Large Dividends From American Capital and Two Harbors Benefit From Record Low Interest Rates

15 Août 2012 - 2:20PM

Marketwired

High yielding Real Estate Investment Trusts (REITs) have performed

well in the current economic climate. REITs are a popular play in

the current economy due to their steady dividends. REITs can avoid

corporate income tax, provided they invest in real estate-related

assets and pay out at least 90 percent of their income in dividends

to investors, rather than reinvesting in their business. The

Paragon Report examines investing opportunities in diversified

REITs and provides equity research on American Capital Agency Corp.

(NASDAQ: AGNC) and Two Harbors Investment Corp. (NYSE: TWO).

Access to the full company reports can be found at:

www.ParagonReport.com/AGNC

www.ParagonReport.com/TWO

The Mortgage REIT market has been boosted by record low interest

rates, and there have been talks from the Federal Reserve to

continue to keep interest rates at these low levels beyond 2014.

With the current problems with Europe's economy the most likely

response would be for governments to cut interest rates further or

purchase assets.

"Even if the United States falls into a double-dip recession or

has a contagion, that would basically inure to our benefit as those

rates extend even further," said Dynex Capital Inc. Chairman and

CEO Thomas Akin.

The Paragon Report releases regular market updates on

diversified REITs so investors can stay ahead of the crowd and make

the best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.ParagonReport.com and get

exclusive access to our numerous stock reports and industry

newsletters.

American Capital has $101 billion in assets under management and

seven offices in the U.S. and Europe. American Capital and European

Capital will consider investment opportunities from $10 million to

$500 million. The company declared a cash dividend of $1.25 per

share for the second quarter 2012, for a yield of roughly 14.6

percent.

Two Harbors Investment Corp. is a Maryland corporation focused

on investing, financing and managing residential mortgage-backed

securities (RMBS) and related investments. The company offers

investors an annual dividend of $1.60 per share for a yield of

around 14 percent. Two Harbors shares are up over 20 percent for

the year.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at:

http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

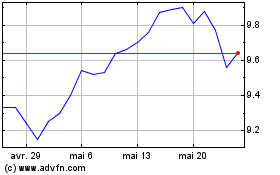

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024