AngioDynamics, Inc. (NASDAQ: ANGO), a leading and transformative

medical technology company focused on restoring healthy blood flow

in the body’s vascular system, expanding cancer treatment options,

and improving quality of life for patients, today announced

financial results for the second quarter of fiscal year 2025, which

ended November 30, 2024.

Fiscal Year 2025 Second Quarter Highlights

Quarter Ended November 30,

2024

Pro Forma* YoY Growth

Pro Forma* Net Sales

$73.0 million

9.2%

Med Tech Net Sales

$31.5 million

25.0%

Med Device Net Sales

$41.5 million

(0.4)%

- GAAP Gross margin of 54.8%

- GAAP loss per share of $(0.26)

- Adjusted loss per share of $(0.04)

- Adjusted EBITDA of $3.1 million

- Received CPT Category I Codes for Irreversible Electroporation

(IRE), the primary method of action for the NanoKnife System, for

the treatment of lesions in the prostate and liver, effective

January 1, 2026

- Received FDA 510(k) clearance for NanoKnife Prostate Tissue

Ablation in December 2024

- Announced NanoKnife hit all primary endpoints of PRESERVE

clinical trial for use in Prostate Tissue Ablation in December

2024

- Raising fiscal year 2025 guidance for Adjusted EBITDA and

Adjusted EPS

*Pro forma results exclude the Dialysis and BioSentry businesses

divested in June 2023 and the PICC and Midline product portfolios

divested in February 2024, as well as the discontinued

Radiofrequency and Syntrax products in February 2024. Pro forma

revenue for Q2 FY25 excludes approximately $0.2 million of returns

of divested products during the quarter.

"We are very excited about our strong performance during the

second quarter, and in particular the continued strength of our Med

Tech segment, which grew 25% over the prior year. We also hit a

number of key milestones for our NanoKnife System, with the receipt

of CPT Category I Codes and FDA 510(k) clearance for prostate

tissue ablation. These achievements put us in a fantastic position

to drive accelerated growth for NanoKnife in coming quarters,"

commented Jim Clemmer, President and Chief Executive Officer of

AngioDynamics, Inc. "Through a combination of strong sales results,

increasing contribution from our Med Tech segment, and operating

efficiency efforts, we delivered positive Adjusted EBITDA and

operating cash flow in the quarter. As a result of the tremendous

progress made towards our goal of achieving profitability, we now

expect to be Adjusted EBITDA positive for the fiscal year.”

Second Quarter 2025 Financial Results

Unless otherwise noted, all financial metrics and growth rates

presented below are on a pro forma basis.

Net sales for the second quarter of fiscal year 2025 were $73.0

million, an increase of 9.2% compared to the prior-year

quarter.

Med Tech net sales were $31.5 million, a 25.0% increase from

$25.2 million in the prior-year period. Med Tech includes the

Auryon peripheral atherectomy platform, the thrombus management

platform, which includes the AlphaVac and AngioVac mechanical

thrombectomy systems, and the NanoKnife irreversible

electroporation platform.

Growth in the quarter was driven by strength across all product

lines, including Auryon sales of $13.7 million, which increased

21.8%, AngioVac sales of $8.1 million, which increased 50.7%,

AlphaVac sales of $2.5 million, which increased 33.3%, and

NanoKnife disposable sales of $5.0 million, which increased 23.1%.

Total NanoKnife sales, including capital, of $6.0 million,

increased 4.9%.

Med Device net sales were $41.5 million, a decrease of 0.4%

compared to $41.6 million in the prior-year period. U.S. net sales

of Med Device products grew 1.6% during the second quarter compared

to last year.

U.S. net sales in the second quarter of fiscal 2025 were $62.7

million, an increase of 12.3% from $55.8 million a year ago.

International net sales were $10.3 million, a decrease of 6.6%,

compared to $11.1 million a year ago.

Gross margin for the second quarter of fiscal 2025 was 54.7%,

which was 10 basis points down compared to the second quarter of

fiscal 2024, and 30 basis points sequentially up from 54.4% in the

first quarter of fiscal 2025.

Gross margin for the Med Tech business was 63.7%, an increase of

120 basis points from the second quarter of fiscal 2024 driven by

growth in AngioVac. Gross margin for the Med Device business was

47.8%, a decrease of 240 basis points compared to the second

quarter of fiscal 2024 due to inflationary pressures and costs

associated with the transition to outsourced manufacturing.

The Company recorded a GAAP net loss of $10.7 million, or a loss

per share of $0.26, in the second quarter of fiscal 2025. Excluding

the items shown in the non-GAAP reconciliation table below,

adjusted net loss for the second quarter of fiscal 2025 was $1.7

million, or a loss per share of $0.04. This compares to an adjusted

net loss during the fiscal second quarter of 2024 of $3.4 million,

or a loss per share of $0.08.

Adjusted EBITDA in the second quarter of fiscal 2025, excluding

the items shown in the non-GAAP reconciliation table below, was

$3.1 million, compared to $(0.0) million in the second quarter of

fiscal 2024.

In the second quarter of fiscal 2025, the Company generated $2.5

million in operating cash.

At November 30, 2024, the Company had $54.1 million in cash and

cash equivalents compared to $55.0 million in cash and cash

equivalents at August 31, 2024. During the second quarter, the

Company utilized $1.1 million on share repurchases.

In accordance with the Company’s previously announced

expectations regarding cash usage for the fiscal year ended May 31,

2025, the Company expects to utilize cash in the third fiscal

quarter and generate cash in the fourth fiscal quarter.

Received CPT Category I Codes for IRE for the Treatment of

Lesions in the Prostate and Liver

In October, the Company announced that Irreversible

Electroporation (IRE), the primary method of action for the

NanoKnife System, has received CPT® Category I codes for the

treatment of lesions in the prostate and liver. The decision by the

American Medical Association’s (“AMA”) CPT® Editorial Panel will

facilitate reimbursement for healthcare providers performing IRE

ablation procedures and enables broader access to the NanoKnife

System for patients. The new codes will be effective, with

physician Relative Value Units (RVUs) attached, on January 1,

2026.

With these new CPT® Category I codes, healthcare providers will

be able to bill more precisely for the treatments provided and

should achieve broader insurance coverage and defined reimbursement

rates for NanoKnife procedures, increasing market access to this

minimally invasive IRE technology.

NanoKnife System Receives FDA 510(k) Clearance for Prostate

Tissue Ablation

In December, subsequent to the end of the quarter, the Company

received FDA 510(k) clearance for the NanoKnife System for prostate

tissue ablation.

Prostate cancer is the second most common cancer in men

worldwide, with approximately 1.5 million new cases diagnosed

annually.1 Many of these patients seek alternatives to radical

procedures that can lead to significant, long-term urological side

effects.2 The NanoKnife System is the first and only non-thermal,

radiation-free, ablation technology designed to treat prostate

tissue by using IRE technology, offering patients a minimally

invasive option for prostate treatment.

The NanoKnife System minimizes the life-altering complications

often associated with traditional treatments by selectively

targeting prostate tissue while preserving critical functions. As

the Company expands its global footprint and increases access to

the technology, the Company is launching comprehensive education

and awareness campaigns to empower physicians with hands-on

training and clinical support while engaging patients through

innovative outreach initiatives.

NanoKnife System Hit All Primary Endpoints in PRESERVE

Study

The NanoKnife System’s clearance followed the completion of the

pivotal PRESERVE clinical study and submission of results in

September of 2024.

The PRESERVE clinical study met its primary effectiveness

endpoint demonstrating the performance of the NanoKnife System for

the ablation of prostate tissue in patients with intermediate-risk

PCa. At 12-months post-procedure, 84.0% of men were free from

in-field, clinically significant disease. In addition, the study

demonstrated strong quality of life outcomes with respect to

short-term urinary continence and sexual function preservation.

3

The study’s results validated the robust safety and clinical

efficacy profile of the NanoKnife System, reinforcing findings from

more than 32 clinical studies performed around the world involving

over 2,600 patients.3

Fiscal Year 2025 Financial Guidance

For fiscal year 2025:

- The Company continues to expect net sales to be in the range of

$282 to $288 million, representing growth of between 4.2% – 6.4%

over fiscal 2024 pro forma revenue of $270.7 million

- The Company now expects Med Tech net sales to grow in the range

of 12% to 15%, an increase from 10% to 12%

- The Company now expects Med Device net sales to be flat, a

decrease from 1% to 3%

- The Company continues to expect Gross margin to be

approximately 52% to 53%

- The Company now expects Adjusted EBITDA in the range of $1.0 to

$3.0 million, an increase from the previous guidance of a loss of

$2.5 million to $0. The updated guidance compares to a pro forma

Adjusted EBITDA loss of $3.2 million in fiscal 2024

- The Company now expects Adjusted loss per share in the range of

$0.34 to $0.38, an improvement from the previous guidance of a loss

per share of $0.38 to $0.42. The updated guidance compares to a pro

forma Adjusted loss per share of $0.45 in fiscal 2024

Conference Call

The Company’s management will host a conference call at 8:00

a.m. ET the same day to discuss the results. To participate in the

conference call, dial 1-877-407-0784 (domestic) or +1-201-689-8560

(international).

This conference call will also be webcast and can be accessed

from the “Investors” section of the AngioDynamics website at

www.angiodynamics.com. The webcast replay of the call will be

available at the same site approximately one hour after the end of

the call.

A recording of the call will also be available, until Wednesday,

January 15, 2025 at 11:59 PM ET. To hear this recording, dial

1-844-512-2921 (domestic) or +1-412-317-6671 (international) and

enter the passcode 13750571.

Use of Non-GAAP Measures

Management uses non-GAAP measures to establish operational goals

and believes that non-GAAP measures may assist investors in

analyzing the underlying trends in AngioDynamics' business over

time. Investors should consider these non-GAAP measures in addition

to, not as a substitute for or as superior to, financial reporting

measures prepared in accordance with GAAP. In this news release,

AngioDynamics has reported pro forma results, adjusted EBITDA,

adjusted net income and adjusted earnings per share. Management

uses these measures in its internal analysis and review of

operational performance. Management believes that these measures

provide investors with useful information in comparing

AngioDynamics' performance over different periods. By using these

non-GAAP measures, management believes that investors get a better

picture of the performance of AngioDynamics' underlying business.

Management encourages investors to review AngioDynamics' financial

results prepared in accordance with GAAP to understand

AngioDynamics' performance taking into account all relevant

factors, including those that may only occur from time to time but

have a material impact on AngioDynamics' financial results. Please

see the tables that follow for a reconciliation of non-GAAP

measures to measures prepared in accordance with GAAP.

About AngioDynamics, Inc.

AngioDynamics is a leading and transformative medical technology

company focused on restoring healthy blood flow in the body’s

vascular system, expanding cancer treatment options and improving

quality of life for patients.

The Company’s innovative technologies and devices are chosen by

talented physicians in fast-growing healthcare markets to treat

unmet patient needs. For more information, visit

www.angiodynamics.com.

Safe Harbor

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements regarding AngioDynamics' expected future financial

position, results of operations, cash flows, business strategy,

budgets, projected costs, capital expenditures, products,

competitive positions, growth opportunities, plans and objectives

of management for future operations, as well as statements that

include the words such as "expects," "reaffirms," "intends,"

"anticipates," "plans," "believes," "seeks," "estimates,"

"projects," "optimistic," or variations of such words and similar

expressions, are forward-looking statements. These forward-looking

statements are not guarantees of future performance and are subject

to risks and uncertainties. Investors are cautioned that actual

events or results may differ materially from AngioDynamics'

expectations, expressed or implied. Factors that may affect the

actual results achieved by AngioDynamics include, without

limitation, the scale and scope of the COVID-19 global pandemic,

the ability of AngioDynamics to develop its existing and new

products, technological advances and patents attained by

competitors, infringement of AngioDynamics' technology or

assertions that AngioDynamics' technology infringes the technology

of third parties, the ability of AngioDynamics to effectively

compete against competitors that have substantially greater

resources, future actions by the FDA or other regulatory agencies,

domestic and foreign health care reforms and government

regulations, results of pending or future clinical trials, overall

economic conditions (including inflation, labor shortages and

supply chain challenges including the cost and availability of raw

materials), the results of on-going litigation, challenges with

respect to third-party distributors or joint venture partners or

collaborators, the results of sales efforts, the effects of product

recalls and product liability claims, changes in key personnel, the

ability of AngioDynamics to execute on strategic initiatives, the

effects of economic, credit and capital market conditions, general

market conditions, market acceptance, foreign currency exchange

rate fluctuations, the effects on pricing from group purchasing

organizations and competition, the ability of AngioDynamics to

obtain regulatory clearances or approval of its products, or to

integrate acquired businesses, as well as the risk factors listed

from time to time in AngioDynamics' SEC filings, including but not

limited to its Annual Report on Form 10-K for the year ended May

31, 2024. AngioDynamics does not assume any obligation to publicly

update or revise any forward-looking statements for any reason.

1

https://www.wcrf.org/cancer-trends/prostate-cancer-statistics/

2 Cheng JY. The Prostate Cancer Intervention Versus Observation

Trial (PIVOT) in Perspective. J Clin Med Res. 2013;5(4):266-268.

doi:10.4021/jocmr1395w

3 Data on file.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

CONSOLIDATED INCOME

STATEMENTS

(in thousands, except per share

data)

Three Months Ended

Three Months Ended

Actual (1)

Pro Forma Adjustments (2)

Pro Forma

As Reported (1)

Pro Forma Adjustments (2)

Pro Forma

Nov 30, 2024

Nov 30, 2024

Nov 30, 2024

Nov 30, 2023

Nov 30, 2023

Nov 30, 2023

(unaudited)

(unaudited)

Net sales

$

72,845

170

$

73,015

$

79,073

(12,190

)

$

66,883

Cost of sales (exclusive of intangible

amortization)

32,939

151

33,090

38,811

(8,600

)

30,211

Gross profit

39,906

19

39,925

40,262

(3,590

)

36,672

% of net sales

54.8

%

54.7

%

50.9

%

54.8

%

Operating expenses

Research and development

6,434

—

6,434

8,658

(323

)

8,335

Sales and marketing

25,589

—

25,589

25,464

(1,469

)

23,995

General and administrative

10,391

—

10,391

9,289

(74

)

9,215

Amortization of intangibles

2,562

—

2,562

3,562

(964

)

2,598

Change in fair value of contingent

consideration

156

—

156

221

—

221

Acquisition, restructuring and other

items, net

5,868

9

5,877

6,188

(106

)

6,082

Total operating expenses

51,000

9

51,009

53,382

(2,936

)

50,446

Operating loss

(11,094

)

10

(11,084

)

(13,120

)

(654

)

(13,774

)

Interest income, net

234

—

234

534

—

534

Other income (expense), net

12

—

12

(32

)

—

(32

)

Total other income, net

246

—

246

502

—

502

Loss before income tax benefit

(10,848

)

10

(10,838

)

(12,618

)

(654

)

(13,272

)

Income tax expense (benefit)

(110

)

—

(110

)

16,430

—

16,430

Net loss

$

(10,738

)

$

10

$

(10,728

)

$

(29,048

)

$

(654

)

$

(29,702

)

Loss per share

Basic

$

(0.26

)

$

(0.26

)

$

(0.72

)

$

(0.74

)

Diluted

$

(0.26

)

$

(0.26

)

$

(0.72

)

$

(0.74

)

Weighted average shares outstanding

Basic

40,922

40,922

40,219

40,219

Diluted

40,922

40,922

40,219

40,219

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses on

June 8, 2023, the sale of the PICCs and Midlines Businesses on

February 15, 2024 and the discontinuation of the RadioFrequency

Ablation and Syntrax products ("the Businesses") as of February 29,

2024, for the three months ended November 30, 2024 and 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

CONSOLIDATED INCOME

STATEMENTS

(in thousands, except per share

data)

Six Months Ended

Six Months Ended

Actual (1)

Pro Forma Adjustments (2)

Pro Forma

As Reported (1)

Pro Forma Adjustments (2)

Pro Forma

Nov 30, 2024

Nov 30, 2024

Nov 30, 2024

Nov 30, 2023

Nov 30, 2023

Nov 30, 2023

(unaudited)

(unaudited)

Net sales

$

140,336

179

$

140,515

$

157,752

(24,125

)

$

133,627

Cost of sales (exclusive of intangible

amortization)

63,706

150

63,856

77,430

(17,082

)

60,348

Gross profit

76,630

29

76,659

80,322

(7,043

)

73,279

% of net sales

54.6

%

54.6

%

50.9

%

54.8

%

Operating expenses

Research and development

12,719

—

12,719

16,599

(530

)

16,069

Sales and marketing

51,194

—

51,194

52,832

(2,956

)

49,876

General and administrative

21,366

—

21,366

20,145

(75

)

20,070

Amortization of intangibles

5,132

—

5,132

7,187

(1,928

)

5,259

Change in fair value of contingent

consideration

232

—

232

91

—

91

Acquisition, restructuring and other

items, net

10,179

164

10,343

9,400

(128

)

9,272

Total operating expenses

100,822

164

100,986

106,254

(5,617

)

100,637

Gain on sale of assets

—

—

—

47,842

(47,842

)

—

Operating income (loss)

(24,192

)

(135

)

(24,327

)

21,910

(49,268

)

(27,358

)

Interest income, net

840

—

840

653

—

653

Other income (expense), net

(161

)

—

(161

)

(320

)

—

(320

)

Total other income, net

679

—

679

333

—

333

Income (loss) before income tax

benefit

(23,513

)

(135

)

(23,648

)

22,243

(49,268

)

(27,025

)

Income tax expense

23

—

23

5,407

—

5,407

Net income (loss)

$

(23,536

)

$

(135

)

$

(23,671

)

$

16,836

$

(49,268

)

$

(32,432

)

Earnings (loss) per share

Basic

$

(0.58

)

$

(0.58

)

$

0.42

$

(0.81

)

Diluted

$

(0.58

)

$

(0.58

)

$

0.42

$

(0.81

)

Weighted average shares outstanding

Basic

40,787

40,787

40,030

40,030

Diluted

40,787

40,787

40,103

40,030

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses on

June 8, 2023, the sale of the PICCs and Midlines Businesses on

February 15, 2024 and the discontinuation of the RadioFrequency

Ablation and Syntrax products ("the Businesses") as of February 29,

2024, for the six months ended November 30, 2024 and 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

GAAP TO NON-GAAP

RECONCILIATION

(in thousands, except per share

data)

Reconciliation of Net Income (Loss) to

non-GAAP Adjusted Net Loss:

Three Months Ended

Six Months Ended

Nov 30, 2024

Nov 30, 2023

Nov 30, 2024

Nov 30, 2023

(unaudited)

(unaudited)

Net income (loss)

$

(10,738

)

$

(29,048

)

$

(23,536

)

$

16,836

Amortization of intangibles

2,562

3,562

5,132

7,187

Change in fair value of contingent

consideration

156

221

232

91

Acquisition, restructuring and other

items, net (1)

5,868

6,188

10,179

9,400

Gain on sale of assets

—

—

—

(47,842

)

Tax effect of non-GAAP items (2)

410

17,039

1,856

7,459

Adjusted net loss

$

(1,742

)

$

(2,038

)

$

(6,137

)

$

(6,869

)

Reconciliation of Diluted Earnings

(Loss) Per Share to non-GAAP Adjusted Diluted Loss Per

Share:

Three Months Ended

Six Months Ended

Nov 30, 2024

Nov 30, 2023

Nov 30, 2024

Nov 30, 2023

(unaudited)

(unaudited)

Diluted earnings (loss) per share

$

(0.26

)

$

(0.72

)

$

(0.58

)

$

0.42

Amortization of intangibles

0.06

0.09

0.13

0.18

Change in fair value of contingent

consideration

0.01

0.01

0.01

—

Acquisition, restructuring and other

items, net (1)

0.14

0.15

0.24

0.24

Gain on sale of assets

—

—

—

(1.20

)

Tax effect of non-GAAP items (2)

0.01

0.42

0.05

0.19

Adjusted diluted loss per share

$

(0.04

)

$

(0.05

)

$

(0.15

)

$

(0.17

)

Adjusted diluted sharecount (3)

40,922

40,219

40,787

40,030

(1) Includes costs related to merger and

acquisition activities, restructuring, and unusual items, including

asset impairments and write-offs, certain litigation, and other

items.

(2) Adjustment to reflect the income tax

provision on a non-GAAP basis has been calculated assuming no

valuation allowance on the Company's U.S. deferred tax assets and

an effective tax rate of 23% for the periods ended November 30,

2024 and 2023.

(3) Diluted shares may differ for non-GAAP

measures as compared to GAAP due to a GAAP loss.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

GAAP TO NON-GAAP

RECONCILIATION (Continued)

(in thousands, except per share

data)

Reconciliation of Net Income (Loss) to

Adjusted EBITDA:

Three Months Ended

Six Months Ended

Nov 30, 2024

Nov 30, 2023

Nov 30, 2024

Nov 30, 2023

(unaudited)

(unaudited)

Net income (loss)

$

(10,738

)

$

(29,048

)

$

(23,536

)

$

16,836

Income tax expense (benefit)

(110

)

16,430

23

5,407

Interest income, net

(234

)

(534

)

(840

)

(653

)

Depreciation and amortization

6,863

6,685

13,648

13,373

Change in fair value of contingent

consideration

156

221

232

91

Stock based compensation

2,528

1,877

5,733

6,021

Acquisition, restructuring and other

items, net (1)

4,575

6,188

7,616

9,400

Gain on sale of assets

—

—

—

(47,842

)

Adjusted EBITDA

$

3,040

$

1,819

$

2,876

$

2,633

Per diluted share:

Adjusted EBITDA

$

0.07

$

0.05

$

0.07

$

0.07

(1) Includes costs related to merger and

acquisition activities, restructuring, and unusual items, including

asset impairments and write-offs, certain litigation, and other

items.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

GAAP TO NON-GAAP

RECONCILIATION

(in thousands, except per share

data)

Reconciliation of Pro Forma Net Loss to

Pro Forma Adjusted Net Loss:

Pro Forma

Pro Forma

Three Months Ended

Six Months Ended

Nov 30, 2024

Nov 30, 2023

Nov 30, 2024

Nov 30, 2023

(unaudited)

(unaudited)

Pro forma net loss

$

(10,728

)

$

(29,702

)

$

(23,671

)

$

(32,432

)

Amortization of intangibles

2,562

2,598

5,132

5,259

Change in fair value of contingent

consideration

156

221

232

91

Acquisition, restructuring and other

items, net (1)

5,877

6,082

10,343

9,272

Tax effect of non-GAAP items (2)

407

17,436

1,849

8,260

Adjusted pro forma net loss

$

(1,726

)

$

(3,365

)

$

(6,115

)

$

(9,550

)

Reconciliation of Pro Forma Diluted

Loss Per Share to Pro Forma Adjusted Diluted Loss Per

Share:

Pro Forma

Pro Forma

Three Months Ended

Six Months Ended

Nov 30, 2024

Nov 30, 2023

Nov 30, 2024

Nov 30, 2023

(unaudited)

(unaudited)

Pro forma diluted loss per share

$

(0.26

)

$

(0.74

)

$

(0.58

)

$

(0.81

)

Amortization of intangibles

0.06

0.06

0.13

0.13

Change in fair value of contingent

consideration

0.01

0.01

0.01

—

Acquisition, restructuring and other

items, net (1)

0.14

0.15

0.25

0.23

Tax effect of non-GAAP items (2)

0.01

0.44

0.04

0.21

Adjusted pro forma diluted loss per

share

$

(0.04

)

$

(0.08

)

$

(0.15

)

$

(0.24

)

Adjusted diluted sharecount (3)

40,922

40,219

40,787

40,030

(1) Includes costs related to merger and

acquisition activities, restructuring, and unusual items, including

asset impairments and write-offs, certain litigation, and other

items.

(2) Adjustment to reflect the income tax

provision on a non-GAAP basis has been calculated assuming no

valuation allowance on the Company's U.S. deferred tax assets and

an effective tax rate of 23% for the periods ended November 30,

2024 and 2023.

(3) Diluted shares may differ for non-GAAP

measures as compared to GAAP due to a GAAP loss.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

GAAP TO NON-GAAP

RECONCILIATION (Continued)

(in thousands, except per share

data)

Reconciliation of Pro Forma Net Loss to

Pro Forma Adjusted EBITDA:

Pro Forma

Pro Forma

Three Months Ended

Six Months Ended

Nov 30, 2024

Nov 30, 2023

Nov 30, 2024

Nov 30, 2023

(unaudited)

(unaudited)

Pro forma net loss

$

(10,728

)

$

(29,702

)

$

(23,671

)

$

(32,432

)

Income tax expense (benefit)

(110

)

16,430

23

5,407

Interest income, net

(234

)

(534

)

(840

)

(653

)

Depreciation and amortization

6,863

5,691

13,648

11,373

Change in fair value of contingent

consideration

156

221

232

91

Stock based compensation

2,528

1,802

5,733

5,859

Acquisition, restructuring and other

items, net (1)

4,584

6,082

7,780

9,272

Adjusted EBITDA

$

3,059

$

(10

)

$

2,905

$

(1,083

)

Per diluted share:

Adjusted EBITDA

$

0.07

$

—

$

0.07

$

(0.03

)

(1) Includes costs related to merger and

acquisition activities, restructuring, and unusual items, including

asset impairments and write-offs, certain litigation, and other

items.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

ACQUISITION, RESTRUCTURING,

AND OTHER ITEMS, NET DETAIL

(in thousands)

Three Months Ended

Six Months Ended

(in thousands)

Nov 30, 2024

Nov 30, 2023

Nov 30, 2024

Nov 30, 2023

Legal (1)

$

56

$

5,322

$

410

$

7,139

Mergers and acquisitions

737

252

737

252

Plant closure (2)

5,102

—

8,691

—

Transition service agreement (3)

(454

)

(177

)

(960

)

(323

)

Manufacturing relocation (4)

—

689

—

1,277

Other (5)

427

102

1,301

1,055

Total

$

5,868

$

6,188

$

10,179

$

9,400

(1) Legal expenses related to litigation

that is outside the normal course of business.

(2) Plant closure expenses, related to the

restructuring of our manufacturing footprint which was announced on

January 5, 2024.

(3) Transition services agreements that

were entered into with Merit and Spectrum.

(4) Expenses to relocate certain

manufacturing lines out of Queensbury, NY.

(5) Included in the $1.1 million in other

for the six months ended November 30, 2023 is $0.9 million of

deferred financing fees that were written-off in conjunction with

the sale of the Dialysis and BioSentry businesses and concurrent

extinguishment of the debt.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

NET SALES BY PRODUCT CATEGORY

AND BY GEOGRAPHY

(in thousands)

Three Months Ended

Three Months Ended

Actual (1)

Pro Forma

Adj. (2)

Pro Forma

As

Reported (1)

Pro Forma

Adj. (2)

Pro Forma

Actual

Pro Forma

Nov 30, 2024

Nov 30, 2024

Nov 30, 2024

Nov 30, 2023

Nov 30, 2023

Nov 30, 2023

% Growth

Currency Impact

Constant Currency Growth

% Growth

Currency Impact

Constant Currency Growth

(unaudited)

(unaudited)

Net Sales

Med Tech

$

31,554

$

—

$

31,554

$

25,363

$

(122

)

$

25,241

24.4

%

25.0

%

Med Device

41,291

170

41,461

53,710

(12,068

)

41,642

(23.1

)%

(0.4

)%

$

72,845

$

170

$

73,015

$

79,073

$

(12,190

)

$

66,883

(7.9

)%

0.0

%

(7.9

)%

9.2

%

0.0

%

9.2

%

Net Sales

United States

$

62,678

$

—

$

62,678

$

64,002

$

(8,182

)

$

55,820

(2.1

)%

12.3

%

International

10,167

170

10,337

15,071

(4,008

)

11,063

(32.5

)%

(0.1

)%

(32.6

)%

(6.6

)%

$

72,845

$

170

$

73,015

$

79,073

$

(12,190

)

$

66,883

(7.9

)%

0.0

%

(7.9

)%

9.2

%

0.0

%

9.2

%

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses on

June 8, 2023, the sale of the PICCs and Midlines Businesses on

February 15, 2024 and the discontinuation of the RadioFrequency

Ablation and Syntrax products ("the Businesses") as of February 29,

2024, for the three months ended November 30, 2024 and 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

GROSS PROFIT BY PRODUCT

CATEGORY

(in thousands)

Three Months Ended

Three Months Ended

Actual (1)

Pro Forma

Adj. (2)

Pro Forma

As Reported (1)

Pro Forma

Adj. (2)

Pro Forma

Actual

Pro Forma

Nov 30, 2024

Nov 30, 2024

Nov 30, 2024

Nov 30, 2023

Nov 30, 2023

Nov 30, 2023

% Change

% Change

(unaudited)

(unaudited)

Med Tech

$

20,113

$

—

$

20,113

$

15,816

$

(33

)

$

15,783

27.2

%

27.4

%

Gross profit % of sales

63.7

%

63.7

%

62.4

%

62.5

%

Med Device

$

19,793

$

19

$

19,812

$

24,446

$

(3,557

)

$

20,889

(19.0

)%

(5.2

)%

Gross profit % of sales

47.9

%

47.8

%

45.5

%

50.2

%

Total

$

39,906

$

19

$

39,925

$

40,262

$

(3,590

)

$

36,672

(0.9

)%

8.9

%

Gross profit % of sales

54.8

%

54.7

%

50.9

%

54.8

%

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses on

June 8, 2023, the sale of the PICCs and Midlines Businesses on

February 15, 2024 and the discontinuation of the RadioFrequency

Ablation and Syntrax products ("the Businesses") as of February 29,

2024, for the three months ended November 30, 2024 and 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

NET SALES BY PRODUCT CATEGORY

AND BY GEOGRAPHY

(in thousands)

Six Months Ended

Six Months Ended

Actual (1)

Pro Forma

Adj. (2)

Pro Forma

As

Reported (1)

Pro Forma

Adj. (2)

Pro Forma

Actual

Pro Forma

Nov 30, 2024

Nov 30, 2024

Nov 30, 2024

Nov 30, 2023

Nov 30, 2023

Nov 30, 2023

% Growth

Currency Impact

Constant Currency Growth

% Growth

Currency Impact

Constant Currency Growth

(unaudited)

(unaudited)

Net Sales

Med Tech

$

59,523

$

—

$

59,523

$

51,224

$

(253

)

$

50,971

16.2

%

16.8

%

Med Device

80,813

179

80,992

106,528

(23,872

)

82,656

(24.1

)%

(2.0

)%

$

140,336

$

179

$

140,515

$

157,752

$

(24,125

)

$

133,627

(11.0

)%

0.0

%

(11.0

)%

5.2

%

0.0

%

5.2

%

Net Sales

United States

$

122,159

$

10

$

122,169

$

128,401

$

(16,578

)

$

111,823

(4.9

)%

9.3

%

International

18,177

169

18,346

29,351

(7,547

)

21,804

(38.1

)%

0.1

%

(38.0

)%

(15.9

)%

$

140,336

$

179

$

140,515

$

157,752

$

(24,125

)

$

133,627

(11.0

)%

0.0

%

(11.0

)%

5.2

%

0.0

%

5.2

%

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses on

June 8, 2023, the sale of the PICCs and Midlines Businesses on

February 15, 2024 and the discontinuation of the RadioFrequency

Ablation and Syntrax products ("the Businesses") as of February 29,

2024, for the six months ended November 30, 2024 and 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

GROSS PROFIT BY PRODUCT

CATEGORY

(in thousands)

Six Months Ended

Six Months Ended

Actual (1)

Pro Forma

Adj. (2)

Pro Forma

As Reported (1)

Pro Forma

Adj. (2)

Pro Forma

Actual

Pro Forma

Nov 30, 2024

Nov 30, 2024

Nov 30, 2024

Nov 30, 2023

Nov 30, 2023

Nov 30, 2023

% Change

% Change

(unaudited)

(unaudited)

Med Tech

$

37,810

$

—

$

37,810

$

32,543

$

(72

)

$

32,471

16.2

%

16.4

%

Gross profit % of sales

63.5

%

63.5

%

63.5

%

63.7

%

Med Device

$

38,820

$

29

$

38,849

$

47,779

$

(6,971

)

$

40,808

(18.8

)%

(4.8

)%

Gross profit % of sales

48.0

%

48.0

%

44.9

%

49.4

%

Total

$

76,630

$

29

$

76,659

$

80,322

$

(7,043

)

$

73,279

(4.6

)%

4.6

%

Gross profit % of sales

54.6

%

54.6

%

50.9

%

54.8

%

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses on

June 8, 2023, the sale of the PICCs and Midlines Businesses on

February 15, 2024 and the discontinuation of the RadioFrequency

Ablation and Syntrax products ("the Businesses") as of February 29,

2024, for the six months ended November 30, 2024 and 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(in thousands)

Nov 30, 2024

May 31, 2024

(unaudited)

(audited)

Assets

Current assets:

Cash and cash equivalents

$

54,089

$

76,056

Accounts receivable, net

43,158

43,610

Inventories

65,918

60,616

Prepaid expenses and other

12,195

12,971

Total current assets

175,360

193,253

Property, plant and equipment, net

32,977

35,666

Other assets

10,103

11,369

Intangible assets, net

73,110

77,383

Total assets

$

291,550

$

317,671

Liabilities and stockholders'

equity

Current liabilities:

Accounts payable

$

34,746

$

37,751

Accrued liabilities

39,919

41,098

Current portion of contingent

consideration

4,960

4,728

Other current liabilities

8,970

7,578

Total current liabilities

88,595

91,155

Deferred income taxes

4,334

4,852

Other long-term liabilities

11,853

16,078

Total liabilities

104,782

112,085

Stockholders' equity

186,768

205,586

Total Liabilities and Stockholders'

Equity

$

291,550

$

317,671

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

Three Months Ended

Six Months Ended

Nov 30, 2024

Nov 30, 2023

Nov 30, 2024

Nov 30, 2023

(unaudited)

(unaudited)

Cash flows from operating

activities:

Net income (loss)

$

(10,738

)

$

(29,048

)

$

(23,536

)

$

16,836

Adjustments to reconcile net income (loss)

to net cash used in operating activities:

Depreciation and amortization

6,863

6,685

13,648

13,373

Non-cash lease expense

499

481

993

957

Stock based compensation

2,528

1,877

5,733

6,021

Gain on disposal of assets

—

—

—

(47,842

)

Transaction costs for disposition

—

—

—

(2,427

)

Change in fair value of contingent

consideration

156

221

232

91

Deferred income taxes

(249

)

16,366

(588

)

4,951

Change in accounts receivable

allowances

118

627

388

549

Fixed and intangible asset impairments and

disposals

39

174

59

239

Write-off of other assets

—

—

—

869

Other

(2

)

(129

)

119

(138

)

Changes in operating assets and

liabilities:

Accounts receivable

(3,734

)

(2,480

)

50

677

Inventories

(1,250

)

(4,270

)

(5,303

)

(8,844

)

Prepaid expenses and other

764

(811

)

(72

)

(4,979

)

Accounts payable, accrued and other

liabilities

7,479

15,573

(7,503

)

(966

)

Net cash provided by (used in)

operating activities

2,473

5,266

(15,780

)

(20,633

)

Cash flows from investing

activities:

Additions to property, plant and

equipment

(797

)

(554

)

(1,889

)

(1,345

)

Additions to placement and evaluation

units

(1,164

)

(1,239

)

(2,477

)

(2,006

)

Proceeds from sale of assets

—

—

—

100,000

Net cash (used in) provided by

investing activities

(1,961

)

(1,793

)

(4,366

)

96,649

Cash flows from financing

activities:

Repayment of long-term debt

—

—

—

(50,000

)

Payment of acquisition related contingent

consideration

—

—

—

(10,000

)

Repurchase of common stock

(1,118

)

—

(1,670

)

—

Proceeds from exercise of stock options

and employee stock purchase plan

(5

)

(352

)

38

58

Net cash used in financing

activities

(1,123

)

(352

)

(1,632

)

(59,942

)

Effect of exchange rate changes on cash

and cash equivalents

(305

)

189

(189

)

202

Increase (decrease) in cash and cash

equivalents

(916

)

3,310

(21,967

)

16,276

Cash and cash equivalents at beginning of

period

55,005

57,586

76,056

44,620

Cash and cash equivalents at end of

period

$

54,089

$

60,896

$

54,089

$

60,896

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250108903948/en/

AngioDynamics, Inc. Stephen Trowbridge, Executive Vice President

& CFO (518) 795-1408

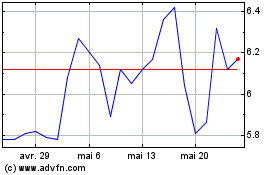

AngioDynamics (NASDAQ:ANGO)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

AngioDynamics (NASDAQ:ANGO)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025