High Yielding REITs Continue to Benefit From Steady Recovery of the U.S. Housing Market

02 Août 2012 - 2:20PM

Marketwired

High Yielding REITs have benefited from the steady recovery of the

U.S. housing market in 2012. The Vanguard REIT ETF -- which tracks

the performance of an index that measures the performance of

publicly traded equity REITs -- is up over 15 percent for the year,

outperforming the Dow Jones Industrial by a large margin. "The way

I like to think about REITs is they are real estate, period. REITs

delivers more for investors and gives you bond-like yield," said

Michael Hudgins, real estate strategist with JP Morgan Asset

Management. Five Star Equities examines the outlook for diversified

REITs and provides equity research on American Capital Agency Corp.

(NASDAQ: AGNC) and ARMOUR Residential REIT, Inc. (NYSE: ARR).

Access to the full company reports can be found at:

www.FiveStarEquities.com/AGNC www.FiveStarEquities.com/ARR

A recent AP article stated that through June of this year real

estate funds have gained $2.9 billion in new cash from investors,

while a majority of other stock fund groups have seen investors

pull out. The recent strength of REITs combined with their high

yields have made them attractive targets for investors as interests

rates and bond yields are near record lows.

Positive data supporting the U.S. housing market's recovery

continues to roll in. Data from FHFA showed that U.S. home prices

rose for the fourth consecutive month with a 0.8 percent increase

in May. Real-estate firm Zillow also recently put out a report

showing home prices in the second quarter increased from the

year-ago period for the first time in five years. "Home prices are

turning upward, another clear indication that housing market is in

the midst of a growing comeback," wrote Joel Naroff, president and

chief economist at Naroff Economic Advisors.

Five Star Equities releases regular market updates on

diversified REITs so investors can stay ahead of the crowd and make

the best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.FiveStarEquities.com and

get exclusive access to our numerous stock reports and industry

newsletters.

American Capital, both directly and through its asset management

business, originates, underwrites and manages investments in middle

market private equity, leveraged finance, real estate and

structured products. American Capital has $101 billion in assets

under management and seven offices in the U.S. and Europe. The

company offers a dividend yield of approximately 14 percent.

ARMOUR is a Maryland corporation that invests primarily in

hybrid adjustable rate, adjustable rate and fixed rate residential

mortgage-backed securities issued or guaranteed by U.S.

Government-chartered entities. The company offers investors a

dividend yield of 15.6 percent.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.FiveStarEquities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

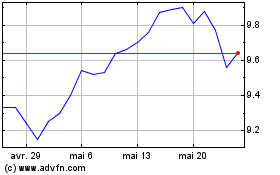

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024