Bernanke Helps Boost REIT Dividend Expectations

14 Juin 2011 - 2:16PM

Marketwired

Real Estate Investment Trusts (REITs) have some of the highest

yields on Wall Street. As a REIT, these companies are typically not

taxed on their income but are required to pay out 90 percent of

their taxable income in dividends. While this makes dividend

payments more volatile, analysts argue that REITs' profits should

remain stable given the current economic conditions. The Bedford

Report examines the outlook for diversified REITs and provides

equity research on American Capital Agency Corporation (NASDAQ:

AGNC) and Annaly Capital Management, Inc. (NYSE: NLY). Access to

the full company reports can be found at:

www.bedfordreport.com/AGNC

www.bedfordreport.com/NLY

Companies like American Capital Agency and Annaly Capital

Management earn their money on the spread between low-interest

short-term borrowing and purchasing high-interest long-term

securities. The Federal Reserve has expressed its intention to keep

interest rates low which means that REITs should enjoy a good

spread for the foreseeable future. Reports from Reuters argue that

remarks from Federal Reserve Chairman Ben Bernanke have helped send

expectations of an interest rate hike back to about October of

2011.

The Bedford Report releases stock research on REITs so investors

can stay ahead of the crowd and make the best investment decisions

to maximize their returns. Take a few minutes to register with us

free at www.bedfordreport.com and get exclusive access to our

numerous analyst reports and industry newsletters.

Currently Annaly Capital Management pays an annual dividend of

$2.36 for a yield of around 13.6 percent. Last month Annaly booked

net income of $699.9 million, or 92 cents per share, up from $281.1

million, or 50 cents per share, in the year-earlier period.

American Capital Agency presently pays an annual dividend of

$5.60 for a hefty yield of around 18.6 percent.

The Bedford Report provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

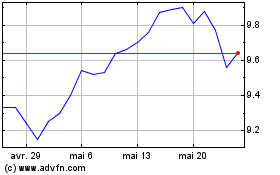

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024