Alto Ingredients, Inc. (NASDAQ: ALTO), a leading

producer and distributor of specialty alcohols and essential

ingredients, today announced the following executive leadership

changes as of August 1, 2023: Bryon T. McGregor, the company’s

former Chief Financial Officer, has been appointed President and

Chief Executive Officer. He succeeds Michael D. Kandris, who has

retired as President and Chief Executive Officer and has been

appointed Interim Chief Operating Officer for a period of up to a

year. Kandris will continue to serve as a Director of the company.

Robert R. Olander, the company’s former Vice President, Corporate

Controller, has been appointed Chief Financial Officer.

“Mike has been integral to our business transformation into a

leading producer and distributor of specialty alcohols and

essential ingredients,” said Chairman of the Board Douglas Kieta.

“We thank Mike for his exemplary leadership and significant

contributions over the past 15 years. We are pleased he will

continue on as Interim Chief Operating Officer to offer valuable

guidance until we name a successor, and we will continue to benefit

from his ongoing services as an active member of our board of

directors.”

Kandris stated, “In planning for my eventual retirement, Bryon

and I have worked closely together for many years, and even more so

in the last three years, on our strategy to diversify revenue

streams, optimize operations and expand EBITDA. Recognized for his

strong leadership, strategic vision and outstanding management,

Bryon has developed and managed capital financing for over 40

global industrial and infrastructure projects valued in excess of

$12 billion. Then, as a critical player at Alto for over 15 years,

he gained a deep understanding of our markets and business needs.

The board and I are confident Bryon will lead the team to deliver

sustainable profitability.”

McGregor added “Rob, an expert in public company accounting,

process improvement and contract review, has been a valuable player

in developing and implementing our financial strategy. Having

worked together for over 15 years, I know Rob’s financial and

accounting acumen as well as his foresight have contributed greatly

to where we are today. These qualities have also prepared him well

to assume his new role as Chief Financial Officer.”

McGregor concluded, “I am proud of the company’s progress in our

business transformation to date. More importantly, I am confident

our talented and experienced team will execute our initiatives,

including carbon capture and sequestration, to increase additional

annualized EBITDA by approximately $125 million by the end of 2026

when we expect our projects will be fully realized.”

Bryon T. McGregorMcGregor, named President and

Chief Executive Officer, joined the company in 2008 as Vice

President Finance/Treasurer and was later appointed Chief Financial

Officer in 2009. During his tenure as Chief Financial Officer,

McGregor has led multiple financings, raising over $640 million for

the company; integrated two acquisitions, increasing the company’s

production capacity by three-fold; strengthened the company’s

balance sheet and implemented cost reduction programs. With over 35

years’ experience, he has developed expertise in business

development, project development, corporate planning, M&A, risk

management, corporate and international finance, investor

relations, treasury operations and accounting. Prior to joining the

company, McGregor was Brokerage Treasurer for E*TRADE Financial,

overseeing Europe and Asian treasury operations. As Manager, Global

Head of Project Finance at BP (formerly ARCO, one of the top 10

fully integrated multi-national oil and gas companies in the world

at that time), McGregor was responsible for the development of and

managing investments in global industrial and infrastructure

projects, including a multi-billion dollar LNG project in

Indonesia, a $3 billion heavy-oil project in Venezuela, over $1

billion in regasification and natural gas pipeline projects, and

over $1 billion in various other energy and chemical investments

located both domestically and internationally. When at Credit

Suisse, he developed limited-recourse financing opportunities

globally in excess of $8 billion in energy, mining, petrochemical,

infrastructure and telecommunications, as well as facilitated

M&A for clients.

McGregor has a B.S. degree in Business Management from Brigham

Young University.

Michael D. Kandris Kandris, named Interim Chief

Operating Officer, has served the company for over 15 years.

Originally an independent contractor with the company focusing on

plant operations, Kandris became a member of the company’s board of

directors in 2008, began serving as Chief Operating Officer in

2013, and served as President and Chief Executive Officer from 2020

until retiring from those roles in 2023. He has over 40 years of

general management experience in the transportation and logistics

including serving as President of Ruan Transportation Management

Systems (RTMS) prior to joining Alto. Additionally, Kandris served

on the Executive Committee of the American Trucking Association and

as a board member for the National Tank Truck Organization.

Kandris has a B.S. degree in Business from California State

University, Hayward.

Robert R. OlanderOlander, named Chief Financial

Officer, has served the company for over 16 years with increasing

responsibility, and, most recently, as Vice President, Corporate

Controller. Olander has over 20 years of accounting, treasury and

finance experience. Prior to joining the company, he served as

Controller and Business Manager at Hampton Distribution Companies

and supervised audit and consulting at James Marta & Company.

He began his career at Deloitte & Touche in audit and assurance

working with ConAgra, Berkshire Hathaway and Union Pacific, among

others.

Olander has a B.S. in Business Administration from Midland

University and is a Certified Public Accountant.

About Alto Ingredients, Inc.Alto Ingredients,

Inc. (NASDAQ: ALTO) is a leading producer and distributor of

specialty alcohols and essential ingredients. The company is

focused on products for four key markets: Health, Home &

Beauty; Food & Beverage; Essential Ingredients; and Renewable

Fuels. The company’s customers include major food and beverage

companies and consumer products companies. For more information,

please visit www.altoingredients.com.

Safe Harbor Statement under the Private Securities

Litigation Reform Act of 1995

Statements and information contained in this

communication that refer to or include Alto Ingredients’ estimated

or anticipated future results or other non-historical expressions

of fact are forward-looking statements that reflect Alto

Ingredients’ current perspective of existing trends and information

as of the date of the communication. Forward looking statements

generally will be accompanied by words such as “anticipate,”

“believe,” “plan,” “could,” “should,” “estimate,” “expect,”

“forecast,” “outlook,” “guidance,” “intend,” “may,” “might,”

“will,” “possible,” “potential,” “predict,” “project,” or other

similar words, phrases or expressions. Such forward-looking

statements include, but are not limited to, the cost, timing and

effects of, including the financial results deriving from, Alto

Ingredients’ capital improvement projects and other business

initiatives and strategies; the timing and amount of expected

increases in annualized EBITDA; and Alto Ingredients’ other plans,

objectives, expectations and intentions. It is important to note

that Alto Ingredients’ plans, objectives, expectations and

intentions are not predictions of actual performance. Actual

results may differ materially from Alto Ingredients’ current

expectations depending upon a number of factors affecting Alto

Ingredients’ business. These factors include, among others, Alto

Ingredients’ ability to timely and effectively fund and complete

its capital improvement projects and other business initiatives and

strategies, and to operate them as expected and attain the

anticipated results; adverse economic and market conditions,

including for alcohols and essential ingredients; export conditions

and international demand for the company’s products; fluctuations

in the price of and demand for oil and gasoline; raw material

costs, including production input costs, such as corn and natural

gas. These factors also include, among others, the inherent

uncertainty associated with financial and other projections; the

anticipated size of the markets and continued demand for Alto

Ingredients’ products; the impact of competitive products and

pricing; the risks and uncertainties normally incident to the

alcohol production, marketing and distribution industries; changes

in generally accepted accounting principles; successful compliance

with governmental regulations applicable to Alto Ingredients’

facilities, products and/or businesses; changes in laws,

regulations and governmental policies; the loss of key senior

management or staff; and other events, factors and risks previously

and from time to time disclosed in Alto Ingredients’ filings with

the Securities and Exchange Commission including, specifically,

those factors set forth in the “Risk Factors” section contained in

Alto Ingredients’ Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on May 9, 2023.

Company IR & Media Contact:

Michael

Kramer, Alto Ingredients, Inc., 916-403-2755,

Investorrelations@altoingredients.com

IR Agency Contact: Kirsten Chapman, LHA

Investor Relations, 415-433-3777,

Investorrelations@altoingredients.com

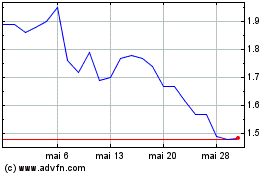

Alto Ingredients (NASDAQ:ALTO)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Alto Ingredients (NASDAQ:ALTO)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024