TIDMWSP

RNS Number : 8817T

Wynnstay Properties PLC

22 March 2023

WYNNSTAY PROPERTIES PLC

("Wynnstay" or the "Company")

Board Changes

Wynnstay Property Plc (AIM:WSP) is pleased to announce that,

following an external recruitment process, Hugh Ford and Ross Owen

have been appointed to the Board as non-executive directors with

effect from 26 March 2023.

Hugh Ford (56) qualified and practised as a solicitor with

Freshfields both in London and abroad. In 1996, he joined the legal

department of British Airways plc to broaden his commercial

experience before moving to Virgin Atlantic in 2001. He was

appointed general counsel of the listed company Intu Properties Plc

("Intu") in 2003 and was also appointed group treasurer of Intu in

2015. He was not a director of Intu, although he served as a

director of various group companies as part of his role. Intu was

put into administration in June 2020, following which he worked

with the administrators on implementing the administration. He is a

non-executive director of Hertfordshire Catering Ltd and a trustee

and director of Beechwood Park School.

Ross Owen (58) is a chartered surveyor. After qualifying at

Matthews & Goodman and working for Hillier Parker, he joined

Cluttons in 1997, where he was an equity partner for twelve years

and became head of investment and fund management. On his

retirement from Cluttons in 2017, he served for over three years as

chairman of Lambert Smith Hampton Investment Management to which he

remains a consultant. He is a member of the property investment

committees of University College, Oxford, The Royal Borough of

Kensington and Chelsea pension fund and John Lyon's Charity. He is

also a trustee and director of the Cowes Town Waterfront Trust,

which owns the principal yachting marina in Cowes, Isle of Wight

and a portfolio of commercial property investments .

The AIM Rules Schedule Two paragraph (g) disclosures relating to

Hugh Ford and Ross Owen are set out at the end of the

announcement.

The Company also announces that Charles Delevingne has decided

to retire from the Board and will cease to be a director at the end

of the Company's financial year on 25 March 2023.

Philip Collins, Chairman, comments:

"Our external recruitment process attracted keen interest from a

good range of qualified candidates. I am delighted that Hugh and

Ross have accepted invitations to join the Board. Their

complementary backgrounds, experience and skills in business and

commercial property will bring fresh insight and perspective to our

Board deliberations on the evolution of Wynnstay's portfolio and

the Company's future direction.

I am sure that I speak on behalf of all shareholders in thanking

Charles Delevingne for his contribution to Wynnstay's success over

the past twenty years during which his wisdom and guidance have

been invaluable in implementing the major changes we have made to

the portfolio which have underpinned delivery of our successful

results for shareholders."

For further information:

Wynnstay Properties plc

Philip Collins (Chairman) Tel: 020 7554 8766

WH Ireland Limited (Nomad &

Broker) Tel: 020 7220 1666

Hugh Morgan, Chris Hardie, Sarah

Mather

LEI number: 2138006MASI24JYW5076

For more information on Wynnstay visit:

www.wynnstayproperties.co.uk

The information communicated within this announcement is deemed

to constitute inside information for the purposes of the Market

Abuse Regulation (EU) No. 596/2014 as it forms part of UK domestic

law by virtue of the European Union (Withdrawal) Act 2018. Upon the

publication of this announcement, this information is considered to

be in the public domain.

The following information is disclosed pursuant to Schedule Two

paragraph (g) of the AIM Rules for Companies.

Hugh Michael Ford

Hugh Michael Ford, age 56, is or has during the last five years

been a director or partner of the following companies and

partnerships:

Current directorships/partnerships (other than Intu group

companies)

Beechwood Park School Ltd

Hertfordshire Catering Ltd

Past directorships/partnerships in the last five years (other

than Intu group companies )

N/A

Intu group companies

Hugh Ford is, or has during the last five years, been a director

of certain companies within the Intu group of companies listed

below, some of which have been the subject of receiverships,

liquidations, administrations or other insolvency proceedings

arising from the placing into administration of Intu Properties plc

in June 2020. The companies where he was a director at the time of,

or within the twelve months preceding, such events are designated

in the list with the mark # followed by a reference number for the

details of the events provided below the list.

He was not a director of Intu Properties plc, the listed holding

company, although he served as a director of various group

companies as part of his role within the group. The administrators

are in the process of winding up the group. He worked with the

administrators after June 2020 and, as is common practice in these

situations, he remains a director of certain Intu group companies

in order to assist with implementing their administration,

transferring assets to creditors and preparing for the eventual

winding down of the group.

All the companies are, or were prior to dissolution,

incorporated in England and Wales save where otherwise stated.

Current directorships (Intu group companies)

Broadmarsh Retail General Partner Ltd # (1)

Intu IP Limited # (2)

Intu (Jersey) 2 Ltd # (3) (incorporated in Jersey)

Intu Management Services Ltd # (4)

Intu Shopping Centres Plc # (5)

Liberty International Group Treasury Ltd # (6)

Past directorships (Intu group companies)

Barton Square Holdco Ltd # (7) Intu MH Participations Ltd

Barton Square Investments Ltd Intu MH Phase 1 Ltd

Belside Ltd (incorporated in Intu MH Properties Ltd

Jersey) Intu MH Waterfront Ltd

Braehead Glasgow Ltd Intu MHDS Holdco Ltd

Braehead Park Estates Ltd Intu Milton Keynes Ltd

Braehead Park Investments Ltd Intu Nottingham Investments Ltd

Broadway Retail Leisure Ltd # # (1)

(8) Intu Payments Ltd #(9)

Cable Plaza Ltd Intu Property Management Ltd

Castle & Pedmore Houses Ltd Intu Shelfco 3 Plc

Chapelfield LP Ltd Intu Spain Ltd

Chapelfield Property Management Intu The Hayes Ltd

Ltd Intu Trafford Centre Ltd

Crossmane Ltd Intu Watford Holdco Ltd

CSC Uxbridge Ltd Intu Watford Property Management

Curley Ltd (incorporated in Jersey) Ltd

Intu (SGS) Topco Ltd Lakeside Centre Ltd

Intu Braehead Property Management Liberty International Holdings

Ltd Ltd # (10)

Intu Cardiff Ltd Merry Hill Finance DAC # (11)

Intu Centaurus Retail Ltd (incorporated in the Republic

Intu Chapelfield Ltd of Ireland)

Intu Debenture Plc Merry Hill Management Services

Intu Experiences Ltd Ltd

Intu Finance MH Ltd Merry Hill Services Ltd

Intu India (Direct) Ltd Merry Hill Trading Ltd

Intu India (Portfolio) Ltd Metrocentre Parent Company Ltd

Intu Investments Ltd Metropolitan Uxbridge Ltd (formerly

Intu Lakeside Hotel Ltd Intu Uxbridge Ltd) # (12) (incorporated

Intu Lakeside Property Management in Jersey)

Ltd SGS 2020 Ltd

Intu Metrocentre Property Management SGS Finco Ltd

Ltd SGS Holdco Ltd

Intu Metrocentre Topco Ltd The Trafford Centre Ltd

Intu MH Acquisitions Ltd Trafford Centre Group (UK) Ltd

Intu MH Group Ltd Trafford Palazzo Ltd

Intu MH Holdings Ltd VCP (GP) Ltd

Intu MH Investments Ltd VCP Nominees No1 Ltd

Intu MH Leaseholds Ltd VCP Nominees No2 Ltd

Victoria Centre Nottingham Ltd

Watford Centre Ltd

Whitesun Ltd

WRP Management Ltd

(1) On 15 April 2020, Mr Ford was appointed as a Director of

Broadmarsh Retail General Partner Ltd ("BRGP"). Mr Ford was also a

director of Intu Nottingham Investments Ltd ("INIL") from 5

December 2011 until 15 April 2020. BRGP and INIL were, respectively

the general partner and limited partner of The Broadmarsh Retail

Limited Partnership. BRGP and INIL were both put into compulsory

liquidation with the Official Receiver at the instigation of their

directors on 03 July 2020, along with the partnership and the other

companies associated with it. At that time, the partnership (and

BRGP as its general partner with unlimited liability) had in excess

of GBP11.8m secured creditors and GBP4.5m unsecured creditors and

INIL had in excess of GBP99m unsecured creditors. The companies

remain in liquidation and Mr Ford has received no further

information from the liquidator, and is not aware that a

liquidator's report has been filed to date, and is thus unaware of

the total amount outstanding to creditors.

(2) On 13 March 2013, Mr Ford was appointed as a Director of

Intu IP Ltd. The company went into members' voluntary liquidation

at the instigation of its shareholders on 17 November 2021,

following a declaration of solvency and recommendation from the

directors. The company remains in liquidation and the latest

progress report filed by the liquidators dated 11 January 2023

confirms that there are no known creditors of the company,

realisation of the company's assets is ongoing and the liquidators

anticipate a distribution to members in due course.

(3) On 15 April 2020, Mr Ford was appointed as a Director of

Intu (Jersey) 2 Ltd (a company incorporated in Jersey) . The

company went into a creditors' winding up on 11 August 2020 at the

instigation of its shareholder following a recommendation from the

directors, with an estimated GBP377,570,749 of outstanding

creditors. The company remains in liquidation and Mr Ford has

received no further information from the liquidators, nor seen any

further statement of affairs published, and is thus unaware of the

total amount outstanding to creditors.

(4) On 03 November 2011, Mr Ford was appointed as a Director of

Intu Management Services Ltd . The company went into administration

at the instigation of its directors on 26 June 2020. The company

remains in administration with GBP152,544 of preferred creditors

and GBP6,155,000 of unsecured creditors, according to the

administrator's progress report dated 23 January 2023. The report

states that the administrators' latest indicative estimates are for

preferred creditors to be paid in full and that unsecured creditors

may ultimately receive a return of 6.9 pence in the pound.

(5) On 03 November 2011, Mr Ford was appointed as a Director of

Intu Shopping Centres Plc . The company went into administration at

the instigation of its directors on 26 June 2020. Receivers were

also appointed on 18 November 2020 in respect of charges over

shares in certain subsidiaries of the company at the instigation of

creditors of those subsidiaries. The company remains in

administration with GBP31,597,000 of unsecured creditors, according

to the administrator's progress report dated 23 January 2023. The

report states that unsecured creditors have received an interim

distribution of 50 pence in the pound and the administrators'

latest indicative estimate is that unsecured creditors may

ultimately receive a return of up to 100 pence in the pound. The

company's liability to its secured creditors is limited to the

shares of its subsidiaries which are the subject of the

security.

(6) On 12 March 2013, Mr Ford was appointed as a Director of

Liberty International Group Treasury Ltd . The company went into

administration at the instigation of its directors on 26 June 2020.

The company remains in administration with GBP2,925,971,000 of

unsecured creditors, according to the administrator's progress

report dated 23 January 2023. The report states that creditors have

received an interim distribution of 1.3 pence in the pound and the

administrators' latest indicative estimate is for unsecured

creditors to receive a return of up to 2.8 pence in the pound.

After the administration began, receivers were appointed at the

instigation of creditors of other Intu group companies in respect

of charges over certain assets of the company but all have now

ceased to act.

(7) Mr Ford was a Director of Barton Square Holdco Ltd from 6

September 2013 until 15 April 2020 . Receivers were appointed on 8

April 2021 in respect of a charge over shares in a subsidiary of

the company at the instigation of creditors of that subsidiary. The

receivers ceased to act on 28 October 2021 and the company was

dissolved through voluntary strike off on 1 March 2022.

(8) Mr Ford was a Director of Broadway Retail Leisure Ltd from 3

November 2011 until 15 April 2020 . The company went into creditors

voluntary liquidation at the instigation of its creditors on 25

November 2020. The company remains in liquidation with

GBP17,234,747 of unsecured creditors, according to the

administrator's progress report dated 20 January 2023. The report

states that an interim dividend of 2.24 pence in the pound was

declared on 1 September 2022 and paid thereafter and the

administrators' latest indicative estimate is that unsecured

creditors may receive a small final dividend but they have yet to

determine the amount.

(9) Mr Ford was a Director of Intu Payments Ltd from 3 November

2011 until 15 April 2020 . Between 9 December 2020 and 4 August

2021, receivers were appointed at the instigation of creditors of

other Intu group companies in respect of charges over certain

assets of the company but all have now ceased to act. The company

went into creditors voluntary liquidation at the instigation of its

creditors on 26 October 2021. The company remains in liquidation

with GBP2,906,830 of unsecured creditors, according to the

administrator's progress report dated 14 December 2022. The report

states that the administrators are not aware of any secured

creditors and anticipate unsecured creditors will receive a

dividend but the quantum and timing is not yet known.

(10) Mr Ford was a Director of Liberty International Holdings

Ltd from 20 March 2014 until 15 April 2020 . The company went into

administration at the instigation of its directors on 26 June 2020.

The company remains in administration with GBP111,391,000 of

unsecured creditors, according to the administrator's progress

report dated 23 January 2023. The report states that creditors have

received an interim distribution of 4.4 pence in the pound and the

administrators' latest indicative estimate is that unsecured

creditors may ultimately receive a total return of up to 15.1 pence

in the pound. After the administration began, receivers were also

appointed in respect of charges over shares in certain subsidiaries

of the company at the instigation of creditors of those

subsidiaries but all have now ceased to act. The administrators do

not anticipate any distributions to secured creditors.

(11) On 24 April 2015, Mr Ford was appointed as a Director of

Merry Hill Finance DAC (incorporated in the Republic of Ireland).

The company went into members' voluntary liquidation at the

instigation of its shareholders on 18 December 2017, following a

declaration of solvency and recommendation from the directors. The

company was dissolved on 16 December 2021 following distribution of

its remaining assets to members.

(12) Mr Ford was a Director of Metropolitan Uxbridge Limited

(previously Intu Uxbridge Limited, incorporated in Jersey) from 3

November 2011 until 20 June 2014 . The company owned the Intu

Uxbridge shopping centre and Mr Ford resigned following the sale of

the company to a joint venture Jersey unit trust in which the Intu

group retained a 20% interest. The company subsequently went into

liquidation as part of a simplification of the holding structure

for the shopping centre asset by the joint venture partners. Mr

Ford does not have access to information regarding the liquidation

but is aware that the company was dissolved on 16 December

2015.

Ross Peter Owen

Ross Peter Owen, age 58, is or has during the last five years

been a director or partner of the following companies and

partnerships:

Current directorships/partnerships

Cityblock (Reading) Ltd

Cityblock (Gillows) Ltd

Cityblock (Lancaster 6) Ltd

CLLP Realisations LLP (formerly Cluttons LLP)*

Cowes Town Waterfront Trust Ltd

Past directorships/partnerships in the last five years

Cluttons Investment Management (UK) LLP

Kingston Upon Thames Investment Ltd

Lambert Smith Hampton Investment Management Ltd

*Mr Owen is an LLP Member of CLLP Realisations LLP, which

was put into administration in April 2017 and subsequently

moved to a creditors voluntary liquidation in January

2018. The process is still ongoing with the latest statement

of receipts and payments, filed by the liquidators for

the period 12 January 2022 to 11 January 2023. This reports

that the agreed claims total GBP119.6m, which predominantly

relates to the Pension Protection Fund in respect of

the company's pension deficit. Since 28 April 2017 there

have been GBP7.9 million of assets realised and GBP0.4k

of costs incurred, with interim distributions declared

and paid to unsecured creditors totalling GBP7.3m, and

a cash balance held of GBP0.2m. Any final distribution

to unsecured creditors is likely to be modest and its

timing is uncertain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

BOANKBBPKBKDONB

(END) Dow Jones Newswires

March 22, 2023 06:59 ET (10:59 GMT)

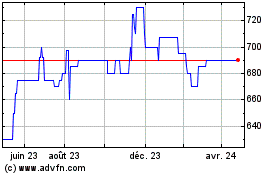

Wynnstay Properties (LSE:WSP)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

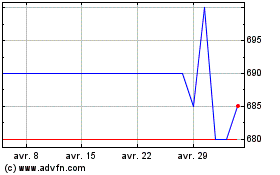

Wynnstay Properties (LSE:WSP)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024