UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-41324

AKANDA CORP.

(Exact Name of Registrant as Specified in Charter)

Akanda Corp.

1a, 1b Learoyd Road

New Romney TN28 8XU, United Kingdom

Tel: +44 (203) 488-9514

(Address, including zip code, and telephone number,

including area code, of Registrant’s principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒

Form 40-F ☐

Exhibit Index

On October 2, 2024, Akanda Corp. issued a press release announcing

the pricing of its underwritten public offering, a copy of which is furnished herewith as Exhibit 99.1 to this Report on Form 6-K.

The press release furnished in this report as Exhibit 99.1 shall not

be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the

liabilities of that section.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

Date: October 2, 2024

| |

AKANDA CORP.

(Registrant) |

| |

|

| |

By: |

/s/ Katharyn Field |

| |

Name: |

Katharyn Field |

| |

Title: |

Interim Chief Executive Officer and Director |

| |

|

|

2

Exhibit 99.1

Akanda Corp. Announces Pricing of Underwritten

Public Offering

London, October 2, 2024 – Akanda

Corp. ("Akanda" or the “Company”) (NASDAQ: AKAN), an international

medical cannabis company, today announced that it has entered into a firm commitment underwriting agreement with Univest Securities, LLC,

as underwriter, whereby Univest has agreed to purchase 1,500,000 common shares (or pre-funded warrants in lieu thereof) at a public offering

price of $1.00 per share or $0.9999 per pre-funded warrant in an underwritten public offering.

The gross proceeds to Akanda are estimated to

be approximately $1,500,000 before deducting the underwriter fees and other offering expenses payable by the Company. The offering is

expected to close on about October 3, 2024, subject to the satisfaction of customary closing conditions. Akanda plans to use the net proceeds

from the offering for capital expenditures, operating capacity, working capital, potential milestone payments of the option to purchase

agreement for certain Canadian property, general corporate purposes, and the refinancing or repayment of existing indebtedness and acquisitions

of complementary products, technologies or businesses.

The securities described above are being offered

by Akanda pursuant to an effective registration statement on Form F-1, as amended (File No. 333-281945), declared effective by the U.S.

Securities and Exchange Commission (“SEC”) on September 30, 2024. A final prospectus relating to the offering will be filed

with the SEC and will be available free of charge on the SEC’s website at http://sec.gov.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

state or jurisdiction. Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration

requirements of the Securities Act of 1933, as amended.

About Akanda Corp.

Akanda Corp. is an international cannabis company

with operations in Europe and North America. The company is dedicated to cultivating and distributing high-quality medical cannabis and

wellness products that improve lives. Akanda’s mission is to provide safe, reliable, and accessible cannabis products to consumers

worldwide while promoting sustainable business practices.

Connect with Akanda: Email | Website | LinkedIn | Twitter | Instagram

Investor Contact

ir@akandacorp.com

Cautionary Note Regarding Forward-Looking

Information and Statements

This press release contains certain “forward-looking

information” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995.

Such forward-looking information and forward-looking statements are not representative of historical facts or information or current condition,

but instead represent only Akanda’s beliefs regarding future events, plans or objectives, many of which, by their nature, are inherently

uncertain and outside of Akanda’s control. Generally, such forward-looking information or forward-looking statements can be identified

by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”,

“anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or

may contain statements that certain actions, events or results “may”, “could”, “would”, “might”

or “will be taken”, “will continue”, “will occur” or “will be achieved” and similar expressions

and include statements regarding the timing and completion of the proposed offering. Forward-looking information may relate to anticipated

events or results including, but not limited to business strategy, product development and sales and growth plans. The forward-looking

information and forward-looking statements contained in this press release are made as of the date of this press release, and Akanda does

not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except

in accordance with applicable securities laws.

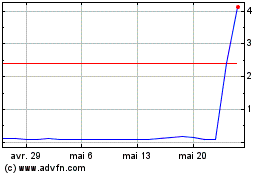

Akanda (NASDAQ:AKAN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

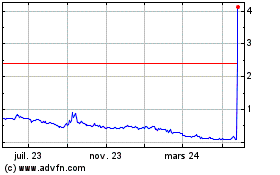

Akanda (NASDAQ:AKAN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025