false

0000741516

0000741516

2024-01-23

2024-01-23

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

FORM 8-K

|

|

CURRENT REPORT

|

|

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported) January 23, 2024

|

AMERICAN NATIONAL BANKSHARES INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Virginia

|

0-12820

|

54-1284688

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

628 Main Street, Danville, VA 24541

|

|

(Address of principal executive offices) (Zip Code)

|

Registrant’s telephone number, including area code: 434-792-5111

|

Not Applicable

|

|

(Former name or former address, if changed since last report.)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $1.00 par value

|

AMNB

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On January 23, 2024, American National Bankshares Inc. ("the Company") reports earnings for fourth quarter and full year 2023.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

| Exhibit No. |

Description |

| |

|

| 99.1 |

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

American National Bankshares Inc. |

| |

|

|

(Registrant) |

| |

|

|

|

| Date: |

January 23, 2024 |

By: |

/s/ Jeffrey W. Farrar |

| |

|

|

Jeffrey W. Farrar |

| |

|

|

Senior Executive Vice President, |

| |

|

|

Chief Financial Officer, and Chief Operating Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Contact:

Jeffrey W. Farrar

Executive Vice President, COO & CFO

(434)773-2274

farrarj@amnb.com

AMERICAN NATIONAL BANKSHARES

REPORTS FOURTH QUARTER AND FULL YEAR 2023 EARNINGS

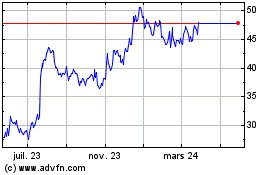

Danville, VA, January 23, 2024 – American National Bankshares Inc. (NASDAQ: AMNB) (“American National” or the “Company”) today reported fourth quarter 2023 earnings of $4.0 million, or $0.38 per diluted common share. Those results compare to earnings of $8.0 million, or $0.76 per diluted common share, during the same quarter in the prior year, and earnings of $5.8 million, or $0.54 per diluted common share, for the third quarter of 2023. Earnings for the twelve months ended December 31, 2023, were $26.2 million, or $2.46 per diluted common share, compared to $34.4 million, or $3.23 per diluted common share, for the same period of 2022. Earnings for the fourth quarter and twelve months ended December 31, 2023, reflect the impact of merger related expenses of $875 thousand and $2.6 million in connection with the Company’s pending merger with Atlantic Union Bankshares Corporation (“Atlantic Union”).

President and Chief Executive Officer, Jeffrey V. Haley, commented, “As we await regulatory approval for our combination with Atlantic Union, we can reflect on another solid year of balance sheet growth and operating earnings performance (adjusting for merger related expenses) for American National. I am especially grateful for our customers’, employees’ and shareholders’ support during this transitional period, and am excited for the future of the combined organization.”

NET INTEREST INCOME

Net interest income for the fourth quarter of 2023 decreased by $1.1 million, or 5.4%, to $19.5 million compared to $20.7 million for the third quarter of 2023. The fourth quarter of 2023 compared to the same quarter of 2022 reflected a decrease of $4.7 million, or 19.5%, from $24.3 million. The full-time equivalent net interest margin for the quarter was 2.60%, down from 2.76% in the prior quarter and 3.33% in the same quarter a year ago (non-GAAP). The margin contraction relative to the previous quarter of 2023 resulted from funding costs increasing more than earning asset yields. The yield on average earning assets increased 3 basis points quarter-over-quarter, while the cost of average interest-bearing liabilities rose 27 basis points due to higher rates paid on interest-bearing deposits and various borrowing sources. Similarly, the 51 basis point increase in average earning asset yields was more than offset by the 186 basis point increase in the cost of average interest-bearing liabilities when comparing the fourth quarter of 2023 to the same quarter of 2022.

ASSET QUALITY

Nonperforming assets (“NPAs”) totaled $5.8 million as of December 31, 2023, up $2.1 million compared to $3.7 million as of September 30, 2023, and up $4.4 million compared to $1.4 million at December 31, 2022. NPAs as a percentage of total assets were 0.19% at December 31, 2023, 0.12% at September 30, 2023, and 0.05% at December 31, 2022. The Company recorded a provision for credit losses for the fourth quarter of 2023 of $437 thousand compared to recovery of credit losses of $538 thousand in the previous quarter and a provision of $1.2 million in the fourth quarter of the previous year. The fourth quarter of 2023 reflected net loan charge-offs of $269 thousand compared to $315 thousand of net recoveries in the third quarter, primarily accounting for the change quarter-over-quarter. The decrease in provision in the fourth quarter of 2023 compared to the same quarter of 2022 was the result of continued improvement in economic conditions, ongoing low charge-off and delinquency rates, and overall strong asset quality metrics.

The allowance for credit losses - loans was $25.3 million at December 31, 2023, compared to $25.1 million at September 30, 2023, and $19.6 million at December 31, 2022. Annualized net charge-offs (recoveries) as a percentage of average loans outstanding were 0.05% for the fourth quarter of 2023 compared to (0.06%) in the third quarter of 2023 and 0.15% in the fourth quarter of 2022. The allowance as a percentage of loans held for investment was 1.10% at December 31, 2023, compared to 1.11% at September 30, 2023, and 0.89% at December 31, 2022.

NONINTEREST INCOME

Noninterest income increased $61 thousand, or 1.3%, to $4.8 million for the quarter ended December 31, 2023, from the prior quarter and $1.2 million, or 33.9%, from $3.6 million in the same quarter in the prior year. The increase in the fourth quarter of 2023 compared to the third quarter was increased interchange income on deposit accounts and other operating income partially offset by decreases in income from equity investments in small business investment companies (“SBIC”). The increase as compared to the fourth quarter of the previous year was primarily due to increased income from equity investments in SBIC, wealth management revenues and other operating income.

NONINTEREST EXPENSE

Noninterest expenses for the fourth quarter of 2023 amounted to $17.9 million, down $466 thousand, or 2.5%, when compared to $18.3 million for the previous quarter and up $1.0 million, or 6.2%, from $16.8 million for the same quarter in the previous year. The decrease in the fourth quarter compared to the third quarter of 2023 was primarily the result of increased salaries and employee benefit costs of $426 thousand substantially offset by a decrease in merger related expenses of $828 thousand. The increase from the same quarter of 2022 was primarily due to fourth quarter 2023 merger related expenses of $875 thousand.

INCOME TAXES

The effective tax rate for the three months ended December 31, 2023, was 32.9%, compared to 24.2% for the prior quarter and 18.9% for the same quarter in the prior year. The increase in the fourth quarter of 2023 compared to the third quarter of 2023 and to the same quarter of 2022, is primarily the result of the non-deductibility of merger related expenses for tax purposes. Excluding merger related expenses, the effective tax rate fluctuations are attributable to changes in pre-tax earnings and the levels of permanent tax differences.

BALANCE SHEET

Total assets at December 31, 2023 were $3.1 billion, essentially flat to September 30, 2023, and an increase of $24.8 million, or 0.81%, from December 31, 2022.

At December 31, 2023, loans held for investment (net of deferred fees and costs) were $2.3 billion, an increase of $14.9 million, or 0.65%, from September 30, 2023. Loans held for investment (net of deferred fees and costs) increased $101.9 million, or 4.7%, from December 31, 2022.

Investment securities available for sale amounted to $521.5 million at December 31, 2023, a decrease of $22.4 million, or 4.1%, compared to September 30, 2023, and a decrease of $86.5 million, or 14.2%, compared to December 31, 2022.

Deposits amounted to $2.6 billion at December 31, 2023, an increase of $35.3 million, or 1.37%, from September 30, 2023, and an increase of $10.2 million, or 0.4%, compared to December 31, 2022.

The Company continues to be well-capitalized as defined by regulators, with tangible common equity to tangible assets of 8.52% at December 31, 2023, compared to 7.98% at September 30, 2023 and compared to 7.82% at December 31 2022 (non-GAAP). The Company’s preliminary common equity Tier 1, Tier 1, total, and Tier 1 leverage capital ratios were 11.70%, 12.81%, 13.82%, and 10.61%, respectively, at December 31, 2023.

ABOUT AMERICAN NATIONAL

American National is a multi-state bank holding company with total assets of approximately $3.1 billion. Headquartered in Danville, Virginia, American National is the parent company of American National Bank and Trust Company. American National Bank is a community bank serving Virginia and North Carolina with 26 banking offices. American National Bank also manages an additional $1.2 billion of trust, investment and brokerage assets in its Wealth Division. Additional information about American National and American National Bank is available on American National's website at www.amnb.com.

NON-GAAP FINANCIAL MEASURES

This release contains financial information determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). American National’s management uses these non-GAAP financial measures in its analysis of American National’s performance. These measures typically adjust GAAP performance measures to exclude the effects of the amortization of intangibles and include the tax benefit associated with revenue items that are tax-exempt, as well as adjust income available to common shareholders for certain significant activities or transactions that are infrequent in nature. Management believes presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of American National’s core businesses. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. For a reconciliation of non-GAAP financial measures, see “Reconciliation of Non-GAAP Financial Measures” at the end of this release.

FORWARD-LOOKING STATEMENTS

Certain statements in this release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, statements regarding anticipated changes in the interest rate environment, future economic conditions and the impacts of current economic uncertainties, and projections, predictions, expectations, or beliefs about future events or results, or otherwise are not statements of historical fact. Such forward-looking statements are based on certain assumptions as of the time they are made and are inherently subject to known and unknown risks and uncertainties, some of which cannot be predicted or quantified, that may cause actual results, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. Such statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “intend,” “will,” “may,” “view,” “seek to,” “opportunity,” “potential,” “continue,” “confidence” or words of similar meaning, or other statements concerning opinions or judgment of our management about future events. Although we believe that our expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of our existing knowledge of our business and operations, there can be no assurance that actual future results, performance, or achievements of, or trends affecting, us will not differ materially from any projected future results, performance, achievements or trends expressed or implied by such forward-looking statements. Actual future results, performance, achievements or trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to, the following: the businesses of American National and Atlantic Union may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; the expected growth opportunities or cost savings from the merger with Atlantic Union may not be fully realized or may take longer to realize than expected; deposit attrition, operating costs, customer losses and business disruption prior to and following the merger with Atlantic Union, including adverse effects on relationships with employees and customers, may be greater than expected; the regulatory and shareholder approvals required for the merger with Atlantic Union may not be obtained; the level of inflation; financial market volatility including the level of interest rates, could affect the values of financial instruments and the amount of net interest income earned; the ability to maintain adequate liquidity by retaining deposit customers and secondary funding sources, especially if the Company's or banking industry's reputation becomes damaged; the adequacy of the level of the Company’s allowance for credit losses, the amount of credit loss provisions required in future periods, and the failure of assumptions underlying the allowance for credit losses; general economic or business conditions, either nationally or in the market areas in which the Company does business, may be less favorable than expected, resulting in deteriorating credit quality, reduced demand for credit, or a weakened ability to generate deposits; competition among financial institutions may increase, and competitors may have greater financial resources and develop products and technology that enable those competitors to compete more successfully than the Company; businesses that the Company is engaged in may be adversely affected by legislative or regulatory changes, including changes in accounting standards and tax laws; the ability to recruit and retain key personnel; cybersecurity threats or attacks, the implementation of new technologies, and the ability to develop and maintain reliable and secure electronic systems; the effects of climate change, natural disasters, and extreme weather events; geopolitical conditions, including acts or threats of terrorism and/or military conflicts, or actions taken by the U.S. or other governments in response to acts of threats or terrorism and/or military conflicts, negatively impacting business and economic conditions in the U.S. and abroad; the impact of health emergencies, epidemics or pandemics; risks related to environmental, social and governance practices; risks associated with mergers, acquisitions, and other expansion activities; and other factors described from time to time in the Company’s reports (such as our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

|

American National Bankshares Inc.

|

|

Consolidated Balance Sheets

|

|

(Dollars in thousands, except per share data)

|

| Unaudited |

| |

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Cash and due from banks

|

|

$ |

31,500 |

|

|

$ |

32,207 |

|

|

Interest-bearing deposits in other banks

|

|

|

35,219 |

|

|

|

41,133 |

|

|

Securities available for sale, at fair value

|

|

|

521,519 |

|

|

|

608,062 |

|

|

Restricted stock, at cost

|

|

|

10,614 |

|

|

|

12,651 |

|

|

Loans held for sale

|

|

|

1,279 |

|

|

|

1,061 |

|

|

Loans, net of deferred fees and costs

|

|

|

2,288,320 |

|

|

|

2,186,449 |

|

|

Less allowance for loan losses

|

|

|

(25,273 |

) |

|

|

(19,555 |

) |

|

Net Loans

|

|

|

2,263,047 |

|

|

|

2,166,894 |

|

|

Premises and equipment, net

|

|

|

31,809 |

|

|

|

32,900 |

|

|

Assets held-for-sale

|

|

|

1,131 |

|

|

|

1,382 |

|

|

Other real estate owned, net

|

|

|

- |

|

|

|

27 |

|

|

Goodwill

|

|

|

85,048 |

|

|

|

85,048 |

|

|

Core deposit intangibles, net

|

|

|

2,298 |

|

|

|

3,367 |

|

|

Bank owned life insurance

|

|

|

30,409 |

|

|

|

29,692 |

|

|

Other assets

|

|

|

76,844 |

|

|

|

51,478 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

3,090,717 |

|

|

$ |

3,065,902 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Demand deposits -- noninterest-bearing

|

|

$ |

805,584 |

|

|

$ |

1,010,602 |

|

|

Demand deposits -- interest-bearing

|

|

|

516,255 |

|

|

|

484,037 |

|

|

Money market deposits

|

|

|

706,986 |

|

|

|

574,330 |

|

|

Savings deposits

|

|

|

205,622 |

|

|

|

269,426 |

|

|

Time deposits

|

|

|

372,066 |

|

|

|

257,933 |

|

|

Total deposits

|

|

|

2,606,513 |

|

|

|

2,596,328 |

|

|

Customer repurchase agreements

|

|

|

59,348 |

|

|

|

370 |

|

|

Other short-term borrowings

|

|

|

35,000 |

|

|

|

100,531 |

|

|

Long-term borrowings

|

|

|

28,435 |

|

|

|

28,334 |

|

|

Other liabilities

|

|

|

18,253 |

|

|

|

19,165 |

|

|

Total liabilities

|

|

|

2,747,549 |

|

|

|

2,744,728 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders' equity

|

|

|

|

|

|

|

|

|

|

Preferred stock, $5 par value, 2,000,000 shares authorized, none outstanding

|

|

|

- |

|

|

|

- |

|

|

Common stock, $1 par value, 20,000,000 shares authorized, 10,633,409 shares outstanding at December 31, 2023 and 10,608,781 shares outstanding at December 31, 2022

|

|

|

10,551 |

|

|

|

10,538 |

|

|

Capital in excess of par value

|

|

|

142,834 |

|

|

|

141,948 |

|

|

Retained earnings

|

|

|

232,847 |

|

|

|

223,664 |

|

|

Accumulated other comprehensive loss, net

|

|

|

(43,064 |

) |

|

|

(54,976 |

) |

|

Total shareholders' equity

|

|

|

343,168 |

|

|

|

321,174 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity

|

|

$ |

3,090,717 |

|

|

$ |

3,065,902 |

|

|

American National Bankshares Inc.

|

|

Consolidated Statements of Income

|

|

(Dollars in thousands, except per share data)

|

| Unaudited |

| |

|

For the Three Months Ended

|

|

|

For the Twelve Months Ended

|

|

| |

|

12/31/23

|

|

|

9/30/23

|

|

|

12/31/22

|

|

|

12/31/23

|

|

|

12/31/22

|

|

|

Interest and Dividend Income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans

|

|

$ |

27,995 |

|

|

$ |

27,512 |

|

|

$ |

23,544 |

|

|

$ |

106,471 |

|

|

$ |

82,568 |

|

|

Interest and dividends on securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable

|

|

|

2,503 |

|

|

|

2,564 |

|

|

|

2,721 |

|

|

|

10,358 |

|

|

|

10,065 |

|

|

Tax-exempt

|

|

|

24 |

|

|

|

24 |

|

|

|

110 |

|

|

|

139 |

|

|

|

407 |

|

|

Dividends

|

|

|

147 |

|

|

|

163 |

|

|

|

126 |

|

|

|

676 |

|

|

|

473 |

|

|

Other interest income

|

|

|

767 |

|

|

|

797 |

|

|

|

415 |

|

|

|

2,585 |

|

|

|

2,491 |

|

|

Total interest and dividend income

|

|

|

31,436 |

|

|

|

31,060 |

|

|

|

26,916 |

|

|

|

120,229 |

|

|

|

96,004 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on deposits

|

|

|

9,693 |

|

|

|

9,057 |

|

|

|

1,597 |

|

|

|

28,843 |

|

|

|

3,553 |

|

|

Interest on short-term borrowings

|

|

|

1,767 |

|

|

|

938 |

|

|

|

633 |

|

|

|

5,192 |

|

|

|

659 |

|

|

Interest on long-term borrowings

|

|

|

429 |

|

|

|

402 |

|

|

|

398 |

|

|

|

1,612 |

|

|

|

1,554 |

|

|

Total interest expense

|

|

|

11,889 |

|

|

|

10,397 |

|

|

|

2,628 |

|

|

|

35,647 |

|

|

|

5,766 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Income

|

|

|

19,547 |

|

|

|

20,663 |

|

|

|

24,288 |

|

|

|

84,582 |

|

|

|

90,238 |

|

|

Provision for (recovery of) loan losses

|

|

|

437 |

|

|

|

(538 |

) |

|

|

1,159 |

|

|

|

495 |

|

|

|

1,597 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Income After Provision for (recovery of) Loan Losses

|

|

|

19,110 |

|

|

|

21,201 |

|

|

|

23,129 |

|

|

|

84,087 |

|

|

|

88,641 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest Income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trust and brokerage fees

|

|

|

1,721 |

|

|

|

1,736 |

|

|

|

1,522 |

|

|

|

6,751 |

|

|

|

6,521 |

|

|

Service charges on deposit accounts

|

|

|

531 |

|

|

|

565 |

|

|

|

597 |

|

|

|

2,216 |

|

|

|

2,676 |

|

|

Interchange fees

|

|

|

1,316 |

|

|

|

1,162 |

|

|

|

1,117 |

|

|

|

4,775 |

|

|

|

4,107 |

|

|

Other fees and commissions

|

|

|

157 |

|

|

|

169 |

|

|

|

207 |

|

|

|

650 |

|

|

|

906 |

|

|

Mortgage banking income

|

|

|

190 |

|

|

|

293 |

|

|

|

176 |

|

|

|

824 |

|

|

|

1,666 |

|

|

Securities gains, net

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(68 |

) |

|

|

- |

|

|

Income (loss) from Small Business Investment Companies

|

|

|

44 |

|

|

|

453 |

|

|

|

(263 |

) |

|

|

932 |

|

|

|

1,409 |

|

|

Income from insurance investments

|

|

|

171 |

|

|

|

128 |

|

|

|

103 |

|

|

|

764 |

|

|

|

747 |

|

|

Losses on premises and equipment, net

|

|

|

(42 |

) |

|

|

- |

|

|

|

(146 |

) |

|

|

(155 |

) |

|

|

(228 |

) |

|

Other

|

|

|

747 |

|

|

|

268 |

|

|

|

297 |

|

|

|

1,647 |

|

|

|

1,003 |

|

|

Total noninterest income

|

|

|

4,835 |

|

|

|

4,774 |

|

|

|

3,610 |

|

|

|

18,336 |

|

|

|

18,807 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest Expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits

|

|

|

9,655 |

|

|

|

9,229 |

|

|

|

9,446 |

|

|

|

36,356 |

|

|

|

36,382 |

|

|

Occupancy and equipment

|

|

|

1,543 |

|

|

|

1,601 |

|

|

|

1,499 |

|

|

|

6,219 |

|

|

|

6,075 |

|

|

FDIC assessment

|

|

|

351 |

|

|

|

354 |

|

|

|

209 |

|

|

|

1,404 |

|

|

|

903 |

|

|

Bank franchise tax

|

|

|

502 |

|

|

|

520 |

|

|

|

501 |

|

|

|

2,052 |

|

|

|

1,953 |

|

|

Core deposit intangible amortization

|

|

|

252 |

|

|

|

262 |

|

|

|

300 |

|

|

|

1,069 |

|

|

|

1,260 |

|

|

Data processing

|

|

|

954 |

|

|

|

821 |

|

|

|

864 |

|

|

|

3,565 |

|

|

|

3,310 |

|

|

Software

|

|

|

439 |

|

|

|

470 |

|

|

|

417 |

|

|

|

1,829 |

|

|

|

1,505 |

|

|

Other real estate owned, net

|

|

|

- |

|

|

|

(10 |

) |

|

|

(1 |

) |

|

|

(10 |

) |

|

|

3 |

|

|

Merger related expenses

|

|

|

875 |

|

|

|

1,702 |

|

|

|

- |

|

|

|

2,577 |

|

|

|

- |

|

|

Other

|

|

|

3,306 |

|

|

|

3,394 |

|

|

|

3,599 |

|

|

|

12,989 |

|

|

|

12,695 |

|

|

Total noninterest expense

|

|

|

17,877 |

|

|

|

18,343 |

|

|

|

16,834 |

|

|

|

68,050 |

|

|

|

64,086 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Before Income Taxes

|

|

|

6,068 |

|

|

|

7,632 |

|

|

|

9,905 |

|

|

|

34,373 |

|

|

|

43,362 |

|

|

Income Taxes

|

|

|

1,995 |

|

|

|

1,844 |

|

|

|

1,872 |

|

|

|

8,214 |

|

|

|

8,934 |

|

|

Net Income

|

|

$ |

4,073 |

|

|

$ |

5,788 |

|

|

$ |

8,033 |

|

|

$ |

26,159 |

|

|

$ |

34,428 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income Per Common Share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.38 |

|

|

$ |

0.54 |

|

|

$ |

0.76 |

|

|

$ |

2.46 |

|

|

$ |

3.23 |

|

|

Diluted

|

|

$ |

0.38 |

|

|

$ |

0.54 |

|

|

$ |

0.76 |

|

|

$ |

2.46 |

|

|

$ |

3.23 |

|

|

Weighted Average Common Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

10,631,001 |

|

|

|

10,625,709 |

|

|

|

10,607,678 |

|

|

|

10,627,709 |

|

|

|

10,672,314 |

|

|

Diluted

|

|

|

10,631,001 |

|

|

|

10,625,709 |

|

|

|

10,609,937 |

|

|

|

10,628,559 |

|

|

|

10,674,613 |

|

|

American National Bankshares Inc.

|

|

Financial Highlights

|

| Unaudited |

|

(Dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or for the Twelve Months

|

|

| |

|

4th Qtr

|

|

|

3rd Qtr

|

|

|

4th Qtr

|

|

|

Ended December 31,

|

|

| |

|

2023

|

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

EARNINGS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

$ |

31,436 |

|

|

$ |

31,060 |

|

|

$ |

26,916 |

|

|

$ |

120,229 |

|

|

$ |

96,004 |

|

|

Interest expense

|

|

|

11,889 |

|

|

|

10,397 |

|

|

|

2,628 |

|

|

|

35,647 |

|

|

|

5,766 |

|

|

Net interest income

|

|

|

19,547 |

|

|

|

20,663 |

|

|

|

24,288 |

|

|

|

84,582 |

|

|

|

90,238 |

|

|

Provision for (recovery of) loan losses

|

|

|

437 |

|

|

|

(538 |

) |

|

|

1,159 |

|

|

|

495 |

|

|

|

1,597 |

|

|

Noninterest income

|

|

|

4,835 |

|

|

|

4,774 |

|

|

|

3,610 |

|

|

|

18,336 |

|

|

|

18,807 |

|

|

Noninterest expense

|

|

|

17,877 |

|

|

|

18,343 |

|

|

|

16,834 |

|

|

|

68,050 |

|

|

|

64,086 |

|

|

Income taxes

|

|

|

1,995 |

|

|

|

1,844 |

|

|

|

1,872 |

|

|

|

8,214 |

|

|

|

8,934 |

|

|

Net income

|

|

|

4,073 |

|

|

|

5,788 |

|

|

|

8,033 |

|

|

|

26,159 |

|

|

|

34,428 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PER COMMON SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share - basic

|

|

$ |

0.38 |

|

|

$ |

0.54 |

|

|

$ |

0.76 |

|

|

$ |

2.46 |

|

|

$ |

3.23 |

|

|

Net income per share - diluted

|

|

|

0.38 |

|

|

|

0.54 |

|

|

|

0.76 |

|

|

|

2.46 |

|

|

|

3.23 |

|

|

Cash dividends paid

|

|

|

0.30 |

|

|

|

0.30 |

|

|

|

0.30 |

|

|

|

1.20 |

|

|

|

1.14 |

|

|

Book value per share

|

|

|

32.27 |

|

|

|

30.79 |

|

|

|

30.27 |

|

|

|

32.27 |

|

|

|

30.27 |

|

|

Book value per share - tangible (a)

|

|

|

24.06 |

|

|

|

22.55 |

|

|

|

21.94 |

|

|

|

24.06 |

|

|

|

21.94 |

|

|

Closing market price

|

|

|

48.75 |

|

|

|

37.94 |

|

|

|

36.93 |

|

|

|

48.75 |

|

|

|

36.93 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL RATIOS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets

|

|

|

0.53 |

% |

|

|

0.75 |

% |

|

|

1.05 |

% |

|

|

0.85 |

% |

|

|

1.07 |

% |

|

Return on average common equity

|

|

|

4.91 |

|

|

|

7.02 |

|

|

|

10.15 |

|

|

|

7.94 |

|

|

|

10.36 |

|

|

Return on average tangible common equity (a)

|

|

|

6.99 |

|

|

|

9.91 |

|

|

|

14.50 |

|

|

|

11.18 |

|

|

|

14.56 |

|

|

Average common equity to average assets

|

|

|

10.72 |

|

|

|

10.68 |

|

|

|

10.33 |

|

|

|

10.70 |

|

|

|

10.35 |

|

|

Tangible common equity to tangible assets (a)

|

|

|

8.52 |

|

|

|

7.98 |

|

|

|

7.82 |

|

|

|

8.52 |

|

|

|

7.82 |

|

|

Net interest margin, taxable equivalent (a)

|

|

|

2.60 |

|

|

|

2.76 |

|

|

|

3.33 |

|

|

|

2.86 |

|

|

|

2.97 |

|

|

Efficiency ratio (a)

|

|

|

68.39 |

|

|

|

64.31 |

|

|

|

58.82 |

|

|

|

62.31 |

|

|

|

57.37 |

|

|

Effective tax rate

|

|

|

32.88 |

|

|

|

24.16 |

|

|

|

18.90 |

|

|

|

23.90 |

|

|

|

20.60 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERIOD-END BALANCES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities

|

|

$ |

532,133 |

|

|

$ |

556,851 |

|

|

$ |

620,713 |

|

|

$ |

532,133 |

|

|

$ |

620,713 |

|

|

Loans held for sale

|

|

|

1,279 |

|

|

|

1,981 |

|

|

|

1,061 |

|

|

|

1,279 |

|

|

|

1,061 |

|

|

Loans, net

|

|

|

2,288,320 |

|

|

|

2,273,455 |

|

|

|

2,186,449 |

|

|

|

2,288,320 |

|

|

|

2,186,449 |

|

|

Goodwill and other intangibles

|

|

|

87,346 |

|

|

|

87,598 |

|

|

|

88,415 |

|

|

|

87,346 |

|

|

|

88,415 |

|

|

Assets

|

|

|

3,090,717 |

|

|

|

3,091,258 |

|

|

|

3,065,902 |

|

|

|

3,090,717 |

|

|

|

3,065,902 |

|

|

Assets - tangible (a)

|

|

|

3,003,371 |

|

|

|

3,003,660 |

|

|

|

2,977,487 |

|

|

|

3,003,371 |

|

|

|

2,977,487 |

|

|

Interest-bearing deposits

|

|

|

1,800,929 |

|

|

|

1,723,227 |

|

|

|

1,585,726 |

|

|

|

1,800,929 |

|

|

|

1,585,726 |

|

|

Noninterest bearing demand deposits

|

|

|

805,584 |

|

|

|

848,017 |

|

|

|

1,010,602 |

|

|

|

805,584 |

|

|

|

1,010,602 |

|

|

Customer repurchase agreements

|

|

|

59,348 |

|

|

|

60,035 |

|

|

|

370 |

|

|

|

59,348 |

|

|

|

370 |

|

|

Other short-term borrowings

|

|

|

35,000 |

|

|

|

85,000 |

|

|

|

100,531 |

|

|

|

35,000 |

|

|

|

100,531 |

|

|

Long-term borrowings

|

|

|

28,435 |

|

|

|

28,410 |

|

|

|

28,334 |

|

|

|

28,435 |

|

|

|

28,334 |

|

|

Shareholders' equity

|

|

|

343,168 |

|

|

|

327,278 |

|

|

|

321,174 |

|

|

|

343,168 |

|

|

|

321,174 |

|

|

Shareholders' equity - tangible (a)

|

|

|

255,822 |

|

|

|

239,680 |

|

|

|

232,759 |

|

|

|

255,822 |

|

|

|

232,759 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE BALANCES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities (b)

|

|

$ |

622,686 |

|

|

$ |

634,313 |

|

|

$ |

713,996 |

|

|

$ |

646,658 |

|

|

$ |

720,001 |

|

|

Loans held for sale

|

|

|

2,047 |

|

|

|

2,488 |

|

|

|

972 |

|

|

|

1,788 |

|

|

|

3,235 |

|

|

Loans, net

|

|

|

2,276,999 |

|

|

|

2,248,675 |

|

|

|

2,168,636 |

|

|

|

2,232,795 |

|

|

|

2,052,158 |

|

|

Interest-earning assets

|

|

|

2,953,377 |

|

|

|

2,939,234 |

|

|

|

2,920,992 |

|

|

|

2,928,996 |

|

|

|

3,042,775 |

|

|

Goodwill and other intangibles

|

|

|

87,506 |

|

|

|

87,758 |

|

|

|

88,593 |

|

|

|

87,900 |

|

|

|

89,048 |

|

|

Assets

|

|

|

3,098,235 |

|

|

|

3,088,231 |

|

|

|

3,066,362 |

|

|

|

3,077,352 |

|

|

|

3,211,668 |

|

|

Assets - tangible (a)

|

|

|

3,010,729 |

|

|

|

3,000,473 |

|

|

|

2,977,769 |

|

|

|

2,989,452 |

|

|

|

3,122,620 |

|

|

Interest-bearing deposits

|

|

|

1,744,549 |

|

|

|

1,758,994 |

|

|

|

1,609,503 |

|

|

|

1,697,250 |

|

|

|

1,765,134 |

|

|

Noninterest bearing demand deposits

|

|

|

838,105 |

|

|

|

872,488 |

|

|

|

1,031,630 |

|

|

|

897,199 |

|

|

|

1,028,871 |

|

|

Customer repurchase agreements

|

|

|

704 |

|

|

|

65,550 |

|

|

|

704 |

|

|

|

48,409 |

|

|

|

24,005 |

|

|

Other short-term borrowings

|

|

|

75,669 |

|

|

|

12,935 |

|

|

|

62,004 |

|

|

|

58,072 |

|

|

|

15,629 |

|

|

Long-term borrowings

|

|

|

28,419 |

|

|

|

28,393 |

|

|

|

28,318 |

|

|

|

28,381 |

|

|

|

28,280 |

|

|

Shareholders' equity

|

|

|

332,127 |

|

|

|

329,812 |

|

|

|

316,697 |

|

|

|

329,339 |

|

|

|

332,356 |

|

|

Shareholders' equity - tangible (a)

|

|

|

244,621 |

|

|

|

242,054 |

|

|

|

228,104 |

|

|

|

241,439 |

|

|

|

243,308 |

|

|

American National Bankshares Inc.

|

|

Financial Highlights

|

| Unaudited |

|

(Dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or for the Twelve Months

|

|

| |

|

4th Qtr

|

|

|

3rd Qtr

|

|

|

4th Qtr

|

|

|

Ended December 31,

|

|

| |

|

2023

|

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

CAPITAL

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic

|

|

|

10,631,001 |

|

|

|

10,625,709 |

|

|

|

10,607,678 |

|

|

|

10,627,709 |

|

|

|

10,672,314 |

|

|

Weighted average shares outstanding - diluted

|

|

|

10,631,001 |

|

|

|

10,625,709 |

|

|

|

10,609,937 |

|

|

|

10,628,559 |

|

|

|

10,674,613 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMON STOCK REPURCHASE PROGRAM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shares of common stock repurchased

|

|

|

- |

|

|

|

- |

|

|

|

3,269 |

|

|

|

34,131 |

|

|

|

206,978 |

|

|

Average price paid per share of common stock

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

36.44 |

|

|

$ |

30.58 |

|

|

$ |

36.26 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLOWANCE FOR LOAN LOSSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning balance

|

|

$ |

25,124 |

|

|

$ |

25,342 |

|

|

$ |

19,189 |

|

|

$ |

19,555 |

|

|

$ |

18,678 |

|

|

Day 1 Impact of CECL adoption

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,192 |

|

|

|

- |

|

|

Provision for (recovery of) loan losses

|

|

|

418 |

|

|

|

(533 |

) |

|

|

1,159 |

|

|

|

433 |

|

|

|

1,597 |

|

|

Charge-offs

|

|

|

(573 |

) |

|

|

(19 |

) |

|

|

(834 |

) |

|

|

(1,002 |

) |

|

|

(1,019 |

) |

|

Recoveries

|

|

|

304 |

|

|

|

334 |

|

|

|

41 |

|

|

|

1,095 |

|

|

|

299 |

|

|

Ending balance

|

|

$ |

25,273 |

|

|

$ |

25,124 |

|

|

$ |

19,555 |

|

|

$ |

25,273 |

|

|

$ |

19,555 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOANS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction and land development

|

|

$ |

274,035 |

|

|

$ |

269,840 |

|

|

$ |

197,525 |

|

|

$ |

274,035 |

|

|

$ |

197,525 |

|

|

Commercial real estate - owner occupied

|

|

|

414,321 |

|

|

|

413,151 |

|

|

|

418,462 |

|

|

|

414,321 |

|

|

|

418,462 |

|

|

Commercial real estate - non-owner occupied

|

|

|

830,655 |

|

|

|

803,440 |

|

|

|

827,728 |

|

|

|

830,655 |

|

|

|

827,728 |

|

|

Residential real estate

|

|

|

369,892 |

|

|

|

366,557 |

|

|

|

338,132 |

|

|

|

369,892 |

|

|

|

338,132 |

|

|

Home equity

|

|

|

90,298 |

|

|

|

91,393 |

|

|

|

93,740 |

|

|

|

90,298 |

|

|

|

93,740 |

|

|

Commercial and industrial

|

|

|

302,305 |

|

|

|

322,209 |

|

|

|

304,247 |

|

|

|

302,305 |

|

|

|

304,247 |

|

|

Consumer

|

|

|

6,814 |

|

|

|

6,865 |

|

|

|

6,615 |

|

|

|

6,814 |

|

|

|

6,615 |

|

|

Total

|

|

$ |

2,288,320 |

|

|

$ |

2,273,455 |

|

|

$ |

2,186,449 |

|

|

$ |

2,288,320 |

|

|

$ |

2,186,449 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONPERFORMING ASSETS AT PERIOD-END

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming loans:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

90 days past due and accruing

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

16 |

|

|

$ |

- |

|

|

$ |

16 |

|

|

Nonaccrual

|

|

|

5,814 |

|

|

|

3,740 |

|

|

|

1,307 |

|

|

|

5,814 |

|

|

|

1,307 |

|

|

Other real estate owned and repossessions

|

|

|

- |

|

|

|

- |

|

|

|

80 |

|

|

|

- |

|

|

|

80 |

|

|

Nonperforming assets

|

|

$ |

5,814 |

|

|

$ |

3,740 |

|

|

$ |

1,403 |

|

|

$ |

5,814 |

|

|

$ |

1,403 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSET QUALITY RATIOS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses to total loans

|

|

|

1.10 |

% |

|

|

1.11 |

% |

|

|

0.89 |

% |

|

|

1.10 |

% |

|

|

0.89 |

% |

|

Allowance for loan losses to nonperforming loans

|

|

|

434.69 |

|

|

|

671.76 |

|

|

|

1,478.08 |

|

|

|

434.69 |

|

|

|

1,478.08 |

|

|

Nonperforming assets to total assets

|

|

|

0.19 |

|

|

|

0.12 |

|

|

|

0.05 |

|

|

|

0.19 |

|

|

|

0.05 |

|

|

Nonperforming loans to total loans

|

|

|

0.25 |

|

|

|

0.16 |

|

|

|

0.06 |

|

|

|

0.25 |

|

|

|

0.06 |

|

|

Annualized net (recoveries) charge-offs to average loans

|

|

|

0.05 |

|

|

|

(0.06 |

) |

|

|

0.15 |

|

|

|

- |

|

|

|

0.04 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiduciary assets at period-end (c) (d)

|

|

$ |

834,150 |

|

|

$ |

774,126 |

|

|

$ |

736,121 |

|

|

$ |

834,150 |

|

|

$ |

736,121 |

|

|

Retail brokerage assets at period-end (c) (d)

|

|

$ |

395,585 |

|

|

$ |

413,956 |

|

|

$ |

413,235 |

|

|

$ |

395,585 |

|

|

$ |

413,235 |

|

|

Number full-time equivalent employees (e)

|

|

|

352 |

|

|

|

358 |

|

|

|

359 |

|

|

|

352 |

|

|

|

359 |

|

|

Number of full service offices

|

|

|

26 |

|

|

|

26 |

|

|

|

26 |

|

|

|

26 |

|

|

|

26 |

|

|

Number of loan production offices

|

|

|

1 |

|

|

|

1 |

|

|

|

1 |

|

|

|

1 |

|

|

|

1 |

|

|

Number of ATMs

|

|

|

34 |

|

|

|

34 |

|

|

|

34 |

|

|

|

34 |

|

|

|

34 |

|

|

Notes:

|

| |

|

(a) - This financial measure is not calculated in accordance with GAAP. For a reconciliation of non-GAAP financial measures, see "Reconciliation of Non-GAAP Financial Measures" at the end of this release.

|

|

(b) - Average does not include unrealized gains and losses.

|

|

(c) - Market value.

|

|

(d) - Assets are not owned by American National and are not reflected in the consolidated balance sheet.

|

|

(e) - Average for period.

|

| |

|

|

|

|

|

|

|

|

|

Interest

|

|

|

|

|

|

|

|

|

|

| |

|

Average Balance

|

|

|

Income/Expense (a)

|

|

|

Yield/Rate

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total loans (b)

|

|

$ |

2,279,046 |

|

|

$ |

2,169,608 |

|

|

$ |

28,058 |

|

|

$ |

23,585 |

|

|

|

4.83 |

%

|

|

|

4.34 |

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable

|

|

|

618,466 |

|

|

|

693,573 |

|

|

|

2,650 |

|

|

|

2,847 |

|

|

|

1.71 |

|

|

|

1.64 |

|

|

Tax exempt

|

|

|

4,220 |

|

|

|

20,423 |

|

|

|

30 |

|

|

|

137 |

|

|

|

2.85 |

|

|

|

2.73 |

|

|

Total securities

|

|

|

622,686 |

|

|

|

713,996 |

|

|

|

2,680 |

|

|

|

2,984 |

|

|

|

1.72 |

|

|

|

1.67 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits in other banks

|

|

|

51,645 |

|

|

|

37,388 |

|

|

|

767 |

|

|

|

415 |

|

|

|

5.90 |

|

|

|

4.40 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total interest-earning assets

|

|

|

2,953,377 |

|

|

|

2,920,992 |

|

|

|

31,505 |

|

|

|

26,984 |

|

|

|

4.20 |

|

|

|

3.69 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-earning assets

|

|

|

144,858 |

|

|

|

145,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

3,098,235 |

|

|

$ |

3,066,362 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand

|

|

$ |

492,925 |

|

|

$ |

494,572 |

|

|

|

1,077 |

|

|

|

95 |

|

|

|

0.87 |

|

|

|

0.08 |

|

|

Savings and money market

|

|

|

880,402 |

|

|

|

864,089 |

|

|

|

5,443 |

|

|

|

1,041 |

|

|

|

2.45 |

|

|

|

0.48 |

|

|

Time

|

|

|

371,222 |

|

|

|

250,842 |

|

|

|

3,173 |

|

|

|

461 |

|

|

|

3.39 |

|

|

|

0.73 |

|

|

Total deposits

|

|

|

1,744,549 |

|

|

|

1,609,503 |

|

|

|

9,693 |

|

|

|

1,597 |

|

|

|

2.20 |

|

|

|

0.39 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer repurchase agreements

|

|

|

58,312 |

|

|

|

704 |

|

|

|

695 |

|

|

|

— |

|

|

|

4.72 |

|

|

|

— |

|

|

Other short-term borrowings

|

|

|

75,669 |

|

|

|

62,004 |

|

|

|

1,072 |

|

|

|

633 |

|

|

|

5.54 |

|

|

|

4.08 |

|

|

Long-term borrowings

|

|

|

28,419 |

|

|

|

28,318 |

|

|

|

429 |

|

|

|

398 |

|

|

|

5.90 |

|

|

|

5.62 |

|

|

Total interest-bearing liabilities

|

|

|

1,906,949 |

|

|

|

1,700,529 |

|

|

|

11,889 |

|

|

|

2,628 |

|

|

|

2.48 |

|

|

|

0.62 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest bearing demand deposits

|

|

|

838,105 |

|

|

|

1,031,630 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other liabilities

|

|

|

21,054 |

|

|

|

17,506 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity

|

|

|

332,127 |

|

|

|

316,697 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity

|

|

$ |

3,098,235 |

|

|

$ |

3,066,362 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest rate spread

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.72 |

%

|

|

|

3.07 |

%

|

|

Net interest margin

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.60 |

%

|

|

|

3.33 |

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income (taxable equivalent basis)

|

|

|

|

|

|

|

|

|

|

|

19,616 |

|

|

|

24,356 |

|

|

|

|

|

|

|

|

|

|

Less: Taxable equivalent adjustment (c)

|

|

|

|

|

|

|

|

|

|

|

69 |

|

|

|

68 |

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

|

|

|

|

|

|

|

|

$ |

19,547 |

|

|

$ |

24,288 |

|

|

|

|

|

|

|

|

|

|

Notes:

|

| |

|

(a) - Interest income includes net accretion/amortization of acquired loan fair value adjustments and the net accretion/amortization of deferred loan fees and costs.

|

|

(b) - Nonaccrual loans are included in the average balances.

|

|

(c) - A tax rate of 21% was used in adjusting interest on tax-exempt assets to a fully taxable equivalent basis.

|

| |

|

|

|

|

|

|

|

|

|

Interest

|

|

|

|

|

|

|

|

|

|

| |

|

Average Balance

|

|

|

Income/Expense (a)

|

|

|

Yield/Rate

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|