30-Year Mortgage Rates Averaged 3.66 Percent in 2012 -- The Lowest in 65 Years

18 Janvier 2013 - 2:20PM

Marketwired

High yielding mortgage REITs after an impressive start to 2012,

began to show volatility in the fourth quarter. Increases in

prepayments and stimulus measures by the Federal Reserve have

pressured spreads and as a result a number of mortgage-based REITs

have lowered their dividends. Research Driven Investing examines

investing opportunities on Real Estate Investment Trusts and

provides equity research on American Capital Agency Corp. (NASDAQ:

AGNC) and Hatteras Financial Corp. (NYSE: HTS).

Access to the full company reports can be found at:

www.RDInvesting.com/AGNC www.RDInvesting.com/HTS

REITs trade like stocks, but by law, they must pay out 90

percent of their taxable income to shareholders as dividends.

Dividend returns for Mortgage REITs are partially dependent on

interest rate spreads.

Freddie Mac on Thursday reported that the average U.S. rate on

the 30-year fixed mortgage fell to 3.38 percent, hovering near the

40 year low of 3.31 percent seen in November. According to Freddie

Mac 30-year mortgage rates average 3.66 percent in 2012, which was

the lowest average seen in 65 years. Low mortgage rates allow

homeowners who are underwater with their mortgages to refinance,

and in turn increase prepayments on mortgages. Mortgage prepayment

rates at the beginning of the fourth quarter 2012 soared to 7 year

highs.

Research Driven Investing releases regular market updates on

Real Estate Investment Trusts so investors can stay ahead of the

crowd and make the best investment decisions to maximize their

returns. Take a few minutes to register with us free at

www.RDInvesting.com and get exclusive access to our numerous stock

reports and industry newsletters.

American Capital Agency is a real estate investment trust that

invests in agency pass-through securities and collateralized

mortgage obligations for which the principal and interest payments

are guaranteed by a U.S. Government agency or a U.S.

Government-sponsored entity. The Company's average net interest

rate spread for the third quarter was 1.42%, a decrease of 23 bps

from the second quarter of 1.65%.

Hatteras Financial is a real estate investment trust formed in

2007 to invest in single-family residential mortgage pass-through

securities guaranteed or issued by U.S. Government agencies or U.S.

Government-sponsored entities, such as Fannie Mae, Freddie Mac or

Ginnie Mae. The Company's net interest margin decreased to 1.22%

for the third quarter of 2012 from 1.49% in the second quarter of

2012.

Research Driven Investing has not been compensated by any of the

above-mentioned publicly traded companies. Research Driven

Investing is compensated by other third party organizations for

advertising services. We act as an independent research portal and

are aware that all investment entails inherent risks. Please view

the full disclaimer at: http://www.rdinvesting.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

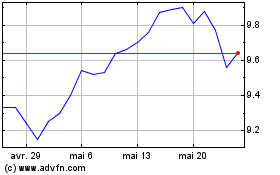

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024