American Capital Director Appointed Chairman of Freddie Mac

18 Septembre 2008 - 6:32PM

PR Newswire (US)

BETHESDA, Md., Sept. 18 /PRNewswire-FirstCall/ -- American Capital,

Ltd. (NASDAQ:ACAS) announced today that its Director John A.

Koskinen has been appointed to serve as the non-executive Chairman

of Freddie Mac, the mortgage finance firm recently placed into

conservatorship by the federal government. Mr. Koskinen intends to

remain on American Capital's Board, which he joined in 2007.

"Freddie Mac stands to benefit from John's outstanding experience

in complex management environments," said Malon Wilkus, Chairman

and CEO, American Capital. "I wish John great success in his new

role and am very appreciative that he will continue with American

Capital." Mr. Koskinen, former Chairman of the Board of Trustees of

Duke University, was also Chief Executive of The Palmieri Company,

which restructured large, troubled operating companies. During Mr.

Koskinen's 21 years with Palmieri, he helped reorganize the Penn

Central Transportation Co.; Levitt and Sons, Inc.; the Teamsters

Pension Fund and Mutual Benefit Life Insurance Co. Following

Palmieri, Mr. Koskinen served on the White House staff and in the

District of Columbia government. Mr. Koskinen recently stepped down

as President of the United States Soccer Foundation but continues

to serve as a Director of the AES Corporation, one of the world's

largest global power companies, since 2004. While Mr. Koskinen will

remain on the American Capital Board, he will not participate in

any American Capital investments involving Freddie Mac securities,

including its affiliate American Capital Agency Corp.

(NASDAQ:AGNC). ABOUT AMERICAN CAPITAL American Capital, with $20

billion in capital resources under management(1), is the only

private equity fund and the largest alternative asset management

company in the S&P 500. American Capital, both directly and

through its global asset management business, originates,

underwrites and manages investments in private equity, leveraged

finance, real estate and structured products. American Capital and

its affiliates invest from $5 million to $800 million per company

in North America and euro 5 million to euro 500 million per company

in Europe. American Capital was founded in 1986 and currently has

12 offices in the U.S. and Europe. As of August 31, 2008, American

Capital shareholders have enjoyed a total return of 292% since the

Company's IPO -- an annualized return of 13%, assuming reinvestment

of dividends. American Capital has paid a total of $2.5 billion in

dividends and paid or declared $29.25 dividends per share since

going public in August 1997 at $15 per share. Companies interested

in learning more about American Capital's flexible financing should

contact Mark Opel, Senior Vice President, Business Development, at

(800) 248-9340, or visit http://www.americancapital.com/ or

http://www.europeancapital.com/. Performance data quoted above

represents past performance of American Capital. Past performance

does not guarantee future results and the investment return and

principal value of an investment in American Capital will likely

fluctuate. Consequently, an investor's shares, when sold, may be

worth more or less than their original cost. Additionally, American

Capital's current performance may be lower or higher than the

performance data quoted above. This press release contains

forward-looking statements. The statements regarding expected

results of American Capital are subject to various factors and

uncertainties, including the uncertainties associated with the

timing of transaction closings, changes in interest rates,

availability of transactions, changes in regional, national or

international economic conditions, or changes in the conditions of

the industries in which American Capital has made investments. (1)

Capital resources under management is internally and externally

managed assets and available capital resources as of June 30, 2008.

DATASOURCE: American Capital, Ltd. CONTACT: Jennifer Burke,

Corporate Communications of American Capital, Ltd., +1-301-951-6122

Web site: http://www.americancapital.com/

http://www.europeancapital.com/

Copyright

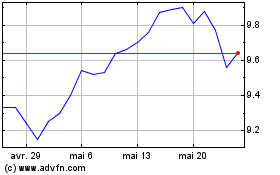

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024