Aimfinity Investment Corp. I (“Aimfinity”) (NASDAQ: AIMAU), a

Cayman Islands incorporated special purpose acquisition company

listed on the Nasdaq Global Market, and Docter Inc. (“Docter”), a

Taiwanese non-invasive blood glucose watch developer, today

announced that they have entered a definitive merger agreement (the

“Merger Agreement”) pursuant to which a newly established

subsidiary of Aimfinity will become a publicly listed company

combining Aimfinity and Docter (the “Combined Company”) upon the

closing of the transaction contemplated therein (the “Proposed

Transaction”). Upon closing, the Combined Company expects to list

its ordinary shares on Nasdaq.

Since 2016, Docter, along with its subsidiary, Horn Enterprise

Co., Ltd., has been developing a non-invasive blood sugar trend

monitoring technology, alleviating the necessity for blood

sampling. The company operates Docter brand watches and employs

Docter Cloud platform technologies to facilitate health monitoring,

vascular elasticity tracking, and myocardial infarction prediction.

Additionally, Docter has made investments in the development of

biological radar wave technology to cater to those requiring

long-term care or individuals experiencing sub-optimal health.

In addition to this exciting transaction, Docter Inc. has

recently announced that it has signed a Memorandum of Understanding

(MOU) with Harvard Medical School for the purchase of 10,000 Docter

watches. These watches will be utilized in a Harvard Medical School

Long Covid research project, highlighting the growth potential of

Docter Inc.'s technology in advanced medical research.

Management Comments

I-fa Chang, CEO of Aimfinity Investment Corp. I, comments on the

transaction:

“We are genuinely excited to announce our merger with Docter

Inc. Their focus on wearable devices has the potential to

revolutionize healthcare, and this partnership allows us to be at

the forefront of this transformation. By combining our resources

and expertise, we believe this business combination will provide

Docter Inc. and the Combined Company with the necessary support to

further develop Docter’s groundbreaking wearable devices and

introduce them to the public.”

Hsin-Ming Huang, CEO of Docter Inc. comments:

“Docter Inc. is committed to pushing the boundaries of what

wearable devices can achieve in the realm of health and well-being.

Our team is confident that, with the support of Aimfinity

Investment Corp. I, we can continue to innovate and bring our

revolutionary wearable technologies to a broader audience as a

publicly traded company. We are thrilled to have found such

outstanding partners as we embark on this new phase of our

journey.”

Key Transaction Terms

As provided in the Merger Agreement, the merger consideration is

$60,000,000, payable by newly-issued shares of the Combined Company

valued at $10.00 per share. Additional earnout shares may be

issuable to Docter stockholders after closing, upon achievement of

certain sales targets in 2024 and 2025.

Following the closing, assuming no redemption by existing public

shareholders of Aimfinity, the Aimfinity shareholders will have

approximately 51.92% equity interest in the Combined Company and

the Docter Stockholders will have approximately 48.08% equity

interest in the Combined Company. If, however, there is a maximum

redemptions of existing public shareholders of Aimfinity resulting

in remaining balance of trust account of $5,000,000, the Aimfinity

shareholders will have approximately 29.45% equity interest in the

Combined Company and the Docter stockholders will have

approximately 70.55% equity interest in the Combined

Company.

The boards of directors of both Docter and Aimfinity have

unanimously approved the Proposed Transaction, which is expected to

be completed in the first quarter of 2024, subject to, among other

things, approval by the Aimfinity shareholders and the Docter

stockholders respectively, and satisfaction (or waiver, as

applicable) of the conditions provided in the Merger Agreement,

including regulatory approvals and other customary closing

conditions, including a registration statement in connection with

the Proposed Transaction being declared effective by the U.S.

Securities and Exchange Commission (the “SEC”) and the listing

application being approved by the Nasdaq Capital Markets LLC.

Additional information about the Proposed Transaction, including

a copy of the Merger Agreement, will be provided in a Current

Report on Form 8-K to be filed by Aimfinity with the SEC and

available at www.sec.gov. Additional information about the Proposed

Transaction will be described in the Registration Statement, which

Aimfinity and/or its subsidiary will file with the SEC.

Advisors

US Tiger Securities is serving as M&A and Capital Markets

advisor and Robinson & Cole LLP is serving as legal advisor to

Aimfinity. Winston & Strawn LLP is serving as legal advisor to

Docter.

Forward-Looking Statements

This press release contains certain “forward-looking statements”

within the meaning of the Securities Act of 1933 and the Securities

Exchange Act of 1934, both as amended. Statements that are not

historical facts, including statements about the pending

transactions described herein, and the parties’ perspectives and

expectations, are forward-looking statements. Such statements

include, but are not limited to, statements regarding the proposed

transaction, including the anticipated initial enterprise value and

post-closing equity value, the benefits of the proposed

transaction, integration plans, expected synergies and revenue

opportunities, anticipated future financial and operating

performance and results, including estimates for growth, the

expected management and governance of the combined company, and the

expected timing of the transactions. The words “expect,” “believe,”

“estimate,” “intend,” “plan” and similar expressions indicate

forward-looking statements. These forward-looking statements are

not guarantees of future performance and are subject to various

risks and uncertainties, assumptions (including assumptions about

general economic, market, industry and operational factors), known

or unknown, which could cause the actual results to vary materially

from those indicated or anticipated.

Such risks and uncertainties include, but are not limited to:

(i) risks related to the expected timing and likelihood of

completion of the pending business combination, including the risk

that the transaction may not close due to one or more closing

conditions to the transaction not being satisfied or waived, such

as regulatory approvals not being obtained, on a timely basis or

otherwise, or that a governmental entity prohibited, delayed or

refused to grant approval for the consummation of the transaction

or required certain conditions, limitations or restrictions in

connection with such approvals; (ii) risks related to the ability

of Aimfinity and Docter to successfully integrate the businesses;

(iii) the occurrence of any event, change or other circumstances

that could give rise to the termination of the applicable

transaction agreements; (iv) the risk that there may be a material

adverse change with respect to the financial position, performance,

operations or prospects of Docter or Aimfinity; (v) risks related

to disruption of management time from ongoing business operations

due to the proposed transaction; (vi) the risk that any

announcements relating to the proposed transaction could have

adverse effects on the market price of Aimfinity’s securities;

(vii) the risk that the proposed transaction and its announcement

could have an adverse effect on the ability of Docter to retain

customers and retain and hire key personnel and maintain

relationships with their suppliers and customers and on their

operating results and businesses generally; (viii): risks relating

to the medical device industry, including but not limited to

governmental regulatory and enforcement changes, market

competitions, competitive product and pricing activity; and (ix)

risks relating to the combined company’s ability to enhance its

products and services, execute its business strategy, expand its

customer base and maintain stable relationship with its business

partners.

A further list and description of risks and uncertainties can be

found in the prospectus filed on April 26, 2022 relating to

Aimfinity’s initial public offering, the annual report of Aimfinity

on Form 10-K for the fiscal year ended on December 31, 2022, filed

on April 17, 2023, and in the Registration Statement/proxy

statement that will be filed with the SEC by Aimfinity and/or its

affiliates in connection with the proposed transactions, and other

documents that the parties may file or furnish with the SEC, which

you are encouraged to read. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those indicated

or anticipated by such forward-looking statements. Accordingly, you

are cautioned not to place undue reliance on these forward-looking

statements. Forward-looking statements relate only to the date they

were made, and Aimfinity, Docter, and their subsidiaries undertake

no obligation to update forward-looking statements to reflect

events or circumstances after the date they were made except as

required by law or applicable regulation.

No Offer or Solicitation

This press release is not a proxy statement or solicitation of a

proxy, consent or authorization with respect to any securities or

in respect of the transactions described above and shall not

constitute an offer to sell or a solicitation of an offer to buy

the securities of Aimfinity or Docter, nor shall there be any sale

of any such securities in any state or jurisdiction in which such

offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of such

state or jurisdiction. No offering of securities shall be made

except by means of a prospectus meeting the requirements of Section

10 of the Securities Act of 1933, as amended, or an exemption

therefrom.

Participants in the Solicitation

Aimfinity and Docter, and certain shareholders of Aimfinity, and

their respective directors, executive officers and employees and

other persons may be deemed to be participants in the solicitation

of proxies from the holders of Aimfinity ordinary shares in respect

of the proposed transaction. Information about Aimfinity’s

directors and executive officers and their ownership of Aimfinity

ordinary shares is set forth in the 10-K Annual Report filed on

April 17, 2023 and filed with the SEC as modified or supplemented

by any Form 3 or Form 4 filed with the SEC since the date of that

filing. Other information regarding the interests of the

participants in the proxy solicitation will be included in the

Registration Statement/proxy statement pertaining to the proposed

transaction when it becomes available. These documents can be

obtained free of charge from the sources indicated above.

Docter and its directors and executive officers may also be

deemed to be participants in the solicitation of proxies from the

stockholders of Aimfinity in connection with the proposed business

combination. A list of the names of such directors and executive

officers and information regarding their interests in the proposed

business combination will be included in the Registration

Statement/proxy statement pertaining to the proposed transaction

when it becomes available for the proposed business

combination.

Contacts

Aimfinity Investment Corp. I:I-Fa Chang, CEO221 W 9th St, PMB

235Wilmington, Delaware 19801

Docter Inc.:Investor Relationsir@docter.one

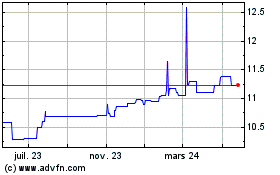

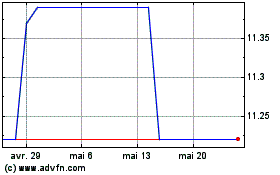

Aimfinity Investment Cor... (NASDAQ:AIMAU)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Aimfinity Investment Cor... (NASDAQ:AIMAU)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024