0000882361 False 0000882361 2025-02-18 2025-02-18 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 18, 2025

_______________________________

Aptose Biosciences Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Canada | 001-32001 | 98-1136802 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

66 Wellington Street West, Suite 5300

TD Bank Tower, Box 48

Toronto, Ontario M5K 1E6

Canada

(Address of Principal Executive Offices) (Zip Code)

(310) 849-8060

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, no par value | APTO | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On February 18, 2025, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in the press release attached as Exhibit 99.1 hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | Aptose Biosciences Inc. |

| | | |

| | | |

| Date: February 18, 2025 | By: | /s/ William G. Rice, Ph.D. |

| | | William G. Rice, Ph.D. |

| | | President and Chief Executive Officer |

| | | |

EXHIBIT 99.1

Aptose Announces Reverse Share Split

SAN DIEGO and TORONTO, Feb. 18, 2025 (GLOBE NEWSWIRE) -- Aptose Biosciences Inc. (“Aptose” or the “Company”) (NASDAQ: APTO, TSX: APS), a clinical-stage precision oncology company developing the tuspetinib (TUS)-based triple drug frontline therapy to treat patients with newly diagnosed AML, today announced that its board of directors (the “Board”) has approved, subject to required regulatory and stock exchange approvals, a plan to consolidate all of its outstanding common shares (the “Common Shares”) on the basis of 1 Common Share for every 30 Common Shares currently outstanding (the "Reverse Share Split"). The Company expects the Reverse Share Split to restore compliance with the minimum bid price requirement set out in Nasdaq Listing Rule 5550(a)(2) and to ensure the Company continues to have access to a wide range of investors.

The Company has 64,301,183 Common Shares outstanding as of February 17, 2025 and, assuming no additional Common Shares are issued prior to the Reverse Share Split, the Reverse Share Split will reduce the issued and outstanding Common Shares to approximately 2,143,372 Common Shares. The Reverse Share Split is subject to approval by the Toronto Stock Exchange (the “TSX”) and the post Reverse Share Split Common Shares are expected to commence trading on the TSX and the Nasdaq at market open on February 26, 2025, subject to final confirmation from the TSX and the Nasdaq. No fractional Common Shares will be issued in connection with the Reverse Share Split. Any fractional Common Shares arising from the Reverse Share Split will be deemed to have been tendered by its registered owner to the Company for cancellation for no consideration.

A letter of transmittal (a "Letter of Transmittal") with respect to the Reverse Share Split will be mailed to registered shareholders of the Company. All registered shareholders with physical certificates will be required to send their certificates representing pre-Reverse Share Split Common Shares along with a completed Letter of Transmittal to the Company's transfer agent, Computershare Investor Services Inc. (“Computershare”), in accordance with the instructions provided in the Letter of Transmittal. Additional copies of the Letter of Transmittal can be obtained through Computershare. All shareholders who submit a duly completed Letter of Transmittal along with their pre- Reverse Share Split Common Share certificate(s) to Computershare will receive a post- Reverse Share Split Common Share certificate. Shareholders who hold their Common Shares through a broker or other intermediary and do not have Common Shares registered in their name will not need to complete a Letter of Transmittal.

The exercise or conversion price and the number of Common Shares issuable under any of the Company's outstanding warrants, convertible notes, stock options and any other securities convertible in Common Shares will be proportionately adjusted to reflect the Reverse Share Split in accordance with the respective terms thereof.

About Aptose

Aptose Biosciences is a clinical-stage biotechnology company committed to developing precision medicines addressing unmet medical needs in oncology, with an initial focus on hematology. The Company's small molecule cancer therapeutics pipeline includes products designed to provide single agent efficacy and to enhance the efficacy of other anti-cancer therapies and regimens without overlapping toxicities. The Company’s lead clinical-stage, oral kinase inhibitor tuspetinib (TUS) has demonstrated activity as a monotherapy and in combination therapy in patients with relapsed or refractory acute myeloid leukemia (AML) and is being developed as a frontline triplet therapy in newly diagnosed AML. For more information, please visit www.aptose.com.

Forward Looking Statements

This press release may contain forward-looking statements within the meaning of Canadian and U.S. securities laws, including, but not limited to, statements relating to the Reverse Share Split and the effective date thereof, the time as well as statements relating to the Company’s plans, objectives, expectations and intentions and other statements including words such as “continue”, “expect”, “intend”, “will”, “should”, “would”, “may”, and other similar expressions. Such statements reflect our current views with respect to future events and are subject to risks and uncertainties and are necessarily based upon a number of estimates and assumptions that, while considered reasonable by us are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements described in this press release. Such factors could include, among others: our ability to regain compliance with the NASDAQ Listing Rules prior to March 31, 2025; our ability to obtain the capital required for research and operations and to continue as a going concern; the inherent risks in early stage drug development including demonstrating efficacy; development time/cost and the regulatory approval process; the progress of our clinical trials; our ability to find and enter into agreements with potential partners; our ability to attract and retain key personnel; changing market conditions; inability of new manufacturers to produce acceptable batches of GMP in sufficient quantities; unexpected manufacturing defects; and other risks detailed from time-to-time in our ongoing quarterly filings, annual information forms, annual reports and annual filings with Canadian securities regulators and the United States Securities and Exchange Commission.

Should one or more of these risks or uncertainties materialize, or should the assumptions set out in the section entitled "Risk Factors" in our filings with Canadian securities regulators and the United States Securities and Exchange Commission underlying those forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this press release and we do not intend, and do not assume any obligation, to update these forward-looking statements, except as required by law. We cannot assure you that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Investors are cautioned that forward-looking statements are not guarantees of future performance and accordingly investors are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein.

For further information, please contact:

Aptose Biosciences Inc.

Susan Pietropaolo

Corporate Communications & Investor Relations

201-923-2049

spietropaolo@aptose.com

v3.25.0.1

Cover

|

Feb. 18, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 18, 2025

|

| Entity File Number |

001-32001

|

| Entity Registrant Name |

Aptose Biosciences Inc.

|

| Entity Central Index Key |

0000882361

|

| Entity Tax Identification Number |

98-1136802

|

| Entity Incorporation, State or Country Code |

Z4

|

| Entity Address, Address Line One |

66 Wellington Street West, Suite 5300

|

| Entity Address, Address Line Two |

TD Bank Tower, Box 48

|

| Entity Address, City or Town |

Toronto

|

| Entity Address, State or Province |

ON

|

| Entity Address, Postal Zip Code |

M5K 1E6

|

| City Area Code |

310

|

| Local Phone Number |

849-8060

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, no par value

|

| Trading Symbol |

APTO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

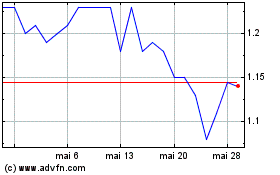

Aptose Biosciences (NASDAQ:APTO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Aptose Biosciences (NASDAQ:APTO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025