Form SD - Specialized disclosure report

07 Août 2024 - 10:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM SD

Specialized Disclosure Report

_______________

ALLIANCE RESOURCE PARTNERS, L.P.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| | |

Delaware (State or other jurisdiction of incorporation or organization) | 0-26823 (Commission File Number) | 73-1564280 (IRS Employer Identification No.) |

1717 South Boulder Avenue, Suite 400, Tulsa, Oklahoma 74119 (Address of principal executive offices and zip code) |

Cary P. Marshall (918) 295-7673 (Name and telephone number, including area code, of the person to contact in connection with this report.) |

_______________

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in the form applies:

[ ]Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023.

[X]Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023.

Section 2.RESOURCE EXTRACTION ISSUER DISCLOSURE

Item 2.01 Resource Extraction Issuer Disclosure and Report

Disclosure of Payments by Resource Extraction Issuers

The specified payment disclosure required by this Form is included as Exhibit 2.01 to this Specialized Disclosure Report on Form SD.

Section 3.Exhibits

Item 3.01 Exhibit

2.01 – Interactive Data File (Form SD for the year ended December 31, 2023 filed in XBRL).

99.1 – Resource Extraction Payment Report as required by Item 2.01 of this Form.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized, in Tulsa, Oklahoma, on August 7, 2024.

| | | |

| ALLIANCE RESOURCE PARTNERS, L.P. |

| |

| By: | Alliance Resource Management GP, LLC |

| | its general partner |

| | |

| | /s/ Cary P. Marshall | |

|

| | Cary P. Marshall |

| | Senior Vice President and |

| | Chief Financial Officer |

EXHIBIT 99.1

PAYMENTS BY SEGMENT

| | | | | | | | |

SEGMENT | PROJECT / SUBNATIONAL POLITICAL JURISDICTION | RESOURCE / METHOD OF EXTRACTION | GOVERNMENTAL RECIPIENT / COUNTRY | PAYMENT TYPE | PAYMENT AMOUNT

(in USD) | FISCAL YEAR | |

| Illinois | Coal / Underground | Federal government / United States | Federal black lung excise taxes | $ | 5,130,666 | 2023 | |

| Indiana | Coal / Underground | Federal government / United States | Federal black lung excise taxes | $ | 4,780,708 | 2023 | |

| Kentucky | Coal / Underground | Federal government / United States | Federal black lung excise taxes | $ | 16,906,104 | 2023 | |

| Illinois Basin federal black lung excise taxes subtotal: | $ | 26,817,478 | 2023 | |

| Illinois | Coal / Underground | Federal government / United States | Federal reclamation fees | $ | 434,742 | 2023 | |

| Indiana | Coal / Underground | Federal government / United States | Federal reclamation fees | $ | 488,831 | 2023 | |

Illinois Basin Coal Operations | Kentucky | Coal / Underground | Federal government / United States | Federal reclamation fees | $ | 1,319,196 | 2023 | |

| Illinois Basin federal reclamation fees subtotal: | $ | 2,242,769 | 2023 | |

| Indiana | Coal / Underground | Federal government / United States | Black lung benefits | $ | 1,293 | 2023 | |

| Kentucky | Coal / Underground | Federal government / United States | Black lung benefits | $ | 118,778 | 2023 | |

| Illinois Basin black lung benefits: | $ | 120,071 | 2023 | |

| Indiana | Coal / Underground | Federal government / United States | Permitting fees | $ | 12,388 | 2023 | |

| Illinois Basin permitting fees: | $ | 12,388 | 2023 | |

| | | | | | | | |

| Total Illinois Basin payments to United States federal government: | $ | 29,192,706 | 2023 | |

| | | | | | | | |

SEGMENT | PROJECT / SUBNATIONAL POLITICAL JURISDICTION | RESOURCE / METHOD OF EXTRACTION | GOVERNMENTAL RECIPIENT / COUNTRY | PAYMENT TYPE | PAYMENT AMOUNT

(in USD) | FISCAL YEAR | |

| Kentucky | Coal / Underground | Federal government / United States | Federal black lung excise taxes | $ | 662,768 | 2023 | |

| West Virginia | Coal / Underground | Federal government / United States | Federal black lung excise taxes | $ | 10,264,403 | 2023 | |

| Appalachia federal black lung excise taxes subtotal: | $ | 10,927,171 | 2023 | |

| Kentucky | Coal / Underground | Federal government / United States | Federal reclamation fees | $ | 123,368 | 2023 | |

Appalachia Coal | West Virginia | Coal / Underground | Federal government / United States | Federal reclamation fees | $ | 833,055 | 2023 | |

Operations | Appalachia federal reclamation fees subtotal: | $ | 956,423 | 2023 | |

| Kentucky | Coal / Underground | Federal government / United States | Black lung benefits | $ | 150,220 | 2023 | |

| Maryland | Coal / Underground | Federal government / United States | Black lung benefits | $ | 54,083 | 2023 | |

| Appalachia black lung benefits: | $ | 204,303 | 2023 | |

| West Virginia | Coal / Underground | Federal government / United States | Permitting fees | $ | 10,300 | 2023 | |

| Appalachia permitting fees: | $ | 10,300 | 2023 | |

| | | | | | | | |

| Total Appalachia payments to United States federal government: | $ | 12,098,197 | 2023 | |

| | | | | | | | |

SEGMENT | PROJECT / SUBNATIONAL POLITICAL JURISDICTION | RESOURCE / METHOD OF EXTRACTION | GOVERNMENTAL RECIPIENT / COUNTRY | PAYMENT TYPE | PAYMENT AMOUNT

(in USD) | FISCAL YEAR | |

Oil & Gas Royalties | (1) | Oil and natural gas / Wells | Federal government / United States | Federal income taxes | $ | 12,500,000 | 2023 | |

| (1) | The United States federal government levies income taxes at the Alliance Minerals, LLC (“Alliance Minerals”) level rather than on a per project basis. Alliance Minerals is an indirect wholly owned subsidiary of Alliance Resource Partners, L.P. and holds its oil & gas mineral interests. Income tax payment information in the table above is presented at the Alliance Minerals entity level. |

| | | | |

Total payments | | | | |

Federal black lung excise taxes | $ | 37,744,649 | 2023 | |

Federal reclamation fees | $ | 3,199,192 | 2023 | |

Black lung benefits | $ | 324,374 | 2023 | |

Permitting fees | $ | 22,688 | 2023 | |

Alliance Minerals federal income taxes | $ | 12,500,000 | 2023 | |

Total payments to United States federal government: | $ | 53,790,903 | 2023 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe three character ISO 4217 code for the currency used for reporting purposes. Example: 'USD'.

| Name: |

dei_EntityReportingCurrencyISOCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:currencyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.2.u1

Payments, by Category - USD ($)

|

Total Payments |

Federal black lung excise taxes |

Federal reclamation fees |

Black lung benefits |

Permitting fees |

Alliance Minerals federal income taxes |

| Total |

$ 53,790,903

|

$ 37,744,649

|

$ 3,199,192

|

$ 324,374

|

$ 22,688

|

$ 12,500,000

|

v3.24.2.u1

Payments, by Project

|

Total Payments

USD ($)

|

| Total |

$ 53,790,903

|

v3.24.2.u1

Payments, by Government - 12 months ended Dec. 31, 2023 - USD ($)

|

Total Payments |

Federal black lung excise taxes |

Federal reclamation fees |

Black lung benefits |

Permitting fees |

Alliance Minerals federal income taxes |

| Total |

$ 53,790,903

|

$ 37,744,649

|

$ 3,199,192

|

$ 324,374

|

$ 22,688

|

$ 12,500,000

|

| United States | Federal government |

|

|

|

|

|

|

| Total |

$ 53,790,903

|

$ 37,744,649

|

$ 3,199,192

|

$ 324,374

|

$ 22,688

|

$ 12,500,000

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_US |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=arlp_FederalGovernmentMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.2.u1

Payments, Details - 12 months ended Dec. 31, 2023 - USD ($)

|

Amount |

Type |

Country |

Subnat. Juris. |

Govt. |

Resource |

Segment |

Ext. Method |

| #: 1 |

|

|

|

|

|

|

|

|

|

$ 5,130,666

|

Taxes

|

United States

|

snj:US-IL

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:IllinoisBasinCoalOperationsMember

|

Underground Mining

|

| #: 2 |

|

|

|

|

|

|

|

|

|

4,780,708

|

Taxes

|

United States

|

snj:US-IN

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:IllinoisBasinCoalOperationsMember

|

Underground Mining

|

| #: 3 |

|

|

|

|

|

|

|

|

|

16,906,104

|

Taxes

|

United States

|

snj:US-KY

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:IllinoisBasinCoalOperationsMember

|

Underground Mining

|

| #: 4 |

|

|

|

|

|

|

|

|

|

434,742

|

Fees

|

United States

|

snj:US-IN

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:IllinoisBasinCoalOperationsMember

|

Underground Mining

|

| #: 5 |

|

|

|

|

|

|

|

|

|

488,831

|

Fees

|

United States

|

snj:US-IN

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:IllinoisBasinCoalOperationsMember

|

Underground Mining

|

| #: 6 |

|

|

|

|

|

|

|

|

|

1,319,196

|

Fees

|

United States

|

snj:US-KY

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:IllinoisBasinCoalOperationsMember

|

Underground Mining

|

| #: 7 |

|

|

|

|

|

|

|

|

|

1,293

|

Taxes

|

United States

|

snj:US-IN

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:IllinoisBasinCoalOperationsMember

|

Underground Mining

|

| #: 8 |

|

|

|

|

|

|

|

|

|

118,778

|

Taxes

|

United States

|

snj:US-KY

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:IllinoisBasinCoalOperationsMember

|

Underground Mining

|

| #: 9 |

|

|

|

|

|

|

|

|

|

12,388

|

Fees

|

United States

|

snj:US-IN

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:IllinoisBasinCoalOperationsMember

|

Underground Mining

|

| #: 10 |

|

|

|

|

|

|

|

|

|

662,768

|

Taxes

|

United States

|

snj:US-KY

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:AppalachiaCoalOperationsMember

|

Underground Mining

|

| #: 11 |

|

|

|

|

|

|

|

|

|

10,264,403

|

Taxes

|

United States

|

snj:US-WV

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:AppalachiaCoalOperationsMember

|

Underground Mining

|

| #: 12 |

|

|

|

|

|

|

|

|

|

123,368

|

Fees

|

United States

|

snj:US-KY

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:AppalachiaCoalOperationsMember

|

Underground Mining

|

| #: 13 |

|

|

|

|

|

|

|

|

|

833,055

|

Fees

|

United States

|

snj:US-WV

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:AppalachiaCoalOperationsMember

|

Underground Mining

|

| #: 14 |

|

|

|

|

|

|

|

|

|

150,220

|

Taxes

|

United States

|

snj:US-KY

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:AppalachiaCoalOperationsMember

|

Underground Mining

|

| #: 15 |

|

|

|

|

|

|

|

|

|

54,083

|

Taxes

|

United States

|

snj:US-MD

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:AppalachiaCoalOperationsMember

|

Underground Mining

|

| #: 16 |

|

|

|

|

|

|

|

|

|

10,300

|

Fees

|

United States

|

snj:US-WV

|

Federal government

|

arlp:ResourceCoalMember

|

arlp:AppalachiaCoalOperationsMember

|

Underground Mining

|

| #: 17 |

|

|

|

|

|

|

|

|

|

$ 12,500,000

|

Taxes

|

United States

|

|

Federal government

|

arlp:ResourceOilAndNaturalGasMember

|

arlp:OilAndGasRoyaltiesMember

|

Well

|

| X |

- Details

| Name: |

rxp_PmtAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=2 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=3 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=4 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=5 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=6 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=7 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=8 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=9 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=10 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=11 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=12 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=13 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=14 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=15 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=16 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=17 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

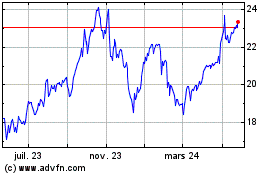

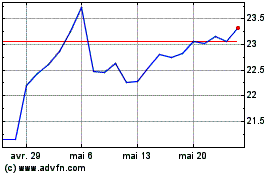

Alliance Resource Partners (NASDAQ:ARLP)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Alliance Resource Partners (NASDAQ:ARLP)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024