Above Average Dividend Outlooks for American Capital Agency and Chimera Investment Poised to Lure Investors

29 Mars 2012 - 2:20PM

Marketwired

Mortgage REITs have outperformed the market in 2012 as investors

continue to flock towards their large dividends. Presently the

Market Vectors Mortgage REIT Income ETF (MORT) -- with holdings

such as American Capital Agency Corporation and Chimera Investment

Corp -- is up more than ten percent year to date. Five Star

Equities examines the outlook for diversified REITs and provides

investment research on American Capital Agency Corporation (NASDAQ:

AGNC) and Chimera Investment Corporation (NYSE: CIM). Access to the

full company reports can be found at: www.fivestarequities.com/AGNC

www.fivestarequities.com/CIM

In a recent report from Keefe, Bruyette & Woods (KBW), REITs

are currently attractive relative to the fixed income markets,

given the sector's above-average dividend growth outlook. The firm

expects 10 percent annual dividend growth per year for the next few

years, Barron's reports.

According to Nomura Securities analyst Bill Carcache, effective

prepayment risk management helps agency mortgage REITs generate

higher returns "by being able to run at higher leverage without

compromising their equity cushion and minimize spread

compression."

Five Star Equities releases regular market updates on

diversified REITs so investors can stay ahead of the crowd and make

the best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.fivestarequities.com and

get exclusive access to our numerous stock reports and industry

newsletters.

American Capital Agency Corporation invests in residential

mortgage pass-through securities and collateralized mortgage

obligations for which the principal and interest payments are

guaranteed by government-sponsored entities or by the United States

government agency. The company presently pays an annual dividend of

$5 per share for a large yield of more than 17 percent.

Through its subsidiaries, Chimera Investment Corporation invests

in residential mortgage-backed securities (RMBS), residential

mortgage loans, commercial mortgage loans, real estate-related

securities, and other asset classes. The company currently pays an

annual dividend of 44 cents a share for a yield of roughly 14.9

percent.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.fivestarequities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

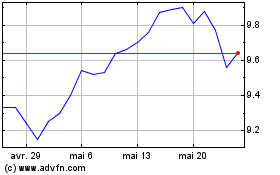

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024