UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2024 |

ARCA biopharma, Inc.

(Exact

name of Registrant as Specified in Its Charter)

| Delaware |

|

000-22873 |

|

36-3855489 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

10170 Church Ranch Way

Suite 100 |

|

| Westminster, Colorado |

|

80021 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| Registrant’s

Telephone Number, Including Area Code: (720) 940-2100 |

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☒ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

Title

of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common |

|

ABIO |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

August 14, 2024, ARCA biopharma, Inc., a Delaware corporation (“ARCA”), entered into an asset purchase agreement (the

“Asset Purchase Agreement”) with Genvara Biopharma, Inc., a Colorado corporation (the “Buyer”),

pursuant to which the Buyer has agreed to purchase, assume and accept from ARCA all of the rights, title and interest in, to and under

the assets, interests and liabilities exclusively related to the business of ARCA as conducted at any time prior to August 14, 2024,

solely related to ARCA’s legacy Gencaro (bucindolol hydrochloride) program for the treatment of atrial fibrillation, and rNAPc2(AB201)

for the treatment of COVID-19 (excluding certain excluded assets) (the “ARCA Legacy Assets”) to Buyer in exchange

for a one-time cash payment of $300,000 (the “Transaction”). The closing of the Transaction will be automatically

effective as of immediately following the consummation of the First Merger (as defined below) (the “Closing”) pursuant

to that certain Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) dated as of April 3, 2024,

among ARCA, Atlas Merger Sub Corp., a Delaware corporation and a wholly-owned subsidiary of ARCA (“Merger Sub I”),

Atlas Merger Sub II LLC, a Delaware limited liability company and a wholly-owned subsidiary of ARCA (“Merger Sub II”)

and Oruka Therapeutics, Inc., a Delaware corporation (“Oruka”), pursuant to which, among other things, Merger Sub

I will merge with and into Oruka, with Oruka surviving the merger as the surviving corporation (the “First Merger”)

and as part of the same overall transaction, the surviving corporation in the First Merger will merge with and into Merger Sub II with

Merger Sub II continuing as a wholly owned subsidiary of ARCA (the “Second Merger” and together with the First Merger,

the “Merger”).

The

Asset Purchase Agreement contains representations, warranties and covenants of the parties as further described therein.

Dr.

Michael Bristow, the former President and Chief Executive Officer and a former member of the board of directors of ARCA, is the majority

stockholder, founder and president and chief executive officer of the Buyer.

The

foregoing description of the Asset Purchase Agreement does not purport to be complete and is subject to, and qualified in its entirety

by, the full text of the Asset Purchase Agreement, a copy of which is attached as Exhibit 10.1 to this report and is incorporated by

reference herein.

Forward-Looking

Statements

This

Current Report on Form 8-K and the exhibits filed or furnished herewith contain forward-looking statements (including

within the meaning of Section 21E of the Exchange Act and Section 27A of the Securities Act) concerning ARCA, Oruka, the proposed

transactions and other matters. These forward-looking statements include express or implied statements relating to the structure, timing

and completion of the proposed Merger and the Transaction; the combined company’s listing on Nasdaq after closing of the proposed

Merger; expectations regarding the ownership structure of the combined company; the expected executive officers and directors of the

combined company; each company’s and the combined company’s expected cash position at the closing of the proposed Merger

(including completion of ARCA’s Asset Purchase Agreement and Oruka’s private placement) and cash runway of the combined company;

the expected contribution and payment of dividends in connection with the Merger, including the timing thereof; the future operations

of the combined company; the nature, strategy and focus of the combined company; the development and commercial potential and potential

benefits of any product candidates of the combined company; anticipated preclinical and clinical drug development activities and related

timelines, including the expected timing for data and other clinical results; the combined company having sufficient resources to advance

its pipeline candidates; and other statements that are not historical fact. The words “anticipate,” “believe,”

“contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “will,” “would” and similar expressions (including the negatives of these terms or variations

of them) may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects.

There can be no assurance that future developments affecting ARCA, Oruka, including the pre-closing private financing, or the Merger

will be those that have been anticipated.

The

forward-looking statements contained in this communication are based on current expectations and beliefs concerning future developments

and their potential effects and therefore subject to other risks and uncertainties. These risks and uncertainties include, but are not

limited to, risks associated with the possible failure to satisfy the conditions to the closing or consummation of the Merger, including

ARCA’s failure to obtain stockholder approval for the Merger, risks associated with the potential failure to complete the financing

transaction and the Transaction in a timely manner or at all, risks associated with the uncertainty as to the timing of the consummation

of the Merger, including the Transaction, and the ability of each of ARCA and Oruka to consummate the transactions contemplated by the

Merger, risks associated with ARCA’s continued listing on Nasdaq until closing of the Merger, the failure or delay in obtaining

required approvals from any governmental or quasi-governmental entity necessary to consummate the Merger; the occurrence of any event,

change or other circumstance or condition that could give rise to the termination of the Merger prior to the closing or consummation

of the Merger, risks associated with the possible failure to realize certain anticipated benefits of the Merger, including with respect

to future financial and operating results; the effect of the completion of the Merger on the combined company’s business relationships,

operating results and business generally; risks associated with the combined company’s ability to manage expenses and unanticipated

spending and costs that could reduce the combined company’s cash resources; risks related to the combined company’s ability

to correctly estimate its operating expenses and other events; changes in capital resource requirements; risks related to the inability

of the combined company to obtain sufficient additional capital to continue to advance its product candidates or its preclinical programs;

the outcome of any legal proceedings that may be instituted against the combined company or any of its directors or officers related

to the Merger Agreement or the transactions contemplated thereby; the ability of the combined company to obtain, maintain and protect

its intellectual property rights, in particular those related to its product candidates; the combined company’s ability to advance

the development of its product candidates or preclinical activities under the timelines it anticipates in planned and future clinical

trials; the combined company’s ability to replicate in later clinical trials positive results found in preclinical studies and

early-stage clinical trials of its product candidates; the combined company’s ability to realize the anticipated benefits of its

research and development programs, strategic partnerships, licensing programs or other collaborations; regulatory requirements or developments

and the combined company’s ability to obtain necessary approvals from the U.S. Food and Drug Administration or other regulatory

authorities; changes to clinical trial designs and regulatory pathways; competitive responses to the Merger and changes in expected or

existing competition; unexpected costs, charges or expenses resulting from the Merger; potential adverse reactions or changes to business

relationships resulting from the completion of the Merger; legislative, regulatory, political and economic developments; and those risks

and uncertainties and other factors more fully described in filings with the Securities and Exchange Commission (“SEC”),

including reports filed on Form 10-K, 10-Q and 8-K, in other filings that ARCA makes and will make with the

SEC in connection with the proposed Merger, including the Proxy Statement/Prospectus described below under “Important Additional

Information About the Proposed Transaction Filed with the SEC,” and in other filings made by ARCA with the SEC from time to

time and available at www.sec.gov. These forward-looking statements are based on current expectations, and with regard to the proposed

transaction, are based on ARCA’s current expectations, estimates and projections about the expected date of closing of the proposed

transaction and the potential benefits thereof, its business and industry, management’s beliefs and certain assumptions made by

ARCA, all of which are subject to change. Such forward-looking statements are made as of the date of this release, and the parties undertake

no obligation to update such statements to reflect subsequent events or circumstances, except as otherwise required by securities and

other applicable law.

No

Offer or Solicitation

This

Current Report on Form 8-K and the exhibits filed or furnished herewith are not intended to and do not constitute (i) a solicitation

of a proxy, consent or approval with respect to any securities or in respect of the proposed transactions (the “Proposed Transactions”)

between ARCA and Oruka Therapeutics, Inc. (“Oruka”) or (ii) an offer to sell or the solicitation of an offer to subscribe

for or buy or an invitation to purchase or subscribe for any securities pursuant to the Proposed Transactions or otherwise, nor shall

there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities

shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom.

Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not

be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction,

or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet)

of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

NEITHER

THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS CURRENT REPORT ON FORM

8-K AND THE EXHIBITS FILED OR FURNISHED HEREWITH ARE TRUTHFUL OR COMPLETE.

Important

Additional Information About the Proposed Transaction Filed with the SEC

This

Current Report on Form 8-K and the exhibits filed or furnished herewith are not substitutes for the registration statement on Form

S-4 or for any other document that ARCA has filed or may file with the SEC in connection with the Proposed Transactions. In

connection with the Proposed Transactions, ARCA has filed with the SEC a registration statement on Form S-4, which contains a

proxy statement/prospectus of ARCA. ARCA URGES INVESTORS AND STOCKHOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, PROXY

STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE OR MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY DO AND WILL CONTAIN IMPORTANT INFORMATION ABOUT ARCA,

ORUKA, THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and stockholders can obtain free copies of the proxy

statement/prospectus and other documents filed by ARCA with the SEC through the website maintained by the SEC at www.sec.gov.

Stockholders are urged to read the proxy statement/prospectus and the other relevant materials filed with the SEC before making any

voting or investment decision with respect to the Proposed Transactions. In addition, investors and stockholders should note that

ARCA communicates with investors and the public using its website (https://arcabio.com/investors/).

Participants

in the Solicitation

ARCA,

Oruka and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders

in connection with the Proposed Transactions. Information about ARCA’s directors and executive officers including a description

of their interests in ARCA is included in the proxy statement/prospectus relating to the Proposed Transactions and ARCA’s most

recent Annual Report on Form 10-K, including any information incorporated therein by reference, each as filed with the SEC.

Information about ARCA’s and Oruka’s respective directors and executive officers and their interests in the Proposed Transactions

is included in the proxy statement/prospectus relating to the Proposed Transactions filed with the SEC.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

| * | Exhibits

and/or schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The

registrant hereby undertakes to furnish supplementally copies of any of the omitted exhibits

and schedules upon request by the SEC; provided, however, that the

registrant may request confidential treatment pursuant to Rule 24b-2 under the

Exchange Act for any exhibits or schedules so furnished. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

ARCA biopharma,

Inc.

(Registrant) |

| |

|

|

| Date: August 15, 2024 |

By: |

/s/

C. Jeffrey Dekker |

| |

|

Name: C.

Jeffrey Dekker

Title: Chief Financial Officer |

4

Exhibit 10.1

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement

(“Agreement”) is made as of August 14, 2024 (“Effective Date”), by and between Genvara Biopharma,

Inc., a Colorado corporation (the “Buyer”) and ARCA biopharma, Inc., a Delaware corporation (the “Seller”)

(each a “Party,” and together the “Parties”).

WHEREAS, Seller is

a party to that certain Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) dated as of April

3, 2024, among Seller, Atlas Merger Sub Corp., a Delaware corporation and a wholly-owned subsidiary of ARCA (“Merger Sub I”),

Atlas Merger Sub II LLC, a Delaware limited liability company and a wholly-owned subsidiary of ARCA (“Merger Sub II”)

and Oruka Therapeutics, Inc., a Delaware corporation (“Oruka”), pursuant to which, among other things, Merger Sub I

will merge with and into Oruka, with Oruka surviving the merger as the surviving corporation (the “First Merger”) and

as part of the same overall transaction, the surviving corporation in the First Merger will merge with and into Merger Sub II with Merger

Sub II continuing as a wholly owned subsidiary of Seller; and

WHEREAS, immediately

following the consummation of the First Merger, Seller desires to assign to Buyer all of the Seller’s right, title and interest

in and to the Acquired Assets and the Assumed Liabilities, and Buyer has agreed to accept such assignment and assume all of the Assumed

Liabilities, in exchange for a one-time cash payment (without interest) of $300,000 (the “Purchase Price”).

NOW, THEREFORE, in

consideration of the mutual agreements and covenants contained in this Agreement, and other good and valuable consideration, the receipt

and sufficiency of which is hereby acknowledged, the Parties agree as follows:

1. Closing.

(a) Closing

Mechanics. The closing of the transactions contemplated by this Agreement shall be automatically effective as of immediately following

the First Effective Time (which time and place are designated as the “Closing”). At the Closing (a) Seller shall sell,

contribute, assign, transfer and convey (collectively, the “Assignment”) to the Buyer all of Seller’s right,

title, benefit, privileges and interest in and to the Acquired Assets and all of the Assumed Liabilities and (b) Buyer shall accept the

Assignment and assume and agree to observe and perform all of the duties, obligations, terms, provisions and covenants, and to pay and

discharge all of the Assumed Liabilities.

(b) Deliveries

by Seller. Concurrently with the execution and delivery of this Agreement, Seller shall execute and deliver to the Buyer a Bill of

Sale, in substantially the form attached hereto as Exhibit A, a Patent Assignment, in substantially the form attached hereto as

Exhibit B, and a Trademark Assignment, in substantially the form attached hereto as Exhibit C, each to be effective automatically

upon the Closing.

(c) Deliveries

by the Buyer.

(i) Concurrently

with the execution and delivery of this Agreement, Buyer shall execute and deliver to the Seller an Assumption Agreement in substantially

the form attached hereto as Exhibit D to be effective automatically upon the Closing.

(ii) At

least five (5) business days prior to the effective time of the First Merger (the “First Effective Time”), Buyer shall

pay to the Seller the Purchase Price by wire transfer of immediately available funds to an account designated by the Buyer in writing

which will be held in escrow by the Seller until the Closing, at which time such amounts will automatically be released to the Seller

without any further action by Buyer or any other Person.

2. Other

Covenants and Agreements. At the reasonable written request of a party, the other party shall (without further consideration) (i)

execute and deliver such other instruments of sale, transfer, conveyance, assignment and confirmation as may be reasonably requested in

order to more effectively transfer, convey and assign to Buyer and to confirm Buyer’s interest in and to the Acquired Assets and

Assumed Liabilities, (ii) provide any additional information or documentation necessary to comply with any Laws applicable to the transactions

contemplated by this Agreement, including any bulk sale, bulk transfer or similar laws, or (iii) obtain any consents or approvals from

any Governmental Authority or Person necessary to consummate the transactions contemplated by this Agreement.

3. Representations

and Warranties of Seller. Seller hereby represents and warrants to Buyer as follows:

(a) Seller

is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware. Seller has all necessary

corporate power and authority: (i) to conduct its businesses in the manner in which its businesses are currently being conducted; (ii)

to own and use its assets in the manner in which its assets are currently owned and used; and (iii) to perform its obligations under all

Contracts by which it is bound.

(b) Seller

(in jurisdictions that recognize the following concepts) is qualified to do business as a foreign corporation, and is in good standing,

under the laws of all jurisdictions where the nature of its business requires such qualification, except as would not reasonably be expected

to have a material adverse effect on Seller.

(c) The

execution and delivery of this Agreement and the consummation of the transactions contemplated hereby have been duly authorized by all

necessary corporate action on the part of Seller and no further action is required on the part of Seller to authorize this Agreement and

the transactions contemplated hereby. This Agreement has been duly executed and delivered by Seller and assuming the due authorization,

execution and delivery by the other Parties hereto and thereto, constitute the valid and binding obligations of Seller hereto and thereto,

enforceable against each in accordance with their respective terms, except as such enforceability might be limited by bankruptcy, insolvency,

reorganization, moratorium and similar Laws relating to or affecting creditors generally and by equitable principles.

(d) Other

than filings required by applicable securities Laws, the execution, delivery and performance of this Agreement and the transactions contemplated

hereby does not require a consent, notice, waiver, approval, order or authorization of, or registration, declaration or filing with, any

Governmental Authority.

4. Representations

and Warranties of Buyer. Buyer hereby represents and warrants to Seller as follows:

(a) Buyer

is a corporation duly organized, validly existing and in good standing under the laws of the State of Colorado. Buyer has all necessary

corporate power and authority: (i) to conduct its businesses in the manner in which its businesses are currently being conducted; (ii)

to own and use its assets in the manner in which its assets are currently owned and used; and (iii) to perform its obligations under all

Contracts by which they are bound.

(b) Buyer

(in jurisdictions that recognize the following concepts) is qualified to do business as a foreign corporation, and is in good standing,

under the laws of all jurisdictions where the nature of its business requires such qualification, except as would not reasonably be expected

to be material to Seller.

(c) The

execution and delivery of this Agreement and the consummation of the transactions contemplated hereby have been duly authorized by all

necessary corporate action on the part of Buyer and no further action is required on the part of Buyer to authorize this Agreement and

the transactions contemplated hereby. This Agreement has been duly executed and delivered by Buyer and assuming the due authorization,

execution and delivery by the other Parties hereto and thereto, constitute the valid and binding obligations of Buyer hereto and thereto,

enforceable against each in accordance with their respective terms, except as such enforceability might be limited by bankruptcy, insolvency,

reorganization, moratorium and similar Laws relating to or affecting creditors generally and by equitable principles.

(d) The

execution, delivery and performance of this Agreement and the transactions contemplated hereby does not require a consent, notice, waiver,

approval, order or authorization of, or registration, declaration or filing with, any Governmental Authority.

5.

Non-Reliance.

(a) No

Other Representations or Warranties. Except for the representations and warranties expressly and specifically made by Seller in Section

4, none of Seller, any subsidiary or Affiliate of Seller or any other person acting on their behalf has made, or will be deemed to

have made, any representation or warranty to Buyer or any person acting on Buyer’s behalf, in connection with this agreement or

the transactions, and any representation or warranty other than those expressly and specifically made by Seller in Section 4 are

hereby disclaimed. Without limiting the generality of the foregoing, none of Seller or any person acting on its behalf has made, or will

be deemed to have made, any representation or warranty to Buyer or any person acting on Buyer’s behalf, express or implied, oral

or written, relating to the merchantability, suitability, noninfringement or fitness for a particular purpose of the Acquired Assets,

or to their quality, condition, design, working order or workmanship, or to the absence of any defects therein, whether latent, obvious

or otherwise, or with respect to any risks and other incidents associated with the Acquired Assets, including the nature of and risks

associated with the Assumed Liabilities. In addition, without limiting the generality of the foregoing, any estimate, projection, financial

information, data, memorandum, presentation or any other materials provided to Buyer, its Affiliates or their respective representatives

are not and shall not be deemed to be or include representations and warranties of Buyer for any purpose.

(b) Independent

Investigation; Reliance. Buyer acknowledges and affirms that it has conducted to its satisfaction an independent investigation of

the Acquired Assets and the Assumed Liabilities and, in making its determination to enter into this Agreement and to consummate the transactions

contemplated hereby, Buyer has relied solely on the results of its own independent investigation and the representations and warranties

expressly and specifically set forth in Section 4. Without limiting the generality of the foregoing, Buyer acknowledges and affirms

and agrees to the disclaimer of representations and warranties made by Seller in Section 6(a) hereof, and Buyer acknowledges and

affirms that the Acquired Assets are being sold and transferred by Seller on a “where is” and, as to condition, “as

is” basis, and in their condition “with all faults”, including with respect to any Assumed Liabilities relating thereto.

6. Notices.

Any notice or other communication required or permitted to be delivered to any party under this Agreement will be in writing and will

be deemed properly delivered, given and received: (a) if delivered by hand, when delivered; (b) if sent on a business day by email before

11:59 p.m. (recipient’s time), when transmitted; (c) if sent by email on a day other than a business day, or if sent by email after

11:59 p.m. (recipient’s time), on the business day following the date when successfully transmitted; (d) if sent by registered,

certified or first class mail, the third business day after being sent; and (e) if sent by overnight delivery via a national courier

service, one business day after being sent, in each case to the address set forth beneath the name of such party below (or to such other

address as such party shall have specified in a written notice given to the other Parties hereto):

If to Seller:

ARCA biopharma, Inc.

10170 Church Ranch Way, Suite 100

Westminster, CO 80021

Attention: C. Jeffrey Dekker

Email: ***

with a copy (which shall not constitute

notice) to each of:

Wilson Sonsini Goodrich & Rosati

1881 9th Street, Suite 110

Boulder, CO 80302

Attention: Brent Fassett

Email: bfassett@wsgr.com

and

Wilson Sonsini Goodrich & Rosati

650 Page Mill Rd

Palo Alto, CA 94304

Attention: Ethan Lutske; Ross Tanaka

Email: elutske@wsgr.com; rtanaka@wsgr.com

If to Buyer:

Genvara Biopharma, Inc.

***

Attention: Michael Bristow

E-Mail: ***

7. Severability.

If any term or other provision of this Agreement is invalid, illegal or incapable of being enforced by any rule of law, or public policy,

all other conditions and provisions of this Agreement will nevertheless remain in full force and effect so long as the economic or legal

substance of the transactions contemplated hereby is not affected in any manner adverse to any party. Upon such determination that any

term or other provision is invalid, illegal or incapable of being enforced, the Parties hereto will negotiate in good faith to modify

this Agreement so as to effect the original intent of the Parties as closely as possible in an acceptable manner to the end that transactions

contemplated hereby are fulfilled to the extent possible.

8. Binding

Effect. This Agreement shall be binding upon and shall inure to the benefit of the Buyer and the Seller and their respective legal

representatives, successors and permitted assigns.

9. Remedies Cumulative; Specific

Performance. All rights and remedies existing under this Agreement are cumulative to,

and not exclusive of, any rights or remedies otherwise available. Each party to this Agreement agrees that, in the event of any breach

or threatened breach by the other Party of any covenant, obligation or other provision set forth in this Agreement: (a) such party will

be entitled, without any proof of actual damages (and in addition to any other remedy that may be available to it) to: (i) a decree or

order of specific performance or mandamus to enforce the observance and performance of such covenant, obligation or other provision;

and (ii) an injunction restraining such breach or threatened breach; and (b) such party will not be required to provide any bond or other

security in connection with any such decree, order or injunction or in connection with any related action or Legal Proceeding.

10. Governing Law; Venue;

Waiver of Jury Trial.

(a) This

Agreement will be governed by, and construed in accordance with, the laws of the State of Delaware, regardless of the laws that might

otherwise govern under applicable principles of conflicts of laws thereof.

(b) Any

action, suit or other Legal Proceeding relating to this Agreement or the enforcement of any provision of this Agreement will be brought

or otherwise commenced exclusively in the Court of Chancery of the State of Delaware or, if jurisdiction over the matter is vested exclusively

in the federal courts, the United States District Court for the District of Delaware. Each party to this Agreement: (i) expressly and

irrevocably consents and submits to the exclusive jurisdiction of such court (and each appellate court therefrom) in connection with any

such action, suit or Legal Proceeding; (ii) agrees that such court will be deemed to be a convenient forum; and (iii) agrees not to assert

(by way of motion, as a defense or otherwise), in any such action, suit or Legal Proceeding commenced in any such court, any claim that

such party is not subject personally to the jurisdiction of such court, that such action, suit or Legal Proceeding has been brought in

an inconvenient forum, that the venue of such action, suit or other Legal Proceeding is improper or that this Agreement or the subject

matter of this Agreement may not be enforced in or by such court.

(c) EACH

OF THE PARTIES HERETO HEREBY IRREVOCABLY WAIVES, TO THE EXTENT PERMITTED BY APPLICABLE LAWS, ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY

ACTION, SUIT OR OTHER LEGAL PROCEEDING ARISING OUT OF OR RELATED TO THIS AGREEMENT OR THE TRANSACTIONS.

11. Amendments;

Waivers, Etc. Neither this Agreement nor any term hereof may be amended, changed, waived, discharged or terminated other than by an

instrument in writing, signed by the Party against which enforcement of such amendment, change, waiver, discharge or termination is sought.

12. Interpretations.

When a reference is made in this Agreement to an Exhibit such reference shall be to an Exhibit to this Agreement unless otherwise indicated.

When a reference is made in this Agreement to a Section, such reference shall be to a Section of this Agreement unless otherwise indicated.

The words “hereof,” “herein” and “hereunder” and words of like import used in this Agreement shall

refer to this Agreement as a whole and not to any particular provision of this Agreement. The word “or” is used in the inclusive

sense of “and/or.” The terms “or,” “any” and “either” are not exclusive. When used herein,

the phrase “to the extent” shall be deemed to be followed by the words “but only to the extent.” The word “extent”

in the phrase “to the extent” means the degree to which a subject or other thing extends, and such phrase shall not mean simply

“if”. The words “include,” “includes” and “including” when used herein shall be deemed

in each case to be followed by the words “without limitation.” “Writing,” “written” and comparable

terms refer to printing, typing and other means of reproducing words (including electronic media) in a visible form. References to any

statute, rule or regulation shall be deemed to refer to such statute, rule or regulation as amended or supplemented from time to time,

including through the promulgation of applicable rules or regulations. References to any Contract are to that Contract as amended, modified

or supplemented from time to time in accordance with the terms hereof and thereof. References to any Person include the successors and

permitted assignees of that Person. References from or through any date mean, unless otherwise specified, from but not including or to

but not including, respectively. References to one gender include all genders. When used herein, references to “$” or “dollar”

shall be deemed to be references to dollars of the United States of America. The table of contents and headings contained in this Agreement

are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement. The Parties hereto agree

that they have been represented by counsel during the negotiation and execution of this Agreement and, therefore, waive the application

of any Law or rule of construction providing that ambiguities in an agreement or other document will be construed against the party drafting

such agreement or document.

13. Counterparts

and Delivery. This Agreement may be executed in two or more counterparts, each of which shall be deemed to be an original but all

of which together shall constitute one and the same agreement and shall become effective when one or more counterparts have been signed

by each of the Parties hereto and delivered to the other. This Agreement may be executed and delivered by electronic signature (including

portable document format).

14. Modification.

This Agreement constitutes the entire understanding of the Parties, and supersedes any and all agreements or understandings of any of

the Parties with respect to the subject matter set forth herein, and may not be modified or otherwise changed orally, but only by a writing

signed by the Party against whom enforcement of any such waiver, change, modification, extension, or discharge is sought.

15. Definitions.

As used in the Agreement, the following terms have the following meanings:

(a) “Acquired

Assets” means all of the Assets exclusively related to the Business including the Assets listed on Schedule 1 and excluding,

for the avoidance of doubt, the Assets listed on Schedule 2.

(b) “Assumed

Liabilities” means all Liabilities arising out of or relating to (i) the Acquired Assets, (ii) the conduct or operation of the

Business, or (iii) the failure to deliver any notices or obtain any consents with respect to the Acquired Assets.

(c) “Assets”

means any and all properties, items, rights, Contracts, interests and assets of every kind, nature and description (wherever located),

real, personal or mixed, tangible and intangible (wherever located and whether or not required to be reflected on a balance sheet prepared

in accordance with United States generally accepted accounting principles consistently applied), in electronic form or otherwise, including

all cash, inventory, receivables, prepaid rentals, deposits, advances and other prepaid expenses, equipment, fixtures, furniture, improvements,

machinery, vehicles, instruments, computers, tools, parts, supplies and other personal property, data, records, files, manuals, blueprints

and other documentation (including sales promotion materials, creative materials, art work, photographs, public relations and advertising

material, studies, reports, correspondence and other similar documents and records and all client and customer lists, telephone and/or

facsimile numbers, electronic mail addresses with respect to past, present or prospective clients and customers, other directory listings

and customer information, web properties data, sales and credit records, catalogs and brochures, purchasing records and records relating

to suppliers and copies of all personnel records), Software, Technology, Intellectual Property Rights, and all rights and claims (whether

contingent or absolute, matured or unmatured and whether in tort, Contract or otherwise) against any Person.

(d) “Affiliate”

shall have the meaning given to such term in Rule 145 under the Securities Act of 1933, as amended.

(e) “Business”

means the business of Seller, as conducted at any time prior to the date hereof, solely related to Seller’s legacy Gencaro (bucindolol

hydrochloride) program for the treatment of atrial fibrillation, and rNAPc2(AB201) for the treatment of COVID-19.

(f) “Contract”

means any agreement, contract, mortgage, indenture, lease, license, covenant, plan, insurance policy, instrument, arrangement, understanding

or commitment, permit, concession, franchise or license, in each case, whether oral or written.

(g) “Governmental

Authority” means any: (a) nation, state, commonwealth, province, territory, county, municipality, district or other jurisdiction

of any nature, (b) federal, state, local, municipal, foreign, supra-national or other government, (c) governmental or quasi-governmental

authority of any nature (including any governmental division, department, agency, commission, bureau, instrumentality, official, ministry,

fund, foundation, center, organization, unit, body or entity and any court or other tribunal, and for the avoidance of doubt, any taxing

authority) or (d) self-regulatory organization (including Nasdaq).

(h) “Intellectual

Property Rights” means all intellectual property and proprietary rights, including all statutory, common law and other rights

in, to, or arising out of, Technology (whether recorded or not and regardless of form or method of recording), which may exist or be created

under the Laws of any jurisdiction in the world, including without limitation all rights the following types: (a) rights associated with

works of authorship (including rights in Software), including copyrights, rights of attribution and integrity and other moral rights;

(b) rights in or arising out of logos, trademark, trade dress, business name, domain name and trade name rights and similar rights; (c)

rights associated with confidential information, including trade secret rights; (d) patent and industrial design property rights, and

equivalent or similar rights in, or arising out of, inventions (whether or not patentable), invention disclosures, improvements, modifications,

methods or processes; (e) rights in, arising out of, or associated with a person’s name, voice, signature, photograph, or likeness,

including rights of personality, privacy, and publicity; (f) rights in, or arising out of, or associated with databases; and (g) rights

in or relating to applications, registrations, renewals, extensions, combinations, divisions, re-examinations, and reissues of, and right

to apply for applications or the applications for, any of the rights referred to in clauses (a) through (g) above.

(i) “Law”

means any U.S. federal, state, national, supra-national, non-U.S., local or municipal or other law, statute, constitution, principle of

common law, resolution, ordinance, code, edict, decree, rule, regulation, ruling or requirement issued, enacted, adopted, promulgated,

implemented or otherwise put into effect by or under the authority of any Governmental Authority (including under the authority of Nasdaq

or the Financial Industry Regulatory Authority).

(j) “Legal

Proceeding” means any action, suit, litigation, arbitration, proceeding (including any civil, criminal, administrative, investigative

or appellate proceeding), hearing, inquiry, audit, examination or investigation commenced, brought, conducted or heard by or before any

court or other Governmental Authority or any arbitrator or arbitration panel.

(k) “Liability”

means, with respect to any Person, any and all liabilities, obligations, claims, and deficiencies of any kind (whether known or unknown,

contingent, accrued, due or to become due, secured or unsecured, matured or otherwise), including accounts payable, all liabilities, obligations,

claims, and deficiencies related to indebtedness or guarantees, costs, expenses, royalties payable, and other reserves, termination payment

obligations, and all other liabilities, obligations, claims, and deficiencies of such Person or any of its subsidiaries or Affiliates,

in each case, regardless of whether or not such liabilities, obligations, claims, and deficiencies are required to be reflected on a balance

sheet in accordance with United States generally accepted accounting principles consistently applied.

(l) “Person”

means any individual, or any U.S. or non-U.S. corporation, partnership, joint venture, estate, trust, company (including limited liability

company and joint stock company), association, organization, firm, enterprise or other entity or any Governmental Authority.

(m) “Software”

means computer software and databases, whether in Object Code, Source Code, or executable form, and documentation related thereto.

(n) “Source

Code” means computer programming code in human readable form that is not suitable for machine execution without the intervening

steps of interpretation or compilation.

(o) “Object

Code” means one or more computer instructions in machine readable form (whether or not packaged in directly executable form),

including any such instructions that are readable in a virtual machine, whether or not derived from Source Code, together with any partially

compiled or intermediate code that may result from the compilation, assembly or interpretation of any Source Code.

(p) “Tax”

means any U.S. federal, state, local, non-U.S. or other tax, including any income tax, franchise tax, capital gains tax, gross receipts

tax, value-added tax, surtax, estimated tax, employment tax, unemployment tax, national health insurance tax, environmental tax, excise

tax, ad valorem tax, transfer tax, conveyance tax, stamp tax, sales tax, use tax, property tax, business tax, withholding tax, payroll

tax, social security tax, customs duty, licenses tax, alternative or add-on minimum or other tax or similar charge, duty, levy, fee, tariff,

impost, obligation or assessment in the nature of a tax (whether imposed directly or through withholding and whether or not disputed),

and including any fine, penalty, addition to tax, interest or additional amount imposed by a Governmental Authority with respect thereto

(or attributable to the nonpayment thereof).

(q) “Technology”

means algorithms, APIs, diagrams, formulae, inventions (whether or not patentable), invention disclosures, programmer’s notes, improvements,

modifications, know-how, logos, marks (including brand names, product names, logos, and slogans), methods, network configurations and

architectures, processes, confidential information, proprietary information, protocols, schematics, specifications, product designs, roadmaps,

marketing strategies, Software (in any form, including Source Code and executable or Object Code), subroutines, techniques, user interfaces,

domain name registrations, URLs, web sites, social media accounts, systems, tools, databases, data collections, concepts, data, coding,

images, designs, documentation, books (including lab books), records, works of authorship (including written, audio and visual materials)

and all other forms of technology.

[remainder of page intentionally

left blank.]

IN WITNESS WHEREOF,

the Parties have executed this Agreement as of the Effective Date.

| SELLER: |

|

BUYER: |

| |

|

|

|

| ARCA BIOPHARMA, INC. |

|

GENVARA BIOPHARMA, INC. |

| |

|

|

|

|

| By: |

/s/ Jeffrey Dekker |

|

By: |

/s/ Michael Bristow |

| Name: |

C. Jeffrey Dekker |

|

Name: |

Michael R. Bristow |

| Title: |

Chief Financial Officer |

|

Title: |

President/CEO |

9

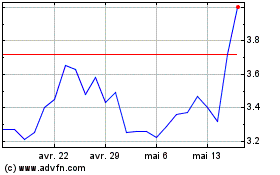

ARCA Biopharma (NASDAQ:ABIO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

ARCA Biopharma (NASDAQ:ABIO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025