TIDMVP.

RNS Number : 8273U

Vp PLC

28 November 2023

Press Release 28 November 2023

Vp plc

('Vp' or the 'Group')

Interim Results

Solid performance reflects strength of business and leading

position in diverse end markets

Vp plc, the equipment rental specialist, today announces its

Interim Results for the six months ended 30 September 2023 ('H1

2024' or the 'period').

Financial highlights

H1 2024 H1 2023 Change

Revenue (GBPm) 190.9 186.5 2.4%

Adjusted profit before tax, amortisation, impairment

of intangible assets and exceptional items*

(GBPm) 21.9 21.5 1.9%

Return on Average Capital Employed* 14.7% 14.4% 0.3pp

Adjusted basic EPS before amortisation, impairment

of intangible assets and exceptional items*

(pence per share) 40.3 42.5 (5.2%)

Interim dividend (pence per share) 11.5 11.0 4.5%

Adjusted EBITDA* (GBPm) 47.8 47.8 -

Net debt excluding lease liabilities* (GBPm) 133.4 148.9 (10.4%)

Capital investment in rental fleet (GBPm) 27.8 33.8 (17.8%)

Statutory profit before tax (GBPm) 19.9 17.9 11.2%

Statutory profit before tax, amortisation,

impairment of intangible assets and exceptional

items (GBPm) 21.7 21.4 1.4%

-- Strong first half across key metrics, ahead of prior period

-- Increase in Return on Average Capital Employed (ROACE*)

-- Continued investment in the rental fleet with GBP28 million Fleet Capex in the period

-- Robust balance sheet with gearing and interest cover well

within covenants. Leverage expected to be c.1.5x at end of year

-- Refinance of GBP90 million Revolving Credit Facility ('RCF')

secured, complementing existing private placements of GBP93

million, with 70% of period end borrowings fixed at low rates

-- Interim dividend increased by 4.5% to 11.5 pence per share,

reflecting confidence in the Group's prospects

Operational highlights

-- Strong performance, particularly in Infrastructure with

continued demand from rail, transmission and water sectors

-- Continued ESG** progress - focussed investment in the rental

fleet, Science Based Targets recently validated by the SBTi***

* These measures are explained and reconciled in Note 14: Alternative Performance

Measures

** Environmental Social Governance *** Science Based Targets initiative

-- Greater emphasis on Digital, with innovations including carbon calculators to improve the customer experience

-- Refreshed leadership, with new CEO in place and CFO joining in January 2024

Current H2 2024 Trading and Outlook

-- Despite the immediate market challenges, particularly in Construction which has been soft and Housebuilding which has been subdued but stable, the Group continues to make progress and leverage opportunities in its specialist markets

-- Recent HS2 announcements should not impact short term

business performance. Lost HS2 opportunities should, in part, be

replaced by activity from alternative rail initiatives

-- Operational excellence remains a priority with continued

progress on the Group's Digital roadmap

-- ESG remains an important part of the Group's strategy and its day-to-day operations

-- Strong balance sheet and recently refinanced RCF positions

the Group well to exploit both organic and M&A

opportunities

-- New leadership team in Brandon Hire Station executing

tactical actions alongside a wider operational review in order to

drive margin improvements. This will lead to minor restructuring

activities and some exceptional items in H2

-- The Board is confident in the Group's ability to deliver

sector-leading returns and anticipates a full year performance

broadly in line with market expectations.

Commenting on the Interim Results, Jeremy Pilkington, Chairman

of Vp plc, said:

"We have delivered a solid performance with continuing sector

leading returns in the period reflecting the strength of our

diverse business offering. We are particularly pleased to have

maintained net margin and a strong return on average capital

employed, demonstrating high quality of earnings in difficult

market conditions.

"Having multiple sector exposure diversifies our revenue streams

and has contributed to the robust performance in the period, with

infrastructure demand remaining supportive, and whilst there are

immediate challenges within general construction, I am confident

that the actions taken will be of benefit in the medium term. The

Group continues to produce strong operating cash flows and

maintains a solid financial base, having refinanced our RCF in

November on similar terms for a further three years, and we are

well positioned for growth.

"Vp has an excellent track record of successfully navigating

difficult markets and the diversity of our operations provides us

with a solid foundation from which to grow the business both

organically and via acquisitions. We remain confident in the

Group's ability to drive demand for our products and services which

embrace our customers' needs for sustainable and digital solutions.

There is a great sense of enthusiasm throughout the Group, driven

in part by a refreshed leadership team, which makes us optimistic

for the future and our ability to continue to deliver an attractive

level of returns for our shareholders."

- Ends -

For further information:

Vp plc Tel: +44 (0) 1423 533 400

Jeremy Pilkington, Chairman www.vpplc.com

Anna Bielby, Chief Executive

Media enquiries:

Buchanan

Henry Harrison--Topham / Jamie Hooper Tel: +44 (0) 20 7466 5000

/ George Beale

Vp@buchanan.uk.com www.buchanancomms.co.uk

The person responsible of the arrangement for the release of

this announcement on behalf of Vp plc is Anna Bielby, Chief

Executive.

CHAIRMAN'S STATEMENT

I am pleased to report solid Interim Results demonstrating a

resilient performance against a background of macro-economic

challenges.

Financial Performance

In the period to 30 September 2023, adjusted profit before tax,

amortisation, impairment of intangible assets and exceptional

items* ('Adjusted PBTAE') rose 1.9% to GBP21.9 million (H1 2023:

GBP21.5 million) on revenue 2.4% ahead at GBP190.9 million (H1

2023: GBP186.5 million). This achieved a net margin* of 11.5%,

consistent with the prior period. Statutory profit before tax was

GBP19.9 million (H1 2023: GBP17.9 million).

The Group's interest cost rose by GBP0.9 million compared with

the prior period, mainly due to increases in Sterling Overnight

Indexed Average ('SONIA'). We remain in a strong position with 70%

of the Group's period-end debt fixed at low rates into the medium

term. In November 2023, we successfully refinanced our revolving

credit facility of GBP90 million for an additional three years, on

similar terms and with an increase to the accordion from GBP20

million to GBP30 million.

Adjusted earnings per share pre-amortisation, impairment of

intangible assets and exceptional items* ('Adjusted Basic EPS')

fell 5.2% to 40.3 pence per share (H1 2023: 42.5 pence per share),

largely due to changes in the rate of corporation tax.

Return on Average Capital Employed* improved to 14.7% (H1 2023:

14.4%), demonstrating the high and sustainable quality of the

Group's earnings.

The Group continues to have a strong balance sheet:

-- We have a young, well-maintained fleet and continue to invest

with capex of GBP27.8 million (H1 2023: GBP33.8 million) in the

period. Around two thirds of this spend was either zero emissions

at point of use or represented the transition towards lower

emission technologies.

-- We have maintained our Days' Sales Outstanding (DSO) at 61,

despite a more challenging credit environment.

-- Net debt excluding lease liabilities* is GBP133.4 million,

which is GBP15.5 million lower than the comparative period.

Pre-IFRS 16 gearing is below 1.5x leaving the Group well placed to

exploit organic and M&A opportunities as they arise.

Reflecting these results and our confidence of the prospects of

the Group, the Board is declaring an interim dividend of 11.5 pence

per share (H1 2023: 11.0 pence per share) an increase of 4.5%,

payable on 10 January 2024 to shareholders registered at 8 December

2023. As previously stated, the dividend cover target is 2x over

the cycle and the interim dividend announced today continues the

Group's 30 year uninterrupted dividend track record.

ESG remains an important element of our strategy and we have

continued to make progress, including SBTi validation of our

Science Based Targets received in November. ESG is embedded into

our day to day operations and we have been working closely with our

suppliers and customers on initiatives such as the Vp Capture

system and TPA's carbon comparison model.

Our well-established Digital capabilities give us a platform to

improve both the customer experience and our operational processes.

We continue to develop new initiatives such as YourSolution Pro in

Groundforce, a self-service design solution adding value to our

customers. Further progress on the Group's Digital roadmap is

expected in the remainder of the year.

Business performance

Our key infrastructure markets including water (AMP7), rail

(CP6) and transmission were supportive, whilst elsewhere general

construction activity remained soft. Housebuilding fundamentals

are, in our view, positive over the medium term and current

activity is stable but marginally below prior year levels.

The announcement of the cancellation of HS2 beyond Birmingham

was not unexpected and will have little impact on immediate

business activity. We hope that activity from alternative rail

initiatives, replacing HS2, will provide opportunities for TPA UK

and Groundforce in particular.

During the period, we have seen the difficulties that previously

affected supply chains ease, however staff and skills shortages

have emerged as near universal themes across our businesses and

geographies. Higher interest rates have not only raised our

borrowing costs but have also adversely impacted the viability of

certain elements of our customer base, particularly at

sub-contractor level. Despite this, we have maintained DSO levels

in line with the comparative period.

In UK Forks, activity has settled at a lower level since the

beginning of the calendar year, largely down to subdued

housebuilding activity. In response, we have re-emphasised cost

management disciplines and re-sized the fleet to better align with

current demand. Supportive markets have enabled this business to

dispose of surplus fleet at a useful profit in the period and we

expect residual values to be maintained going forward. Pricing

improvements have been achieved and the business is now well

positioned to take full advantage of any future upturn in

demand.

Brandon Hire Station has suffered from the softness of the

general construction market and its performance is materially below

prior year levels. Now led by a new management team, targeted

revenue and cost initiatives will significantly improve

profitability in this highly operationally geared business into H2

and beyond. Brandon Hire Station remains the only tools and small

plant provider able to service its customer base from a truly

national footprint. The latent capacity of a young, well-maintained

rental fleet will enable the business to respond to an upturn in

demand without requiring significant additional capital

investment.

MEP suffered from a slightly slower start to the year with some

major project delays in London, but momentum is building and we

expect the business to deliver another good performance for the

year as a whole. Whilst well controlled, bad debt experience has

deteriorated as its sub-contractor customer base has experienced

cash flow challenges.

ESS has faced the same market challenges as elsewhere in the

Group, but significant opportunities exist to refocus and expand

the product offering on the back of a leaner cost base following

last year's successful restructuring exercise.

Groundforce is enjoying a period of strong trading with

particular contributions from water (AMP7) and other major

infrastructure projects. In Europe, Groundforce has performed well

benefitting from significant project activity.

Torrent Trackside enjoyed a solid first half ahead of prior year

levels, supported by CP6 workloads. Torrent is more a maintenance

rather than new-build oriented provider and the curtailment of the

HS2 programme will not therefore have a major negative impact and

indeed, if promised investment elsewhere in the network is

delivered, there may be an overall benefit to the business.

TPA UK has enjoyed an excellent first half with supportive

markets, nimble contract selection and effective cost management.

TPA in Europe has had a much-improved first half with all its major

markets performing strongly and a very positive forward order

book.

TR has enjoyed satisfactory trading across its various

geographies of Australia, New Zealand and wider South East

Asia.

Airpac has benefitted from supportive fundamentals in most

geographies and markets including exploration, distribution and

infrastructure maintenance and renewed activity on LNG projects.

Airpac has taken advantage of these opportunities with bold

investment timing and significant pricing improvements with the

Asia-Pacific region having been particularly strong. Growing

concerns over energy security and the increasing adoption of a more

pragmatic approach towards net zero will be supportive in the

medium term.

Board Changes

It is my pleasure to welcome Anna Bielby as the Group's new

Chief Executive, taking over from Neil Stothard who retired from

the Group at the end of September. Anna joined as Chief Financial

Officer in January 2023 and has already had an immediate impact in

her new role. We also look forward to welcoming Keith Winstanley as

our new CFO in January 2024.

Neil and I worked together at Vp for over 26 years. During this

time we confronted numerous challenges and oversaw huge change

within the business. On behalf of myself, the Board, all our

colleagues in the Group and our wider stakeholder base, I would

like to thank Neil most sincerely for his outstanding contribution

to the Group over this time and wish him every enjoyment of his

well-earned retirement.

Outlook

We have delivered a solid performance with sector leading

returns in the period reflecting the strength of our diverse

business offering. We are particularly pleased to have maintained

net margin and a strong return on average capital employed

demonstrating high quality of earnings in difficult market

conditions.

Having multiple sector exposure diversifies our revenue streams

and has contributed to the robust performance in the period, with

infrastructure demand remaining supportive. Whilst there may be

immediate challenges within general construction, I am confident

that the measures taken will start to be of near-term benefit. The

Group continues to produce strong operating cash flows and

maintains a solid financial base, having refinanced our RCF in

November on similar terms for a further three years. We are well

positioned for growth.

Vp has an excellent track record of successfully navigating

difficult markets and the diversity of our operations provides us

with a solid foundation from which to grow the business both

organically or via acquisitions. We remain confident in the Group's

ability to drive demand for our products and services whilst

embracing our customers' needs for sustainable and digital

solutions. There is a great sense of enthusiasm throughout the

Group, driven in part by a refreshed leadership team, which makes

us optimistic for the future and our ability to continue to deliver

an attractive level of returns for our shareholders. The Board

anticipates a full year performance broadly in line with market

expectations.

It is my pleasure to thank all our employees for their hard work

and commitment in contributing to these positive half year

results.

Jeremy Pilkington

Chairman

28 November 2023

* These measures are explained and reconciled in Note 14:

Alternative Performance Measures

Condensed Consolidated Income Statement

For the period ended 30 September 2023

Six months Restated* Full year

to Six months to

Note 30 Sept to 31 Mar 2023

2023 30 Sept GBP000

GBP000 2022

GBP000

----------- ------------ -------------

Revenue 3 190,920 186,487 371,519

Cost of sales (141,318) (139,615) (284,176)

-----------

Gross profit 49,602 46,872 87,343

Administrative expenses (22,977) (23,378) (44,763)

Impairment losses on trade

receivables (1,828) (1,654) (3,305)

----------- ------------ -------------

Operating profit before

amortisation, impairment

of intangible assets and

exceptional items 26,591 25,377 48,775

Amortisation and impairment

of intangible assets (1,794) (1,669) (4,490)

Exceptional items 4 - (1,868) (5,010)

----------- ------------ -------------

Operating profit 3 24,797 21,840 39,275

Net financial expense (4,901) (3,982) (8,569)

Profit before tax, amortisation,

impairment of intangible

assets and exceptional

items 21,690 21,395 40,206

Amortisation and impairment

of intangible assets (1,794) (1,669) (4,490)

Exceptional items 4 - (1,868) (5,010)

----------- ------------ -------------

Profit before tax 19,896 17,858 30,706

Taxation 5 (5,513) (4,281) (7,696)

----------- ------------ -------------

Profit after tax 14,383 13,577 23,010

Pence Pence Pence

Basic earnings per share 7 36.43 34.24 58.05

Diluted earnings per share 7 36.12 33.86 57.76

Dividend per share 8 11.50 11.00 37.50

*In accordance with IAS1, impairment losses on trade receivables

are required to be presented separately on the face of the Income

Statement. Previously such losses were presented within Cost of

Sales. This was corrected at 31 March 2023 and the comparative

restated accordingly.

Condensed Consolidated Statement of Comprehensive Income

For the period ended 30 September 2023

Six months Six months Full year

to to to

30 Sept 30 Sept 31 Mar

2023 2022 2023

GBP000 GBP000 GBP000

Profit for the period 14,383 13,577 23,010

Other comprehensive (expense)/income:

Items that will not be reclassified

to profit or loss

Remeasurements of defined benefit

pension scheme - - (319)

Tax on items taken to other

comprehensive income - - 5

Impact of tax rate change - - 58

Items that may be subsequently

reclassified to profit or loss

Foreign exchange translation

difference (772) 1,602 502

Other comprehensive (expense)/income (772) 1,602 246

Total comprehensive income

for the period 13,611 15,179 23,256

----------- ----------- ----------

Condensed Consolidated Statement of Changes in Equity

For the period ended 30 September 2023

Note Six months Six months Full year

to to to

30 Sept 2023 30 Sept 31 Mar 2023

2022

GBP000 GBP000 GBP000

Total comprehensive

income for the period 13,611 15,179 23,256

Tax movements to equity (12) (133) 62

Impact of tax rate change - - 16

Share option charge

in the period 463 675 580

Net movement relating

to shares held by Vp

Employee Trust (698) (535) (1,096)

Dividends to shareholders 8 (10,460) (10,112) (14,471)

Change in equity during

the period 2,904 5,074 8,347

Equity at the start

of the period 174,932 166,585 166,585

Equity at the end of

the period 177,836 171,659 174,932

------------- ----------- ------------

There were no movements in issued share capital, the capital

redemption reserve or share premium in the reported periods.

Condensed Consolidated Balance Sheet

At 30 September 2023

Note 30 Sept 31 Mar 30 Sept

2023 2023 2022

GBP000 GBP000 GBP000

Non-current assets

Property, plant and equipment 6 250,890 252,385 254,984

Goodwill 44,584 44,649 44,997

Intangible assets 12,386 13,099 15,834

Right of use assets 58,883 54,637 52,822

Employee benefits 2,240 2,300 2,670

------------ ------------ ------------

Total non-current assets 368,983 367,070 371,307

------------ ------------ ------------

Current assets

Inventories 9,321 8,915 8,657

Trade and other receivables 83,755 81,513 86,903

Cash and cash equivalents 9 9,214 11,140 9,428

Income tax receivable 496 736 -

Total current assets 102,786 102,304 104,988

------------ ------------ ------------

Total assets 471,769 469,374 476,295

------------ ------------ ------------

Current liabilities

Interest bearing loans

and borrowings 9 (49,815) - -

Lease liabilities (16,056) (14,622) (14,172)

Trade and other payables (70,135) (72,184) (74,380)

Income tax payable - - (854)

------------ ------------ ------------

Total current liabilities (136,006) (86,806) (89,406)

------------ ------------ ------------

Non-current liabilities

Interest bearing loans

and borrowings 9 (92,786) (145,508) (158,370)

Lease liabilities (46,570) (43,896) (42,053)

Provisions (1,663) (1,612) (895)

Deferred tax liabilities (16,908) (16,620) (13,912)

------------ ------------ ------------

Total non-current liabilities (157,927) (207,636) (215,230)

------------ ------------ ------------

Total liabilities (293,933) (294,442) (304,636)

------------ ------------ ------------

Net assets 177,836 174,932 171,659

------------ ------------ ------------

Equity

Issued share capital 2,008 2,008 2,008

Capital redemption reserve 301 301 301

Share premium 16,192 16,192 16,192

Foreign currency translation

reserve (1,290) (518) 577

Retained earnings 160,625 156,949 152,581

------------ ------------ --------------

Total equity 177,836 174,932 171,659

------------ ------------ --------------

Condensed Consolidated Statement of Cash Flows

For the period ended 30 September 2023

Note Six months Six months Full year

to to to

30 Sept 30 Sept 31 Mar

2023 2022 2023

GBP000 GBP000 GBP000

Cash flows from operating

activities

Profit before taxation 19,896 17,858 30,706

Adjustment for:

Share based payment charges 463 675 580

Depreciation 6 22,664 23,831 46,853

Depreciation of right of use

assets 8,367 8,098 16,305

Amortisation and impairment

of intangibles 1,794 1,669 4,490

Net financial expense 4,901 3,982 8,569

Profit on sale of property,

plant and equipment (4,350) (5,041) (9,174)

Release of arrangement fees 93 149 287

----------- ----------- -----------

Operating cash flow before

changes in working capital

and provisions 53,828 51,221 98,616

Increase in inventories (406) (701) (959)

Increase in trade and other

receivables (2,242) (10,846) (5,452)

Increase/(decrease) in trade

and other payables 535 (8,034) (11,979)

----------- ----------- -----------

Cash generated from operations 51,715 31,640 80,226

Interest paid (3,268) (2,462) (5,413)

Interest element of lease

liability payments (1,634) (1,482) (3,038)

Interest received 16 4 32

Income tax paid (4,999) (3,465) (5,496)

----------- ----------- -----------

Net cash flows from operating

activities 41,830 24,235 66,311

Cash flows from investing

activities

Proceeds from sale of property,

plant and equipment 12,845 12,202 24,855

Purchase of property, plant

and equipment (33,840) (36,013) (63,312)

Purchase of intangible assets (176) - -

Net cash flows used in investing

activities (21,171) (23,811) (38,457)

Cash flows from financing

activities

Purchase of own shares by

Employee Trust (698) (535) (1,096)

Repayment of loans (17,000) (10,000) (29,000)

New loans 14,000 24,000 30,000

Capital element of lease liability

payments (8,505) (8,188) (15,921)

Dividends paid 8 (10,460) (10,112) (14,471)

----------- ----------- -----------

Net cash flows used in financing

activities (22,663) (4,835) (30,488)

Net decrease in cash and cash

equivalents (2,004) (4,411) (2,634)

Effect of exchange rate fluctuations

on cash held 78 222 157

Cash and cash equivalents

at beginning of period 11,140 13,617 13,617

----------- ----------- -----------

Cash and cash equivalents

at end of period 9 9,214 9,428 11,140

----------- ----------- -----------

Notes to the Condensed Financial Statements

1. Basis of Preparation

Vp plc (the "Company") is a company limited by shares,

incorporated and domiciled in the United Kingdom. Its registered

office and principal place of business is Central House, Beckwith

Knowle, Otley Road, Harrogate, North Yorkshire, HG3 1UD. Its shares

are listed on the London Stock Exchange. The Condensed Consolidated

Interim Financial Statements of the Company for the half year ended

30 September 2023 consolidate the financial information of the

Company and its subsidiaries (together referred to as the

"Group").

The condensed interim financial statements have been prepared

using accounting policies set out in the Annual Report and Accounts

2023. They are unaudited and have not been reviewed by the

Company's auditor. This report has been prepared in accordance with

the UK-adopted International Accounting Standard 34 'Interim

Financial Reporting' and the Disclosure Guidance and Transparency

Rules sourcebook of the United Kingdom's Financial Conduct

Authority.

The results for the year ended 31 March 2023 and the

Consolidated Balance Sheet as at that date are abridged from the

Group's Annual Report and Accounts 2023 which have been delivered

to the Registrar of Companies. The auditor's report on those

accounts included a material uncertainty related to going concern

as the Group's revolving credit facility had an expiry date within

the going concern assessment period. The RCF has since been

refinanced on similar terms and extended to November 2026.

The condensed interim financial statements do not constitute

statutory accounts within the meaning of Section 434 of the

Companies Act 2006.

The interim announcement was approved by the Board of Directors

on 28 November 2023.

The preparation of financial statements requires management to

make judgements, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expense. Actual results may

differ from these estimates. In preparing these condensed

consolidated interim financial statements, the significant

judgements made by management in applying the Group's accounting

policies and key sources of estimation uncertainty were the same as

those that applied to the consolidated financial statements for the

year ended 31 March 2023.

The Group continues to be in a healthy financial position with

total banking facilities at the period end of GBP190.5 million,

including an overdraft facility. Since the year end net debt

excluding lease liabilities has reduced by GBP1.0 million to

GBP133.4 million, which is GBP15.5 million lower than 30 September

2022. The Board has evaluated the banking facilities and the

associated covenants on the basis of current forecasts, taking into

account the current economic climate. These forecasts have been

subjected to sensitivity analysis, involving the flexing of key

assumptions reflecting severe but plausible scenarios, including a

downturn in economic activity. Based on this assessment, the

Directors have a reasonable expectation that the Group will be able

to continue in operation and meet its liabilities as they fall due.

Having reassessed the principal risks the Directors consider it

appropriate to adopt the going concern basis of accounting in

preparing the interim financial information.

2. Risks and Uncertainties

The principal risks and uncertainties facing the Group and the

ways in which they are mitigated are described on pages 39 to 42 of

the 31 March 2023 Annual Report and Accounts. The principal risks

and uncertainties are market, competition, investment / fleet

management, people, safety, financial, contractual, legal and

regulatory requirements, climate change and IT resilience which

remain the same for this interim financial report.

3. Summarised Segmental Analysis

Revenue Operating Profit Before

Amortisation, Impairment

of Intangible Assets

and Exceptional Items

Sept Sept Mar Sept Sept Mar

2023 2022 2023 2023 2022 2023

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

UK 171,276 166,932 333,453 24,196 23,820 45,564

International 19,644 19,555 38,066 2,395 1,557 3,211

190,920 186,487 371,519 26,591 25,377 48,775

----------- ----------- -------- -------- --------- ---------

Amortisation and impairment of intangible

assets (1,794) (1,669) (4,490)

Exceptional items - (1,868) (5,010)

-------- --------- ---------

Operating Profit 24,797 21,840 39,275

-------- --------- ---------

Assets Liabilities

Sept Mar Sept Sept Mar Sept

2023 2023 2022 2023 2023 2022

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

UK 430,108 427,056 433,870 279,754 279,951 292,261

International 41,661 42,318 42,425 14,179 14,491 12,375

471,769 469,374 476,295 293,933 294,442 304,636

-------- -------- -------- -------- -------- --------

Net Assets

Sept 2023 Mar 2023 Sept 2022

GBP000 GBP000 GBP000

UK 150,354 147,105 141,609

International 27,482 27,827 30,050

177,836 174,932 171,659

---------- --------- ----------

Below summarises the disaggregation of revenue from contracts

with customers from the total revenue disclosed in the Condensed

Consolidated Income Statement:

Sept 2023 Sept 2022 Mar 2023

GBP000 GBP000 GBP000

Equipment hire 143,297 140,889 275,257

Services 32,666 31,234 65,045

Sales of goods 14,957 14,364 31,217

Total revenue 190,920 186,487 371,519

-------------------- -------------------- -------------------

4. Exceptional Items

During the half year to 30 September 2023, the Group incurred no

exceptional costs. In H1 2023, the Group incurred GBP1.9 million of

exceptional costs in relation to formal sale process costs and

restructuring costs.

Sept 2023 Sept 2022 Mar 2023

GBP000 GBP000 GBP000

Formal sales process - 1,837 1,687

Restructuring costs - 31 3,323

Total Exceptional Items - 1,868 5,010

--------------------- -------------------- -------------------

5. Income Tax

The effective tax rate is 27.7% in the period to 30 September

2023 (H1 2023: 24.0%). The effective rate for the period reflects

the current standard tax rate of 25% (H1 2023: 19%), as adjusted

for estimated permanent differences for tax purposes offset by

gains covered by exemptions. The rate includes the effect of higher

statutory tax rates levied in Australia and Germany.

6. Property, Plant and Equipment

Sept 2023 Mar 2023 Sept 2022

GBP000 GBP000 GBP000

Opening carrying amount 252,385 247,526 247,526

Additions 31,327 66,860 37,151

Depreciation (22,664) (46,853) (23,831)

Disposals (9,426) (15,680) (7,158)

Effect of movements in

exchange rates (732) 532 1,296

-------------------- ------------------- --------------------

Closing carrying amount 250,890 252,385 254,984

-------------------- ------------------- --------------------

The value of capital commitments at 30 September 2023 was

GBP10,313,000 (31 March 2023 GBP10,715,000).

7. Earnings Per Share

Earnings per share have been calculated on 39,482,946 shares (H1

2023: 39,651,301 shares) being the weighted average number of

shares in issue during the period excluding those shares held by Vp

Employee Trust. Diluted earnings per share have been calculated on

39,820,019 shares (H1 2023: 40,099,143 shares) adjusted to reflect

conversion of all potentially dilutive ordinary shares. The

calculation of diluted earnings per share does not assume

conversion, exercise, or other issue of potential ordinary shares

that would have an antidilutive effect on earnings per share.

Basic earnings per share before the amortisation of intangibles

and exceptional items was 39.83 pence (H1 2023: 42.34 pence) and

was based on an after-tax add back of GBP1,345,000 (H1 2023:

GBP3,213,000) in respect of the amortisation of intangibles and

exceptional items. Diluted earnings per share before amortisation

of intangibles and exceptional items was 39.50 pence (H1 2023:

41.87 pence).

8. Dividends

The Directors have declared an interim dividend of 11.50 pence

per share (H1 2023: 11.00 pence) payable on 10 January 2024 to

shareholders on the register at 8 December 2023. The dividend

declared will absorb an estimated GBP4.537 million (H1 2023:

GBP4.359 million) of shareholders' funds.

The cost of dividends in the Statement of Changes in Equity is

after adjustments for the interim and final dividends waived by the

Vp Employee Trust in relation to the shares it holds for the

Group's share option schemes.

9. Analysis of Net Debt

As at Cash Non-cash As at

1 Apr Flow Movements 30 Sep

2023 2023

GBP000 GBP000 GBP000 GBP000

Cash and cash equivalents 11,140 (1,926) - 9,214

Secured loans (146,000) 3,000 - (143,000)

Arrangement Fees 492 - (93) 399

---------- -------- ---------- ----------

Net debt excluding lease

liabilities (134,368) 1,074 (93) (133,387)

Lease liabilities (58,518) 10,139 (14,247) (62,626)

----------

Net debt including lease

liabilities (192,886) 11,213 (14,340) (196,013)

---------- -------- ---------- ----------

The Group has two private placements with PGIM Inc. for GBP65

million (drawn down in January 2020) and GBP28 million (drawn down

in April 2021). The Group also has committed revolving credit

facilities of GBP90 million which was refinanced in November 2023.

The Group also has overdraft facilities of GBP7.5 million, leading

to total available facilities of GBP190.5 million.

10. Related Party Transactions

Transactions between Group Companies, which are related parties,

have been eliminated on consolidation and therefore do not require

disclosure. The Group has not entered into any other related party

transactions in the period which require disclosure in this interim

statement.

11. Contingent Liabilities

In an international group a variety of claims arise from time to

time in the normal course of business. Such claims may arise due to

actions being taken against group companies as a result of

investigations by fiscal authorities or under regulatory

requirements. Provision has been made in these consolidated

financial statements against any claims which the directors

consider are likely to result in significant liabilities.

12. Post balance sheet event

On 23 November 2023, the Group refinanced its committed

revolving credit facility with a new three year, GBP90 million

facility. The revolving credit facility agreement also includes a

GBP30 million uncommitted accordion facility. Financial covenants

associated with the revolving credit facility remain unchanged from

the previous facility.

13. Forward Looking Statements

The Chairman's Statement includes statements that are forward

looking in nature. Forward looking statements involve known and

unknown risks, assumptions, uncertainties and other factors which

may cause the actual results, performance or achievements of the

Group to be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements. Statements in respect of the Group's

performance in the year to date are based upon unaudited management

accounts for the period 1 April 2023 to 30 September 2023. Nothing

in this announcement should be construed as a profit forecast.

Except as required by the Listing Rules and applicable law, the

Company undertakes no obligation to update, review or change any

forward looking statements to reflect events or developments

occurring after the date of this report.

14. Alternative Performance Measures

The Board monitors performance principally through adjusted and

like-for-like performance measures. Adjusted profit and earnings

per share measures exclude certain items including the impact of

IFRS16, amortisation of intangible assets, goodwill impairment

charges and exceptional items.

The Board believes that such alternative measures are useful as

they exclude one-off (amortisation, impairment of intangible assets

and exceptional items) and non-cash (amortisation of intangible

assets) items which are normally disregarded by investors, analysts

and brokers in gaining a clearer understanding of the underlying

performance of the Group from one year to the next when making

investment and other decisions. Equally, IFRS16 is excluded from

measures used by these same stakeholders and so is removed from

certain APMs.

The key measures used as APMs are reconciled below:

Sep 2023 Sep 2022 Mar 2023

GBP000 GBP000 GBP000

Profit before tax as per Income Statement 19,896 17,858 30,706

Adjustment to remove IFRS 16 impact 188 62 283

--------- --------- ---------

Adjusted profit before tax APM 20,084 17,920 30,989

Amortisation and impairment of intangible

assets 1,794 1,669 4,490

Exceptional items - 1,868 5,010

--------- --------- ---------

Adjusted profit before tax, amortisation,

impairment of intangible assets and

exceptional items APM (PBTAE) 21,878 21,457 40,489

Interest (excluding interest on lease

liabilities) 3,271 2,503 5,542

--------- --------- ---------

Adjusted operating profit before tax,

amortisation, impairment of intangible

assets and exceptional items APM 25,149 23,960 46,031

Depreciation (excluding depreciation

of right of use of assets) 22,664 23,831 46,853

--------- --------- ---------

Adjusted EBITDA APM 47,813 47,791 92,884

--------- --------- ---------

Net margin of 11.5% is calculated by dividing adjusted profit

before tax, amortisation, impairment of intangible assets and

exceptional items by revenue.

Sep 2023 Sep 2022 Mar 2023

pence pence pence

Basic earnings per share 36.4 34.2 58.1

Impact of amortisation, impairment of

intangible assets and exceptional items

after tax 3.4 8.1 20.3

Impact of IFRS 16 0.5 0.2 0.6

--------- --------- ---------

Adjusted basic earnings per share APM 40.3 42.5 79.0

--------- --------- ---------

14. Alternative Performance Measures (continued)

Sep 2023 Sep 2022 Mar 2023

GBP000 GBP000 GBP000

Net debt including lease liabilities 196,013 205,167 192,886

Lease liabilities (62,626) (56,225) (58,518)

--------- --------- ---------

Net debt excluding lease liabilities

APM 133,387 148,942 134,368

--------- --------- ---------

Return on average capital employed (ROACE) is based on adjusted

operating profit before tax, amortisation, impairment of intangible

assets and exceptional items as defined above divided by average

capital employed on a monthly basis using the management accounts

excluding IFRS16.

Responsibility statement of the directors in respect of the

half-yearly financial report

We confirm that to the best of our knowledge:

-- the condensed consolidated set of interim financial

statements has been prepared in accordance with UK-adopted IAS 34

Interim Financial Reporting;

-- the interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

By order of the Board

28 November 2023

The Board

The Directors who served during the six months to 30 September

2023 were:

Jeremy Pilkington (Chairman)

Neil Stothard (Chief Executive, resigned 30 September 2023)

Anna Bielby (Chief Executive, previously Chief Financial Officer

until 1 September 2023)

Phil White (Non-Executive Director)

Stuart Watson (Non-Executive Director)

Mark Bottomley (Non-Executive Director)

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UBSKROSUAUAA

(END) Dow Jones Newswires

November 28, 2023 02:00 ET (07:00 GMT)

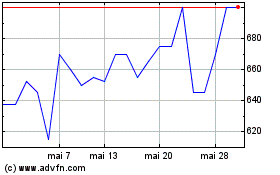

Vp (LSE:VP.)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Vp (LSE:VP.)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024