Absci Corporation (Nasdaq: ABSI), a data-first generative AI drug

creation company, today reported financial and operating results

for the quarter ended September 30, 2024.

"The recent progress we have made across our

portfolio of internal and partnered programs illustrates our

commitment to delivering results," said Sean McClain, Founder and

CEO. "Through achieving a milestone in our collaboration with

AstraZeneca, adding a new partnership with Twist, and continuing to

advance each of our own proprietary internal programs, the last few

months represent another period of solid execution for Absci."

Recent Highlights

-

Successfully delivered AI de novo designed antibody sequences to

AstraZeneca in fulfillment of the first milestone under the

companies’ AI-driven drug discovery collaboration, first announced

in December 2023. The collaboration combines Absci’s Integrated

Drug Creation™ platform with AstraZeneca's expertise in oncology

with the goal to deliver an AI-designed antibody against an

oncology target.

-

Entered into a collaboration with Twist Bioscience to design a

novel therapeutic using AI. Under the collaboration, the companies

will integrate their industry-leading platforms to accelerate the

design and development of a novel antibody therapeutic for a key

biological target that potentially impacts multiple disease

areas.

-

Continuing to advance ABS-101, ABS-201, and ABS-301 programs

through preclinical studies, and expecting to advance at least one

additional internal asset program to a lead stage this year.

Internal Pipeline Updates, Anticipated Program Progress,

and 2024 Outlook

-

ABS-101 (potential best-in-class anti-TL1A

antibody): Last month, at Festival of Biologics Europe

2024, Absci gave a presentation titled "Development of an AI

designed therapeutic anti-TL1A antibody for IBD.” A poster

containing additional data was also shared at this event, a copy of

which can be found on Absci's website. Absci continues to advance

ABS-101 through IND-enabling studies, plans to initiate Phase 1

clinical studies for ABS-101 in the first half of 2025, and

continues to expect an interim data readout in the second half of

2025.

-

ABS-201 (potential best-in-class antibody for undisclosed

dermatology target): ABS-201 is designed for an

undisclosed dermatological indication with significant unmet need,

where the efficacy of the pharmacological standard of care is not

satisfactory. Absci anticipates selecting a development candidate

for this program in the second half of 2024.

-

ABS-301 (potential first-in-class antibody for undisclosed

immuno-oncology target): ABS-301 is a fully human antibody

designed to bind to a novel target discovered through Absci's

Reverse Immunology platform. Absci anticipates completion of

mode-of-action validation studies for this program in the first

half of 2025.

-

Additional Internal Pipeline Programs: In addition

to further development of ABS-101, ABS-201, and ABS-301, Absci

expects to advance at least one additional internal asset program

to a lead stage in 2024.

-

Drug Creation Partnerships: Absci continues to

make further progress on its existing drug creation partnerships,

and continues to anticipate signing drug creation partnerships with

at least four Partners in 2024, including one or more multi-program

partnerships.

Absci now expects a gross use of cash, cash

equivalents, and short-term investments of approximately $75

million, below the previous expectation of approximately $80

million, for the fiscal year ending December 31, 2024. This amount

includes the expected costs associated with advancing the

IND-enabling studies for ABS-101 with a third-party contract

research organization.

Absci continues to focus its investments and

operations on advancing its internal pipeline of programs,

alongside current and future partnered programs, while achieving

ongoing platform improvements and operational efficiencies. Based

on the company's current plans, Absci believes its existing cash,

cash equivalents, and short-term investments will be sufficient to

fund its operations into the first half of 2027.

Third Quarter 2024 Financial

Results

Revenue was $1.7 million for the three months

ended September 30, 2024 compared to $0.7 million for the

three months ended September 30, 2023. This increase was

driven by mix of partnered programs and related progress.

Research and development expenses were $18.0

million for the three months ended September 30, 2024 compared

to $11.0 million for the three months ended September 30,

2023. This increase was primarily driven by increased lab

operations, including direct costs associated with IND-enabling

studies for ABS-101, and an increase in stock compensation

expense.

Selling, general, and administrative expenses

were $9.3 million for the three months ended September 30,

2024 compared to $9.5 million for the three months ended

September 30, 2023. This decrease was due to lower personnel

costs and continued reductions in administrative costs, offset by

an increase in stock compensation expense.

Net loss was $27.4 million for the three months

ended September 30, 2024, as compared to $22.0 million for the

three months ended September 30, 2023.

Cash, cash equivalents, and short-term

investments as of September 30, 2024 were $127.1 million,

compared to $145.2 million as of June 30, 2024.

Webcast Information

Absci will host a conference call to discuss its

third quarter 2024 business updates and financial and operating

results on Tuesday, November 12, 2024 at 8:00 a.m. Eastern Time /

5:00 a.m. Pacific Time. A webcast of the conference call can be

accessed at investors.absci.com. The webcast will be archived and

available for replay for at least 90 days after the event.

About Absci

Absci is a data-first generative AI drug

creation company that combines AI with scalable wet lab

technologies to create better biologics for patients, faster. Our

Integrated Drug Creation™ platform unlocks the potential to

accelerate time to clinic and increase the probability of success

by simultaneously optimizing multiple drug characteristics

important to both development and therapeutic benefit. With the

data to learn, the AI to create, and the wet lab to validate, we

can screen billions of cells per week, allowing us to go from

AI-designed candidates to wet lab-validated candidates in as little

as six weeks. Absci’s headquarters is in Vancouver, WA, with our AI

Research Lab in New York City and an Innovation Center in Zug,

Switzerland. Visit www.absci.com and follow us on LinkedIn

(@absci), X (Twitter) (@Abscibio), and YouTube.

Forward-Looking Statements

Certain statements in this press release that

are not historical facts are considered forward-looking within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, including

statements containing the words “will,” “pursues,” “anticipates,”

“plans,” “believes,” “forecast,” “potential,” “goal,” “estimates,”

“extends,” “expects,” and “intends,” or similar expressions. We

intend these forward-looking statements, including statements

regarding our expectations related to business operations,

portfolio strategy, financial performance, and results of

operations, our expectations and guidance related to the success of

our partnerships, the gross use of cash, cash equivalents, and

short-term investments, including revised guidance, our projected

cash usage, needs, and runway, our expectations regarding the

signing and number of additional partners and number of programs

included in such partnerships, our technology development efforts

and the application of those efforts, including for generalizing

our platform, accelerating drug development timelines, improving

the economics of drug discovery by lowering costs, and increasing

the probability of success for drug development, our ability to

execute with our partners to create differentiated antibody

therapeutic candidates in an efficient manner, create and execute a

successful development and commercialization strategy related to

such candidates with current or future partners, and design and

develop differentiated therapeutics to treat disease with unmet

need, our ability to market our platform technologies to potential

partners, our plans related to our R&D Day scheduled for

December 12, and our internal asset programs, including our

clinical development strategy, the progress and timing for various

stages of development including advancement to lead stage,

completion of pre-clinical studies, candidate selection, IND

enabling studies, initiating clinical trials and the generation and

disclosure of data related to these programs, the translation of

preclinical results and data into product candidates, and the

significance of preclinical results, including in comparison to

competitor molecules and in leading to differentiated clinical

efficacy or product profiles, to be covered by the safe harbor

provisions for forward-looking statements contained in Section 27A

of the Securities Act and Section 21E of the Securities Exchange

Act, and we make this statement for purposes of complying with

those safe harbor provisions. These forward-looking statements

reflect our current views about our plans, intentions,

expectations, strategies, and prospects, which are based on the

information currently available to us and on assumptions we have

made. We can give no assurance that the plans, intentions,

expectations, or strategies will be attained or achieved, and,

furthermore, actual results may differ materially from those

described in the forward-looking statements and will be affected by

a variety of risks and factors that are beyond our control,

including, without limitation, risks and uncertainties relating to

obtaining and maintaining necessary approvals from the FDA and

other regulatory authorities, replicating in clinical trials

promising or positive results observed in preclinical studies, our

dependence on third parties to support our internal asset programs,

including for the manufacture and supply of preclinical and

clinical supplies of our product candidates or components thereof,

our ability to effectively collaborate on research, drug discovery

and development activities with our partners or potential partners,

our existing and potential partners’ ability and willingness to

pursue the development and commercialization of programs or product

candidates under the terms of our partnership agreements, and

overall market conditions and regulatory developments that may

affect our and our partners’ activities under these agreements,

along with those risks set forth in our most recent periodic report

filed with the U.S. Securities and Exchange Commission, as well as

discussions of potential risks, uncertainties, and other important

factors in our subsequent filings with the U.S. Securities and

Exchange Commission. Except as required by law, we assume no

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events, or

otherwise.

Investor Contact:Alex KhanVP,

Finance & Investor Relationsinvestors@absci.com

Media Contact:press@absci.com

absci@methodcommunications.com

| |

|

Absci CorporationUnaudited Condensed

Consolidated Statements of Operations |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

For the Three Months Ended September 30, |

|

|

|

For the Nine Months Ended September 30, |

|

|

|

(In thousands, except for share and per share

data) |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

Technology development revenue |

|

$ |

1,701 |

|

|

$ |

744 |

|

|

$ |

3,869 |

|

|

$ |

5,380 |

|

|

| Total revenues |

|

|

1,701 |

|

|

|

744 |

|

|

|

3,869 |

|

|

|

5,380 |

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

17,985 |

|

|

|

11,029 |

|

|

|

45,482 |

|

|

|

35,798 |

|

|

|

Selling, general and administrative |

|

|

9,256 |

|

|

|

9,505 |

|

|

|

27,346 |

|

|

|

28,508 |

|

|

|

Depreciation and amortization |

|

|

3,355 |

|

|

|

3,513 |

|

|

|

10,155 |

|

|

|

10,515 |

|

|

|

Goodwill impairment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

21,335 |

|

|

| Total operating expenses |

|

|

30,596 |

|

|

|

24,047 |

|

|

|

82,983 |

|

|

|

96,156 |

|

|

| Operating loss |

|

|

(28,895 |

) |

|

|

(23,303 |

) |

|

|

(79,114 |

) |

|

|

(90,776 |

) |

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(130 |

) |

|

|

(229 |

) |

|

|

(456 |

) |

|

|

(806 |

) |

|

|

Other income, net |

|

|

1,664 |

|

|

|

1,572 |

|

|

|

5,496 |

|

|

|

4,613 |

|

|

| Total other income, net |

|

|

1,534 |

|

|

|

1,343 |

|

|

|

5,040 |

|

|

|

3,807 |

|

|

| Loss before income taxes |

|

|

(27,361 |

) |

|

|

(21,960 |

) |

|

|

(74,074 |

) |

|

|

(86,969 |

) |

|

| Income tax expense |

|

|

(37 |

) |

|

|

(34 |

) |

|

|

(49 |

) |

|

|

(52 |

) |

|

| Net loss |

|

$ |

(27,398 |

) |

|

$ |

(21,994 |

) |

|

$ |

(74,123 |

) |

|

$ |

(87,021 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Net loss per share:Basic and

diluted |

|

$ |

(0.24 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.68 |

) |

|

$ |

(0.95 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Weighted-average common shares

outstanding:Basic and diluted |

|

|

113,613,488 |

|

|

|

92,217,234 |

|

|

|

108,665,095 |

|

|

|

91,844,221 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Absci CorporationUnaudited Condensed

Consolidated Balance Sheets |

| |

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

|

December 31, |

|

| (In thousands, except

for share and per share data) |

|

|

2024 |

|

|

|

2023 |

|

| ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

38,195 |

|

|

$ |

72,362 |

|

|

Restricted cash |

|

|

15,799 |

|

|

|

16,193 |

|

|

Short-term investments |

|

|

88,873 |

|

|

|

25,297 |

|

|

Receivables under development arrangements, net |

|

|

1,500 |

|

|

|

2,189 |

|

|

Prepaid expenses and other current assets |

|

|

5,777 |

|

|

|

4,537 |

|

|

Total current assets |

|

|

150,144 |

|

|

|

120,578 |

|

| Operating lease right-of-use

assets |

|

|

4,223 |

|

|

|

4,490 |

|

| Property and equipment,

net |

|

|

32,374 |

|

|

|

41,328 |

|

| Intangibles, net |

|

|

45,726 |

|

|

|

48,253 |

|

| Restricted cash,

long-term |

|

|

1,155 |

|

|

|

1,112 |

|

| Other long-term assets |

|

|

1,609 |

|

|

|

1,537 |

|

| TOTAL ASSETS |

|

$ |

235,231 |

|

|

$ |

217,298 |

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

1,672 |

|

|

$ |

1,503 |

|

|

Accrued expenses |

|

|

18,248 |

|

|

|

19,303 |

|

|

Long-term debt |

|

|

3,274 |

|

|

|

3,258 |

|

|

Operating lease obligations |

|

|

1,573 |

|

|

|

1,679 |

|

|

Financing lease obligations |

|

|

140 |

|

|

|

641 |

|

|

Deferred revenue |

|

|

1,781 |

|

|

|

3,174 |

|

|

Total current liabilities |

|

|

26,688 |

|

|

|

29,558 |

|

| Long-term debt, net of current

portion |

|

|

2,155 |

|

|

|

4,660 |

|

| Operating lease obligations,

net of current portion |

|

|

4,847 |

|

|

|

5,643 |

|

| Finance lease obligations, net

of current portion |

|

|

— |

|

|

|

76 |

|

| Deferred tax liability,

net |

|

|

175 |

|

|

|

186 |

|

| Deferred revenue,

long-term |

|

|

— |

|

|

|

966 |

|

| Other long-term

liabilities |

|

|

31 |

|

|

|

33 |

|

| TOTAL LIABILITIES |

|

|

33,896 |

|

|

|

41,122 |

|

| |

|

|

|

|

| STOCKHOLDERS' EQUITY |

|

|

|

|

| Preferred stock, $0.0001 par

value |

|

|

— |

|

|

|

— |

|

| Common stock, $0.0001 par

value |

|

|

11 |

|

|

|

9 |

|

| Additional paid-in

capital |

|

|

681,691 |

|

|

|

582,699 |

|

| Accumulated deficit |

|

|

(480,618 |

) |

|

|

(406,495 |

) |

| Accumulated other

comprehensive income (loss) |

|

|

251 |

|

|

|

(37 |

) |

| TOTAL STOCKHOLDERS'

EQUITY |

|

|

201,335 |

|

|

|

176,176 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

$ |

235,231 |

|

|

$ |

217,298 |

|

|

|

|

|

|

|

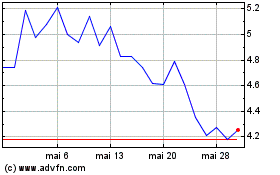

AbSci (NASDAQ:ABSI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

AbSci (NASDAQ:ABSI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025