0000861838

false

0000861838

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 14, 2023

Aceragen, Inc.

(Exact name of registrant as specified in its

charter)

|

Delaware

(State or other jurisdiction

Of

incorporation) |

001-31918

(Commission File

Number) |

04-3072298

(I.R.S. Employer

Identification No.) |

| 505

Eagleview Blvd., Suite 212 |

|

|

| Exton, Pennsylvania |

|

19341 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (484) 348-1600

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240-14d-2(b)). |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c)). |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each

class |

|

Trading

Symbol(s) |

|

Name of each

exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ACGN |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Contemporary Arrangements of

Certain Officers. |

On

August 15, 2023, Cristina Csimma, Michael Dougherty, Maxine Gowen, Vincent Milano and Ron Wooten, members of the Board of Directors

(the “Board”) of Aceragen, Inc. (the “Company”), each provided notice of their decision to resign from the

Board effective contemporaneous with the execution of the Assignment Agreement (defined below) and effectuation of the Assignment

(defined below) pursuant thereto (the “Effective Date”).

Also

on August 15, 2023, the Company and John Taylor, the Company’s President, Chief Executive Officer, Chief Financial Officer

and member of the Board, entered into that certain Executive Separation Agreement (the “Separation Agreement”), pursuant to

which, in connection and contemporaneous with the Company’s entry into the Assignment Agreement and effectuation of the Assignment

pursuant thereto, Mr. Taylor’s employment with the Company terminated. The Separation Agreement sets forth severance benefits

arising under Mr. Taylor’s employment agreement as well as the previously disclosed $100,000 success fee to which Mr. Taylor

is entitled in connection with his provision of consulting services reasonably requested by the Assignee in connection with its successful

liquidation of the Company’s assets.

The

foregoing description of the Separation Agreement does not purport to be complete and is qualified in its entirety by reference to the

Separation Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

| Item 5.07 | Submission

of Matters to a Vote of Security Holders. |

At

the Special Meeting of Stockholders of the Company held on August 14, 2023 (the “Special Meeting”), the Company’s

stockholders voted upon the following proposals, each of which is described in more detail in the Company’s definitive proxy statement

filed with the Securities and Exchange Commission (the “SEC”) on July 21, 2023 (the “Special Meeting Proxy Statement”):

(1) a proposal to approve the resolutions attached as Exhibit A to the Special Meeting Proxy Statement, approving and authorizing

the transfer of all or substantially all of the Company’s assets to an Assignee (the “Assignee”) through an assignment

for the benefit of creditors (the “Assignment,” and such proposal, the “Assignment Proposal”) and (2) a proposal

to approve the adjournment or postponement of the Special Meeting, if necessary, to continue to solicit votes for the Assignment Proposal

(the “Adjournment Proposal” and, together with the Assignment Proposals, the “Proposals”). The Adjournment Proposal

was not presented at the Special Meeting because there were enough votes to approve the Assignment Proposal.

Set forth below are the final voting results for

each of the Proposals submitted to a vote of the Company’s stockholders at the Special Meeting.

Proposal No. 1: Assignment Proposal

The stockholders approved the Assignment Proposal,

with votes as follows:

| Shares For |

|

Shares Against |

|

Shares Abstained |

|

Broker Non-Votes |

| 4,993,040 |

|

54,342 |

|

3,640 |

|

0 |

Item 8.01 – Other Matters.

Assignment for the Benefit of Creditors

On

August 14, 2023, following the approval of the Assignment Proposal by the stockholders of the Company at the Special Meeting, the

Board approved entering into that certain General Assignment for the Benefit of Creditors (the “Assignment Agreement”), by

and between the Company and ACG (ABC), LLC, as the Assignee, providing for the transfer

of substantially all of the Company’s assets to the Assignee. The Company entered into the Assignment Agreement on August 16, 2023.

The

foregoing description of the Assignment Agreement does not purport to be complete and is qualified in its entirety by reference to the

Assignment Agreement, which is filed as Exhibit 10.2 to this Current Report on Form 8-K and incorporated by reference herein.

Delisting

from Nasdaq and Deregistration

As

previously announced, the Company intends to voluntarily terminate the listing of its common stock, par value $0.001 per share, from the

Nasdaq Capital Market (“Nasdaq”) by filing a Form 25 with SEC on August 15, 2023. The Company also intends to terminate

its status as an Exchange Act reporting company as soon as practicable.

Item 9.01 – Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ACERAGEN, INC. |

|

| |

|

| By: |

/s/ John Taylor |

|

| |

John Taylor |

|

| |

Authorized Person |

|

Dated: August 16, 2023

Exhibit 10.1

EXECUTIVE SEPARATION AGREEMENT

This Executive Separation

Agreement (this “Agreement”), is entered into as of August 15, 2023 (the “Execution Date”),

by and between John Taylor (“you”) and Aceragen, Inc., a Delaware corporation (together with its wholly owned

subsidiaries and affiliates, the “Company”).

BACKGROUND

WHEREAS, you currently serve

as Chief Executive Officer of the Company;

WHEREAS, you and the Company

are parties to that certain Employment Letter Agreement dated February 21, 2021 (the “Employment Agreement”);

WHEREAS, the Board of Directors

(the “Board”) of the Company determined that it is in the best interests of the Company and its stockholders and creditors

to effect a transfer and assignment of substantially all of the Company’s assets to an assignee (the “Assignee”)

for the benefit of creditors (the “Assignment”);

WHEREAS, in connection and

contemporaneous with the effectuation of the Assignment, your employment with Company will end (such date, the “Termination Date”);

WHEREAS, the Board desires

to incentivize you to provide consulting services reasonably requested by the Assignee in connection with its successful liquidation the

Company’s assets (the “ABC Sales Process”); and

WHEREAS, both you and the

Company desire to enter into this Agreement to set forth the terms and conditions of the termination of your employment with the Company,

including severance amounts owed to you under the Employment Agreement, and an additional amount to which you may become entitled following

the Termination Date upon a successful completion of the ABC Process.

NOW THEREFORE, in consideration

of the mutual promises set forth in this Agreement and of other good and valuable consideration, the sufficiency of which you acknowledge,

and intending to be legally bound hereby, you and the Company agree as follows:

1. Recitals.

The foregoing recitals are hereby made part of this Agreement and are incorporated herein by reference.

2. General

Terms of Separation; Success Fee.

(a) Regardless

of whether you sign this Agreement, you will be entitled to (a) any earned and unpaid base salary through the Termination Date; (b)

any accrued but unused personal time off days; (c) reimbursement for any outstanding expenses for which you have not been reimbursed

and which are authorized; and (d) any vested benefits under the Company’s employee benefit plans in accordance with the terms

of such plans, as accrued through the Termination Date (collectively, the “Accrued Obligations”). For the avoidance

of doubt, all outstanding equity awards you hold in the Company will continue to be governed by the terms and conditions of the applicable

award agreements and equity plan documents, as applicable.

(b) In

consideration your provision following the Termination Date of consulting services (on terms and conditions agreed between you and the

Assignee) as may be reasonably requested by the Assignee in connection with the ABC Sales Process, upon the successful completion of the

ABC Sales Process, you will be entitled to a one-time success fee of $100,000 (the “Success Fee”), which will be added to

other claims that you then hold as a creditor of the Company. Following your Termination Date and while providing the consulting services,

you shall not be entitled to any Company benefits or other benefits as may accrue to a full or part-time employee of the Company. You

expressly agree that you will be responsible for all taxes that may be owed to any applicable legal entity for the Success Fee.

3. Severance

Benefits. If you (a) sign and do not revoke this Agreement and (b) comply with the obligations set forth herein, , then

you will be entitled to the severance benefits as set forth in Section 6 of the Employment Agreement (collectively, the “Severance

Benefits”) except that any limitation of such benefits resulting from you commencement of new employment or substantial self-employment

prior to the first anniversary of the Termination Date shall be disregarded. The Severance Benefits Consideration will be added to other

claims that you then hold as a creditor of the Company. You will not be eligible for the Severance Benefits described in this Paragraph 3

unless the Company has received an executed copy of this Agreement, which has not been revoked. You hereby acknowledge and agree that

the Severance Benefits is in full satisfaction of the Company’s obligations under the Employment Agreement and any other agreement

or understanding between you and the Company.

4. General

Release. In exchange for the consideration and other conditions set forth in this Agreement, you hereby generally and completely release

the Company, each of their affiliated entities, and their respective current and former directors, officers, employees, shareholders,

stockholders, partners, general partners, limited partners, managers, members, managing directors, operating affiliates, agents, attorneys,

predecessors, successors, Company and subsidiary entities, insurers, assigns and affiliated entities (collectively, the “Released

Parties”) of and from any and all claims, liabilities and obligations, both known and unknown, arising from or related to events,

acts, or omissions occurring prior to or on the date you sign this Agreement (collectively, the “Released Claims”).

The Released Claims include, but are not limited to: (a) all claims arising from or in any way related to your employment or other

participation in connection with any of the Released Parties, or the termination of that employment or participation, including all claims

under the Employment Agreement; (b) all claims related to compensation or benefits, including salary, bonuses, commissions, vacation

pay, expense reimbursements, severance pay, change-in-control payments, fringe benefits, or profit sharing; (c) all claims for breach

of contract, wrongful termination, and breach of the implied covenant of good faith and fair dealing; (d) all tort claims, including

claims for fraud, defamation, emotional distress, and discharge in violation of public policy; and (e) all federal, state, and local

statutory claims, including claims for discrimination, harassment, retaliation, attorneys’ fees, or other claims arising under the

federal Civil Rights Act of 1964 (as amended), the federal Americans with Disabilities Act of 1990, the federal Age Discrimination in

Employment Act of 1967 (as amended) (the “ADEA”), the Employee Retirement Income Security Act of 1974 (“ERISA”)

(including, but not limited to, claims for breach of fiduciary duty under ERISA), and the Older Workers Benefit Protection Act (the “OWBPA”).

In giving the releases set forth above, which include claims which may be unknown to you at present, you hereby expressly waive and relinquish

all rights and benefits under any law or legal principle in any jurisdiction with respect to your release of claims herein, including

but not limited to the release of unknown and unsuspected claims. Notwithstanding anything to the contrary in this Paragraph 4, you are

not prohibited from making or asserting and you are not waiving: (i) your rights under this Agreement; (ii) any other right

that may not be released under applicable law; and (iii) your rights, if any, to indemnification pursuant to the Company’s

organizational documents, the indemnification agreement or any D&O insurance policy.

5. No

Actions Pending Against the Company. You acknowledge and agree that that: (a) you are not aware of any facts that may constitute

violations of the Company’s policies and/or legal obligations; and (b) you have not filed any discrimination, wrongful discharge,

wage and hour, or any other complaints or charges against the Released Parties in any local, state or federal court, tribunal, or administrative

agency.

6. Compliance

with Section 409A of the Code. This Agreement is intended to comply with the requirements of section 409A of the Code or an exception,

and shall be administered accordingly. Notwithstanding anything in the Agreement to the contrary, distributions may only be made under

the Agreement upon an event and in a manner permitted by section 409A to the extent applicable. Payments to be made upon termination of

employment under this Agreement may only be made upon a “separation from service” under section 409A. For purposes of section

409A, each payment shall be treated as a separate payment. In no event may you, directly or indirectly, designate the calendar year of

a payment.

7. Governing

Law. This Agreement will be governed by and construed in accordance with the laws of the State of Delaware.

8. Entire

Agreement. This Agreement constitutes the entire agreement between the parties relating to the matters contained herein and supersedes

any and all prior representations, agreements, written or oral, expressed or implied.

9. Severability.

In the event a court, arbitrator, or other entity with jurisdiction determines that any portion of this Agreement (other than the general

release clause) is invalid or unenforceable, the remaining portions of the Agreement shall remain in full force and effect.

10. Headings;

Days. Headings contained in this Agreement are for convenience of reference only and are not intended, and shall not be construed,

to modify, define, limit, or expand the intent of the parties as expressed in this Agreement, and they shall not affect the meaning or

interpretation of this Agreement. All references to a number of days throughout this Agreement refer to calendar days.

11. Representations.

You agree and represent that (a) you have read carefully the terms of this Agreement, including the general release; (b) you

have had an opportunity to and have been advised by the Company to review this Agreement, including the general release, with an attorney;

(c) you understand the meaning and effect of the terms of this Agreement, including the general release; (d) you were given

twenty-one (21) days to determine whether you wished to sign this Agreement, including the general release; (e) your decision to

sign this Agreement, including the general release, is of your own free and voluntary act without compulsion of any kind; (f) no

promise or inducement not expressed in this Agreement has been made to you; and (g) you have adequate information to make a knowing

and voluntary waiver.

12. Revocation

Period. If you sign this Agreement, you will retain the right to revoke it for seven (7) days (“Revocation Period”).

If you revoke this Agreement, you are indicating that you have changed your mind and do not want to be legally bound by this Agreement.

This Agreement shall not be effective until after the Revocation Period has expired without your having revoked it. To revoke this Agreement,

you must send a letter to the attention of the General Counsel of the Company. The letter must be received within seven (7) days

of your execution of this Agreement. If the seventh day is a Sunday or federal holiday, then the letter must be received by the following

business day. If you revoke this Agreement on a timely basis, you shall not be eligible for the Consideration set forth in Paragraph 3

above.

13. Expiration

Date. As noted above, you have twenty-one (21) days to decide whether you wish to sign this Agreement. If you do not sign this Agreement

on or before that time, then this Agreement is withdrawn and you will not be eligible for the Consideration set forth in Paragraph 3 above.

[Signature Page Follows]

IN

WITNESS WHEREOF, and intending to be legally bound hereby, you and the Company hereby execute the foregoing Executive Separation

Agreement as of the Execution Date.

| JOHN TAYLOR |

|

ACERAGEN, INC. |

|

/s/ John Taylor |

|

/s/ Vincent Milano |

| John Taylor |

|

By: |

Vincent Milano |

| |

|

Title: |

Chair of the Board of Directors |

Exhibit 10.2

GENERAL ASSIGNMENT FOR THE BENEFIT OF CREDITORS

THIS GENERAL ASSIGNMENT

FOR THE BENEFIT OF CREDITORS (the “General Assignment”) is made this 16th day of August, 2023 (the “Effective

Date”), by and between Aceragen, Inc., a Delaware corporation located at 505 Eagleview Boulevard, Exton, PA 19341, Federal

Tax Identification Number 04-3072298, hereinafter referred to as “Assignor” and ACG (ABC), LLC, a Delaware limited

liability company, with offices in care of Rock Creek Advisors, LLC (“Rock Creek”), 1738 Belmar Blvd., Belmar, New

Jersey 07719, Federal Tax Identification Number 93-2643891, hereinafter referred to as “Assignee.”

RECITALS

A. Assignor

is indebted to various persons, corporations, and other entities and is unable to pay its debts in full. As a result, Assignor desires

to transfer all of its property to an assignee for the benefit of creditors so that the property transferred may be expeditiously liquidated

and the proceeds thereof fairly distributed to its creditors without any preference or priority, except such priority as established

and permitted by law (including, without limitation, the law of contracts); and

B. Assignor

has determined that Assignee is an entity possessing the capabilities to administer the Assignment Estate (defined below), including

(without limitation) the liquidation of the estate’s assets;

C. In

connection with the administration of the Assignment Estate, Assignee has executed a certain Collateral and Forbearance Agreement dated

as of the date hereof (the “Collateral Agreement”) in favor of NovaQuest Co-Investment Fund XV, L.P. (”NovaQuest”)).

D. NovaQuest

has a first, valid and perfected security interest in, and lien on, all of the assets of Assignor, which security interest and lien shall

be released in accordance with the terms of that certain Security Agreement and that certain Funding Agreement, each between NovaQuest

and Assignor and dated July 11, 2023.

NOW, THEREFORE, in

consideration of Assignor’s existing indebtedness to its creditors, the covenants and agreements to be performed by Assignee and

other consideration, receipt of which is hereby acknowledged, it is hereby AGREED:

1. Creation

of Assignment Estate. Upon the execution of this General Assignment, a certain assignment estate shall be created (herein referred

to as the “Assignment Estate”) to enable the Assignee to administer the estate, which includes the orderly liquidation of

the property and assets of Assignor and the distribution of the proceeds therefrom to creditors of Assignor, in accordance with applicable

law, the Collateral Agreement and the Secured Obligations Documents (as defined in the Collateral Agreement). Assignor hereby nominates

and appoints Assignee to administer the Assignment Estate. The Assignee and its agents shall have the powers and duties hereinafter set

forth and shall receive reasonable compensation for their services and reimbursement of their expenses, including (without limitation)

reimbursement of the Assignee’s attorneys’ fees and costs. The Assignee may serve without bond, except to the extent a bond

is required by law or court order. The Assignee may seek to have any bond required by law waived by court order and also is authorized

to seek the waiver of any other court-required filing for the purposes of preserving Assignment Estate resources.

2. Transfer

of Assets. Assignor hereby assigns, grants, conveys, transfers, and sets over to Assignee all of Assignor’s currently existing

right, title, and interest in all real or personal property and all other assets, whatsoever and where so ever situated, which assets

include (without limitation) all personal property and any interest therein, including all that certain stock of merchandise, office furniture

and fixtures, machinery, equipment, leasehold interests and improvements, inventory (raw goods, work in process and finished goods), book

accounts, books and records, bills, accounts receivable, cash on hand, cash in bank, intellectual property including all patents, patent

applications, copyrights, trademarks and trade names, and all goodwill associated therewith, insurance policies (including any and all

policies for Directors and Officers Liability Insurance), tax refunds, rebates, general intangibles (including any and all causes of action),

insurance refunds and claims (including any payments arising out of Directors and Officers Liability Insurance), and choses in action

that are legally assignable, together with the proceeds of any non-assignable choses in action that may hereafter be recovered or received

by the Assignor, and all real property interests. Further, this General Assignment specifically includes all claims for refunds or abatement

of all excess taxes heretofore or hereafter assessed against or collected from the Assignor by the United States or any of its departments

or agencies, any state or local taxing authority. Assignor agrees to endorse any refund checks relating to the prior operations of said

Assignor’s business and to deliver such checks immediately to Assignee, except in the case of any of the foregoing, solely to the

extent the same is prohibited from transfer or assignment by the terms of any applicable contract or by operation of law. All of the assets

assigned by this General Assignment shall be referred to herein as the “Assigned Assets.” Notwithstanding the above, (a) the

Assignee shall provide Assignor and its representatives with reasonable access to the books and records and other financial information

of the Assignor as reasonably requested by the Assignor; (b) the Assignee shall ensure that any agreement to sell the Assignor’s

assets contains a provision requiring any purchaser to provide the Assignor with such reasonable access; and (c) the definition of

Assigned Assets shall not include any policy proceeds that would be directly payable to or payable on behalf of any insured individual

under the Assignor’s insurance policies, including (without limitation) so-called “Side A” Coverage under the Assignor’s

Directors and Officers Liability Insurance and nothing in this Agreement shall be construed to prevent or hinder any such individual from

seeking access to any such policy proceeds. The assignment of the Assigned Assets by Assignor to Assignee hereunder shall be subject to

all properly perfected liens encumbering any of the Assigned Assets existing as of the date of this Assignment, including, but not limited

to, the liens of NovaQuest as more fully set forth in the Collateral Agreement and Secured Obligations Documents.

3. Leases

and Leasehold Interests. The Assigned Assets shall not include any leases or leasehold interests of Assignor, including, but not

limited to, the leased office space in Exton, Pennsylvania, unless specifically designated and identified herein and only to the extent

assignable; provided, however, the Assigned Assets shall include any and all prepaid deposits and expenses in connection with any and

all leases and leasehold interests.

4. Delivery

of Documents, Endorsements, and Forwarding of Mail. Assignor authorizes the forwarding of its mail by the U.S. Postal Service,

as directed by Assignee. Assignor agrees to (i) deliver to Assignee all existing books and records, (ii) execute and deliver

all additional and reasonably necessary documents upon Assignor’s reasonable discretion, promptly upon request by Assignee, and

(iii) endorse all indicia of ownership, where required by Assignee in order to complete the transfer of all Assigned Assets to Assignee

as intended by this General Assignment.

5. Powers

and Duties of Assignee. Assignee shall have all powers under law necessary to marshal and liquidate the Assignment Estate, including

(without limitation):

a. To

collect any and all accounts receivable and obligations owing to Assignor and not otherwise sold by Assignee;

b. Consistent

with the terms of the Collateral Agreement, to sell or otherwise dispose of all of the Assigned Assets, including (without limitation)

all of Assignor’s machinery, equipment, inventory, service or trademarks, trade names, patents, franchises, and causes of action

in such manner as Assignee deems best. Assignee shall have the power to execute bills of sale and any other such documents necessary to

convey right, title, and interest in Assignor’s property to any bona fide buyer;

c. To

sell or otherwise dispose of all Assigned Assets, Assignee shall have the power to employ an auctioneer to appraise said assets and to

conduct any public or private sale of the assets and to advertise said sale in such manner as Assignee deems best;

d. To

employ attorneys (including Womble Bond Dickinson (US) LLP), accountants, and any other additional personnel to whatever extent may be

necessary to administer the Assigned Assets and claims of the Assignment Estate;

e. To

require all of Assignor’s creditors to whom any balance is owing to submit verified statements to Assignee of said claim(s);

f. To

settle any and all claims against or in favor of Assignor, with the full power to compromise, or, in the Assignee’s sole discretion,

to sue or be sued, and to prosecute or defend any claim or claims of any nature whatsoever existing with regard to the Assignor;

g. To

open bank accounts in the name of the Assignee or its nominees or agents and to deposit the Assigned Assets or the proceeds thereof in

such bank accounts and to draw checks thereon and with the further power and authority to do such acts and execute such papers and documents

in connection with this General Assignment, as Assignee may deem necessary or advisable;

h. To

conduct the business of the Assignor should the Assignee deem such operation proper;

i. To

incur indebtedness sufficient to fund the ongoing operation of the Assignee’s business and the administration of the Assignment

Estate;

j. Consistent

with the terms of the Collateral Agreement., to apply the net proceeds arising from the operation of and liquidation of Assignor’s

business and the Assigned Assets and as allowed by law, in the following manner as to amounts only and not time of distribution:

(1) FIRST,

payment of a reasonable fee to the Assignee and payment of reasonable compensation and reimbursement of expenses for the services of:

(i) attorneys for the Assignee (including Womble Bond Dickinson (US) LLP); (ii) financial advisor to the Assignee; (iii) certain

professionals retained by the Assignor in connection with the transactions contemplated by this General Assignment; and (iv) any

other professionals and/or employees retained by Assignee for assistance in administration of the Assignment Estate;

(2) SECOND,

to reimburse Assignee as to all costs advanced by the Assignee for the preservation of the Assigned Assets, including the maintenance

and insurance of said assets;

(3) THIRD,

payment of all sums required to be paid in order to discharge any lien on, or any security interest in, any of said property and any secured

indebtedness which under applicable law is entitled to priority of payment (including, without limitation, all Assignee financing and

any other indebtedness secured by liens on the Assigned Assets sold by Assignee), in the order required under applicable law;

(4) FOURTH,

payment of all other costs and expenses incidental to the administration of the Assignment Estate, including (without limitation) all

sales or similar tax resulting from disposition or sale of the Assigned Assets that is not paid by purchaser of such assets, legal fees

of the Assignor for legal services rendered, including services related to the making of and administration of the General Assignment,

and fees or expenses of any other professionals the Assignee deems necessary to properly administer the Assignment Estate, to the extent

not paid pursuant to paragraph 5(j)(1) hereof, as well as the cost of defense and satisfaction of indemnification claims pursuant

to the terms hereof and the cost of any required appraisal or bond, as well as payment of all wages and other costs associated with the

Assignee’s utilization of Assignor’s employees, as applicable;

(5) FIFTH,

all federal taxes of any nature whatsoever owing as of the date of this General Assignment or such other claim of any federal governmental

agency, as defined under 31 U.S.C. § 3713, including (without limitation) federal withholding taxes, federal unemployment taxes,

and any other federal income, excise, property, and employment taxes;

(6) SIXTH,

all state, county, and municipality taxes of any nature whatsoever owing as of the date of this General Assignment, including (without

limitation) employment, property, and income taxes;

(7) SEVENTH,

all other debts owing as of the date of this General Assignment that are entitled to priority treatment and payment under applicable law;

(8) EIGHTH,

with the exception of those classes set forth above, to other unsecured creditors of Assignor, within each class of such creditors established

by Assignee, pro-rata in accordance with the terms of each creditor’s indebtedness, until all such debts are paid in full. No payment

shall be made to any creditor whose claim is disputed until such time as such dispute is resolved. Each creditor’s otherwise pro-rata

share of such distribution shall be fully reserved for by the Assignee until such time as the dispute is resolved. The Assignee may make

interim distributions whenever the Assignee has accumulated sufficient funds to enable it to make a reasonable distribution;

(9) NINTH,

any monies (distributions) unclaimed by creditors ninety (90) days after the final distribution to unsecured creditors, if any, or the

termination of the administration of the Assignment Estate created by this General Assignment shall be re-distributed to all known unsecured

creditors who cashed their respective distribution checks from the Assignment Estate, so long as any such distribution exceeds one percent

of each such creditor’s allowed claim; and

(10) TENTH,

the surplus, if any, of the Assignment Estate funds, when all debts of the Assignor shall have been paid in fall, shall be paid and transferred

to the equity holders of the Assignor.

k. To

do and perform any and all other acts necessary and proper for the liquidation or other disposition of the assets, including (without

limitation) abandonment and the distribution of the proceeds derived therefrom to Assignor’s creditors, provided, however, that

the Assignee shall not abandon any of such assets to the Assignor.

l. To

complete the delisting and/or withdraw Assignor’s common stock, par value $0.001 per share (the “Common Stock”),

from trading on the Nasdaq Capital Market or any other stock exchange on which the Common Stock may be traded and terminate the registration

of the Common Stock under Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

and/or suspend Assignor’s duty to file reports under Sections 13 and 15(d) of the Exchange Act.

m. To

dissolve the Assignor.

6. Rights

of Creditors. Nothing herein modifies any rights and remedies of the creditors of Assignor against any surety or sureties for

the Assignor and nothing herein shall prevent the creditors or any of them from suing any third parties or persons who may be liable to

any of the creditors for all or any part of their claims against the Assignor, or from enforcing or otherwise obtaining the full benefit

of any mortgage, charge, pledge, lien, or other security which they now hold on any property of the Assignor.

7. Administration

of Assignment Estate. The Assignee shall administer the Assignment Estate in a manner consistent with Delaware law and other applicable

state law. Additionally, the Assignee will file all necessary pleadings required in an assignment for the benefit of creditor proceeding

under 10 Del. C. 7381 et. seq. The Assignee also shall have the right to ask any court of competent jurisdiction

for a declaratory judgment or such other relief as the Assignee may deem necessary, if, in its opinion, said action is desirable in connection

with any dispute or claim arising hereunder.

8. Limitation

of Liability of Assignee; Indemnification.

a. Assignor

acknowledges that Assignee is acting solely in its limited capacity as Assignee of the Assignment Estate, and not in Assignee’s

personal capacity. The parties hereto acknowledge and agree that neither the Assignee nor any of its members, managers, employees, officers,

agents, or representatives will assume any personal liability or responsibility for any of the Assignee’s acts described herein.

Assignee’s obligations shall be limited to the performance of the terms and conditions of the General Assignment in good faith and

in the exercise of its best business judgment. No implied covenants or obligations shall be read into this Assignment against the Assignee.

b. The

Assignee shall be indemnified by the Assignment Estate for any claims brought against the Assignee for any of its acts or omissions as

Assignee except where it is determined in a final judgment by a court of competent jurisdiction that the Assignee’s conduct was

willful or grossly negligent.

9. Reliance.

The Assignee may conclusively rely and shall be protected in acting upon on the truth, accuracy, and completeness of any statement, certificate,

opinion, resolution, instrument, report, notice, request, consent, order, or other paper or document furnished to the Assignee by the

Assignor or its directors, managers, employees, officers, agents, or representatives. The Assignee may conclusively rely and shall be

protected in acting upon the truth, accuracy, and completeness of any statement, certificate, opinion, resolution, instrument, report,

notice, request, consent, order, or other paper or document believed by it to be genuine and to have been properly signed or presented.

10. Representations

and Warranties of Assignor.

a. As

of the date hereof, Assignor has all requisite power and authority to execute, deliver, and perform its obligations under this General

Assignment, including (without limitation) to transfer the property transferred to the Assignee hereby;

b. The

execution, delivery, and performance by the Assignor of this General Assignment has been duly authorized by all necessary corporate and

other action and does not and will not require any registration with, consent or approval of, or notice to or action by, any person (including

any governmental authority) in order to be effective and enforceable; and

c. This

General Assignment constitutes the legal, valid, and binding obligation of the Assignor, enforceable against it in accordance with their

respective terms.

11. Power

of Attorney. The Assignor, by this General Assignment, hereby grants the Assignee a general power of attorney, which power of

attorney specifically includes the right of the Assignee to prosecute any action in the name of the Assignor as Attorney-in-Fact. Further,

on the date the General Assignment is accepted by the Assignee, the Assignee shall succeed to all of the rights and privileges of the

Assignor, including (without limitation) any attorney-client privilege, in respect to any potential or actual claims, cases, controversies,

or causes of action, and shall be deemed to be a representative of the Assignor with respect to all such potential or actual claims, cases,

controversies, or causes of action.

12. Acceptance

by Assignee. By execution of this General Assignment, the Assignee does hereby accept the estate herein created and agrees to

faithfully perform its duties according to the best of the Assignee’s skill, knowledge, and ability in accordance with applicable

law. It is understood that the Assignee shall receive reasonable compensation for its services in connection with the administration

of the Assignment Estate. Reasonable compensation does not replace or subsume the reimbursement of all the Assignee’s expenses

incurred as a result of the administration of the Assignment Estate from the proceeds generated therefrom.

13. Resignation

by Assignee. The Assignee may resign and be discharged from its duties hereunder at any time; provided that such resignation shall

not become effective until (i) a successor assignee has been appointed by the Assignee, and such successor has accepted its appointment

in writing delivered to the Assignee, or (ii) the Assignee petitions the Court of Chancery of the State of Delaware (the “Court”)

to appoint a successor assignee, and the Court so appoints such a successor. Thereupon, such successor assignee shall, without any further

act, become vested with all of the estates, properties, rights, powers, trusts, and duties of its predecessor in connection with the General

Assignment with like effect as if originally named therein, but the Assignee shall nevertheless, when requested in writing by the successor

assignee, execute and deliver an instrument or instruments conveying and transferring to such successor assignee all of the estates, properties,

rights, powers, and trusts of the Assignee in connection with the General Assignment and shall duly assign, transfer, and deliver to such

successor assignee all property and money held by the Assignee hereunder.

14. Governing

Law. This General Assignment shall be governed by and construed in accordance with the Laws of the State of Delaware applicable

to a contract executed and performed in such State, without giving effect to the conflicts of laws principles thereof.

15. Counterparts.

This General Assignment may be executed in any number of counterparts, each of which will be deemed an original, but all of which together

will constitute one and the same instrument.

[Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF,

the parties have hereunto set their hands the day and year first above written.

| |

ASSIGNOR |

| |

|

| |

ACERAGEN, INC. |

| |

|

| |

By: |

/s/ John Taylor |

| |

|

Name: John Taylor |

| |

|

Title: Chief Executive Officer |

| |

|

| |

ASSIGNEE |

| |

|

| |

ACG (ABC), LLC |

| |

|

| |

By: |

/s/ James Gansman |

| |

|

Name: James Gansman |

| |

|

Title: President |

SIGNATURE PAGE TO ACERAGEN, INC. GENERAL ASSIGNMENT

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

001-31918

|

| Entity Registrant Name |

Aceragen, Inc.

|

| Entity Central Index Key |

0000861838

|

| Entity Tax Identification Number |

04-3072298

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

505

Eagleview Blvd.

|

| Entity Address, Address Line Two |

Suite 212

|

| Entity Address, City or Town |

Exton

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19341

|

| City Area Code |

484

|

| Local Phone Number |

348-1600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ACGN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

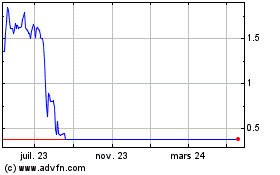

Aceragen (NASDAQ:ACGN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Aceragen (NASDAQ:ACGN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024