Tekcapital plc First Day Of Dealings (0140E)

04 Avril 2014 - 9:00AM

UK Regulatory

TIDMTEK

RNS Number : 0140E

Tekcapital plc

04 April 2014

4 April 2014

TEKCAPITAL PLC

("Tekcapital", the "Company" or the "Group")

FIRST DAY OF DEALINGS AND ADMISSION TO TRADING ON AIM

Tekcapital plc, an international provider of technology and IP

services, is pleased to announce the commencement at 08.00 today of

dealings in its Ordinary Shares on AIM, a market operated by London

Stock Exchange plc.

Admission Details

-- Gross proceeds to the Group of GBP2 million, through the

placing of 8 million new shares at a price of 25 pence per Ordinary

Share (the "Placing Price").

-- The total number of Ordinary Shares in issue at Admission is

22,503,977,giving the Group a market capitalisation of GBP5.6

million at the Placing Price.

-- The Group intends to use the net proceeds of the Placing to

accelerate the growth of the Group's sales, marketing and delivery

of services, in particular through the expansion of the Company's

sales and marketing team; the development of additional technology

indexing algorithms and the recruitment of additional support

staff; general working capital purposes; and for IPO costs.

-- The Group's trading symbol is TEK and the Group's ISIN code is GB00BKXGY798.

Northland Capital Partners Limited is acting as Nominated

Adviser and Joint Broker to the Company and Optiva Securities

Limited as Joint Broker.

Commenting on the successful Placing and Admission to AIM, Dr

Clifford Gross, Executive Chairman of Tekcapital plc, said:

"I am delighted to have successfully completed our fundraising

and admission to AIM and welcome on board our new institutional

shareholder base. We have strong foundations already in place,

which include the development of our Innovation Discovery Network

which is connected to over 3,300+ universities and research

institutionsin over 160 countries, combined with a first rate

Science Advisory Board. Capturing innovation developed by some of

the world's leading universities and research institutions is the

core of Tekcapital's strategy. We work across technology sectors

and are aligned and driven by our client's need for rapid

innovation and intellectual property protection. Together, we

assist our customers around the world, to rapidly find, review and

acquire the intellectual property they need to advance their

businesses.

"Tekcapital has a bright future ahead of it and our team is

looking forward to delivering on the market-driven strategy that we

have laid out to create value for our clients, university suppliers

and shareholders."

For further information please contact:

Tekcapital Plc via FTI Consulting, LLP

Clifford Gross, Executive Chairman

Malcolm Groat, Finance Director

Northland Capital Partners Limited (NOMAD

& Broker) +44 (0) 20 7382 1100

Louis Castro / Lauren Kettle (Corporate

Finance)

John Howes / Alice Lane (Corporate Broking)

Optiva Securities Limited (Co-Broker) +44 (0) 20 3137 1904

Jeremy King / Vishal Balasingham

FTI Consulting, LLP +44 (0) 20 7831 3113

Chris Lane / Emma Appleton / Roger Newby

* * * * *

About Tekcapital plc

-- Tekcapital is an international technology and intellectual

property ("IP") services company. Using its technology, the Group

is able to source university discoveries and intellectual property

from over 3,300 universities and research institutions located in

over 160 countries. The Group seeks to enable its clients to

innovate faster and protect their core products or services by

identifying relevant cutting-edge technology and intellectual

property acquisition opportunities which have been developed by

leading universities and research institutions.

-- The Group has developed an innovation discovery network

("IDN") which is capable of searching through a defined global

database of universities and research institutions to identify IP

acquisition opportunities relevant to the client's search

parameters.

-- Tekcapital is able to provide its retained clients with a

complete turnkey solution to locate, screen and acquire

technologies available for acquisition or licence from some of the

world's leading universities and research institutions. Once a

suitable technology acquisition opportunity has been identified and

presented to the client in a monthly advisory report, the Company

can evaluate the IP through its science advisory board; a group of

expert advisers from a range of academic and professional

backgrounds (the "Science Advisory Board"). Tekcapital can then act

as an intermediary between the client and the university or

research institution with a view to the acquisition or licensing of

the specific technology.

-- The Directors estimate that, from a technology supply

perspective, the market for IP acquisitions is approximately GBP4.5

billion per year. This is based on an average patent purchase price

of GBP222,500 and an estimated 20,000 technology transfers being

completed world-wide in 2012.

-- The market for university or research institution developed

IP is benefitting from the global trend for businesses to outsource

research and development. This use of external research and

development has coincided with an increase in the pace of

innovation and an increase in the number of patent lawsuits. As a

result, many companies are now seeking to identify and to acquire

IP from external or alternative sources to protect and grow their

respective businesses. New legislation, for example The Patent Box

tax law 2013 in the U.K., a tax relief which enables companies to

apply a lower rate of corporation tax on profits earned from

patented inventions, has also increased interest in IP given the

potential for companies to benefit from increased innovation and

profits.

-- The Group's Board and senior management team have a strong

track record across multiple sectors and have significant expertise

in the IP and technology transfer industries, having completed over

400 transactions in previous engagements.

-- The Directors believe that the Placing and Admission will

enable the Company to more quickly and more effectively pursue its

strategy for growth. Aided by the funds raised from the Placing,

the Directors believe that Tekcapital is well positioned to assist

its current and future clients to efficiently source and acquire

relevant university technologies and intellectual properties to

both protect their existing market position and to innovate to

secure further growth.

Ends

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCZXLFBZZFXBBK

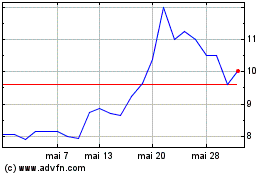

Tekcapital (LSE:TEK)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Tekcapital (LSE:TEK)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024