with target

-- Portfolio of four properties sold for GBP7.6 million, in line

with book value of GBP7.9 million and representing an increase of

GBP0.7 million (9.6%) compared to the aggregate purchase price paid

by the Group for the properties.

-- The dividend to be paid on 30 September 2023 brings the total

dividend per share paid or declared by the Company in respect of

the six month period to 30 June 2023 to 2.73 pence per share, in

line with the Company's stated target for the year to 31 December

2023 of 5.46 pence per share. (2)

-- Dividend cover on an adjusted earnings basis at 30 June 2023

was 0.81x (31 December 2022: 0.92x). If an adjustment is made for

the portion of the Expected Credit Loss recognised in the six

months ended 30 June 2023 that relates to unpaid rent due in 2022,

dividend cover for the six months ended 30 June 2023 was 0.90x.

Operational highlights

-- 88.1% of rent due was collected during the period, and 25 out

of the Group's 27 lessees recorded no material rent arrears. Post

the period end, the Investment Manager has made progress in respect

of both Approved Providers which have material rent arrears.

o There is now a creditor agreement in place with Parasol in

respect of future rental payments.

o Similarly, a creditor agreement is being negotiated with My

Space in respect of future rental payments together with a payment

plan for arrears . Simultaneoulsy a transfer of properties to

alternative Registered Providers is being considered.

-- EPRA blended NIY of 5.65% based on the value of the portfolio

on an IFRS basis as at 30 June 2023 , against the portfolio's

blended net initial yield on purchase of 5.91%, equating to yield

compression of 26bps .

-- Diversified portfolio of 497 properties (3) :

o 11 regions

o 15 3 local authorities

o 39 4 leases

o 27 Approved Providers

o 123 care providers

-- As at 30 June 2023, the weighted average unexpired lease term (" WAULT ") was 24.8 years.

-- Agreed a new lease clause , with support from stakeholders,

which seeks to address general risks raised by the Regulator of

Social Housing in relation to long leases, to be implemented in the

Group's existing Registered Provider leases in the second half of

2023 .

-- Commenced the pilot phase of an energy efficiency improvement

initiative which entails upgrading all of the Group's properties to

an Energy Performance Certificate ("EPC") rating of C or above.

Over 70% of the Group's properties already meet this standard

(compared to a social housing sector average of c. 57%).

-- Partnership with Golden Lane, a R egistered Provider with a

regulatory compliance rating of G1 V2 and one of the leading

providers in the Specialised Supported Housing sector, on a

pipeline of projects.

Notes:

1 Including acquisition costs

2 These are targets only and not a profit forecast and there can

be no assurance that they will be met

3 Four out of these 497 properties are classified as assets held for sale at 30 June 2023

FOR FURTHER INFORMATION ON THE COMPANY, PLEASE CONTACT:

Triple Point Investment Management Tel: 020 7201 8989

LLP

(Investment Manager)

Max Shenkman

Isobel Gunn-Brown

Akur Limited (Joint Financial Tel: 020 7493 3631

Adviser)

Tom Frost

Anthony Richardson

Siobhan Sergeant

Stifel Nicolaus Europe Limited Tel: 020 7710 7600

(Joint Financial Adviser and Corporate

Broker)

Mark Young

Rajpal Padam

Madison Kominski

Brunswick Group (Financial PR Tel: 020 7404 5959

Adviser)

Nina Coad

Diana Vaughton

Mara James

The Company's LEI is 213800BERVBS2HFTBC58.

Further information on the Company can be found on its website

at www.triplepointreit.com .

IMPORTANT INFORMATION:

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014, as it

forms part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018, as amended and supplemented ("UK MAR") and

is disclosed in accordance with the Company's obligations under UK

MAR. Upon the publication of this announcement, this inside

information will be considered to be in the public domain.

NOTES:

The Company invests in primarily newly developed social housing

assets in the UK, with a particular focus on supported housing. The

assets within the portfolio are subject to inflation-linked,

long-term (typically from 20 years to 30 years), Fully Repairing

and Insuring ("FRI") leases with Approved Providers (being Housing

Associations, Local Authorities or other regulated organisations in

receipt of direct payment from local government). The portfolio

comprises investments into properties which are already subject to

an FRI lease with an Approved Provider, as well as forward funding

of pre-let developments but does not include any direct development

or speculative development.

The Company was admitted to trading on the Specialist Fund

Segment of the Main Market of the London Stock Exchange on 8 August

2017 and was admitted to the premium segment of the Official List

of the Financial Conduct Authority and migrated to trading on the

premium segment of the Main Market on 27 March 2018. The Company

operates as a UK Real Estate Investment Trust ("REIT") and is a

constituent of the FTSE EPRA/NAREIT index.

Meeting for analysts and audio recording of results

available

T he Company presentation for analysts will be held at 8.00 am

today via live webcast . The presentation will also be accessible

on-demand later in the day via the Company website:

www.triplepointreit.com .

Those wishing to access the live webcast are kindly asked to

contact the Company Secretary at Hanway Advisory on +44 (0) 20 3909

3519 or cosec@hanwayadvisory.com .

The Interim Results will also be available to view and download

on the Company's website at www.triplepointreit.com and hard copy

will be posted to shareholders on or around 15 September 2023 .

CHAIR'S STATEMENT

Introduction

The macroeconomic backdrop during the first half of 2023 has

remained uncertain. High interest rates and gilt yields have

impacted the wider property sector. Despite these challenges , the

Specialised Supported Housing sector has continued to demonstrate

strong rental growth and valuation resilienc e .

Last year, we took the decision to cap the Group's 2023 rent

increases at 7%, in line with the government's cap on social

housing rent increases, even though Specialised Supported Housing

was excluded from this cap. Given UK CPI has remained elevated ,

rent s have been increased in line with the cap. This rental growth

has offset general market wide yield compression and helped us to

deliver growth in the Group's portfolio value and EPRA NTA per

share in the first half of the year despite the very challenging

economic environment, differentiating us from other UK property

sectors that have suffered material reductions in value.

The relatively strong performance of the Specialised Supported

Housing sector is reassuring and in line with the sector's

fundamentals. There remains a lack of supply and all forecasts

point to growing excess demand for more independent community-based

homes for people with care and support needs. This, combined with

government financial support for the individuals that live in

Specialised Supported Housing, means that the sector is well placed

to withstand periods of economic uncertainty.

Capital Allocation

We aim to supplement our existing portfolio of properties with

forward funding projects and acquisitions over the medium term,

however all deployment is considered in the context of delivering

shareholder value and the broader market conditions. During the six

months ended 30 June 2023, the Board has viewed share buybacks as a

more attractive and appropriate use of the Group's capital, buying

back GBP5 million ( 9,322,512 shares ) between 19 April 2023 and 12

June 2023 at an average discount to the prevailing published EPRA

NTA of 52.8%, which has been accretive to dividend cover. The Group

does intend to invest into a competitively priced forward funding

project in conjunction with Golden Lane, a Registered Provider with

a regulatory compliance rating of G1 V2 and one of the leading

providers in the Specialised Supported Housing sector . Further

detail on this new partnership can be found in the Investment

Manager's Report .

As indicated in the Group's 2022 Annual Report, it has been a

priority of the Board to demonstrate the value of the Group's

assets through a sale of a portfolio of properties. Since the

period end, we have successfully concluded a portfolio disposal of

four properties for an aggregate consideration of GBP7.6 million

which is principally in line with the book value of GBP7 .9 million

as at 30 June 2023 and reflects a GBP0. 7 million gain (9.6%)

against the aggregate purchase price that the Group paid for the

properties. The portfolio of properties sold contained a mix of

property types, lessees and care providers. F ollowing consultation

with shareholders over the coming weeks , and with consideration

given to the Group's leverage position, the Board will consider

whether some of the proceeds from the sale should be used for an

additional share buyback programme. More details on the sale and

capital allocation are included in the Investment Manager's R

eport.

Portfolio P erformance

Consolidating and optimising the performance of the Group's

portfolio has been a principal focus of the Board and the

Investment Manager.

Since early 2020 , the operating environment has been difficult

for all our Approved Providers. As the numerous challenges posed by

COVID-19 eased, they were replaced with the financial headwinds of

rising inflation and increased regulatory costs. Despite

challenging economic conditions, the majority of the Group's

Approved Providers are performing in line with expectations, and

have managed to navigate these issues successfully. Reassuringly we

are seeing signs of improvement, with a recent reduction in gas

prices, a less challenging labour market and an overall improvement

in the operational backdrop for our partners which allows us to

look forward with renewed confidence.

We believe the strength of our relationships with our partners

sets us apart in the Specialised Supported Housing sector. This

ensures that we have both the operational data and anecdotal

feedback required for a granular understanding of the performance

of the Group's portfolio of properties. All aspects of portfolio

management, including compliance, care provider performance and

local authority nominations, are monitored and assessed on an

ongoing basis. This enables us to intervene quickly if issues arise

and to help our lessees move forward through initiatives such as

the roll out of our new lease clause as described in the Investment

Manager's Report .

As previously reported, rent receipts were lower than expected

for two of the Group's lessees, My Space and Parasol. We are

pleased to report that a creditor agreement has been put in place

with Parasol which reflects the current level of rents being

received and allows for rents to increase over time. Similarly, we

hope to agree a creditor agreement with My Space shortly, and

continue to engage with alternative Registered Providers so that

the Group's properties can be moved should we deem this to be in

the best interests of residents and the sustainability of the

Group's income . The Group's Board and the Investment Manager are

focused on ensuring that My Space and Parasol perform in line with

expectations. A full update on the performance of these lessees is

included in the Investment Manager's R eport.

Alongside maintaining the performance of our portfolio , we have

evolved our investment structure to provide appropriate support to

our Registered Provider lessee partners as they look to progress

from a risk management and regulatory perspective. We have led the

sector on managing risk by rolling out a new risk sharing clause

across all our Registered Provider leases which can help boards of

Registered Providers demonstrate material progress on risk

management to the Regulator of Social Housing.

Recognising the link between value creation and the quality of

the homes we deliver, the Board is taking increased measures to

oversee the broader sustainability credentials of the Group. A

separate Sustainability Committee has been established to ensure

due consideration of a range of sustainability activities and

outcomes, which will be detailed further in the 2023 Annual

Report.

Financial Results

The Group has continued to demonstrate strong financial

resilience in challenging conditions. The EPRA NTA per share as at

30 June 2023 was 111.31 pence per share, an increase of 2.25 pence

compared to the NTA of 109.06 pence per share as at 31 December

2022. This increase was driven by growth in the value of the

Group's property portfolio and the accretive impact of the share

buybacks undertaken by the Group in the period.

In August , Fitch Ratings Ltd re affirmed the Company's existing

Investment Grade, long-term Issuer Default Rating (IDR) of 'A-'

with a stable outlook and a senior secured rating of 'A' for the

Group's existing loan notes , for the second consecutive time.

I am pleased to report that we continue to pay dividends in line

with our annual targets, as we have done consistently since IPO.

For the six months ended 30 June 2023 , dividend cover, based on

adjusted earnings, was 0.81x. Dividend cover was lower than in

previous periods due to an additional provision of GBP 1.0 million

recognised in the period, relating to the My Space and Parasol rent

arrears for the year ended 31 December 2022. Without this

additional provision , adjusted dividend cover for the six months

ended 30 June 2023 was 0.90x (1) . Through our focus on addressing

the current level of rent payments from My Space and Parasol

(details on which are provided in the Investment Manager's Report)

we will look to improve dividend cover over the course of this year

and preserve it over the longer-term.

Overall, we are proud of another set of resilient financial

results which build on our performance to date and the encouraging

operational progress made during the period. This would not have

been possible without the support of our stakeholders, all of whom

played an important role in helping deliver on our investment

strategy. You can read more about our financial performance during

the period in our Key Highlights, along with a more in-depth review

in the Investment Manager's R eport.

Social Impact

Social Impact continues to be at the forefront of our

decision-making processes and is central to our business model. The

independent Impact Report prepared by The Good Economy for the six

months ended 30 June 2023 provides an independent assessment of our

impact performance, based on an analysis of quantitative data and

evidence, as well as in-depth interviews with a range of

stakeholders. You can read more on the social value and impact that

our properties create in the Impact Report prepared by the Good

Economy, available separately on our website.

Outlook

Whilst capital markets remain challenging, our focus remains on

the operating performance of our portfolio which we expect to

demonstrate continued operational and valuation resilience . As a

responsible investor, we are proactive in managing the portfolio,

working alongside housing providers to identify and address risks

in order to ensure the sustainability of our investments over the

long term.

We are well placed to continue to deliver on our return targets

to investors. We expect further strong rental growth, which helps

to underpin the Group's property valuations and increases income.

This, combined with our long-term, fixed - price debt means that we

do not need to raise additional capital or refinance to meet return

expectations in the near term. By focusing on our operational

performance, we can ensure that over time, net assets and

distributions to investors increase whilst our gearing levels

naturally decline.

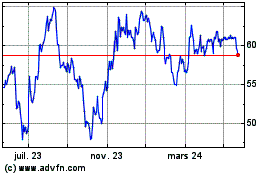

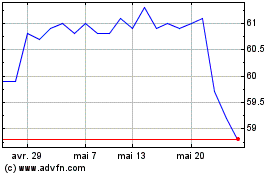

We are committed to addressing the performance of the Company's

share price, and to work to narrow the discount to prevailing Net

Asset Value. The Group continues to report strong operational and

financial performance and we are increasing our efforts to ensure

our shareholders and the wider investment community understand our

compelling fundamentals. Further, we critically consider capital

allocation, recycling capital into what we evaluate to be accretive

investments.

On behalf of the Board, I would like to thank the Investment

Manager and advisers for their continued hard work and dedication

to our investment strategy. Most importantly, I would like to thank

our shareholders and other stakeholders for their continued support

as we work to evolve and execute our strategy to deliver good homes

and long-term sustainable returns.

Chris Phillips

Chair

6 September 2023

Notes:

1 See Notes 3 and 4 for further explanation.

INVESTMENT MANAGER'S REPORT

Specialised Supported Housing Market

Since the inception of the Company, there has never been a

greater need for private capital to help deliver Specialised

Supported Housing. The government estimate s that demand for

Supported Housing is expected to increase by 125,000 by 2030. (1)

Demand continues to grow whilst Registered Providers face

challenges of high inflation and interest rates, at a time when

there is growing pressure to invest into their existing housing

stock to meet the latest energy efficiency and fire safety

standards. There is growing recognition by Registered Providers

that private capital that takes a long-term view of ownership and

that can invest on flexible terms, has a vital role to play in the

delivery of Specialised Supported Housing. Registered Providers

working with experienced and pragmatic investors can form effective

partnerships and help deliver additional homes to individuals

throughout the UK.

We are seeing an unprecedented level of demand from Registered

Providers looking for funding partners to help them deliver

development pipelines over the coming months and years. This

partnership approach is critical to addressing the undersupply of

Specialised Supported Housing, and is the primary driver behind our

partnership with Golden Lane with whom we are working on a pipeline

of projects, with the first one being in Chorley .

Leasing, A sset and P roperty M anagement

The six months ended 30 June 2023 have seen the Group deliver on

a set of initiatives that distinguish it from peers and demonstrate

its commitment to the sector. We were amongst the first within the

sector to cap 2023 rent increases in our leases at 7.0%,

irrespective of the Specialised Supported Housing rents' exclusion

from the government's rent cap. This aims to ensure that our

Registered Provider tenants and the individuals living in our

properties are not put under undue financial pressure. In June, we

commenced the roll out of our new lease clause, which will help our

Registered Provider partners demonstrate to the Regulator of Social

Housing that they have accommodated concerns with regards to risk

sharing in long leases. Finally, we have recently commissioned the

initial works in the roll-out of our Eco-Retrofit programme, which

will demonstrate a tenant-first approach in ensuring that the

Group's properties are compliant with energy efficiency

requirements, and that carbon emissions and utility bills of both

our lessees, and the individuals living in our properties, are

minimised.

As well as benefiting the sector, our lessees and the residents,

we believe that taking a long-term approach to asset management

decisions supports and enhances shareholder value. Investing in

energy efficiency will help to preserve the value of the Group's

portfolio. Rebalancing risk in existing leases should promote the

Regulatory compliance of the Group's lessees and support the

Group's portfolio performance and valuation. Capping rents helps to

ensure the long-term sustainability of the Group's rental

income.

The benefit of this long-term approach is evidenced by a

resilient set of interim results. Against a backdrop of very

challenging market conditions the EPRA NTA has increased by 2.25

pence per share. Similarly, annualised contracted rental income has

increased from GBP39.0 million in the prior year to GBP40.5 million

in the current period.

Whilst the operating environment remains challenging, the

majority of our lessee partners continue to perform in line with

expectations and we expect the performance of the Group's lessees

to demonstrate resilience in times of economic uncertainty. Our

lessees provide homes to individuals whom local authorities have a

statutory obligation to house and typically the relevant local

authority will meet the entirety of the cost of this housing.

Combined with the systemic undersupply of Specialised Supported

Housing, this underpins the income generated by our Registered

Provider partners.

Our lessees' income is resilient, however, their costs have

increased significantly over the last two years. Whilst gas prices

have calmed, our lessees remain mindful of other cost pressures

including repairs and maintenance costs which continue to increase.

It is important that the Group's lessees manage this increase in

their cost base whilst continuing to comply with their maintenance

obligations under the Group's leases.

New L ease C lause

As noted in our 2022 Annual Report, and having since received

supportive feedback from shareholders, our intention is to include

a new clause in all the Group's existing leases with Registered

Providers. The aim of this clause is to address some of the general

risks raised by the Regulator in relation to long leases and in so

doing protect Registered Providers in the event policy changes

(i.e. factors beyond their control) reduce the amount of rent that

they are able to generate from a property or properties that they

lease from the Group.

The key terms of the clause are summarised below:

-- Triggering of the clause is subject to a materiality

threshold measured against the aggregate value of the rental income

generated from the portfolio of leases that the Group has with the

relevant Registered Provider.

-- Subject to the above trigger threshold being met, the

Registered Provider can approach the Group in relation to amending

the lease rent to allow for the occurrence of either of the

circumstances below:

o A change in central government policy that negatively impacts

the level of rent that is applicable to Specialised Supported

Housing or the exempt rent status of Specialised Supported Housing;

or

o A change in local government policy that impacts the

commissioning of the relevant property or properties.

In addition, the new clause provides for an increase in the

annual rent payable to the Group amounting to the lower of UK CPI

(or RPI where applicable), or the maximum rent increase allowed

under prevailing policy to the extent that it applies to

Specialised Supported Housing rents. Using this year's rent

increases as an example of how this part of the clause would apply

in practice, under the terms of the lease, the Group would have

been able to increase its leases by CPI because the rent cap did

not apply to Specialised Supported Housing.

The clause has been approved by the Investment Manager's

Investment Committee and the Group's Board. It has been reviewed by

the Group's valuers and the valuers of the Group's lenders, both of

whom have confirmed that they do not expect the clause to have a

detrimental impact on the valuation of the Group's properties. The

clause has also been shared with the Regulator of Social Housing.

The Group's lenders are also supportive of the inclusion of the

clause, understanding the benefit it should unlock for the Group's

Registered Providers.

We feel that the clause strikes the right balance between

allowing Registered Providers to mitigate risks over which they

have limited or no control in a way that should assist with their

regulatory compliance, whilst not fundamentally undermining the

value of the Group's leases.

Eco-Retrofit

By 2030 all socially rented properties need to have an Energy

Performance Certificate ("EPC") rating of C or above. Currently

28.8% of the Group's properties have an EPC rating of lower than C

which compares favourably to the social housing sector average of

43.1%. We are committed to protecting the value of the Group's

properties, reducing carbon emissions, and supporting our lessees

and the individuals living in the Group's properties.

We have started the pilot phase of an energy efficiency

improvement initiative which entails upgrading all of the Group's

properties. Over the next 12 months we will undertake works on 11

of the Group's properties that previously had EPC ratings ranging

from D to E and look to upgrade these to C or above. The pilot

project will enable us to learn how to conduct the works

efficiently, cost-effectively and in a way that causes minimum

disruption to tenants. It will enable us to form strong

relationships with our key contractors and help ensure the

successful rollout of the wider project.

Housing creates a large carbon footprint when not managed and

homes are at increasing risk of impacts from climate change. Taking

steps to manage these challenges is a strategic commitment for the

Group. We will continue to publish our approach to managing climate

risk and opportunity through the framework of the Taskforce on

Climate-related Financial Disclosure (TCFD), as first provided in

our 2022 Annual Report.

Portfolio Sale

As well as investing in the long-term value of the Group's

portfolio, we have also sought to evidence the portfolio's current

valuation by selling a portfolio of properties. Our objectives were

to achieve a sale price that is supportive of the Group's Net Asset

Value, and demonstrate that there is liquidity in the Specialised

Supported Housing market. To achieve these aims, we believed it was

important not only to attain a good price, but that the portfolio

of properties sold was representative of the Group's wider

portfolio.

We are pleased to report that we have sold four properties post

the period end, for GBP7 .6 million which is in line with the book

value of the properties of GBP7.9 million as at 30 June 2023. The

sale price is reflective of a GBP0. 7 million gain against the

aggregate purchase price the Group paid for the properties

(excluding transaction costs) . The portfolio properties were

located across four Local Authorities, leased to Inclusion Housing

CIC and Chrysalis Supported Association Ltd, and care was provided

by four separate care providers. The portfolio contained a mixture

of adapted and new build properties as well as individual and

shared homes. Below, we have provided a table comparing some of the

key metrics of the portfolio of properties sold to the Group's

wider portfolio:

Sale Portfolio Group Portfolio

Properties 4 497

--------------- -----------------

Residents 38 3,455

--------------- -----------------

Average residents

per property 9.5 7.0

--------------- -----------------

Fair Market Value GBP7.9 million GBP675.1 million

--------------- -----------------

Blended valuation

yield 5.75% 5.69%

--------------- -----------------

WAULT 19.3 years 24.8 years

--------------- -----------------

We feel that the successful portfolio sale is supportive of the

Group's Net Asset Value, whilst also evidencing the continued

investor demand for Specialised Supported Housing properties. As

noted in the Chair's Statement, following consultation with

shareholders over the coming weeks and with consideration given to

the Group's leverage position, the Board will determine whether to

return to shareholders a portion of these proceeds by way of

further share buybacks.

Registered Provider Update

There have been no material rent arrears in the period in the

Group's portfolio other than those that relate to My Space and

Parasol as previously reported. Progress has been made with both

organisations since our last update.

In August we agreed a creditor agreement with Parasol (9.2% of

our Group revenues) which sets a minimum level for monthly rent

payments over the next six months post the current interim period ,

with the stated intention that payments will increase above this

minimum level over time. At the end of the six-month agreement,

full rent becomes due again. If rent payments are not in line with

the terms of the creditor agreement, we have the ability to move

leases to a different Registered Provider and we have had

constructive discussions with potential alternative partners. We

have informed the Group's valuer, JLL, of the nature of this

agreement and they have confirmed that it will not have a material

impact on the value of the Group's properties leased to Parasol. We

have a constructive relationship with the C hair and the CEO of

Parasol and will continue to engage with them and support them as

they move the organisation forward.

Similarly, we hope to agree a creditor agreement with My Space

(7.7% of our Group revenues) shortly . Th is agreement is required

to enable My Space to address its solvency position, and we expect

it to cover both rent due going forward and arrears. My Space has

recently hired a new CEO and CFO and is in the process of

recruiting a COO. Simultaneously, new trustees are in the process

of being identified for the board, with a view to bolstering the

level of audit, financial and legal expertise. We are working with

the new management team as they look to put in place the creditor

agreement and consider options for the organisation including a

possible business combination or merger. Concurrently, we continue

to engage with alternative Registered Providers so that the Group's

properties can be moved to an alternative lessee should we be of

the view that this is in the best interests of residents and the

sustainability of the Group's rental income. My Space continues to

engage with the Regulator of Social Housing in relation to the

Enforcement Notice issued earlier this year. My Space has

undertaken a range of actions as prescribed by the Regulator of

Social Housing and provided an initial response to all points

raised in the notice.

The Regulator of Social Housing remains active in the sector. It

continues to monitor the Group's Registered Provider partners and

in the first six months of this year they issued Enforcement

Notices in relation to My Space and Auckland Home Solutions who

account for 7.7% and 4.7% of the Group's rent roll, respectively.

Both notices were noted and commented on by the Group. With regards

to Auckland Home Solutions, the Regulator of Social Housing's

Enforcement Notice stated that three board members had been

appointed to Auckland's board and that Auckland must commission an

independent review focused on appraising governance, business

planning, risk management and compliance with the Rent Standard.

Through our ongoing engagement with Auckland Home Solutions we

understand that the new board members have already delivered

improvements in governance and that the independent review has been

commissioned and is underway.

Financial Review

We are pleased to present resilient financial results for the

six months ended 30 June 2023 as highlighted earlier . The Group's

financial performance is underpinned by increases in annualised

rental income from its CPI and RPI - linked lea ses. (2) We expect

dividend cover to increase during the second half of the year now

that a creditor agreement is in place with Parasol , and we

similarly hope to agree a creditor agreement with My Space

shortly.

Key highlights:

-- The annualised contracted rental income of the Group was

GBP40.5 million as at 30 June 2023, compared to GBP39.0 million on

31 December 2022. IFRS Gross Revenue for the period was GBP19.6

million compared to GBP18.2 million for the six months ended 30

June 2022.

-- A fair value gain of GBP5.9 million was recognised during the

period on the revaluation of the Group's properties compared to

GBP17.1 million for the same period in 2022.

-- The EPRA NIY has increased from 5.46% at 31 December 2022 to

5.65% at 30 June 2023 following the rental uplifts in the

period.

-- IFRS Earnings per S hare was 3.65 pence for the period,

compared to 6.19 pence for the same period in 2022. The reduction

was largely driven by a lower gain from fair value adjustment on

investment properties being recognised than in the prior year. The

ECL adjustment in the six months ended 30 June 2023 also had a

negative impact on net profit.

-- The EPRA Earnings p er Share ("EPRA EPS") excludes the fair

value gain on investment propert ies and is measured on the

weighted average number of shares in issue during the period. EPRA

EPS was 2.18 pence for the period compared to 2.43 pence for the

same period in 2022.

-- The Adjusted Earnings per Share ("Adjusted EPS") includes

adjustment for non-cash items and is measured on the weighted

average number of shares in issue during the year. Adjusted EPS was

2.21 pence per share for the six months to 30 June 2023, compared

to 2.57 pence for the same period in 2022.

-- The EPRA NTA per share at 30 June 2023 was 111.31 pence per

share, the same as the IFRS NAV per share, compared to 109.06 pence

as at 31 December 2022.

-- At the period end, the portfolio was valued at GBP675.1

million on an IFRS basis compared to GBP669. 1 million at 31

December 2022, reflecting a valuation uplift of 12. 2 % against the

portfolio's aggregate purchase price (including acquisition costs).

This reflects an EPRA net initial yield of 5.65%, against the

portfolio's blended net initial yield of 5.91% at the point of

acquisition. This equates to a yield compression of 26 basis

points, reflecting the quality of the Group's asset selection and

off-market acquisition process.

-- The EPRA ongoing charges ratio is calculated as a percentage

of the average net asset value for the period under review. The

ongoing charges ratio for the period was 1.63% compared to 1. 60 %

for the year ended 31 December 2022. The increase is primarily due

to the impact of inflation on the Group's cost base .

-- The Group held cash and cash equivalents of GBP23.8 million

as at 30 June 2023 , of which GBP0.4 million was restricted or

ring-fenced, compared to GBP30.1 million as at 31 December 2022, of

which GBP0.4 million was restricted or ring fenced, leaving

available cash of GBP23.4 million as at 30 June 2023.

Property Portfolio

As at 30 June 2023, the portfolio comprised 497 properties with

3,455 units and represented a broad geographic diversification

across the UK. The four largest concentrated areas by market value

were the North West (19.8%), West Midlands (16.9%), Yorkshire

(14.6%) and East Midlands (12.0%). The IFRS value of the portfolio

at 30 June 2023 was GBP675.1 million compared to GBP669.1 million

at 31 December 2022, growth of 0.9% during the period.

Rental Income

In total, the Group had 39 4 leases which at the period end,

generated total annualised contracted rental income of GBP40.5

million. During the period IFRS Revenue was GBP19.6 million

compared to GBP18.2 million for the same period in 2022 .

At the period end, the Group's three largest Approved Providers

by rental income and units were Inclusion (GBP12.2 million and 944

units), Parasol Homes (GBP3.7 million and 246 units) and Falcon

(GBP3.5 million and 304 units).

As at 30 June 2023, t he portfolio had a WAULT of 24.8 years.

The WAULT includes the initial lease term upon completion as well

as any reversionary leases and put/call options available to the

Group at expiry of the initial term. Notwithstanding the Group's

recent change to its investment policy to remove the minimum lease

term, at present the Group's WAULT is anticipated to remain above

20 years.

100% of the Group's contracted income is generated under leases

which are indexed against either CPI (92.4%) or RPI (7.6%). These

inflation linkages provide the Group and its investors with the

comfort that the rental income will generally increase in line with

inflation.

Some leases have an index 'premium' under which the standard

rental increase is based upon CPI or RPI plus a further percentage

point, reflecting top-ups by local authorities. These account for

7.9% of the Group's leases. A small portion of the Group's leases

(4.9% of rental income) contain a cap and collar on rental

increases. For the purposes of the portfolio valuation, JLL assumed

CPI and RPI to increase at 2 .0 % per annum and 2.5% per annum ,

respectively , over the term of the relevant leases. Despite the

high levels of inflation that are currently being experienced and

are projected in the short term in the UK, JLL's inflation

assumptions remain unchanged from previous periods given the

Group's long-term outlook, with a WAULT and contracted income

streams of 24.8 years.

Rent collection during the period was 88.1% and a full update on

rent arrears is included in the Registered Provider Update section

above.

Outlook

We expect to commenc e our first forward funding project since

the completion of our last development in March 2021. This should

see the Group fund the development of 12 adapted flats for people

with learning disabilities in Chorley. The property will be leased

on flexible lease terms to Golden Lane, a Registered Provider with

a regulatory compliance rating of G1 V2 and one of the leading

providers in the Specialised Supported Housing sector. We are

pleased to have been chosen by Golden Lane as their partner on this

project which is testament to the approach we take to investment in

the Specialised Supported Housing sector.

We expect the majority of our lessees to continue to operate in

line with historical performance. Our Housing Team takes a granular

and proactive approach to asset management, focused on the

underlying operational performance of the Group's 49 3 properties.

In addition, at an organisational level, our team will support our

Approved Provider management teams as they continue to tackle the

challenges posed by inflation. We will actively monitor performance

at My Space and Parasol to support progress on rent collection and

planned organisational improvements.

Whilst dividend cover was lower than historical levels in the

first six months of the year, we expect cover to improve in the

latter half of the year given the plan that is now in place with

Parasol and the plan we hope to shortly agree with My Space , and

as annual rent increases partially offset previously reported

reductions in rent collection. Over the medium to long-term we

expect there to be a high level of dividend cover due to the

inflation -linked nature of the Group's income streams and

advantageous capital structure which includes GBP263.5 million of

long-term , fixed - price debt with a blended cost of 2.74%.

By the end of the year, we plan to have included our new lease

clause in all the Group's existing Registered Provider leases,

thereby enabling the Boards of our lessees to demonstrate to the

Regulator of Social Housing that they have made tangible progress

in terms of addressing some of the Regulator's stated concerns

around the balance of risk sharing in long-term leases. Similarly,

we expect to have made good progress on our Eco-Retrofit pilot

programme, with a view to gaining invaluable learnings in relation

to the wider project whilst beginning to improve the energy

efficiency of the Group's portfolio.

Through these initiatives the Group is well positioned for

resilient operational and financial performance, whilst

demonstrating how, as a landlord, the Group can help to move the

sector forward by addressing historic regulatory concerns, getting

ahead of future requirements around energy efficiency and

delivering new, much needed homes to people with care and support

needs in partnership with leading Registered Providers.

Max Shenkman

Head of Investment

6 September 2023

Notes:

1 Department of Health and Social Care policy paper, People at

the Heart of Care: adult social care reform, March 2022.

2 4.9% of our leases are capped (excluding the temporary rent

cap at 7% applied to the Group's rent increases for the year of

2023).

PORTFOLIO SUMMARY

By Location

Properties % of Funds Invested*

Region * *

------------------------------------- ----------- ---------------------

North West 99 19.8

West Midlands 84 16.3

Yorkshire 64 14.8

East Midlands 58 11.9

South East 62 9.4

North East 50 9.0

London 27 8.5

South West 29 4.7

East 20 4.1

Scotland 2 1.0

Wales 2 0.5

------------------------------------- ----------- ---------------------

Total 497 100.0

------------------------------------- ----------- ---------------------

* including assets held

for sale

**calculated excluding acquisition

costs

KEY PERFORMANCE INDICATORS

In order to track the Group's progress the following key

performance indicators are monitored:

KPI AND DEFINITION RELEVANCE TO STRATEGY PERFORMANCE COMMENT

1. Dividend

-------------------------------------------------------- ----------------------------- ---------------------------

Dividends paid to The dividend reflects the Total dividends of 2.73 The Company has declared a

shareholders and declared Company's ability to pence per share were paid or dividend of 1.365 pence

during the year. deliver a low risk but declared in respect of the per Ordinary share in

growing income stream period 1 January respect of the period

Further information is set from the portfolio. 2023 to 30 June 2023. 1 April 2023 to 30 June

out in Note 16. 2023, which will be

(30 June 2022: 2.73 pence) payable on or around 29

September 2023. Total

dividends paid and

declared for the period

are in line with the

Company's target.

--------------------------- ----------------------------- ---------------------------

2 . EPRA Net Tangible Assets (NTA)

The EPRA NTA is equal to EPRA NTA measure that 111.31 pence per share as at The EPRA NTA (equivalent

IFRS NAV as there are no assumes entities buy and 30 June 2023. to IFRS NAV ) per share at

deferred tax liabilities sell assets, thereby IPO was 98 pence.

or other adjustments crystallising certain (31 December 2022: 109.06

applicable to the Group levels of deferred tax pence per share) This represents an

under the REIT regime. liability. increase of 13.6% since

IPO driven primarily by

Further information is set yield compression at

out in Note 3 of the acquisition

Unaudited Performance and subsequent annual

Measures. rental uplifts.

3 . Loan to Value (LTV)

A proportion of our The Company uses gearing 37.5% LTV as at 30 June Borrowings comprise two

portfolio is funded to enhance equity returns. 2023. private placements of loan

through borrowings. Our notes totalling GBP263.5

medium to long-term target (31 December 2022: 37.4% million provided

LTV is 35% to 40% with a LTV) by MetLife Investment

maximum of 50%. Management and Barings.

Further information is set

out in Note 14.

4 . EPRA Earnings per Share

EPRA Earnings per share A measure of a Group's 2.18 pence per share for the EPRA EPS reduced slightly

(EPRA EPS) excludes gains underlying operating six months ended 30 June reflecting the increase in

from fair value adjustment results and an indication 2023, based on earnings ECL in the current period.

on investment of the extent to which excluding the

properties that are current dividend payments fair value gain on

included in the are supported by earnings. investment properties and

calculation of the IFRS the write off of arrangement

Earnings per share. fees relating to

the cancelled RCF,

Further information is set calculated on the weighted

out in Note 21 . average number of shares in

issue during the

period.

(30 June 2022: 2.43 pence)

5 . Adjusted Earnings per Share

Adjusted earnings per A key measure which 2.21 pence per share for the This demonstrates the

share includes adjustment reflects actual cash flows six months ended 30 June Company's ability to meet

for non-cash items. The supporting dividend 2023, based on earnings dividend payments from net

calculation is shown payments. after deducting cash inflows. It

in Note 21 . the fair value gain on represents a dividend

properties, and amortisation cover for the six months

and write-off of loan ended 30 June 2023 of

arrangement fees; 0.81x.

calculated on the weighted

average number of shares in

issue during the year.

(30 June 2022: 2.57 pence)

6 . Weighted Average Unexpired Lease Term (WAULT)

-------------------------------------------------------- ----------------------------- ---------------------------

The average unexpired The WAULT is a key measure 2 4.8 years as at 30 June As at 30 June 2023, the

lease term of the of the quality of our 2023 (includes put and call portfolio's WAULT stood at

investment portfolio, portfolio. Long lease options). 24.8 years.

weighted by annual passing terms underpin the

rents. security of our income (31 December 2022: 25.3

stream. years)

Further information is set

out in the Investment

Manager's Report.

--------------------------- ----------------------------- ---------------------------

7 . Exposure to Largest Approved Provider

--------------------------------------------------------------------------------------------------------------------

The percentage of the The exposure to the 30.1% of Gross Asset Value Our maximum exposure limit

Group's gross assets that largest Approved Provider as at 30 June 2023. is 30% of GAV.

are leased to the single must be monitored to

largest Approved ensure that we are not (31 December 2022: 29.5%) This represents the

Provider. overly exposed to one Group's aggregate exposure

Approved Provider in the to both Inclusion Housing

event of a default CIC and Inclusion

scenario. Homes CIC which is

expected to reduce below

the 30% limit following

the completion of the

portfolio sale.

--------------------------- ----------------------------- ---------------------------

8 . Total Return

--------------------------------------------------------------------------------------------------------------------

Change in EPRA NTA plus The Total Return measure EPRA NTA per share was The EPRA NTA per share at

total dividends paid highlights the gross 111.31 pence as at 30 June 30 June 2023 was 111.31

during the period. return to investors 2023. pence. Adding back

including dividends paid dividends paid during

since the prior year. Total dividends paid during the period of 2.73 pence

the period ended 30 June per Ordinary Share to the

2023 were 2.73 pence per EPRA NTA at 30 June 2023

share. results in an

increase of 4.57%.

Total return was 4.57% for

the six months ended 30 June The Total Return since the

2023. IPO is 42.47% at 30 June

2023.

(30 June 2022: 5.71%)

--------------------------- ----------------------------- ---------------------------

EPRA PERFORMANCE MEASURES

The table below shows additional performance measures,

calculated in accordance with the Best Practices Recommendations of

the European Public Real Estate Association (EPRA). We provide

these measures to aid comparison with other European real estate

businesses.

Full reconciliations of EPRA Earnings and NAV performance

measures are included in Note 21 of the condensed Group interim

financial statements and Notes 1 and 3 of the Unaudited Performance

Measures, respectively. A full reconciliation of the other EPRA

performance measures are included in the Unaudited Performance

Measures section.

KPI AND DEFINITION PURPOSE PERFORMANCE

1. EPRA Earnings per share

----------------------------------------------------------------------------------------------------------------------

EPRA Earnings per share excludes A measure of the Group's underlying 2.18 pence per share for the six

gains from fair value adjustment on operating results and an indication months ended 30 June 2023.

investment properties of the extent to which

that are included in the IFRS current dividend payments are (30 June 2022: 2.43 pence)

calculation for Earnings per share. supported by earnings.

-------------------------------------- --------------------------------------

2. EPRA Net Reinstatement Value (NRV) per share

----------------------------------------------------------------------------------------------------------------------

The EPRA NRV adds back the A measure that highlights the value GBP479.6 million / 121.90 pence per

purchasers' costs deducted from the of net assets on a long-term basis. share as at 30 June 2023.

IFRS valuation.

GBP480.6 million / 119.31 pence per

share as at 31 December 2022.

-------------------------------------- --------------------------------------

3. EPRA Net Tangible Assets (NTA)

----------------------------------------------------------------------------------------------------------------------

The EPRA NTA is equal to IFRS NAV as A measure that assumes entities buy GBP438.0 million / 111.31 pence per

there are no deferred tax liabilities and sell assets, thereby share as at 30 June 2023.

or other adjustments crystallising certain levels

applicable to the Group under the of deferred tax liability. GBP439.3 million / 109.06 pence per

REIT regime. share as at 31 December 2022.

-------------------------------------- --------------------------------------

4. EPRA Net Disposal Value (NDV)

----------------------------------------------------------------------------------------------------------------------

The EPRA NDV provides a scenario A measure that shows the shareholder GBP514.6 million / 130.79 pence per

where deferred tax, financial value if assets and liabilities are share as at 30 June 2023.

instruments, and certain other not held until maturity.

adjustments are calculated as to the GBP510.1 million / 126.63 pence per

full extent of their liability. share as at 31 December 2022.

-------------------------------------- --------------------------------------

5. EPRA Net Initial Yield (NIY)

----------------------------------------------------------------------------------------------------------------------

Annualised rental income based on the A comparable measure for portfolio 5.65% at 30 June 2023.

cash rents passing at the statement valuations. This measure should make

of financial position it easier for investors 5.46% at 31 December 2022.

date, less non-recoverable property to judge for themselves how the

operating expenses, divided by the valuation of a portfolio compares

market value of the with others.

property, increased with (estimated)

purchasers' costs.

-------------------------------------- --------------------------------------

6. EPRA "Topped-Up" NIY

----------------------------------------------------------------------------------------------------------------------

This measure incorporates an The topped-up net initial yield is 5.68% at 30 June 2023.

adjustment to the EPRA NIY in respect useful in that it allows investors to

of the expiration of rent-free see the yield based 5.51% at 31 December 2022.

periods (or other unexpired lease on the full rent that is contracted

incentives such as discounted rent at 30 June 2023.

periods and step rents).

-------------------------------------- --------------------------------------

7. EPRA Vacancy Rate

----------------------------------------------------------------------------------------------------------------------

Estimated Market Rental Value (ERV) A "pure" percentage measure of 0.34% at 30 June 2023.

of vacant space divided by ERV of the investment property space that is

whole portfolio. vacant, based on ERV. 0.00% at 31 December 2022.

-------------------------------------- --------------------------------------

8. EPRA Cost Ratio

----------------------------------------------------------------------------------------------------------------------

Administrative and operating costs A key measure to enable meaningful 20.13% at 30 June 2023.

(including and excluding costs of measurement of the changes in the

direct vacancy) divided Group's operating costs. 21.09% at 31 December 2022.

by gross rental income.

-------------------------------------- --------------------------------------

PRINCIPAL RISKS AND UNCERTAINTIES

The Audit Committee, which assists the Board with its

responsibilities for managing risk, considers that the principal

risks and uncertainties as presented on pages 67 to 71 of our 2022

Annual Report were unchanged during the period and will remain

unchanged for the remaining six months of the financial year.

The Board undertakes a formal risk review, with the assistance

of the Audit Committee twice a year to assess the principal risks

and uncertainties. The Investment Manager on an ongoing basis has

responsibility for identifying potential risks and escalating these

in accordance with the risk management procedures.

DIRECTORS' RESPONSIBILITY STATEMENT

The Directors confirm that to the best of their knowledge this

condensed set of financial statements has been prepared in

accordance with UK-adopted International Accounting Standard ( IAS

) 34 and that the operating and financial review includes a fair

review of the information required by DTR 4.2.7 and DTR 4.2.8 of

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority namely:

-- an indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed financial statements and a description of the principal

risks and uncertainties for the remaining six months of the

financial year; and

-- material related party transactions in the first six months

of the financial year as disclosed in N ote 18 and any material

changes in the related party transactions disclosed in the 2022

Annual Report.

Shareholder information is as disclosed on the Triple Point

Social Housing REIT plc website.

Approval

This Directors' responsibilities statement was approved by the

Board of Directors and signed on its behalf by:

Chris Phillips

Chai r

6 September 2023

GROUP FINANCIAL STATEMENTS

CONDENSED GROUP STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2023

For the For the For the

six months six months y ear ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

(unaudited) (unaudited) (audited)

Note GBP'000 GBP'000 GBP'000

-------------------------------- ----- ------------ ------------------------ -------------

Income

Rental income 4 19,576 18,208 37,300

Expected credit loss 4 (3,157) (474) (2,073)

Other income - 110 110

------------ ------------------------ -------------

Total income 16,419 17,844 35,337

Expenses

Directors' remuneration (156) (151) (308)

General and administrative

expenses (1,446) (1,361) (2,854)

Management fees 5 (2,339) (2,362) (4,704)

------------ ------------------------ -------------

Total expenses (3,941) (3,874) (7,866)

Gain from fair value

adjustment on investment

propert ies 8 5,886 17,120 8,264

------------

Operating profit 18,364 31,090 35,735

------------ ------------------------ -------------

Finance income 29 16 56

Finance costs 6 (3,777) (6,178) (10,889)

------------

Profit before tax 14,616 24,928 24,902

------------ ------------------------ -------------

Taxation 7 - - -

Profit and total comprehensive

income 14,616 24,928 24,902

============ ======================== =============

IFRS Earnings per share

- basic and diluted 2 1 3.65p 6.19p 6.18p

CONDENSED GROUP STATEMENT OF FINANCIAL POSITION

As at 30 June 2023

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

------------------------------- -----

Note GBP'000 GBP'000 GBP'000

------------------------------- ----- ------------ ------------ ------------

Assets

Non-current assets

Investment properties 8 665,422 668,348 667,713

Trade and other receivables 9 3,042 2,607 2,889

------------ ------------ ------------

Total non-current assets 668,464 670,955 670,602

Current assets

Assets held for sale 7,871 640 -

Trade and other receivables 10 3,063 3,589 4,272

Cash, cash equivalents

and restricted cash 11 23,843 41,636 30,139

------------ ------------ ------------

Total current assets 34,777 45,865 34,411

Total assets 703,241 716,820 705,013

============ ============ ============

Liabilities

Current liabilities

Trade and other payables 12 2,556 3,944 3,120

------------

Total current liabilities 2,556 3,944 3,120

Non-current liabilities

Other payables 13 1,522 1,518 1,520

Bank and other borrowings 14 261,178 261,051 261,088

------------ ------------ ------------

Total non-current liabilities 262,700 262,569 262,608

Total liabilities 265,256 266,513 265,728

============ ============ ============

Total net assets 437,985 450,307 439,285

============ ============ ============

Equity

Share capital 15 3,940 4,033 4,033

Share premium reserve 203,753 203,753 203,753

Treasury shares reserve (378) (378) (378)

Capital redemption reserve 15 93 - -

Capital reduction reserve 15 155,359 160,394 160,394

Retained earnings 75,218 82,505 71,483

------------ ------------ ------------

Total Equity 437,985 450,307 439,285

============ ============ ============

IFRS Net asset value

per share - basic and

diluted 2 2 111.31p 111.80p 109.06p

The Condensed Group Financial Statements were approved and

authorised for issue by the Board on 6 September 2023 and signed on

its behalf by:

Chris Phillips

Chair

6 September 2023

CONDENSED GROUP STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2023

For the six Share Treasury Capital Capital

months ended Share premium shares redemption reduction Retained Total

30 June 2023 capital reserve reserve reserve reserve earnings equity

(unaudited) Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ----- --------- --------- --------- ------------ ----------- ---------- ---------

Balance at 1

January 2023 4,033 203,753 (378) - 160,394 71,483 439,285

Profit and total

comprehensive

income for the

period - - - - - 14,616 14,616

Transactions

with owners

Dividends paid 16 - - - - - (10,881) (10,881)

Shares repurchased 15 (93) - - 93 (5,035) - (5,035)

Balance at 30

June 2023 (unaudited) 3,940 203,753 (378) 93 155,359 75,218 437,985

========= ========= ========= ============ =========== ========== =========

For the six Share Treasury Capital Capital

months ended Share premium shares redemption reduction Retained Total

30 June 2022 capital reserve reserve reserve reserve earnings equity

(unaudited) Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ----- --------- --------- --------- ------------ ----------- ----------- ---------

Balance at 1

January 2022 4,033 203,753 (378) - 160,394 68,311 436,113

Profit and total

comprehensive

income for the

period - - - - - 24,928 24,928

Transactions

with owners

Dividends paid 16 - - - - - (10,734) (10,734)

Balance at 30

June 2022 (unaudited) 4,033 203,753 (378) - 160,394 82,505 450,307

========= ========= ========= ============ =========== =========== =========

Share Treasury Capital Capital

For the year Share premium shares redemption reduction Retained Total

ended 31 December capital reserve reserve reserve reserve earnings equity

2022 (audited) Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ----- --------- --------- --------- ------------ ----------- ---------- ---------

Balance at 1

January 2022 4,033 203,753 (378) - 160,394 68,311 436,113

Profit and total

comprehensive

income for the

period - - - - - 24,902 24,902

Transactions

with owners

Dividends paid 16 - - - - - (21,730) (21,730)

Balance at 31

December 2022

(audited) 4,033 203,753 (378) - 160,394 71,483 439,285

========= ========= ========= ============ =========== ========== =========

CONDENSED GROUP STATEMENT OF CASH FLOWS

For the six months ended 30 June 2023

For the For the For the

six months six months y ear ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

(unaudited) (unaudited) (audited)

--------------------------------- ----- -------------- --- -------------- -------------

Note GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Profit before income tax 14,616 24,928 24,902

Adjustments for:

Expected Credit Loss 3,157 474 2,073

Gain from fair value adjustment

on investment propert ies 8 (5,886) (17,120) (8,264)

Finance income (29) (16) (56)

Finance costs 6 3,777 6,178 10,889

--------------

Operating results before

working capital changes 15,635 14,444 29,544

Increase in trade and other

receivables (2,101) (710) (4,127)

(Decrease)/increase in

trade and other payables (402) (294) 280

-------------- -------------- -------------

Net cash generated from

operating activities 13,132 13,440 25,697

-------------- -------------- -------------

Cash flows from investing

activities

Purchase of investment

properties 147 (10,962) (20,611)

Disposal proceeds from

sale of assets - 1,480 2,120

Restricted cash - released - - 133

Restricted cash - paid - - (5)

Interest received 7 - 18

Net cash generated from/(

used in ) investing activities 154 (9,482) (18,345)

-------------- -------------- -------------

Cash flows from financing

activities

Ordinary Share s repurchased (5,035) - -

Loan arrangement fees paid (52) (444) (599)

Dividends paid 1 6 (10,881) (10,734) (21,730)

Interest paid (3,614) (3,614) (7,226)

-------------- -------------- -------------

Net cash used in financing

activities (19,582) (14,792) (29,555)

-------------- -------------- -------------

Net decrease in cash and

cash equivalents (6,296) (10,834) (22,203)

C ash and cash equivalents

at the beginning of the

period 29,696 51,899 51,899

--------------

C ash and cash equivalents

at the end of the period 11 23,400 41,065 29,696

============== ============== =============

NOTES TO THE CONDENSED GROUP INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

For the six months ended 30 June 2023

1. CORPORATE INFORMATION

Triple Point Social Housing REIT plc (the "Company") is a Real

Estate Investment Trust ("REIT") incorporated in England and Wales

under the Companies Act 2006 as a public company limited by shares

on 12 June 2017. The address of the registered office is 1 King

William Street, London, United Kingdom, EC4N 7AF. The Company is

registered as an investment company under section 833 of the

Companies Act 2006 and is domiciled in the United Kingdom.

The principal activity of the Company is to act as the ultimate

parent company of Triple Point Social Housing REIT plc and its

subsidiaries (the "Group") and to provide shareholders with an

attractive level of income, together with the potential for capital

growth from investing in a portfolio of social homes.

2. BASIS OF PREPARATION

These condensed Group interim financial statements for the six

months ended 30 June 2023 have been prepared in accordance with IAS

34 "Interim Financial Reporting" and also in accordance with the

measurement and recognition principles of UK-adopted international

accounting standards. They do not include all of the disclosures

that would otherwise be required in a complete set of financial

statements and should be read in conjunction with the 2022 Annual

Report.

The comparative figures for the financial year ended 31 December

2022 presented herein do not constitute the full statutory accounts

within the meaning of section 434 of the Companies Act 2006. Those

accounts have been reported on by the Group's auditors and

delivered to the registrar of companies. The report of the auditor

(i) was unqualified, (ii) did not include a reference to any

matters to which the auditor drew attention by way of emphasis

without qualifying their report and (iii) did not contain a

statement under section 498 (2) or (3) of the Companies Act

2006.

The condensed Group interim financial statements for the six

months ended 30 June 2023 have been reviewed by the Company's

Auditor, BDO LLP, in accordance with International Standard on

Review Engagements 2410, Review of Interim Financial Information

Performed by the Independent Auditor of the Entity. The condensed

Group interim financial statements are unaudited and do not

constitute statutory accounts for the purposes of the Companies Act

2006.

The condensed Group interim financial statements have been

prepared on a historical cost basis, as modified for the Group's

investment properties, which have been measured at fair value.

Gains or losses arising from changes in fair values are included in

profit or loss.

The Group has applied the same accounting policies and method of

computation in these condensed Group interim financial statements

as in its 2022 annual financial statements and are expected to be

consistently applied during the year ending 31 December 2023. At

the date of authorisation of these financial statements, there were

a number of standards and interpretations which were in issue but

not yet effective. The Group has assessed the impact of these

amendments and has determined that the application of these

amendments and interpretations in current and future periods will

not have a significant impact on the financial statements.

2.1. Going concern

The Group benefits from a secure income stream from long leases

which are not overly reliant on any one tenant and present a

well-diversified risk. The Directors have reviewed the Group's

forecast which show the expected annualised rental income exceeds

the expected operating costs of the Group. 88.1% of rental income

due and payable for the six months ended 30 June 2023 has been

collected, rent arrears are predominantly attributable to two

Approved Providers, My Space Housing Solutions and Parasol

Homes.

The Directors believe that the Group is still well placed to

manage its financing and other business risks and that the Group

will remain viable, continuing to operate and meet its liabilities

as they fall due. During the period, Fitch Ratings Limited assigned

the Company an investment Long-Term Issuer Default Rating 'A-' with

a stable outlook and a senior secured rating of 'A' for the Group's

existing loan notes.

The Directors have performed an assessment of the ability of the

Group to continue as going concern, for a period of at least 12

months from the date these condensed Group interim financial

statements have been authorised for issue. The Directors have

considered the expected obligations of the Group for the next 12

months and are confident that all will be met.

The Directors have also considered the financing provided to the

Group. Norland Estates Limited and TP REIT Propco 2 Limited have

bank facilities with MetLife and MetLife and Barings respectively.

TP REIT Propco 5 Limited's Revolving Credit Facility (RCF) with

Lloyds and Natwest was cancelled in December 2022. Prior to

cancellation the facility was undrawn.

The loans secured by Norland Estates Limited and TP REIT Propco

2 Limited are subject to asset cover ratio covenants and interest

cover ratio covenants which can be found in the table below. The

Directors have also considered reverse stress testing and the

circumstances that would lead to a covenant breach. Given the level

of headroom, the Directors are of the view that the risk of

scenarios materialising that would lead to a breach of the

covenants is remote.

Norland Estates TP REIT Propco

Limited 2 Limited

Asset Cover Ratio (ACR)

---------------- ---------------

Asset Cover Ratio Covenant x2.00 x1.67

---------------- ---------------

Asset Cover Ratio at 30 June

2023 x2.77 x2.04

---------------- ---------------

Blended Net initial yield 5.60% 5.85%

---------------- ---------------

Headroom (yield movement) 201bps 120bps