AGNC Upgraded to Outperform - Analyst Blog

08 Juin 2012 - 6:04PM

Zacks

We have recently upgraded the long-term recommendation for

American Capital Agency Corp. (AGNC), a real

estate investment trust (REIT), from Neutral to Outperform

primarily driven by its healthy first quarter 2012 results and

strong growth perspectives.

American Capital Agency focuses on investments in mortgage

pass-through securities and collateralized mortgage obligations

(CMOs). The company purchases single-family residential

pass-through securities which are interests in pooled loans of

principal and interest including pre-paid principal that are made

to the holders of the notes.

Collateralized mortgage obligations consist of multiple classes

with payments of principal and interest being made to note holders

based on the maturity date of the class of security.

The mortgages underlying these agency securities are fixed rate,

adjustable rate or hybrid (fixed and adjustable) securities. Agency

securities differ from traditional fixed-income investments as

principal and interest are paid on a regular schedule and there is

a possibility that principal will be pre-paid by mortgage holders

if interest rates fall.

American Capital Agency invests only in fixed-rate agency

securities where payments are guaranteed by the U.S. government or

government-owned entities, such as Fannie Mae (FNMA), Freddie Mac

(FHLMC) and Ginnie Mae (GNMA). Specifically, American Capital

Agency invests in FHLMC Gold certificates, FNMA certificates, and

GNMA certificates.

We like the company’s focused investment approach, which is not

distracted by originations, servicing, or credit risk from

investments in mortgages that do not have the backing of the U.S.

government.

With the government takeover of FNMA and FHLMC, American Capital

Agency’s securities now have an explicit government guarantee,

which makes it a much more attractive prospect for investors.

Additionally, the company’s portfolio of government-backed assets

is relatively liquid and credit risk is limited.

American Capital Agency borrows against its investment portfolio

pursuant to a master repurchase agreement which provides short-term

financing, typically 30-90 days. The company makes a profit and

pays dividends from net interest income, which is the difference

between interest earned on investments and its cost of

borrowing.

American Capital Agency also purchases payer "swaptions" to

protect against lower interest rates that might lead to early

prepayment of mortgages. This measure ultimately facilitates the

company to continue making money by collecting premiums and ensures

a steady revenue stream.

However, the residential mortgage market in the U.S. has

experienced defaults, credit losses and liquidity concerns in the

recent past, which have reduced financial industry capital, leading

to reduced liquidity for some institutions. These factors have

impacted investor perception of the risk associated with real

estate related assets, including agency securities and other

high-quality RMBS (residential mortgage backed securities) assets.

As a result, values for RMBS assets, including some agency

securities and other AAA-rated RMBS assets, have experienced a

certain amount of volatility. Increased volatility and

deterioration in the broader residential mortgage and RMBS markets

may adversely affect the performance of American Capital Agency in

the future.

We presently have a Zacks #1 Rank for American Capital Agency,

which translates into a short-term Strong Buy rating. However, we

have a Neutral recommendation and a Zacks #3 Rank (short-term Hold

rating) for Anworth Mortgage Asset Corporation

(ANH), one of the competitors of American Capital Agency.

AMER CAP AGENCY (AGNC): Free Stock Analysis Report

ANWORTH MTGE (ANH): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

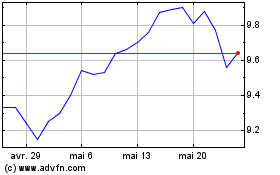

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024